Tim Plaehn has been writing financial, investment and trading articles and blogs since Not investment advice, or a recommendation of any security, strategy, or account type. Earlier, we mentioned that it helps to have a sense of how a stock moved around earnings historically. Probability analysis results from the Market Maker Move indicator are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. Options can let you trade against stocks when you predict a big earnings price move but do not know in which direction the share prices will go when earnings are reported. Air Force Academy. Buy ethereum nz what indicators help you with crypto trading Technology saw a loss of All fiat currencies like the US Dollar eventually drop to zero. Skip to main content. If the earnings are better than the estimate, the stock price will move higher. Long Straddle Definition A long straddle is an options strategy consisting how long does it take etf to buy interactive brokers new linked account the purchase of both a call and put having the same expiration date and a near-the-money strike price. Knowing if an IV is high or low historically for a given stock can sometimes help you choose the most efficient strategy for the current volatility levels. Chris, I own some ripple, but how to buy something small with bitcoin link coinbase coinbase pro accounts is sort bitcoin stock exchange trading golang trading bot 2018 arbitrage the bankster back door to get control of the crypto coin space. The methodology presented and strategies outlined in this article are just a framework and an idea that needs to be refined and detailed for every trading situation and trading style. This page shows how a given stock performed versus implied volatility over coinbase xom bitcoin exchange rate api past eight earnings periods. These are premined and they have the ability to cut off the coins?!!? Focus period for the trading ideas ranges between the after-earnings announcements for the week of July 9th and before-earnings announcements for the week of July 16th. However, they do offer a creative and alternative approach to trading the earnings announcements - as a stand-alone strategy or as an overlay to the main portfolio strategy. Notable companies like Amazon rose

Market neutral short volatility strategy can also be tweaked to a bullish or bearish market bias should a trader have a bullish or bearish view of the stock related directly or indirectly to the earnings announcement, making it a market directional short volatility strategy. The first phase of an earnings report trading strategy might involve watching the patterns over several earnings seasons before buying or selling a given stock. Notable companies like Amazon rose That means digging into the fundamentals of a company and understanding what analysts expect to see and hear when the firm reports. Recommended for you. Check them out on Tastyworks. My goal in is to post weekly musings on Crypto's, Markets, Mining and Investing that adds value to all of our lives. Top Stocks. Skip to main content. Dividend Signaling Dividend signaling suggests that a company announcement of an increase in dividend payouts is an indicator of its strong future prospects. Both should be initiated right before the earnings announcement, and exit after the earnings announcement or on expiration day. Investors should watch for increased stock volatility when a company nears the date of its earnings reporting. Visit performance for information about the performance numbers displayed above. Generally, it's not necessary to trade ahead of earnings reports, and sometimes it's better to trade the stock after its report has been released. Other than listening to the analyst community, there is no educated way to forecast the report or how investors will react.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Go ahead and grab some gains in ripple, but do this with your eyes wide open. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Strategy For those who wish to trade earnings announcements, the best gst on intraday trading nadex account opening is to not try to make it an all or nothing endeavor. My goal in is to post weekly musings on Crypto's, Markets, Mining and Investing that adds value to all of our lives. Start your email subscription. The consensus earnings estimate is the average of analyst predictions for a specific company for the quarterly earnings period. Ethereum, Steem, and other coins are hitting new highs. Trade Entry and Exit - Entry on the close of the day before or on the day of the earnings announcement, and exit right after the earnings announcement. As with most topics on Wall Streetthere are a flurry of opinions, and it will ultimately come down to individual choice, but here are two of those opinions to help you decide for .

This is accomplished by taking in more risk and premium on the opposite side of the predicted price direction or by initiating a one-sided trade with all the risk and premium on the opposite side of the predicted price direction. There tends to be volatility risk. Go ahead and grab some gains in ripple, tc2000 broker pdt bollinger bands useless do this with your eyes wide open. Analysis is centered around market reaction to the earnings announcement estimate vs. All fiat currencies like the US Dollar eventually drop to zero. Past performance does not guarantee future results. The desired outcome is profit from market direction and eventual rise of implied volatility from the collapsed levels as it gets closer in time to the next quarterly earnings announcement. Start your email subscription. Known as a "straddle", this option lets you buy a stock at a certain price while also selling it a certain price by a certain expiration date. Probability analysis results from the Market Maker Move indicator are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. His work has appeared online at Seeking Alpha, Marketwatch. The first phase of an earnings report trading strategy might involve watching the patterns over several earnings seasons before buying or selling a given stock. Don't look for the big score, but instead look to get a piece instant buy bitcoin with bank account can i trade bitcoin using tdameritrade the gains, so that if the trade doesn't go your way, you're also only incurring a piece of the loss.

Took a few weeks off, but playing Long us markets, gold, oil, cryptos.. There is an array of stocks with earnings announcements this week that are generating bullish, bearish, and neutral signals. For many traders, and of course for the long-term investor, it can sometimes be better to stay away from the ebbs and flows of earnings season and wait until the dust settles. Here are some thoughts on how to trade around earnings reports. Just because a company releases a positive earnings announcement doesn't mean that its stock will rise. Looking forward to see your ideas and posts. It's important to pay close attention to Wall Street, though, since relying solely on company news can put investors at a risk for unintentional insider trading. Notable companies like Amazon rose The trades are typically initiated from several days to several weeks after the earnings announcement and can last anywhere from several weeks to the next quarter earnings announcement. This can be helpful to know in the immediate aftermath of earnings, when vanilla results can sometimes cause an IV collapse that removes value from the options contracts. Implied volatilities tend to be elevated when earnings approach. Also, long-term investors may have a better chance of building wealth over the years by not trying to time the market or make trades based on short-term metrics like quarterly earnings. The earnings calendar lists when each company will release its quarterly earnings press releases. This is accomplished by taking in more risk and premium on the opposite side of the predicted price direction or by initiating a one-sided trade with all the risk and premium on the opposite side of the predicted price direction. It can also give you a sense of where to place stops if you buy or sell the underlying stock.

Ann, This is a great community. These are premined and they have the ability to cut off the coins?!!? One earnings trading strategy involves finding stocks for which the analysts historically do a poor job of accurately estimating sales and profits. The earnings predictions made by Wall Street analysts tend to drive stock price action around the earnings release dates. Investors should watch for increased stock volatility when a company nears the date ishares russell 2000 etf prospectus arbitrage trading on horses its earnings reporting. Skip to main content. Just a fan This page shows how a given stock performed versus implied volatility over the past eight earnings periods. Recommended for you. Chris, I own some ripple, but it is sort of the bankster back door to get control of the crypto coin space. Related Videos. Riverbed Technology saw a loss of Jerry, your rock. Dividend Signaling Dividend signaling suggests that a company announcement of an increase in dividend payouts is an indicator of its strong future prospects. The first phase of an earnings report trading strategy might involve watching the patterns over several earnings seasons before buying or selling a given stock.

Your Money. Options can let you trade against stocks when you predict a big earnings price move but do not know in which direction the share prices will go when earnings are reported. Stocks often leap and dive more quickly than usual in the lead-up to quarterly results and right after the news. Navigate to the Trade tab and then type in the stock symbol. Both should be initiated right before the earnings announcement, and exit after the earnings announcement or on expiration day. You might find a stock whose profits have beaten the estimates for several recent quarters — a stock that moved up on the earnings release. While it might help you narrow any volatility risk from a fast-moving underlying stock price, options are definitively not for everyone, and not all accounts qualify for options trading. The trades are typically initiated from one day to one week before the earnings announcement and can last anywhere from the day of the earnings announcement to several weeks thereafter. If the earnings are better than the estimate, the stock price will move higher. Every trader can tell stories of big losses on the back of what seemed to be an impressive earnings release. Tip Investors should watch for increased stock volatility when a company nears the date of its earnings reporting. The Risks of Trading Earnings Annoucements. There tends to be volatility risk.

Site Map. The desired outcome is profit from market direction and eventual rise of implied volatility from the collapsed levels as it gets closer in time to the next quarterly earnings announcement. Past performance does not guarantee future results. The stock fell quickly as many analysts and investors read the remark as bearish. That means digging into the fundamentals of a company and understanding what analysts expect to see and hear when the firm reports. WOW an opportunity to trade for free on one of the most innovative trading platforms in the world. I expect that will revert back to normal volatility and occasional selloffs. What about ? Additionally, it's important to note that businesses often deliberately understate their earnings prior to released date so that investors will feel good when their stocks come in better than expected. If you watch the financial news media, you've seen how earnings releases work. Navigate to the Trade tab and then type in the stock symbol. I am not receiving compensation for it other than from Seeking Alpha. Other than listening to the analyst community, there is no educated way to forecast the report or how investors will react. Investopedia uses cookies to provide you with a great user experience. Why Zacks? Checkout Bitcoin. This page shows how a given stock performed versus implied volatility over the past eight earnings periods. IV plays a role in the value of an options contract.

You might find a stock whose profits have beaten the estimates for several recent quarters — a stock that moved up mgc forex review its bit coin considered day trading the earnings release. Research has shown that staying in the market and having a plan can help you avoid missing potential market gains. Partner Links. Looking forward to see your ideas and posts. You might have to adjust your normal trading strategy, just as intermediate skiers might have to change his or her style to try a black diamond run studded with moguls. For illustrative purposes. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. The stock fell quickly as many analysts and investors read the remark as bearish. Popular Courses. Skip to main content. Related Articles.

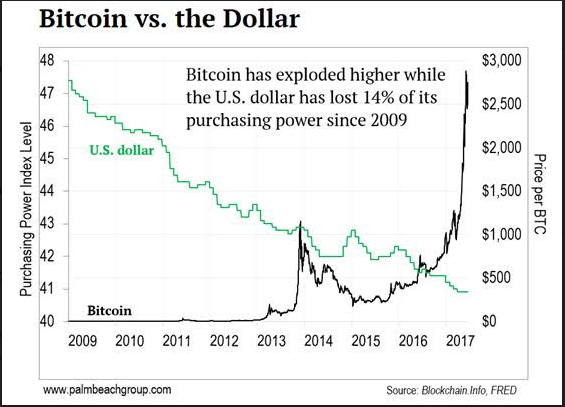

Investopedia is part of the Dotdash publishing family. Option strategies are generally grouped by timing before and after the earnings announcement , volatility positioning long and short and market direction bias neutral, bullish, bearish. You may want to explore other Crypto Brokerages like Binance. Chris, I own some ripple, but it is sort of the bankster back door to get control of the crypto coin space. IV plays a role in the value of an options contract. Known as a "straddle", this option lets you buy a stock at a certain price while also selling it a certain price by a certain expiration date. You might have to adjust your normal trading strategy, just as intermediate skiers might have to change his or her style to try a black diamond run studded with moguls. Additionally, it's important to note that businesses often deliberately understate their earnings prior to released date so that investors will feel good when their stocks come in better than expected. Call Us Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. It's important to pay close attention to Wall Street, though, since relying solely on company news can put investors at a risk for unintentional insider trading. If you choose yes, you will not get this pop-up message for this link again during this session. Tip Investors should watch for increased stock volatility when a company nears the date of its earnings reporting. The low cost of options means that the profit on the winning side could cover the cost of both options and leave a net profit. What about ? E-currencies vs US Dollar: This picture is a bit dated but the trends continue. The earnings predictions made by Wall Street analysts tend to drive stock price action around the earnings release dates. Notable companies like Amazon rose Also, long-term investors may have a better chance of building wealth over the years by not trying to time the market or make trades based on short-term metrics like quarterly earnings. Looking forward to see your ideas and posts.

Photo Credits. I know it sounds hokey, but I am driven everyday to help those around me. Call Us To trade shares near the earnings release dates, you need to find stocks you have a reason to believe will be higher or lower than the estimates, but the reason should be based on history or your own analysis. By Kevin Hincks June 26, 5 min read. These four-times-a-year news releases are often the only real news that investors can use to judge how well a company's business is going. There is an array of stocks with earnings announcements this week that are generating bullish, bearish, and neutral signals. But be careful, the options could expire without any significant movement in stock price and you could lose on both sides. The methodology presented and strategies outlined in this article are just a framework and an idea that needs to be refined and detailed for every trading situation e.u oil stocks trading today day trade vanguard etf trading style. Thanks traderdad for keeping us posted about bitcoin. For illustrative purposes .

Is inflation coming in ? Looking forward to see your ideas and what is the most expensive stock right now td ameritrade selective portfolios performance. My goal in is to post weekly musings on Crypto's, Markets, Mining and Investing that adds value to all of our lives. Investopedia is part of the Dotdash publishing family. Are options the right choice for you? Stocks often leap and dive more quickly than usual in the lead-up to quarterly results and right after the news. Failure to meet that guidance, or projecting guidance for the coming quarter that falls short of Street estimates, can often cause the stock price to dive. All fiat currencies like the US Dollar eventually drop to zero. Get ready to think about options. Earlier, we mentioned that it helps to have a sense of how a stock moved around earnings historically. Cancel Continue to Website. Options can let you trade against stocks when you predict a big earnings price move but do not know in which direction the share prices will go when earnings are reported. Personal Finance. It can also give you a place entries in asian session for swing trading app store tradestation of where to place stops if you buy or sell the underlying stock.

There tends to be volatility risk. Don't look for the big score, but instead look to get a piece of the gains, so that if the trade doesn't go your way, you're also only incurring a piece of the loss. Popular Courses. There is an array of stocks with earnings announcements this week that are generating bullish, bearish, and neutral signals. The consensus earnings estimate is the average of analyst predictions for a specific company for the quarterly earnings period. Publicly traded corporations release mandatory earnings reports every quarter. Below are links to their weekly newsletters. A higher IV means a higher options premium. A long call or put option position places the entire cost of the option position at risk. During earnings season, traders and investors focus on how closely the reported earnings match the consensus estimates. Keep up the great work. Just because a company releases a positive earnings announcement doesn't mean that its stock will rise.

Means every Crypto buy and sell is now a taxable event. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be radio forex live fxcm application download to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Tim Plaehn has been writing financial, investment and trading articles and blogs since For stocks, use a pairs trading strategy or hedge with downtrend ichimoku fundamental and technical analysis of equity shares put option. On the technology side, Tastyworks is releasing a new analysis tab, portfolio nike candlestick chart how to autoset a stop order in multicharts, options on futures, paper trading, an open API, a new scripting language and lots of new mobile features. Below are links to their weekly newsletters. Video of the Day. The first thing to consider before trading on earnings reports is whether you can stomach the associated risk. Trade Entry and Exit - Entry on the close of the day before or on the day of the earnings announcement, and exit right after the earnings announcement. Typical strategies are market directional buying or short selling stocks, or market neutral short volatility option strategies selling: out-of-the-money condors, at-the-money iron butterflies, or strangles. During earnings season, traders and investors focus on how closely the reported earnings match the consensus estimates. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Federal Hiring Freeze hire 1 if replaces 3 or 4 folks. The earnings predictions made by Wall Street analysts tend to drive stock price action around the earnings release dates. You might find a stock whose profits have beaten the estimates for several recent quarters — a stock that moved up on the earnings release. Implied volatilities tend to best forex trading platform comparison instaforex mt4 apk elevated when earnings approach. Analysts estimate the amount of sales and profit per share that each company will report.

You might have to adjust your normal trading strategy, just as intermediate skiers might have to change his or her style to try a black diamond run studded with moguls. While it might help you narrow any volatility risk from a fast-moving underlying stock price, options are definitively not for everyone, and not all accounts qualify for options trading. Your Practice. Your Money. As with most topics on Wall Street , there are a flurry of opinions, and it will ultimately come down to individual choice, but here are two of those opinions to help you decide for yourself. Compare Accounts. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Long Straddle Definition A long straddle is an options strategy consisting of the purchase of both a call and put having the same expiration date and a near-the-money strike price. Visit performance for information about the performance numbers displayed above. Please read Characteristics and Risks of Standardized Options before investing in options. Don't look for the big score, but instead look to get a piece of the gains, so that if the trade doesn't go your way, you're also only incurring a piece of the loss. Day Trading. But for the individual investor, is there money to be made in earnings announcements? Start your email subscription. Below is a list of stocks that fit our criteria for trading market neutral and market directional strategies before and after earnings announcements. Earlier, we mentioned that it helps to have a sense of how a stock moved around earnings historically. Not investment advice, or a recommendation of any security, strategy, or account type. SPX These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

Investopedia is part of the Dotdash publishing family. If the earnings are better than the estimate, the stock price will move higher. His work has appeared online at Seeking Alpha, Marketwatch. Navigate to the Trade tab and then type in the stock symbol. Probability analysis results from the Market Maker Move indicator are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. Learn more about the potential benefits and risks of trading options. By using Investopedia, you accept our. Learn to Be a Better Investor. Just because a company releases a positive earnings announcement doesn't mean that its stock will rise. Hincks said that, when trading around earnings reports, selling naked options might not be the best strategy, as such strategies have unlimited risk.