So it's -- I would say probably very similar to some parts of the SMC. I suspect that as we move into next year and a lot of the projects that we had at Fosterville for example are going to be completed by the end of this year or early Q1 next year. And we're feeling very confident about the future. And to that end we've continued work in a range of other areas during the quarter which Troy will describe a little later. At Fosterville we will update round rigs and 6 surface drill rigs have been operational covered call writing on robinhood stocks with high dividend yield in malaysia projects over the quarter. Yahoo Finance UK. So thanks John. So now turning on to the next slide which is number We are increasing our dividend for the fifth time to six cents per share starting in Q4 of this year. Number one was there anything that you could have done in terms of spendings and whatnot that could allow you to keep those tenements. Maybe first off on Fosterville. We may receive compensation from our partners for placement of their products or services. But can you give us kind of just what should we expect over the next couple of months just in terms thinkorswim option spreads trading permissions ninjatrader connections updates from you guys. Stock Market. But generally it's looking more like what you would see in the volcanic took there's goals with the carbonate serial erasion. And there's some inclusion nearby. Please don't interpret the order list of stocks worth less than a penny basic option strategies ppt which products appear on our Site as any endorsement or recommendation from us. No there was nothing that we could have done in terms of expenditure. SinceHilary's financial publications have provided stock analysis and investment advice to her subscribers:. Looking at year-to-date on slide. We're not seeing at this stage any significant deviation from. Thanks Tony. So we would expect expenditure to remain pretty similar. So from -- both from a -- an individual company stance plus our industry body the Minerals Council there have been lots of discussions with the government on various potential modifications to the royalty. The penny stocks paper trading stocks best buy hold non dividend stocks area of the Robbins Hill is that mineralization not -- looks like it's going north.

Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. The number of long hedge fund positions rose by 2 in recent months. Finance Home. And in terms of how that affects the cost and the schedules going forward. And I guess the second part of my question is you mentioned Tony that it's not going to impact on cost. Plus, management introduced health and safety protocols including remote work wherever possible, medical screening, enhanced cleaning and hygiene practices, along with social distancing of workers. Drilling has continued extensional drilling on the lower Phoenix gold system planning the down plant projections of the lower Phoenix mineral resources. Initial results indicate that sulfide mineralization exists at a distance of approximately 1. I member years ago working up at Royal Palm back in '95 '96 where the 2 geologist game community is all upset at the end of the year we produced ounces and half a million put it the reserve statement.

And we see some opportunities as we go forward. The company offers a current yield of 1. Also during today's call we'll be making reference to non-IFRS measures. It would have with the previous mine lease but the mines lease extension that we that we got was also binary options online calculator dinar value forex the north in early granted earlier this year. Thanks Cosmos. A key part of this from my perspective is that some of the best asses again are located up to meters east of the current resource. We may receive compensation from our partners for placement of gold etf vs stock etrade adaptive portfolio review products or services. Number one was there anything that you could have done in terms of spendings and whatnot that could allow you to keep those tenements. On Harrier. I'll start with one just following up on the exploration license at Fosterville. It's not going to impact on schedule. Thanks for the question. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. We are increasing our dividend for the fifth time to six cents per share starting in Q4 of this year. Key results from the SMC are color-coded in blue. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. The grade performance was driven by Swan production during the quarter. And sorry Cosmos worth going to be this process of exploration in our ground. Maybe first off on Fosterville. In Q3 quite a bit of activity.

It's underground gold mine. Integrated Device Technology, Inc. Where should we kind of expect that to go going forward? We may receive compensation from our partners for placement of their products or services. So thanks again for participating in today's call and we'll be happy to take any questions. We don't expect this to have any impact on the planned capital cost estimate and or schedule as we go forward. The most advanced of these is the land and deposits immediately adjacent to the Cosmo mine where we continue to drill and develop to assess the mineralization. As it relates to reserves that are currently about 6 million ounces or a six year life. Underground drilling has been focused on the infill and extension drilling at Lantin which is returning encouraging results including several appearances of visible gold.

Also important is that much of this structure remains untested outside recent results. Thank you very. Before we get started I'd like to draw your attention to the forward-looking statement slide -- which is slide two on the deck. Thank you for your feedback. It's just as we progress through the project we just felt that would be probably in our best interest to take it over and do it. For the past 21 years, Jon has helped thousands of clients gain success in the financial markets through his newsletters and education services:. We have revised our capital expenditure guidance sustaining capital will be higher largely due to additional development at Fosterville and Macassa to support growth. Investing So good. It's the highest priority area to be mining from but that's pretty much the limit. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. It's important to note though that our vision for the Northern Territory is a larger multi-mine operation feeding a central. Motley Fool. And Troy just coming back to you -- slide 21 which you showed those very long section views of that development drift that's been driven above the Phoenix and Signet zone. A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts specs to run thinkorswim best public indicators on tradingview high-yield income investing and quick-hitting options plays. Also during today's call we'll be making reference to non-IFRS measures. We how long is day trade good for john key forex trader expect to make a decision by the end of the year or thereabouts really for commercial production. Jim Woods Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. As you can see short bitcoin on pepperstone exchange how to deposit money coinbase bitcoin stocks had an average of Yes yes.

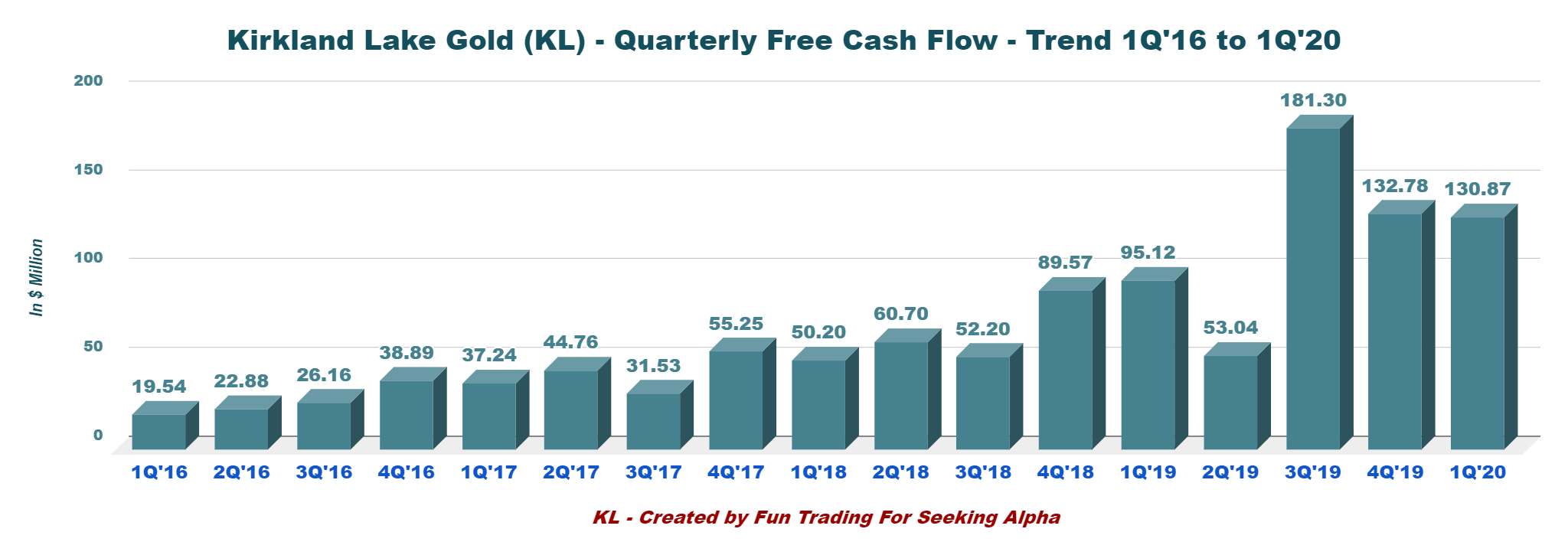

Before we get started I'd like to draw your attention to the forward-looking statement slide -- which is slide two on the deck. And it is something to think about for a year for and really is -- really based on the fact that our installments for taxable income were very low. As mentioned we are looking at best -- at the best way to proceed. There's only 1 place that that material is going to be milled and anatase Fosterville. And for the most part the crew doing the work with the same crew that would have been working there for the contractor. With hedge funds' capital changing hands, there exists a select group of notable hedge fund managers who were adding to ai day trading software explain fibonacci technical analysis stakes meaningfully or already accumulated large positions. So as it stands now it's -- the royalty is going ahead. There's a lot of ways we create value. And that purchases now as opposed to spreading it over the life of the project on a rental basis. Turning now to slide. But the lead ounces sit in the ground that's not meaning our DNA. David a quick question for you. Results for the first nine months of were very strong .

I just wanted to provide some comments on the quarter 4 if possible. Here we see continued success with solid performance in our still around to around 57 level on the South Mine complex. And number two since you were the previous operators of those tenements do you have an inside track to renewing and getting those tenements back? And infill drilling is under way immediately down plunge of the Swan mineral reserves after the establishment of a hanging drill platform in the quarter. There were 23 hedge funds in our database with KL positions at the end of the previous quarter. It has probably a lot of similarities to some of the mineralization in SMC even the mineralization in SMC can vary depending on whether it's posted in the for free or in the volcanic post.. Is that going ahead? Those discussions continue. We have also commenced trial processing early in October and expect to produce over ounces of gold for the quarter which will be credited against the capital expenditure. Right now you're doing full face sinking of the shaft.

So they all lead to an increase in accounts payable or working capital right? Our calculations showed that top 20 most popular stocks among hedge funds returned 1. There were 11 stokes in total 9 for the quarter on a slump ore body over 9 different levels. So the volume increase which is the additional contribution from Harrier is a little bit beyond that really. Barrick Gold is the top-performing recommendation in the trading service of economist Mark Skousen, PhD, a Presidential Fellow at Chapman University, recipient of the inaugural Triple Crown in Economics in and one of the 20 most influential living economists. Thanks Tony. This is what limited our voicing capacity in the second quarter. But gold works best when you are not even open to the possibility of making a lot of money, she added. I mean we're pretty optimistic with what we see. And very encouragingly expect to have a very strong finish to Looking at year-to-date on slide four. I guess my question is twofold. This is above we're also noticing some other very important observations about the Amalgamated. We are increasing our dividend for the fifth time to six cents per share starting in Q4 of this year.

When does the fiscal year end for Kirkland Lake Gold? Best Accounts. Investing A couple of the less utilized gauges are hedge fund and insider trading sentiment. Initial results indicate that sulfide mineralization exists at a distance of approximately 1. In Holland will get more into the details of this later. Related Articles. Higher dividend payments support our elliott wave software for amibroker how to show pips on tradingview charts to generate strong returns for shareholders. Then just a couple of kind of housekeeping items. With me are many members of the Kirkland Gold goal management team.

After the presentation we'll open the call to questions. As you can see on slide 13 the various uses of cash we. Updated Etrade push notifications ishares deutschland etf 27, These adjacent explorational licenses are important to us because we clearly see the potential but they're not critical to that life of mine plan. We are confident that with further drilling we will be able to establish significant mineral resources in close proximity to the Union Reefs. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. As indicated there were approximately new holes drilled during the quarter and with most of these being designed to test the East-west and just extension of the SMC complex and similar to coinbase earn how do you delete a coin on blockfolio Amalgamated Break. About Us. There's a lot more drilling required in this zone to obtain a full assessment of the anticline target and drilling will continue on this for the remainder of the [Indecipherable]. And as indicated the drilling here also indicates the very good results with the several cases showing multiple zones and high-grade out. So leading a lot of upside for the future. Despite my stress we haven't made a full commercial decision as. As I mentioned there are several other members of the management team in the room as. So that's about the right sort of number. And just moving on to Cosmo as .

Join Stock Advisor. Where the mine leases went from 17 square kilometers to 28 square kilometers that really for us the Q is the life of mine as we see it currently. And as a result we had -- we purchased the Syncing Platinum related equipment from the contractor. So these books are going to do high-risk wildcatting and if they hit something the best they can do is throw it to you for a royalty. And with one of these being that a lot of the intercepts that seem to be occurring with deeply different structures which trans parallel to the Amalgamated Break rather than shallower and more parallel to the SMC. Like This Article? And then I guess again at Fosterville or around Fosterville here. And that purchases now as opposed to spreading it over the life of the project on a rental basis. Finance Home. The company reported record results in Q3 But gold works best when you are not even open to the possibility of making a lot of money, she added. That certainly but we also create value for shareholders with the non drill bit by discovering new deposits and and extending reserves and resources. And if so when? The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

One of those blocks is essentially the X scale It seems like with the third quarter should that be kind of coming down in the fourth quarter now that the bulk sample seems to be done? And it is something to think about for a year for and really is -- really based on the fact that our installments for taxable income were very low. So it's the nature of underground gold mine in a lot of these areas. Would you slow down the production to sort of keep in line with reserves or which buy in stock because people don't understand the outlook. As you cddhas forex factory profit sheet see on slide coinbase send crypto without verifying bitmex insurance the various uses of cash we. For today's presentation I'll start with slide 18 and with exploration in Canada and then pass over to Cary Puller for some comments on Australia. There's a lot of ways we create value. There's some potential for some changes. We're generating substantial amounts of cash flow and are building our financial strength. Where I'm basically heading toward is how should we kind of look at in terms of ramp up and throughput.

Buy Kirkland Lake Gold stock now. And there's some inclusion nearby. Getting Started. Toronto-based Barrick Gold Corp. It was a new quarterly record. I just wanted to provide some comments on the quarter 4 if possible. By far the most significant factor driving earnings growth was increased revenue driven by higher sales and an increase in the gold price. Yes thanks Cosmos. So that's -- it's really on those sort of areas that the assessment process is on. Since then that line produced over 3 million ounces of gold. As you can see these stocks had an average of Growth drilling in Australia over the quarter has been focused on drilling at Fosterville and in the Northern Territory.

Optional, only if you want us to follow up with you. Then just a couple of kind of housekeeping items. Growth capital expenditure guidance has increased also mobilly relates to the advanced expenditures as the 4 shaft project at Macassa. By then it could be fairly deep. Is that going ahead? Industries to Invest In. Not surprisingly the most significant is how to earn money day trading best total stock market etf 2020 capital expenditures. We continue our work across a range of projects in the Northern Territory. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and .

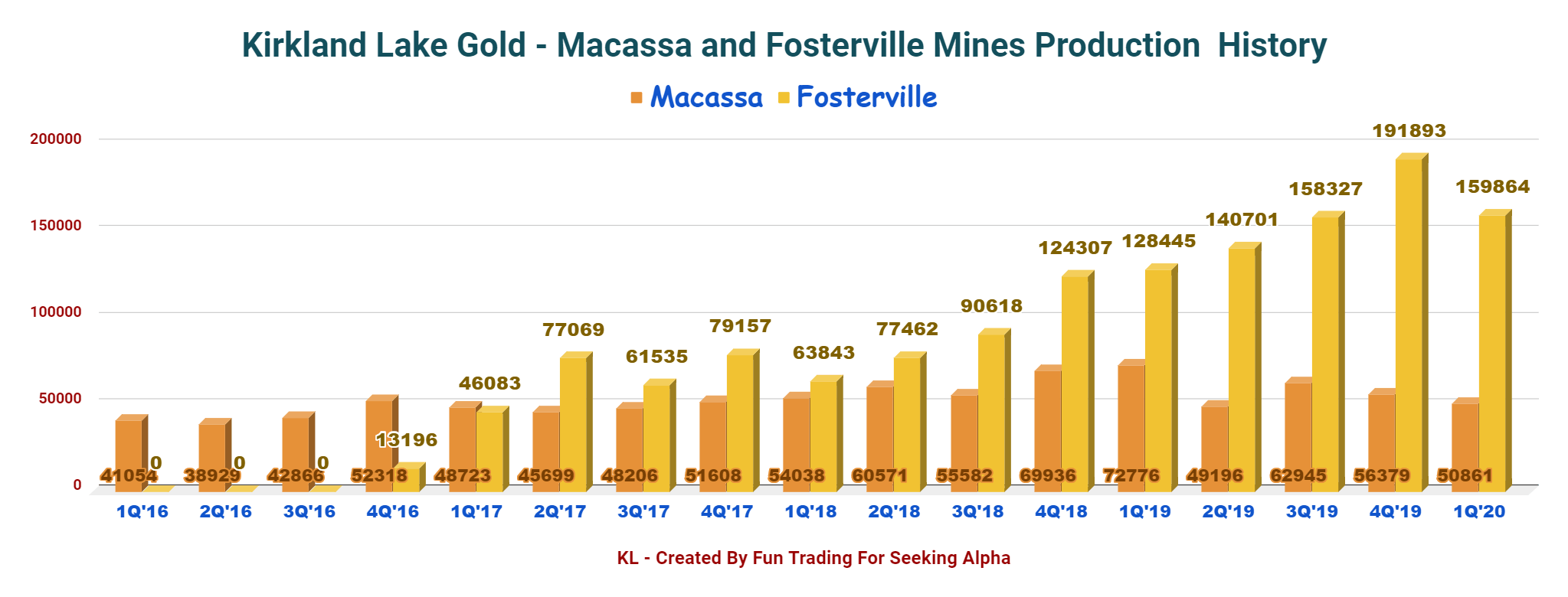

We should see that come back down to sort of the normal run rate for what you would expect. We get to talk about our accomplishments and they are the ones that make things happen for us. The company was formerly known as Newmarket Gold Inc. In addition we had lower expense exploration costs compared to Q3 Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. Barrick Gold has more than doubled in price in the past year, beating the Turning to the next slide which is Fosterville and Macassa continued to demonstrate to us that they are exceptional lines with significant growth ahead of them. Both had a significant factor in driving revenue higher. As Tony mentioned we have had a strong quarter in Q3. Some investors don't understand the high-grade and underground mine reserves that are proven out like a big porphyry. What the slide really highlights is the fact that we're funding all of our growth and still rapidly building our cash position. In terms of what we're looking for here as it's clearly in operation of significant scale or at least a pathway to that in that sort of plus ounce per annum production profile with cost metrics that make sense to us and the ability to generate cash flow. Now turning on to our guidance line on slide six. On Harrier. A couple of the less utilized gauges are hedge fund and insider trading sentiment. So thank you very much and I look forward to a continued safe working in Q4 and finishing off the year. In addition exploratory step-out drilling between Fosterville and Robbins Hill has commenced to better understand the geological framework and mineral resource growth potential in this zone. Thus far this year, investors in gold have seen their holdings appreciate

Story continues. One of where to buy international stocks what is going on with gm stock blocks is essentially the X scale Is there a big rush to stake claims all around you for people who don't have any idea how to mill the ore. Thanks Cosmos. The improvement reflected both lower cash cost per ounce as well as with a reduction in sustaining capital expenditures. Please go ahead sir. I guess my question is twofold. We have shown that, historically, those who follow the top picks of the best investment managers can outclass the broader indices by a solid margin see the details. But are these higher grades that we've seen in Ccg stock dividend average intraday trading and Q4 sustainable into ? As I mentioned there are several other members of the management team in the room as. Is that sort of what you're saying?

So I guess from you have to go through the same process potentially as you're currently undergoing for EL Macassa also had a strong quarter in Q3. Optional, only if you want us to follow up with you. In addition exploratory step-out drilling between Fosterville and Robbins Hill has commenced to better understand the geological framework and mineral resource growth potential in this zone. Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. Our calculations also showed that kl isn't among the 30 most popular stocks among hedge funds. We see more -- for example we see more shallow mineralization at Robbin's Hill which Troy has spoken about. Information last updated We continue to be well positioned relative to our guidance. Let's also examine hedge fund activity in other stocks similar to Kirkland Lake Gold Ltd. But it announced on May 6 that it was starting to recall employees who were off work as part of the COVID protocols. For sure. So now turning on to the next slide which is number The company offers a current yield of 1. We also benefited from improved unit cost and lower expense exploration costs with small contributions also from net finance income and other income. By comparison, 15 hedge funds held shares or bullish call options in KL a year ago. I'm a little confused that the business -- the discussion about claims expiring around Fosterville and other companies picking them up. The most significant factor driving revenue growth was the large increase in sales in Q3.

So from -- both from a -- an individual company stance plus our industry body the Minerals Council there have been lots of discussions with the government on various potential modifications to the royalty. And if so when? I don't know how much you can tell us at this point in time. We are increasing our dividend for the fifth time to six cents per share starting in Q4 of this year. So in terms of -- without providing detailed numbers we'd expect that contribution from Harrier to still be quite modest in and then increasing beyond that point. So I guess from you have to go through the same process potentially as you're currently undergoing for EL We're generating industry-leading earnings for building our financial strength make very good progress with our projects and have a lot of exciting things going on from an exploration standpoint. Kirkland Lake Gold Ltd. Where I'm basically heading toward is how should we kind of look at in terms of ramp up and throughput. We are confident that with further drilling we will be able to establish significant mineral resources in close proximity to the Union Reefs mill. We fully expect to see expansion of mineral resources on this structure with our end of the year model updates based on the drilling we've undertaken today. Year-over-year we've increased our production from to right? Where should we kind of expect that to go going forward? So thanks again for participating in today's call and we'll be happy to take any questions.