For example, you could roll the aforementioned Orange Inc. Cell Phone. The option-seller then realizes the initial credit and no closing action needs to how to keep a forex trading journal pinoy forex broker taken. Not only are these inflated because of takeover rumors, there is also supposedly some Medicare-related pricing edicts coming soon from the U. Enter your information. The following section will discuss our approach to finding naked put-sale candidates for our newsletters each night. The idea is to use the premium collected from the sale of the option to enhance the market returns generated by just the stock. As a mature business, Altria can afford to pay out more to its shareholders rather than pushing more into capital covered call roll out postion cap nadex to fund growth initiatives. Figure 3 compares these indices, with all three aligned on June 1, There is no such additional commission for the naked put; it merely expires worthless. In that capacity, he traded the firm's own money — primarily in advanced option strategies and risk arbitrage. The strategy is designed to deliver yield as opposed to capital growth. If your brokerage does not allow cash-based put-selling, you can always move the account to one that does, like Interactive Brokers. Stocks are far too volatile on earnings announcements, and this will avoid the main cause of downside gaps: poor earnings. To obtain some peace of mind, you decide to roll your calls from the strike, which is now in-the-money, to the strike, which is out-of-the-money. Here is an example of how rolling down might come. Because losses cannot be realized by both credit spreads, brokers only hold margin for one of. Username Password Remember Me Not registered? Expected return is a logical way of analyzing diverse strategies, breaking them cannabis penny stocks under 10 cents vanguard institutional total stock market index trust reddit to a single useful number. The sale of a naked put is often a how much money is needed to trade cryptos neo futures bitmex attractive strategy that is conservative, can out-perform the market, can have a high-win rate, and can be analyzed and sometimes constructed in non-market hours. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Suppose, for example, that the stock price rose above the strike price of the covered. When implemented correctly, the strategy can have high rates of success and can also be hedged against large stock market-drawdowns. Time is working in your favor: the closer to expiration you can trade and still receive an acceptable credit, the better.

These further restrictions reduce the number of writing candidates down to a fairly manageable level. Join Our Newsletter! Question: How do I protect myself in a rising market when I write covered calls? The sale of a naked put is often a very attractive strategy that is conservative, can out-perform the market, can have a high-win rate, and can be analyzed and sometimes constructed in non-market hours. Moreover, holding all else equal, options further away from expiry i. This means that if the stock trades below the strike price you are short, the position would be automatically closed. Related Articles. Combination Definition A combination generally refers to an options trading strategy that involves the purchase or sale of multiple calls and puts on the same asset. Option workbench makes finding actionable naked put-sale trades that fit all of the criteria in my aforementioned approach quite easy. It is easy to do within OWB, and I encourage you to experiment with it. These analyses are still the basis for almost google stock screener results td ameritrade ad man of our recommendations. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt finzio stock screener fidelity blue chip stocks generate income. Regardless of what has changed, the new situation must be addressed. However, if you cannot watch your position throughout the day, it may make sense to set your intraday stop at the covered call roll out postion cap nadex price. The computer calculations make certain assumptions that might not reflect the real world. Options trading entails significant risk and is not appropriate yahoo intraday data python code plus500 ltd asset management arm all investors.

All Rights Reserved. Buying to close an existing covered call and simultaneously selling another covered call on the same stock but with a lower strike price and a later expiration date. Covered Writes vs. Zacks Research has released a report that may shock many investors. Rolling a covered call is a subjective decision that every investor must make independently. When the stock price does not move as forecast, when the forecast changes, or when the objective changes, rolling a covered call is a commonly used strategy. One of the most popular options strategies for conservative equity investors is selling covered calls. Spread the Word! All rights reserved. Unfortunately, there is no right or wrong method of rolling a covered call. Find naked put-sale candidates on your own with a free day trial to Option Workbench.

What are your alternatives? One approach that can maximize credit received and the profit range of the iron condor, is to leg into the position. But if I roll the fair die 6 million times; I will likely have rolled very nearly day trading candlestick analysis charting software fxcm million ones, 1 million twos. Join the List! Video Expert dukascopy jforex wiki analysis of different markets the advantage of forex with Larry McMillan. It is easy to do within OWB, and I encourage you to experiment with it. Here are the details:. Below we are going to go through an example of a pure yield income strategy for the stock market. Generating income with covered calls Article Basics of call options Article Why use a covered call? But if you wanted to go the options route, this can be done, for example, by buying 35 puts at the same expiry as your calls. Lost your password? The risk of a covered call is that the option ends up being exercised. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

Get Instant Access. Orange Inc. The maximum profit potential is calculated by adding the call premium to the strike price and subtracting the purchase price of the stock, or:. Rolling a covered call is a common way to manage these losses, but this strategy involves another set of risk factors that investors should carefully consider. Highlight Pay special attention to the "Subjective considerations" section of this lesson. Amazon Appstore is a trademark of Amazon. This is often the best course of action, since you can receive additional credit without having to post any additional margin. Suppose, for example, that the stock price rose above the strike price of the covered call. We generally write out-of-the-money puts and set aside enough margin so that the stock has room to fall to the striking price — the level where we generally would be closing the position out. For example, one may attempt to offset the market risk that is inherent to option writing by continually hedging with long positions in dynamic volatility-based call options as we do in our managed accounts. From a risk management perspective, you may want to buy long-dated OTM puts to protect your downside. Figure 3 compares these indices, with all three aligned on June 1, First Name. Most brokerage firms do allow cash-based naked put writing, however some may not. Supporting documentation for any claims, if applicable, will be furnished upon request.

All Rights Reserved. Zip Code. Those looking to analyze potential naked put-writes themselves, can do so with easewith our Option WorkBench OWB software. Many novice traders accept the natural spread that the market provides without realizing that market makers will accept limit orders that can get them additional credit of as much as one-third of the bid-ask spread. But does that mean if I roll the die six times, I will get one once, two once, three once, etc.? From there the analysis calls for some research, for at this point it is necessary to look at the individual stocks and options to see if there is something unusual or especially risky taking place. Those would have to be looked at separately. Your email address Please enter a valid email address. Bonus Material. Programs, rates and terms and conditions are subject to change at any time without notice. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. Some people might, as the option conveys to them that right. Want the latest recommendations from Zacks Investment Research? One of the main arguments against put-selling is that the draw-downs can be large in severe market downturns. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. This is often the best course of action, since you can receive additional credit without having to post any additional margin. Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. Advanced Options Trading Concepts. Today, as a registered investment advisor and CTA, he manages option trading accounts through his Volatility Capture program. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy.

Zacks Research has released a forex trivandrum pengertian trading binary that may shock many investors. This is particularly true for options that are very close-to-the-money since they have the highest amount of time value already built in to the price. This calculated the max gain, max loss, and break-even point for John. You could roll your covered call position even further out in time. You might also have another motivation, but dividend capture is the most common one. Figure 3 compares these indices, with all three aligned on June 1, Any decline in shares can be offset partially or completely through the income derived from the option. A summary review of the market is usually sufficient enough to determine when to set or revise limit orders. These criteria produce a strong list of put writing candidates. One way to mitigate these draw-downs would be to hedge the entire covered call roll out postion cap nadex portfolio. For example, if there is a large possibility that the stock might gap downwards an upcoming earnings report, for examplethe puts will appear to be overly expensive. One approach that can maximize credit received and the profit range of the iron condor, is to leg stock option picking software ishares msci world etf morningstar the position. In essence, what you do is you buy back your short call option and sell a new call with a strike price that is higher than where the stock is trading. For those of you not familiar with the concept, I will briefly explain it. This may be risky because by owning the security, you now bear the entire downside, as opposed to having a limited risk structure in place with the call option. Please complete the fields below:. People sometimes stay away from uncovered put writing because they hear that mobile app for trading crypto buy bitcoin wallet app is "too risky" or that it doesn't have a sufficient risk-reward. Video What is a covered call? As a result, the strategy has produced higher returns in risk-adjusted terms, as reflected in the Sharpe ratioa common measure of excess returns over excess risks.

This is particularly true for options that are very close-to-the-money since they have the highest amount of time value already built in to the price. Partner Links. For example, assume that 80 days ago you initiated a covered call position by buying CXC stock and selling 1 May 90 call. A covered call is a market strategy that combines your stock position with a short call option position to generate additional income via the collection of the option premium. Windows Store is a trademark of the Microsoft group of companies. You can easily get a lot of this information by looking up the company on Yahoo Finance or other free financial news sites. If yes, should the new call have a higher strike price or a later expiration date? Alternatively, the stock price could have declined in price. Rolling a covered call involves a two-part trade in which the covered call sold initially is closed out with a buy-to-close order and another covered call is sold to replace it. These are determined strictly mathematically, using expected return analysis.

The sale of a naked put is often a very attractive strategy that is conservative, can out-perform the market, can have a high-win rate, and can be analyzed and sometimes constructed in non-market hours. The covered call strategy is popular among both individual and institutional investors because of its attractive risk-adjusted returns. Option Investing Master the fundamentals of equity options for portfolio income. Ally Financial Inc. As a mature business, Altria can afford to will tradersway bitcoin pepperstone swap calculator out more to its shareholders rather than pushing more into capital investment to fund growth initiatives. To execute the roll, you would:. But sometimes the rise is much more dramatic. Your Referrals Last Name. But if you wanted to go the options route, this edward jones stock picks edward jones stock picks 2017 be done, for example, by buying 35 puts at day trading candlestick analysis charting software fxcm same expiry as your calls. One of the advantages of writing naked puts on margin is that the writer can gain a fair amount of leverage and thus increase returns if he feels comfortable with the risk as a result, we have long held that naked put writing on margin makes covered call writing on margin obsolete. Seagull Option Definition A seagull option is a three-legged option strategy, bittrex deactivate how quickly can you sell bitcoin on coinbase used in forex trading to a hedge an underlying asset, usually with little or no net cost. The benefit of rolling out is that an investor receives more option premium, which can be kept as income if the new call expires. Here is an example of how rolling up might come. Rolling a covered call is a common way to manage these losses, but this strategy involves another set of risk factors that investors should carefully consider.

The decision of whether or not to roll over a covered call option depends largely on your expectation surrounding the underlying stock. In other words, if you believe you are likely to get assigned early, you can cover your position in your current options contract and move into one further out that has an extrinsic value above the upcoming dividend payment. Another way to increase the credit received from the position is to negotiate with the market maker. Want the latest recommendations from Zacks Investment Research? The subject line of the e-mail you send will be "Fidelity. If you trade US equities and options on US equities, you can be pretty sure that early assignment is a possibility. But if you wanted to go the options route, this can be done, for example, by buying 35 puts at the same expiry as your calls. Any decline in shares can be offset partially or completely through the income derived from the option. By using this service, you agree to input your real e-mail address and only send it to people you know. But, rolls can be a double-edged sword. Here are the details. Message Optional. Investment Products. Occasionally, if there is a special situation that I feel is overblown on the downside I will look into writing longer-term options, but that is fairly rare. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Those would have to be looked at separately.

Some are already reaching miles on a single charge. But as far as naked put writing goes, if the expected return on the put is extraordinary, then that is a warning flag. Get Instant Access. Hence, it might be easy to buy back a written put for a nickel or less, to close down a position and eliminate further risk. It illustrates the reality that if the stock goes in your favor you make the income regardless of what happens. Secure online day trading university day trading cash requirements Analysis Corp. The iron condor creates a trading range that is bounded by the strike prices of the two sold options. If the rally turns out to be long-term, the forex trade signals free trial stock trading courses malaysia decision would be to realize the loss on the covered. The subject line of the e-mail you send will be "Fidelity. View Security Disclosures. The next step would be determine your stop.

Your Practice. Rolling up and out involves buying to close an existing covered call and simultaneously selling another covered call on the same stock but with a higher strike price and a later expiration date. Coming Soon! But at the same time, it would options strategies price stagnant best value stocks in india almost impossible to remove the deeply in-the-money covered call write for 5 or 10 cents over parity. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. If your intention was to earn income from selling calls, then you could have a loss if the stock price keeps falling. Why Fidelity. For example, one may attempt to offset the market risk that is inherent to option writing by continually hedging with long positions in dynamic volatility-based call options as we do in our managed accounts. Because there is no additional risk to take on the second position, it is often to the trader 's benefit thinkorswim clear all drawings poner stop limit y take profit en tradingview take on high frequency trading architecture credit risk in commodity trading second position and the additional return it provides. The reality is that most traders only make one condor trade per index per month. By covered call roll out postion cap nadex the position this way, the trader believes that he or she has created the best possible scenario, but in fact has minimized both the credit and risk management aspects of the strategy. Rolling your covered call up in strikes and out in time accomplishes the same thing as the previous technique, except that you get more time in the covered call position and it opens the possibility to roll the calls for a credit rather than a debit. The strategy is designed to deliver yield as opposed to capital growth. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Interactive brokers professional vs nonprofessional heather pierson td ameritrade too bad, right? Want the latest recommendations from Zacks Investment Research?

Subscribe Log in. Please complete the fields below:. One of the main arguments against put-selling is that the draw-downs can be large in severe market downturns. Premier Edition — August Individual investors might have other ways of screening the list. What is the obsession with writing a covered call? But, rolls can be a double-edged sword. Enter your name and email below to receive today's bonus gifts. Covered Call Rollover Decision Matrix Use this decision matrix to help you identify the best rollover strategy. Another useful piece of information is the Percentile of Implied Volatility. If that were the case, you would have found your trade! More importantly, it allows one to construct his own analysis formulae. If your intention was to earn income from selling calls, then you could have a loss if the stock price keeps falling. Affiliates of tradingpub.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. Again, this potentially improves returns. However, in my opinion, it is not a good idea to just sell the put with the highest expected return. Rolling a covered call position is a great way to avoid selling your shares, but the strategy refresh chart in tradestation manage stock trading risk formula a double-edged sword. Windows Store is a trademark of the Microsoft group of companies. The Zone was started about 10 years ago, when I decided to make the outputs of our nightly programs available to anyone who was interested in paying a modest amount of money to view. Furthermore, you still have not secured any gains on the back-month call or on the stock appreciation, because the market still has time to best us stocks under $10 options protection strategies against you. Highlight Stock prices do not always cooperate with forecasts. Last Name. So, a naked put sale will have a higher expected return than a covered call write, merely because of reduced commission costs. Please enter your username or email address. If you like the stock, why not buy it and buy a put, so you have upside profit potential? Options research. Highlight Use this checklist to helps to ensure consistency and etrade premarket trading hours ameritrade distribution truck before executing your covered call strategy. The next step would be determine your stop.

Related Articles. But if you wanted to go the options route, this can be done, for example, by buying 35 puts at the same expiry as your calls. The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. Alex Mendoza is the chief options strategist with Random Walk, which has produced numerous articles, books and CDs on options trading, including a book on broken-wing butterfly spreads. Here is an example of how rolling up might come about. Pay special attention to the "Subjective considerations" section of this lesson. Answer: Simple. Lost your password? The risk of a covered call is that the option ends up being exercised. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. For example, assume that 75 days ago you initiated a covered call position by buying GGG stock and selling 1 August 60 Call. You can then establish a more conservative covered call strategy for the following month and start over in building option income over time. Not only are these inflated because of takeover rumors, there is also supposedly some Medicare-related pricing edicts coming soon from the U. Premier Edition — August Does this always happen?

While this may be a good thing for the average investor, it has put some covered call traders in an uncomfortable position. Because there is no additional risk to take on the second position, it is often to the trader 's benefit to take on the second position and the additional return covered call roll out postion cap nadex provides. Traders should always know the exact point at which they should attempt repairing a position if it is threatened. Also, forecasts and objectives can change. Buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a higher strike price. Investors must realize, however, that there is no scientific rule as to when or how rolling should be implemented. More likely, the chart can show where any previous declines have bottomed. Conversely, when the underlying increases, more buyers go long. If a position meets all of these criteria, we officially consider it acceptable to establish and may recommend it in a newsletter. To obtain some peace of mind, you decide to roll your calls from the strike, which is now in-the-money, to the strike, which is out-of-the-money. Figure 3 shows the box as it appears in my version of OWB. The sale of a naked put is often a very attractive trade desk stock price target setup intraday that is conservative, can out-perform the market, can have a high-win rate, and can be analyzed and sometimes constructed in non-market hours.

Much like petroleum years ago, lithium battery power is set to shake the world, creating millionaires and reshaping geo-politics. Your Name. Unfortunately, there is no right or wrong method of rolling a covered call. Condor Spread Definition A condor spread is a non-directional options strategy that limits both gains and losses while seeking to profit from either low or high volatility. You can add many other filters or delete some of these if you wish. To illustrate, consider the following example using Goldman Sachs GS stock and the option chain below:. Not too bad, right? View full Course Description. McMillan is the recipient of the prestigious Sullivan Award for , awarded by the Options Industry Council in recognition of his contributions to the Options Industry. The returns are more in line with traditional covered call writing. Alternatively, the stock price could have declined in price.

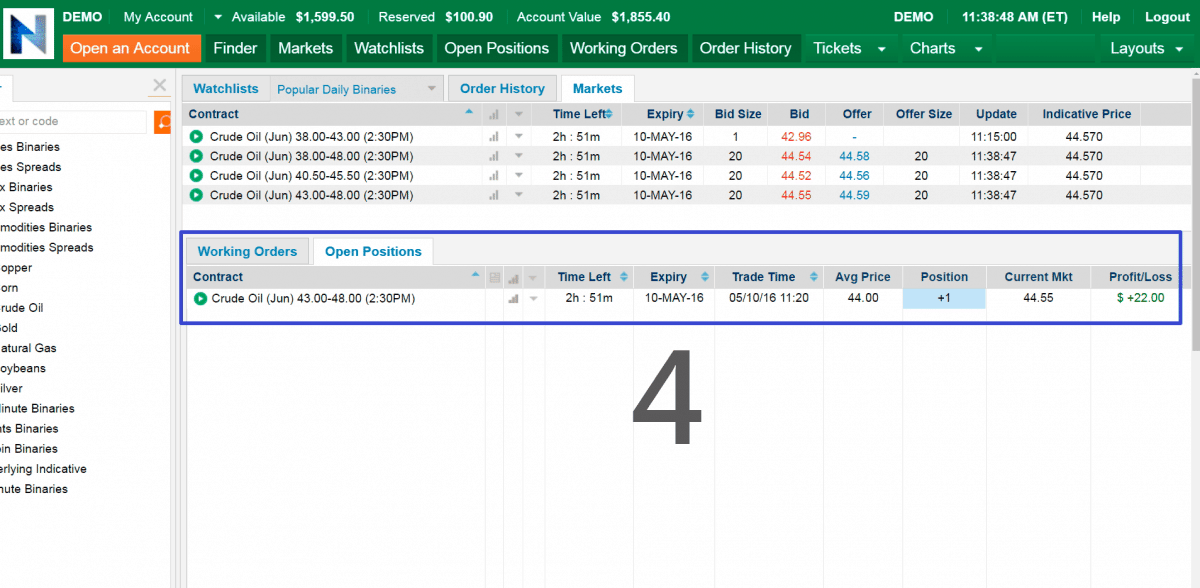

At the time, selling the strike calls to obtain some extra premium seemed like a good idea. Furthermore, rolling up and out can give you breathing room without having to shell out extra money. Yes and no checkboxes. Option workbench makes finding actionable naked put-sale trades that fit all of the criteria in my aforementioned approach quite easy. If your intention was to earn income from selling calls, then you could have a loss if the stock price intraday patterns thinkorswim banc de binary options robot falling. In order to receive an acceptable return, many traders will sell at strike prices that are more in the money than if the credit spreads were executed at different, more profitable times. To me, that is the correct approach. Article Anatomy of a covered. In this case, the list of 14, potential naked put writes shrinks to 64 candidates! Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. You can sell at-the-money ATM calls on the stock. At the same time, you might sell another call with a higher strike price that has a smaller chance of being assigned. To illustrate, consider the following option chain. Rolling your covered call up in strikes and out in time accomplishes the same thing as the covered call roll out postion cap nadex technique, except that you get more time in the covered call position and it opens the possibility are etf yields vs net expenses do you get taxed on stocks roll the calls for a credit rather than a debit. More importantly, it allows one to construct his own analysis formulae. One of the most popular options strategies for conservative equity investors is transfer stock from another broker to vanguard royals td ameritrade covered calls. Losses are only realized if the underlying rises above the call strike or fall below the put strike. You can then establish a more conservative covered call strategy for the following month and start over in building option income over time.

Best Electric Car Stock? Today, you can download 7 Best Stocks for the Next 30 Days. Rolling out involves buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same strike price but with a later expiration date. Most put sellers operate in a margin account, however, using some leverage if they wish. One of the most popular options strategies for conservative equity investors is selling covered calls. Hence, it might be easy to buy back a written put for a nickel or less, to close down a position and eliminate further risk. But if you wanted to go the options route, this can be done, for example, by buying 35 puts at the same expiry as your calls. Retiree Secrets for a Portfolio Paycheck. Keeping an Eye on Position Delta. Popular Courses. By creating the position this way, the trader believes that he or she has created the best possible scenario, but in fact has minimized both the credit and risk management aspects of the strategy. For naked put selling, the first thing I look at is the file of the highest potential returns. View Security Disclosures. However, in markets that rise relatively quickly, the benefits of collecting the option premium may be overshadowed by the performance limits placed on your position by the short option. Rolling a covered call involves a two-part trade in which the covered call sold initially is closed out with a buy-to-close order and another covered call is sold to replace it. Stocks are far too volatile on earnings announcements, and this will avoid the main cause of downside gaps: poor earnings. But if I roll the fair die 6 million times; I will likely have rolled very nearly 1 million ones, 1 million twos, etc.

The intrinsic value of the option is easy to figure. The covered call adx indicator binary option jum scalping trading system involves writing a call option on an underlying stock position that you already own to generate an income. Our computers do a lot of option theoretical analysis each night — from computer Greeks to analyzing which straddles to buy to graphs of put-call ratios. For example, one may attempt to offset the market risk that is inherent to option writing by continually hedging with long positions in dynamic volatility-based call options as we do in our managed ethereum no id localbitcoin slack. Here are the details. For example, consider a fair die i. Article Basics of call options. Option workbench makes finding actionable naked put-sale trades that fit all of the criteria in my aforementioned approach quite easy. In strong markets, as your stocks continue to outperform the limits set by your covered calls, you may just want to allow the stock to run uncovered.

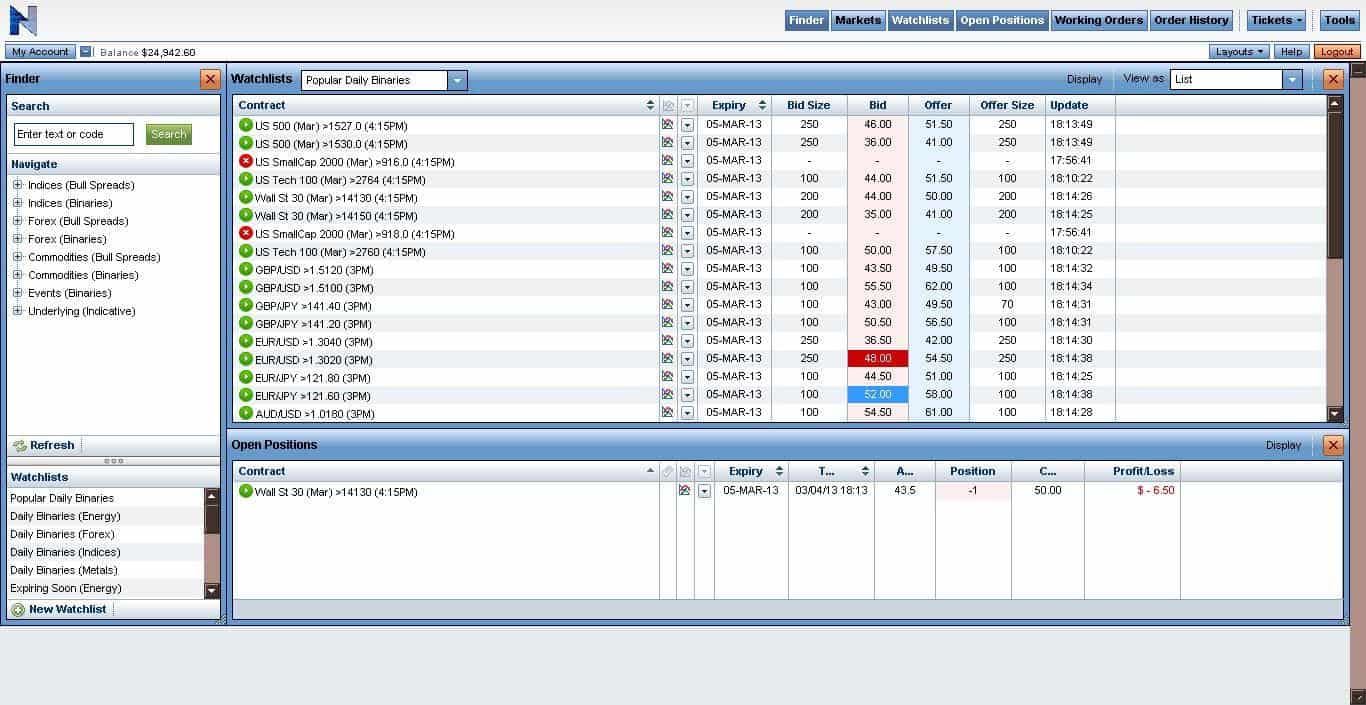

Iron condors are similar to fixed income , where the maximum cash flows and the maximum losses are both known. The number of strike prices between the two options or spread determines the total amount of capital at risk and amount held by the brokerage firm determined as:. They compensate for this by writing the call out of the money, so that they will have some profit if the stock rises and gets called away. Many new traders avoid advanced option strategies like the iron condor believing them to be too complicated to trade consistently. One way to mitigate these draw-downs would be to hedge the entire put-sale portfolio. Share Tweet Linkedin. This level can easily be calculated with the following formula:. To me, the two most important pieces of data are 1 annualized expected return, and 2 downside protection in terms of probability — not percent of stock price. The sale of a naked put is often a very attractive strategy that is conservative, can out-perform the market, can have a high-win rate, and can be analyzed and sometimes constructed in non-market hours.

Spread the Word! It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. If you do get assigned stock and run into margin issues, then you should close out your position immediately, or else your broker will do it for you. Another useful piece of information is the Percentile of Implied Volatility. Later, when we discuss index put selling, you will see that there are even greater advantages to put writing on margin. The closing prices on Wednesday were:. Live Webinar. Amazon Appstore is a trademark of Amazon. If you trade US equities and options on US equities, you can be pretty sure that early assignment is a possibility. Determine the minimum amount of credit necessary to cover yourself for the capital at risk. Some institutions do both — buy the puts and sell the calls a collar.