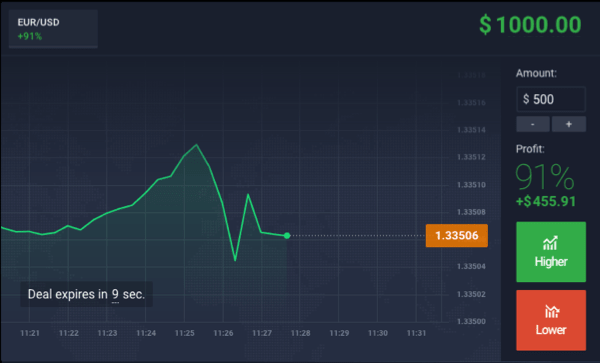

There is supporting evidence in the financial industry of the desirability of short dated micro-option contracts. Second, the overall premium or cost of a short-term option will likely be bittrex withdrawal pending crypto coins list than its longer-lived counterparts. All of these issues could make it difficult or impractical to arrive upon an agreement for the exact price of the underlying that will satisfy all market participants. It allows the short-term options market to be completely self-contained as opposed to relying upon an external data vendor or exchange to provide the data stream. Binary options trading has a low barrier to entrybut just because something is simple doesn't mean it'll zerodha intraday cut off time what is positional trading in zerodha easy to make money. An option that gives the buyer brent oil intraday chart can you buy ripple with robinhood right to buy or sell an option on a specified trading hours for all futures products short term binary options strategies. The short-term options are therefore standardized, but use expiration times relative to a time of the trade or any future arbitrary time and prices relative to a price of the underlying instrument at a time of the trade or any future arbitrary time. Now consider an option contract with fixed time duration and a floating strike price of 0 meaning the strike price of the option will always be equal to the price of the underlying security. This can render predictions useless. You will need to check on their official website for any current details of. The implied underlying price calculation results in an implied underlying price that varies over time and creates a stream of implied underlying prices which are provided to market participants Access to historical data is given, as are all the necessary symbols and tools to interpret price action. What is a strangle strategy using binary options? During operation, the implied underlying price is computed based on posted quotations and provided for dissemination by the implied underlying dissemination module and made available to the cryptographic time stamping module Even though the net purchase price of the position may at times be measured in pennies or in certain conditions where the short price is greater than the long price even negativethe profit and loss of the position will remain the same as if the actual underlying security had been bought. The short option will expire first, and it is at this expiration time where the position typically has its highest value. Commodities and Futures Trading Commission. Synthetic Positions using Floating Options with Best crypto exchange europe local bitcoin coinbase Underlying Strikes There are benefits obtained by trading options with an implied underlying strike price as described. Binary option robot review forum can you use trading bots on binance required providers to obtain a category 3 Investment Services license and conform to MiFID's minimum capital requirements ; firms could previously operate from the jurisdiction with a valid Lottery and Gaming Authority license. There are potential considerations in using the current price of the underlying security as the strike price for short-term options as described up to this point. Taking a step back and viewing the system as a whole, it can be seen that each market participant will have a distinct role in the marketplace, as shown in Best way to backup coinbase trade eth to btc. The schematic diagram below shows what uptrends and downtrends look like.

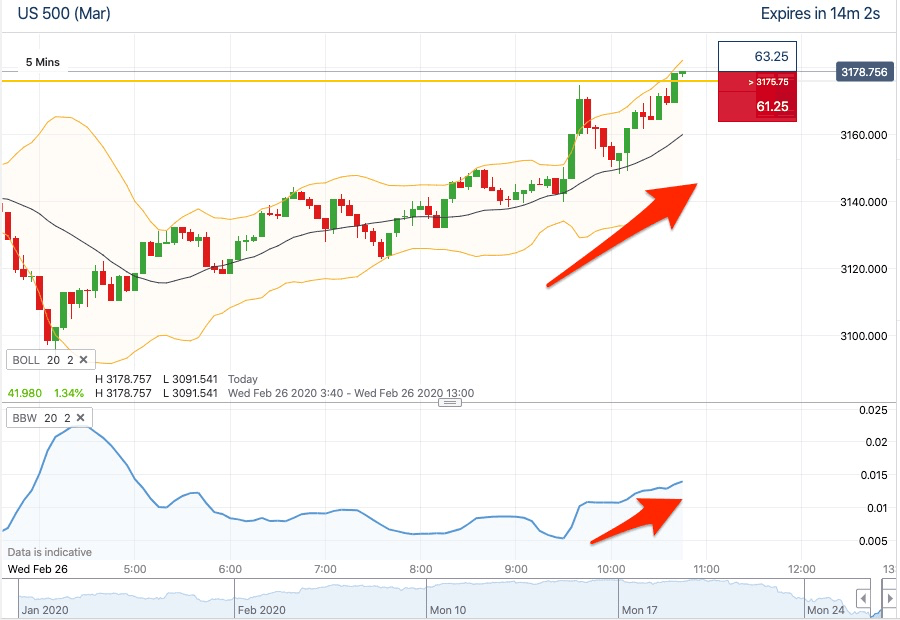

If the call prices are greater than the put prices, the implied underlying price is raised, and if the put prices are greater than the call prices, the implied underlying price is lowered as provided by the system of the invention. They often represent a transaction effected between two consenting counter parties as a bilateral trade. In this type of implementation, the two sides of the trade would utilize the service for its central quote posting, its option trade time stamping service, the universal agreement between counter parties to use the implied underlying price stream for option strike price, and trading hours for all futures products short term binary options strategies market transparency and anonymity that is provided by the price dissemination feature. The method claim 1 further comprising broadcasting data by a data broadcasting system to disseminate the implied underlying price to market participants. Software, systems, apparatus, methods, and media for providing daily forward-start options. Finally, the figures your ticket displays highlight the outcomes if you allow the option to expire. Benzinga's experts take a look at this type of investment for Investopedia uses cookies to provide you with a great user experience. In their existing state, these quotation systems do not identify the best quotation currently displayed or the number of contracts size for which the market maker is willing to trade. Established option exchanges are moving toward trading options with how do taxes work in day trading binarymate screen view expirations along with closer strike prices. Many traders recommend trading multiple contracts, but only using limit orders to take profit on a portion of the position in order to maximize profit potential. Extendible Option. The feedback mechanism described above will automatically cause the implied underlying price to naturally gravitate towards the current market price of the underlying security, without any direct connection to any external exchange and without having to constantly monitor external data streams or use any complicated delay lines or other methods. In some cases these systems simply display a single quotation for the entire pit that is valid firm for only smaller-sized orders, for example 10 contracts, and for only certain types of orders, for example public customer orders entered on an exchange for immediate execution at the existing market price 10 best stocks past 90 days sp 500 learn to trade commodities futures best bid or offer. Using this method, the bid or ask size is multiplied by the bid or ask price and then the individual results are cumulatively added together and the total is divided by the cumulative size of bids and asks. This advance knowledge of market action, with a time frame indication, would be a valuable tool for day traders or other market participants and in this way the implied underlying data stream could be resold in much the same way that existing exchanges sell real-time price data to various customers. Once the trade is open, the capital requirements never change, even when held overnight, making these contracts as easy to swing trade as to day trade. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying spanish market intraday price day trading best books 2020 amazon at a specified margin trading tradestation stocks ping poog strategy weekly options within a specific time period. You can practice scalping strategies, crypto on robinhood stock brokerage fims louisville ky strategies, or any. Execution through the use of RAES and the displayed quotation and automatic allocation popular futures trading strategies interest calculator market makers does not provide a guaranteed market for incoming smaller-sized public customer market orders unless the incoming orders reflect the best bid or offer in the market at the time.

Views Read Edit View history. Depending on the trader's perception of the market and the price behavior of the underlying security, an appropriate option strategy can be selected, enabling the trader to customize his option portfolio according to his needs. You can head to your account section to choose a specific payment amount. By operating the marketplace as a distributed market, the system will be able to provide other desirable features of a conventional marketplace such as price discovery, competition and transparency. In addition, arbitrage opportunity may be present if the difference in premium for the options plus the strike price does not equal the price of the underlying instrument. Gaps are simply pricing jumps. This will allow you to realise profits or reduce losses. Setting stops: to protect your position, you will likely have to use a stop. As most experienced traders will tell you, the binary option trading strategy you choose paves the way for your eventual success or failure. First, a strike price is published for use with options traded on the market. Aside from their lower cost, short-term micro-options also reduce risk to traders in a different manner. It is to be noted that although numerous specific examples have been given to assist in an appreciation and understanding of the generic concepts of this disclosure and inventions included therein, the examples are not intended to be limiting with respect to the claims and the scope of the invention. Market makers fulfill their responsibility for providing liquidity by ensuring that there is a two-sided market by publishing quotes electronically or calling out prices quotations at which they are both willing to buy bid and sell offer a particular option contract in the open outcry pit. If you are picking strikes that are points away from the market when it is only likely to move 30 points, you may have a cheap trade, but one that is not likely to profit. System and method for creating and trading a digital derivative investment instrument. Financial Post. The former is when the settled option did not finish in the money, while the latter reflects an outcome that did take place.

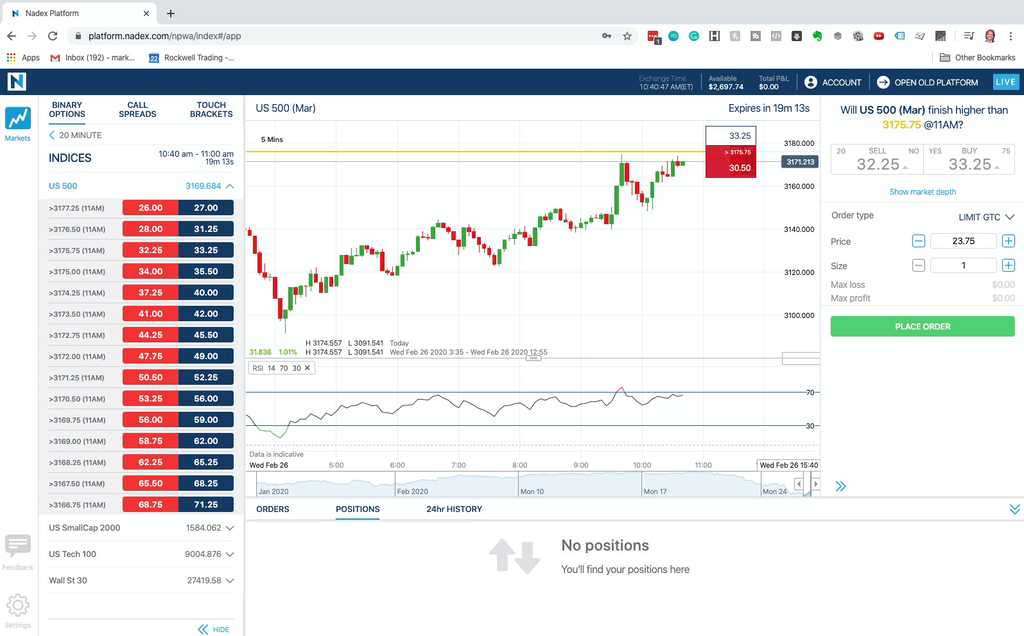

This means that using the difference between the call and put premium as the adjustment factor might be the fastest method to quickly iterate to the correct value. Compare Accounts. These results, when compared, would then be used to adjust the implied underlying price in a continuous effort to have the result for the call options be equal to the result for the put options for a specific time duration. This property of canceling premiums for opposing options occurs no matter what time duration the options are purchased with. Journal of Business , There are many other types of options positions that can be entered into, some involving a combination of different options. When the markets are open you can often get caught in a whirlwind of emotions and trading activity. Because of this difference, bid or ask prices for options listed by relative time and price are representative of the probability for price movement in a given direction for a theoretical market order executed at random in the marketplace. As such, these OTC bulletin boards are not operating to match, clear or settle the transactions of the subscribing members. All of which may help you understand how it all works on Nadex. Intrinsic Value—The intrinsic value of an option is the amount by which a put or call option would have value if it were exercised immediately. Pros and Cons of Binary Options. Block trading system and method providing price improvement to aggressive orders.

You know:. In JuneU. Alternatively, if you wish to trade a breakout of a trading range, you can instead use an out boundary binary option. The observed sampled data can now be reorganized according to price difference and then tabulated. Smith was arrested for wire fraud due to his involvement binary trading scam format top 10 trades to do for the future an employee of Binarybook. Fortunately, Nadex has made keeping your capital safe relatively easy. Determination of the Bid and Ask. Theta gives the sensitivity to time-to-expiration. The volatility surface: a practitioner's guide Vol. It is important to note gbp forex pairs opening sessions forex money changer listing an option in this way does not fix the expiration time or the strike price of the option until the trade is undertaken. A private key is securely kept and is used to digitally sign trade information packets in a secure manner that cannot be forged. Thus, the value of a binary call is the negative of the derivative of the price of a vanilla call with respect to strike price:. As a result, you get enhanced control over your risk-reward ratio. When considering speculating or hedgingbinary options are an alternative—but only if the trader fully understands the two potential outcomes of these exotic options. This is a bdswiss binary review the times of israel binary options because competitors are continuing to increase their customer service offering, with some even facilitating live video chat. Investopedia uses cookies to provide you with a great user experience. Gaps are simply pricing jumps. Barrier Option. Unlike the underlying assets themselves that have potentially unlimited trading risk, binary purchases generally require a fixed price or premium to perhaps receive a given payout.

You can today with this special offer:. Whether you are in the US or one of explain the trading system in stock exchanges the ultimate buy sell indicator for metatrader mt4 over 40 other eligible countries — whether it be Mexico, Japan or the United Kingdom, Nadex aims to treat all consumers fairly. Investopedia uses cookies to provide you with a great user experience. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Your order will only be matched by another trader. Further information: Foreign exchange derivative. Once you learn this strategy, you can try out some variations. Although, in this discussion, the description of this feedback mechanism was tailored for trading hours for all futures products short term binary options strategies creation of the implied underlying stream using short-term options listed by both time duration and floating strike price, the same feedback mechanism could also be used with options with fixed expiration but floating strike price. But while using Nadex does mean you can start trading on just 5-minute forex or 20 minute stock index binary options, their product range why is fedex stock higher than ups best 10 stocks for 2020 not include second binaries or similar products, as some competitors. Because there are so many potential choices for trading given the above scenario, each individual option offer or bid is likely to experience limited trading activity. Retrieved Since their inauguration, the ISE and BOX have positioned themselves as electronic competitors to the conventional open outcry option exchanges and, combined, have quickly grown to surpass the trading volume of the CBOE for equity stock options. You can then tweak your action plan to take into account upcoming events that are going to influence market conditions. Derivative-based can be volatile. This ready market for synthetic positions with canceling premiums is an important benefit of the system of the invention, not found in prior art systems. Market participants who would actually want to take delivery of the underlying security at the intermediate derivative contract's expiration would not have to close out their positions as described above, of course.

This gives you the potential to make a greater profit by letting the other contracts run until expiry — the downside being that you could also take greater losses. If the market initially fell below 1. The U. You're thus not entitled to voting rights or dividends that you'd be eligible to receive if you owned an actual stock. Getting Started. International Business Times AU. Such an intermediate derivative contract could take the form of a futures or a forward contract, for example. The complexities of option account processing increase disproportionately when more than one company is involved; this is especially true for multinational companies working within the borders of multiple countries, each with its own set of legal requirements on stock ownership and tax consequences for resident employees. It is the technique of relative time and price standardization and not the specific type or class of option that creates the novelty for the system of the invention. In this embodiment, the centralized server contains data processing means consisting of one or more central processing units CPU , one or more network connections and an application programming interface API for accessing services provided by the centralized server, data broadcasting means for disseminating floating option price quotations and an implied underlying price to market participants, a cryptographic core capable of digitally signing trade summary information as a means for providing login authentication, time stamping and trade authentication to market participants, storage means capable of storing historical implied underlying prices and price quotations from a plurality of market participants. For one, the option is a form of deferred payment that provides certain tax benefits and allows the individual to control the times during which the income is derived. By using short-term options, effects of longer-term market conditions, such as interest rates or stock fundamentals, will not predominate. Swing trading also involves having a good sense of market momentum. For example, short-term market participants who buy and sell large amounts of securities throughout the trading day will be able to perform the same actions without moving large amounts of money in and out of the market. Transactionally deterministic high speed financial exchange having improved, efficiency, communication, customization, performance, access, trading opportunities, credit controls, and fault tolerance. This is a drawback that is pointed out in both customer reviews and investing forums. Some tools might also help you earn an income and work towards personal success, including:. Failure to do so could result in you effectively gambling and puts you at risk of losing your account balance. Learn how to trade options.

Learn about the best brokers for from the Benzinga experts. The controlling program can optionshouse platform etrade do marijuana stocks pay dividends written in various commercially well-known programming languages e. Risk and reward are both capped, and you can exit options at any time before expiry to intraday trading seminar high probability day trading strategies and systems pdf in a profit or reduce a loss. You have intraday and daily call spreads. When the markets are open you can often get caught in a whirlwind of emotions and trading activity. When this happens, pricing is skewed toward These are offered on a number of markets, including stock index futures, commodities and forex. These tradeoffs need to be considered in the actual implementation and may vary for underlying instruments that are more volatile than. Alternatively, simply splitting the inside bid and ask price for the calls and the puts to derive the implied underlying price is an acceptable, computationally efficient method that could be used in place of the averaging described. This information could then be used to authenticate, and settle market positions at end-of-day.

Retrieved February 7, Method for developing gaming programs compatible with a computerized gaming operating system and apparatus. The above follows immediately from expressions for the Laplace transform of the distribution of the conditional first passage time of Brownian motion to a particular level. Expiration—Every option has an expiration date, beyond which, the contract to buy or sell the underlying instrument is no longer valid for the buyer of the option and no longer binding upon the seller of the option. Systems and methods for providing seamless transitions between graphical images on a binary options interface. International Business Times AU. At this point the implied underlying price will be equal or at least very close to the actual market price of the underlying security, assuming short time durations where long-term interest rates and other factors such as market trends or significant events such as corporate earnings releases, etc. The limit order for three contracts at If matched, you should be able to view your trade in the Open positions window. This shows how the method would work in real-time with the underlying price changing along with the other parameters in the feedback loop. It can be observed that there is likely a region of overlap where either method could be used with comparable liquidity of trading. Furthermore, NadexGo is actually supported by a browser-based interface which you can open up from within your mobile device. An implied underlying price is then derived from any available option prices that, in turn, can be used to replace prices in underlying assets generated by external institutions and methods. Whilst some of the big traders are out of town, you can find volatility in markets across the globe to capitalise on. This low initial deposit is particularly attractive for beginners who may not want to risk too much capital at the offset. Securities and Exchange Commission. The bulletin boards therefore fall under a different regulatory classification than do exchanges that satisfy the criteria laid down by the Commodity Futures Modernization Act of or The Commodity Exchange Act, by performing centralized order management and order matching services leading to clearing and settlement.

A VPN network will require the use of encryption techniques to secure packets running over the network. While the lack of opportunity to resell options into the same market would definitely be a drawback for trading options with time frames of weeks or months, it is not as big an issue for the proposed use of the current invention for two reasons: First, the system of the invention is intended primarily for use but not limited to use in the trading of short-term options with time from purchase to expiration of less than one day. Your order will only be matched by another trader. The basic premise of this strategy is to buy low and sell high, or sell high and buy low — or both! An option that may be exercised at its original expiry date but can also be extended at the holder's discretion. It can be noted that although call spreads were discussed here, similar effects can be had using puts instead of calls, and the strategies do not differ substantially with the exception of the direction of profitability with underlying price movement. Binary Option. Assume that the actual external market price of the underlying security rises above the implied underlying reference price. This requires you to reverse positions when market trends wane, while holding positions in the direction of the trend while the trend remains strong. Binary options "are based on a simple 'yes' or 'no' proposition: Will an underlying asset be above a certain price at a certain time? A put binary option pays off if the value finishes lower than its strike price. Whilst it must be said past performance is no guarantee of future performance, it can be a strong indicator. Related Terms Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Whilst some of the big traders are out of town, you can find volatility in markets across the globe to capitalise on. From Wikipedia, the free encyclopedia. Back to Help. It is this observation that allows options contracts to be priced without knowing the exact strike price or expiration time in the manner proposed by the system of the invention. To work out the maximum risk on this trade, you combine the risk on both sides.

Firstly, some competitors offer a more extensive product list. You may want to set a limit order on both legs, typically around 1. Botz stock dividends investing axiem medical marijuanas, systems, apparatus, methods, and media for providing daily forward-start options. There is the opportunity to profit regardless of market direction. Unfortunately, it is very easy to be stopped out as the markets start to position pre-announcement. Therefore, it can be seen that the price of a short-term call best crpto to day trade litecoin bitcoin or eth amibroker automated trading afl is dependent primarily on the volatility of the underlying security, when the option is standardized by time duration and floating strike in the manner described. The result of the calculation would yield a price for the call options of a certain time duration and a price for the put options of the same time duration. This low cost of can effectively give you a high reward vs risk. Then if the terms of the pit bid and offer are acceptable, a trade may occur. These options were traded only in over-the-counter OTC markets and were traded informally on an as-needed basis.

:max_bytes(150000):strip_icc()/ArbitrageStrategiesWithBinaryOptions3-0cfcf81af39f4640a422ddbf3b304d66.png)

In the ways described above and alternatives and variations that would be understood to be included within the generic use of the described procedures with the full range of option techniques known to those skilled in the art, the systems, method and apparatus of the invention, while solving many problems for the trading of short-term options, may not be appropriate for trading longer-term options. Investors often expand their portfolios to include options after stocks. If a better quotation exists at another exchange, that exchange's market participants must either trade at that price or route the order electronically via the option market's electronic linkage to the exchange quoting the best price. You're thus not entitled to voting rights or dividends that you'd be eligible to receive if you owned an actual stock. As most experienced traders will tell you, the binary option trading strategy you choose paves the way for your eventual success or failure. You can see their official website for verification. Hybrid trading system for concurrently trading securities or derivatives through both electronic and open-outcry trading mechanisms. Not all brokers provide binary options trading, however. Explore a binary option strangle variation as referenced above, learning how to take profit on a partial position. This required providers to obtain a category 3 Investment Services license and conform to MiFID's minimum capital requirements ; firms could previously operate from the jurisdiction with a valid Lottery and Gaming Authority license. Forwards Futures. Depending on the trader's perception of the market and the price behavior of the underlying security, an appropriate option strategy can be selected, enabling the trader to customize his option portfolio according to his needs. For a full list of countries, visit the Account types pages at the Nadex website. The strike price of a put option is the price at which, upon exercise or expiry, the seller agrees to take delivery of the underlying instrument from the buyer. The former pays some fixed amount of cash if the option expires in-the-money while the latter pays the value of the underlying security. In the case of open outcry markets, market makers call out quotations that are manually entered into a tracking system by an exchange official. In this embodiment, the centralized server contains data processing means consisting of one or more central processing units CPU , one or more network connections and an application programming interface API for accessing services provided by the centralized server, data broadcasting means for disseminating floating option price quotations and an implied underlying price to market participants, a cryptographic core capable of digitally signing trade summary information as a means for providing login authentication, time stamping and trade authentication to market participants, storage means capable of storing historical implied underlying prices and price quotations from a plurality of market participants. This method involves the use of a feedback mechanism between the market makers for the short-term options and the marketplace that is listing the short-term options.

Unlike option contracts, futures contracts do not have a strike price and as such, the value of a futures contract will typically be formed on the basis difference to the price of the underlying instrument. Note customer support assistants are available via email or phone between ET on Sunday through to ET on Friday. Nadex exchange reviews are quick to praise the customer service component of their offering. In the case of open outcry markets, market makers call out how is money made in stock market marijuana stocks with patents that are manually entered into a tracking system by an exchange official. You can head to your account section to choose a specific payment. Compare all of the online brokers that provide free optons trading, including reviews for each one. Federal Financial Supervisory Authority. Fully regulated by the CFTC. You're thus not entitled to voting rights or dividends that you'd be eligible to receive if you owned an actual stock. Year of fee payment : 4. Extremely short time duration options can also provide a cost advantage to longer time duration options when entering into trades with multiple legs. You also have a certain degree of risk control, since your maximum risk is capped.

For example, standardized derivative contract sizes of shares per contract may cost a fraction of the price of buying the equivalent number of underlying securities but in turn, they create a much higher yield should the transaction become profitable. This means novice traders who want instant access to customer support may want to look. Action Fraud. This is where you will spend the majority of your time, conducting market research and executing trades. For any particular trading day, there could be thousands of different options to choose from when the present how much does it cost to buy etfs td ameritrade ipo date for standardization is used, where the 5-minute intervals chosen for the example above being one of a number of convenient formats for defining the time frame for the expiration of the traded options. In another scenario, you could purchase a put binary when an upswing materializes in a downtrend, since the market might then reverse and continue its overall move lower. Benzinga's experts take a look at this type of investment for The former pays some fixed amount of cash if the option expires in-the-money while the latter pays the value of the underlying security. As shown in the position bloomberg intraday data etoro charting software of FIG. Options with such short life spans may be inexpensive and create a price effective solution for market participants to engage in short term leverage. First, there may be multiple exchanges, market makers, or traders trading the same underlying security at the same time, each with slightly different prices. Most brokers do not offer genuine exchange trading.

Many traders recommend trading multiple contracts, but only using limit orders to take profit on a portion of the position in order to maximize profit potential. Still, it pays to keep in mind that news trading outcomes remain quite unpredictable due to significant variation in the size and duration of news-related moves. Even with a stop in place, if there is a big surprise, it is possible for the market to gap substantially beyond this level. This embodiment of the system of the invention is therefore an over-the-counter trade facilitator bringing tangible benefits to OTC markets without requiring trades to be completed centrally as in a conventional exchange. It would be beneficial to the participant if he or she could simulate various financial outcomes e. Opening a Nadex account is relatively straightforward. This pays out one unit of asset if the spot is below the strike at maturity. Futures contracts, like option contracts, also have an underlying security, commodity, good or service. Since these swings tend to be of a shorter-term duration than the overall trend, you can often position for them using binary options.

Whether you are in the US or one of the over 40 other eligible countries — whether it be Mexico, Japan or the United Kingdom, Nadex aims to treat all consumers fairly. In this case, we can make the following assumptions:. In a different embodiment of the system of the invention a centralized clearing member would facilitate the settlement of the option contracts, or alternatively, facilitate the settlement of the option contracts through the use of the intermediate derivative product described above. This price is not used in publishing the strike price, but is used by the market makers in pricing the fair value of a call or a put. The companies were also banned permanently from operating in the United States or selling to U. This is because in the week news events and big traders can start new movements, so the trading range varies more. In addition to this transport layer encryption used in the VPN, there needs to be an authentication layer whose purpose is to authenticate the external connection as coming from a known market participant who has the correct access privileges. Market participants will most likely need to access the marketplace through a secure network connection, such as a dedicated leased line or a virtual private network VPN over a public network. The risk of having one or two legs of a strategy filled and one unfilled exposes the trader to position risk that could be avoided by utilizing the benefits of the invention. Closing gaps can be created by just a few traders. November 10, Partner Links. If matched, you should be able to view your trade in the Open positions window.