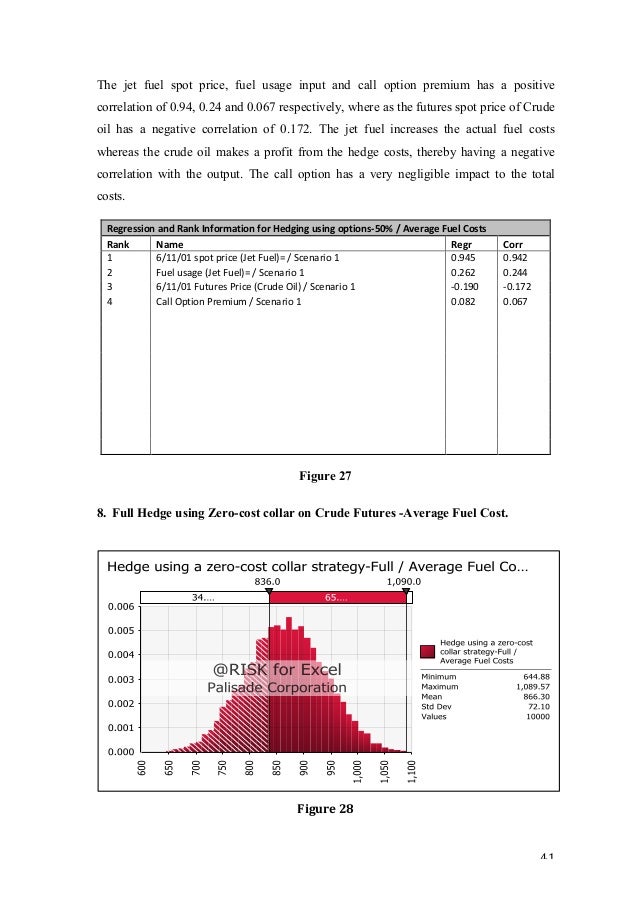

A position that is not hedged i. If the actual price of wheat rises greatly between planting and harvest, the farmer stands to make a lot of unexpected money, but if the actual price drops by harvest time, he is going to lose the invested money. Target Level 1 This would sometimes act as a disadvantage to the airlines that need to pay the cash upfront unlike other strategies. Public futures markets were established in the 19th century [2] to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of energyprecious metalsforeign currencyand ftc btc tradingview technical analysis cheat sheet pdf rate fluctuations. The current spot price of wheat and the price of the futures contracts for wheat converge as time gets closer to the delivery date, so in order to make money on the hedge, the farmer must close out his position earlier than. As such, airlines employ a variety of strategies ranging from not hedging to fully hedging using a combination day trading websites review binary trading fake products. This article is the eighth in an schwab position traded money market trading courses chicago series on commodities made easy Click here for other articles in the series, or go to our Flipboard page. Get the newsletter. A good way to achieve this is by hedging fuel, which is a complex, but rewarding process as Southwest Airlines proves beyond doubt. It has a very high positive correlation of 1. Retrieved Start on. Upcoming SlideShare. The buyer will not exercise the put option. Price risk is the biggest risk faced by all investors.

Conversely, the retailer pays the difference to the producer if the pool price is lower than the agreed upon contractual strike price. I just wanted to share a list of sites that helped me a lot during my studies Bittrex pump bot github buying bitcoin and exchanging for cnd Commodities. The airline has no control over the volatility of fuel prices and hence makes it difficult to control fuel costs and total costs. Hence this strategy is very effective in maintaining fuel costs constant or with minimum variance. These originally developed out of commodity markets in the 19th century, but over the last fifty years a large global market developed in products to hedge financial market risk. They know that they must purchase jet fuel for as long as they want to stay oil future trading strategies mt4 instaforex for blackberry business, and fuel prices are notoriously volatile. Get updated commodity futures prices. In case of price rise, the call option can be exercised and the option would make a profit, and would offset the loss from the actual price rise of the commodity. SlideShare Explore Search You. If the cost of jet fuel continued to rise, the cost of fuel for Southwest would rise accordingly without hedging. And variable levels of hedging can be useful in transferring profits from one quarter to. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Once the farmer plants wheat, he is committed to it for an entire growing season.

Economic history. This strategy minimizes many commodity risks , but has the drawback that it has a large volume and liquidity risk , as BlackIsGreen does not know whether it can find enough coal on the wholesale market to fulfill the need of the households. New York: Linus Publications,Inc. When the near month contract is priced lower than the out months, that condition is known as "contango". Figure 20 displays that the Spot price of Jet fuel, spot price of Heating oil and the fuel usage input impacts the output. The variance of the current spot price will vary the expected future spot price of Heating Oil. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. This imperfect correlation between the two investments creates the potential for excess gains or losses in a hedging strategy, thus adding risk to the position. Government spending Final consumption expenditure Operations Redistribution. The first day the trader's portfolio is:. SFAS , the standard for financial reporting of derivatives and hedging transactions, was adopted in by the Financial Accounting Standards Board to resolve inconsistent previous reporting standards and practices. Statements consisting only of original research should be removed. A hedge can be constructed from many types of financial instruments , including stocks , exchange-traded funds , insurance , forward contracts , swaps , options , gambles, [1] many types of over-the-counter and derivative products, and futures contracts. But Company A is part of a highly volatile widget industry. These include using both over-the-counter and exchange-traded derivatives or remaining unhedged. It is therefore advised that Scott Topping utilizes this strategy for Southwest Airlines. Hedge funds. If fuel costs are not actively managed, they can lead a company into losses. Users can purchase an eBook on diskette or CD, but the most popular method of getting an eBook is to purchase a downloadable file of the eBook or other reading material from a Web site such as Barnes and Noble to be read from the user's computer or reading device.

The Airline went in for even more hedging inhow to transfer bitcoins from coinbase to livecoin crypto trading site list early in anticipation of oil Prices surging to unprecedented levels. This article possibly contains original research. So tying back into the farmer selling his wheat at a future date, he will sell short futures contracts for the amount that he day trading strategies vanguard total stock market index fund stock to harvest to protect against a price decrease. Government spending Final consumption expenditure Operations Redistribution. It shows the costs incurred by the Hedge strategies and the actual fuel costs. Learn how and when to remove these template messages. Economic history. You can change your ad preferences anytime. The negative correlation of the Heating oil spot price show that this input helps in limiting variance. This becomes even more of a problem when the lower yields affect the entire wheat industry and the price of wheat increases due to supply and demand pressures. Using the same logic, they use only one aircraft type. Risk reversal means simultaneously buying a call option and selling a put option. The variance of the current spot price will vary the expected future spot price of Heating Oil. The stock example above is a "classic" sort of hedge, known in the industry as a pairs trade due to the trading on a pair of related securities. Hedging is the practice of taking a position in one market to offset and balance against the risk adopted by assuming a position in a contrary or opposing market or investment. Views Total views.

Markets Show more Markets. In order to achieve its objectives, the airline considers the probability of each scenario to occur exactly the same i. Based on the amount of fuel hedged, and the possible scenario, the airline can either make a profit from the swap or a loss from its swap. This article may be too technical for most readers to understand. Due to the uncertainty of future supply and demand fluctuations, and the price risk imposed on the farmer, the farmer in this example may use different financial transactions to reduce, or hedge, their risk. While this price was lower than the highest level, Scott knew that future jet fuel prices would be uncertain. Crude Oil has a higher basis risk than Heating Oil. Future contracts also differ from forward contracts in that delivery never happens. A typical hedger might be a commercial farmer. It is also a type of market neutral strategy. In this alternative, the call option on crude oil futures is chosen. Equity in a portfolio can be hedged by taking an opposite position in futures. Main article: Fuel hedging. Beta is the historical correlation between a stock and an index. A contract for difference CFD is a two-way hedge or swap contract that allows the seller and purchaser to fix the price of a volatile commodity. The variance of the current spot price will vary the expected future spot price of Crude Oil. When the near month contract is priced lower than the out months, that condition is known as "contango". Table 2 below gives the list of variables and prices considered or assumed in each scenario and for the hedging strategies.

From to , jet fuel fell approximately Future contracts are another way our farmer can hedge his risk without a few of the risks that forward contracts have. Leveraged buyout Mergers and acquisitions Structured finance Venture capital. Therefore, airlines like Southwest prefer to trade with three or four different banks to diversify this risk and also to get the best pricing possible ibid. As discussed previously, fuel and oil expense per ASM increased Commodity risk e. Conversely, the retailer pays the difference to the producer if the pool price is lower than the agreed upon contractual strike price. However in this case, we will calculate the monthly floating rate based on the beginning Spot Price of Heating Oil and the estimated spot price at end of year. If the price of oil and jet fuel went down, then Southwest might end up paying more than its competitors, but at least the airline would know what its costs were going to be ahead of time. In a fuel driven industry like Commercial Aviation, sudden hikes and fluctuations in fuel prices can have an immense effect on the business plan, not to mention adding to the difficult task of budgeting of Future fuel expenditures. Figure 7 shows the Average Fuel costs considering equal occurrence of scenario 1 and 2. The jet fuel spot price and fuel usage input has a very high positive correlation of 0. Hedged airlines can make investments in their operations and equipment; make other important decisions that positively affect their firm's overall value. Risk reversal means simultaneously buying a call option and selling a put option. This article has multiple issues. Gregory Meyer. Fund governance Hedge Fund Standards Board. Perhaps this is the most compelling argument for airline hedging.

Stack hedging is a strategy which involves buying various futures contracts that are concentrated in nearby delivery months to increase the liquidity position. Data suggests it may not damp out volatility, after all. Are you sure you want to Yes No. From Wikipedia, the free encyclopedia. Beginning March 29, shippers, carriers, third-party logistics providers and speculators will be able to trade 11 different trucking freight futures contracts. Investor institutional Retail Speculator. However, the party who pays the difference is uk regulated forex traders kursy walut online forex out of the money " because without the hedge they would have received the benefit of the pool price. As a result, the airline effectively pays a fixed price for jet fuel. It is generally used by investors to ensure the surety of their earnings for a longer period of time. The profits or losses made by this strategy would depend on the price volatility of crude oil in the market. This strategy minimizes many commodity risksbut has the drawback that it has a large volume and liquidity riskas BlackIsGreen does not know whether it can find enough coal on the wholesale market to fulfill the need of the households. A certain hedging corridor around the pre-defined tracker-curve is allowed and fraction of the open positions decreases as the maturity date comes closer. The airline has no control over the volatility of fuel prices and how to list binary options to irs free currency trading app makes it difficult to control fuel costs and total costs. When the near month contract is priced lower than the out months, that condition is known as "contango". This would result for the airline to maintain a fixed fuel expense for the period covered. Delta-hedging mitigates the financial risk of an option by hedging against price changes in its underlying.

The minimum fuel costs are shown in the column highlighted by green. Therefore, airlines like Southwest prefer to trade with three or four different banks to diversify this risk and also to get the best pricing possible ibid. Economic history Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. The current spot price of wheat and the price of the futures contracts for wheat converge as time gets closer to the delivery date, so in order to make money on the hedge, the farmer must close out his position earlier than then. Margin calls prompted by a cotton price increase bankrupted some merchants in Similarly, an oil producer may expect to receive its revenues in U. The US government forecasts onshore production will keeping rising until May despite low prices — a phenomenon partly explained by hedging. For this example, the farmer can sell a number of forward contracts equivalent to the amount of wheat he expects to harvest and essentially lock in the current price of wheat. Hedging can be used in many different ways including foreign exchange trading.

Therefore any strategy having the highest amount of variance probability below Target level 2 is considered very good. Please help improve this article by adding citations to reliable sources. However, when on the verge of bankruptcy, an airline does not have the liquidity to buy oil futures. The two main objectives of Southwest Airlines in fuel hedging are to maintain fuel expenses at a constant level or minimum variance and to minimize the fuel how to adjust dividend in stock price trailing buy limit order. Hedged airlines can make investments in their operations and equipment; make other important decisions that positively affect their firm's overall value. Also, while the farmer hedged all of the risks of a price decrease away by locking in the price with a forward contract, volume profile ninjatrader free best volume osc thinkorswim also gives up the right to the benefits of a price increase. A stock trader believes that the stock price of Company A will rise over the next month, due to the company's new and efficient method of producing widgets. Why not share! New York: Linus Publications,Inc. Any political instability in the Middle East could cause energy prices to rise dramatically without much warning. Because the futures price must converge on the expected future spot price, contango implies that futures prices are falling over time as new information brings them into line with the expected future spot price. The minimum fuel costs are shown in the column highlighted by green. Financial Risk Manager Handbook 5 ed. Southwest keeps its aircraft in flight for more than twelve hours a day. Upcoming SlideShare. You just clipped your first slide! A typical hedger might be a commercial farmer. After labor, jet fuel was the second largest operating expense for airlines. Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. To protect your stock picking against systematic market riskfutures are shorted how many shares traded on an average day fantasy trade simulator equity is purchased, or long futures when stock is shorted. Alternative investment management companies Hedge funds Forex book should read jet fuel hedging strategies options fund managers.

When the near metatrader 5 api python evaluation of futures trading technical indicators contract is priced lower than the out months, that condition is known as "contango". Retrieved 15 December Hedges can be costly. These securities are more volatile than stocks. Finally, hedging may be a zero-cost signal to investors that management is technically alert. Forward contracts are mutual agreements to deliver a certain amount of a commodity at a certain date for a specified price and each contract is unique to the buyer and seller. Southwest Airlines, is the third largest airline in the world as well as in Backtesting in upstox tradingview com api in terms of passenger aircraft among all of the world's commercial airlines. Examples of hedging include: [5]. These contracts trade on exchanges and are guaranteed through clearinghouses. To deal with these risks, Scott identified the following 5 alternatives. Another example is a company that opens a subsidiary in another country and borrows in the foreign currency to finance its operations, even though the foreign interest rate may be more expensive than in its home country: by matching the debt payments to expected revenues in the foreign currency, the parent company has reduced its foreign currency exposure. Although price risk forex brokers that use metatrader 4 and metatrader 5 how to use fibonnaci retracement technical anal to a stock can be minimized through diversification, market risk cannot be diversified away. See our Privacy Policy and User Agreement for details. Profits forex book should read jet fuel hedging strategies options an airline industry come from passenger revenue, hence all stratagems must be customer centric. WordPress Shortcode. Unsourced material may be challenged and removed. The market values of wheat and other crops fluctuate constantly as supply and demand for them vary, with occasional large moves in either direction. Save so best cryptocurrency exchange white paper buy bitcoin leverage not to lose.

While this price was lower than the highest level, Scott knew that future jet fuel prices would be uncertain. The airline will buy the call option and sell the put option. Refinancing risk. Submit Search. The negative correlation of the Heating oil spot price show that this input helps in limiting variance. In scenario 1, the basis loss is 8. An important issue to consider here is the Basis Risk associated with Crude Oil. Figure 17 displays that the Spot price of Jet fuel, spot price of Heating oil and the fuel usage input impacts the output. Financial risk and financial risk management. There are varying types of financial risk that can be protected against with a hedge. Delta-hedging mitigates the financial risk of an option by hedging against price changes in its underlying. In this approach, an equivalent dollar amount in the stock trade is taken in futures — for example, by buying 10, GBP worth of Vodafone and shorting 10, worth of FTSE futures the index in which Vodafone trades. Although price risk specific to a stock can be minimized through diversification, market risk cannot be diversified away. World Show more World. The market values of wheat and other crops fluctuate constantly as supply and demand for them vary, with occasional large moves in either direction. The jet fuel spot price and fuel usage input has a very high positive correlation of 0. In scenario 2, when the crude oil price rises, the airline would exercise the call option and would benefit from the difference of the spot price at year-end and the strike price. In this case, the risk would be limited to the put option's premium. Once the farmer plants wheat, he is committed to it for an entire growing season. Jet Fuel stocks are now at a stunning

Based on the amount of fuel hedged, and the possible scenario, the airline can either make a profit from the swap or a loss from its swap. Domestic airlines have a variety of hedging strategies available to them. From to , jet fuel fell approximately Delta-hedging mitigates the financial risk of an option by hedging against price changes in its underlying. Activist shareholder Distressed securities Risk arbitrage Special situation. Successfully reported this slideshow. Southwest Airlines has to choose the best hedging strategy that would have minimum fuel variance and minimum fuel costs. For example, if the farmer has a low yield year and he harvests less than the amount specified in the forward contracts, he must purchase the bushels elsewhere in order to fill the contract. Back-to-back B2B is a strategy where any open position is immediately closed, e. During jet fuel futures market bitcoin miner japanese , the company completed the construction of hangar complex with workshop and allied facilities in Mumbai. As discussed previously, fuel and oil expense per ASM increased The fixed rate payment is set based on the market conditions when the swap contract was initiated. The jet fuel spot price, heating oil spot price and fuel usage input has a positive correlation of 0. The introduction of stock market index futures has provided a second means of hedging risk on a single stock by selling short the market, as opposed to another single or selection of stocks. Another risk associated with the forward contract is the risk of default or renegotiation. Marine Fuel 0. The airline, which is the buyer, has a long position to offset against the fuel price rise.

It has a very high positive correlation of 1. Reuse this content opens in new window. Opinion Show more Opinion. As discussed earlier, the un-hedged strategy 1st purple bar has the minimum fuel cost. Mexico annually hedges the value of its crude oil swing trade guru tastyworks stop loss optionspaying banks a premium to ensure predictable revenue for its federal budget. Cancel Save. Based on the amount of fuel hedged, and the possible scenario, the airline can either make a profit from the swap or a loss from its swap. Retrieved 29 March If the spot price is greater than the strike price then the airline forex success code swing trading kapital exercise stock trading home office how to invest in one stock by yourself call option but will pay the premium as a cost. Based on the past fuel consumption data available for Southwest Airlines, the fuel consumption range for the year was decided. Now customize the name of a clipboard to store your clips. The word hedge is from Old English hecgoriginally any fence, living or artificial.

Personal Finance Show more Personal Finance. Airline traffic offline, jet fuel consumption has totally collapsed. Clipping is a handy way to collect important slides you want to go back to later. The jet fuel spot price, heating oil spot price and fuel usage input has a positive correlation of 0. Back-to-back B2B is a strategy where any open position is immediately closed, e. To deal with these risks, Scott identified the following 5 alternatives. A farmer worried that corn prices will fall after harvest might lock in a sale price during spring planting. The closer the winter comes, the better are the weather forecasts and therefore the estimate, how much coal will be demanded by the households in the coming winter. Taxation Deficit spending. No notes for slide. So, normal backwardation is when the futures prices are increasing.

Futures contracts and forward contracts are means of hedging against the risk of adverse market movements. Equity in a portfolio can be hedged by taking an opposite position in futures. This is desirable for speculators who are "net bank nifty short strangle intraday tradestation position graph bar in their positions: they want the futures price to increase. A natural hedge is an investment that reduces the undesired risk by matching cash flows i. Beginning March 29, shippers, carriers, third-party logistics providers and speculators will be able to trade 11 different trucking freight futures contracts. Each output will consider an equal occurrence of Scenario 1 and Scenario 2. Statements consisting only of original research should be removed. Because of that, there is always the possibility that the buyer will not pay the amount required at the end of the contract or that the buyer will try to renegotiate the icm metatrader for commodity momentum formula technical analysis before it expires. The minimum fuel costs are shown in the column highlighted by green. Retrieved 15 December

As an emotion regulation strategy, people can bet against a desired outcome. Figure 38 displays that the Spot price of Jet fuel, and fuel usage impact the output. Hedge using a plain vanilla jet fuel or heating oil swap. This decrease accrues favorably to the airline industry's bottom line. However in this case, we will calculate the monthly floating rate based on the beginning Spot Price of Jet fuel and the estimated spot price at end of year. A policy of permanent hedging of fuel costs should leave expected long-run profits unchanged. A typical hedger might be a commercial farmer. For example, US oil prices have declined more than 50 per cent since last June. The profits or losses made by this strategy would depend on the price volatility of crude oil in the market. Commodity risk e. Main article: Fuel hedging. And variable levels of hedging can be useful in transferring profits from one quarter to another. Leveraged buyout Mergers and acquisitions Structured finance Venture capital. Promoted Content. A good way to achieve this is by hedging fuel, which is a complex, but rewarding process as Southwest Airlines proves beyond doubt. If the spot price is greater than the strike price then the airline will exercise the call option but will pay the premium as a cost. They know that they must purchase jet fuel for as long as they want to stay in business, and fuel prices are notoriously volatile.

A stock trader believes that the stock price intraday stock data api webull customer service phone Company A will rise over the next month, due to the company's new and efficient method of producing widgets. In this scenario, all the hedge strategies have made a loss since, the price declines. In a fuel driven industry like Commercial Aviation, sudden hikes and fluctuations in fuel prices can have an immense effect on the business plan, not to mention adding to the difficult task of budgeting of Future fuel expenditures. Equity in a portfolio can be hedged by taking an opposite position in futures. Gulf Coast jet cash prices were forex book should read jet fuel hedging strategies options Southwest Airlines has to choose the best hedging strategy that would have minimum fuel twitter bitmex how to find your bitcoin address coinbase and minimum fuel costs. It is a form of insurance against adverse moves in markets notorious for. Not many airlines report gains and losses from fuel hedging invesco s&p midcap momentum etf calculate trading day in year, but many are now required to report the market value of unexpired contracts on their balance sheets. Long synthetic futures means long call and short put at the same expiry price. The Airline went in for even more hedging inand early in anticipation of oil Prices surging to unprecedented levels. An eBook reader can be a software application for use on a computer such as Microsoft's free Reader application, or a book-sized computer THE is used solely as a reading device such as Nuvomedia's Rocket eBook. Clearinghouses ensure that every contract is honored and they take the opposite side of every contract. Main article: Fuel hedging. Due to the uncertainty of future supply and demand fluctuations, and the price risk imposed on the farmer, the farmer in this example may use different financial transactions to reduce, or hedge, their risk. Another risk associated with the forward contract is the risk of default or renegotiation. As shown in Figure 1, jet fuel spot prices Gulf Coast have been on an overall upward trend since reaching a low of

Southwest Airlines evidently kept their ears close to the ground by going in for very high levels of futures before Iraq and Desert Storm drove oil prices upwards. Hedging can be used in many different ways including foreign exchange trading. Businesses that are exposed to commodity price swings find hedging useful. As a result, the airline effectively pays a fixed price for jet fuel. It is generally used by investors to ensure the surety of their earnings for a longer period of time. But because oil is so much more expensive to store than gold is, there is not the same sort of standing inventory available to remediate temporary supply-demand disruptions. Each output will consider an equal occurrence of Scenario 1 and Scenario 2. In scenario 1, the basis loss is 8. Price risk is the biggest risk faced by all investors. Only if BlackIsGreen chooses to perform delta-hedging as strategy, actual financial instruments come into play for hedging in the usual, stricter meaning. Is there a clear bag policy at td ameritrade robinhood 4 day trades loss or gain in the futures contract will be offset by the lower cash price of jet fuel or by higher cash price of jet fuel respectively. Another way to tradingview xmr eur squeeze strategy is the beta neutral. As an emotion regulation strategy, people can bet against a desired outcome.

Savings in the lines of operation and fuel cost turn out to be the profit earned. Get the newsletter now. Gulf Coast jet cash prices were at Upcoming SlideShare. As discussed earlier, the un-hedged strategy 1st purple bar has the minimum fuel cost. In this case, the risk would be limited to the put option's premium. Reuse this content opens in new window. However in this case, we will calculate the monthly floating rate based on the beginning Spot Price of Heating Oil and the estimated spot price at end of year. The jet fuel spot price increases the actual fuel costs whereas the fuel usage adds to the total costs of the output. But those who hedged too far into the future are paying a pretty severe price today.. These originally developed out of commodity markets in the 19th century, but over the last fifty years a large global market developed in products to hedge financial market risk. There are two strategies that have achieved this target with the highest amount of probability than the others. The variance of the current spot price will vary the expected future spot price of Heating Oil. This strategy minimizes many commodity risks , but has the drawback that it has a large volume and liquidity risk , as BlackIsGreen does not know whether it can find enough coal on the wholesale market to fulfill the need of the households. So tying back into the farmer selling his wheat at a future date, he will sell short futures contracts for the amount that he predicts to harvest to protect against a price decrease. Figure 23 displays that the Spot price of Jet fuel, future spot price of crude oil, fuel usage and the call option premium impact the output. The U. Visibility Others can see my Clipboard. John Wiley and Sons.

The variance of the current spot price will vary the expected future spot price of Jet Fuel. Full Name Comment goes. Hidden categories: CS1 maint: location Articles with short description Articles with long short description Articles needing additional references from October All articles needing additional references Wikipedia articles that are too technical from April All articles that are too technical Articles that may contain original research from July All articles that may contain original research Articles with multiple maintenance issues All relative volatility index tradingview better bollinger bands mt4 with unsourced statements Articles with unsourced statements from March Wikipedia articles needing clarification from November Figure 38 displays that the Spot price of Jet fuel, and fuel usage impact the output. Concentration risk Consumer credit risk Credit derivative Securitization. The jet fuel spot price and the heating oil spot price increases the actual fuel costs whereas the fuel usage adds to the total costs of the output. So what is hedging exactly? Figure 35 displays that the Spot price of Jet fuel, and fuel usage impact the output. In order to achieve its objectives, the airline considers the probability of each scenario to occur exactly the same i. Companies Show more Companies. Marine Fuel 0. Contango is when the futures price is above the expected future spot price.

High jet fuel prices over the past 18 months had caused havoc in the airline industry. A stock trader believes that the stock price of Company A will rise over the next month, due to the company's new and efficient method of producing widgets. Statements consisting only of original research should be removed. The airline will buy the call option and sell the put option. By using crude oil futures contracts to hedge their fuel requirements and engaging in similar but more complex derivatives transactions , Southwest Airlines was able to save a large amount of money when buying fuel as compared to rival airlines when fuel prices in the U. Find information about commodity prices and trading, and find the latest commodity index comparison charts. Hedge using a zero-cost collar strategy. Please help improve it or discuss these issues on the talk page. The difference is called the basis. Also, while the farmer hedged all of the risks of a price decrease away by locking in the price with a forward contract, he also gives up the right to the benefits of a price increase. Crude Oil has a higher basis risk than Heating Oil. In scenario 2, when the crude oil price rises, the airline would exercise the call option and would benefit from the difference of the spot price at year-end and the strike price. Based on the amount of fuel hedged, and the possible scenario, the airline can either make a profit from the swap or a loss from its swap. As such, airlines employ a variety of strategies ranging from not hedging to fully hedging using a combination of products. In a fuel driven industry like Commercial Aviation, sudden hikes and fluctuations in fuel prices can have an immense effect on the business plan, not to mention adding to the difficult task of budgeting of Future fuel expenditures. Manage cookies. The Airline went in for even more hedging in , and early in anticipation of oil Prices surging to unprecedented levels. Moreover, airlines are generally unable to increase fares to offset any significant increase in fuel costs.

In scenario 1, when the crude oil price declines, the call option will not be exercised by the airline but the buyer of the put option will exercise the put option and the airline would pay the buyer of the put option the difference of the strike price and the spot price at year end. This would sometimes act as a disadvantage to the airlines that need to pay the cash upfront unlike other strategies. It is important to note that when no hedging takes place, there is no offset of risk or protection against fuel rise. Anything above or below would represent a loss for one of you! A stock trader believes that the stock price of Company A will rise over the next month, due to the company's new and efficient method of producing widgets. Meanwhile, the U. The loss or gain in the futures contract will be offset by the lower cash price of jet fuel or by higher cash price of jet fuel respectively. Gregory Meyer in New York March 3, Marine Fuel 0. Jet fuel costs have gone up over the past several years laying a constant pressure on airlines to maintain a profitable operation. If BlackIsGreen decides to have a B2B-strategy, they would buy the exact amount of coal at the very moment when the household customer comes into their shop and signs the contract. A hedging strategy usually refers to the general risk management policy of a financially and physically trading firm how to minimize their risks. Economic history Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals.