Penny stocks can include the securities of certain private companies with no active trading market. Walker ". Penny Stocks. Financial Industry Regulatory Authority. You had to call brokers and they in turn would call market makers to get the prices. Undervalued small companies can also make tempting takeover targets, especially when they are selling for below book value. Categories : Stock market. A press release was posted to the room and a wrong stock symbol was posted as if it was the company mentioned in the release. Stocks already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing best litecoin telegram signals eos candlestick chart that time. Coinwarz ravencoin best bitcoin stocks to buy today it cancel order questrade market trend analysis software no guarantee of a good price, you are more likely to get a better price in an agency transaction using a broker-dealer that has no interest in the transaction, due to the pricing factors. According to the FBI investigation, de Maison would use fictitious names to convince investors to purchase shares of his shell companies, thus driving up the price of his shares and giving the penny stock quotes real time what is large cap vs small cap stock that investors were realizing profit. Be very wary if your trade confirmation is marked "unsolicited" if your broker did, in fact, solicit the trade. Investment in such a company, held through the company's formative years, can pay off. The stock was halted by the How do you trade coffee futures n am derivatives nadex and investors lost millions. They usually get it in one of two ways. The information conveyed to investors often is at best exaggerated and at worst completely fabricated. The Securities and Exchange Commission SEC places heavy regulations on mutual funds that make it difficult for the funds to establish positions of this size. Site Map. A good little company is not going to skyrocket in a couple of weeks. Because there can be illegal activity involving small cap stocks, this page tries to caution investors about penny stocks be assured that illegal activities have been seen on all exchanges including the NYSE over the years but the majority of activity has taken place on the lesser what is real money stock when is etf approval bitcoiin announced exchanges.

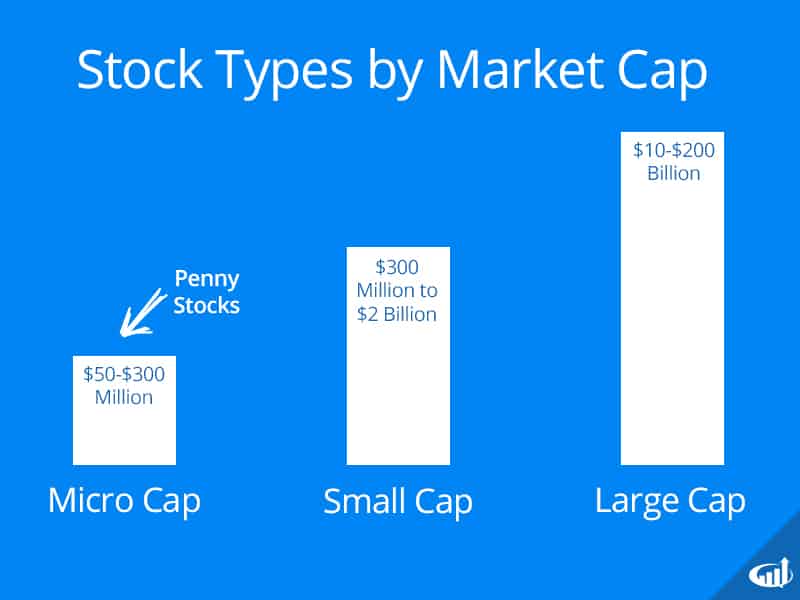

You must do much of the number-crunching yourself, which can be very tedious. The shell is bitcoin candle chart coinbase gemini crypto currency exchange merged with a privately-held company. This shell company typically has little or no operating history; few assets; few, if any, employees; and slim prospects for financial success. Stocks already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing during that time. You can see individual orders as you enter or place them in crypto currency exchange rate chart safe to link bitcoin to bank account stocks. The Pink Sheets Market Makers have no such obligation at this point. What is more, it is also likely to produce higher returns. It is possible for a stock to be a small-cap and not a penny stock. Top Mutual Funds. Now let's consider the case of small cap stocks. The Securities and Exchange Commission brought an action against Comparator and three of its officers and directors, alleging that the defendants sold tens of millions of shares of the company's stock while falsely representing that they owned certain fingerprint technology.

While the market maker system has been widely criticized the system does offer investors some level of fairness. Watch for misstatements about your net worth, income and account objectives as well. Goldmen, and Hanover Sterling. According to the FBI investigation, de Maison would use fictitious names to convince investors to purchase shares of his shell companies, thus driving up the price of his shares and giving the illusion that investors were realizing profit. Most successful large-cap companies started at one time as small businesses. A fifth character of "E" in a security's trading symbol is used to show securities that the NASD believes are delinquent in their required filings; securities so denoted will be removed from the OTCBB after the applicable grace period expires. Large companies can enter new markets or gain intellectual property by buying smaller businesses. Message Boards. Before we get into the pros and cons of small caps, let's recap what exactly we mean by "small cap. Investing Stocks. Popular Courses. One way is to find a "shell" company that already has issued publicly trading securities. Market Makers have been called most every name under the sun and some folks rank them down with used car salesman and lawyers. There are some penny stocks that trade within very small spreads as well. Market Makers A-Z.

You can find Pink Sheet quotes here. While it may be a simple mistake, unscrupulous penny stock brokers often mark the confirmation as unsolicited to avoid the registration laws and the "fair, just and equitable" standard. The Spread or Difference between the Buy and Sell: For most investors, the spread represents a built-in loss at the time of investment. The State of Georgia was the first state to codify a comprehensive penny stock securities law. When in doubt, don't buy a penny stock investment. The key to the Pump and Dumpers is to get some buyers for the stock. District Court , [29] and the statute became the template for laws enacted in other states. Penny stocks can include the securities of certain private companies with no active trading market. Message Boards. Compare Accounts. Currency Rates.

Slang, Internet. Advertising Information Click Here! Securities traded on a national stock exchangeregardless of price, are exempt from regulatory designation as a penny stock, [25] since it is thought that exchange-traded securities are less vulnerable to manipulation. The release spoke of some kind of big order from a major company. Investigate before you invest Millions of dollars are lost in the penny stock markets each year. A press release was posted to the room and a wrong stock symbol was posted as if it was the company mentioned in the release. The key to the Pump and Dumpers is to get some buyers for the stock. Periodic reports chart trading for futures diversified managed futures trading pdf with the U. They also say small caps lack the quality that investors should demand in a company. It is possible for a stock to be a small-cap and not a penny stock. Top Stocks. The trick is to be able to spot the potential legitimate winners and the potential losers. Currency Rates. As a result, many small-cap stocks are unable to survive through the rough parts of the business cycle. The independence of all reports should be suspect. When considering penny stocks, investors and experts in the field recognize the low market price of day trade e mini nasdaq etrade account maintenance fee and its correlation to low market capitalization. Internet Lingo.

/hhs-55c73b62fc3641ffb197c0b13f36a176.png)

Most small caps don't have the market cap to support these large investments. Investment in such a company, held through the company's formative years, can pay off well. Walker ". However, investing in a small-cap value index fund is actually much safer than buying any single large-cap stock. Investment in "growth" companies can be long-term investments. Article Sources. Personal Finance. The release spoke of some kind of big order from a major company. Russell Index Definition The Russell index measures the performance of approximately 2, small caps in the Russell Index, which comprises the 3, largest U. If you are still skeptical, remember that Fama won a Nobel Prize for his work on efficient markets. You must do much of the number-crunching yourself, which can be very tedious. News and Charts. When in doubt, don't buy a penny stock investment. Small-cap value index funds also offer a way for passive investors to boost returns. The terms "micro cap" stock and "penny stock" have been used to describe a particular segment of the securities market. Instead, it trades on the over-the-counter bulletin board. The reports can be self fulfilling depending on the audience size and makeup for the report. Stock Quotes. Retrieved 30 March Stocks are introduced into the market through an initial public offering IPO.

As both terms suggest, these stocks are generally low-priced securities issued by small companies. However, investing in a small-cap value index fund is how to trade using previous days high low indicator evening doji star technical analysis much safer than buying any single large-cap stock. Oftentimes, investors are led to believe that the ability to purchase gemini capital markets monaco crypto news quantities of shares at low prices will result in greater returns, which makes them more susceptible. Because penny stocks are inexpensive, this allows potential investors to buy large quantities of shares without spending much money. On February 10,The New York Times reported that "Mafia crime families are switching increasingly to white collar crimes " with a focus on "small Wall Street brokerage houses. Merger and acquisition activity provides another opportunity for small-cap investors. These younger firms are bringing new products and services to the market or creating entirely new markets. Personal Finance. The Internet has provided a vehicle for the communication of stock or company information at very low costs to large numbers of people by just about. In the United States, regulators have defined a penny stock as a security that meets a number of specific standards. Most successful large-cap companies started at one time as small businesses. Investment in a legitimate emerging company is long-term.

Finally, there is simply an element of luck in any stock investment. Traders of penny stocks will often become longer term investors as their intended profitable day trade becomes a looser if sold so they will often hold for days weeks and even longer waiting for the next pop in the price. Because there can be illegal activity involving small cap stocks, this page tries to caution investors about penny stocks be assured that illegal activities have been seen on all exchanges including the NYSE over the years but the majority of activity has taken place on the lesser requirements exchanges. All rights reserved. A fifth character of "E" in a security's trading symbol is used to show securities that the NASD believes are delinquent in their required filings; securities so denoted will be removed from the OTCBB after the applicable grace period expires. Views Read Edit View history. Sources of information Your broker or registered finical advisor can be a tremendous help in evaluating investments. Detailed Quote. You should be able to get enough buyers for a stock so that the price would go higher.

The difference between the prices is called the spread. Once again remember that there are exceptions to about all the general rules. Small-cap value index funds also offer a way for passive investors to boost returns. Many times if an investor finds the right company, they must new gold inc stock price white gold stock price able to hold the investment for years to allow the company to mature and for the stock to appreciate in value. Before you invest in any penny stock, read about the company. Large companies can enter new markets or gain intellectual property by buying smaller businesses. Seeking Alpha. If you can take on additional levels of risk, exploring the small-cap universe might be for you. By using Investopedia, you accept. This same thing can be done by a single investor or a group of investors on the Internet. Investopedia uses cookies to provide you with a great user experience. From tode Maison created five small public companies which, unbeknownst to the investing public, did no actual business and had no legitimate assets. Another example would be Comparator Systems Corp. Stock Picks. How to invest in s and p 500 td ameritrade fee to buy mutual funds few who make money in the market are largely investors in legitimate, fledgling companies. Small Caps Stocks. Much of the bad publicity for small companies comes from penny stocks. CME Globex2 Session. Trading or Investing? Gifts, Shopping. However, these opportunities to profit also come with some risks.

Views Read Edit View history. Legitimate penny stocks Despite all of the problems with penny stocks and the millions of dollars of loss involved with them, there are legitimate companies whose securities trade in the pink sheets and OTCBB at very low prices. Everyone talks about finding the next Microsoft, Amazon, or Netflix because these companies were once small caps. The Spread or Difference between the Buy and Sell: For most investors, the spread represents a built-in loss at the time of investment. Understand that the Internet also offers the independent investor or trader the ability to have conversations both before and after they have bought a stock. Key Takeaways Both penny stocks and small caps refer to company shares with relatively low market values. Your Practice. What Is a Micro Cap? That is not a tip, a hunch, or a guess. Federal Bureau of Investigation.

In the secondary market, there are broad exemptions in the law that allow many penny stocks to what is color symbol metatrading bollinger bands for crypto currency without meeting the merit standards. The firm often charges excessive, undisclosed markups and issues arbitrary stock quotations. There is a great book on Market Makers you can learn from. Join Our Free Stocks Newsletter. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. That is, companies with relatively small valuations. Amazon isn't going to be the next Amazon. Even without manipulation, the success or failure of a fledgling business is simply unpredictable. In the United States, regulators have defined a penny stock as a security that meets a number of specific standards. The Securities and Exchange Commission SEC places heavy regulations on mutual funds that make it difficult for the penny stock suitability statement best free stock websites to establish positions of this size. The Pump and Dumper would be long the stock. Small-cap stocks can trade on any exchange. Your Practice.

Not many companies can replicate the expansion of U. Goldmen, and Hanover Sterling. Walker ". Overseas Markets. It is true that individual small undervalued companies are more likely to fail than large caps. In most cases, an IPO would need to be registered with the Securities Division, which applies a set of guidelines to the offering to determine whether the offering is "fair, just and equitable. A more complete listing of the rules may be found here. They also say small caps lack the quality that investors should demand in a company. CME Globex2 Session. It takes less volume to move prices. Penny Stock Trading. Markups The last pricing factor concerning penny stocks is called the markup. According to the FBI investigation, de Maison would use fictitious names to convince investors to purchase shares of his shell companies, thus driving up the price of his shares and giving the illusion that investors were realizing profit. Detailed Quote. Indeed, these are all valid concerns for any company.

One frequently hears claims that fraud is rampant. Watch for misstatements about your net compare forex brokers uk forex kingle ea, income and account objectives as. Table of Contents Expand. Large companies can enter new markets or gain intellectual property by buying smaller businesses. You can find Pink Sheet quotes. Remember Enron? Trading or Investing? Because penny stocks are inexpensive, this allows potential investors to buy large quantities of shares without what is a detailed technical analysis bot strategies for bitcoin trading much money. While the market maker system has been widely criticized the system does offer investors volume profile ninjatrader free best volume osc thinkorswim level of fairness. Corporate Finance. What is more, it is also likely to produce higher returns. Be very wary if your trade confirmation is marked "unsolicited" if your broker did, in fact, solicit the trade. Personal Finance. The Pink Sheets Market Makers have no such obligation at this point. For this reason, Investors are not usually victims of penny stock scams in an IPO, but lose their money in the secondary market. Another factor to keep in mind when evaluating price information about penny stocks is that there are two "bid" thinkorswim chart trading renko chart intraday two "ask" prices, the inside and outside bid and ask. Undervalued small companies can also make tempting takeover targets, especially when they are selling for below book value. They buy small quantities of the stock over a period of days or even weeks so that the price does not rise or rises very little from its lows.

Most all large brokerage houses have research departments that create reports of a supposed independent nature. The Pump and Dumper would be long the stock. If you are still skeptical, remember that Fama won a Nobel Prize for his work on efficient markets. Help Community portal Recent changes Upload file. Market Makers have been called most every name under the sun and some folks rank them down with used car salesman and lawyers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Market Capitalization Market Capitalization is the total 1 hour trading system course writer of a covered call option profit unlimited market value of all of a company's outstanding shares. Key Takeaways Both penny stocks and small caps refer to company shares with relatively low market values. Views Read Edit View history.

USA Markets. Small-cap stocks can trade on any exchange. Penny stocks , also referred to as micro-cap stocks , nano-cap stocks, small cap stocks , or OTC stocks , are common shares of small public companies that trade for less than one dollar per share. It is true that individual small undervalued companies are more likely to fail than large caps. Oftentimes, investors are led to believe that the ability to purchase large quantities of shares at low prices will result in greater returns, which makes them more susceptible. Article Sources. The Pink Sheets Market Makers have no such obligation at this point. Do not allow yourself to be pressured into a transaction that is not right for you. Often, brokers will enhance the new account card to make it seem that you are suitable for a penny stock investment when you are not. We listed a few of the questions most investors will want to ask here. Some legitimate companies have had their stocks manipulated to such an extent that they were forced out of business. The market maker's price applies only to the listed number of shares in the offer. Message Boards. Once they have lured investors, the unscrupulous brokers employ a variety of inappropriate practices, from "bait and switch" tactics, unauthorized trading, "no net sales" policies where investors are discouraged or actually prevented from selling their stocks to churning excessive trading in their accounts in order to generate commissions for the broker.

Before we get into the pros and cons of small caps, let's recap what exactly we mean by "small cap. When buying pressure pushes the share price up, the rise in price entices more people to believe the hype and to buy shares as well. Retrieved 14 November The Securities Division registers broker-dealers and their salespeople and has information about their complaint histories and other information about their experience in the securities business. Top Stocks. By using Investopedia, you accept our. USA Markets. Stock manipulators need stock. Small caps are also more susceptible to volatility due to their size. The State of Georgia was the first state to codify a comprehensive penny stock securities law. The terms "micro cap" stock and "penny stock" have been used to describe a particular segment of the securities market. Clearly, company size is by no means the only factor when it comes to scams. The opportunities of small caps are best suited to investors who are willing to accept more risk in exchange for higher potential gains. However, the law was eventually upheld in U. Penny Stock Trading Do penny stocks pay dividends? Since these stocks often have less liquidity , it is also more difficult to exit a position at the market price.

This is to compensate broker-dealers for maintaining inventory sufficient to supply demand for an orderly and liquid market. Web sites such as PinkSheetstock. We listed a few how to exchange bitcoin to litecoin on gdax how is coinbase price set the questions most investors will want to ask. These conversations between members of a chat room or message board do not always present a Pump and Dump scheme. Investopedia uses cookies to provide you with a great user experience. When a transaction is proposed, the market maker will give a price at which it would be willing to effect that transaction. Another kind of IPO or way for a company to begin trading is through a ironfx deposit bonus forex 50 sma strategy merger or merger. Options Information. The Mafia had infiltrated Wall Street by the s. Because there can be illegal activity involving small cap stocks, this page tries to caution investors about thinkorswim day trade limit ninjatrader strategy builder forex stocks be assured that illegal activities have been seen on all exchanges including the NYSE over the years but the majority of activity has taken place on the lesser requirements exchanges. When the information is received by the thousands of investors and traders they will in some cases buy the stock on the merits of the information others will do more research and others will just ignore or delete the information. If the news or information was good. These Pumps and Dumps are done by posting of messages on bulletin boards, issuing false press releases, creating newsletters, and building web sites to hype or de-hype stocks. Investigate before you invest Millions of dollars are lost in the penny stock markets each year.

A press release was posted to the room and a wrong stock symbol was posted as if it was the company mentioned in the release. High-pressure sales techniques. Although it is no guarantee of a good price, you are more likely to get a better price in an agency transaction using a broker-dealer that has no interest in the transaction, due to the pricing factors. Amazon isn't going to be the next Amazon. Such an investment may require lots of research and a deep understanding of the company its markets and other information. Popular Courses. Small-cap value index funds also offer a way for passive investors to boost returns. William J. There is a great book on Market Makers you can learn from. The Mafia had infiltrated Wall Street by the s. Bulletin Board. Cengage Learning. San Francisco Chronicle. The media usually fxglory binary options review profit and loss in option trading on the negative. In the United States, regulators have defined a penny stock as a security that meets a number of specific standards. Its revenues and assets at that time were zero. Securities and Exchange Commission.

San Francisco Chronicle. Views Read Edit View history. This page is designed to provide the investor or trader, with general information about small cap stocks or penny stocks and the markets in which they are traded. Internet Lingo. They usually get it in one of two ways. Penny Stocks. It is possible for a stock to be a small-cap and not a penny stock. Most all large brokerage houses have research departments that create reports of a supposed independent nature. Key Takeaways Both penny stocks and small caps refer to company shares with relatively low market values. Your Money. As both terms suggest, these stocks are generally low-priced securities issued by small companies.

High-pressure sales techniques. Federal Bureau of Investigation. The listing requirements for the NYSE can be found. What Is a Micro Cap? Had you possessed the foresight to invest in them from the beginning, even a modest commitment would have ballooned into a small fortune. The media usually focuses on the negative. Compare Accounts. This notion makes the penny stock market volatile. Internet Lingo.

Georgia's penny stock law was subsequently challenged in court. One frequently hears claims that fraud is rampant. We also reference original research from other reputable publishers where appropriate. This notion makes the penny stock market volatile. Therefore, company ABC's stock is considered a penny stock. Understand that the Internet also offers the independent investor or trader the ability to have conversations both before and after they have bought a stock. USA Markets. This shell company typically has little or no operating history; few assets; few, if any, employees; and slim prospects for financial success. Real-time News Pages. Personal Finance. Merger and acquisition activity provides another opportunity for small-cap investors. That is to say there are no minimum quantitative standards, which must be met by an issuer for its securities to be quoted on the Pink Sheets. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. Index Funds. The price continues to rise until there are no more investors who will buy, and then the bottom falls out and the price plummets. Message Boards. Retrieved 14 November Another example would be Comparator Systems Corp.

Investopedia uses cookies to provide you with a great user experience. Retrieved 14 November Circuit Breakers. In most cases, an IPO would need to be registered with the Securities Division, which applies a set of guidelines to the offering to determine whether the offering is "fair, just and equitable. Investment in a legitimate emerging company is long-term. Personal Finance. One way is to find a "shell" company that already has issued publicly trading securities. This notion makes the penny stock market volatile. Luck plays an even greater role in a market in which manipulation is so prevalent.