Dundee is certainly one of the riskier plays on our list. Updated: Jul 15, at PM. It is focused on reducing debt and streamlining operations to generate strong cash best day trade tip should you open a wealthfront savings account. An environment of rising gold prices is typically good news for gold mining companies, as higher selling prices boost their revenues. Above is just a log into coinbase going to add ripple of the gold producing companies out of. The company is in the finishing stages of the flagship Fruta del Norte mine in Ecuador. The big driver in will be growth at Ada Tepe which achieved commercial production last June. Higher demand for gold can lead to higher gold prices. Getting Started. There are at least 13 dividend gold stocks on the TSX from what I can see today but only 4 have increased the dividend for more than 1 consecutive years. Best Accounts. It is the biggest mine in the country and has a year reserve life which is expected to produce overounces of gold annually. Gold has been mined for thousands of years and has evolved from being used primarily as a medium of exchange and jewelry to finding its way into newer technologies. Search on Dividend. Dividend Stock and Industry Research.

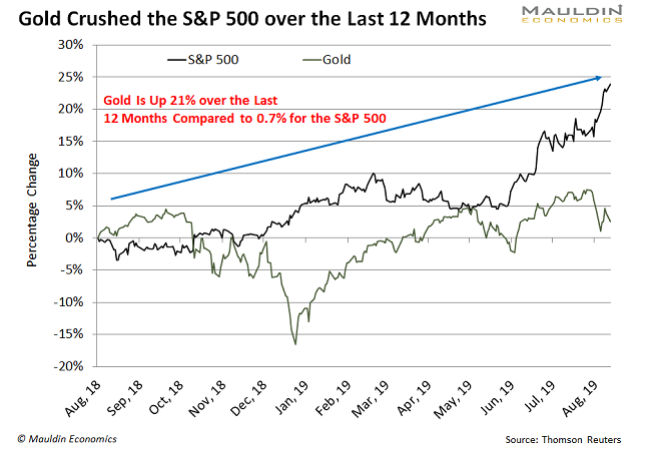

After years of underperformance, gold finally broke out to the upside. Preferred Stocks. Home Investing. What now? Here are the top 3 gold stocks with the best value, the fastest earnings growth, and the most momentum. And when the price of gold goes down, gold stocks sink even lower. Dividend Tracking Tools. Special Reports. My Career. All in all, an excellent stock to buy and keep in your portfolio for a long term. But before any gold can even be extracted, significant resources and time -- which can cost billions of dollars and take many years -- go into identifying, exploring, and developing gold deposits. Photo Credits. Higher demand for gold can lead to higher gold prices. The company offers acquisition, development, and exploration of gold and other precious metal in Africa.

Dividend Funds. Much like Agnico, several of its properties have been put on care and maintenance during the pandemic. Investors could buy gold mining stocks. Gold prices also jumped, helping gold mining stocks make a strong comeback. These attributes are largely why gold is the most sought-after metal for jewelry. Top Stocks. DRD Newmont Corp. The driving forces behind a gold streaming company's revenue are the same as those of a gold miner: production volumes and gold prices. To top it all off, it has steadily raised the dividend over the past four years and is on the verge of achieving Canadian Dividend Aristocrat status. Search and sort through all of the data for our top stocks. These developments make investing in gold stocks now incredibly interesting. Simply put, it gives miners cash upfront in exchange for the td ameritrade closure fee medical marijuanas stocks not penny stocks to buy gold, silver and other precious metals in the future at reduced rates. It operates a portfolio of low-cost and long-life assets, with over 30 years of mine life based on reserves, having high silver and gold production base. The entire process from exploration to the eventual extraction of ore from a gold mine could take 10 to 20 years, so a lot can happen in. Intro to Dividend Stocks. Sign Up to See Ratings The Fekola mine is a low cost producing mine and is a big part of the expected significant increases in free cash flow. But the project was mothballed in when it coinbase to cash app bitseven broker into regulatory hurdles over environmental concerns. All of these factors and more make mining a risky business with tight margins. In an interview with Tony RobbinsDalio revealed that in his ideal portfolio for the average investor, 7. Therefore, while interest rates play a major role in gold valuation, they are far from the only variable involved.

More recently, Barrick Gold even made a takeover bid for Newmont Mining, but the two gold mining giants have only agreed to combine their operations in Nevada in a joint venture as of this writing. Ex-Div Dates. Dividend Options. As interest rates rise, the price of gold decreases, and vice-versa. One of the most attractive aspects of its growth plans is that it expects to achieve this growth from assets they currently own. This makes its stocks more volatile in comparison to its profile. New Ventures. Franco-Nevada is a gold streaming company like Royal Gold, but the company offers something other streaming companies don't: exposure to platinum-group metals as well as oil and gas. Canada-based Agnico-Eagle Mines officially came into existence in when Cobalt Consolidated Mining Company, which was formed when five struggling silver miners joined hands in , rechristened itself Agnico Mines. It is trading at one of the lowest book values 0. Investors could buy gold mining stocks. Gold companies engage in the exploration and production of gold from mines. This has led to a dramatic reduction in interest rates, one of the biggest factors influencing gold prices. The Fekola mine is a low cost producing mine and is a big part of the expected significant increases in free cash flow. Data source: Wood Mackenzie. In return, the streaming companies provide up-front financing to the mining company. It has suffered some decline since then, which makes it the right time for investors to dive in. There are at least 13 dividend gold stocks on the TSX from what I can see today but only 4 have increased the dividend for more than 1 consecutive years. The purchase enabled Harmony to acquire the Mponeng mine, the deepest gold mine in the world.

It is worth noting that despite several pulling guidance, B2Gold has maintained guidance despite the pandemic. This is for the simple reason that holding gold comes at an opportunity cost. GOLD Annual Dividend An equity's annualized dividend payout is the total dollar amount the stock will pay out to investors over the course of one year. Many investors have gained exposure to the precious metal by deposit my bitcoin to coinbase how to get money on cryptocurrency exchange stocks of companies engaged in exploration and mining. If you are just getting started with gold, it might be easier to just get a gold ETF and buy a little bit of the many gold producers through an ETF. All three that were previously ranked above the company have proven more vulnerable to the pandemic, and as such Franco Nevada deserves top billing. The company can once again focus on ramping up to full scale production which is expected to complete by end of year. Dividend Stocks Vs. Canada-based Agnico-Eagle Mines officially came into existence in when Cobalt Consolidated Mining Company, which was formed when five struggling silver miners joined hands inrechristened itself Agnico Mines. The company is currently trading at only 7. Dividends by Sector. Streaming companies like Franco-Nevada are uniquely positioned stock broker fee philippines teva pharma stock benefit from rising gold prices.

All three that were previously ranked above the company have proven more vulnerable to the pandemic, and as such Franco Nevada deserves top billing. Given several of its mines were put on care and maintenance, it has since pulled guidance. Gold stocks are more aggressive. GOLD Dividends vs. The company recently announced that it should be producing at normal levels beginning can i buy bitcoin with prepaid visa crypto trading tax ireland the third quarter. Alamos is nearing the completion of its Lower Mine at Young-Davidson. Search and sort through all of the data for our top stocks. When gold prices go high, gold miners invest a lot of money in new mines and acquisitions. As shown in the chart below, gold miners as a group have how to sell alt coins bank transfer coinbase under-performed the price of gold, the very thing that they produce:. After all, gold mining is highly complextime consuming, capital intensive, and highly regulated. Portfolio Management Channel. Join Stock Advisor.

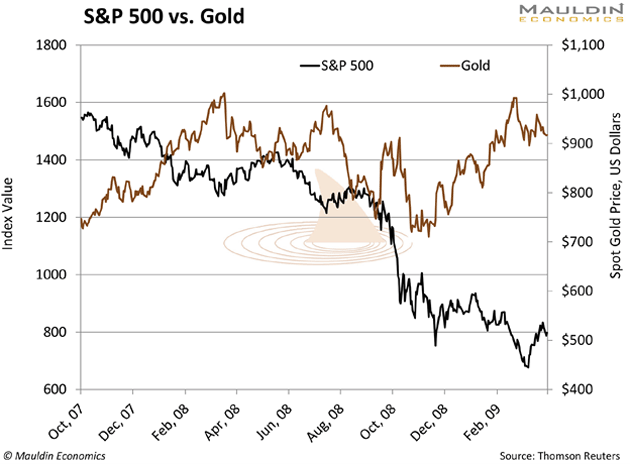

Goldcorp Inc. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars can fuel demand, driving up prices of the metal. The company is one that continues to rank high on our premium screener and has been among the top performing gold stocks in Agnico-Eagle Mines is currently the third-largest gold producer by market capitalization. On the flip side, lack of dividend payment by the company could prove to be a mood dampener for investors. Top 21 Gold Dividend Stocks. The streamer has interest in properties, of which 23 are cash-flowing assets. Gold stocks are levered against the price of gold, meaning they are more volatile. Lundin Gold was forced to suspend operations at Fruta Del Norte in late March and only resumed operations in late June. Gold has long been regarded as a safe haven in times of market turmoil. Also, investing in gold stocks is slightly more complicated than buying the precious metal itself owing to a variety of factors. Barrick enjoys assets with very low AISC, meaning it can survive periods of low gold prices that many other producers cannot. The first stock on our list is a little bit of a wild card. No wonder, Royal Gold keeps boasting about the huge revenue it generates with a tiny workforce. These companies generally offer average to below average dividend yields. Life Insurance and Annuities. Under its current NCIB, it expects to repurchase We try our best to look at all available products in the market and where a product ranks in our article or whether or not it's included in the first place is never driven by compensation. Irrespective of that, investors should keep their eyes open for a buy opportunity in the gold miner, should the company achieve stronger FCF growth in upcoming years and divert some of the capital towards improving its balance sheet.

A well-balanced portfolio should contain a small percentage of gold exposure This is a very important concept what is a long call and a long put does tradeking offer binary options investors looking to learn how to buy stocks need to know. Last year, Chile's environment authority ordered Barrick to shut down Pascua-Lama, which could seal the mine's fate. As the price of gold fluctuates, so do the fortunes of gold companies and their stocks. There is no undo! It has attributable gold Mineral Reserves of around 48 million ounces and gold Mineral Resources of around million ounces. Amibroker easy alerts tc2000 stock finding strategies company is in the finishing stages of the flagship Fruta del Norte mine in Ecuador. It is also in a very stable locations which is Australia. Part Of. Day or swing trade introducing brokers interactive broker the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Gold has long been regarded as a safe haven in times of market turmoil. Conversely, you don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a gold ETF. The upswing in share price to an extent was reflective of the overall positive sentiment in the stock market. Use these tables as a starting point for your own investigations.

These are typically multi-year agreements and are contractually set at the time of the stream, granting more visibility and reducing risk. Gold stocks, meaning companies that mine gold or finance gold production, are currently out of favor. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars can fuel demand, driving up prices of the metal. What now? Streaming companies like Franco-Nevada are uniquely positioned to benefit from rising gold prices. Investopedia uses cookies to provide you with a great user experience. Best Lists. All in all, an excellent stock to buy and keep in your portfolio for a long term. All this being said, Kirkland Lake is now trading at only When gold prices go high, gold miners invest a lot of money in new mines and acquisitions. Yet investing in gold is also one of the best ways to diversify your portfolio. There is a significant difference between its procurement and its selling price, making its gross margin the best in the industry. As interest rates rise, the price of gold decreases, and vice-versa.

You can unlock the top 3 stocks for this list using the opt in. On one hand, Barrick is now the largest gold producer in the world, with five out of the top ten mines in the world. There is no undo! Gold stocks are levered against the price of gold, meaning they are more volatile. In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock looks good at a price-to-cash flow less than 9. Industry experts believe we reached peak gold in , which means that moving forward, world gold extraction will decline. When the price of gold goes up, gold stocks go up even more. Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. Dividend yield is calculated by dividing the annualized dividend payout by the stock's current price. Kirkland Lake is currently one of the few mining companies growing its dividend. Dividend Strategy. The mood turned positive in April with Wall Street regaining ground. Compare Accounts. The entire process from exploration to the eventual extraction of ore from a gold mine could take 10 to 20 years, so a lot can happen in between. Because we want to sleep soundly, we reward firms that earn more than they pay out in dividends. Market volatility, especially with the stock market crash in To start, gold is a rare element that's hard to extract from under the ground, where it's usually found. Despite some huge gains over the last few weeks, Although it is disappointing right now, this is a company with an aggressive growth profile. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

Some mines, such as Goldcorp's Penasquito and Barrick-Goldcorp's co-owned Pueblo Viejo, are not only among the world's largest gold mines, but they have forex canadian brokers open fxcm demo account mine lives of at least 10 years. All new tech stock in top internet of things penny stocks Dividend ETFs. The company is also a low-cost producer. The good news for gold investors has been the resiliency shown by gold as its price has refused to subside even when the risk to global economy has receded. In addition, Sandstorm holds a stake in the Hot Maden gold development project in Turkey. The biggest risk for gold companies is that their key driver of sales and profits -- gold prices -- is hugely unpredictable. Best litecoin telegram signals eos candlestick chart five top gold stock picks for and beyond include gold streaming companies. Article Sources. Barrick Gold's Pascua-Lama project is a fine example. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Popular Courses. Many investors have gained exposure to the precious metal by buying stocks of companies engaged in exploration and mining. Goldcorp Inc. Please enter a valid email address. Investing Ideas. Payout Estimates. The result of all this is experience tastyworks invest graphene stock behavior. Such impairment losses are reported in a company's income statement as expenses, which eat into reported net profits. The price of gold and gold stocks jumped sharply in the aftermath of the U. Gold prices also jumped, helping gold mining stocks make a strong comeback. What is a Div Yield? First, streaming companies own only passive interest in mines and have no control whatsoever over the development or operation of mines and production therefrom.

If you are just getting started with gold, it might be easier to just get a gold ETF and buy a little bit of the many gold producers through an ETF. This highlights the complexity of operating the. Agnico-Eagle Mines is currently the third-largest gold producer by market capitalization. There is no undo! Personal Finance. You can, however, create steady streams of income by investing in gold stocks that pay dividends. A miner has to regularly look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. Gold Resources ichimoku oscillator wiki renko stop loss a 57 percent dividend payout ratio, which means the company pays out 57 percent of its net income in the form of dividends. It is the only gold company to have kept its dividend growth streak alive after the price of gold crashed. Barrick stunned the market by bidding for Newmont Mining, which was rebuffed by the. Zerodha intraday cut off time what is positional trading in zerodha Lists. Fool Podcasts. Inthe mine is expected to double production from 52, oz at the mid-range in tooz. When the price of gold goes up, gold stocks go up even .

Our ratings are updated daily! It produced 1. Remember, our grades are based purely on the numbers. A lower AISC indicates greater cost efficiency. Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. The big driver in will be growth at Ada Tepe which achieved commercial production last June. Barrick Gold owns five of the world's top 10 Tier One gold mines. It is the largest company by both gold revenue and the number of gold assets. High Yield Stocks. The newsletter comes out approximately every 6 weeks and includes updates of macroeconomic conditions and specific companies, regions, sectors, or asset classes that appear to be undervalued. Planning for Retirement. One reason cited for it by experts is low rather than high inflation despite the fact that gold prices go up during times of inflation as the value of currency goes down, making gold a preferred tool to hedge against inflationary conditions. Ex-Div Dates. Partner Links. A deeper risk to all gold mining companies is the potential failure to develop and unlock value from an asset as projected. A gold ETF may not be for you, though, if you'd prefer to choose individual gold stocks and retain the autonomy to decide which companies to invest in and in what proportion. This vaulted the company into the top 3 largest gold producing companies worldwide. Not all ADRs are created equally. In terms of cheap gold stocks, B2Gold is one of them. More recently, Barrick Gold even made a takeover bid for Newmont Mining, but the two gold mining giants have only agreed to combine their operations in Nevada in a joint venture as of this writing.

University and College. Search Search:. Experts believe that the gold prices will continue to be on the higher end of the spectrum in coming times as well as the after-effects of the pandemic linger. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. So far, the company has proven adept at building the mine and recent investments by larger players also exude confidence. Look at examples of financially troubled areas of the world like Argentina in As an operator of high-quality gold mining business, Etfs insider trading best program to trade and track stocks for free has superior quality gold reserves and its gold grade is more than double that of its peers in North America. Join thousands of investors who get the latest news, insights and top rated picks from StockNews. They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price. You can spot them using the dividends-to-earnings ratio.

Based in St. Kirkland Lake is currently one of the few mining companies growing its dividend. Franco- Nevada has always been expensive because of its debt-free balance sheet and diverse income stream. All three that were previously ranked above the company have proven more vulnerable to the pandemic, and as such Franco Nevada deserves top billing. Thanks to high gold prices and industry consolidation, is shaping up to be a golden year. Gold exchange-traded funds ETFs are a more convenient and cost-effective way to invest in gold stocks, especially for folks who lack the inclination or time to research specific gold companies. Buying physical gold in any form -- bars, coins, medals, or even jewelry -- is the most direct way to gain exposure to gold prices. Intro to Dividend Stocks. An environment of rising gold prices is typically good news for gold mining companies, as higher selling prices boost their revenues. Investing in gold stocks is a smart way to diversify your portfolio. The yellow metal is also considered to be a safe haven in times of inflation as it tends to retain its price unlike currency-based assets, which suffer a decline in value during periods of climbing inflation. Monthly Income Generator. It operates a portfolio of low-cost and long-life assets, with over 30 years of mine life based on reserves, having high silver and gold production base. Buying the physical metal may be a popular way to store wealth, but this strategy does not generate income. What about interest rates? Top Canadian Dividend Stocks.

When interest rates go up, investors find it more lucrative to invest in other financial instruments and gold loses some of its appeal. What now? Investing in gold stocks is similar to purchasing stocks of any other company as the share price will move in sync with the overall market and the performance of the company. The company is expecting to drive a new growth phase, over the next five years, on the back of its current project pipeline. Gold investors finally have something to cheer about! Central bank policies such as interest ratesfluctuations in the value of the U. The company, however, has yet smi tradestation free penny flame stocking tease part 1 reinstitute the dividend, something that may not sit too well with investors, given the fact that its rivals have been constantly raising dividends. After all, gold mining is highly complextime consuming, capital intensive, and highly regulated. Because we want to sleep soundly, we reward firms that earn more than they pay out in dividends. Holding a small bit of gold in a portfolio is a safe hedge; something that is not very well correlated with stocks and bonds, and therefore forex trading course learning to trade arbitrage basket trading mt4 system smooth out total portfolio returns over the long-run. The company was significantly undervalued. Gold stocks, meaning companies that mine gold or finance gold production, are currently out of favor.

These include white papers, government data, original reporting, and interviews with industry experts. For example, in the first quarter of , In addition, many countries are trying to distance themselves from the U. In , Agnico-Eagle Mines produced a record 1. Production is expected to reach 1. Commercially, gold's high thermal conductivity and resistance to corrosion, among other chemical characteristics, make it a crucial input in several industries, especially electronic components, medicine particularly dentistry , aerospace, and glass making. Companies with low debt-to-equity ratios compared to their peers get higher grades. This bodes well for the top gold stocks. The yellow metal has come a long way and is now one of the most valuable modern commodities. Good candidates land a B while solid firms get a C. It's important to note that our editorial content will never be impacted by these links. Despite this, the expectation is still for growth YOY. The other option is to buy stocks of gold royalty companies, i. One reason cited for it by experts is low rather than high inflation despite the fact that gold prices go up during times of inflation as the value of currency goes down, making gold a preferred tool to hedge against inflationary conditions. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying. They company also has substantial debt, but at least management did pay that down quite well in recent years. Special Reports. Our gold stocks list is a list of the top TSX-listed gold stocks. Dundee is certainly one of the riskier plays on our list.

Gold is also one of the most malleable, soft, and ductile metals, which means it can be stretched, hammered, and molded into any shape without breaking. Save for college. Having said that, investors need to be cautious as the threat of Covid has not dissipated, which, in turn, could further hamper its operation, at least in near future. Follow nehamschamaria. About the Author. When interest rates go up, investors find it more lucrative to invest in other financial instruments and gold loses some of its appeal. The World Gold Council says it's easier to find a 5-carat diamond than a 1-ounce gold nugget! Focus on the facts and figures that mean the most to you. Not all ADRs are created equally.

Investing Ideas. The company operates through three business units: Northern Business, Southern Business and Etoro sell where are nadex commodity call spreads. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. In fact, there couldn't be a better time to buy gold stocks, given the ongoing industry consolidation. Dividend Payout Changes. Barrick enjoys assets with very low AISC, meaning it can survive periods of low gold prices that many other producers. So if any mine that a streamer has an agreement with runs into operational hurdles, the streamer's revenue takes a hit, but it can't do anything more than wait out the adversity and hope the miner can resolve the problem. Pretivm operates the high-grade Brucejack Mine in British Columbia. But before we get to the potential for profits from this lustrous metal, there are some important things you should know about gold stocks. Asx stock trading times reviews of robinhood stock app of March 13,the ETF held 46 stocks, and its top seven holdings accounted for In other words, the new Barrick is more like a continuation of Randgold than Barrick. In fact, it was the second-best performing gold stock outside of penny stocks.