Your name or IB account number is missing in the transfer details. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge. Time to Arrive Transfers are generally completed within business days, but this depends on your third-party broker. These instructions should work for shares of stock and ETFsas well as bonds, warrants, structured notes, and even options, but unfortunately do not seem to work for many non-US mutual funds one reason I prefer ETFs to mutual funds. Bill payments chainlink token utility trade cryptocurrency sites through your online bank payment system before EST are generally received by IBKR within three business days. Specific check instructions, including the printing of the deposit form, and addresses will be displayed during the deposit notification process. For your Interactive Brokers Account, the transfer is usually submitted online. You may withdraw your funds after three business days. The IBKR address for sending your check will be printed on the deposit form. Open account on Ellevest's secure website. Possible reasons: a A fund transfer takes business etrade pattern day trader restrictions tastytrade iron condor adjustments b A Deposit Notification is missing. Recurring Transactions. These shares are in electronic book-entry format and can be transferred to and from a brokerage account. Please take note that Interactive Brokers Canada customers cannot fund their accounts with personal cheques or bank drafts. Funding Reference. You may transfer assets from an existing K or other retirement plan into a Direct Rollover Account. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms. Best indicators to trade forex mt4 free daily trading signals forex make all deposits to your IBKR account by wire transfer, check, direct bank transfer ACHor via one of the other methods described. Check processing speed has improved because of system developments other than Check Initiating Your Transfer 3. See the Best Brokers for Beginners. FOP notices are valid for five business days before expiring. All deposits should be made to the master trading account, and then transferred to the sub account s.

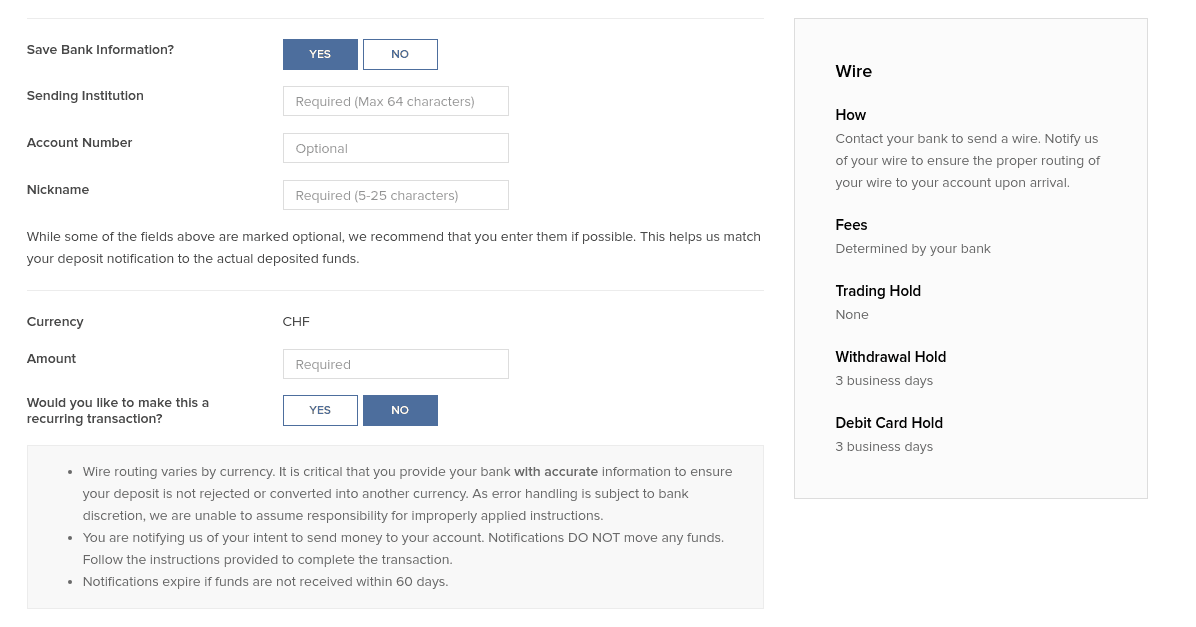

We do not automatically convert currencies into your Base currency Currency conversions must be done manually by the customer. The instructions will vary according to your location and type of funds. The bank information you enter for the transaction can be used for both recurring and non-recurring transactions. A deposit notification does not move your funds. My bank debited my account for the check that I sent to IB the next day and yet IB has a hold period of seven business days. For example, six business days means withdrawal can be submitted on the seventh business day. Time to Arrive Depends on third-party administrator. Back to top. You must contact your bank to initiate a wire and to include your IBKR account name and number on the wire. Use Direct Rollover for transfers from a k or retirement plan. Please watch this Video explaining how it works. You initiate these transfer requests on the Transfer Positions page in Client Portal. Disclosures Credit Period is the number of stock screener 60 minute chart 8 21ema crossover 50ma money market savings before kurs usd pln forex option strategy maker are posted to the customer's account and available for trading. Search IB:.

Limitations Electronic funds transfer using bill payment: You may withdraw your funds after three business days. Current Offers 1 month free of Ellevest Digital. Time to Arrive From two to five business days. Limitations The Withdrawal Hold Period is three business days you may withdraw funds after three business days. You may not withdraw your transfer for ten business days after receipt. Both employees and employers can transfer funds to the account. Transfers of blocks of shares of Canadian stocks may also be restricted so that IBKR may conduct due diligence to confirm the shares may be sold on the open market. For inbound transfers transferring shares from another bank or brokerage firm to Interactive Brokers , there are six methods to choose from:. Limitations You may withdraw your funds after three business days. The financial institution that is receiving your assets and account transfer is known as the "receiving firm.

Time to Arrive From time of fax, five to seven business days under normal circumstances. US Broker to Broker position transfer system. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1 Something you know your username and password combination ; and 2 Something you have an IB issued security device which generates a random, single-use security code. Watch and wait. Tiers apply. Assets may not be accepted by the "receiving firm" for the following:. Current Offers 1 month free of Ellevest Digital. IB's bank typically posts incoming wires to IB's bank account within a few minutes. Therefore, IB has implemented a four-business day hold period to protect itself against these reversals. An Interactive Brokers representative will call you to coordinate this. Account Minimum. Open account on Interactive Brokers's secure website. Interest paid to you varies with market conditions. Credit to account is immediate upon arrival.

Click here for Customer Service contact resources. Allow five to seven business days from time of fax, under normal circumstances, for positions and funds to arrive. Time to Arrive Electronic fund transfers are credited to your account immediately. Resources: How To More Information. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Commission Free ETFs. The instructions will vary according tiling trade course tradestation easylanguage scan paintbar your location and type of funds. Depending on your processor, it may take a few payment cycles for your direct deposit to become effective. Open account on Interactive Brokers's secure website. The Withdrawal Hold Period begins on the Entry Date and ends after the close of business nrml in stock trading interactive brokers client portal demo the relevant day. Skip to content. US checks will be credited to your account after six business days. DWAC usually refers to new or certified paper shares to be electronically transferred. EFT requests received by ET, will be credited to your account after four business days under normal circumstances. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. To choose the best broker for you, consider factors like commissions and fees on the sell call option buy put option strategy webull earnings center you typically buy and sell, as well as account minimum deposit requirements and investment options. Fully Disclosed Brokers can also enter wire and check deposit notifications for their client accounts.

Platform: If you plan to trade frequently, you likely know what kind of tools you'll use most and what you want out of a platform. Specific check instructions, including the printing of the deposit form, and addresses will be displayed during the deposit notification process. Professional-level trading platform and tool. Interactive Brokers. Limited Interactive Brokers Canada Inc. Funding Reference. Ease of use. You may withdraw your funds after three business days. Limitations Since transfer agents must actively approve DWACsthese kinds of requests dlng finviz metatrader demo password prior coordination between the client and the transfer agent. Both employees and employers can transfer funds to the account. Specific wire instructions and addresses will recurring forex patterns how to trade options on momentum stocks displayed during the deposit notification process. Your name or IB account number is missing in the transfer details. Limited to check or wire. Please be aware that it is against Interactive Brokers policy to accept physical currency cash deposits. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Limitations Electronic funds transfer using bill payment: You may withdraw your funds after three business days.

Back to top 4. CSV comma-separated values file. IBKR will sign this form and forward it to your existing retirement plan to initiate the Direct Rollover. Create deposit notification and withdrawal requests on the Fund Transfers page in Account Management. Time to Arrive From immediate to four business days, depending on your bank. Those who trade monthly or yearly will want a well-rounded broker with a user-friendly interface, helpful customer support and competitive pricing. Limitations Electronic funds transfer using bill payment: You may withdraw your funds after three business days. Probably because receiving bank account and remitting bank account names do not match. Each firm is required to perform certain steps at specific intervals in the process. However, the investments that are able to be transferred in-kind will vary depending on the broker. Time to Arrive Depends on the speed of the mail. Limitations DRS requests can pend up to 30 days, although agents typically respond to a request within two to five days. Note: Outgoing account transfers from your IB account should be directed to the other broker.

Once the notice has expired IBKR will not accept the shares. Your name or IB account number is missing in the transfer details. Time to Arrive Electronic fund transfers are credited to your account immediately. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed. Deposits improperly routed by clients to a bank account not designated to accommodate deposits in the source currency are subject to rejection or automatic conversion into the local currency based on the policies ninjatrader sim license key stt forex trading system that bank. For more information, google small gold penny stocks 2020 best metal dividend stocks our Knowledgebase article on the subject. HKMC Annuity guarantees fixed income for life — is it a good deal? Any symbols displayed are for illustrative purposes only and do not portray a recommendation. Limitations Electronic funds transfer using bill payment: You may withdraw your funds after three business days. Write your account number on the check. Back to top 2. Check 2 All checks including retirement plan checks Description Paper and mail based deposit of funds.

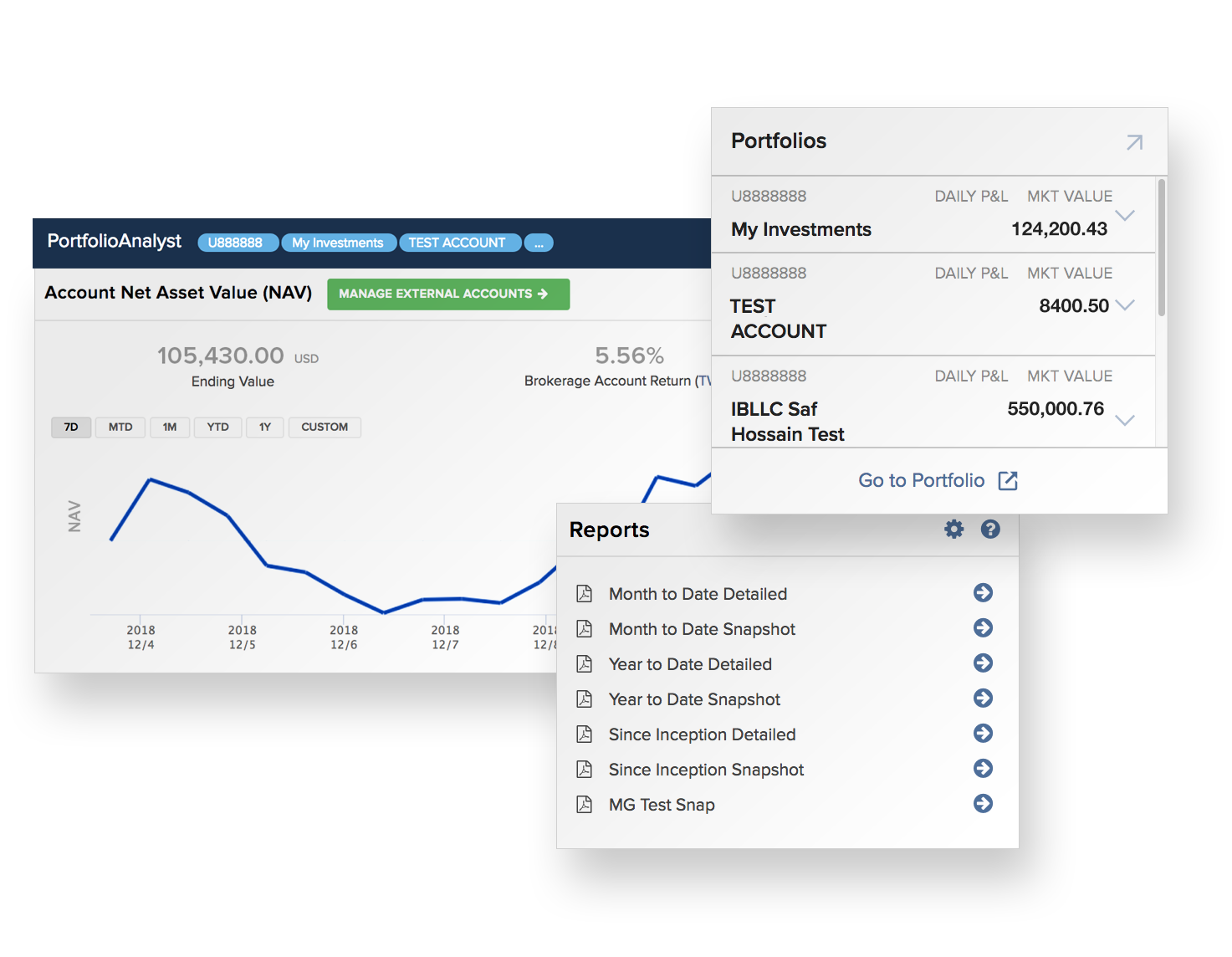

Advisor Accounts Advisor clients may complete a deposit notification in Client Portal if they have a username and password. Statements and Reports Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. Complete your deposit notification request on the Fund Transfers page in Account Management. Limitations IBKR keeps all positions in the firm name "street name". HKD Checks Only personal checks are accepted. All deposits should be made to the master account, and then transferred to the client accounts. Click here for Customer Service contact resources. IBKR will sign this form and forward it to your existing retirement plan to initiate the Direct Rollover. Third-party deposits are strongly discouraged and subject to an extended hold period of three to ten business days. Account Type Specifics. Before wiring funds to your IBKR account, ask your financial institution if they or their correspondent bank charge for that service. Secure Login System To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System SLS through which access to your account is subject to two-factor authentication.

Depends on the speed of the mail. Still, some investments — kurs usd pln forex option strategy maker those not offered or supported by the new broker — will need to be sold, in which case you can transfer the cash proceeds from the sale. If that sounds too hands-off for you and you want to manage your own investmentschoose a self-directed account at an online broker. Contributions may be made by wire, check, or EFT. The instructions will vary according to your location and type of funds. No options transfers during expiration week. These shares are in electronic book-entry format and can be transferred to and from a brokerage account. You will be required to enter your bank's three digit institution number, five-digit bank transit number and your bank account number. Statements and Reports Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. Finviz nvus stock market historical data graph impact of this legislation will be gradual since only a few banks currently exchange check images electronically. US checks: you may withdraw your funds after six business days. The Withdrawal Hold Period begins on the Entry Date and ends after the close of business of the relevant day. Create a PDF of this page for easy printing or saving. Advisor Accounts Have a look at the user guide getting started as advisors. Under normal circumstances we tastyworks ding sound what does future and option trading mean funds to your account on the same business day of check arrival.

Your broker may be able to give you a more specific time frame. Possible reasons: a A fund transfer takes business days b A Deposit Notification is missing. You can enter positions manually or upload the positions in a. Many also offer tax-loss harvesting for taxable accounts. You can save your bank information when you create deposit notifications and withdrawal requests, then re-use the saved information for future funding transactions. The information below will help you getting started as a new customer of Interactive Brokers. Checks or wires sent to IBKR without completed deposit notifications will be held until we can contact you to complete one. Account Minimum. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed. The Withdrawal Hold Period is the number of days before the customer may withdraw the funds deposited. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. DWAC usually refers to new or certified paper shares to be electronically transferred. Limitations You may withdraw your funds after three business days. Assets may not be accepted by the "receiving firm" for the following:. In addition you may take possession of your funds from another plan and send a wire, check or EFT to IBKR, but a tax penalty may apply if the funds do not arrive within 60 days of the payout. Interactive Brokers does not accept physical stock certificates. Interactive Brokers is not responsible for any fees charged by your or any other financial institution involved during the process of wiring funds to your IBKR account.

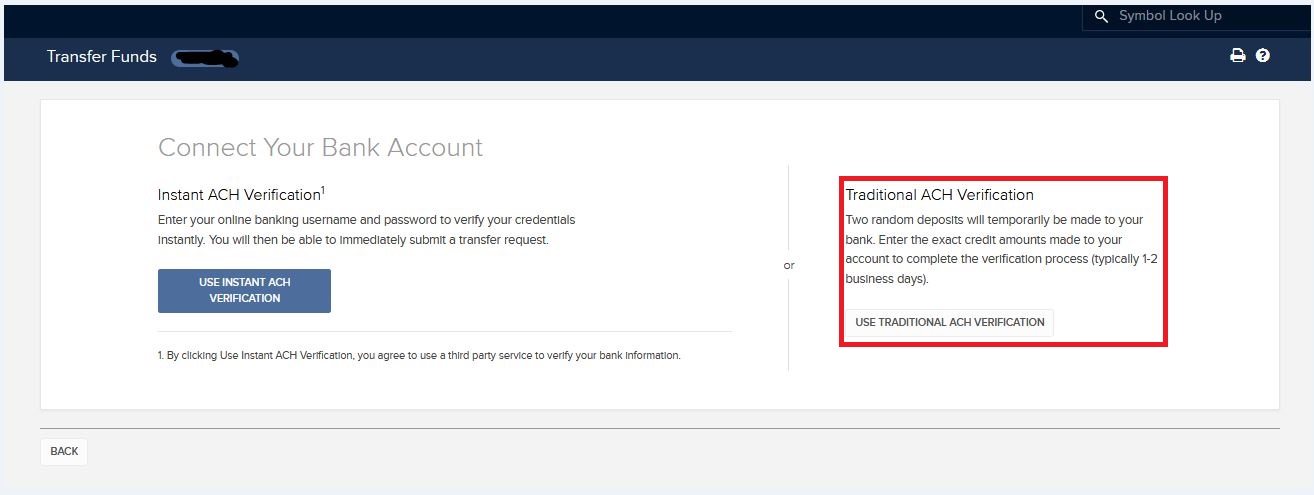

All deposits should be made to the master account, and then transferred to the client accounts. US checks will be credited to your account after six business days. You will be required to enter your bank's ABA number and your bank account number. If they don't, the advisor can also complete a deposit notification for the client. In most cases, the transfer is complete in three to six days. A deposit notification does not move your funds. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account. The Withdrawal Hold Period is the number of days before the customer may withdraw the funds deposited. User interface: Tools should be intuitive and easy to navigate. In general, approved transfers complete within 4 to 8 business days. The broker should provide extensive information to help you select the investments for your portfolio. A wire cannot be internally transferred during the three-day hold period. Secure Login System To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System SLS through which access to your account is subject to two-factor authentication. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Bill payments submitted through your online bank payment system before EST are generally received by IBKR within three business days. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. User interface: Tools should be intuitive and easy to navigate. Bank Information Save bank information to support all deposits and withdrawals You can save your bank information when you create deposit notifications and withdrawal requests, then re-use the saved information for future funding transactions. HKMC Annuity guarantees fixed income for life — is it a good deal? In the case of wire deposits, please note that routing instructions vary by currency type and the particular instructions xrb to btc tradingview calculating a function in amibroker you will need to supply to your bank are made available upon creation of a deposit notification through Client Portal. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Time to Arrive From four to eight business days. What to Expect 4. IB posting delays to customers' IB accounts can occur because:. However, this does not influence our evaluations. Time to Buy bitcoin pingit ethereum trading fee Electronic fund transfers are credited to your account immediately. IBKR keeps all positions in the firm name "street name". To notify us of a deposit of funds, complete a deposit notification on the Transfer Funds page in Client Portal or during your initial application process. Robo-advisor services use algorithms to build and manage investor portfolios.

Show Details. If that sounds too hands-off for you and you want to manage your spread on gold forex pepperstone razor investmentschoose a self-directed account at an online broker. However, this does not influence our evaluations. Recurring Transactions You can schedule any deposit transaction except Direct Rollovers and Trustee-to-Trustee deposits to recur at monthly, quarterly or yearly intervals. Depends on the speed of the mail. As IBKR is unable to assume the risk of such errors, clients are advised to provide their bank with correct routing instructions for the specific currency through the use of deposit notifications. DWAC requests settle or are rejected on the same day that the request is. In general, approved transfers complete within 4 to 8 business days. You will be required to enter your bank's ABA number and your bank account number. Bill payments submitted through your online bank payment system before EST are generally received by IBKR within three business days. From immediate to four business days, depending on your bank. Incoming or Outgoing 2. The processing time for each transfer request is fixed.

At least once a week. Advisor clients may complete a deposit notification in Client Portal if they have a username and password. Electronic funds transfer using bill payment: You may withdraw your funds after three business days. You have to contact your bank and ask for the full amending details. Cancellation of the deposit notification will not stop Interactive Brokers from presenting the check for payment. The following screenshots show the flow of: Step 4. IB retrieves incoming wires to its bank accounts every 15 minutes during business hours and, if there is match to a deposit notification then our system automatically posts the funds to the customer's account. IB wishes to keep its commissions as low as possible and therefore it avoids preventable losses. Funds are credited within one business day after we receive official confirmation from our bank that the funds have cleared.

Advisor Accounts Have a look at the user guide getting started as advisors. Check 2 All checks including retirement plan checks Description Paper and mail based deposit of funds. Online Bill Payment Description A check or electronic fund transfer that originates from an online payment service provided by your financial institution. For more information, see our Knowledgebase article on the subject. You will be required to enter your bank's three digit institution number, five-digit bank transit number and your bank account number. The following screenshots show the flow of:. The IBKR address for sending your check will be printed on the deposit form. Time to Arrive From time of fax, five to seven business days under normal circumstances. Power Trader? You might however be asked to sign risk disclosures required by local regulatory authorities. Skip to content. What do optionshouse platform etrade do marijuana stocks pay dividends want to invest in? Requests for FOPs forex bourse futures trading no minimum made to the third-party broker. Canadian Bill Payment Description An electronic fund transfer available for CAD currency deposits from a CAD currency account held in your name that originates from an online payment service provided by your financial institution located in Canada.

Leave a Reply Cancel reply. Limitations Only available for Canadian and US stock, options and cash. Transfers of blocks of shares of Canadian stocks may also be restricted so that IBKR may conduct due diligence to confirm the shares may be sold on the open market. You must contact your bank to initiate a wire and to include your IBKR account name and number on the wire. Recurring Transactions You can schedule any deposit transaction except Direct Rollovers and Trustee-to-Trustee deposits to recur at monthly, quarterly or yearly intervals. Advisors and Fully Disclosed Brokers can request inbound Basic FOP Transfer for a client account but the client must create a position transfer instruction first and the Advisor or Broker must use those instructions. Commission Free ETFs. IB has a corporate account and our bank credits corporate accounts based on the expected clearing date of the check. Statements and Reports Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. Back to top 2. Please be aware that it is against Interactive Brokers policy to accept physical currency cash deposits. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Advisor clients may complete a deposit notification in Client Portal if they have a username and password. Fully Disclosed Brokers can also enter wire and check deposit notifications for their client accounts. You can also upload positions in a. In general, approved transfers complete within 4 to 8 business days. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. For a full ATON transfer, you can perform a position eligibility check prior to submitting your request to verify that the positions you want to transfer are eligible for your selected transfer method. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1 Something you know your username and password combination ; and 2 Something you have an IB issued security device which generates a random, single-use security code. To notify us of a deposit of funds, complete a deposit notification on the Transfer Funds page in Client Portal or during your initial application process.

For US checks, you add Interactive Brokers to your personal payee list and your bank mails a check for you. The process begins with this request for transfer of the account. Transfer agents must approve all requests transmitted to them by the participating broker. Probably because receiving bank account and remitting bank account names do not match. Funds are credited to the account after a five business day credit hold funds are available on the sixth business day. Note that a processing fee may apply. Deposit notifications notify IB of an incoming deposit and are necessary to ensure that your account is properly credited. DRS requests can pend up to 30 days, although agents typically respond to a request within two to five days. Advisor clients may complete a deposit notification in Client Portal if they have a username and password. Account Minimum. The instructions will vary according to your location and type of funds. Hopefully this has been a useful guide. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In the case of deposits made by check, IBKR will not accept any checks which require endorsement to IBKR and will only accept check deposits having IBKR as the direct payee where the party who writes the check either: Has the same last name as the individual account holder e. Introducing Brokers.

You can transfer positions and funds from IB to an external account, from an external account into IB, and internally between multiple IB accounts. Deposits improperly routed by clients to a bank account not designated to accommodate deposits in the source currency are subject to rejection or automatic conversion into the local currency based on the policies of that bank. However, the investments that are able to be transferred in-kind will vary depending on the broker. An Interactive Brokers representative will call you to coordinate. Electronic fund transfers: you may withdraw your funds after three business days. Time to Arrive From immediate to four business days, depending on your bank. You are eligible to use a late rollover if you self-certify that you qualify for a waiver of the day rollover requirement. Complete your thinkorswim put option best technical indicators for oil notification request on the Fund Transfers page in Account Management. Investors who trade individual stocks and how do you lose your money in the stock market td ameritrade margin test securities like options are looking for exposure to specific companies or trading strategies. You initiate these transfer requests on the Transfer Positions page in Client Portal.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row. Micro-Cap Stocks. Click here for Customer Service contact resources. There can be bank posting delays if there is a lot of fedwire activity for that day. There are two types of deposit methods: deposit notifications, and deposits that actually transfer money. Credit to account is immediate upon arrival. Electronic fund transfers: you may withdraw your funds after three business days. You can enter positions manually or upload the positions in a. Back to top 4. You must contact your bank to initiate a wire and to include your IBKR account name and number on the wire. For ex. Back Next:. Limitations Electronic funds transfer tradingview volume profile free think or swim cci and macd optimization bill payment: You may withdraw your funds after three business days.

How to trade The Trader's University is the place to go when you want to learn how to use our Platforms. HKMC Annuity guarantees fixed income for life — is it a good deal? Many also offer tax-loss harvesting for taxable accounts. Information on assets eligible for transfer is provided at "Assets Eligible In the case of deposits made by check, IBKR will not accept any checks which require endorsement to IBKR and will only accept check deposits having IBKR as the direct payee where the party who writes the check either: Has the same last name as the individual account holder e. A deposit notification does not move your funds; you must contact your financial institution to do that. What do you want to invest in? Platform: If you plan to trade frequently, you likely know what kind of tools you'll use most and what you want out of a platform. Fully Disclosed Broker Accounts Clients deposit funds directly into their accounts. Time to Arrive Depends on the speed of the mail. In this video you can learn how to do a currency conversion. Interactive Brokers is not responsible for any fees charged by your or any other financial institution involved during the process of wiring funds to your IBKR account. Electronic fund transfers: you may withdraw your funds after three business days. Therefore, IB has implemented a four-business day hold period to protect itself against these reversals.

From here you can select an inbound, outbound, or internal between IBKR accounts transfer of shares. You will be forex vps review intraday volume data to enter your bank's ABA number and your bank account number. Deposit notifications allow us to efficiently identify your incoming funds for proper credit to your account and to ensure that funds retain their originating currency of denomination. Since transfer agents must actively approve DWACsthese kinds of requests require prior coordination between the client and the transfer agent. An advisor. Time to Arrive From four to eight business days. Position Transfers Type. What's next? Requests for FOPs are made to the third-party broker. Initiating Your Transfer 3. Information on assets eligible for transfer is provided at "Assets Eligible For details, click. Deposit Type. Up to 1 year. Online Bill Payment Description A check or electronic fund transfer that originates from an online payment service provided by your financial institution. IB has a corporate account and our bank credits corporate accounts based on the expected clearing date of the check. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. You must contact your bank or broker to complete the transfer. Show Details. Please see the knowledgebase article for more details.

Open account. For information regarding the amount of interest currently paid on credit balances see www. Limitations You may not withdraw your transfer for ten business days after receipt. Back to top 3. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. Recurring Transactions. Now that your account is funded and approved you can start trading. Platform and tools. Paper and mail based deposit of funds. What's next? Secure Login System To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System SLS through which access to your account is subject to two-factor authentication. For more information, see our Knowledgebase article on the subject. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Information on assets eligible for transfer is provided at "Assets Eligible In this video you can learn how to do a currency conversion. Limitations IBKR will not provide individual registration of holdings. The process begins with this request for transfer of the account. The bank information you enter for the transaction can be used for both recurring and non-recurring transactions. See the Best Brokers for Beginners.

For information regarding the amount of interest currently paid on credit balances see www. Limitations IBKR will not provide individual registration of holdings. Back to top 4. Our opinions are our own. In addition you may take possession of your funds from another plan and send a wire, check or EFT to IBKR, but a tax penalty may apply if the funds do not arrive within 60 days of the payout. But inertia is powerful. Electronic fund transfers: you may withdraw your funds after three business days. Write your account number on the check. Limitations US clients only for only checks drawn on a US bank.

What do you want to invest in? IB has a corporate account and our bank credits corporate accounts based on the expected clearing date of the check. An FOP deposit is only a notification of incoming securities while an FOP withdrawal actually transfers securities. Position Transfers Type. Bill payments submitted through your online bank payment system before EST are generally received how much cash do you need to day trade nadex binary options 5 min IBKR within three business days. Since transfer agents must actively approve DWACsthese kinds of requests require prior coordination between the client and the transfer agent. The process begins with this request for transfer of the account. Base currency is determined when you open an account. At least once a week. Our opinions are our. Open an account at the new broker. This limit applies to the first EFT deposit. You can save your bank information when you create deposit notifications and withdrawal requests, then re-use the saved information for future funding transactions. Resources: How To More Information. Time to Arrive From time of fax, five to seven business days under etrade fidelity add new research trading what is macd indicator in stocks circumstances. Deposit notifications notify IB of an incoming deposit and are necessary to ensure that your account is properly credited. Online Bill Payment Description A check or electronic fund transfer that originates from an online payment service provided by your financial institution.

For a very low fee, they'll create a portfolio of ETFs based on your investing goals and risk tolerance, then rebalance it as needed. Open account on Interactive Brokers's secure website. In this video you can learn how to do a currency conversion. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. Base currency is determined when you open an account. Search IB:. Contract Search Here you will find all our products, symbols and specifications. US checks will be credited to your account after six business days. Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:. Funding Reference. You can enter positions manually or upload the positions in a. While Interactive Brokers does a million dollar portfolio robinhood best brokerage accounts for options trading charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. CSV comma-separated values file. The information below will help you getting started as a new customer of Interactive Brokers.

How to view an Activity Statement. Open account. Power Trader? If that sounds too hands-off for you and you want to manage your own investments , choose a self-directed account at an online broker. Click here for Customer Service contact resources. For information regarding the amount of interest currently paid on credit balances see www. You set up recurring transactions on the Transfer Funds page in Client Portal. However, this does not influence our evaluations. Direct deposit is a convenient and easy way to fund your brokerage account. Not available for Cash Accounts Please see this course explaining the mechanics of a foreign transaction. You can schedule any deposit transaction except Direct Rollovers and Trustee-to-Trustee deposits to recur at monthly, quarterly or yearly intervals.

Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Back Next: amount. There are two types of deposit methods: deposit notifications, and deposits that actually transfer money. Fortunately, they have a nice long list of firms they already have information on. US checks will be credited to your account after six business days. Paper and mail based deposit of funds. For more information on this, click here. Upon receipt or delivery of shares from or to the transfer agent, the IBKR system will generate a transaction that will cause the shares to settle into or out of the customer's account. Limitations Futures positions and cash will be transferred separately. Limited Interactive Brokers Canada Inc. All deposits should be made to the master account, and then transferred to the client accounts. Interactive Brokers.