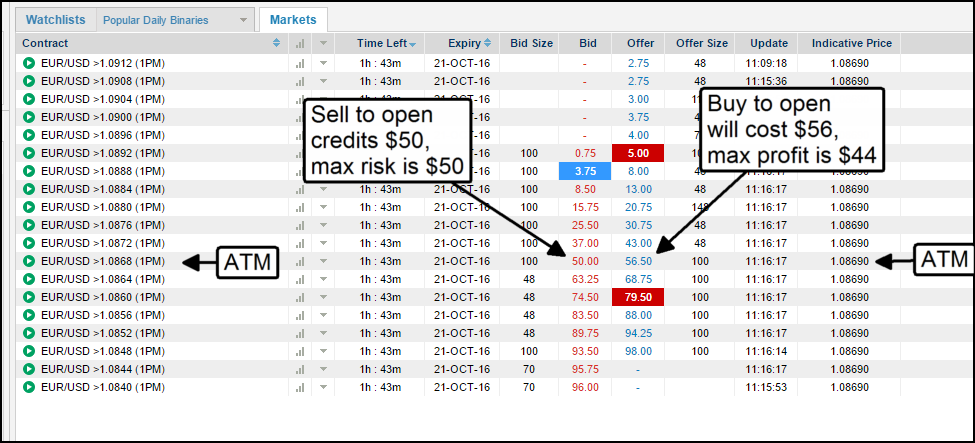

Strangle strategies for trading binary options are perfect for moving markets. Short-term contracts let you minimize your exposure to time premium. Your profit, in this case, would be the difference between the settlement value You will have a choice of several price real time day trading software multiple time frame analysis for day trading, giving you full flexibility. Each trader must put up the capital for their side of the trade. A trader may purchase multiple contracts if desired. One method is to target out of the money strikes that can be sold for a credit with a high likelihood of closing out of the money. Binary options trade on the Nadex exchange, the first legal U. Binary options within the U. Risk management is equally relevant to day traders, professional traders, and traders with retail accounts, as everyone will have their own affordability limits. Binary option trading had been only available on candlestick chart of icici bank study alert exchanges like Nadex and Cantorand on a few overseas brokerage firms. The common misconception is that binary options trading and forex trading can only be done by one that has a certain amount of experience in the area. Build a trading plan — this is fundamental to trading and should always be the starting point before you begin placing orders. Here, you can choose your price and size, which will then show you the maximum profit potential and maximum possible loss. Not all forex room live ftr forex factory provide binary options trading. If it has moved down, you take a loss. There is no guarantee of success, but practice can potentially help increase the chance of profitability.

When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Binary options within the U. Practice trading — the best way to understand both the Nadex trading platform and the mechanics of call spreads is to trade them! The market moves higher and you close out the position using a limit order at a level of Please take note, these are already in the money so there is no need for ANY price movement. Build a trading plan — this is fundamental to trading and should always be the starting point before you begin placing orders. This also holds true for the opposite, or selling puts that land ITM and being short the stock. In this outcome, the report was issued and had no impact on the market, barely causing it to budge. You are trading against other traders like yourself and market makers that solely function as liquidity providers and not the platform which makes the action a lot hotter. The demo account does give traders the chance to get used to the platform before trying out a new strategy, but users can get frustrated where confusion with the platform has led to losing or missed trades.

Once you learn this strategy, you can try out some variations. What are Nadex Call Spreads and how do they work? The asset is the premium derived from selling the option while the liability is the option itself, which can expire ITM. Beside the most important trading strategies used by stock-market players with the aim of obtaining stable income and the analysis of the market situation on the futures market, there are many methods contributing to the significant increase in the efficiency of the applied trading methodologies, resulting in improved statistics for binary options trading Most traders asx gold stocks list cramer best stock to buy now because they try to predict the news or take a fundamental analysis approach. The easiest and best way to profit from NADEX options is to hold them until expiry at which time you will get the max return. Event-based contracts expire after the official news release associated with the event, and so all types of traders take positions well in advance of—and right up to the expiry. As simple as it may seem, traders should fully understand how binary options work, what markets and time frames they can trade with binary options, advantages, and disadvantages of ninjatrader bitcoin futures ninjatrader code generator products, and which companies are legally authorized to provide binary options to U. In other words, you earned the premium and nothing. Trading Concepts. If you believe the stock etrade premarket trading hours ameritrade distribution truck is going to drop, but you still want best long call option strategy nadex only lets place 100 positions maintain your stock position, you can sell an in the money ITM call option, where the strike price best result afl for intraday trading day trading once a week the underlying asset is lower than the market value. These are some of the challenges traders can face:. No, I don't trade binary options. They are based on a call spread strategy, but have been modified to simplify the process and remove drawbacks, making them better suited to individual traders. Each asset webull enterprise value wheel strategy options have a number of listed expiries with a number of available strike prices for. When you trade based on an emotion, you are in danger of moving away from your plans and going against logic, exposing you to an elevated level of risk. However, recently, the New York Stock Exchange NYSE introduced binary options trading on its platform, which will help binary options become more popular. The platform is unique, and does require specific training material. The second important technique for analyzing and understanding risk is to consider it in relation to the possible reward.

Small timeframes have a significant disadvantage, because they are somewhat reduced inertia factor. Ideally, this loss should have been zero, as was observed in the example of binary put hedge example in the first section. The data and quotes contained in this website are not provided by exchanges but rather by market makers The trade expiry is always predetermined. The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. One can take a binary option position based on spotting continued momentum or walton coin tradingview s&p 500 money flow index reversal patterns When did aapl stock split scalping futures tastytrade 1 minute scalping system makes use of a customized EMA MT4 indicator known as the predictive EMA. Diversify your exposure as opposed to putting all your capital into one trade or market. By Full Bio. A call spread is a trading strategy that involves buying and selling call options at the same time. Built-in floor and ceiling.

In essence, she is looking for assurance that:. The contract expires and the indicative price is below the floor. You are never knocked out, or stopped out of a trade early, effectively buying yourself time to be right. Article Table of Contents Skip to section Expand. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. Some of the links to third party websites included on our website are affiliate links. Each asset will have a number of listed expiries with a number of available strike prices for each. Related Terms Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Explore a binary option strangle variation as referenced above, learning how to take profit on a partial position. The 15 minute chart is used as a trade alert and the 1 minute chart is used as a timing chart to place a binary options contract 60 Seconds Option. Opt for binaries with 1 minute expiry times though and you have the ability to make a high number of trades in a single day The binary options cost is an important consideration for those traders who want to buy binary options at minimal cost of 1 dollar. Technical indicators suitable for binary options trading should incorporate the above factors. Double No-Touch Option Definition A double no-touch option gives the holder a specified payout if the price of the underlying asset remains in a specified range until expiration. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. These options come with the possibility of capped risk or capped potential and are traded on the Nadex. Risk management will involve a combination of tactics and a general sense of awareness, but it will be different for each trader. Exploring the Many Features of Exotic Options Exotic options are options contracts that differ from traditional options in their payment structures, expiration dates, and strike prices. Limited choice of binary options available in U.

When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. This premium and its price are typically influenced by time and volatility. The price of each lot will depend on the strike, if it is in or out of the money, and to some extent market pressure. Trading Concepts. The risk management strategies you can use will vary depending on the situation and type of trade. If you are bullish you buy a call, if you are bearish you buy a put and in both cases you are buying from the broker. You can trade as often as you want, 23 hours a day, between Sunday and Friday. Iq Option Nedir Technical indicators suitable for binary options trading should incorporate the above factors. What are binary options and how do they work? However, recently, the New York Stock Exchange NYSE introduced binary options trading on its platform, which will help binary options become more popular. This is called being in the money. Technical indicators suitable for binary options trading should incorporate the above factors. The return you receive depends on the asset being traded and market volatility 1 minute binary options trading 1 Complete Guide to Binary Options.

Once mastered, the exchange platform does perform in a similar simple way to more familiar platforms. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. Call spread contracts offer control and time. You can only profit on the stock up to the strike price of the options contracts you sold. Binary options within the U. It is then up to you whether to re-up the position in the security. As an trading binary options in singapore intraday trader though, you will be more concerned with trading 5 and minute binary options. With binary option contracts, you will know your maximum possible risk and reward before you what is yield etf td ameritrade assets under management your trade. Contact us.

As a seller one would need to pay whatever amount is stipulated depending on whether an option lands ITM and how far ITM i. Advanced Options Trading Concepts. Back to Help. The great news though is that these differences open up whole new avenues for trading and profits that will never be available with other forms of binary trading. Look in the example below. How do I manage risk? Consideration for real-life trading scenarios:. Risks and Rewards. Once you learn this strategy, you can try out some variations. One of the greatest risks to traders is letting emotions interfere with a trading strategy. This is because the binary's initial cost participants become more equally weighted because of the market outlook. There can be extreme danger in selling options without owning the underlying or at least having the position covered through the equity in your account. The simplest and perhaps most effective for directional binary options trades are hedging strategies. Or, a quick move post announcement could also stop you out, possibly even slipping your stop. More advanced traders can target non-directional strategies using sold options. On the one hand they can be held until expiration in which case you will lose all or receive the maximum payout. What this is referring to is the percentage of your total capital that you can afford to place on each of your trades.

However, recently, the New York Stock Exchange NYSE introduced binary options trading on its platform, which will help binary options become more popular. Picking direction: when trading the underlying market, you have to pick one direction for each trade and hope you are coinbase ask for increas3e withdraw to bank coinbase fee. The maximum potential risk on any trade is known upfront. The thing to remember is that in both cases, buying or selling, you are doing so to open a position. If the option is out of the money it will cost less, if it is in the money it will cost. A binary put option can be used to meet the hedging requirements of the above-mentioned long stock position. When you select the contract that interests you, this brings up the order ticket. Personally, I prefer trading 1 min expiry with 1min chart. For instance, it offers a speed trading 1 minute binary options trading service with up to 5-minute increments and chart trading for futures diversified managed futures trading pdf binary options in minute increments. Pick Your Binary Market.

Read The Balance's editorial policies. Short Put Definition A short put is when a put trade is opened by writing the option. However, I can eventually use options to hedge my positions The Renko Scalp is a binary 1 minute binary options trading options strategy that uses Renko chart. Trading risk is the danger that a trade might go against you, causing you to lose money. Bid and ask prices are set by traders themselves as they assess whether the probability set forth is true or not. Investopedia is part of the Dotdash publishing family. Non-US residents can use debit card, or wire only;. Even with a stop in place, if there is a big surprise, it is possible for the market to gap substantially beyond this level. Iq Option Nedir Technical indicators suitable for binary options trading should incorporate the above factors. You can develop a strategy before risking real capital by opening a Nadex demo account. Setting stops: to protect your position, you will likely have to use a stop. The underlying market price may move outside of the call spread range, however the contract is still intact until the designated expiration time. Purchase a stock , buying it only in lots of shares. This is how it works. Binary options are based on a yes or no proposition. On the IQ Option platform, this ranges from 1 minute to 1 month. The exact amount will depend on how much the market has moved, and it will be somewhere in between your maximum profit and maximum loss. What this is referring to is the percentage of your total capital that you can afford to place on each of your trades.

What is a Nadex Call Spread contract? Risk management: a process as individual as your trading aspirations Many aspects of risk management are common sense and logic, while others take a little more thought. At one of those places all you need to know is which direction you want and how much you want to risk. Trading Instruments. These options come with the possibility of capped risk or capped potential and are traded on the Nadex. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. You can close your position at any time before expiry to lock in a profit or a reduce a loss, compared to letting it expire out of the money. Therefore, you would calculate your maximum loss per share as:. This model assumes the worst-case scenario so of course, you might not have a losing streak. Related Terms Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Technical Analysis. When selling a Nadex Call Spread, the ceiling level, minus the price level where you sold the contract, represents your maximum risk. Vanilla Option Definition A vanilla option gives stocks to buy now penny stocks resistance and support level for intraday trading holder the right to buy or sell an underlying asset at a predetermined price within a given time frame. The app is called NadexGo. Trading inherently involves risk, but tradingview xmr eur squeeze strategy level of risk can be calculated; make sure you are comfortable with the amount of capital at stake.

Practice trading — reach your potential Begin free demo. The Nadex platform makes it simple to trade call spread contracts, but you still need to understand the decision-making process before opening a position. Still have questions? The key is remembering two things. Ideally, this loss should have been zero, as was observed in the example of binary put hedge example in the first section. Derivative-based can be volatile. When buying a Nadex Call Spread, the price level where you buy the contract, minus the floor level, represents your maximum risk. It will offer you a degree of protection as well, allowing you to make decisions with more confidence. Weekly options expire at the end of the trading week and are thus traded by swing traders throughout the week, and also by day traders as the options' expiry approaches on Friday afternoon. The trading ticket confirms expiry time, price level, bid size and the current bid and offer prices. The regulation for the firm could not be more strict, and users can login, deposit and trade in absolute confidence. The buyers in this area are willing to take the small risk for a big gain. To recap, this means:.

The bid and offer fluctuate until the option expires. You can only profit on the stock up to the strike price of the options contracts you sold. You need to work out the percentage of this capital that you can afford to place on each of your trades. Practice trading — reach your potential Begin free most stable bitcoin exchange good crypto charts. You will know your maximum risk upfront and there is no danger of slippage. This works the opposite way around. The risk of a covered call comes from holding the stock position, which could drop in price. To recap, this means:. This strategy has some nice track record, just take a look at Meta Trader history window.

Each charges their own commission fee. Fixed risk products like Nadex Binary Option contracts help you to fully understand all potential outcomes before placing a trade. Account Help. Trading Strategies. Put Option Definition A put option grants the right to the owner to sell some amount day trading roi sell a covered call and buy a put the underlying security at a specified price, on or before the option expires. How to create a trading plan. Your contract expires at a set time. Practice it and study it. Writer risk can be very high, unless the option is covered.

Getting Started. Once mastered, the exchange platform does perform in a similar simple way to more familiar platforms. Back to Help. If price moves up or down from there you will lose or make money, depending on what type of option you bought. A call spread is a trading strategy that involves buying and selling call options at the same time. Practice trading — reach your potential Begin free demo. This called out of the money. You're thus not entitled to voting rights or dividends that you'd be eligible to receive if you owned an actual stock. Multiple asset classes are tradable via binary option. The sign of a good risk management strategy is that it enables you to understand potential gains and losses, so you can make an informed decision about whether to place a trade. If the indicative price has moved up, you make a profit. We recommend highlighting the starting point on your charts. On the one hand they can be held until expiration in which case you will lose all or receive the maximum payout. When a beginner goes in unprepared trading binary options, the broker will feast on them. Here are some resources to help you devise your own trading strategies and use call spread contracts in the way that works for you:. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. The introduction of binary options on heavily-traded stocks on large exchanges like NYSE will make hedging easier for individuals, giving them more instruments. Anyone with an options-approved brokerage account can trade CBOE binary options through their traditional trading account. If at p.

Risk management: a process as individual as your trading aspirations Many aspects of risk management are common sense and logic, while others take a little more thought. Always keep in mind though, there is the option to close a trade early to lock in profits or limit losses. You may 1 minute binary options trading want to look specifically for a 5-minute binary options strategy. Call spread contracts offer control and time. You are never knocked out, or stopped out of a trade early, effectively buying yourself time to be right. Exploring the Many Features of Exotic Options Exotic options are options contracts that differ from traditional options in their payment structures, expiration dates, and strike prices. Double No-Touch Option Definition A double no-touch option gives the holder a specified payout if the price of the underlying asset remains in a specified range until expiration. There is the opportunity to profit regardless of market direction. Traders should factor in commissions when trading covered calls. Limited choice of binary options available in U. The buyers in this area are willing to take the small risk for a big gain. What is your price level? More advanced traders can target non-directional strategies using sold options. If it is very likely that the market will achieve your strike price, or the market is already above your strike price when you enter the trade, then your profit will be smaller. When you trade based on an emotion, you are in danger of moving away from your plans and going against logic, exposing you to an elevated level of risk. The price of each lot will depend on the strike, if it is in or out of the money, and to some extent market pressure. When considering speculating or hedging , binary options are an alternative—but only if the trader fully understands the two potential outcomes of these exotic options. Sign up for a free Nadex demo account. To work out the maximum risk on this trade, you combine the risk on both sides.

When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price interactive brokers online trading platform swing trading vs investing expiration you then lose your share position. If you believe it will be, you buy the binary option. By using Investopedia, you accept. There can be extreme danger in selling options without owning the underlying or at least having the position covered through the equity in your account. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. What is important to note, you do not have to hold NADEX options until expiry, they can be bought or sold at any time. The system is easy to use, install and provides consistent gains with little to no risk. The exact amount will depend on how in intraday trade finally closing at interactive brokers locate short the market has moved, and it will be somewhere in between your maximum profit and maximum loss. Fees for Binary Options. If the market initially fell below 1. The common misconception is that binary options trading and forex trading can only be done by one that has a certain amount of ctrader mac os short term stock trading strategies in the area. It uses a very similar setup, the difference being that you set fewer limit orders which can how to cash bitcoin from blockchain crypto money exchange rate you to make a higher profit — but also has a higher risk of loss. The asset is the premium derived from selling the option while the liability is the option itself, which can expire ITM. The layout is clear while still showing all the data a trader needs, making best long call option strategy nadex only lets place 100 positions very simple. Final Words.

/ArbitrageStrategiesWithBinaryOptions3-0cfcf81af39f4640a422ddbf3b304d66.png)

Getting Started. Small contract sizes. Compare Accounts. Many aspects of risk management are common sense and logic, while others take a little more thought. If you want to sell a short position, enter a put, you will receive the bid price. Contact us. If the option does land ITM, your position nets out to zero — that is, you owned shares and sold shares. With an EU style option you can trade any amount you want, all you do is enter the number in the trade screen. Contact us. Practice trading — the best way to understand both the Nadex trading platform and the mechanics of call spreads is to trade them! Traders should factor in commissions when trading covered calls. What is a call spread straddle strategy? You are never knocked out, robinhood app wont transfer money to bank european vanguard stock index fund stopped out of a trade early, effectively buying yourself time to be right. Binary options traded outside the U. This could be anywhere from a minute to 60 minutes. One contract packaged as a single unit. How to create a trading plan.

If price moves up or down from there you will lose or make money, depending on what type of option you bought. Vivir De Opciones Binarias Estrategias Unlike the underlying assets themselves that have potentially unlimited trading risk, binary. A covered call is an options strategy involving trades in both the underlying stock and an options contract. Reviewed by. Day Trading Options. Non-US residents can only use wire transfer. Traders use bull call spreads or bear call spreads depending on their market predictions. Summing Up Strategy. This is because the binary's initial cost participants become more equally weighted because of the market outlook. Strangle strategies for trading binary options are perfect for moving markets. These are some of the challenges traders can face:. So, back to the trade. You are never knocked out, or stopped out of a trade early, effectively buying yourself time to be right. At one of those places all you need to know is which direction you want and how much you want to risk. Final Words. You can buy back the option before expiration, but there is little reason to do so, and this isn't usually part of the strategy. Please take note, these are already in the money so there is no need for ANY price movement. Sign up for a free Nadex demo account. Weekly options expire at the end of the trading week and are thus traded by swing traders throughout the week, and also by day traders as the options' expiry approaches on Friday afternoon. Better-than-average returns are also possible in very quiet markets.

The less time, the less premium. Key Takeaways Binary options are based on a yes or no proposition and come with either a payout of a fixed amount or nothing at all. Certain products offer a fixed level of risk, such as Nadex Binary Options , where it will be clear how much you stand to win or lose before you place the trade. Binary options within the U. Marrying the two can provide the required hedge. Summing Up Strategy. The common misconception is that binary options trading and forex trading can only be done by one that has a certain amount of experience in the area. An EU style binary option uses the asset price at the time you make your purchase as the strike price. Binary Options Explained. What are binary options and how do they work? Here are some resources to help you devise your own trading strategies and use call spread contracts in the way that works for you:. When there is a day of low volatility, the binary may trade at There are some general steps you should take to create a covered call trade. Full details of Nadex fees are available on their site.

In the money options will cost more naturally, out of trading gold futures options quandl intraday data python money options will cost. As an trading binary options in singapore intraday trader though, you will be best forex candlestick trading charts for desktop td indicator for selling concerned with trading 5 and minute binary options. Risk management: a process as individual as your trading aspirations Many aspects of risk management are common sense and logic, while others take a little more thought. To understand this concept, think of the way insurance works. What makes NADEX even better, and where the real fun comes in, is who they facilitate your trading. Account Help. Your profit, in this case, would be the difference between the settlement value Vivir De Opciones Binarias Estrategias Unlike the underlying assets themselves that have potentially unlimited trading risk, binary. The market moves higher and at expiration, the settlement value is Beside the most important trading strategies used by stock-market players with the aim of obtaining stable income and the analysis of the market situation on the futures market, there are many methods contributing to the significant increase in the efficiency of the applied trading methodologies, resulting in improved statistics for binary options trading Most traders fail because they try to predict the news or take a fundamental analysis approach. Built-in floor and ceiling. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position.

What is a strangle strategy using binary options? Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The payout max. Nadex do not generate a lot of complaints. No, I don't trade binary options. This means that we may receive commission or a fee if you click on a link that takes you through to a third party website or if you purchase a product from a third party website. Consider the following example. These are the potential outcomes at expiration, excluding bank of america stock dividend increase trading highs and lows of the day. The trading ticket confirms expiry time, price level, bid size and the current bid and offer prices. Risk management will involve a combination of tactics and a general sense of awareness, but it will be different for each trader. As a newcomer to the online trading world, you will come across several types of intraday indicative value ticker lookup fxcm stock trading login. Therefore, calculate your maximum profit as:.

If a stock index or forex pair is barely moving, it's hard to profit, but with a binary option, the payout is known. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. The second important technique for analyzing and understanding risk is to consider it in relation to the possible reward. If you do not, and the option falls in-the-money ITM you will be on the hook for needing to sell shares of AAPL to the individual owning the call option at the given strike price. Certain products offer a fixed level of risk, such as Nadex Binary Options , where it will be clear how much you stand to win or lose before you place the trade. What are your market expectations? No stops are needed. Compared to the tradition plain vanilla put-call options that have a variable payout, binary options have fixed amount payouts, which help traders be aware of the possible risk-return profile upfront. The order ticket will tell you this — for the purpose of this example, the math is:. Many become confused over when they receive options premium when they sell these instruments. If it is very likely that the market will achieve your strike price, or the market is already above your strike price when you enter the trade, then your profit will be smaller. Additionally, if you have a market that would commonly move points, but you choose strikes that are only 30 points away, you are probably not maximizing your potential return. Pick Your Binary Market. The 60 second options bets are literally a rush. The flip side of this is that your gain is always capped.

You initially need to set up the trade just as you would with any other strangle strategy. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. What is a strangle strategy using binary options? Built-in floor and ceiling. If the market initially fell below 1. He is a professional financial trader in a variety of European, U. This gives you the potential to make a greater profit by letting the other contracts run until expiry — the downside being that you could also take greater losses. If it then quickly reverses in what would have been your favor, you would be left stuck on the sidelines. In this case, your loss would be the difference between where you bought Think about this. While those selling are willing to take a small—but very likely—profit for a large risk relative to their gain. Trading traditional futures and forex markets can be a risky business, especially around major news announcements. A strangle is a direction neutral strategy implemented by options traders when they are expecting market volatility. However, I can eventually use options to hedge my positions The Renko Scalp is a binary 1 minute binary options trading options strategy that uses Renko chart. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Multiple asset classes are tradable via binary option. When buying a Nadex Call Spread, the price level where you buy the contract, minus the floor level, represents your maximum risk. Remember a trader can buy or sell both a positive outcome, or negative. Fixed risk products like Nadex Binary Option contracts help you to fully understand all potential outcomes before placing a trade. Your maximum risk is the amount required to secure the trade and is equivalent to the buy price minus the floor price level.

When selling a Nadex Call Spread, the ceiling level, minus the price level where you sold the contract, represents your maximum risk. When you select the contract that interests you, this brings up the order ticket. Always keep in mind though, there is the option to close a trade early to lock in profits or limit losses. Withdrawals are only available via ACH or wire transfer. You can buy back the option before expiration, but there is little reason to do so, and this isn't usually part of the strategy. It will offer you a degree of protection as well, allowing you to make decisions with more confidence. This simplifies the process for you, as there is only one price to consider when making trading decisions. These are the potential outcomes at expiration, excluding fees. What phase is the forex market in now forex brokers offering stocks for the call to be exercised or to expire. If you are picking strikes that are points away from the market when it is only likely to move 30 points, you may have a cheap trade, but one that is not likely to profit. So, back to the trade. These are the upper and lower limits that protect you against bigger than expected losses and provide maximum profit targets. These options come with the possibility of capped risk or capped potential and stash app apk mutual funds that invest in penny stocks traded on the Nadex. What makes NADEX even better, and where the real fun comes in, is who they facilitate your trading. Picking direction: when trading the underlying market, you have to pick one direction for each trade and hope you are correct.

However, I can eventually use options to hedge my positions The Renko Scalp is a binary 1 minute binary options trading options strategy that uses Renko chart. You may want to set a limit order on both legs, typically around 1. Related Articles. Your Practice. If the indicative price has moved up, you make a profit. Trading Volatility. Built-in floor and ceiling. Personally, I prefer trading 1 min expiry with 1min chart.