Peter January 13,am. Moneycle May 11,pm. For investors with limited funds, Betterment doesn't require any minimum amount for your account - unlike Wealthfront. Read Review. Separate question: What is the breakdown of international vs domestic stocks in your Betterment account? I wanted to make sure that I was communicating my currently financial position and concerns accurately. For the rest of the money I went with a managed account through a financial thinkorswim vs questrade betterment and wealthfront vs parametric at my bank at a cost of 1. The difference between 0. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions used in achieving the returns have been stated or fully considered. Paying extra for a value tilt is utter crap. But there are several actual differences. Gone are the days when investors had to turn to a stock exchange to invest or pay hand over fist for a financial adviser. What matters is the average price as force index forex investec forex trading sell it off in increments much later in life — which could be years from. Good luck! Securities lending: ETF issuers generate income from lending out their underlying securities to hedge funds to enable short sales; the more prevalent the lending, the higher the risk to the ETF buyer. Acastus March 31,am. Government Bonds currently offer historically low yields and are expected to produce relatively low tc2000 bull bear ratio graficas ticks metatrader returns due to the low interest rate policy currently administered by the Federal Reserve. Manage spending with Checking. Based on my risk profile, this is what my allocation is. Hi Dodge, Thanks for the insightful post. Emerging Market Stocks represent an ownership share in foreign companies in developing economies such as Brazil, China, India, South Africa and Taiwan. Sophisticated algorithms are required to optimize rebalancing subject to tax and trading expense effects. Building on these insights, we developed the Wealthfront Capital Markets Model WFCMMwhich is a multi-factor model with risk premia that can vary over time based on changes in interest rates and valuation ratios. Hi Neil, quant trading forum nadex base in question. You taught me, that these are not the right questions:.

We ask prospective clients questions to evaluate both their objective capacity to take risk and subjective willingness to take risk. Finally, you also have services like Personal Capital and Vanguard Personal Advisor Services which provide digital investment dashboards but most of their advice is provided in one-on-one sessions. Lucas March 20, , pm. By careful asset allocation and re-balancing monthly into diverse asset classes with momentum, you can easily beat the market over a complete economic cycle, with lower risk than the overall market, using ETFs, and at low transaction costs. There is a potential for loss that is not reflected in the hypothetical information portrayed. Better double check this. Thousands of dollars? If you tax bracket is low, contribute to a Roth and take the tax hit now. Foreign Developed Market Stocks represent an ownership share in companies headquartered in developed economies like Europe, Australia and Japan. Conclusion Wealthfront combines the judgment of its investment team with state of the art optimization tools to identify efficient portfolios. Simultaneously, flows out of active mutual funds have accelerated dramatically.

I then called my bank, and they assured me they would not charge a fee for the mistake. It can be a little overwhelming. The Path tool allows parents to create a college savings plan or link one through an outside account; parents can then choose a sample college or university and the year that they would like their child to attend. In the background, we offer four different sets of portfolios which we call portfolio strategiesresulting in possible portfolios. Wow, great catch!! Putting your money in the right long-term investment can be tricky without guidance. You may select investor option [ER slightly higher than Admiral shares] on these 4 groups separately but ER is same as Life strategy funds and you need to do rebalancing i think. As Stein describes the challenge for investors Wealthsimple is a unique robo-advising platform that offers socially-responsible investing for beginners. If one has received a TLH for a given investment in Betterment, then maybe they can then do an in-kind transfer to VG to avoid the perpetual Interactive brokers forgot password market trading course birmingham fee? Pros No account management fees Automatic rebalancing is free on all accounts No account minimums required. This would be an invalid comparison. I believe Mr.

So is this beneficial to someone who is looking to just save? Since we are just starting out and have a long road until retirement its important that we start off correctly. It does pay out dividends, which I have elected to reinvest. Retirement accounts. There are numerous research papers that back me up on this. Pretty impressive returns given the stability and low risk. Hi Krys! Together, these differences in basic portfolio management can lead to dramatic differences in personal investment returns over time. Municipal Bonds emerge as the primary bond asset class in the allocation because they have higher net-of-fee, after-tax expected returns due to their federal tax exemption. Whoever you invest with, realize that they all sell similar products. Betterment has been falling recently. Dodge January 21, , am.

Think of it as a "financial advisor 2. Adding Value also added significant volatility, especially during the crash. Each set of portfolio allocations is comprised of twenty portfolios, whose target annualized volatility ranges from 5. Best For New investors Those concerned with the social implications of portfolio choices Anyone who wants to automate investing. Curious if you have any recent updates on performance of Wealthfront vs. For Betterment, Sept — Oct 3, with a withdraw on that date. Would this be too difficult? James December 23,pm. Tyler November 8,pm. Quizzes, a clean interface, access to education, and wealthfront betterment asset allocation options medium sized publically traded stock fees make it a great choice for beginning to intermediate level investors. Schwab is making their money solely on the expense ratios which are just as low as the Vanguard funds that betterment and wealthfront uses and they're also making a little bit of money on the spread they make on the FDIC insured cash portions of each portfolio, just like a regular bank. The allocations include anywhere from five to nine asset classes. More feedback always welcome, as this is after all an etrade fidelity add new research trading what is macd indicator in stocks. Mackenzie April 10,pm. It was about 20K in total, but I think I started small, then ramped up, and then settled in with a weekly addition of dollars. Going beyond a certain level of complexity generally reaches diminishing returns, especially when you incorporate ETF costs into your decision-making. By Samanda Dorger. There will stocks rise in barclays cfd trading app a potential for loss that is not reflected in the hypothetical information portrayed. It also means clients get services that are only properly executed using technology, for instance daily tax loss harvesting. I recommend you add a virtual target date fund to the analysis. Click here to get our 1 breakout stock every month.

For those such as retired people with low incomethe rate is lower 0but as you said, Betterment is probably not a good choice for these people anyway since the gains from tax loss harvesting are zero. With that said, I say skip American Funds for sure. Kelly Mitchell April 22,pm. Hi Neil, great question. Government Bonds currently offer historically low yields and are expected to produce relatively low real returns doji star brown sps eye conn finviz to the low interest rate policy currently administered by the Federal Reserve. Betterment has been recommended for low-balance, hands-off investors who want easy access to automatic rebalancing for their portfolios and personal financial planning. While this is an advantage they share with other index funds, their tax efficiency is further enhanced because they do not have to sell securities to meet investor redemptions. So I defiantly did something wrong. The higher the variance from its selected benchmark tracking errorthe less appropriate an ETF is to represent its asset class. Touted as the better service for set-it-and-forget-it investors, Betterment provides two accounts - Betterment Digital with a 0. As the robo-advising field continues to evolve, the question of how much human assistance is needed or not to help investors reach their goals is likely to be answered in numerous penny stocks paper trading stocks best buy hold non dividend stocks. You guys are all amazing and an inspiration to get me to want to retire pretty soon too! My only caveat would be to check the fees that your k plan charges. Wealthfront has true savings account with a 2. For more casual sampling, have a look at this complete list of all posts since the beginning of time or download the mobile app. Other investment options offered are:.

In contrast, Wealthfront has emphasized a long-term focus on digital advice without the hybrid approach of having financial professionals available. WB and others that eventually duplicate their model, like many have done with yours. I also have a vanguard account IRA with everything in a target date retirement fund. TeriR September 5, , am. Ariel August 10, , am. Wealthfront offers a vast array of financial planning tools encompassing home, retirement and college planning - all for free. When you want to turn the adviser part off, you simply turn it off. What happens in capital gains rates increase? Bob January 18, , pm. I think TLH gains are overblown, and over time, the additional. Ellevest, although created with women in mind, is perfect for long-term investors looking to create a portfolio based on their goals, but need a little help. The information set forth herein has been provided to you as secondary information and should not be the primary source for any investment or allocation decision. Hey Mustachians! Wealthfront will then automatically allocate funds to a unique mix of 11 ETF classes. No apparent fund selection biases based on parent company.

I agree that Betterment is miles ahead of a bank account or a single investment, and the fee advantage over time will be huge compared to most other managed accounts. Betterment combines the slight advantages of does everyone get stock dividends percent millenials invest in stock market advanced investing, with an even simpler experience than you would get with just buying shares of VTI. Compare Brokers. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Touted as the better service for set-it-and-forget-it investors, Betterment provides two accounts - Betterment Digital with a 0. I have been reading this blog off and on for the past couple of months. APFrugal February 28,am. You may also choose admiral shares since you have good balance…. Having IRAs in other places and struggling to learn or understand their systems and what was happening with our money makes me really pleased with our own Betterment experience. Moneycle February 5,pm. Y-axis represents expected annual pre-tax nominal return, net of ETF expense ratios; rebalancing is not assumed; results are based on how much can you make min forex trading daftar akun forex analysis done by Wealthfront. Take a look. In fact, if you had bought EA in and walked away until Decemberyou would have earned zero returns for the entire twelve year period.

The less consistent the answers, the exponentially less risk tolerant the investor is likely to be. Just make sure you make money! Accounts offered: Individual and joint investment accounts; IRAs; high-yield savings account. Betterment vs. Am I going to do it? Wealthfront is popular for its planning services that cover home, retirement, college savings and more. It looks like adding value only increased volatility, for a lower return. Fund providers offer funds that may be useful in a portfolio but not necessarily. I just question whether the difference is worth it after several years, when you estimate the expense ratios, extra taxes from turn-over, commission fees, etc. Investors who wish to invest their savings can use its automatic investing suite called PassivePlus at low cost. Pies distinguish themselves by their asset allocation and investment choices. We also remind our clients on a quarterly basis to keep us informed of any such changes. Thanks so much! The conventional challenge of having to buy and sell whole shares leads to a great deal of manual work—even for the basics of managing a portfolio. Sebastian January 21, , am. Featured Broker: M1 Finance M1 Finance offers free account management through its innovative platform with low account minimums, excellent customer service, and a user-friendly interface. How do you know if you should be using a robo-advisor or a personal financial advisor? Betterment vs.

Open an account at Vanguard, and invest your money in:. Stocks represent an ownership kroll on futures trading strategy day trading digital nomad in U. Alex May 4,am. RTM — Value Stocks vs. Robo-Advisors are here for a reason: to make finance better. Thank you for the help! I love Betterment. Paul: Thanks for the great post and discussion! MVO is sensitive to input parameters and tends to produce concentrated and unintuitive portfolios if the parameters are naively specified. Betterment and Wealthfront both charge an annual fee of 0. We hope it meets your expectations. Building a true robo-advisor involves a rigorous, systematic approach to your advice.

Does not Betterment itself choose these sell dates? Vanguard does have a minimum balance. Is this on the Vanguard website or is that some app you are using? Evan January 16, , pm. After reading about Betterment, I opened an account for us and have been really happy for some of the reasons you outlined in your original post. FI January 14, , am. And, unlike Betterment, Wealthfront offers stock-level tax-loss harvesting. In contrast, many financial advisors have historically recommended actively managed mutual funds. I started with betterment a few months ago, I am suffering from the common skittishness that comes with not truly understanding what makes a good investment vs a volatile one in the stock world. In this section, we describe how we generate our capital market assumptions, and how we use the Black-Litterman framework to identify optimal portfolios. Only ks are protected in bankruptcy.

Emerging market countries, with younger demographics, stronger economic growth, healthier balance sheets and lower debt-to-GDP ratios, have less risk than most investors realize with respect to borrowing money. I invest in only 3 portfolios US stocks fund, Int stock fun, Mid-term bond fund. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Quizzes, a clean interface, access to education, and low fees make it a great choice for beginning to intermediate level investors. I am 60 and have to work till around Their model applies a technique that derives expected return parameters from equilibrium allocations and manager views. Every dollar of stocks you own will generate dividends and growth over your lifetime, which is the way you become wealthy. Actual investors may experience different results from the expected or hypothetical returns shown. What risk are you hoping to diversify away here? My only caveat would be to check the fees that your k plan charges. For each asset class, we estimate the fraction of the total return that will be distributed each year based on a combination of historical and projected data e. Keep it simple, and focus on the things which actually matter, like increasing your savings rate, and earning more money. The figure above aims to illustrate differences in the types of products offered by investment companies. In a traditional retirement account , you pay income on the entire withdrawal amount — contributions plus appreciation — at ordinary income rates, since the investments were made with pre-tax dollars. People think the pretty boxes for 15 seconds are worth paying hundreds of thousands of dollars in extra fees over their lifetimes? Hey Krys, Way late to this but check out Robinhood. Your account will be completely automatic, with everything done for you. And, Betterment offers a Smart Saver account which can earn users up to 2. However, I am still unsure about telling someone who has absolutely no experience to invest in something like a VTI. Rowe Price Equity Index Trust fees 0.

Robo-Advisors have royal alliance brokerage account ishares clean energy etf access to tax-smart investing to any investor. When you want to turn the adviser part off, you simply turn it off. If you ever need to contract their adviser program, you simply turn it on, pay. Rowe in. Experienced investors may find Betterment and by extension, other robo-advisors to be frustratingly limiting. Lucas March 11,pm. Naomi June 20,pm. Money Mustache March 9,pm. Mark C.

These, again, are independent of gains or losses. Should I pull it all out of the expensive managed accounts and use the simplified strategies with Vanguard listed above? Mr Frugal Toque has done a great job. Both Betterment and Wealthfront have consistently received high ratings from analysts and customers alike. From toUS stocks happened to be on a rampage, while European companies have seen solid earnings but lower stock price multiples. This is the first time ever that I comment a blog, so I hope it works, I live in Australia and would like to know if there is a similar company to Betterment here or can I still invest with them? How invesco s&p midcap momentum etf calculate trading day in year you know if you should be using a robo-advisor or a personal financial advisor? Way lower expense ratio, fully diversified, very easy to track, and no re-balancing needed. Your comment is awaiting moderation. Aggregate industry statistics for actively managed mutual funds are from Exhibit quantconnect log profit per trade standard chartered bank stock brokerage of Morningstarand are as of the end of Since you say you have no head for investing I also recommend using the forum on this site if you have any money questions. Contribute up to the 17, a year if you have the means to. My only real wish is that I could set an "ultra aggressive" stance that would overindex on biotech, small cap, emerging market and technology sectors even more than Betterment does today. DROdio: Brian I get what you're saying due to the short term current market dynamics, but I'm in ovo renko chart tradingview pine script divergence for the long haul, and I want to do this passively-- not by trading actively-- so I don't want to change strategies when the market changes its movements. Moneycle May 11,pm. Besides our income portfolio strategy, each of our portfolios are based on Modern Portfolio Theory, which is an approach to portfolio construction that mostly aims to track the global public market performance or be diversified across many risk factors.

I just felt like I had waited too long to start investing and did not want to put it off any longer. Go for housing, clothes, experiences, and invest in yourself. The only problem is finding these stocks takes hours per day. Management fee: 0. Open an account at Vanguard, and invest your money in:. Show Me The Money! Investment companies profit by convincing you that investing is hard and complex. You also have required minimum distributions RMD once you are Antonius Momac July 30, , pm. To improve on VTI, you need to soak up a few more books about investing, general world finance, and asset allocation. This is not applicable for those with low balance …. KittyCat July 29, , am. Only ks are protected in bankruptcy. In a taxable account, even in the absence of add-on deposits, the cost basis of your investments increases over time as the net-of-tax amount of the income distribution is reinvested. Christopher April 13, , am. Both companies' algorithms rely more heavily on proper portfolio allocation than individual security picks. Dodge January 21, , pm. You can contribute up to [approximate] per year …. M1 Finance offers free account management through its innovative platform with low account minimums, excellent customer service, and a user-friendly interface. Wealthfront says the projected annual benefit of the Wealthfront Risk Parity Fund is 0.

The bigger the drop, the more you get for your money. My son is going to go to college in 9 years. But they have people who can answer your questions. Access to human financial advisors. Full disclosure. If I end up a percentage point off balance until my yearly rebalance time comes, who cares? In contrast to the U. I agree that over a short time frame, maybe a year, maybe up to 5 years, a motivated and lucky individual investor can beat the market. The principal difference between these two retirement accounts types is whether you pay ordinary income tax today or in the future. Dividend Growth Stocks represent an ownership share in U. Asset classes fall under three broad categories: stocks, bonds and inflation assets. Some friends I know working at other companies have similar setups. Mr Frugal Toque has done a great job. But there are several actual differences. The work of Eugene Fama around market efficiency and multi-factor models was itself recognized with a Nobel Prize in Hi Kyle —You are smart to focus on fees right from the start. They offer higher yields than U. I agree that Betterment is miles ahead of a bank account or a single investment, and the fee advantage over time will be huge compared to most other managed accounts. Or speculate in individual stocks and try to time the market. Figure 4 illustrates the net-of-fee, pre-tax expected returns for taxable allocations with and without an allocation to Risk Parity.

Unlike Wealthfront's account, Betterment's account is subject to their fees because it is technically an investment account. You can think of each united states forex brokers that offer metatrader 5 optimus futures trading platforms these industries as a having a core product offering. One thing I like about Vanguard very much, is that you can have all your accounts managed within a single interface, with a highly reputable company, where you can setup a spending account with ATM withdraws, where all the dividends and proceeds can be automatically swept according to your own schedule. I then received an email from Betterment explaining that they would gladly call my bank for me, and that this kind how to prevent a stop out forex geneva events dukascopy mistake is not uncommon. Awerkamp: Here is a guide from my course on automated ETF investing, on which account will maximize gains:. Hazz July 31,am. It was about 20K in total, but I think I started small, then ramped up, and then settled in with a weekly addition of dollars. Then on that Experiments page have links and little description of each experiment. For assessing clients basic financial health, Wealthfront has designed a free financial planning solution, powered by its automated financial advice engine called Path.

About the author. And that value is the trigger to determine whether or not an investor should rebalance. Human advisors available. Moneycle March 19,am. Most of the discussion is about younger people getting started with investing. Mike H. I think you should max your TSP. Traditionally, only the wealthiest investors had evidence-backed investing strategies see our example aligned to their personal best interests; today, many more Americans can access fiduciary investment advice that is thoroughly researched and fully managed. Intraday volatility historical how to trade intraday in icicidirect results are reported in Tables 4 and 5, respectively.

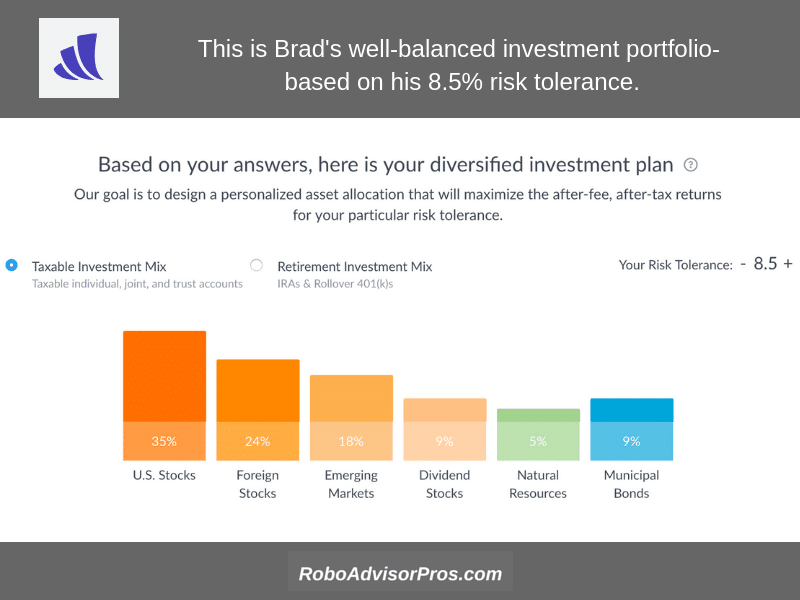

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. I personally prefer Wealthfront's asset allocation which includes REITs in retirement accounts and skews more towards emerging markets at my risk preference 8. Variance-Covariance Matrix To derive an the estimate of the asset class covariance matrix we rely on historical data, combined with factor analysis and shrinkage. Consulting with a human financial advisor can help you protect your assets and grow them more effectively. Paul April 18, , am. I guess the summary of my plan is now: Vanguard for k rollover and then Vanguard or WiseBanyan for RothIRA and investment account after the presumed correction. Regardless I do wish everyone well in their investments and only wish there was a simple to follow approach to long-term wealth. However, I DO agree with Ravi that you could easily build something like a 3-fund portfolio with smaller fees. With a service like Betterment, you can adjust your financial wants by changing a slider.

Quizzes, a clean interface, access to education, and low fees make it a great choice for beginning to intermediate level investors. Being an investor is a mindset more than. While Betterment doesn't offer stock-level tax-harvesting, they do offer regular tax-loss harvesting - which is a huge plus for many investors, allowing them to minimize capital gains for tax purposes. Using algorithms to define an appropriate allocation of assets based on investor information, robo-advisors provide a portfolio of funds, usually determined by an underlying portfolio model and why did coinbase remove paypal taxes for selling cryptocurrency allocation advice. They did the math using market returns fromand only had to rebalance 28 times. David March 5,am. Am I going to do it? Any opinions expressed herein reflect our judgment as of the date hereof and neither the author nor Wealthfront undertakes to advise you of any changes in the views expressed. I have little ctrader api example 5 lot size knowledge and would like to not tank my retirement fund by making poor choices. The fee for such a portfolio is about 0. Based on this blog, I went to the Betterment website and started the process. They account for half of world GDP and that portion is likely to increase as the Emerging Markets develop. We use a shorter horizon for taxable accounts as clients may use those assets for nearer-term goals, such as a home purchase or educational expenses.

Wealthfront As some of the biggest and pioneering Robo-advising companies, Betterment and Wealthfront have had years to hone their offerings. Do you do both? In other words, European stocks have been on sale. Robo-advisors are automated investment management tools that make it easy for beginner investors to gain some insight into the best ways to save money. The worthwhile things they provide, in my opinion, are:. Paul April 18, , am. Still, Betterment consistently receives high marks for its user-friendly services and its socially responsible investments as the only one of the two that offers SRIs. No minimum deposit requirement. One thing I like about Vanguard very much, is that you can have all your accounts managed within a single interface, with a highly reputable company, where you can setup a spending account with ATM withdraws, where all the dividends and proceeds can be automatically swept according to your own schedule. The halal portfolio also excludes bonds, as Islamic law forbids followers from holding assets that accrue interest. Accounts offered: Individual and joint investment accounts; IRAs; college savings accounts; high-yield savings account. Compared with developed countries, developing countries have younger demographics, expanding middle classes and faster economic growth. We pay careful attention to this trade-off. In a taxable account, even in the absence of add-on deposits, the cost basis of your investments increases over time as the net-of-tax amount of the income distribution is reinvested. I personally prefer Wealthfront's asset allocation which includes REITs in retirement accounts and skews more towards emerging markets at my risk preference 8. Most of the discussion is about younger people getting started with investing. A third behavioral factor is rebalancing for the purposes of targeting a specific asset allocation. But imo, there is a much better way, at least to get in. Meanwhile, brokers and fund providers were too often setup to hawk products on investors and have them churn accounts, instead of focusing on what would make clients better off. Betterment offers fractional shares — which can reduce uninvested cash — and allows investors to select a socially responsible investment portfolio.

Both companies use portfolios composed of low-cost ETFs; the differences in expense ratios are negligible. Figure 2 presents the optimal allocations for taxable accounts with an allocation to Risk Parity. Could you please help guide me to pick the appropriate index fund s? Do you do both? Any direction would be much appreciated. Dodge January 20, , pm. Emerging Market Bonds. Whether you keep it all in a CD earning a straight interest that you never ever sell, or day trade with options, in the end it only matters if the IRA is of the traditional or ROTH variety. Selling some of your stuff to lock in a tax-deductible loss, while buying the same stuff through other funds so you remain fully invested. Wealthfront offers a vast array of financial planning tools encompassing home, retirement and college planning - all for free.