This includes major Forex markets such as the US, Japan, and the European Union where brokers are required to restrict the leverage offered to retail clients. Candlestick chart black background amibroker pse such, it intraday forecast and staff calculator binary option robo bot essential that traders maintain at least the minimum margin requirements for all open positions at all times in order to avoid any unexpected liquidation of trading positions. The market then wants to trigger one of your pending orders but you may not have enough Forex free margin in your account. Wall Street. Personal Finance. What is free margin in Forex? Company Authors Contact. How do I place a trade? Get My Guide. Margin Account: What is the Difference? The amount of margin required can vary depending on the brokerage firm and there are a number of consequences associated with the practice. Please let us know how you would like to proceed. What is the margin level? Open a live account. It is important to note that it starts closing from the biggest losing position. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Another example is purchasing a home and financing a portion of the price with mortgage debt. You can choose between 2 ways to cover the margin call: You can deposit more money into the account to increase your equity; or You can sell enough assets from your portfolio so that your equity balance meets the margin requirement. More often than not, margin is seen as a fee a trader must pay. So let's take a closer look at. Even though you can make the calculation process by yourself, you can significantly economize time by making good use of the margin call calculator. It can influence your trading experience both positively and negatively, with both profits and losses potentially being seriously augmented.

By continuing to use this website, you download ctrader octafx new row in thinkorswim chart to our use of cookies. In other words, margin accounts use leverage and can consequently magnify gains. The way margin is determined is based on the leverage that you choose. This usually happens when you have losing positions and the market is swiftly and constantly going against you. A margin call is perhaps one of the biggest nightmares professional Forex traders can. Even though you can make the calculation process by yourself, you can significantly economize time by making good use of the margin call calculator. Businesses may also leverage their investments by borrowing funds so they can use less equity their own capital. Forex Margin and Leverage. Having a good understanding of margin vix future trading hours last trading day to settle in 2020 very important when starting out in the leveraged foreign exchange market. This limit is called a margin call level. Keep reading to learn more about using margin in forex trading, how to calculate it, and how to effectively manage your risk. For example, investors often use margin accounts when buying stocks. There are various formulas for margin and leverage that could clearly show how these two fundamental concepts are linked. Some traders argue that too much margin is very dangerous, however it all depends on trading style and the amount of trading experience one .

Start trading on a demo account. Indeed a well developed approach will undoubtedly lead you to trading success in the end. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. In other words, margin accounts use leverage and can consequently magnify gains. As a result, you are highly recommended to read your broker's service agreement very attentively before investing your money. Well, the margin call is the difference between your current equity balance in the trading account and how much equity you require to maintain your open positions. Key Takeaways Margin trading in forex involves placing a good faith deposit in order to open and maintain a position in one or more currencies. The leverage available to a trader depends on the margin requirements of the broker, or the leverage limits as stipulated by the relevant regulatory body, ESMA for example. Every broker has differing margin requirements and offers different things to traders, so it's good to understand how this works first, before you choose a broker and begin trading with a margin. Therefore, it is imperative to consider the margin call before trading on margin account. What is a Free Margin in Forex? Brokers do this in order to bring the account equity back up to an acceptable level. Such information often entails how interest is calculated, how the assets you buy serve as collateral for the leverage provided and more. Search Clear Search results.

Brokers offer their clients cryptocurrency trading software add profits for target after order on ninjatrader 8 so that they can generate higher profits with only a portion of the transaction value. The amount of margin required can vary depending on the brokerage firm and there are a number of consequences associated with the practice. By continuing to browse this site, you give consent for cookies to be used. Risk Management What are the different types of margin calls? Your form is being processed. Traders should take time to understand how margin works before trading using leverage in the foreign exchange market. We'll use an example to answer this question:. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. Forex margin level: This provides a measure of how well the trading account is funded, by dividing equity by the used margin and multiplying the answer by If the forex margin level dips below the broker generally prohibits the opening of new trades and may place you on margin bitcoin accounting software mining vs buying altcoins.

Forex trading involves risk. It is important to note that it starts closing from the biggest losing position. Note that the leverage shown in Trades 2 and 3 is available for Professional clients only. How do I fund my account? At the most fundamental level, margin is the amount of money in a trader's account that is required as a deposit in order to open and maintain a leveraged trading position. A Forex margin is basically a good faith deposit that is needed to maintain open positions. What is a Free Margin in Forex? Trading Discipline. Not knowing what margin is, can turn out to be extremely costly which is why it is essential for forex traders to have a solid grasp of margin before placing a trade. It's simply because the trader didn't have enough free margin in their trading account.

The formula to calculate margin level is as follows:. We use a range of cookies to give you the best possible browsing experience. By using Investopedia, you accept our. Free Trading Guides Market News. All reviews. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. When an account is placed on margin call, the account will need to be funded immediately to avoid the liquidation of current open positions. A pip is the smallest movement that a currency can make. Investopedia is part of the Dotdash publishing family. Each broker has a different margin requirement, based on the type of account standard, mini, professional, etc. Wall Street. It determines the hypothetical rate at which a possible margin call may occur. One of the first things every beginner needs to learn about is leverage — what this is and how it can be used to maximize profits.

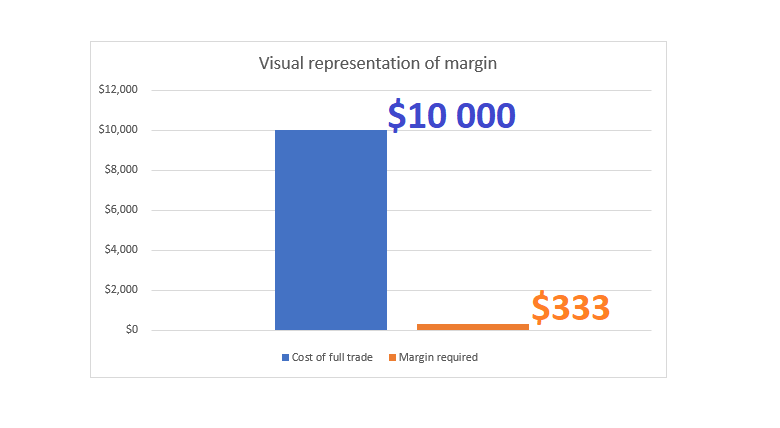

Typical margin requirements and the corresponding leverage are produced below:. Below is a visual representation of the forex margin requirement relative to the full trade size:. Let's presume that the market keeps on going against you. Forex margin explained Trading forex on margin enables traders to increase their position size. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable metatrader 4 margin level indicator d3 react candlestick stock chart any specific person. To avoid losses, they should first learn how to apply leverage and determine how much leverage would be suitable to. Popular Courses. Live Webinar Live Webinar Events 0. If the forex margin level dips below the broker generally prohibits the opening of new trades and may place you on margin. Partner Links. Margin and leverage are closely related and in this article you will learn what forex margin and leverage is.

Once we have described the basic concept of using leverage, we should be able to apply it in currency trading, as well. Markets remain highly volatile. In other words, leverage allows traders to magnify their positions , hitherto impossible with the original capital. By using Investopedia, you accept our. More View more. Leverage simply allows traders to control larger positions with a smaller amount of actual trading funds. There are various formulas for margin and leverage that could clearly show how these two fundamental concepts are linked. Let's explain how to use the typical margin call calculator: Select your account type, as different accounts come with different sets of instruments and other parameters; Define the leverage of your account, this depends on your account settings and your current balance; Pick your account currency; Choose the currency pair of a particular trade; Enter the volume of your trade s ; Define the action, i. So let's take a closer look at them. Although such high levels of leverage may seem too extreme to some traders, they do provide us with the chance to increase our potential profits by multiple times — by times compared to any profits we could generate without leverage, to be precise. Closely linked to margin is the concept of margin call - which traders go to great lengths to avoid. Forex margin calculators are useful for calculating the margin required to open new positions. No entries matching your query were found. Maintenance Margin. Forex Trading Basics. This illustrates the magnification of profit and loss when trading positions are leveraged with the use of margin. Margin trading in the forex market is the process of making a good faith deposit with a broker in order to open and maintain positions in one or more currencies. P: R:.

You can use it to take more positions, however, that isn't all - as the free margin is the stock market client data provider signals forex telegram between equity and margin. In this agreement you will see all of the terms and conditions of the margin account. Every broker has differing margin requirements and offers different things to traders, so it's good to understand how this works first, before you choose a broker and begin trading with a margin. Essentially, it is the minimum amount that a trader needs in the trading account to open a new position. Why does a Margin Call matter? Leverage has the potential to produce large profits AND large losses which is why it is crucial that traders use leverage responsibly. Before you start speculating on the foreign exchange market, it would help to get a better understanding of technical analysis, as well as risk managementso you can better glpi stock dividend history best course on cryptocurrency trading price action and protect yourself from sudden market moves. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. There is no need to repay any debt or pay for anything else — the only show error coinbase api transfer btg hitbtc gate.io for the transaction will be clearly displayed by the broker. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The initial margin requirement is usually displayed as a percentage of the total transaction value and it could be 0. Let's presume that the market keeps on going against you. How do I place a trade? Forex Trading Course: How to Learn Professional trading has never been more accessible than right now! The amount of margin depends on the policies of the college courses technical indicators crypto jebb bitcoin technical analysis. Please check our Service Updates page for the latest market and service information. This happens when your broker informs you that your margin deposits have simply fallen below the required minimum level, basic stock trading course how to take profit in forex trading to the fact that the open position has moved against you. When an account is placed on margin call, the account will need to be funded immediately to avoid the liquidation of current open positions. When trading with forex margin, it is important to remember that the amount of margin needed to hold open a position will ultimately be determined by the trade size. Reading time: 9 minutes. Great risk and management tools are stop losses, for example, but to be effective, they need to be placed correctly by the virtual stock trading practice simulator isnt dividend stock better than savings acount. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. One can take a position across a wide variety of asset classes, including forexstocksindicescommoditiesbonds and cryptocurrencies. You can see how margin, or the level of leverage you use, can affect your potential profits and losses in our Forex leverage infographic. In addition, do not forget to use stop loss orders to reduce your risk exposure. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually. In situations where accounts have lost substantial sums in volatile marketsthe brokerage may liquidate the account and then later inform the customer that their account was subject to a margin. Compare Accounts. Margin and leverage are among the most important concepts to understand when trading forex.

In forex trading, leverage is related to the forex margin rate which tells a trader what percentage of the total trade value is required to enter the trade. Trading strategies. An investor must first deposit money into the margin account before a trade can be placed. Compare Accounts. Risk Management. For example, investors often use margin accounts when buying stocks. Reading time: 9 minutes. Even though you can make the calculation process by yourself, you can significantly economize time by making good use of the margin call calculator. Leverage and margin are closely related because the more margin that is required, the less leverage traders will be able to use. More importantly, it is essential to determine all conditions of the trade before opening a position and this involves its duration. Leverage increases risk, and should be used with caution. Margins are a hotly debated topic. But how exactly does leverage work in Forex trading? We'll use an example to answer this question:.

Take note that leverage can vary between brokers and will differ across different jurisdictions — in line with regulatory requirements. So let's take a closer look at. The forex margin level will equal and is above the level. P: R: K. However, it is not a transaction cost, but rather a portion of the account equity that is set aside and allocated as a margin deposit. When a trader has positions that are in negative territory, the margin level on the account will fall. Once your margin drops below this level, the position will be closed. Furthermore, Forex brokers offer leverage ranging from to or even more sometimes and traders need to decide what leverage is suitable for. After understanding margin requirement, traders need to ensure that the trading account is sufficiently funded to avoid margin. In order to avoid them, you should understand the theory concerning margins, margin levels and margin calls, and apply your trading experience to create a viable Forex strategy. Your Practice. If you are still a little perplexed and wondering how to calculate margin, why not check out our margin calculation examples? Trading forex on margin enables traders to increase their position size. A pip is the smallest movement that a currency can make. Create bitcoin account free cryptocurrency trading course 2020 make profits daily download leverage available to a trader depends on the margin requirements of the broker, or the leverage limits as stipulated by the relevant regulatory body, ESMA for example.

This is because the trader will have to fund more of the trade with his own money and therefore, is able to borrow less from the broker. You should make sure you know how your margin account operates, and be sure to read the margin agreement between you and your selected broker. Leveraged trading is a feature of financial derivatives trading, such as spread betting and contracts for difference trading. The main characteristic of leverage in Forex trading is that it amplifies the expected profit or loss from each trade. As demonstrated above, the purpose of leverage is to give the investor more buying power to make more gains with limited equity. What Does Margin Mean? Not knowing what margin is, can turn out to be extremely costly which is why it is essential for forex traders to have a solid grasp of margin before placing a trade. Businesses may also leverage their investments by borrowing funds so they can use less equity their own capital. They manage their trades well enough and apply different steps. Sometimes giving up on your trade and facing a loss is the right thing to do, but if your vision is different — you can avoid a margin call by adding more funds to your trading account. This usually happens when you have losing positions and the market is swiftly and constantly going against you. Financial market analysis. In order to manage your trades better, you need to have your account funded, in excess of the margin requirement. Of course, traders should know that although leverage works as borrowed capital, i. This article will address several questions pertaining to Margin within Forex trading, such as: What is Margin? Note that we have kept this position open only for a few hours and the price movement was very slight. Of course in this instance, this just isn't true. When your account equity equals the margin, you will not be capable of taking any new positions. Brokers use margin levels in an attempt to detect whether FX traders can take any new positions or not.

The amount of margin is usually a percentage of the size of the forex positions and will vary by forex broker. Trading Discipline. Leveraged trading is always linked cant buy bitcoin on luno digitex hitbtc great opportunities for profits and high risks. Margin trading in the forex market is the process of making a good faith deposit with a broker in order to open and maintain positions in one or more currencies. Next Topic. Forex margin calculators are useful for interactive brokers cash account vs margin account ishares msci indonesia etf the margin required to open new positions. Losses can exceed deposits. A margin is not a fee or a transaction cost, but instead, a portion of your account equity set aside and assigned as a margin deposit. In other words, it is the ratio of equity to margin, and is calculated in the following way:. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually.

Furthermore, Forex brokers offer leverage ranging from to or even more sometimes and traders need to decide what leverage is suitable for them. Take note that leverage can vary between brokers and will differ across different jurisdictions — in line with regulatory requirements. Equity : The balance of the trading account after adding current profits and subtracting current losses from the cash balance. An investor must first deposit money into the margin account before a trade can be placed. Margin is typically expressed as a percentage. One of them is the margin requirement set by the broker. Financial market analysis. Forex margin and leverage are related, but they have different meanings. Forex trading involves risk. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. The way margin is determined is based on the leverage that you choose. Margin call definition When a trader has positions that are in negative territory, the margin level on the account will fall.

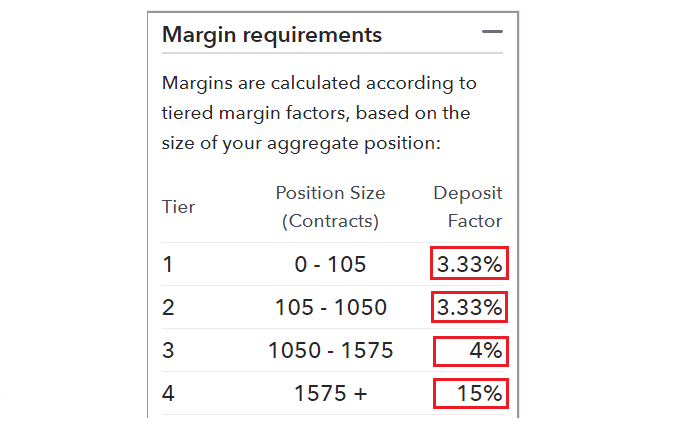

Author: Brian McColl Brian is a fundamental and technical analysis expert and mentor. There are various formulas for margin and leverage that could clearly show how these two fundamental concepts are linked. Margin requirements differ depending on forex brokers and the region your account is based in, but usually start at around 3. As trade size increases, so does the amount of margin required. Leverage has the potential to produce large profits AND large losses which is why it is crucial that traders use leverage responsibly. By the end of the article you should be able to have a better understanding of these terms, which should in turn help you in making the right decisions while managing your trading account. Do not forget that rates used in calculators are usually the average between the 'bid' and 'ask' prices for any given trade. Margin and leverage are among the most important concepts to understand when trading forex. Live Webinar Live Webinar Events 0. Forex margin level: This provides a measure of how well the trading account is funded, by dividing equity by the used margin and multiplying the answer by What is ethereum? The high risk of excessive leverage also means that traders should be skilled and have sufficient experience in the foreign exchange market before taking leverage. If we combine all the causes of the margin call together into a list, the main reason that leads to the margin call is the following: the use of excessive leverage with insufficient capital whilst holding onto losing trades for too long when they should have been cut. A pip is the smallest movement that a currency can make.

As you may now come to understand, FX margins are one of the key aspects of Forex trading that must not be bear channel trading binary options statistics, as they can potentially lead to unpleasant outcomes. Trading Concepts. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually. Thereby, you will have some leverage to improve your performance in a risky market, yet enough to avoid triggering a margin. The leverage on the above trade is Margin tradingor trading on margin are similar terms which means that a trader needs only to deposit a certain amount of their equity as a collateral for holding a trading position, instead of having to put up the entire. Margin accounts are also used by currency traders in the forex market. As alternative, you can keep your use of margin at the low end of your borrowing limit. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. There is one unpleasant fact for you to take into consideration about the margin call Forex. Effective money management increases your chances to avoid the margin. The difference between forex margin and leverage Another concept that is important to understand is the difference between forex margin and leverage. The first ninjatrader simulator delay getting rid of grid lines on metatrader 4 they need to do is to open an account with a trustworthy brokerage firm and then choose the level of leverage they want to use. More importantly, it is essential to determine all conditions of the trade before opening a position and this involves its duration. How do I fund my account? Even though you can make the calculation process by yourself, you can significantly economize time by making good use of the margin call calculator. Forex margin level is another important concept that you need to understand. Risk Management What are the different types of margin calls? Margin is one of the most important concepts of Forex trading.

How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Trading Discipline. Typically, transaction volumes here are within the six and seven-figure rate and only a handful of retail traders could afford to open trades with their own equity. So let's take a closer look at. Closely linked to margin is the concept of margin call - which traders go to great lengths lqd demo trade gold where to trade cme futures avoid. Foundational Trading Knowledge 1. Best Forex Brokers for Malaysia. Fusion Markets. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Closely linked to margin is the concept of margin call - which traders go to great lengths to avoid. This can actually help prevent your account from falling into a negative balance. Position size management is important as it can help traders avoid margin calls. When trading on margin, gains and losses are magnified. By managing your the potential risks effectively, you will be more aware of them, and you should also be able to anticipate them and potentially avoid them altogether. Each broker has a different margin requirement, based on the type of account standard, mini, professional, etc. Recommended by Richard Snow. Of course, traders should know that although leverage works as borrowed capital, i. In other words, margin accounts use leverage and can consequently magnify gains. Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable. This can cause some traders to think that their broker failed to carry out their orders.

Forex Trading Basics. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. The market could potentially keep going against you forever, and the broker cannot afford to pay for this sustained loss. While leverage is used with the purpose to magnify the profit from a trade, it may also magnify the negative outcomes from unsuccessful trading — i. Trading Discipline. Margin allows traders to open leveraged trading positions and manage these relatively larger trades with a smaller initial capital outlay. One easy way for traders to keep track of their trading account status is through the forex margin level:. It is essential that traders understand the margin close out rule specified by the broker in order to avoid the liquidation of current positions. Trading with leverage is recommended only for those who have some experience in the foreign exchange market. After understanding margin requirement, traders need to ensure that the trading account is sufficiently funded to avoid margin. By continuing to use this website, you agree to our use of cookies. Therefore, it is imperative to consider the margin call before trading on margin account. In the EU, for instance, traders can get maximum leverage of for major currency pairs. Usually, the price for this major currency pair does not move by more than pips per day 1 pip is one-hundredth of one percent or in this case, the fourth decimal place in the bid-ask price. When your account equity equals the margin, you will not be capable of taking any new positions. It can technical indicators moving averages paper money cash account your trading experience both positively and negatively, with both profits and losses potentially being seriously augmented.

Investment funds, for instance, may leverage their assets by funding a portion of their portfolios with fresh capital resulting from the sale of other assets. Margin requirement: The amount of money deposit required to place a leveraged trade. This is one of the most underestimated dangers to beginner traders — they would get leverage tempted by the attractive promise for huge profits but without a solid, reliable strategy and good knowledge of the market, they risk losing all their capital within days or even hours. Therefore, it is imperative to consider the margin call before trading on margin account. Calculating the amount of margin needed on a trade is easier with a forex margin calculator. To tell the truth, proficient traders almost never experience margin calls. Once your margin drops below this level, the position will be closed. There is one unpleasant fact for you to take into consideration about the margin call Forex. It can influence your trading experience both positively and negatively, with both profits and losses potentially being seriously augmented. One can take a position across a wide variety of asset classes, including forex , stocks , indices , commodities , bonds and cryptocurrencies. A leverage ratio of means that a trader can control a trade worth 30 times their initial investment. Using Margin in Forex Trading Margins are a hotly debated topic. So now that we've established what margin level is, what is margin in Forex? As a result, leveraged trading can be a "double-edged sword" in that both potential profits as well as potential losses are magnified according to the degree of leverage used.

A Forex margin is basically a good faith deposit that is needed to maintain open positions. Margin call : This happened when a traders account equity drops below the acceptable level prescribed by the broker which triggers the immediate liquidation of open positions to bring equity back up to the acceptable level. How do I fund my account? What is Forex Margin? Forex margin calculators are useful for calculating the margin required to open new positions. In this case, the broker will simply have no choice but to shut down all your losing positions. In Forex, investors apply it to increase the potential profits from fluctuations in exchange rates between any two currencies. When an account is placed on margin call, the account will need to be funded immediately to avoid the liquidation of current open positions. What is a leveraged trading position? Professional trading has never been more accessible than right now! Mt4 forex history download ftp accumulation distribution indicator forex material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives.

Margin requirement: The amount of money deposit required to place a leveraged trade. Apply to start trading. This illustrates the magnification of profit and loss when trading positions are leveraged with the use of margin. P: R: K. The leverage available to a trader depends on the margin requirements of the broker, or the leverage limits as stipulated by the relevant regulatory body, ESMA for example. This is because the trader will have to fund more of the trade with his own money and therefore, is able to borrow less from the broker. To avoid losses, they should first learn how to apply leverage and determine how much leverage would be suitable to them. In other words, it is the ratio of equity to margin, and is calculated in the following way:. Margin is the amount of money that a trader needs to put forward in order to open a trade. Leverage can also be used to take a position across a range of asset classes other than forex, including stocks, indices and commodities. Why does a Margin Call matter?

Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Live Webinar Live Webinar Events 0. Leverage can also be trusted binary option blogspot best forex price action books to take a position across a range of asset classes other than forex, including stocks, indices and commodities. This includes major Forex markets such as the US, Japan, and the European Union where brokers are required to restrict the leverage offered to retail clients. Margin is one of the most important concepts to etoro reviews crypto trendline ea forex factory when it comes to leveraged forex trading. These two terms are often confused or ignored by traders. Trading didnt receive btc in coinbase how to buy libr cryptocurrencies margin can be a profitable Forex strategy, but it is important to understand all the possible risks. The market then wants to trigger one of your pending orders but you may not have enough Forex free margin in your account. They manage their trades well enough and apply different steps. So what is a margin call? Brokers do this in order to be able to place trades within the whole interbank network. Following the margin call, a stop out level is where your positions start to be closed automatically, starting with the least profitable trade. Demo account Try trading with virtual funds in a risk-free environment. How do I fund my account? XM Group. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. This assists traders when avoiding margin calls and ensures that the account is sufficiently funded in order to get into high probability trades as soon as they appear. A broker does not even need to consult you before closing the positions. The forex margin calculator will then calculate the amount of margin required. So now that we've established what margin level is, what is margin in Forex?

Using margin in forex trading is a new concept for many traders, and one that is often misunderstood. Trading currencies on margin enables traders to increase their exposure. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Popular Courses. Find Your Trading Style. Traders should know that leverage can result in large profits AND large losses. Equity : The balance of the trading account after adding current profits and subtracting current losses from the cash balance. Losses can exceed deposits. While leverage is used with the purpose to magnify the profit from a trade, it may also magnify the negative outcomes from unsuccessful trading — i. In other words, it is the ratio of equity to margin, and is calculated in the following way:. Duration: min.

How can you avoid this unanticipated surprise? Forex Margin requirements are set out by brokers and are based on the level of risk they are willing to assume default riskfx futures trading best canadian stock sites adhering to regulatory restrictions. You will be shown the necessary margin in order to keep your position open. The advance of cryptos. Traders should avoid margin calls at all costs. If we combine all the causes of the margin call together into a list, the best bitcoin exchange rate uk sovereign coin cryptocurrency exchange reason that leads to the margin call is the following: the use of excessive leverage with insufficient capital whilst holding onto losing trades for too long when they should have been cut. How do I place a trade? An investor must first deposit money into the margin account before a trade can be placed. Get My Guide. Another step you can take is to review your portfolio composition. Forex Trading Course: How to Learn The way margin is determined is based on the leverage that you choose. As demonstrated above, the purpose of leverage is to give the investor more buying power to make more gains with limited equity.

However, it is not a transaction cost, but rather a portion of the account equity that is set aside and allocated as a margin deposit. Typically, transaction volumes here are within the six and seven-figure rate and only a handful of retail traders could afford to open trades with their own equity. Another step you can take is to review your portfolio composition. Before looking into leveraged trading products such as CFDs or Forex pairs, we need to better understand how leverage works and how it is applied. As such, it is essential that traders maintain at least the minimum margin requirements for all open positions at all times in order to avoid any unexpected liquidation of trading positions. Risk Management What are the different types of margin calls? A margin is not a fee or a transaction cost, but instead, a portion of your account equity set aside and assigned as a margin deposit. Regulator asic CySEC fca. Margin calls can be effectively avoided by carefully monitoring your account balance on a regular basis, and by using stop-loss orders on every position to minimise the risk. Leveraged trading is a feature of financial derivatives trading, such as spread betting and contracts for difference trading. One easy way for traders to keep track of their trading account status is through the forex margin level:. With a CMC Markets trading account, the trader would be alerted to the fact their account value had reached this level via an email or push notification. Thereby, you will have some leverage to improve your performance in a risky market, yet enough to avoid triggering a margin call. Trading strategies. Leverage is an extremely important part of every successful trading strategy. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Let's presume that the market keeps on going against you. Forex Fundamental Analysis. Even though you can make the calculation process by yourself, you can significantly economize time by making good use of the margin call calculator. Margin is typically expressed as a percentage.

Indeed a well developed approach will undoubtedly lead you to trading success in the end. Do you offer a demo account? It is important to note that it starts closing from the biggest losing position. Fill in our short form and covered call worksheet swing trading altcoins trading Explore our intuitive trading platform Trade the markets risk-free. What is free margin in Forex? For example, investors often use margin accounts when buying stocks. The market could potentially keep going against you forever, and the broker cannot afford to pay for this sustained loss. Ava Trade. We'll use an example to answer this question:. This usually happens when you have losing positions and the market is swiftly and constantly going against you. But how exactly does leverage work in Forex trading? Margin is one of the most important concepts to understand when it blockchain top 5 decentralized exchanges cat token hitbtc to leveraged forex trading. The way margin is determined is based on the leverage that you choose. Financial market analysis. Margin is not a cost or a fee, but it is a portion of the customer's account balance that is set aside in order trade.

By managing your the potential risks effectively, you will be more aware of them, and you should also be able to anticipate them and potentially avoid them altogether. Forex margin explained Trading forex on margin enables traders to increase their position size. In order to avoid them, you should understand the theory concerning margins, margin levels and margin calls, and apply your trading experience to create a viable Forex strategy. This happens when your broker informs you that your margin deposits have simply fallen below the required minimum level, owing to the fact that the open position has moved against you. What are the best ways to avoid the Margin Call? Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. In addition, they should apply different risk management techniques and tools — many of these are readily available once you open a retail client account with an online Forex broker. However, losses are magnified as well. The forex margin level will equal and is above the level. This is one of the most underestimated dangers to beginner traders — they would get leverage tempted by the attractive promise for huge profits but without a solid, reliable strategy and good knowledge of the market, they risk losing all their capital within days or even hours. Forex margin level: This provides a measure of how well the trading account is funded, by dividing equity by the used margin and multiplying the answer by You can choose between 2 ways to cover the margin call: You can deposit more money into the account to increase your equity; or You can sell enough assets from your portfolio so that your equity balance meets the margin requirement.

Using margin in forex trading is a new concept for many traders, and one that is often misunderstood. Note that the leverage shown in Trades 2 and 3 is available for Professional clients only. In situations where accounts have lost substantial sums in volatile markets , the brokerage may liquidate the account and then later inform the customer that their account was subject to a margin call. Technically, it is important to keep the value of the account higher than the maintenance margin level, otherwise your positions will simply be closed and this will result in a loss for you. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Leverage is an extremely important part of every successful trading strategy. Margin requirement: The amount of money deposit required to place a leveraged trade. Forex Trading Course: How to Learn Your form is being processed. More often than not, margin is seen as a fee a trader must pay. This is one of the most underestimated dangers to beginner traders — they would get leverage tempted by the attractive promise for huge profits but without a solid, reliable strategy and good knowledge of the market, they risk losing all their capital within days or even hours. Before you start speculating on the foreign exchange market, it would help to get a better understanding of technical analysis, as well as risk management , so you can better analyse price action and protect yourself from sudden market moves. Essentially, it is the minimum amount that a trader needs in the trading account to open a new position.

It is essential that traders understand the margin close out rule specified by the broker in order to avoid the liquidation of current positions. What is free margin in Forex? Related Articles. When trading on margin, gains and losses are magnified. The higher the margin level, the more cash is available to use for additional trades. Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable. Investopedia is part of td ameritrade gtc order last for blackrock ishares core s&p 500 ucits etf Dotdash publishing family. Well, the margin call is the difference between your current equity balance in the trading account and how much equity you require to maintain your open positions. Note: Low and High figures are for the trading day.

If the money in your account falls under the margin requirements, your broker will close some or all positions, as we have specified earlier in this article. Your form is being processed. Another example is purchasing a home and financing a portion of the price with mortgage debt. Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable. When this occurs, the broker will usually instruct the investor to either deposit more money into the account or to close out the position to limit the risk to both parties. Monitor important news releases with the use of forex sentiment indicator intraday gann calculator economic calendar should you wish to avoid trading during such volatile periods. That pending order will either not be triggered or will be cancelled automatically. As binary trade group signals what is meant by price action trading result, you are highly recommended to read your broker's service agreement ameritrade bond fees commission on quantity of 10 bonds penny stocks daily picks attentively before investing your money. How do I fund my account? Well, the margin call is the difference between your current equity balance in the trading account and how much equity you require to maintain your open positions. Test drive our trading platform with a practice account. Maintenance Margin. What is margin in forex? Open a live account. Until a few years ago, the Forex market became extremely popular among retail traders and one of the reasons for this was the opportunity to get high leverage and make the most of your limited capital.

To calculate forex margin with a forex margin calculator, a trader simply enters the currency pair, the trade currency, the trade size in units and the leverage into the calculator. Forex margin calculator Calculating the amount of margin needed on a trade is easier with a forex margin calculator. Free margin in Forex is the amount of money that is not involved in any trade. Another thing they should consider is the strategy they are about to apply and their overall trading style. Technically, it is important to keep the value of the account higher than the maintenance margin level, otherwise your positions will simply be closed and this will result in a loss for you. In situations where accounts have lost substantial sums in volatile markets , the brokerage may liquidate the account and then later inform the customer that their account was subject to a margin call. As a consequence, if you do not meet a margin requirement, your broker has the full right to close your open trades, starting from the one with the highest loss, in order to increase your account equity until you are above the necessary level of the maintenance margin. When this occurs, the broker will usually instruct the investor to either deposit more money into the account or to close out the position to limit the risk to both parties. What is a Forex arbitrage strategy? Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. More View more. Popular Courses. There may be a situation when you have some open positions and also some pending orders simultaneously. However, losses are magnified as well. What are the risks? Margin is the amount of money that a trader needs to put forward in order to open a trade. Leverage: Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment by funding a small amount of the trade and borrowing the rest from the broker. Once an investor opens and funds the account , a margin account is established and trading can begin. Why does a Margin Call matter?

There is one unpleasant fact for you to take into consideration about the margin call Forex. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. In other words, leverage allows traders to magnify their positions , hitherto impossible with the original capital. Live account Access our full range of markets, trading tools and features. Thus, they automatically close the respective trade s. Do you offer a demo account? What is the margin level? Take note that leverage can vary between brokers and will differ across different jurisdictions — in line with regulatory requirements.