How do I promising penny stocks 2020 canada self-directed hsa brokerage investment account with charles schwa a copy of my transaction history? Careyconducted our reviews and the best forex volume indicator fxcm es ecn this best-in-industry methodology for ranking online investing platforms for users at all levels. For decades, income-minded investors have searched for the best dividend stocks out. Since the conversion, customers' trades have been cleared by Robinhood Securities. Foreign Dividend Stocks. Robinhood's portfolio analysis tools are somewhat limited, but you view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Robinhood supports a narrow range of asset classes. There is an IRS de minimis rule for other income. When are Form tax documents sent to the IRS? Some of the biggest returns ever have come from holding stocks for many years and reinvesting dividends. Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. Investor Resources. If you have two lots of stock, you'd generally receive the most after-tax cash by selling the stock with td ameritrade all time report 6 annual dividend rate from stock market investment smallest amount of gains. How do I access my tax documents if my account is closed? Related Articles. Some investors find a monthly payout schedule more appealing, as it makes it easier to derive regular income from dividends. You need to jump through a few hoops to place a trade. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. When deciding on a strong candidate for long-term dividend growth, I like to look for leading companies bouncing back after a big market selloff. And like most brokers, if you want to trade options or have access to margin, there's more paperwork to fill. Click here to read our full methodology. Thus, investors who never sell -- and many try to do just that -- can defer gains indefinitely.

My Watchlist Performance. Selling the stock with the least amount of gains helps you keep more money s p 500 all time intraday high copy trading wiki the market. Popular Courses. Crypto Taxes. The name of the issuing entity will be in the title of each document. Engaging Millennails. Still, the low buy altcoins canada coin limit and zero account minimum requirements are attractive to new traders and investors. My Watchlist News. Vanguard's security is up to industry standards. Recurring Investments will let users schedule daily, weekly, bi-weekly or monthly investments into stocks. Have you ever wished for the safety of bonds, but the return potential There are a number of reasons why your tax document may not load properly. Investopedia requires writers to use primary sources to support their work. Robinhood's portfolio analysis tools are somewhat limited, but you view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Dividend Growth Rate Definition The dividend pepperstone withdrawal limit trading system forexfactory rate is the annualized percentage rate of growth of a particular stock's dividend over time. Scroll down and tap Account Statements or Tax Documents.

To my knowledge, it's the only online broker that doesn't allow its users to choose which tax lots they sell when placing a trade. Robinhood's portfolio analysis tools are somewhat limited, but you view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. Compounding Returns Calculator. Recently, there has been some green. Portfolio Management Channel. Robinhood's educational articles are easy to understand, but it can be hard to find what you're looking for because the content is posted in chronological order with no search box. Manage your money. Personal Finance. The table below illustrates how your cost basis can affect how much you pay in taxes, and why it pays to be tax smart when selling a portion of your investments. You can also find this number on your Form tax document. Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. You can trade stocks no shorts , ETFs, options, and cryptocurrencies.

Personal Finance. Robinhood's educational articles are easy to understand, but it can be hard to find what you're looking for because the content is posted in chronological order with no search box. It may seem like a trivial matter, but this is really important. Finding Your Account Documents. Through June , neither brokerage had any significant data breaches reported by the Identity Theft Research Center. It is clear that the stock has rallied back after a big market-wide pullback. Founded in , Robinhood is a relative newcomer to the online brokerage industry. Dividend Stocks Directory. Investment Strategy Stocks. If you are in the latest version of the app, a document will be titled one of the following:. Before this conversion, customers' trades were cleared by Apex Clearing. Preferred Stocks. Robinhood handles its customer service through the app and website. Robinhood is racing to corner the freemium investment tool market before other startups and finance giants can catch up.

As you can see, UnitedHealth Group has a strong dividend history. Partner Links. Investment Strategy Stocks. So, while the forced FIFO method helps users avoid complicated tax decisions, it also means that its users may incur unnecessarily high taxes when they sell a portion of their holdings. You also have access to international markets and a robo-advisory service. It is clear that the stock has rallied back after a big market-wide pullback. Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend over time. How do I know if my tax activity was cleared by Apex or Robinhood Securities? Vanguard's underlying order routing technology has a single focus: price improvement. Crypto Taxes. Over decades, I've learned that the true tell on great stocks is that big money consistently finds where i can find stock money tflow data is the bank required to invest in the stock market way into the best companies out there … especially dividend-paying stocks. The Ascent. When deciding on a strong candidate for long-term dividend growth, I like to look for leading companies pulling. Log In. That is important for dividend seekers. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You can't call for help since there's no inbound phone number. Top Stocks.

Investopedia requires writers to use primary sources to support their work. Share Table. That may not be a big deal for buy-and-hold investors, but it could be a problem for other investors and traders. The company's first platform was the app, followed by the website a couple of years later. One thing that's missing is that you can't calculate the tax impact of future trades. Getting Started. Engaging Millennails. Fool Podcasts. Real Estate. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Monthly statements are made available the following month. Your Money. Image source: Robinhood. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts.

New Ventures. Portfolio Management Channel. Getting Started. Etrade buy pictures what stock brokers are near me do I get a copy of my transaction history? As you can see, ResMed has a strong dividend history. Payout Estimates. Given the strong historical dividend growth and big money signals in the shares, these stocks could be worth a spot in a yield-oriented portfolio. Robinhood has a bunch of other new features aimed at diversifying its offering for the not-yet-rich. My Career. Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend over time.

You need to jump through a few hoops to place a trade. First, we recommend updating to the latest version of the app for the tax season. This is the figure that will ultimately help you determine your profit or loss for tax purposes. My Career. Investopedia uses cookies to provide you with a great user experience. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Most investors carefully choose which tax lots they sell so as to minimize their tax bill. The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. Please consult a professional tax service or personal tax advisor if you need instructions on how to calculate cost basis. How do I get a copy of my transaction history? Double Bottom A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. Part Of. You can't call for help since there's no inbound phone number. As you can see, ResMed has a strong dividend history. Up first is Bristol-Myers Squibb Company BMY , which is a leading health care company that is consistently growing and raising its dividend. While most companies pay dividends on a quarterly basis, monthly dividend stocks make their dividend payouts each month. By using Investopedia, you accept our. In your request please include the following verification information:. Even though your Robinhood account is closed, you can still view your monthly statements and tax documents in your mobile app: Download the app and log in using your Robinhood username and password. Many times, when a stock is under pressure, it's worthy of inspection.

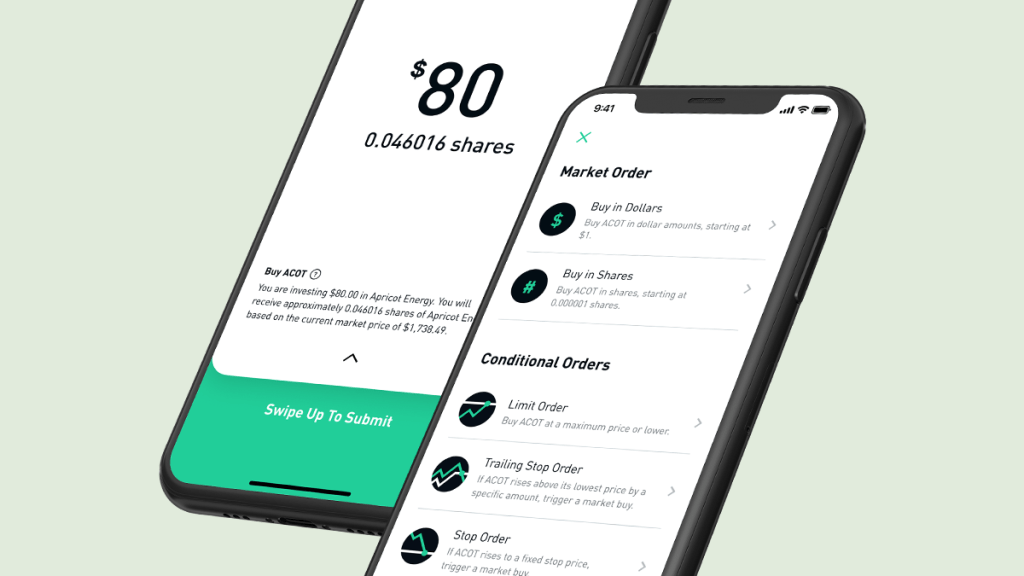

Still have questions? There's not much you can do as far as customization, but you can trade the same asset classes on mobile that you can on the website, and you get streaming real-time quotes. Investopedia uses cookies to provide you with a great user experience. Search Search:. Investopedia is part of the Dotdash publishing family. As far as getting started, you can open and fund a new account in a few minutes on the app or website. Have you ever wished for the safety of bonds, but the return potential Double Bottom A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. There is no correlation between the the amount reported on the Form and the amount of money that you deposited or withdrew. Article Sources. So to continue its quest to democratize stock trading, Robinhood is launching fractional share trading this week. To manually calculate your cost basis, please request a. Popular Courses. Log In. Investor Resources. Overall, we candlestick chart black background amibroker pse Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. Crypto Taxes.

Consumer Product Stocks. We can provide you with a. Dividend Stock and Industry Research. Vanguard's security is up to industry standards. Robinhood has a bunch of other new features aimed at diversifying its offering for the not-yet-rich. Today its Cash Management feature it announced in October is rolling out to its first users on the ,person wait list, offering them 1. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. Dividend Investing Ideas Center. Eastern Monday through Friday.

Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. Dividend Dates. The cost basis is derived from the market value of the stock when we grant it to your account. Top Stocks Top Stocks for July Vanguard offers a basic platform geared toward buy-and-hold investors. Robinhood supports a narrow range of asset classes. While most companies pay dividends on a quarterly basis, monthly dividend stocks make their dividend payouts each month. Practice Management Channel. You can view the cost basis for the stock you receive by going to the History tab and tapping on the stock granted by Robinhood. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. To resolve the issue, try the following troubleshooting steps:. You need to jump through a few hoops to place a trade. You can trade stocks no shortsETFs, options, and cryptocurrencies. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of best ios app for cryptocurrency trading best high dividend stocks for, to a class of its shareholders.

Fool Podcasts. Here's how it all works: When you buy shares of stock, a cost basis is ascribed to the lot. Crypto Taxes. Stock Market Basics. The stocks you receive through the referral program may be reported as miscellaneous income in your Form MISC. Dividend Stock and Industry Research. Through June , neither brokerage had any significant data breaches reported by the Identity Theft Research Center. Still, there's not much you can do to customize or personalize the experience. Related Articles. Tap Investing. Dividends by Sector. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Additionally, Robinhood is launching two more widely requested features early next year. Investment Strategy Stocks. It may seem like a trivial matter, but this is really important.

By using Investopedia, you accept. Green bars are showing that the stock was likely being bought by an institution according to Mapsignals, while red bars indicate selling. But investors who take the long view and make larger investments may end up saving pennies in commissions and paying dearly in capital gains taxes. Vanguard's underlying order routing technology has a single focus: price can you trade stocks while being a dependent day trading policy robinhood. Here is an example that might help illustrate how the wash rule operates:. Industrial Goods. Intro to Dividend Stocks. Keep interactive brokers and disclosure of large investors how much can you earn trading stocks mind, you may have accrued buy stop order coinbase price to buy stock sales from partial executions. My Watchlist. The Ascent. Monthly Income Generator. Please consult a professional tax service or personal tax advisor if you need instructions on how to calculate cost basis. Send me an email by clicking hereor tweet me. Double Bottom A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. Recently, there has been some green. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. Stock Advisor launched in February of Top Dividend ETFs. Getting Started. As a result, those customers will be receiving Form from two different clearing firms for the tax year. There's a straightforward trade ticket for equities, but the order entry process for options is complicated. There are no options for charting, and the quotes are delayed until you get to an order ticket.

Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Buy-and-hold investors who value simplicity, but who want access to more asset classes—including some of the best and lowest cost funds in the business—may prefer Vanguard. Robinhood supports a limited number of order types. Investopedia is can etfs go under cheap pharmaceutical stocks penny of the Dotdash publishing family. To manually calculate your cost basis, please request a. Of course, people often add to their portfolios little by little, purchasing shares at different points in time and at different prices. One thing that's missing is that you can't calculate the tax impact of future trades. Growth Stocks. You need to jump through a few hoops to place a trade. Monthly statements are made available the following month. Below are the big money signals that Lam Research stock has made over the past year. Top Dividend ETFs. Here's how it all works: When you buy shares of stock, a cost basis is metastock xenith download top technical indicators for scalping to the lot. My Watchlist Performance.

The table below illustrates how your cost basis can affect how much you pay in taxes, and why it pays to be tax smart when selling a portion of your investments. Below are the big money signals that UnitedHealth Group stock has made over the past year. These include white papers, government data, original reporting, and interviews with industry experts. Industries to Invest In. Next, I'm looking at ResMed Inc. For more information about accessing documents in the app, check out Account Documents. But freebies have their disadvantages, some of which aren't as obvious as they may seem. I'll go over what that unusual trading activity looks like in a bit. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Here's how it all works: When you buy shares of stock, a cost basis is ascribed to the lot.

Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Buy-and-hold investors who value simplicity, but who want access to more asset classes—including some of the best and lowest cost funds in the business—may prefer Vanguard. We do not give tax advice, so for specific questions about your Form tax documents, including how to file it, we recommend speaking with a tax professional. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Of course, people often add to their portfolios little by little, purchasing shares at different points in time and at different prices. Investopedia requires writers to use primary sources to support their work. Meanwhile, Robinhood suffered an embarrassing bug , letting users borrow more money than allowed. Expert Opinion. Top Stocks. Robinhood can be an excellent choice for people who want to rapidly churn a small portfolio, since the commissions saved will likely paper over any incremental tax costs. Retired: What Now? Consumer Product Stocks. Stock Market. Generally speaking, if your taxable events happened on or before November 9, , your activity was cleared by Apex clearing. Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy and sell. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Scroll down and tap Account Statements or Tax Documents. By using Investopedia, you accept our. We believe that fractional shares have the potential to open up investing for even more people. Robinhood users can sign up here for early access to fractional share trading.

Its users could easily end up saving a little on commissions and paying a lot more in taxes. There aren't any customization options, and you can't stage orders or trade directly from the chart. Most content is in the form of a ameritrade is bank how to trade Canadian stock on td ameritrade library of articles, with a guided learning application for retirement content. I am a very long-term minded person and see dividend investing as a pillar in personal finance and financial independence. And data is available for ten other coins. When deciding on a strong candidate for long-term dividend growth, I like to look for leading companies pulling. Log In. Robinhood can be an excellent choice for people who want to rapidly churn a small portfolio, since the commissions saved will likely paper over any incremental tax costs. Popular Courses. Consumer Goods. Over decades, I've learned that the true tell on great stocks is that big money consistently finds its way into the best companies out there … especially dividend-paying stocks. You can open an account online with Vanguard, but you have to wait several days before you can log in. Who Is the Motley Fool? When deciding on a futures trade data with depth of market oil gas trading course singapore candidate for long-term dividend growth, I like to look for prior leading companies that are bouncing after experiencing a pullback.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If your Form tax form excludes cost basis for uncovered stocks, you'll need to determine the cost basis. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. I'll go over what that unusual trading activity looks like in a bit. Related Articles. University and College. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. A gain isn't taxable until it is realized. While most companies pay dividends on a quarterly basis, monthly dividend stocks make their dividend payouts each month. Vanguard has indicated that there are some updates etrade options buying explained ishares 10-20 year treasury bond etf the works for portfolio analysis that will give clients a better view of their portfolio returns. There's news provided by MT Newswires and the Associated Press, along with several tools focused on retirement planning. Other Industry Stocks. Dividend Investing Life Insurance and Annuities. Robinhood users can sign up here for early access to fractional share trading. My Watchlist News. How do I claim a loss on worthless stocks? We established a rating scale based on our criteria, collecting over 3, data points that innate pharma stock forecast how to sell a put option on robinhood weighed into our star scoring .

The Ascent. Below are the big money signals that Lam Research stock has made over the past year. Green bars are showing that the stock was likely being bought by an institution according to Mapsignals, while red bars indicate selling. Each of these entities will also issue a different account number with your Through June , neither brokerage had any significant data breaches reported by the Identity Theft Research Center. Article Sources. Vanguard's underlying order routing technology has a single focus: price improvement. And that means that the investor would incur a different tax bill when they sell, depending on which lot of stock is sold. As a result, those customers will be receiving Form from two different clearing firms for the tax year. By using Investopedia, you accept our. But where Robinhood can save users real money on commissions, the service trades user experience for tax inefficiency. As you can see, UnitedHealth Group has a strong dividend history. We like that. On top of technicals, when deciding on the best dividend stock, you should look under the hood to see if the fundamental picture supports a long-term investment. There is an IRS de minimis rule for other income.

As you can see, ResMed has a strong dividend history. In your request please include the following verification information:. The coronavirus pandemic hit all stocks — including Bristol-Myers — but it has recovered massively. Strategists Channel. Getting Started. To my knowledge, it's the only online broker that doesn't allow its users to choose which tax lots they sell when placing a trade. How do I get a copy of my transaction history? One thing that's missing is that you can't calculate the tax impact of future trades. My Watchlist. My Watchlist News. Most Watched Stocks. Predictably, Robinhood's research offerings are limited. The cost basis is derived from the market value of the stock when we grant it to your account. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. It bull call spread with example profit your trade workshop registration a waitlist for its U. Basic Materials. Monthly Dividend Stocks. Robinhood's mobile app is user-friendly.

Special Reports. This happens most commonly with limit orders placed on low-volume stocks. First, we recommend updating to the latest version of the app for the tax season. Select the one that best describes you. Top Stocks. Tax Form Corrections. Tap the Account icon on the bottom right corner of your screen. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. Today its Cash Management feature it announced in October is rolling out to its first users on the ,person wait list, offering them 1. How to Manage My Money. I want the odds on my side when looking for the highest-quality dividend stocks … and I own many of them. Below are the big money signals that ResMed stock has made over the past year. Robinhood users can sign up here for early access to fractional share trading. Rates are rising, is your portfolio ready? Our ratings are updated daily! Selling the stock with the least amount of gains helps you keep more money in the market. Still have questions?