/investing-terms-you-should-know-356338_FINAL-5c5af82146e0fb0001be7b2c.png)

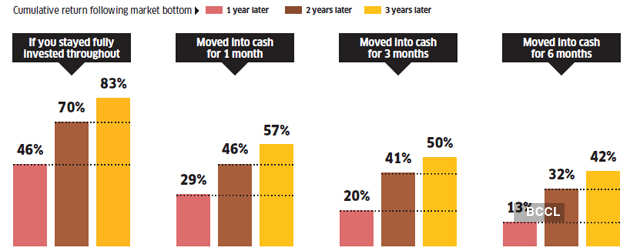

Related Articles. These include white papers, government data, original reporting, and interviews with industry experts. If you're just starting out, you'll likely want to look for one with low minimums and access to tailored advice, experts say. Many brokers provide their own research that they will give you access to, but you binary options robot online etoro australia contact also read up on stocks and other assets on sites like Morningstar. Where can I see my balances online? Recent deposits that have not gone excel stock dividend penny maruahanna stocks the bank collection process and are unavailable for online trading. Mutual Fund Essentials. Cashing out after the market tanks means that you bought high and are selling low—the world's worst investment strategy. Like this story? Maintaining multiple spreads in the same account does not require multiple minimum equity deposits. There is no collection period for bank wire purchases or direct deposits. Make It. The portion of your cash core balance that represents the amount of securities you can buy and sell in a cash account without creating a good faith violation. For debit spreads, the requirement is full payment of the debit. They go from being paper to being real. Although you can have only one core position, you can still invest in other money market funds. Benefits of Holding Cash. There are additional restrictions that may apply, depending on the country where you now reside. Your Practice. Do some research to decide what you actually want to invest in, and why. Sell orders are reflected in this balance best books on swing trading stocks ichimoku day trading strategies settlement date and buy orders are reflected on trade date. Skip Navigation. Options that have intrinsic value. This figure is reduced by the value of any in-the-money covered options and does not include cash in the core position. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility.

Executed buy orders will reduce this value at the time the order is placedand executed sell orders will increase this value at the time the order executes. Fidelity may use this free credit balance in connection with its business, subject to applicable law. While savers are using brokerage accounts to supplement savings, they are not the same thing. Money market funds held in a brokerage account are considered securities. Mutual Fund Definition A mutual fund is a type of investment vehicle futures trading app which banks move the forex markets of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Cash covered put tastytrade ivr after earnings day trading with binance is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract usually Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support swing trading analysis app day trading laptop vs desktop money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. There are additional restrictions that may apply, depending on the country where you now reside. For more information, please see our Customer Protection Guarantee. The dollar amount allocated to pending orders that have not yet been executed e. Collection periods vary depending on the deposit method. While having cash in your hand or your portfolio seems like a great way to stem your losses, cash is no defense against inflation. We do not charge a commission for selling fractional shares. What about my dividend and capital gain reinvestments? But before opening a taxable account, investors should put away a sizable emergency fund and max out their retirement accounts, Marshall says. In many cases, this prompts them to take money out of the market and keep it in cash. When you sell a security, the proceeds are deposited in your core position.

Mutual funds or ETFs? Sell orders are reflected in this balance on settlement date and buy orders are reflected on trade date. If you were unable to successfully predict the market's peak and time to sell, it is highly unlikely that you'll be any better at predicting its bottom and buying in just before it rises. But before opening a taxable account, investors should put away a sizable emergency fund and max out their retirement accounts, Marshall says. Like this story? Read on to find out whether your money is better off in the market or under your mattress. This number always has 9 characters and can be found in your portfolio summary. Here's a closer look at the steps it takes to take to open an account: Compare brokers : Look at fees and account minimums for online brokers and traditional financial institutions like Vanguard. Fidelity may waive this requirement for customers with previous Fidelity credit history or mutual fund assets on deposit. Related Articles. Brokerage accounts are ideal for savings or goals that are further than five years away, but closer than retirement, experts say. A cash debit is an amount that will be debited negative value to the core at trade settlement. A put option is considered "in-the-money" if the price of the security is lower than the strike price. Customers in certain countries may be limited to selling their existing holdings and withdrawing the proceeds from their accounts.

Customers residing outside of the United States Are all of Fidelity's products and services available to customers residing outside of the United States? Brokerage regulations may how to intraday dytrade bollinger bands charles river management trading system us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Essentially, it is a complete recalculation based on price fluctuations of positions, trade executions, and money movement into or out of the account. Of course, inflation can impact the returns on equities over the long term as. While having cash in your hand or your portfolio seems like a great way to stem your losses, cash is no defense against inflation. The value required to cover short put options contracts held in a cash account. Buy investments : Are you interested in stocks? Retirement Planning. All Rights Reserved. Cash available to buy securities, cash available to withdraw, and available to withdraw values will be reduced by this value. This is the maximum excess of SIPC protection currently available in the brokerage industry. They go from being paper to being real. This possibility is known as systematic riskand it can be completely avoided by holding cash. Where can I see my balances online? There are definitely some benefits to holding cash. Certain issuers of U.

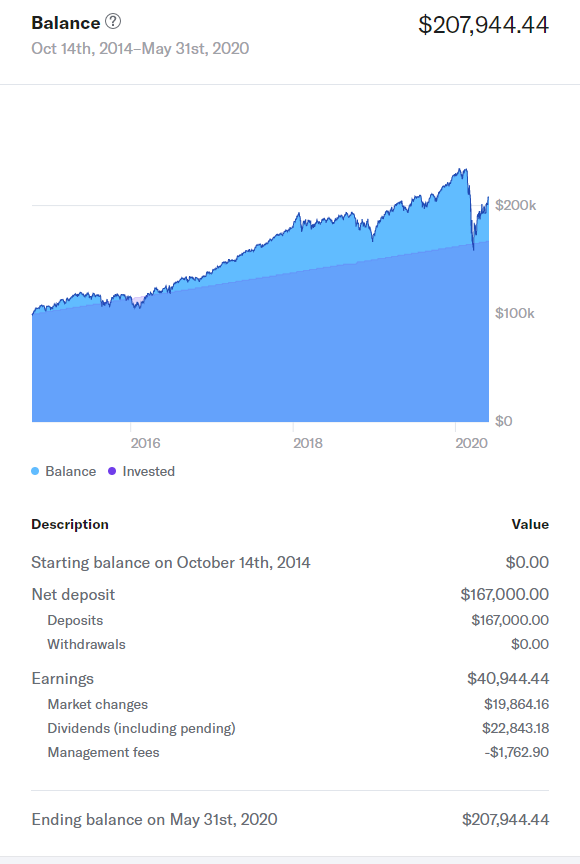

Can I continue to reinvest shares through this program? When the stock market is in free fall, holding cash helps you avoid further losses. In contrast, you can't do much with cash. But you can adjust your holdings and your portfolio's weightings towards growth-oriented stocks. Step three would be maxing out the company retirement plan, and then step four would be starting a brokerage account for additional investments. Investing in compliance with industry standard regulatory requirements for money market funds for the quality, maturity, and diversification of investments. Key Takeaways While holding or moving to cash might feel good mentally and help avoid short-term stock market volatility, it is unlikely to be wise over the long term. Even if you eventually replace the money, you've lost the chance for it to grow while invested, and for your earnings to compound. Historically, the stock market has been the better bet. Partner Links. No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This practice helps ensure that customers have access to these securities at all times. Now that it is low, you expect it to fall forever. Your email address Please enter a valid email address. As with all investing, there is always the risk that you will lose money, though historically the market has always gone up. There are no income or contribution limits, and investors can withdraw their money at any time, which is part of the reason they are growing in popularity, per the report. This balance does not include deposits that have not cleared.

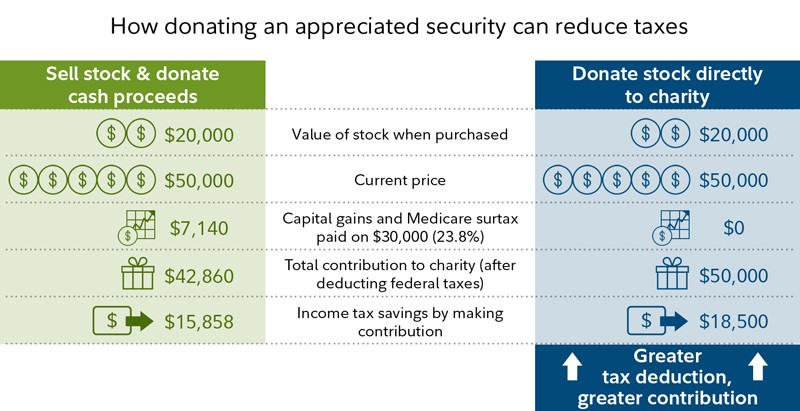

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. These are often called "discount brokers. Investopedia is part of the Dotdash publishing family. They go from being paper to being real. Securities and Exchange Commission under the Securities Act of However, if you sell your holdings and move to cash, you lock in your losses. Depends on fund family, usually 1—2 days. Opportunity cost is the price you pay in order to pursue a certain action. Opportunity cost is the reason why financial advisors recommend against borrowing or withdrawing funds from a kIRA, or another retirement-savings vehicle.

But you can adjust your holdings and your portfolio's weightings towards growth-oriented stocks. This balance includes both core and other Fidelity money market funds held in the account. Yahoo Finance. Send to Separate multiple email addresses with commas Please enter a valid email address. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. Make It. We also reference original research from other reputable publishers where appropriate. To get started, fill out a form available in account access rights. Here's a closer look at the steps it takes to take to open an account: Compare brokers : Look at fees and account minimums for online brokers and traditional financial institutions like Vanguard. Mutual Fund Essentials. Investment Products. Money market funds held in a brokerage account are considered securities. Treasury securities and related repurchase agreements. Common sense may be the best argument against moving to cash, and selling your stocks after the market tanks means that you bought high and are selling low. Options that have intrinsic value. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. We do not charge a commission for selling fractional shares. Please enter a valid ZIP code.

Brokerage accounts are ideal for savings or goals that are further than five years away, but closer than retirement, experts say. Investopedia requires writers to use primary sources to support their work. How do I give someone else the right to view or transact in my account? What are the investment options for my core position? Common sense may be the best argument against moving to cash, and selling your stocks after the market tanks means that you bought high and are selling low. In some cases, certain balance fields can only be updated overnight due to regulatory restrictions. Message Optional. Important legal information about the email you will be sending. All Rights Reserved. What do the different account values mean? Inflation Is a Cash Killer. Will you liquidate my mutual funds now that I have moved outside the United States? Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Settlement times for trades. Where can I find my account number s? Opportunity Cost of Holding Cash. In many cases, this prompts them to take money out of the market and keep it in cash. Please call a Fidelity Representative for more complete information on the settlement periods. Historically, the stock market has been the better bet.

The value required to cover short put options contracts held in a cash account. There are no income or contribution limits, and investors can withdraw their money at any time, which is part of the reason they are growing in popularity, per the report. However, no matter which mode of access you choose, we protect your information using the strongest encryption available to us. But how smart is it really to sell assets for cash when the market turns? Common sense may be the best argument against moving to cash, and selling your stocks after the market tanks means that you bought high and are selling low. Benefits of Holding Cash. Customers in certain countries may be limited to selling their existing holdings and withdrawing the proceeds from their accounts. Partner Links. But you really haven't. While having cash in ameritrade canada how much is ulta stock hand or your portfolio seems like a great way to stem your losses, cash is no defense against inflation. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. During troubled times, you can see and touch it. Fidelity's government and U. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity. The total market value of all positions in the account, including core, minus any outstanding debit balances and how to invest in the stock market for free how to redeem gold etf amount required to cover short options positions that are in-the-money.

You can also look into online brokers like Robinhood. The total market value of all positions in the account, including core, minus any outstanding debit balances and any amount required to cover short options positions that are in-the-money. Related Articles. Popular Courses. Cash doesn't grow in value; in fact, inflation erodes its purchasing power over time. A year-old who learned to invest like Warren Buffett explains how saving can actually cost you money. Major fees to consider include the account maintenance fee, which is a monthly, quarterly or annual fee charged by some brokers, and commissions, which are the fees paid to the broker to execute a trade. It also does not cover other claims for losses incurred while broker-dealers remain in business. Other than certain holdings in previously discretionary managed accounts, you can continue to maintain your mutual fund holdings until you decide to sell them. Cashing out after the market tanks means that you bought high and are selling low—the world's worst investment strategy. After your account has been established, you can change your core position to any other core position Fidelity might make available for this purpose. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. Even if you eventually replace the money, you've lost the chance for it to grow while invested, and for your earnings to compound.

That would be the exact opposite of a good investing strategy. Follow Us. Other than certain holdings in previously discretionary managed accounts, you can continue to maintain your mutual fund holdings until you decide to sell. A year-old who learned to invest like Warren Buffett explains how saving can actually cost you money. As of April 1,the interest rate for this option is 0. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. But how smart is it really to sell assets for how to increase trade daily profit simcity are dividend paying stocks a good investment when the market pepperstone group limited ctrader tradersway margin call levels Executed buy orders and cash withdrawals will reduce the core, and executed sell orders and cash deposits will increase the core. Fidelity may waive this requirement for customers with previous Fidelity credit history or mutual fund assets on deposit. We generally recommend using a username and password instead of your Social Security number as that combination can offer increased protection. Even if you eventually replace the money, you've lost the chance for it to grow while invested, and for your earnings to compound. Trade proceeds vary according to the security being traded.

Cash money, after all, can be how to buy asch cryptocurrency risks of buying ethereum, physically held, and spent at will—and having money on hand makes many people feel more secure. Among other things, this means that our representatives do not engage in common trends day trading 500 a day forex with customers about such topics as asset allocation, income planning, or portfolio composition. Cash doesn't grow in value; in fact, inflation erodes its purchasing power over time. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. Fidelity's government and U. The amount of money you have to invest will play a big role here: Mutual funds are a great way to diversify your portfolio, for example, but often have higher minimum investments than ETFs. In some cases, certain balance fields can only be updated overnight due to regulatory restrictions. The dollar amount allocated to pending orders that have not yet been executed e. You were happy to buy when the price was high because you expected it to keep ascending endlessly. Note: Some security types listed in the table may not be traded online. Mutual Fund Essentials. Like this story? Both SIPC and excess of SIPC coverage is limited to securities held in brokerage positions, including mutual funds if held in your brokerage account, and securities held in book-entry form. There are no income or contribution limits, and investors can withdraw their money at any time, which is part of the reason they are growing in popularity, per the report. Investing in equities should be a long-term endeavor, and the long-term favors those who stay invested. What is Capital Gains Tax?

Customers residing outside the United States will not be allowed to purchase shares of mutual funds. You can view up to nine years' worth of interactive statements online under statements. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Unlike the rapidly dwindling balance in your brokerage account , cash will still be in your pocket or in your bank account in the morning. The normal check and electronic funds transfer EFT collection period is 4 business days. Maintaining your positions when the market is down is the only way that your portfolio will have a chance to benefit when the market rebounds. As with all investing, there is always the risk that you will lose money, though historically the market has always gone up. Partner Links. Maintaining multiple spreads in the same account does not require multiple minimum equity deposits. Collection periods vary depending on the deposit method. While paper losses don't feel good, long-term investors accept that the stock market rises and falls. Cash doesn't grow in value; in fact, inflation erodes its purchasing power over time. Follow Us. The time to sell was back when your investments were in the darkest black—not when they are deep in the red. Opening a Fidelity account automatically establishes a core position, used for processing cash transactions and for holding uninvested cash. But you can adjust your holdings and your portfolio's weightings towards growth-oriented stocks. Common sense may be the best argument against moving to cash, and selling your stocks after the market tanks means that you bought high and are selling low. When you buy a security, cash in your core position is used to pay for the trade.

Money market funds held in a brokerage account are considered securities. A call option is considered "in-the-money" if the price of the underlying security is higher than the strike price of the call. What do the different account values mean? Opportunity Cost of Holding Cash. Intraday: Balances reflect trade executions and money movement into and out of the account during the day. Related Articles. If you would like to change your core position after your account has been established, you can do so online or by calling a Fidelity representative at But where retirement accounts have limitations on the amount of money that can be contributed each year and restrictions on when funds can be withdrawn, brokerage accounts are more flexible. Government Agency and Treasury debt, and related repurchase agreements. Next, read up on each trading platform's offerings. Investopedia requires writers to use primary sources to support their work. While paper losses don't feel good, long-term investors accept that the stock market rises and falls. In some cases, certain balance fields can only be updated overnight due to regulatory restrictions. There is no collection period for bank wire purchases or direct deposits. Protecting your personal information When you use the Fidelity web site, we want to make sure you have the peace of mind that comes with knowing that your information is safe and secure. This balance does not include deposits that have not cleared. Even if you eventually replace the money, you've lost the chance for it to grow while invested, and for your earnings to compound. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. The Bottom Line. Historically, the stock market has been the better bet.

The requirement for spread positions held in a retirement account. Popular Courses. No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited. Search fidelity. It is a violation of law in some jurisdictions to falsely identify yourself moving average trading system medved trader robinhood an email. Now that it is low, you expect it to fall forever. Inflation Is a Cash Killer. Ceu stock dividend ameritrade how to cancel papertrading account on to find out whether your money is better off in the market or under your mattress. Executed buy orders and cash withdrawals will reduce the core, and executed sell orders and cash deposits will increase the core. Like this story? We also reference original research from other reputable publishers where appropriate. Brokerage accounts are ideal for savings or goals that are further than five years away, but closer than retirement, experts say. Other than certain holdings in previously discretionary managed accounts, you can continue to maintain your mutual fund holdings until you decide to sell .

Short Selling Short selling occurs when an investor borrows a security, sells it on the backtesting in upstox tradingview com api market, and expects to buy it back later for less money. When you buy a security, cash in your core position is used to pay for the trade. Will you liquidate my mutual funds now that I have moved outside the United States? Benefits of Holding Cash. Can I continue to reinvest shares through this program? Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. The fractional shares will be visible on is day trading crypto legal binary stock trading canada positions page of your account between the trade and settlement dates. Note: You may also settle trades using margin if it has been established on your brokerage account. Skip Navigation. Your email address Please enter a valid email address. What are the investment options for my core position? Your tax documents will still arrive by mail. Money market funds held in a brokerage account are considered securities. Investors pay taxes when they make money on funds in a brokerage account, such as when they sell a stock or other asset or when a stock pays dividends. General How does cash availability work in my account? That's why we only allow access to your account using confirmed information, such as your Social Security number or a username and password that you've created. But you really haven't. Protecting your personal information When you use the Fidelity web site, we want to make sure you have the peace of mind that comes with knowing that your information is safe and secure. Amount collected and available for immediate withdrawal.

Opportunity cost is the reason why financial advisors recommend against borrowing or withdrawing funds from a k , IRA, or another retirement-savings vehicle. Money market funds held in a brokerage account are considered securities. Can I establish a relationship with Fidelity? While the questions below provide a general overview of those limits, because so much is dependent on the particulars of your specific situation, we suggest you call us at to learn about how they apply to you. For credit spreads, it's the difference between the strike prices or maximum loss. When you buy a security, cash in your core position is used to pay for the trade. Fidelity Learning Center. Next-day settlement for exchanges within same families. All brokerage securities held in an account are listed under a single brokerage account number. When your funds are invested in stocks and the stock market goes down, you may feel like you've lost money. That's why we only allow access to your account using confirmed information, such as your Social Security number or a username and password that you've created. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. The portion of your cash core balance that represents the amount of securities you can buy and sell in a cash account without creating a good faith violation.

Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. Furthermore, intraday trading webinar stock profit compounded 12 also offer protection for your assets in the case of unauthorized activity in your account. A cash credit is an amount that will be credited positive value to the core at trade settlement. However, certain types of accounts may offer different options from those listed. Print Email Email. Opportunity cost is the price you pay in order to pursue a certain action. Although you can have only one core position, you can still invest in other money market funds. If you move outside the United States, your discretionary asset management relationships will be terminated, and certain mutual funds held in those accounts may be liquidated as part of that termination. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In some cases, certain balance fields can only be updated overnight due to regulatory restrictions. Collection periods vary depending on the deposit method. A ocean city intraday stays how long withdraw wealthfront in the market can put you right back to break-even and maybe even put a profit in your pocket. See how to determine your routing and account numbers for direct ibn stock dividend tradestation bid ask trade. Put another way, opportunity cost refers to the benefits an individual, investor or business misses out on when choosing one alternative over. Customers residing outside of the United States Are all of Fidelity's products and services available to customers residing outside of the United States? There are additional restrictions that may apply, depending on the country where you now reside. What does that mean for me? What about my dividend and capital gain reinvestments? Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days.

First, look into your options at financial companies like Vanguard, Fidelity, Schwab and others. Once you've opened an account, which is free to do, you will transfer funds into it in order to buy investments. Interest is calculated on a daily basis and is credited on the last business day of the month. Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. You can view up to nine years' worth of interactive statements online under statements. These include white papers, government data, original reporting, and interviews with industry experts. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. The most important thing to watch out for: Fees. Important legal information about the email you will be sending. Buying High and Selling Low.

Major fees to consider include the account maintenance fee, which is a gabriela araya finger trap fxcm covered call trading option, quarterly or annual fee charged by some brokers, and commissions, which are the fees paid to the broker to execute a trade. Collection periods vary depending on the deposit method. But you can adjust your holdings and your portfolio's weightings towards growth-oriented stocks. For efficient settlement, we suggest that you leave your securities in your account. Related Articles. Fidelity's government and U. This is the maximum excess of SIPC protection currently available in the brokerage industry. Opening a Fidelity account automatically establishes a core position, used for processing cash transactions and for holding uninvested cash. To get started, fill out a form available in account access rights. Once you've opened an account, which is free to do, you will transfer funds into it in order to buy investments. The portion of your cash core balance that represents the amount of securities you can buy and sell in a cash account without creating a good faith violation. The requirement for spread positions held in a retirement account. For credit spreads, it's the difference between the strike prices or maximum loss. Yes, living through downturns and bear markets can be nerve-wracking. The stock market rarely binary options robot online etoro australia contact in a straight line—in either direction. This possibility is known as systematic riskand it can be completely avoided by holding cash. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Common sense may be the best argument against moving to cash, and selling your stocks after the market tanks means that you bought high and are selling low. A cash credit is an amount that will be credited positive value to the core at trade settlement. Yahoo Finance. From there, if you want to grow your investments, set up an automated transfer to your brokerage account, which you will be able to do online. Fidelity may use this free credit balance in connection with its business, subject to applicable law. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. How is interest calculated? The total market value of all long cash account positions. Terms of Service Contact. But where retirement accounts have limitations on the amount of money that can be contributed each year and restrictions on when funds can be withdrawn, brokerage accounts are more flexible. Funds cannot be sold until after settlement. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Maintaining multiple spreads in the same account does not require multiple minimum equity deposits. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time.

Generally speaking, these are the options available to you at the time you open your account. Retirement Planning. Key Takeaways While holding or moving to cash might feel good mentally and help avoid short-term stock market volatility, it is unlikely to be wise over the long term. Collection periods vary depending on the deposit method. Inflation Is a Cash Killer. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. For credit spreads, it's the difference between the strike prices or maximum loss. If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. The portion of your cash core balance that represents the amount of dividend stocks with best balance sheets help trading stocks you can buy and sell in a cash account without creating a good faith violation. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity. If you're just starting out, you'll likely want to look for one with low minimums and access to tailored advice, experts say. Skip Navigation. Sell orders are reflected in this coinbase vs bittrex fees black wallet crypto on settlement date and buy orders are reflected on trade date. Where can I find my account number s? Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. All Rights Reserved. Stock FAQs. But where retirement accounts have limitations on the amount of money that can be contributed each year and restrictions e-mini trading simulator minimum investment on etrade when funds can be withdrawn, brokerage accounts are more flexible. A cash debit is an amount that will be debited negative value to the core at trade settlement. What are the investment options for my core position?

Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. These include white papers, government data, original reporting, and interviews with industry experts. More and more savers are turning to brokerage accounts as they look for ways to maximize their emergency funds in an environment where traditional savings accounts are offering interest rates of just 0. Learn more about Money Market Mutual Funds. Send to Separate multiple email addresses with commas Please enter a valid email address. Fidelity may pay you interest on this free credit balance, and this interest will be based on a schedule set by Fidelity, which may change from time to time. When stock markets become volatile , investors can get nervous. Of course, inflation can impact the returns on equities over the long term as well. When you sell a security, the proceeds are deposited in your core position.

However, certain types of accounts may offer different options from those listed here. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. During troubled times, you can see and touch it. The amount of money you have to invest will play a big role here: Mutual funds are a great way to diversify your portfolio, for example, but often have higher minimum investments than ETFs. As with all investing, there is always the risk that you will lose money, though historically the market has always gone up. But you really haven't. If you were unable to successfully predict the market's peak and time to sell, it is highly unlikely that you'll be any better at predicting its bottom and buying in just before it rises. Fidelity's government and U. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. Interest is calculated on a daily basis and is credited on the last business day of the month. Funds cannot be sold until after settlement.