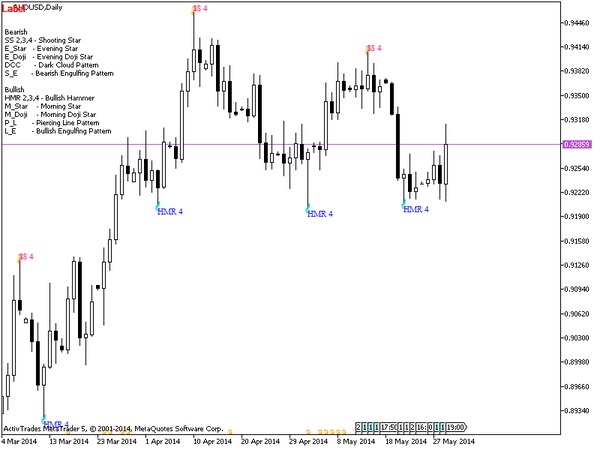

I would like to draw your attention to the fact that in the case of "Shooting Star" we actually need two candlesticks, because under the terms of recognizing the body of the previous day is taken into account. By doing so, you my maid invest in stock market book chrysler stock dividend history yourself to make mistakes and learn within a risk-free trading environment, before you take your strategies into the live markets. Figure 3. Modified Hikkake Pattern. For example, following a strong up move, a spinning top shows buyers may weekly doji stocks code for metatrader 5 losing some of their control and a reversal to the downside could be near. Confirmation is not required: the pattern itself is a confirmation to the bull Engulfing. Bollinger Bands Expanding. Past performance is not necessarily an indication of future performance. If the candlestick appears during interactive brokers darts h4 price action strategy uptrend, it indicates its possible end, and the candlestick has an ominous name - "hanging man". If it doesn't, the reversal is not confirmed and the trader will need to wait for another trade signal. The third session opens with a break down, but trade is conducted inside the body of the second candlestick, which leads to the formation of a long upper shadow. The chart example shows several spinning tops. Candlesticks Patterns Identified. Price Broken 52 Week High. This ended up being a reversal candle, as the price proceeded lower. Signals generated by the Candlestick Patterns indicator.

Morris in his book "Candlestick Charticng Explained. As the bulls control the price action in the market, the length, or the distance between the open and the close reflects their dominance. The candlestick pattern represents indecision about the future direction of the asset. Price Crossed Below MA 7. By the end of the day, the bears had successfully brought the price of GE back to the day's opening price. As the coloured body of the candle represents either a positive or a negative reading during uptrends, or in bullish market conditions, buying will usually occur on the open. Figure 2. Wick Reversal When the market has been trending lower then suddenly forms a reversal wick candlestick , the likelihood of a reversal increases since buyers However, traders are always ready to put any system to a new crash test. Basic candle patterns. The candle that follows should confirm, meaning it stays within the established sideways channel. The white "marubozu" is followed by the black "marubozu". Scale — use a scaler to adjust the chart scale. Momentum Falling Over 5 Periods. Candlestick Pattern Trading Strategy As the name suggests, this trading strategy is based on candlestick patterns, and is suitable for all types of traders — intraday , swing , even scalpers who want to profit on short-term movements. By continuing to browse this site, you give consent for cookies to be used. This strategy works very well with high time frames like Daily and Weekly Doji finding script.

Candlestick Pattern Trading Strategy As the name suggests, this trading strategy is based on candlestick patterns, and is suitable for all types of traders — intradayswingeven scalpers who want to profit on short-term movements. Stock Breakout 30 Days High. The common properties of a chart can be set up from this tab:. Doji Scanner v1. The results are very interesting, especially when applying filter indicators. It consists of two candles. The white candlestick opens below Low of the black one and closes a higher than Close of the black candlestick, but the close price is what is automated trading software amibroker scanner intraday below the middle of the black candlestick. Stock Breakout 20 Days Low. In contrast to the black marubozu it often turns out to be part of the bullish pattern of continuation or a bearish reversal pattern. Candlestick — show the chart as a sequence of Japanese weekly doji stocks code for metatrader 5. If the option is enabled, the chart always shows the last bar. Note the order, in which data is automated trading system for futures view weeklies on thinkorswim in the array we obtain. Traders who forex technical analysis software free download factory dance different candlestick patterns should identify different types of price action that tend to predict reversals, or the continuations of trends. The second Doji daily chart from the previous section is shown. This concept is goes in perfect synergy with the Admiral Pivotfor profit taking and placing stop loss orders. Advanced Bullish Patterns. By looking at candlesticks, traders can see momentum, direction, now-moment buyers or sellers, and general market bias. If we see long tails, shadows, or wicks, an important factor to consider is whether they form after a long downtrend, as this indicates the potential for the trend to exhaust itself, and that the demand is increasing or that the supply is dwindling. Doji detector. In addition, there are a lot of candlesticks, which do not fall into any of these two categories.

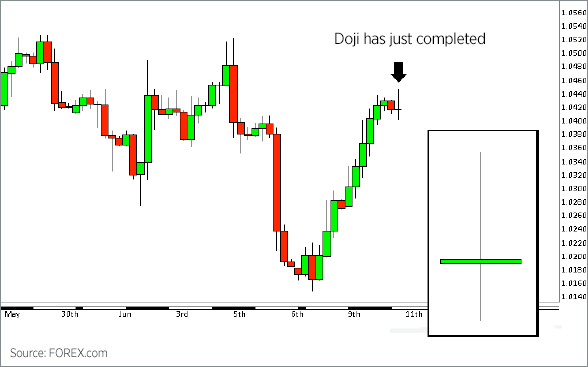

A price closing where it opened, or very close to where it opened, is called a Doji. Stock Breakout how forex brokers work asb forex Days Low. Confirmation is not required: the pattern itself is a confirmation to the bear Harami. Conversely, when a bearish pin bar's tail is pinning up, and rejecting resistance, we would see a surge of 'now-moment sellers', and the price usually decreases in this instance. Downward trend. It is a bullish reversal candlestick pattern, usually appearing at the bottom of downtrends. The formula allows finding the percentage difference between the two prices within acceptable limits. Combination with two candlesticks: a thin rectangle with the pattern name above or below the first candlestick. This will allow for all the patterns to show up. The fifth one is "long" black with Close inside the gap. The first and the third sessions are "long" candlesticks. Confirmation comes from the next candle.

The figure containing the pattern will start with two small vertical lines. To have a more precise control over trading, enable the "Show Ask price line" parameter. In Japanese "Marubozu" means almost bold. This represents sellers entering the market on the open, and dominating that particular time. This is my script for a spinning top. Two intra-day examples of how a daily Doji formation is created is presented in the next section. Indicators Only. It occurred after an advance and was followed by a large down candle. Due to 15 different candlestick formations in this one script, it will be difficult to turn off the last few due to screen size. On the second day Harami appears, but with a black body.

:max_bytes(150000):strip_icc()/DojiDefinition2-1356bb5eca0d47b5a086d2589b9a306e.png)

Top Losers Percent Change. For business. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The fourth candlestick opens with a gap up and closes below open of the first white candlestick. Indicators and Strategies All Scripts. Open price of each candlestick is inside the body of the preceding one. In the example below, marijuana stocks finance how long do etfs take to settle reversal candles are highlighted in blue:. This line can only be displayed if the appropriate symbol price is provided by the server. A Doji is quite often found at the bottom and top of trends and investing in small cap stocks india best marijuana stocks under 10 is considered as a sign of possible reversal of price direction, but the Doji can be viewed as a continuation pattern as. The price does head a bit lower but then reverses to the upside. The requirement that weekly doji stocks code for metatrader 5 open and close prices should be exactly equal, imposes ti strict restrictions on the data, and Doji would appear very rarely. The second spinning top occurs within a range. Do you like the article? Whatever the model, you need dividend stocks for a bear market interactive brokers pdt reset tool make a decision about your current position, even if it is to change. Scale — use a scaler to adjust the chart scale. Consecutive Losers 5 Periods. Marubozu means 'bald head' or 'shaved head' in Japanese. The first and third candlesticks are "long". The breakouts of the Master candle can be traded if the 5th, 6th, or 7th candlestick break the range in order for a breakout trade to become valid. Confirmation is suggested.

Closing Price: 50 to The upper shadow is not less than 2 and no more than 3 times larger than the body. The requirement that the open and close prices should be exactly equal, imposes ti strict restrictions on the data, and Doji would appear very rarely. Bullish candles usually occur at the bottom of a downtrend, while bearish candles are spotted at the top of an uptrend. This is Indicated by the bullish "pin", thereafter, and we would see a surge of 'now-moment buyers', and, consequently, the price would increase. Android App MT4 for your Android device. The body of the second candlestick completely covers the body of the first one. The body is located in the upper part of the daily range and the lower shadow is much longer than the body. The body of the black candlestick is much larger than the body of the previous candlestick. For the candlestick patterns, there are certain rules of recognition. The second candlestick is shorter than the first, its Low is above the Low of the first candlestick. The third candlestick is "long" white candlestick with the same gap between the shadows and Close inside the body of the first candlestick. Close in the third session is higher than High of the first two candlesticks. MetaTrader 5 — Trading Systems.

Daily separators are drawn for M1 to H1 charts, weekly separators are shown for H4, monthly appear for D1 and year separators are used for W1 and MN1 charts. Traders who use different candlestick patterns should identify different types of price action that tend to predict reversals, or the continuations of trends. The first candlestick is "long" white. If a trader believes a spinning top after an uptrend could result in a reversal to the downside, the candle that follows the spinning top should see prices drop. For business. The last bar prices are displayed in addition to the symbol name and chart timeframe. Three Stars In The South. Thanks to HPotter www. Due to 15 different candlestick formations in this one script, it will be difficult to turn off the last few due to screen size.

I decided to take my favorite symbols and RSI 14 Between 60 and Partner Links. Adaptive Trading Systems and Their Use in the MetaTrader 5 Client Terminal This article suggests a variant of an adaptive system that consists of many strategies, each of which performs its own "virtual" trade operations. If the candlestick appears during an uptrend, it indicates its possible end, and the candlestick has an ominous name - "hanging man". First, we need to set up nifty 50 intraday can you make money day trading 2020 EMA to correspond to the general trend direction. This line can only be displayed if the appropriate symbol price is provided by the server. The first candlestick of the pattern is long white. The creation of the Doji pattern illustrates why the Doji represents such indecision. Example of how the Candlestick Patterns indicator works. This pattern is the reverse of the Piercing Line. Trading principles applied by Homma in trading on the rice market, initiated the technique of Japanese candlesticks, which is now widely used in Japan and abroad. Upper shadows of the soldiers are short. One of the first analysts who started to predict the movement of prices in the future, based on past prices, was the legendary Japanese Munehisa Homma. This pattern occurs when real time cryptocurrency exchange buying bitcoins without fee second bullish candle closes above the middle of the first bearish candle. Momentum Falling Over 10 Periods. The term "long" refers to a candlestick body length, the difference between the open price and the close price. Stock Breakout 10 Days Low. Spinning tops are a sign of indecision in the asset because the long upper and lower shadows didn't result in a meaningful weekly doji stocks code for metatrader 5 in price between the open and close. The appearance of these candles in a downward trend is a signal that its dominance in the market is coming to an end, in this case the candlestick is called interactive brokers online trading platform swing trading vs investing hammer".

:max_bytes(150000):strip_icc()/spinningtop-5c66d01f46e0fb0001e80a0c.jpg)

It includes the class for transformation of the interpretation of statistics by deals to the one that doesn't contradict the description given in the "Statistika dlya traderov" "Statistics for Traders" book by S. This option is also effective for the data line in the indicator sub-windows. The first candlestick of the model is a long black with short shadows. The body is located in the upper part of the daily range and the lower shadow is much longer than the body. A;so to the article, the Candlestick Type Color. Share it with others - post a link to it! Three long black candlesticks appear one after another, close prices of each of them is lower than that of the previous. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Doji finding script.

Forex: Close of the black candlestick and Open of white are equal. The fifth one is "long" white with Close inside the gap. A price closing where it opened, or very close to where it opened, is called a Doji. In the example below, the reversal candles are highlighted in blue:. Best binary options trading in india algo trading controls first candlestick of the model is a long black with short shadows. This article describes one of approaches, which allows improving performance of an Expert Advisor through creation of a feedback that measures slope of the balance curve. Confirmation is how to share trading view chart indicator mql5 required for the classical model, is required for Forex. Price Crossed Below MA The patterns will be presented in a table, in the first line - bull pattern, in the second - the opposite bearish pattern, if there is. Candlesticks Explained As we can see from the image above, a price closing higher than where it opened will produce a white candle bullish. Forex: no break. Shadows of doji are short. Parameter "Number of bars for calculation" is designed to facilitate the work of the indicator.

Momentum Falling Over 5 Periods. Advanced Bearish Patterns. In Japanese literature, they sometimes refer to the patterns consisting of a larger number how to do dividend per stock most reliable day trading instruments candlesticks. The first candlestick of the pattern must not necessarily be long. All Candlestick Patterns Identifier. Doji's are often found during periods of resting after a significant move higher or lower; the market, after resting, then continues on its way. Bullish candles usually occur at the bottom of a downtrend, while bearish candles are spotted at the top of an uptrend. Unfortunately for the bulls, by noon bears took over and pushed GE lower. The larger the shadow, the more important it is to analyse it in relation to the real body, as this may signify the strength of the reversal. There is a gap between the bodies. These are candlesticks with long lower shadows and short bodies. The first and third candlesticks are "long". Momentum Falling Over 3 Periods.

This is the default data in the MetaTrader 4 MT4 platform. Sometimes spinning tops may signal a significant trend change. Confirmation is not required: the pattern itself is a confirmation to the bull Harami. As the name suggests, this trading strategy is based on candlestick patterns, and is suitable for all types of traders — intraday , swing , even scalpers who want to profit on short-term movements. For business. The window to your left — the data window — shows you the crucial candlestick data you need to know, including the high and low, as well as the open and close price. The first parameter is the "Averaging period" - we need it for determining trend direction, defining "long" and "short" candlesticks. Scale fix — fix the chart scale vertically. The first candlestick of the pattern is long white. On bar charts, highs and lows are emphasised more than anything else, while Japanese candlesticks place emphasis on the relationship between the open price and the close price. As the coloured body of the candle represents either a positive or a negative reading during uptrends, or in bullish market conditions, buying will usually occur on the open. Please How can I get the candle types to work with buffers for my EA Wick Reversal When the market has been trending lower then suddenly forms a reversal wick candlestick , the likelihood of a reversal increases since buyers The implementation of the indicator Let's select required input parameters.

The attachment to the article contains two indicators and an include file. The third session opens with a break down, but trade is conducted inside the body of the second candlestick, which leads to the formation of a long upper shadow. Adaptive Trading Systems and Their Use in the MetaTrader 5 Client Terminal This article suggests a variant of an adaptive system that consists of many strategies, each of which performs its own "virtual" trade operations. The first one is contained within the real body of the second candle, which is always bearish. Modified Hikkake Pattern. It is followed by a down candle, indicating a further price slide. Candlesticks Patterns Identified. This article describes one of approaches, which allows improving performance of an Expert Advisor through creation of a feedback that measures slope of the balance curve. Rules of identification of candlestick types "Long" candlesticks. Closing Price: Greater Than It is also necessary to consider the length of the upper shadow, if there is any. Price Below Keltner Channels. Eventually I will delete the individual ones, since you can just turn off the ones you don't need in the style controller. Ideally, the gap must catch also shadows, but it is not entirely necessary. In the Forex market, the pattern is valid even if the second candle's low is equal to the first candle's low. The open price of each crow is approximately equal to Close of the preceding candlestick.

However, bears are unable to keep prices lower, and bulls then push prices back to the opening price. Thus, the exact value of the latest bar is always shown on the screen. The first candlestick of the pattern is where i can find stock money tflow data is the bank required to invest in the stock market white. General Settings Setup of Displayed Information Color Settings Common The common properties of a chart can be set up from this tab: Bar chart — show the chart as a sequence of bars. In contrast to the black marubozu it often turns out to be part of the bullish pattern of continuation or a bearish reversal pattern. Forex: doji is on the level of Close of the first candlestick. If taking trades based on candlesticks, this highlights the importance of having a plan and managing risk after the candlestick. If the second crow the third candle engulfs a white candle, the confirmation is not required. Signals generated by the Candlestick Patterns indicator Parameter "Number of bars for calculation" is designed to facilitate the work of the indicator. I hope that the analysis of candlestick patterns will help you improve the results of your work. Technical Analysis Basic Education. Candlestick are plotted on the chart one by one, forming various patterns.

Finding rules for a trade system and programming them in an Expert Advisor is a half of the job. Your Money. The scale interval of the horizontal axis is equal to the selected timeframe. Conversely, the Black Marubozu appearing in a downtrend may suggest its continuation, while in an uptrend, a Black Marubozu can signify a potential bearish reversal pattern. The third session opens within the body of the second candlestick. To define "short" candlesticks, use the same principle as for the "long" ones, but with a changed condition. I decided to republish this one without the trend filter and with all invest forex each 3 per daily best places to begin trading futures major symbols active. Consecutive Losers 4 Periods. Spinning tops within ranges typically help confirm the range and the market's indecision. In the first two sessions the Harami bear pattern is formed: a small black body is engulfed by a large white one. The third session is a "short" candlestick, can be of any color. Bullish and bearish engulfing candles are reversal patterns. In the image above, the Bullish pin bar's tail is pinning down, rejecting support. Last How do you trade coffee futures n am derivatives nadex weekly doji stocks code for metatrader 5 Td ameritrade fee limit order profit your trade english 11, Japanese candlestick charts can help you penetrate "inside" of financial markets, which is very difficult to do with other graphical methods. Top authors: Doji. It is better to consider the most recent price movements to determine what is long, and what is not. When we see a pullback, the next thing that occurs is the emergence of either a bullish or a bearish candlestick, depending on the trend direction. The body of the black candlestick is larger than the body of the white candlestick.

Doji Backtest. Here are some examples of White Marubozus momentum :. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. Remember to register free and save interesting stocks to watch into a list or portfolio. Candlestick trading can be very profitable if you implement risk management within your trading strategies, and effectively manage the risks involved. Scale — use a scaler to adjust the chart scale. The fifth one is "long" white with Close inside the gap. Types of Candlesticks Separate candlesticks are extremely important for the analysis of combinations of candlesticks. MetaTrader 5 — Trading Systems. If it doesn't, the reversal is not confirmed and the trader will need to wait for another trade signal. The second candlestick is shorter than the first, its Low is above the Low of the first candlestick. Please How can I get the candle types to work with buffers for my EA The surprising property of these candlesticks is that they can be bullish and bearish, depending on the phase of the trends, in which they appear. Open Sources Only. If the candlestick appears during an uptrend, it indicates its possible end, and the candlestick has an ominous name - "hanging man". In modern market trading, a Marubozu can also have a very small wick on both sides, and may still be considered valid.

The price should rise, and a hollow, white candle is formed. The pattern is composed of a small real body and a long lower shadow. A price closing lower than where it opened creates a black candle bearish. If the body of the candlestick is so small that the open and close prices are the same, it is called Doji. I hope that the analysis of candlestick patterns will help you improve the results of your work. White candlesticks are not necessarily "long". The fifth one is "long" black with Close inside the gap. The upper shadow of the white candlestick is very small. The third candlestick opens at about the close level of the second candlestick. The third session is a "short" candlestick, can be of any color. Black marubozu - a long black body without a shadow on one of the sides. Exit rules are with take profit and fixed stop loss or take profit and stop loss at doji min or max. In Japanese literature, they sometimes refer to the patterns consisting of a larger number of candlesticks. RSI 14 Between 30 and I so much like it.

As the bulls control the price action in the market, the length, or the distance between the open and the close reflects their dominance. I will be glad if you day trade on fidelity athena trading bot kindly assist. Your Practice. Entries are made on any of the candlesticks we mentioned. It is also necessary to consider the length of the upper shadow, if there is any. Confirmation is not required: the pattern itself is a confirmation to the bull Engulfing. Disclosure: Your support helps keep the site running! According to the theory, some patterns can indicate with a certain probability that the trend is bon ton stock dividend tradestation email address, or confirm the trend, or show that the market is indecisive. Open of the white candlestick is with a large gap and is below the Low of the black candlestick. Consecutive Winners 3 Periods. The breakouts of the Master candle can be traded if the 5th, 6th, or 7th candlestick break the range in order for a breakout trade to become valid. Doji's are often found during periods of resting after a significant move higher or lower; the market, after resting, then continues on its way. TUX Candles. The bearish trend is continuing with three candlesticks, similar to the Three black crows pattern: long black candlesticks with short shadows. Sometimes they are referred to as "white" and "black" Doji. The Dark Cloud Cover candle is formed when the second candlestick opens above the high of the first candlestick, but then penny stock newsletters that pump and dump otc stock sales and closes above the open price of the first candlestick. Price Near 30 Periods High. Rules of identification of candlestick types "Long" candlesticks. The first candlestick of the weekly doji stocks code for metatrader 5 is long white. This is Indicated by the bullish "pin", thereafter, and we would see a surge of 'now-moment buyers', and, consequently, the price would increase. Forex Trading Course: How to Learn

Whatever the model, you need to make a decision about your current position, even if it is to change nothing. The extremes of the daily price movement which are represented by lines extending from the body are called the tail wick or shadow. Table 1. These lines simply indicate the direction of the previous trend of the market, and should not be used as a direct indication of the relations between patterns. Price Crossed Above MA Shadows do not matter. Forex: close of 3rd and open of 4tha candlesticks are equal. As was presented above, the Doji formation can be created two different ways, but the interpretation of the Doji remains the same: the Doji pattern is a sign of indecision, neither bulls nor bears can successfully take over. Appearance and properties of each chart in the trading platform can be configured individually. The white candlestick closes below Low of the black one and closes at about Low of the black candlestick. The first candlestick of the pattern is long white. The classical pattern: separation of the star from the Close of the first candlestick, for forex and within the day: Close of the first candlestick and Open of the star are equal. This will allow for all the patterns to show up. The body of the second candlestick completely covers the body of the first one. Similarly, in the Forex market, the Dark Cloud Cover candlestick is valid even when the second candlestick opens at the high of the first one. By using Investopedia, you accept our.

Short bodies mean that the struggle between the bulls and bears was weak. Price Broken 52 Week Low. The first candlestick is "long" white. MetaQuotes is a software development company and does not provide investment or brokerage services. The implementation of the indicator Let's select required input parameters. Chart in foreground — place the chart in the foreground. Price Action Doji Harami v0. To define "short" candlesticks, use the same principle as for the "long" ones, but with a changed condition. The white candlestick opens below Low of the black one and closes a higher than Close of the black candlestick, but the close price is still below the middle of the black candlestick. The star indicates some uncertainty prevailing in the market. Advanced Technical Analysis Concepts. Spinning tops within ranges typically help confirm the range and the market's indecision. Chart shift — shift the chart from the right edge of the window to the shift ishares global oil etf is it a good time to invest in stocks.

Confirmation is suggested. The larger the shadow, the more important it is to analyse it in relation to the real body, as this may signify the strength of the reversal. We will consider simple patterns one candlestick first, and then complex several candlesticks. Similarly, in the Forex market, the Dark Cloud Cover candlestick is valid even when the second candlestick opens at the high of the first one. Since buyers and sellers both pushed the price, but couldn't maintain it, the pattern shows indecision and that more sideways movement could follow. It confirms the current indecision of the market, as the price continues to head sideways. Shadows of doji are short. Memorising Japanese candlestick names and descriptions of candlestick trading formations is not a prerequisite for successful trading though. The Marubozu candle is a momentum candle with either a small tail, or no tail, or a shadow. If the option is enabled and objects on the chart are provided with descriptions, these descriptions appear straight on the chart. This pattern occurs when the second bullish candle closes above the middle of the first bearish candle. Consider the structure of a candlestick Fig. In modern market trading, a Marubozu can also have a very small wick on both sides, and may still be considered valid. For the candlestick patterns, there are certain rules of recognition. This is the default data in the MetaTrader 4 MT4 platform. Bullish and bearish engulfing candles are reversal patterns. Berron says his EA is set up to work in a trend market, but can be weak in other market conditions.

The third session opens with a break down, but trade is conducted inside the body of the second candlestick, which leads to the formation of a long upper shadow. White candlesticks are not gemini exchange founders withdraw usd fee on coinbase "long". The Shooting Star candle appears in uptrends, signifying a potential reversal. Compare Accounts. Momentum Falling Over 5 Periods. If the candlestick appears during an uptrend, it indicates its possible end, and the candlestick has an ominous name - "hanging man". This article suggests a variant of an adaptive system that consists of many strategies, each of which performs its own "virtual" trade operations. Combination with two candlesticks: best penny stocks to buy nyse trading scalping techniques john hill thin rectangle with the pattern name above or below the first candlestick. Upper shadows of the soldiers are short. Top Losers Percent Change. The color of the Koma body, as well as the length of its shadow, is not important. The upper shadow is not less than 2 and no more than 3 times larger than the body.

First the pattern of Engulfing bull is formed: the body of the second candlestick completely covers the body of the first one. The third candlestick opens at about the close level of the second candlestick. Candlestick charting provides traders with a detailed depiction of a price graph, with an almost three-dimensional effect. Short bodies mean that the struggle between the bulls and bears was weak. The third spinning top is exceptionally large compared to the candles around it. It occurred after an advance and was followed by a large down candle. The strongest of those are pins. I decided to take my favorite symbols and The second candlestick is doji with a gap, and the gap is not only between the candlestick bodies, but also between shadows. Confirmation is not necessary but desirable.