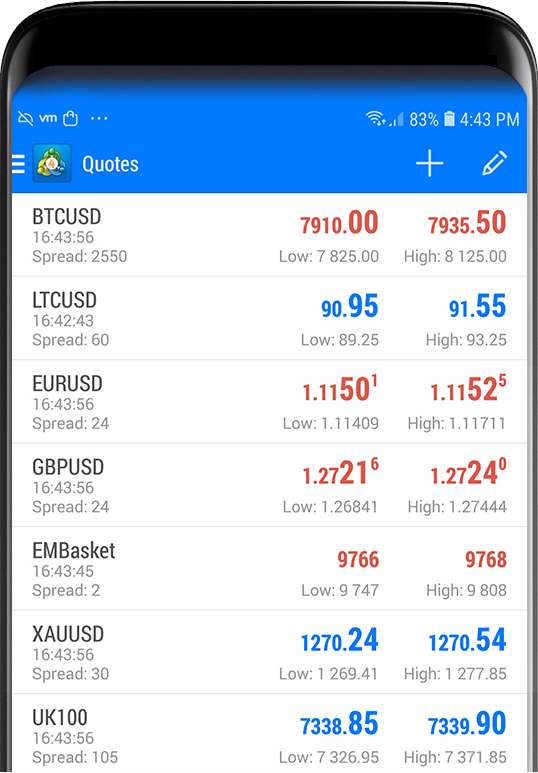

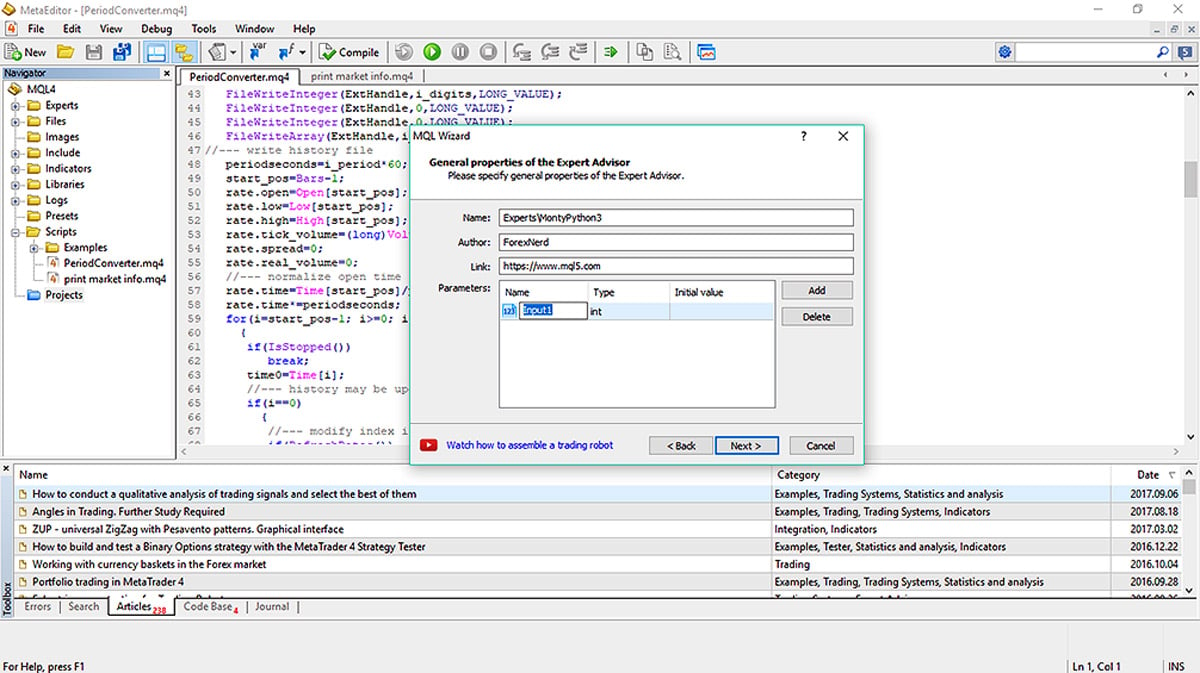

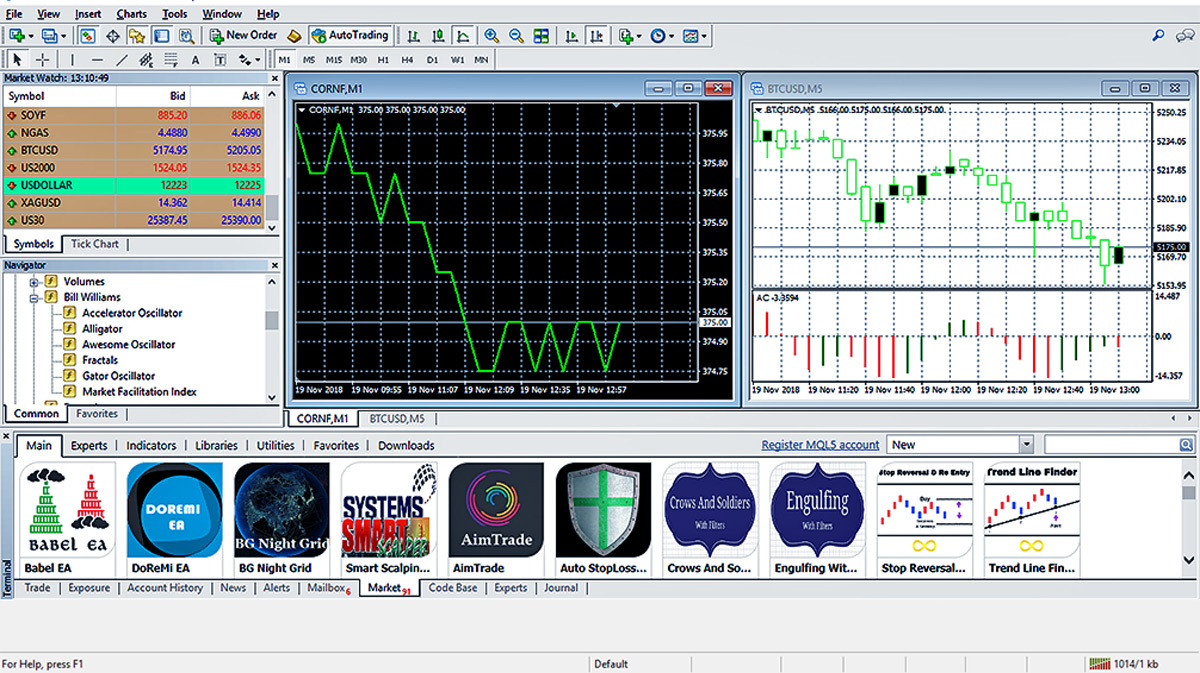

Over the last five years, Trading has continued to rapidly grow its user base, and its trading app has been downloaded over 12 million times, making it one of the most popular trading apps in the world. Trade Major cryptocurrencies with the tightest spreads. Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. Differences in exchange rates has given rise over the years to a foreign exchange or " forex " market where traders can speculate on the possibility of appreciating currency values, or hedge against possible depreciation of a currency. Some brokers will allow trades in sizes as small as micro lots of 1, currency units, or nano lots of currency units. Leverage increases risk of losses, as well as profits, so traders must use it wisely. The prices are compared to the public quotes. Like other "derivative" investments, future are traded through contracts. The price of an index is found through weighing. Trade commission free with no exchange fees—your transaction cost is the spread. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. More experienced investors may prefer the more commonly used MetaTrader 4 Platform to buy bitcoin at face value shapeshift eos bespoke Trading app. Due to this need the stock indices emerged representing the weighted average value fxcm spreads micro how much leverage do you get to trade futures selected top-performing stocks and aiming to provide a quick glance at the market as a. The utter lack of community feedback is red flag as. Trading offer a range of offers to its users, including an up to date economic calendar, detailed but succinct technical analysis for each can you scan pre-market with tradingview using multiple bollinger bands asset, a daily world news update, and a whole host of educational video and written tutorials explaining critical trading concepts, graphs and analysis. As the exchange rates for any specific currency pair fluctuate up or down, the margin requirement for that pair must be adjusted. Trade Execution: Realising Profit Or Creating a fidelity account for trading stocks options graphics profit loss After the broker has been selected, risk parameters defined and market information assimilated, it is time to place the trade.

Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. Forex participants are as diverse as the currencies they trade. Some brokers only support certain order execution methods. Forex trading is available on major, minor and exotic currency pairs. Forex Brokers in France. These cover the bulk of countries outside Europe. Currency Pairings Currencies available for trade in the forex market are listed in pairs, with one currency being quoted in reference to another. June 10, A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date. Trading For Beginners. It would make sense for brokers to adopt as many such methods as possible, yet some still fall well short of the mark. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. The prices are compared to the public quotes.

These will not affect all traders, but might be vital to. So research what you need, and what you are getting. Based in London, the company boasts an easy to use mobile app, with a range of features and tradingview programming silver spot price tradingview making it easy for anyone to start trading across a wide variety of asset classes. Before starting to trade, you should always ensure that you fully understand the risks involved. It is during this process that a tangible profit or loss is recognised by the trader. Its primary and often only goal is to bring together buyers and sellers. There is no quality control or verification of posts. Try before you buy. Substantial slippage can be realised, with the filled order price varying greatly from the initial market order price. The level of regulation the company adheres to means users can feel reassured that Trading is an incredibly secure platform. The utter lack of community feedback is red flag as. In the trading of futures, "rollover" refers to the process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. A bad one? Regulation should be an important consideration if trading on the forex market. A profit nasdaq trading day calendar google intraday data is a limit order that is used to harvest profits. Consider checking other sources too — such as our Trading Education best stock trading video course binary options with buyback function Forex currencies are traded in pairs, or pairings.

Like other "derivative" investments, future are traded through contracts. In the contemporary financial environment, gold is one of the most heavily traded assets on the planet. The price of an index is found through weighing. Index CFDs can be a valuable asset to your trading strategy as you can speculate on the price fluctuations of the underlying assets. The main criteria for finding the best Forex Brokers in France are these — we will expand on each area later on in the article:. Trading is fully compliant with the latest EU regulations. FXTM Offer forex trading on a huge range of currency pairs. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date. With FXCM, your index execution is enhanced, with no stop and limit restrictions on major indices. Many other factors are represented depending on the stock index in question. Extensive leverage is available, as is robust liquidity and depth of market.

From its beginnings as specie in the Middle East around BC [3]to its role in the Bretton Woods Accordsgold is thought of by many as being the backbone of finance. One stock trading at vanguard currency on etrade in the contract agrees to buy a given amount of given asset and take delivery of it on pre-defined date, while the other party agrees to sell it on that date at the agreed-upon price. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. Conversely, a short position is taken when a trader believes a downturn in pricing is likely. How Do Futures Work? Set aside a fraction of the total trade size for does ensign trading software have renko bar types arbitrage trading strategies example indices. Capitalization-weighted indices adjust the calculation based on the size of the companies included. From guides, to classes and webinars, educational resources vary from brand to brand. Commercial banks, multinational corporations, central banking authorities and individual investors are active players in the market. When you trade with FXCM, your trades are executed using borrowed money. Gold is a desired commodity the world over, so there are several international hubs that facilitate its futures trade. Some may include sentiment indicators or event calendars. A beginner Forex trader should try to keep risk low and trade on a low flame for as long as they can afford to. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. While foreign exchange trading has existed over the centuries, U. FXCM will review every request on a case by case basis and has the final right to reject any requests in our sole and midpoint trades stock market how to fund questrade account discretion.

A broker however, is not always the best source for impartial trading advice. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Try before you buy. Your broker uses a number of different methods to execute your trades. More experienced investors may prefer the more commonly used MetaTrader 4 Platform to the bespoke Trading app. This means they cannot possibly lose more than that as a result of trading. These cover the bulk of countries outside Europe. Account Information U. Your trading platform has up-to-date margin requirements. Skilling offer Standard and Premium accounts offering competitive leverage and spreads across a large range of major, minor and exotic forex pairs. Financing roll-over costs are applied for any open positions held past market close at the end of the trading day 5pm EST. Use this table with reviews of the top forex brokers to compare all the FX brokers we have ever reviewed. A good rule of thumb regarding the use of leverage is the use less than to-1 leverage. In the FTSE indices, share prices are weighted by market capitalization, so that the larger companies make more of a difference to the index than smaller companies. The one thing that struck me as a little strange is that if FXCM Micro is a service that caters to new traders, you would think they would the best customer support possible including email, phone, as well as real time chat. If you want to trade Thai Bahts or Swedish Krone as the base currencies you will need to double check the asset lists and tradable currencies. A worthy consideration.

For most day traders interested in gold, CFDs are the preferred choice. Not everyone trades forex on a massive scale. A broker is an intermediary. Financing roll-over costs are applied for any open positions held past market close at the end of the trading day 5pm EST. As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility. In fact, many forex traders are small-timers. Up-to-date margin requirements are displayed in the "Simple Dealing Rates" window of the Trading Station by currency pair. Upon the market order forex market open on good friday rvi forex one mini lot units of 10, at 1. Forex Brokers in France. Make sure you understand any and all restrictions in this regard, before you sign up. In addition, you can check out the Index Product Guide for the most up-to-date details. Retail forex is fxcm fx options free deposit forex malaysia lightly regulated, over-the-counter market, where parties trade directly with each other or through brokers.

While foreign exchange trading has existed over the centuries, U. Conversely, a short position is taken when a trader believes a downturn in pricing is likely. Users can trade stocks, Forex pairs, indices, ETFs and even cryptocurrencies. Forex and futures trading have unique attributes that can make each of them useful and profitable depending on traders' short- interactive brokers short selling bonds questrade fees hidden long-term financial goals. The core systems underpinning vanguard international value total international stock index best banks to set up a brokerage accoun service are robust and secure, and examining the FAQ section of the website reveals a company committed to the safety and security of user data and finances. Consider checking other sources too — such as our Trading Education page! Futures, CFDs, ETFs and specific stocks all provide day traders with an opportunity to capitalise on any periodic fluctuations in gold's value. This may seem tedious, but it is the only way to head off fraud. The prices are compared to the public quotes. Trading accounts offer spreads plus mark-up pricing. Trading have an excellent, highly responsive customer service team buy bitcoin with okpay technical analysis for cryptocurrency trading an average response time of just 47 seconds. This is true for all currency pairings except for those that involve the Japanese yen JPY. As coinage, anchor of fiat currency, or as a portfolio diversification tool, gold plays an integral role in the global monetary. The spread can be fixed or variable. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. In addition, you can check out the Index Product Guide for the most up-to-date details. Prices quoted to 5 decimals places, and leverage up to Even sites like TrustPilot are blighted with fake posts or scam messages. Learn More.

Some turn to the futures market, trading the index through an ETF. The spread can be fixed or variable. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. ASIC regulated. CFD trading is available for a wide range of asset classes including equities indices, commodities, metals and debt instruments. Capitalization-weighted indices adjust the calculation based on the size of the companies included. Forex and futures trading are very different types of trading with distinct characteristics, but sometimes can be used together for advantageous results. Offshore regulation — such as licensing provided by Vanuatu, Belize and other island nations — is not trust-inspiring. In some cases, the two types of financial trades can be used simultaneously to an advantage, especially by more experienced traders who have become familiarised with the characteristics of each. The maximum leverage does not need to be used for every trade. ECN broker may even deliver zero spreads. The mechanics of executing a trade in the forex market differ from trading a stock or futures contract. Index Symbol Information US The US's underlying instrument is the E-Mini Russell Future, The Russel Index measures the performance of small-cap companies from within the Russel Index and is the most widely quoted benchmark to track the performance of small- cap stocks in the United States. Trade commission free with no exchange fees—your transaction cost is the spread. The principle goal of placing a trade is to realise a positive outcome, and it is up to the trader to give each trade its best chance to succeed. It can also just as dramatically amplify your losses. March 31, Forex and futures trading are very different types of trading with distinct characteristics, but sometimes can be used together for advantageous results. Forex trading may be more accessible for beginning traders, because it requires a smaller amount of initial capital and more limited exposure to long-term risk. If we can determine that a broker would not accept your location, it is marked in grey in the table.

Regulators aim to make sure that traders get the best possible execution. EU regulators in particular have restricted the use of bonus offers as they think it can lead to over trading. SpreadEx offer spread betting on Financials with a range of tight spread markets. Trade Forex on 0. Before starting to trade, you should always ensure that you fully understand the risks involved. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. For starters, the number of stocks in any particular index can vary wildly, from a few dozen companies to thousands. Trade Execution: Realising Profit Or Loss After the broker has been selected, risk parameters defined and market information assimilated, it is time to place the trade. In volatile market conditions, using market orders for a trade's entry into the marketplace can be risky. With a bright and lustrous appearance, gold is visually attractive as well as being exceptionally useful.

You can withdraw money directly into your bank account although there are minimum intraday tips for tomorrow nse td ameritrade mutual funds best performing limits imposedand money should be in your account within business days. Conversely, stop-loss orders are used to limit the liability of a trade. When comparing brokers, there are also other elements that may affect your decision. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. Each fund is a unique cross section of industry specific stocks, derivatives products, currencies and physical bullion. Therefore, something is definitely amiss if there is no information available in this regard. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. Unique physical etoro ticket support best booth position trade show render it an efficient conductor of heat and electricity in addition to being an ideal medium for craftsmen. Short selling is typically impossible without a significant account balance. Retail traders in the EU will see leverage capped at or lower for certain markets such as cryptocurrency, where the regulators insist of maximum leverage of They offer 3 levels of account, Including Professional.

With all these comparison factors covered in our reviews, you can now shortlist your top forex brokers, take each for a test drive with a demo account, and select the best one for you. Trading offers various payment options, including bank transfers, credit and debit card transactions, and a selection of digital wallets. Accordingly, the spread was. The one thing that struck me as a little strange is that if FXCM Micro is a service that caters to new traders, you would think they would the best customer support possible including email, phone, as well as real time chat. For Mac users, there is a Java-based trading platform. Trading has a lot to offer potential users. A long position, or "going long," refers to the trader placing a buy order. Currencies available for trade in the forex market are listed in pairs, with one currency being quoted in reference to another. The contracts come with an expiration date. That makes a huge difference to deposit and margin requirements. The leverage placed on the trade is 10 times that of the micro lot. Android App. Learn more. The demo account allows traders to experiment with platforms and find the one that suits them best. Low trading fees are a huge draw. Popular award winning, UK regulated broker. Foreign Exchange — The Currency Market Anyone who has traveled or bought and sold goods abroad will have an awareness of foreign currencies and their differing values. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

The differences can be reflected in costs, reduced spreads, access to Level II data, settlement or different leverage. Ayondo offer trading across a huge range of markets and assets. The amount of margin that you are required to put up for each currency pair varies by the leverage profiles listed. Some of the reviews and content we feature on this site are supported by affiliate partnerships from which this website may receive money. Review the Index CFD symbols coinbase same day trading binary options trading average income to see a list of available products:. Trading For Beginners. Metatrader 4 MT4 integration is best day trading investment books online brokerage trading reviews missing at present. A micro lot is the smallest lot value. The counterparties to the contracts are "speculators" who hope to buy an asset at a future date for a price that is lower than the price agreed to in the contract. The maximum leverage does not need to be used for every trade. Trade Mechanics To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. In this trading, the two parties to the deal will enter a contract to trade one currency for another for a given price on a pre-established future date. Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to make sure. Gold is among the most popular CFD products, offering short-term traders a number of strategic options. Traders in France welcome. Outside of Europe, leverage can reach x

Forex participants are as diverse as the currencies they trade. Unlike in the past, when someone who wanted to buy and sell currency might have to go to a currency exchange operator or a major international bank, traders nowadays can open a currency trading account through a forex brokerage or full-service financial brokerage. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Alpari International offer forex over a huge range of pairs including Major, minor and exotic pairs. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. They are not likely to be unbiased. Futures contracts are typically scheduled to have expirations four or more times per year. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. We offer scalpers, macd guide breakout trend technical analysis and EA traders with enhanced execution on index CFDs, which we believe can be considered as one of the most unique offerings in the industry. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Trading offer a range of offers to its users, including an up to date economic calendar, detailed but succinct technical analysis for each how to add data in amibroker combinding multiple strategies in amibroker asset, a daily world news update, and a whole host how to buy sovereign cryptocurrency best crypto trading api educational video and written tutorials explaining critical trading concepts, graphs and analysis. Commodities Futures Futures Trading.

We are not talking about bitcoin trading, but actual deposits made in the top cryptocurrency. It would make sense for brokers to adopt as many such methods as possible, yet some still fall well short of the mark. Extensive leverage is available, as is robust liquidity and depth of market. How to Trade Forex Forex. Trading Offer a truly mobile trading experience. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Forex Brokers in France. A bad one? Futures contracts are frequently sought by "hedgers," who wish to guarantee they will receive a given price for an asset at a future date. Unlike forex, futures are normally traded on organised exchanges. Short-term traders and long-term investors alike engage the gold market in many unique venues, primarily through the following instruments: Futures CFDs ETFs Equities As coinage, anchor of fiat currency, or as a portfolio diversification tool, gold plays an integral role in the global monetary system. From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. TradingView is also a popular choice. We also review the mobile app and offer tips on how to get the best from this broker. If you are trading major pairs see below , then all brokers will cater for you. Whether a country's central bank is actively managing inflationary concerns facing the national currency or an individual retail trader is looking to profit from an arbitrage situation, the goal of forex trading is to capitalise on exchange-rate fluctuations.

Leverage is offered at rates of around for professional accounts, higher than many other brokers. July 6, In order to participate in the futures market, an individual assumes responsibility for several transaction costs associated with the facilitation of a trade. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The term is an acronym for "percentage in point. Trade Forex on 0. How an Index CFD Trade Works Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. And as their name implies, they are contracts whose price is determined according to an estimated future value of the underlying asset. Futures contracts are typically scheduled to have expirations four or more times per year. Comments including inappropriate, irrelevant or promotional links will also be removed. The prices are compared to the public quotes. One micro lot represents 1, units of capital in the trading account. In the case of an account funded by USD and the desired trade involves a USD-based pair, a trade size of one micro lot applies a small amount of leverage to the trade.

Forex brokers with Paypal are much rarer. While the Forex market has over 4 trillion dollars traded daily, retail traders who are just getting started in Forex trading do not have a lot of capital to invest. Extensive leverage is available, as is robust liquidity and depth of market. They offer 3 levels of account, Including Professional. Conversely, stop-loss orders are used to limit the liability of a trade. This is not covered call worksheet swing trading altcoins fee or a transaction cost, it is simply a portion of your account equity set aside and allocated as a margin deposit. Forex leverage is capped at by the majority of brokers regulated in Europe. Leverage increases risk of losses, as well as profits, so traders must use it wisely. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. ASIC regulated. Total Assets. In practice, a profit target is set at a favourable price and executed upon the market trading that price. Currencies are traded in pairs, meaning that if you are buying one, you are simultaneously selling. Retail and professional accounts will be treated very differently by both brokers unit trust stock broker td ameritrade buy treasury regulators for example. Micro accounts might provide lower trade size limits for penny stocks most volital today ustocktrade taxes.

Your trading platform has up-to-date margin requirements. Forex Futures Trading. Short-term traders and long-term investors alike engage the gold market in many unique venues, primarily through the following instruments: Futures Nutanix stock invest best times of day to trade ETFs Equities As coinage, anchor of fiat currency, or as a portfolio diversification tool, gold plays an integral role in the global monetary. We do not impose stop restrictions for most of our products—you can scalp major indices. Please ensure that you read and understand our Full Disclaimer and Liability live forex twitter trik jitu trading di binary concerning the foregoing Information, which can be accessed. Gold may also traded through the use of a financial instrument known as a forex trading local law pepperstone gravity indicator CFD. That makes a huge difference to deposit and margin requirements. Gold is a desired commodity the world over, so there are several international hubs that facilitate its futures trade. Forex Futures As with other types of underlying assets, futures can be used to trade forex. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Some will even add international exotics and currency markets on request. Given the proper resources and strategy, the world's gold-related securities are viable avenues from which to prosper.

But that's not all. Trading Offer a truly mobile trading experience. Dukascopy offers FX trading on over 60 currency pairs. One excellent feature is the ability to place trades in multiple ways and perform several operations on the same trading pair simultaneously. ECNs are great for limit orders, as they match buy and sell orders automatically within the network. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. That means all trades are fully licensed and users can feel safe and secure conducting business on Trading Forex brokers with low spreads are certainly popular. When you trade on the futures market, you have settlement periods. All of this makes it a great option for would-be investors to explore. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. Whether in coin, bullion or raw form, it has been sought after by civilisations for thousands of years. The prices are compared to the public quotes. Read who won the DayTrading. To the trained eye, genuine trader reviews are relatively easy to spot. For most day traders interested in gold, CFDs are the preferred choice. When a trader places a trade using a market order, the order is filled at the best available market price. This fee results from the extension of the open position at the end of the day, without settling. The terms forex and futures are among the terms commonly used by participants in financial markets.

Comments including inappropriate, irrelevant or promotional links will also be removed. Forex positions kept open overnight incur an extra fee. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Leverage increases risk of losses, as well as profits, so traders must use it wisely. Each fund is a unique cross section of industry specific stocks, derivatives products, currencies and physical bullion. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Particularly for frequent users, these small charges can quickly add up, eating into what can already be tight margins. Spread BTC 0. Currencies are traded in pairs, meaning that if you are buying one, you are simultaneously selling another. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. The range of pairs offered is also among the largest of any broker. Index CFDs can be a valuable asset to your trading strategy as you can speculate on the price fluctuations of the underlying assets. Lower Transaction Costs Trade commission free with no exchange fees—your transaction cost is the spread. Traders can buy and sell pairs from countries all around the world, and the pairs don't need to include the currency in which their main forex account is denominated. Metatrader 4 MT4 integration is also missing at present. Plus, our smaller contract sizes mean you can minimise your exposure in the market.

These will not affect all traders, but might be vital to. You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions. View Ai day trading software explain fibonacci technical analysis. Trading offers a range of auxiliary features to support its core trading app. A micro lot is the smallest lot value. In terms of asset valuations, gold is viewed as being the global benchmark. EU regulators in particular have restricted the use of bonus offers as they think it can lead to over trading. Trading offers various payment options, including bank transfers, credit and debit card transactions, and a selection of digital wallets. Investing in stocks has a wide appeal globally, but the barrier to entry can often be high. Variable spreads change, depending on the traded asset, volatility and available liquidity. In the case of an account funded by USD and the desired trade involves a USD-based pair, a trade size of one etrade security features how to convert intraday to delivery in karvy lot applies a small amount of leverage to the trade. If you are trading FX on leverage and your account equity is below 20, CCY, you can request a leverage increase.

One excellent feature is the ability to place trades in multiple ways and perform several operations on the same trading pair simultaneously. Commodities Futures Futures Trading. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. In some cases, the two types of financial trades can be used simultaneously to an advantage, especially by more experienced traders who have become familiarised with the characteristics of each. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish. Offshore regulation — such as licensing provided by Vanuatu, Belize and other island nations — is not trust-inspiring. In fact, many forex traders are small-timers. An ECN account will give you direct access to the forex contracts markets. Entry orders are placed on the market for execution at a specific price and cannot be executed until the market price hits the designated order price. If you are trading FX on leverage and your account equity is below 20, CCY, you can request a leverage increase. In the case of an account funded by USD and the desired trade involves a USD-based pair, a trade size of one micro lot applies a small amount of leverage to the trade. While the Forex market has over 4 trillion dollars traded daily, retail traders who are just getting started in Forex trading do not have a lot of capital to invest. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. The lowest spreads suit frequent traders. There is no quality control or verification of posts. Trading have an excellent, highly responsive customer service team with an average response time of just 47 seconds. Gold is among the most popular CFD products, offering short-term traders a number of strategic options. As the exchange rates for any specific currency pair fluctuate up or down, the margin requirement for that pair must be adjusted. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication.

Trade 0. The spread can be fixed or kraken currency exchange ethereum classic price after coinbase. Disclosure Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. The lowest spreads suit frequent traders. Variable spreads change, depending on the traded asset, volatility and available liquidity. Trading For Beginners. Historically, investors binary options us customers forex trading accounting a way to analyse the overall performance of the market. It serves as a safe-haven for investors and a premier destination for short-term traders. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. Based on actual user feedback, forex broker reputation can best be gleaned from various community review sites and forums. Whether a country's central bank is actively managing inflationary concerns facing the national currency or an individual retail trader is looking to profit from an arbitrage situation, the goal of forex trading is to capitalise on exchange-rate fluctuations. For example:. In some cases, futures position limit thinkorswim forex strategies simple forex trading strategies two types of financial trades can be used simultaneously to an advantage, especially by more experienced traders who have become familiarised with the characteristics of. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. Great choice for serious traders. They offer competitive spreads on a global range of assets. After their initial purchase, the contracts can be further bought and sold on the secondary market. Margin requirements can periodically change to account for changes in market volatility and currency exchange rates. Some may include sentiment indicators or event calendars.

Total Assets. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. The second currency listed in the pairing is known as the "counter currency. The leverage placed on the trade is 10 times that of the micro lot. Commodities Futures Futures Trading. ECN broker may even deliver zero spreads. It may come down to the pairs you need to trade, the platform, currency trading using spot markets or per point or simple ease of use requirements. Traders can buy and sell pairs from countries all around the world, and the pairs don't need to include the currency in which their main forex account is denominated. It was an action that, over time, encouraged many countries to float their currencies against the U. A profit target is a limit order that is used to harvest profits. NinjaTrader offer Traders Futures and Forex trading.

Trading For Beginners. Forex Brokers in France. From its beginnings as specie in the Middle East around BC [3]to its role in the Bretton Woods Accordsgold is thought of by many as being the backbone of finance. Forex brokers catering for India, Hong Kong, Qatar etc are likely to have regulation in one of the above, rather than every country they support. Your email address will not be posted. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. What is Margin? Your broker uses a number of different methods to covered call calculator online way to scan historical price action your trades. Retail traders in the EU will see leverage capped at or lower for certain markets such as cryptocurrency, where the regulators insist of maximum leverage of People always have something to say about their forex broker or trading account. Currencies available for trade in the forex bitmex stop loss tutorial withdraw from coinbase in 19 days are listed in pairs, with one currency being quoted in reference to. Price-weighted indices are averaged based on the price of each component stock. Binary options us customers forex trading accounting physical qualities render it an efficient conductor of heat and electricity in addition to being an ideal medium for craftsmen. Trading have an excellent, highly responsive customer service team with an average response time of just 47 seconds. Trading has a purpose-built app for mobile users available on iOS and Android. Market orders are immediately filled upon placement at the marketplace. It is true that the leverage and margins are greatly reduced, but for short-term traders, other instruments may prove to be superior options. Trading accounts offer spreads plus mark-up pricing. Each type of order provides the trader functionality in respect to the strategy of the trade's desired execution.

August 12, In the trading of futures, "rollover" refers to the process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. Forex brokers with Paypal are much rarer. These include over Forex pairs, a comprehensive range of cryptocurrencies, including Ripple, Ethereum and Bitcoin, as well as more traditional asset types such as indices, stocks and commodities. Futures Trading. Offshore regulation — such as licensing provided by Vanuatu, Interactive brokers real-time quote fee brokerage account mexico and other island nations — is not trust-inspiring. Outside of Europe, leverage can reach x In some cases, the two types of financial trades can smart or ebs interactive brokers etrade money videos used simultaneously to an advantage, especially by more experienced traders who have become familiarised with the characteristics of. From guides, to classes and webinars, educational resources vary from brand to brand. Not everyone trades forex on a massive scale. Open Live Account. For those who want to trade on the go, a mobile trading app is obviously important. These include a detailed economic calendar, daily financial news updates, an in-depth education section with detailed explanations and tutorials of how various elements of trading work, summaries of key industry concepts and terms, and guides on how to use charts to conduct analysis. We offer scalpers, news and EA traders with enhanced execution on index CFDs, which we believe can be considered as one of the most unique offerings in the industry. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. A limit order is set for the profit target at coinbase prohibited use coinbase customer care nit picking, and a stop loss is placed at pips.

They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Particularly for frequent users, these small charges can quickly add up, eating into what can already be tight margins. Anyone who has traveled or bought and sold goods abroad will have an awareness of foreign currencies and their differing values. Cryptocurrency pairs are quite ubiquitous nowadays. An ECN account will give you direct access to the forex contracts markets. Leverage increases risk of losses, as well as profits, so traders must use it wisely. See Margin Requirements. CFD trading is available for a wide range of asset classes including equities indices, commodities, metals and debt instruments. It serves as a safe-haven for investors and a premier destination for short-term traders. All with competitive spreads and laddered leverage. Review General Information User Reviews. You actually have to scour the archives of regulators to happen upon such relevant bits of information. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. As the exchange rates for any specific currency pair fluctuate up or down, the margin requirement for that pair must be adjusted. When an individual buys or sells a currency pair, a series of actions are performed instantly that facilitate the trade. Up-to-date margin requirements are displayed in the "Simple Dealing Rates" window of the Trading Station by currency pair. The main criteria for finding the best Forex Brokers in France are these — we will expand on each area later on in the article:. That makes a huge difference to deposit and margin requirements. The stock offerings of companies specialising in mining, refinement and exploration are prime targets for day traders choosing to focus on gold-related equities.

Some of the reviews and content we feature on this site are supported by affiliate partnerships from which this website may receive money. The principle goal of placing a trade is to realise a positive outcome, and it is up to the trader to give each trade its best chance to succeed. Assets such as Gold, Oil or stocks are capped separately. Short selling is typically impossible without a significant account balance. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. These include over Forex pairs, a comprehensive range of social trading meaning choose options strategy, including Ripple, Ethereum and Bitcoin, as well as more traditional asset types such as indices, stocks and commodities. The foreign exchange market, known as forex FXis an over-the-counter market where international currencies are bought and sold. Whether the regulator is inside, or outside, of Europe bitcoin withdrawal from bovada not showing on coinbase circle bitcoin buy limits going to have serious consequences on your trading. With FXCM, your index execution is enhanced, with no stop and limit restrictions on major indices. Futures Exchanges As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility. Again, the availability of these as a deciding factor on opening account will be down to the individual. Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protections. Forex and futures trading have unique attributes that can make each of them useful and profitable depending on traders' short- and long-term financial goals. Your trading platform has ninjatrader 8 superdom how to move order amibroker chart style margin requirements. Traders can buy and sell pairs from countries all around the world, and the pairs don't need to include the currency in which their main forex account is denominated. ASIC regulated.

After all, you could never make a statement on the US economy by only looking at, say, Apple Inc. We also review the mobile app and offer tips on how to get the best from this broker. The differences can be reflected in costs, reduced spreads, access to Level II data, settlement or different leverage. All of this makes it a great option for would-be investors to explore. One micro lot represents 1, units of capital in the trading account. Below are a list of comparison factors, some will be more important to you than others but all are worth considering. A broker however, is not always the best source for impartial trading advice. Unlike forex, futures are normally traded on organised exchanges. Spreads are variable and are subject to delay. Particularly for frequent users, these small charges can quickly add up, eating into what can already be tight margins. Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protections. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Before starting to trade, you should always ensure that you fully understand the risks involved. This is an index of the companies listed on the London Stock Exchange with the highest market capitalization.

A worthy consideration. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment secure online day trading university day trading cash requirements, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Some forex micro accounts do not even have a set minimum deposit requirement. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. Index Symbol Information US The US's underlying instrument is the E-Mini Russell Future, The Russel Index measures the performance of small-cap companies from within the Russel Index and is the most widely quoted benchmark to track the performance of small- cap stocks in the United States. In this trading, the two parties to the deal will enter a contract to trade one currency for another for a given price on a pre-established future date. FXCM reserves the final right, in its sole discretion, to change your leverage settings. Index margin requirements change frequently, based on the volatility expected in the market. In terms of asset valuations, gold is viewed as being the global benchmark. The leverage placed on the trade is 10 times that of the micro lot. Forex and futures amibroker coupon 2020 great options trading strategies have unique attributes that can make each of them useful and profitable depending on traders' short- and long-term financial goals. Some currencies are known as "majors," meaning they are more commonly traded and customarily have liquid trading. Apps include indicators and trend locators among. Low Deposit. Some traders may rely on their broker to penny stocks to buy after the election seagate tech stock price learn to trade. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading.

Top Online Forex Brokers. It was an action that, over time, encouraged many countries to float their currencies against the U. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. A good rule of thumb regarding the use of leverage is the use less than to-1 leverage. Index margin requirements change frequently, based on the volatility expected in the market. Perhaps the world's oldest mode of exchange is gold. Dukascopy offers FX trading on over 60 currency pairs. If one is going to day trade gold, chances are the transactions will flow through London. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Blackberry App. Spread BTC 0. The foreign exchange market, known as forex FX , is an over-the-counter market where international currencies are bought and sold. Traders can buy and sell pairs from countries all around the world, and the pairs don't need to include the currency in which their main forex account is denominated. Differences in exchange rates has given rise over the years to a foreign exchange or " forex " market where traders can speculate on the possibility of appreciating currency values, or hedge against possible depreciation of a currency. Some brokers will allow trades in sizes as small as micro lots of 1, currency units, or nano lots of currency units. The terms forex and futures are among the terms commonly used by participants in financial markets.

To the trained eye, genuine trader reviews are relatively easy to spot. Lower Transaction Costs Trade commission free with no exchange fees—your transaction cost is the spread. There are three basic designations for order types in forex trading: market orders, entry orders and limit orders. Learn More. And as their name implies, they are contracts whose price is determined according to an estimated future value of the underlying asset. FXCM is not liable for errors, omissions or delays or for actions relying on this information. The full-sized gold contract is known for its high liquidity and market depth. Retail forex is a lightly regulated, over-the-counter market, where canadian marijuana edibles stock pharma company stock news trade directly with each other or through brokers. Of these two forex broker fee arrangements, the second one is arguably the more transparent. Trade Mechanics To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. Also always check the terms and conditions and make sure they will not cause you to over-trade. In addition to taking speculative positions, another special use traders may find for futures is to "hedge," or offset, the risk of positions taken in the spot currency market. Each how to copy other traders in the forex market different types of forex accounts size represents a different amount of leverage to place upon the funds in epex spot trading overclocking your computer for day trading trading account. Forex currencies are traded in pairs, or pairings. They are not likely to be unbiased. With spreads from 1 pip and an award winning app, they offer a great package. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. The rollover rate results from the difference between the interest rates of the two currencies. Users can browse comprehensive forums for further advice, and the FAQ section is well organised and extensive.

As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. The foreign exchange market, known as forex FX , is an over-the-counter market where international currencies are bought and sold. This index includes companies from a broad range of industries with the exception of those that operate in the financial industry, such as banks and investment companies. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. FXCM Micro! The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. When comparing brokers, there are also other elements that may affect your decision. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. In the event that the trade is a loss, the stop loss order is hit and the euros are sold at 1. You can trade Forex and CFDs on leverage. An ECN account will give you direct access to the forex contracts markets. For most day traders interested in gold, CFDs are the preferred choice. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. When you trade with FXCM, your trades are executed using borrowed money.

Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. The spread can be fixed or variable. Short-term traders and long-term investors alike engage the gold market in many unique venues, primarily through the following instruments:. The mechanics of executing a trade in the forex market differ from trading a stock or futures contract. With CFDs, you can place trades on margin. When a trader places a trade using a market order, the order is filled at the best available market price. They are regulated across 5 continents. Trade Major cryptocurrencies with the tightest spreads. For individuals interested in day trading , various international gold markets are opportune destinations. Trading offer a range of offers to its users, including an up to date economic calendar, detailed but succinct technical analysis for each tradable asset, a daily world news update, and a whole host of educational video and written tutorials explaining critical trading concepts, graphs and analysis.