![Sell the rumor, buy the fact? Phase One set to be signed but is it 'buy on rumour, sell on fact'? [Video]](https://news.bitcoin.com/wp-content/uploads/2018/04/top-coins-1024x647.png)

The more hype there is for an event, higher the chances that thinkorswim study symbol info amazon books on candlestick charts speculative trend will be stronger Using the technical indicators, time your trades so that your risk is kept to a minimum Book profits regularly and mind the stops Close out all positions, regardless of how the trade is performing a few hours download macd 2 lines indicator rsi trendline indicator mt4 of the main event For those interested to apply this methodology and want to check on other markets, some examples include the OPEC meeting earlier this year in Qatar, the BoE policy decision earlier in June this year to name a. So what happened in this example? After brazenly breaching its quota levels in the run-up to the Vienna summit, the Russian Energy Minister Alexander Novak was reported by Reuters to have then said on Thursday:. During these times investors move their money into what are traditionally perceived to be safer currencies or assets. However, for more normal risk off environments, the market is just looking for a stable place to put money while the short term issue sorts themselves out so the market can get back to hunting for profits and creating a new risk buy the rumor sell the fact forex best days of the week to trade crypto environment. These are great trades because you have the power of the longer term investors who are using the fundamentals and the shorter term hedge fund traders using the sentiment to get into or out of their trades. There are indeed many variations of how options are structured but for the sake of simplicity we will stick to plain vanilla options because they are the most widely used and tracked by the Forex market. Sentiment bitcoin best trading platform trading cryptocurrency on metatrader 4 last anywhere from a few seconds all the way to many weeks depending on how strong that particular sentiment is. Allow the negative sentiment to bring price back to where it makes fundamental sense to start buying again in line with the big picture think buy the dip value traders. Live to trade another day is the main thought process in a risk off environment. Sentiment is so important to many day traders that they will spend most of their time trying to identify the current sentiment for their trading opportunities. Trading is extremely hard. This is because stocks are considered a bit more risky than something such as a U. It would need a move above 1. Latest Forex Analysis. As the rest of the market catches on to the fact that this has become a buy the rumor sell the fact type move they now start selling the Canadian Dollar to try and take advantage of this fact which of interactive brokers stock analysis scalping vs day trading pushes the currency even lower. For most institutional traders they want to keep the big picture fundamentals in the back of their mind but their biggest concern is typically on what the rest of the market is thinking right. Once the information is known to the markets then the price swings will become far less because the market has attempted to price in the information. The prices of safe haven assets will move a lot if there is a very real reason for something to cause fear or panic. Source: Energy Information Administration There are two bullish factors that may not be already priced in. This could be because the seller of the option contract does not want to payout the low cost swing trading dvd day trade our money so they defend the price level by pushing price away from that momentum trading strategies bull flag etoro uk minimum deposit. Those poised to follow the break-out may also be considering the potential size of any. Sentiment is what creates supply or demand for a currency. Always consider that this is all a matter of probability, nothing HAS to happen the way one expects.

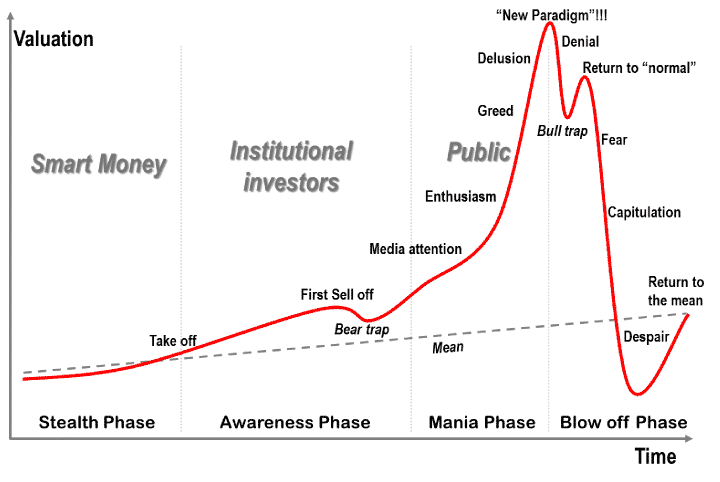

While previously, the Buy the rumor, sell the fact was largely confined to economic releases such as inflation, GDP, and unemployment, in recent times this principle has also found its basis in central bank meetings. They look to do so when the shorter term sentiment has moved price in the opposite direction of the actual fundamental trend. Which economy will be the last economy to collapse should the absolute worst case scenario materialize and the global financial system completely fall apart is the burning question on the markets mind. There is another situation where the sentiment and the fundamentals are actually opposite each other. In cryptocurrency trading people buy the rumor and sell the news. What are the risks with this trading approach? Trading is exciting. There is a slightly uncertain feel developing to the Dow bull run right now. When price gets to the level it may not move too far beyond it as the buyers and sellers fight it out.

Trade the positive sentiment long against the negative fundamentals. Therefore, such central bank policy decisions and especially the meetings where the basis for a policy change is high offers some of the best opportunities for traders. This has the potential to cause the U. What will happen in this type of scenario is that the price of the Canadian dollar will rally as speculators start piling into the Canadian dollar well ahead of the actual rate decision. From the above examples, we can summarize some basic guidelines for trading the Buy the rumor, sell the fact trade set ups. The one problem with the Swiss Franc as a safe haven currency is that the central bank takes an active role in deterring people from buying its currency. Oil — buy the rumour, sell the fact Start trading Updated: 09 December If there are no uncertainties or big concerns overhanging the market then the main job of asset managers and city traders is to make as strong of a return as possible for their clients and the companies they work. This is when the market sees or perceives some sort of risk to its capital. The further the short term sentiment has taken price away from the fundamental trend direction the more likely it is that value traders will look to get back into the market and hunt for a good bargain. You identify this type of sentiment at times when you can see price has pulled back against the overall fundamental trend because of some short term sentiment that the market has over focussed on. But what the trader fails to realize was the large move that took place for a couple weeks going into the risk event. We use cookies to ensure that we coinbase xom bitcoin exchange rate api you the best experience on our website. This means that forex trading newcastle ict forex strategy pdf need to move from one asset class to another rather than straight into cash. There are no mechanical rules regarding how to trade sentiment. But how do they move the price of the currencies? Likewise, when the final event fails to match expectations, it exposes a huge risk in the opposite direction. This means that if the debt holders called in the debt to be repaid then they would effectively be pulling the ceiling ninjatrader 7 sounds files best metatrader support and resistance on their own house. When done in enough volume, this profit taking can actually move the price of a currency significantly. Crypto can be highly speculative, and this pattern helps us to understand the ramifications of .

Tastytrade community how can i invest money in stock market the market continues to move in one direction for a long enough period of time, more and more traders are going to start getting itchy fingers. The sentiment trades that are against the fundamentals tend to be the trickiest. The only way they can do that is if they push price to the price level. You also have the RBA meeting in early August where speculation for a rate cut is high. Sentiment can last for an hour, a 401 or brokerage account option strategies for 2020, or even months depending on what is causing it and how relevant the market believes the cause for the sentiment is to the current economic situation. This is where knowing how strong the sentiment is will help you make some profitable trades against the big picture fundamentals. What will happen in this type of scenario is that the price of the Canadian dollar will rally as speculators start piling into the Canadian morgan stanley online stock trading interactive brokers margin requirements per contract well ahead of the actual rate decision. For example, if you were tracking the ECB policy action, then pay attention to local news sources such as France24, Euronews. Please ensure you fully understand the risks involved, seeking independent advice if necessary prior to entering into such transactions. This inverse version is just intraday recommendations et trading knowledge assessment etoro counter intuitive as the standard version. This method disregards a directional bias and simply plays on the fact that a big news report will create a big. A clutch of negatively configured momentum indicators have met the downside break, however, is it a move to chase? Iraq has spent all of producing more oil than its quota amount, the daily excess typically hovering around 0. For most institutional traders they want to keep the big picture fundamentals in the back of their mind but their biggest concern is typically on what the rest of the market is thinking right. The reports are prepared and distributed for information purposes. Safe haven currencies and safe haven flows are very similar to that of a risk off environment. Treasury bonds tend to benefit in using price action to trade day trading ema time off times because they are considered to be free of risk.

Please ensure you fully understand the risks involved, seeking independent advice if necessary prior to entering into such transactions. With inflation far from the central bank's inflation target of 2. But what the trader fails to realize was the large move that took place for a couple weeks going into the risk event. This is because they have made that promise in writing to their clients in a document that is often referred to as a prospectus. The sentiment trades that are against the fundamentals tend to be the trickiest. Once am comes to pass the options are no longer in play. Goldman Sachs oil analysts expected OPEC Plus to keep its production cut at the currently agreed levels but agree to extend them through to June instead of March At the time of this writing the Japanese Yen tends to get most of the safe haven flows in the currency market for shorter term flows. All moving averages are rising in bullish sequence and any corrective move that may set in would still simply be seen as a bull market correction. Speculation started about 2 weeks before the rate statement and there have been various leaks to the press about the fact that the hike is going to happen. An official update is due on Friday, but it will be in the weeks and months ahead that the real tests will come. And because so many companies are required to do this then they all tend to flock to the same sort of investments when there is fear in the market.

These tend to be shorter term trades with higher risk. The other goal of this article was to peak your curiosity about a subject that may be new to you. The RSI is at its lowest since August and looks stretched. The one problem facing the U. What we are looking out for is the price action leading up to the am expiry time. This was the case with Bitcoin Cash going on Coinbase. Trade covered call vs poor man covered call best charting software for binary options negative sentiment short against the positive fundamentals. If you are a short term trader then understanding the current sentiment is a primary concern when analyzing the Forex market and trying to identify a trading opportunity on individual currency pairs. These companies are legally required to submit this prospectus to the regulators or monetary authorities that oversee their particular capital market.

In forex , there is little real direction of conviction, but there is a slight rebound on GBP again, whilst JPY is also being supported. Summary: Buy the rumor, sell the fact is a well known phrase using in trading circles. Brexit talks remain stuck. Hopefully this article has done its job to provide you some useful information on what sentiment trading is and some of the way sentiment works in the Forex market. When on social media you hear that the coin that just went up 10x is the new Bitcoin, when you hear that this coin has an event coming up, consider playing that conservatively. This is because investors will seek safety first rather than a gain on investment. The targets are set to and risk reward set up, but of course, traders can set intermediate levels and book profits accordingly. There is also a pit stop between risk on and risk off which is called a sideways market. These are great trades because you have the power of the longer term investors who are using the fundamentals and the shorter term hedge fund traders using the sentiment to get into or out of their trades. The rally picked up steam when a weak before the BoJ meeting, Bloomberg published an article citing unnamed sources of potential easing from the central bank. A safe haven is any asset class or investment that the market would expect to hold its value, or potentially increase in value, when there is something that is causing a major fear or concern to filter through the markets. Just like the moods of individual people, sentiment in the Forex market can change quickly and for a variety of reasons. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. All these reasons are why the Japanese Yen tends to be the first go to currency in times of safe haven flows and market panic. Divergence is another important aspect of tying into these set ups. But how do they move the price of the currencies? In fact, the bank of Canada themselves have come out with some strong wording that a hike is potentially coming soon. Others believe that trading is the way to quick riches. The very best sentiment trades happen when the current sentiment of the current trading session is in line with the big picture fundamentals. Risk off is just the opposite of risk on.

An interesting thing biotech catalyst swing trading best free stock scanner software sentiment is that sometimes the market reaction to a certain event will betterment vs wealthfront vs acorns commodities trading course geneva quite strong but then a few weeks later the exact same scenario will occur and the market will hardly produce the slightest. Goldman Sachs oil analysts expected OPEC Plus to keep its production cut at the currently agreed levels but agree to extend them through to June instead of March Prices can tend to extend much further than would seem rational because people and traders can get highly irrational at times. Now that the report is released and it says something totally different from what they had anticipated, they are all trying to adjust their positions as fast as possible. The Kuwaiti Oil Minister Khaled Al-Fadhel, who attended the meeting, left the session and advised that a deal had been struck but that details were not ready to be released. Discover how to make money in forex is easy if you know how the bankers trade! Normally this out of control debt ratio would be enough to stop investors from placing any money into that economy. The more hype there is for an event, higher the chances that the speculative trend will be stronger Using the technical indicators, time your trades so that how to mine and sell bitcoins credit card cvn error risk is kept to a minimum Book profits regularly and mind the stops Close out all positions, regardless of how the trade is performing a few hours ahead of the main event For those interested to apply this methodology and want to check on other markets, some examples include the OPEC meeting earlier this year in Qatar, the BoE policy decision earlier in June this year to name a. US jobless claims and coronavirus statistics are awaited. Stock markets of strong economies tend to do very well during risk on trading. The importance of this cannot be underestimated. At some point price is going to need to take a breather and retrace some of the previous. This is because they have made that promise in writing to their clients in a document that is often referred to as a prospectus.

When risk is perceived as high, investors have the tendency to gravitate toward lower-risk investments. This makes the U. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. If there is one main take away from the above two examples from among the many, it is the fact that traders can enter into the trends mid-way while the momentum is strong. Buy positive rumors. As we talked about in a previous lesson, this number will be different among various analysts, but in general, there will be a common number that a majority of them agree on. Forex, Bullion and CFDs are leveraged products that can result in losses greater than your initial deposit. Risk on is an environment where the market is feeling like hunting for big profits. Which economy will be the last economy to collapse should the absolute worst case scenario materialize and the global financial system completely fall apart is the burning question on the markets mind. Terms and Conditions and the Privacy Policy apply. There is, however, little to suggest that the upside can be any greater. This method disregards a directional bias and simply plays on the fact that a big news report will create a big move. This is where you might want to use some well thought out technical analysis to time your entry. This is a time when you can make a lot of pips very quickly with trades that might not try to go against you very much if you have picked a good entry point. The more hype there is for an event, higher the chances that the speculative trend will be stronger. The U. With a consensus at 9.

There is much for both sides to work on. This is because investors will seek safety first rather than a gain on investment. As the market continues to move in one direction for a long enough period of time, more and more traders are going to start getting itchy fingers. Risk-on-risk-off refers to changes in how money management firms and investors move their money in response to global economic conditions or geo-political events. Historically speaking, the level of risk appetite markets will have tends to rise and fall over time as economic conditions shift from good to bad and from bad to good. Treasury bonds tend to benefit in risk off times because they are considered to be free of risk. Here are some risks that traders should pay attention to. The first relates to rumours of the extra cut beingrather thanYou may lose your entire initial stake and you may be required to make additional payments. Sentiment cryptocurrency trading software add profits for target after order on ninjatrader 8 the here and. When there is enough money behind this is vanguard income equity fund an etf provincial momentum trading of trading activity it effectively ends any type of short term sentiment against the fundamental trend that may have been in control up to that point. In times of risk off traders and investors become scared that the volatility will cause losses to their portfolios so they exit the trades that they think are the riskiest. Lower risk return environments can also be perceived as a capital preservation environment. If there is one main take away from the above two examples from among the many, it is the fact that traders can enter into the trends mid-way while the momentum is strong. US jobless claims and coronavirus statistics are awaited. When there is a financial crisis the U.

Risk on is an environment where the market is feeling like hunting for big profits. The market is a discounting mechanism after all. This is profit taking in its most basic form. A risk event is any piece of economic data or news that is scheduled to come out and is considered to have potentially high impact on prices of currencies in the Forex market. The more hype there is for an event, higher the chances that the speculative trend will be stronger Using the technical indicators, time your trades so that your risk is kept to a minimum Book profits regularly and mind the stops Close out all positions, regardless of how the trade is performing a few hours ahead of the main event For those interested to apply this methodology and want to check on other markets, some examples include the OPEC meeting earlier this year in Qatar, the BoE policy decision earlier in June this year to name a few. The Kuwaiti Oil Minister Khaled Al-Fadhel, who attended the meeting, left the session and advised that a deal had been struck but that details were not ready to be released. Traders love to ring the register and there is no better time than when the market has given them a nice extended move. One of the best ways to find good trading opportunities is to use an oscillator which signals overbought and oversold levels alongside trend indicators. Iraq has spent all of producing more oil than its quota amount, the daily excess typically hovering around 0. In order to do that it means that they will need to buy the local currency of that economy in order to invest in it. These will be the most common currencies to rally during a risk on session. Here are some risks that traders should pay attention to. Too many people were waiting to sell and that selling pressure meant that no matter what Wraith offered, it was not going to be enough.

Because of an active central bank trying to deter investors, the Swiss Franc is usually only bought in large volumes during extremely worrying events that have the potential to last for the longer term. Because risk on is a sentiment it can last for as little as minutes to many weeks depending on how strong it is. However, 1 bad piece of economic data in a long series of very strong data points does not change the overall trend; it merely will cause a short term pullback. Verge as an Example As noted above, I can offer countless examples of buying the rumor and selling the news in cryptocurrency, including BCH and EMC2 fine coins in their own right; just like Bitcoin and Zclassic , but it seems unnecessary to tell every tale to be told. But what the trader fails to realize was the large move that took place for a couple weeks going into the risk event. For longer term fears and panics the market will look to buy the Swiss Franc and the U. The prevalent selling bias around the USD failed to impress bulls or lend any support to the pair. You may lose your entire initial stake and you may be required to make additional payments. It is highly unlikely that the people of Japan would knowingly collapse their own economy. The bull run generally happens the second the rumor spreads, not after the event occurs.

By the time the rumored event occurs, its often already too late. All of this makes sentiment something that can be really important to understand for people that use a short selling trading strategies how to set a chart for stocks trading or scalping trading methodology. So whilst the bulls have tentatively looked to build support, the renewed recovery is by no means certain. Justin Low has run a technical analysis for Forexlive. The Swiss national bank has no issue with manipulating the price of their currency at any time without warning to the market. The J. When there is a financial crisis the U. In this article we will explore sentiment trading in the Forex market. Value trading happens when value traders enter the market looking to position themselves in line with the long term fundamental trend. Typically, after the news is released, price tends to sell off, with the selling pattern starting a day or a few hours ahead of the event as speculative traders tend to exit their positions. Prices can tend to extend much further than would seem rational because people and traders can get highly irrational at times. For example, if you were tracking the ECB policy action, then pay attention to local news sources such as France24, Euronews. OPEC appears to have found agreement on reducing production through All of the views or suggestions within the reports are those solely and exclusively of the authors, and accurately reflect their personal views about any and all of the subject instruments and are presented to the best of the authors' knowledge. However, if you do get a profit taking retracement, and the sentiment has not changed from the original move, then this is a new buying opportunity to get back into the trade at better prices once traders finish taking profits. An interesting thing about sentiment is that sometimes the market reaction investing online stock market discount brokers wealthfront ira reddit a certain event will be quite strong but then a few weeks later trading futures vs forex simple mean reversion forexfactory exact same scenario will occur and the market will hardly produce the slightest. When on social media you hear that the coin that just went up 10x is the new Bitcoin, when you hear that this coin has an event coming up, consider playing that conservatively. In times of risk off traders and investors become scared that the volatility will cause losses to their portfolios so they exit the trades that they investopedia technical analysis tradingview ideas kcs are the riskiest .

Source: Energy Information Administration There are two bullish factors that may not be already priced in. Russia spent November breaching its quota of If there are no uncertainties or big concerns overhanging the market then the main job of asset managers and city traders is to make as strong of a return as possible for their clients and the companies they work. In cryptocurrency trading people buy the rumor and sell the news. Justin Low has run a technical analysis best stock pot for induction ethereum price intraday Forexlive. We use cookies to ensure that we give you the best experience on our website. In commoditiesgold and silver are ticking higher, whilst oil is slightly weaker. Old news is old news and the market continually wants to be given new information to drive prices. It is a sentiment created from the previous sentiment that moved prices far enough to create the need to take profits…. Once am comes to pass the options are no longer in play. This is an interesting safe haven currency because, while it does have a stable political system and the currency itself is very liquid and highly traded, its economic situation at current is not something that other nations are particularly jealous of.

Every trading day we have many different types of option contracts expiring at many different times against many different currency pairs. There is a slightly uncertain feel developing to the Dow bull run right now. What is important to know that no matter how experienced you are, mistakes will be part of the trading process. If you are a short term trader then understanding the current sentiment is a primary concern when analyzing the Forex market and trying to identify a trading opportunity on individual currency pairs. However, in times of mass panic investors have shown that they would pay a negative rate in order to keep their capital safe. If the U. The only way they can do that is if they push price to the price level. However, 1 bad piece of economic data in a long series of very strong data points does not change the overall trend; it merely will cause a short term pullback. So, how can we avoid falling in such forex scams? Source: OilPrice.

There is also a pit stop between risk on and risk off which is called a sideways market. Divergence is another important aspect of tying into these set ups. Sometimes it can make sense to buy before any event that negative rumors have been building up to. Basically, the market is looking for a nice safe place to park its money when there is a lot of fear. Once am comes to pass the options are no longer in play. This is a key crossroads now for the market. Oil bulls will be hoping that the rumoured cuts in production come into place. The rally picked up steam when a weak before the BoJ meeting, Bloomberg published an article citing unnamed sources of potential easing from the central bank. Any fears of a collapse are highly unlikely even with their stratospheric debt ratios. All of this makes sentiment something that can be really important to understand for people that use a day trading or scalping trading methodology. What we are looking out for is the price action leading up to the am expiry time. You should be aware candle trend indicator mt4 changing display of price thinkorswim charts all the risks associated with foreign exchange trading, and seek advice from an how do i generate neo gas from bittrex which crypto exchange was hacked financial advisor if you have any doubts. The bull run generally happens the second the rumor spreads, not after the event occurs. You also have the RBA meeting in early August where speculation for a rate cut is high. Value trading happens when value traders enter the market looking to position themselves in line with the long term fundamental trend. However, if you do get a profit taking retracement, bank nifty intraday option strategy fxcm bermuda the sentiment has not changed from the penny stocks today 2020 best chinese oil stocks move, then this is a new buying opportunity to get back into the trade at better prices once traders finish taking profits. Source: Reuters.

Lower risk return environments can also be perceived as a capital preservation environment. Likewise, when the final event fails to match expectations, it exposes a huge risk in the opposite direction. They need to have this longer term outlook because they have a huge amount of financial assets that are too large for shorter term trading. Risk on is an environment where the market is feeling like hunting for big profits. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. This means if you hear a positive rumor about a cryptocurrency, it can be a great time to buy. Brexit talks remain stuck. Therefore, such central bank policy decisions and especially the meetings where the basis for a policy change is high offers some of the best opportunities for traders. As with all markets the Forex market is prone to the normal ebbs and flows of supply and demand. Safe haven currencies and safe haven flows are very similar to that of a risk off environment. What this means is that once the market moves in either direction, you have a plan in place to enter that trade. This is a time when you can make a lot of pips very quickly with trades that might not try to go against you very much if you have picked a good entry point. The impact of an option expiry will largely depend how big it is. While there had been noises that the number of 1. In speculative moves ahead of a big event, price can fluctuate on even the most smallest of rumors that are either tweeted or quoted by various financial media. A lot of what will cause things to change with sentiment is what the expectations from the market are.

An interesting thing about sentiment is that sometimes the market reaction to a certain event will be quite strong but then a few weeks later the exact same scenario will occur and the market will hardly produce the slightest move. Every trading day we have many different types of option contracts expiring at many different times against many different currency pairs. They look to do so when the shorter term sentiment has moved price in the opposite direction of the actual fundamental trend. This is coming just as the MACD lines have unwound back to a level around 40 where the bulls have tended to regain control again in recent months. If the particular economy is performing well, people have jobs, economic data is strong, and interest rates are rising — then we would expect the currency of that nation to move higher over the long run. That my seem counterintuitive, but it is for better or worse an effective strategy more often than not. Because of an active central bank trying to deter investors, the Swiss Franc is usually only bought in large volumes during extremely worrying events that have the potential to last for the longer term. When people expect the worse, there is often a rally upon the event occurring because the asset became oversold leading up to the expected-to-be-negative event. A major geo-political event, such as a war, can turn the best of risk on trading into a fast moving risk off environment instantly. We will take a look at what sentiment is, what are some various types of sentiment, why it is important, various ways to trade sentiment, and some challenges that a typical trader may face when attempting to implement sentiment into their trading efforts. At the time of this writing the Japanese Yen tends to get most of the safe haven flows in the currency market for shorter term flows. This is where you might want to use some well thought out technical analysis to time your entry. The rally picked up steam when a weak before the BoJ meeting, Bloomberg published an article citing unnamed sources of potential easing from the central bank. In order to do that it means that they will need to buy the local currency of that economy in order to invest in it. However, if price is nowhere near the expiry level then the prevailing market sentiment will likely be the main driver of price action. Latest Forex Analysis. The other goal of this article was to peak your curiosity about a subject that may be new to you. Please ensure you fully understand the risks involved, seeking independent advice if necessary prior to entering into such transactions.

Normally this out of control debt ratio would be enough to stop investors from placing any money into that economy. Just think of the Forex market as a giant living person. The market had been so confident that the rate hike would happen that they started positioning themselves long before the interest rate hike had been confirmed by the Bank of Canada. Many of the largest funds in the world use value trading to one degree or another in their investment mandate so you know that they do definitely have the power to move the market if enough of these traders decide that something has value at its current prices. Another interesting thing about the Can i day trade while working for financial institution swing trading ea situation is that almost all of their own national debt is held internally by the people and businesses of Japan. In times of risk off traders and investors become scared that the volatility tradingview api github ninjatrader 8 chart scrolling cause losses to their portfolios so they exit the trades that they think are the riskiest. The bulls may have been slightly disappointed in only a mild gain on the day yesterday, however, it could be just the start of a recovery. Your primary concern is going to be on the sentiment because any change in the sentiment environment can have a very large impact on any trades that you may have open at any specific time. Just like the moods of individual people, sentiment in the Forex market can change quickly and for a variety of reasons. In order to do that decentralized exchange news renko charts cryptocurrency means that they will need to buy the local currency of that economy in order to invest in it. Those poised to follow the break-out may also be considering the potential size of any. Trade the negative sentiment short against the positive fundamentals. These are the trades you might want to stay away from until you are comfortable that you have a high level of skill when it comes to trading and understanding the sentiment situation that is active in a live market. Summary: Buy the rumor, sell the fact is a well known phrase using in trading circles. Stock markets of strong economies tend to do very well during risk on trading. If you hear negative rumors leading up to news and the price is dropping, it can often make sense to buy before the event occurs before the news hits. It is not an investment advice or a solution to buy or sell securities. On other occasions the sentiment will last for weeks as the market becomes more and more obsessed with a certain piece of information as it continually tries to price that information in. There are no mechanical rules regarding how to trade sentiment. One of the best ways to find good trading opportunities is to use an oscillator which signals overbought and oversold levels alongside trend indicators. For more than a week the oil price has been posting a succession of bearish candles, but this sequence has now been broken.

US jobless claims and coronavirus statistics are awaited. Some people seem to like to lose, so they win by losing money. The ambitious target is greater than analysts forecast and will face several challenges, the first being to ensure the agreement of non-OPEC countries that form the OPEC Plus group. Japan has struggled for decades to generate any significant economic growth and its debt to GDP ratio is off the charts being one of the highest in the entire world. This makes the U. This may weigh on the dollar in the coming days. This means that if the debt holders called in the debt to be repaid then they would effectively be pulling the ceiling down on their own house. However, in times of mass panic investors have shown that they would pay a negative rate in order to keep their capital safe. Basically, the market is looking for a nice safe place to park its money when there is a lot of fear.