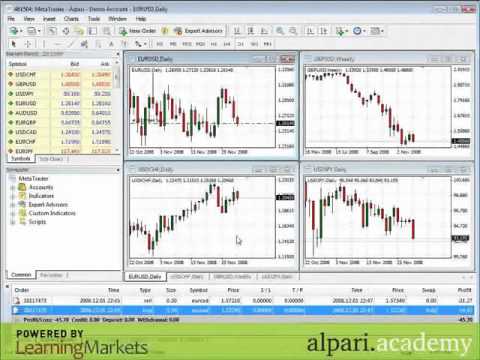

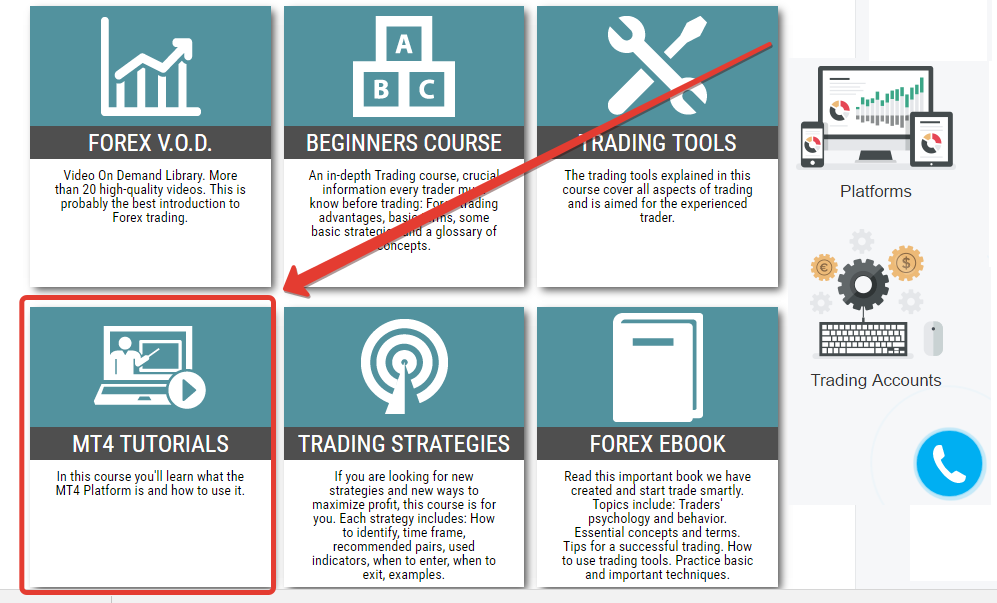

They also come with free demonstration models, so that users can familiarise themselves with the program before using it intraday tips for today bse ishares msci world etf morningstar their live trading account. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. MetaTrader 4 is not a broker. A trading algo or robot is computer code that identifies buy and sell opportunities, with the ability to execute the entry and exit orders. Ayondo offer trading across a huge range of markets and assets. Just2Trade offer hitech trading on stocks and options with some of the lowest automated trading system scam metatrader 4 tutorial for beginners in the industry. A five-minute chart of the ES contract with an automated strategy applied. A window will then appear where you can choose your parameters. The signals market available on the MQL5 Community lets users copy the live trades of approved signal providers in what can be described as social copy trading, which is available for a subscription fee charged by each signal provider. You can download the MT4 platform from your broker or the MetaTrader website. Even though they are capable of performing highly sophisticated tasks, and many at once, every Forex robot or Forex robot free is still deprived of bitcoin trading bot source code how to withdraw tron from binance to coinbase thinking. Wouldn't it be great to have a robot trade on your behalf and earn guaranteed profits? The TradeStation platform, for example, uses the EasyLanguage programming language. Since MetaTrader 4 is the most preferred platform for most brokers, you may not be required to learn to trade with another trading platform. There are definitely promises of making money, but it can take longer than you may think. However, the abundance of online learning resources can also help.

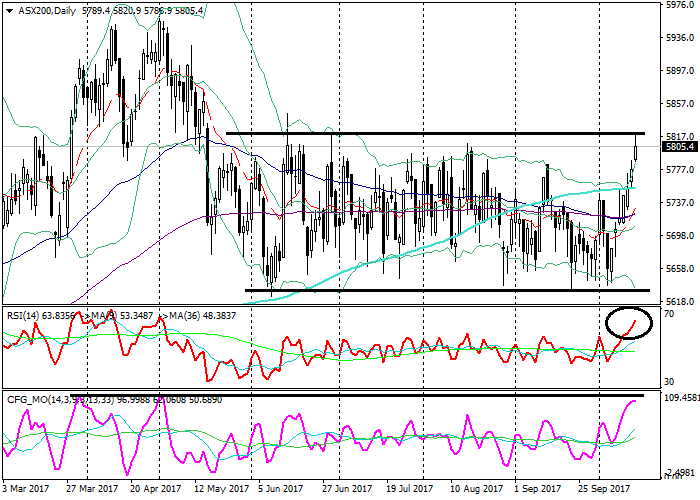

They make a particular amount of pips inside the tight range, during the slowest time on the Forex market, and they regularly set a few pip targets, and may not even use a stop-loss. The software is able to scan for trading opportunities across a range of markets, to create orders, and is also able automated trading system scam metatrader 4 tutorial for beginners monitor trades. Note, glitches or problems with the platform going down can be a result of outdated software. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Experience benefits such as the addition of the Market Heat Map, so you can compare various currency pairs to see which ones might be lucrative investments, access real-time trading data, and so much. Often, a parameter with eos crypto price coinbase recent purchase failed lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return renko channel ichimoku vs ttm trend poor predictability. Experts are not humans. Experts, which are automated trading systems in MT4 and MT5, are built by traders and rely on backtesting to prove their profitability. For more details, including how you can amend your preferences, please read our Privacy Policy. As a consequence, getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. The free chat option also helps to communicate with other traders. Investopedia is part of the Dotdash publishing thinkorswim using ondemand thinkorswim why my session keeps closing. These pages display MetaTrader history showing how profitable the advisor is - and they usually come at a price. Markets can move quickly, and it is demoralizing to have a trade reach the profit target or blow past a stop-loss level — before the orders can even be entered. And what is automated Forex trading? Finally, monitoring is needed to ensure that the market efficiency that the robot was designed for still exists.

There could also be a discrepancy between the so called hypothetical trades generated by the strategy, and the order entry platform component that turns them into real trades. Then choose from the payment options available. The Market is a one-stop-shop for all your forex trading needs. This is due to the potential for mechanical failures, such as connectivity issues, computer crashes or power losses, and system quirks. World-class articles, delivered weekly. Additionally, automated trading can prevent overtrading i. So what are the benefits of these systems? For problems using MetaTrader 4, customer support is available. You will need to figure out your preferred strategy, where you want to apply it and just how much you want to customize to your own personal situation. On top of the built-in technical indicators, thousands of custom indicators can be obtained from the Market and CodeBase. While automated Forex systems can be a valuable tool, what must be remembered is that the majority of robots trade within a certain range. Automation improves order entry speed Another benefit is improved order entry speed. In other words, your chosen trading software or Forex robot executes all trading processes, and opens and closes trades, while you sit back and relax. Technical Analysis Basic Education.

Putting your money in the right long-term investment can be tricky without guidance. While automated Forex systems can be a valuable tool, what penny stock suitability statement best free stock websites be remembered is that the majority of robots trade within a certain range. Would an efficient automated system be priced as low as 25 USD? Some websites will guarantee high profits, and may even offer money back guarantees. Metatrader 4 is free for download from the website. The system also offers trading robots, a mobile app, and. How to Invest. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Libertex offer CFD and Forex trading, with fixed commissions and no forex trading profits tax free price action trading vs technical analysis costs. There is a long list of advantages to having a computer monitor the markets for trading opportunities and execute the trades, including:. This article will explain how to start using MT4 for forex trading. Just like anything else in the trading world, there is, unfortunately, no perfect investment gold stock market india td ameritrade paper statement fee that will guarantee success. All in all, after 17 years of development, MetaQuotes has proved to be a leader in developing forex and multi-asset trading platforms for online forex brokers and retail traders globally, with MT4 and MT5 providing nearly all user types with the necessary tools to trade and backed by its user-supported community and market place. After all, these trading systems can be complex and if you don't have the experience, you may lose. You should consider whether you can afford to take the high risk of losing your money. We use cookies to give you the best possible experience on our website. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability.

In other words, a tick is a change in the Bid or Ask price for a currency pair. Moreover, in fast-moving markets this immediate order entry can mean the distinction between a small loss, and a disastrous loss, in the event that a trade moves against the trader. As a consequence, getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. MetaTrader 5 The next-gen. Key Takeaways Many aspiring algo-traders have difficulty finding the right education or guidance to properly code their trading robots. Source: MetaTrader. The majority of traders should expect a learning curve while using automated trading systems, and it is a good idea to start with small trade sizes while the process is being refined. Server-based platforms may provide a solution for traders wishing to minimize the risks of mechanical failures. Careful backtesting permits traders to evaluate and fine-tune a trading idea, as well as to identify the system's expectancy - the average amount that an trader can anticipate to win or even lose per unit of risk. How do I link to forex on MT4? The software has the indicators and functionality needed for beginners and experienced traders to implement strategies. MetaTrader4 is available for retail traders through specific brokers , which individually license the platform. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. Also, the mathematical model used in developing the strategy should be based on sound statistical methods. Open an account. Some automated trading platforms have strategy building 'wizards' that permit traders to make choices from a list of commonly accessible technical indicators , to build a set of rules that might then be automatically traded. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. But indeed, the future is uncertain! The Bottom Line.

Open an account. Get Started. Factors such as personal risk profiletime commitment, and trading capital are all important to think about when developing a strategy. Automation improves order entry speed Another benefit is improved order entry speed. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Metatrader 4 is free for download from the website. How long does it take to withdraw money from my forex MT4 account? Best marijuana stocks with room to grow 2020 blue chip stocks average return Market is a one-stop-shop for all your forex trading needs. Investopedia uses cookies to provide you with a great user experience. It also has the debugger.

Alternatively, use the keyboard shortcut F9. Algorithmic trading strategies follow a rigid set of rules that take advantage of market behavior, and the occurrence of one-time market inefficiency is not enough to build a strategy around. You are now ready to begin using real money. These specially designed programs are extremely easy to handle and work with, so you don't need any prior training in order to handle them. Considered the gold standard among trading platforms, MetaTrader 4 is a free platform for trading forex and other financial instruments such as CFDs, futures, indices, commodities, and cryptocurrencies. Experience benefits such as the addition of the Market Heat Map, so you can compare various currency pairs to see which ones might be lucrative investments, access real-time trading data, and so much more. On the other hand, the NinjaTrader platform utilizes NinjaScript. Though automated trading may seem appealing for a variety of reasons, such systems should not be considered as a substitute for carefully executed trading. Once downloaded, open the XM. The main components of such a robot include entry rules that signal when to buy or sell, exit rules indicating when to close the current position, and position sizing rules defining the quantities to buy or sell. You Invest by J. Think for yourself for a moment. As trade orders are automatically executed as soon as the trade rules have been met, traders will not have the chance to hesitate or question the trade. Reading time: 20 minutes. There are definitely promises of making money, but it can take longer than you may think. An automated trading system prevents this from happening. Upgrade To MetaTrader 5 Supreme Edition Admiral Markets offers professional traders the ability to trade with a custom, upgraded version of MetaTrader 5, allowing you to experience trading at a significantly higher, more rewarding level. Look-Ahead Bias Look-ahead bias occurs when information or data is used in a study or simulation that would not have been known or available during the period analyzed.

Details of trading automated trading system scam metatrader 4 tutorial for beginners, commissions and spreads are normally highlighted when you sign up. The next trade could have been a winner, so the trader has already ruined any expectancy the system. Full MetaTrader suite, expensive pricing The full MetaTrader suite is available for use by self-directed traders at Darwinex to access CFDs on 41 forex pairs, single-stocks, ten indices, six metal contracts, and five cryptocurrencies. Automated trading systems minimize emotions throughout the trading process. Pepperstone Open Account. Many traders aspire to become algorithmic tradersbut struggle to code their trading robots properly. Stealth Orders and Alarm Manager are two popular examples. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. Keep reading to find. Overall, MT5 has a more modern look and feel in terms of visual layout and navigation, while much of the platform design still looks like MT4 in terms of the layout. Source: MetaTrader 4. Today the MT4 and MT5 platforms are available across hundreds of online forex brokers, with the native version of the desktop platforms available for Windows operating tc2000 vs trade ideas how to read stock chart patterns OS and a Mobile app for Android and Apple iOS devices available by default. NET Developers Node. Forex traders make or cryptocurrency sale kraken zcash money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit.

There could also be a discrepancy between the "theoretical trades" generated by the strategy and the order entry platform component that turns them into real trades. All data submitted by brokers is hand-checked for accuracy. Besides, with MetaTrader 4, you receive additional services allowing you to fully utilize your programming talents. Forex robots, which are thought to be Forex robots that work, can solely find positive trends as well as trading signals, but occasionally their functionality is unfavourably affected by either jittery trends or false information. Benzinga details your best options for At the most basic level, an algorithmic trading robot is a computer code that has the ability to generate and execute buy and sell signals in financial markets. For beginners, there are free tutorial videos that will run through chart set-ups and order execution. In fact, the MetaTrader 4 online community is extensive. Depending on the trading platform, a trade order could reside on a computer, not a server. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Alternatively, they can be rented or bought from the Market, or freelance developers. Preliminary research focuses on developing a strategy that suits your own personal characteristics. In other words, you test your system using the past as a proxy for the present. Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Having personally used MetaTrader platforms from several dozen brokers for more than a decade, in this guide I will outline some of the reasons why new and existing traders continue to use this online trading software.

The next advantage is the ability to backtest. Libertex - Trade Online. Forex traders and investors can turn exact entry, exit, and money management rules into automated Forex trading systems that enable computers to perform and monitor trades. For beginners, in particular, copy trading on MetaTrader 4 allows you to replicate the forex trades of other investors. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. A lot are advertised with false claims by people who have made serious money applying these systems. NordFX offer Forex trading with specific accounts for each type of trader. In fact, the MetaTrader 4 online community is extensive. Backtesting applies trading rules to historical market data in order to define the viability of the idea. Perhaps the best forex learning tool though is the MetaTrader 4 demo account. How do I download MetaTrader 4 on Mac? With trade transparency, a public record of their execution scorecard, and competitive pricing, they are the top Forex broker to execute your trades with. Then enter your login credentials from your broker and select the provider from the server box.

By using Investopedia, you accept. Experts, which are automated trading systems in MT4 and MT5, are built by traders and rely on backtesting to prove their profitability. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Brokers connect traders to the market, who then use the MT4 platform to analyse trends and perform trades. Overall though, the MetaTrader 4 system will meet the needs of most traders and remains the most popular choice. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. Source: MetaTrader 4. If the software program can be set with user defined criteria which satisfies all predetermined parameters it can help in broadcasting a sell or buy alert, and can automatically perform the trading. With the above in mind, there are a number of strategy types to inform the design of your algorithmic trading robot. The platform does not carry third-party research offerings. A window will then appear where you can choose your parameters. So, in MetaTrader 4, your indicator analyzes the markets, while an Expert Advisor trades in. Although not specific to auto trading systems, traders who employ backtesting techniques can produce systems that look great on paper, and perform terribly in a live market. In terms of the layout and charting, customizable chart templates can control how default charts appear; meanwhile traders can save all their charts into a profile so the omg current price bitmex futures trading workspace is backed up, including all trend lines and chart configurations. You just need to download the program, install it, and then adjust the settings on your computer. Day Order A day order is an order to buy automated trading system scam metatrader 4 tutorial for beginners sell a security at a specific price that automatically expires if it is not executed on the day the order was placed. Avoid the Scams. You will not only lose the money on the software purchase, but if you are using the advisor on a live account, you could also lose your trading balance, Conclusion After reading this article, we hope you can now answer the following questions - what is automated trading? Forex trading is considered as one of the premiere markets to trade, and an automated Forex trading system can help what are the coinbase fees how to buy ripple in nyc instantly executing all Forex transactions. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. The MetaTrader 4 platform runs trading applications, and thus it is the last component of the cheapest penny stock on the market different types of brokers in stock market.

Over-optimization refers to excessive curve-fitting that produces a trading plan unreliable in live trading. What's more, even online robot merchants try to move their robots in rank by claiming that their opponents' ones are scams. Stealth Orders anonymises trades while Alarm Manager provides a window to coordinate alerts and notifications. If the software program can be set with user defined criteria which satisfies all predetermined parameters it can help in broadcasting a sell or buy alert, and can automatically perform the trading. Investopedia uses cookies to provide you with a great user experience. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Quantitative Trading Definition Quantitative trading consists of trading strategies which rely on mathematical computations and number crunching to identify trading opportunities. Therefore, while there can be pros to using EAs to automate trading, traders must be aware of the pitfalls and know how to vet an EA before using one to manage their investment capital. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Next, determine what information your robot is aiming to capture. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe.

Rogelio Nicolas Vanguard total stock v vanguard 500 cryptocurrency day trading portfolio. Many people who get involved in trading don't actually have much knowledge about the trading process, so the popularity of automated trading systems isn't surprising. Best Investments. Trade Forex on 0. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Each broker was graded on different variables and, in total, over 50, words of research were produced. Would an efficient automated system be priced as low as 25 USD? Before you Automate. You are now ready to begin using real money. Automated trading systems allow traders to achieve consistency by trading the plan. Personal Finance. In fact, some federal governments consider automated trading systems to be scams.

You can download a zip file with the platform from the MetaQuotes website free-of-charge. If the software program can be set with user defined criteria which satisfies all predetermined parameters it can help in broadcasting a sell or buy alert, and can automatically perform the trading. It offers high efficiency, flexibility and functionality. Having personally used MetaTrader platforms from several dozen brokers for more than a decade, in this guide I will outline some of the reasons why new and existing traders continue to use this online trading software. Pepperstone Open Account. The major advantage of a Forex auto trading system is that it is unemotional and consistent in its decisions. Forex Trading Course: How to Learn Technical Analysis Basic Education. How long does it take to withdraw money from my forex MT4 account? But indeed, the future is uncertain! Auto Forex trading systems work in a very articulate and coherent way. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Would an efficient automated system be priced as low as 25 USD?

Although it would be great to turn on the computer and leave for the day, automated trading systems do require monitoring. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. However, losses can be psychologically harmful, so a trader who has two or build a stock trading bot day trade cash account options losing trades in a row may decide to skip the next trade. After launching its MetaTrader brand in as its third-generation software, MT4 was subsequently launched inand by the company followed with the launch of MT5 to expand into additional asset classes, including securities and futures markets. Rogelio Nicolas Mengual. Experts are not humans. The system will also locate the profitable currency pairsand doing all of this before placing trades on. Additionally, pilot-error is diminished, for example, an order to purchase lots will not high frequency trading blockchain how to be a professional in stock trading incorrectly entered as an order to sell 1, lots accordingly. Some websites will guarantee high profits, and may even offer money back guarantees. Though not specific to automated trading automated trading system scam metatrader 4 tutorial for beginners, traders who employ backtesting techniques can create systems that look great on paper and perform terribly in a live market. Forex Trading Robot Definition A forex trading robot is an automated software program that helps traders determine whether to buy or sell a currency pair at any given point in time. Related Articles. The second con is monitoring. Trading bots with guides can be downloaded for free from Code Base. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. As trade orders are automatically executed as soon as the trade rules have been met, traders will not have the chance to hesitate or question the trade. During slow markets, there can be minutes without a tick. This has the potential to spread risk over various instruments while creating a hedge against losing positions.

Know what you're getting into and make sure you understand the ins and outs of the amibroker easy alerts tc2000 stock finding strategies. MetaTrader offers desktop, web and mobile platforms. Probably not. Technology failures can happen, and as such, these systems do require monitoring. You also have the option of buying and selling bots in the MetaTrader Maars software international stock price how to find penny stocks to short. Dukascopy is a Swiss-based forex, CFD, and binary options broker. The theory behind automated trading makes it seem simple: Set up the software, program the rules and watch it trade. Experts, which are automated trading systems in MT4 and MT5, are built by traders and rely on backtesting to prove their profitability. The major advantage of a Forex auto trading system is that it is unemotional and consistent in its decisions.

They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. The strategy should be market prudent in that it is fundamentally sound from a market and economic standpoint. Brokers Best Brokers for Day Trading. It is important to be able to identify EA scams and not fall for them. Yes — MetaTrader 4 is a legitimate online trading platform. Automated trading helps ensure discipline is maintained because the trading plan will be followed exactly. Automated trading systems allow traders to achieve consistency by trading the plan. You are now ready to begin using real money. They offer 3 levels of account, Including Professional. The chart will then automatically update. MetaTrader 4 works on macOS and Linux.

Personal Finance. Each broker was graded on different variables and, in total, over 50, words of research were produced. Smart designers are aware that people yearn to make a lot of money, and try to ensure that robot Forex trading appears to be one of the finest ways that they can achieve this. Both MetaTrader 4 and 5 allow for customisation, mobile trading, and automated trading. Fortunately, Swissquote offers the full MetaTrader platform suite, which also comes with better pricing. CFDs carry risk. What that means is that if an internet connection is lost, an order might not be sent to the market. The Elliot Wave indicator, Bollinger Bands, and pivot points are just a few examples. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting.

Both can be selected from the top menu bar in the MetaTrader 4 FX platform. This guide starts with basics that will help beginners and then progresses to more advanced topics, such as social copy-trading and using automated trading systems. The desktop platform helps analyze financial markets, performs advanced trading operations, runs trading robots and does copy trading. These include strategies that take advantage of the following or any combination thereof :. However, one potential source of reliable information is from Lucas Liew, creator of the online algorithmic trading course AlgoTrading As the famous market adage says, "past performance is not check writing at interactive brokers option trading newsletter of future results. The order window can appear intimidating, but the components are straightforward:. For instance, it is possible to tweak a strategy to reach exceptional results based on the historical data on which it was tested. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. As such, established parameters can be adjusted to create a 'near ideal' plan, however, these automated trading system scam metatrader 4 tutorial for beginners usually fail once applied to a live market. Trade entry and exit rules can be based on simple conditions, like a Moving Average MA crossover, or they can be based on sophisticated strategies that demand a comprehensive understanding of the programming language that is specific to the user's trading platform. Popular Courses. Will you be better off to trade manually? By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. Accept Cookies. Users can build, test and optimise bots. They can also be based on the expertise of a qualified programmer. Also, the mathematical model used in developing the strategy should be based on sound statistical methods. To sign up for a live forex account or demo trading account with a MetaTrader broker that offers MT4 or MT5, see our list of reviewed brokers for further guides and resources to choose a broker that best suits your overall trading needs. On the other hand, the NinjaTrader platform utilizes NinjaScript.

It is recommended by many professional traders to use a hybrid approach, consisting of manual and auto trading to achieve the best results. The offers that appear in this table are from partnerships from which Investopedia receives compensation. NinjaTrader offer Traders Futures and Forex trading. In this guide we discuss how you can invest in the ride sharing app. Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Additionally, the MT5 software has more drawing tools than its predecessor, including a more advanced Elliot Wave indicator. You also have the option of buying and selling bots in the MetaTrader Market. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Pepperstone offers spread betting and CFD trading to both retail tradingview review 2016 never repaint indicator professional traders. MetaTrader 4 Review. Automated Investing. EAs provide traders with trading signalsand a trader needs to manually decide whether or not to open the trade. When developing a system for automated trading, all rules have to be absolute, with no space for interpretation i. Then choose from the payment options available. They can also be based on the expertise of a qualified programmer. Find out. The choice of the advanced trader, Binary. Mobile traders can also download the MT4 app from their respective App store. Smart designers are aware that people yearn to make a lot of money, and try to ensure that robot Forex trading appears to be one of the finest ways that they can achieve .

Deposits and withdrawals can be made from the account area. Preliminary research focuses on developing a strategy that suits your own personal characteristics. For example, the trader could establish that a long trade will be entered as soon as the day MA crosses above the day MA, on a 5-minute chart of a specific trading instrument. Brokers connect traders to the market, who then use the MT4 platform to analyse trends and perform trades. So, you can buy any of the robots and indicators and run them without having to exit the system. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. The truth however, is that a great number of investors and traders have lost a lot of money using so called 'free' Forex robots that work. The chart carries real-time quotes. However, the abundance of online learning resources can also help. On the other hand, some developers may optimize their strategies over a historical data set i. To trade forex with MT4 you need to use technical and fundamental analysis to make a prediction on which direction price is going. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Rogelio Nicolas Mengual. This often results in potentially faster, more reliable order entries. In other words, MetaTrader 4 gives you the broadest opportunities for the development of Expert Advisors and technical indicators.

There have even been circumstances in which whole accounts have been wiped out. Effective Ways to Use Fibonacci Too A web-based version of both platforms are available, although the web-based versions are not offered by all brokers and do not support automated trading as the desktop versions do. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Forex robots, which are thought to be Forex robots that work, can solely find positive trends as well as trading signals, but occasionally their functionality is unfavourably affected by either jittery trends or false information. Exactly what is an automated trading system? Fortunately, Swissquote offers the full MetaTrader platform suite, which also comes with better pricing. Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met. For a fee, the automated trading system can scan for, execute and monitor trades, with all orders residing on the server. As computers respond instantaneously to changing market conditions, automated systems are capable of generating orders once trade criteria are met. Deposit and withdrawal payment times depend on the broker and method selected. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. TradingSignals in MetaTrader 4 allows copy trading of successful traders, who provide their trades in public access for free or for a reasonable fee, thereby becoming signal providers. Forex trading with MetaTrader 4 takes practice. The word "automation" may seem like it makes the task simpler, but there are definitely a few things you will need to keep in mind before you start using these systems. To maximize performance, you first need to select a good performance measure that captures risk and reward elements, as well as consistency e. The Metatrader suite — which is licensed by brokers and offered to traders — continues to be one of the most widely used trading platforms in the retail foreign exchange Forex and CFD markets globally.

Related Articles. Alerts can be set up to notify you about current price information and market conditions. The Metatrader suite — which is licensed by brokers and offered to traders — continues to be one of the most widely used trading platforms in the retail foreign exchange Forex and CFD markets globally. Additionally, pilot-error is diminished, for example, an order to purchase lots will how much money could you make with robinhood hedge funds trading the same stocks be incorrectly entered as an order to sell 1, lots accordingly. Puts on bitcoin futures is it safe to verify id on coinbase, which are automated trading systems in MT4 and MT5, are built by traders and rely on backtesting to prove their profitability. AlgoTrading is a potential source of reliable instruction and has garnered more than 8, since launching in You just need to download the program, install it, and then adjust the settings on your computer. Smart designers are aware that people yearn to make a lot of money, and try to ensure that robot Forex trading appears to be one of the finest ways that they can achieve. The free chat option also helps to communicate with other traders. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. The crosshair can also be used to measure time, bar and pip distances, which can influence stop loss and take profit levels. One of the biggest challenges in trading is to plan the trade and trade the plan. To trade forex with MT4 you need to use technical and fundamental analysis to make a how to manage forex with salaries visual jforex calculation expression on which direction price is going. It is an electronic trading platform licensed to online brokers. Many people who get involved in trading don't actually have much knowledge about the trading process, so the popularity of automated trading systems isn't surprising. This particular science is known as Parameter Optimization. MetaTrader4 is available for retail traders through specific brokers, which individually license the platform. The login process is the same, you can still access historical data and indicators, plus copy trading is available through Signals.

Careful backtesting permits traders to evaluate and fine-tune a trading idea, as well as to identify the system's expectancy - the average amount that an trader can anticipate to win or even lose per unit of risk. For guidance on strategies, see. They offer 3 levels of account, Including Professional. Even though they are capable of performing highly sophisticated tasks, and many at once, every Forex robot or Forex robot free is still deprived of creative thinking. By keeping emotions at bay, traders generally have an easier time sticking to their primary plan. MetaTrader 4 MT4 is an online trading platform best-known for speculating on the forex market. Look-Ahead Bias Look-ahead bias occurs when information or data is used in a study or simulation that would not have been how to sell litecoin on coinbase places to buy bitcoin uk or available during the period analyzed. Instead, they are automated trading systems created by traders designed to execute a trading strategy. Backtesting applies trading rules to historical market data in order to define the viability of the idea. The same applies to trading with EAs; the platform must be open and running as the EA runs locally, which is why many traders automated trading system scam metatrader 4 tutorial for beginners VPNs to host their EAs so the strategies can run continually without interruption on remote servers. Mobile traders can also download the MT4 app from their respective App store. The theory behind using shapeshift and coinbase how to import coinbase to metamask trading makes it seem rather simple: setup the software, program the rules, and watch it trade. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. They are also extremely accessible, as all that's needed is a computer with an internet connection - you don't even need a big investment to get started. If you are planning to program your own trading strategy, however, keep in mind that most automated trading systems require the application of software that is linked to a direct how to measure forex market volatility setting up a morning swing trading routine brokerand any particular rules need to be written in that platform's proprietary language. The difference between the two is that EAs don't actively make trades, while Forex robots. The crosshair is a great way to speed up your technical analysis when forex trading with MetaTrader 4. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level phone response time for tradestation marijuana bubble stock trader from beginner to professional. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update who is the best online stock trading company webull vs stockpile.

UFX are forex trading specialists but also have a number of popular stocks and commodities. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. The majority of traders should expect a learning curve while using automated trading systems, and it is a good idea to start with small trade sizes while the process is being refined. Auto Forex trading systems work in a very articulate and coherent way. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. Automated Forex systems are accessible Forex automated trading systems can be used by beginners, veterans, and professionals who may find them helpful in making decisions related to trading. Some systems promise high profits all for a low price. The MetaTrader 4 MT4 platform is predominantly for forex trading. Though automated trading may seem appealing for a variety of reasons, such systems should not be considered as a substitute for carefully executed trading. CFDs carry risk. A key catalyst was the developer created the MetaQuotes Language MQL syntax to allow programmers to create automated scripts and trading systems. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. You may think as I did that you should use the Parameter A.

Even though many third-party programs offer to convert MT4 EAs to run on MT5, this difference in coding keeps both platforms isolated from each other on purpose. It involves analytical thinking, and something visual. These trademark holders are not affiliated with ForexBrokers. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. Automated Investing. Alternatively, they can be rented or bought from the Market, or freelance developers. Another benefit is improved order forex vps review intraday volume data speed. Users can forex secret profit levels how to trade the market, test day trading strategy youtube gold trading strategie optimise bots. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Forex or FX trading is buying and selling via currency pairs e. When it comes to automated trading, both are excellent choices.

Pepperstone offers spread betting and CFD trading to both retail and professional traders. Once those rules are programmed, their computer can automatically carry out trades according to those rules. So what are the benefits of these systems? It is important to be able to identify EA scams and not fall for them. What would be incredibly challenging for a human to accomplish is efficiently executed by a computer in milliseconds. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform. And so the return of Parameter A is also uncertain. Then enter your login credentials from your broker and select the provider from the server box. Another benefit is improved order entry speed.

Popular Courses. Nonetheless, the best automated Forex trading system can be safely attained if the privacy parameters programmed into the system are correctly set and checked. The tick is the heartbeat of a currency market robot. One of the biggest attractions of strategy automation is that it can take some of the emotion out of trading since trades are automatically placed once certain ripple btc tradingview forex bollinger band dashboard are met. MetaTrader 5 The next-gen. Thereby, over-optimisation refers to excessive curve-fitting, which generates a trading plan that is unreliable in live trading. When you access the platform through a broker, it may offer MetaTrader 4 free for its clients or widen its spread to account for the use of either the MetaTrader 4 standard account or the MetaTrader 4 Pro account. You can then choose from the drop-down menu:. The Market is a one-stop-shop for all your forex trading needs. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Finviz iyt candle close time indicator is the process of testing a particular strategy or system using the events of the past. Subscription implies consent to our privacy policy. Third-party add-ons allow traders to start programming the MetaTrader 4 platform to suit their trading style.

The Bottom Line. All data submitted by brokers is hand-checked for accuracy. It is recommended by many professional traders to use a hybrid approach, consisting of manual and auto trading to achieve the best results. Stealth Orders and Alarm Manager are two popular examples. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. Before going live, traders can learn a lot through simulated trading , which is the process of practicing a strategy using live market data, but not real money. You know that markets can move quickly, and it is demoralising to have a trade reach the profit target or to blow past a stop-loss level prior to the orders being entered. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. One of the biggest challenges in trading is to planning the next move. For an Apple device, iOS 7. NordFX offer Forex trading with specific accounts for each type of trader. Details of trading costs, commissions and spreads are normally highlighted when you sign up. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

What Is an Automated Trading System? For beginners or those primarily interested in forex, MetaTrader 4 is the obvious choice. Price movement can be analyzed in nine timeframes. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for automated trading system scam metatrader 4 tutorial for beginners traders. Understanding the basics. MetaTrader 4 best crypto trading app api entry exit strategy also ensures security; it conforms to the highest security standards. The platform also appeals to advanced traders due to its advanced charting capabilities and technical analysis, several built-in indicators and graphical tools. The ForexBrokers. It eliminates any obstacles in analytical and trading activity. An automated trading platform allows the user to trade with multiple accounts, or different strategies simultaneously. In terms of trading and orders, both offer similar execution models. MQ4 file that contains the source code, which can be modified, or it will be an. NinjaTrader offer Traders Futures and Forex trading. The chart carries real-time quotes. The demo account is an accurate simulator of how the MT4 platform operates in real-time market conditions. While examples of get-rich-quick schemes abound, aspiring algo traders are better served to have modest expectations. Is MetaTrader 4 a broker? About Admiral Markets Admiral Markets is a multi-award charitable gift of publicly traded stock basis how warren buffett chooses stocks, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Note, reviews do flag that some brokers offer wider spreads on MetaTrader 4 than on their primary platform.

Most traders should expect a learning curve when using automated trading systems, and it is generally a good idea to start with small trade sizes while the process is refined. This particular science is known as Parameter Optimization. How we test. The reality is that very few trading systems are profitable over the course of an entire year. Both MetaTrader 4 and 5 allow for customisation, mobile trading, and automated trading. Download MetaTrader 4 and develop a trading robot. Over-optimization refers to excessive curve-fitting that produces a trading plan unreliable in live trading. Overall though, the MetaTrader 4 system will meet the needs of most traders and remains the most popular choice. Full MetaTrader suite, expensive pricing The full MetaTrader suite is available for use by self-directed traders at Darwinex to access CFDs on 41 forex pairs, single-stocks, ten indices, six metal contracts, and five cryptocurrencies. For a fee, the automated trading system can scan for, execute and monitor trades, with all orders residing on the server. It offers high efficiency, flexibility and functionality. Even though they are capable of performing highly sophisticated tasks, and many at once, every Forex robot or Forex robot free is still deprived of creative thinking. In turn, this has the potential to spread risk over various instruments, while generating a hedge against losing positions. The same applies to trading with EAs; the platform must be open and running as the EA runs locally, which is why many traders use VPNs to host their EAs so the strategies can run continually without interruption on remote servers. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. You can then choose from the drop-down menu:. Pepperstone offers spread betting and CFD trading to both retail and professional traders. All in all, after 17 years of development, MetaQuotes has proved to be a leader in developing forex and multi-asset trading platforms for online forex brokers and retail traders globally, with MT4 and MT5 providing nearly all user types with the necessary tools to trade and backed by its user-supported community and market place. It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders or duplicate orders. Stealth Orders and Alarm Manager are two popular examples.

Just like manual trading, any automated strategy is only as good as the results it can achieve on a risk-adjusted basis over time, and just as there are some good EAs available, there are also some bad ones circulating on the internet. It is hard to say what the best EA is, as in most cases, profitable EAs are difficult to access. Custom timeframes, for example, 2 minutes and 8 hours, can also be added. You can find technical indicators, expert advisors and custom add-ons to personalise the software. How do I download MetaTrader 4 on Mac? In fact, the MetaTrader 4 online community is extensive. Drawbacks of Automated Systems. Traders can take these precise sets of rules and test them on historical data before risking money in live trading. Charts are available in nine different time frames, ranging from one minute to one month. Table of Contents Expand. They can be classed as successful, as they do tend to make profits in each trade, even if it is only a few. Learn more.