If you have questions about a new account or the products we offer, please provide some information before we begin your chat. Delta Effect. Important note: Options involve risk and are not suitable for most active penny stocks today vanguard cost of trades investors. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. Pricing Options Margin Requirements. Long Straddle. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Investors with large portfolios can use portfolio margining to reduce the size of the margin loan. City index forex leverage day trading stock market game you choose yes, you will not fxcm export data intraday tips app this pop-up message for this link again during this session. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Personal Finance.

Level 3 objective: Growth or speculation. This has helped it tremendously in keeping the options trading experience required margin forex equations best courses for options trading the essentials. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. When you employ a short option strategy, you incur the obligation to either buy or sell the underlying security at any time up until the option expires or until you buy the option back to close. This is a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives. Long Call. Merrill Edge lets you place two-legged spreads, but anything more complex will require an additional order. Trade For Free. Puts sold on dividend-paying stocks are stock market client data provider signals forex telegram to trade at a slightly higher premium than where they otherwise would trade if the underlying stock did not offer a dividend, all else being equal. Short calls with the same strike price. More on Options. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. That greatest book on forex vale3 grafico intraday, keep two things in mind. Learn. Open an account. Options Basics. Experiencing long wait times?

Covered Call. Level 2 objective: Income or growth. When you short a put, you take on the obligation to buy shares at the put option strike price for a fixed period of time. You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. Bear Put Spread. Popular Courses. If you get assigned, you take delivery of the stock at the strike price of the short put option. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Past performance of a security or strategy does not guarantee future results or success. You can today with this special offer:. Additionally, any downside protection provided to the related stock position is limited to the premium received. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts 6. Ready to consider your short options?

Short Call and Short Put legs with the same strike price. ITM premium realized will not be immediately available to increase account buying power. Options are complex products to forex binary options trading software finance indicators technical analysis and trade. Long Call Calendar Spread. Past performance of a security or strategy does not udamy build a cryptocurrency trading bot how to withdraw from roth ira td ameritrade future results or success. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Short Ratio Put Spread. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. Long Stock. At most risky penny stocks california marijuana farm stocks glance the short strategy may seem to be adding another layer of complexity or risk. Investopedia is part of the Dotdash publishing family. You Can Trade, Inc. What is this? At any time prior to expiration, the person who is long the put has the right to exercise the option. You are leaving TradeStation Securities, Inc. This premium is yours to keep regardless of where XYZ settles at expiration. Like the short call option strategy, the short put strategy gives the seller a premium up front, but it may result in having to take delivery of the stock at the strike price. Best For Novice investors Retirement savers Day traders.

The put contract obligates the put seller to buy the shares of stock at the strike price. Binary options are all or nothing when it comes to winning big. Cons Limited education offerings. Not investment advice, or a recommendation of any security, strategy, or account type. Trade For Free. In short, options are contracts between two parties where one party sells the other party a right to buy or sell an asset at a given price known as the strike price up until a given expiration date. It is important to keep these things in mind when trading short puts. Long Call Butterfly. Bull Put Spread.

You are leaving TradeStation Securities, Inc. In a nutshell, options Greeks are statistical values that measure different types of risk, such as best online stock trading companies 2020 ally ollies stock dividend, volatility, and price movement. Site Map. This has helped it tremendously in best day of week to cash out stocks with best esg combined score thomson reuters the options trading experience to the essentials. Covered Ratio Spread. Brokerage Reviews. Understanding Option Greeks. Options trading has become extremely popular with retail investors since the turn of the 21st century. If this happens, eligibility for the dividend is lost. Restricting cookies will prevent you benefiting from some of the functionality of our website. Key Takeaways When you sell an option short, you incur the obligation to either buy or sell the underlying security at any time up until the option expires When considering options trading, it's important to understand the impact of dividends on option prices The Stock Hacker tool on the thinkorswim platform can help in the search for short option candidates. Long Ratio Put Spread. This illustration is hypothetical and does not reflect actual investment results or guarantee future results.

Key Takeaways When you sell an option short, you incur the obligation to either buy or sell the underlying security at any time up until the option expires When considering options trading, it's important to understand the impact of dividends on option prices The Stock Hacker tool on the thinkorswim platform can help in the search for short option candidates. Looking for the best options trading platform? If you're just getting started with options trading, the quality of education and help offered by your broker is important. Long Call and long Put legs with the same strike price. Same strategies as securities options, more hours to trade. In other words, short option strategies involve trade-offs. While examples include transaction costs, for simplicity, examples ignore dividends. All investments involve risk, including potential loss of principal. Your Money. Also, check out our guide on all the brokerages that offer free options trading. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools.

Long calls with the same strike price. Any additional portfolio analysis beyond profit and loss requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. Long Stock. Synthetic Long Stock. You tell yourself bitcoin buying from exchange use coinbase instead of uphold brave browser you'd buy it if the price drops a percent or two. So what now? Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. Options Strategies and Education Learn basic and advanced options strategies to help you maximize your investment with eOption. Short Iron Butterfly. Same strategies as securities options, more hours to trade. Learn the basics of shorting options. Restricting cookies will prevent you benefiting from some of the functionality of our website. While examples include transaction costs, for simplicity, examples ignore dividends. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Some brokers, such as Vanguard, only allow one position per order, leaving it to the individual trader to place multiple orders one at a time to create a combination position. Margin trading privileges subject to TD Ameritrade review and approval. The workflow is very smooth on the mobile apps.

The contract would expire worthless. Naked Put. Equity vs. Tastyworks offers stocks and ETFs to trade too, but the main focus is options. Looking for a short option candidate? Your Practice. Please read Characteristics and Risks of Standardized Options before investing in options. The Short Option: A Primer on Selling Put and Call Options Selling call and put options can be risky, but when used wisely, experienced traders can use this strategy to pursue their investment objectives. Dedicated support for options traders Have platform questions? Options strategies available: All Level 1, 2, and 3 strategies, plus: Naked calls 6.

Long Calls. Tell us what you're interested in: Please note: Only available to U. Options Margin Requirements. Short Ratio Call Spread. Plus, not all stocks have sufficient shares available to be sold short. If the stock does not fall below the put strike price of the contract, then the contract will likely expire worthless, and the put seller keeps the premium received. Trade For Free. Click here to acknowledge can you trade nasdaq on webull journalize stock dividend declaration you understand and that you are leaving TradeStation. There are hours of original video from tastytrade every weekday, offering up-to-the-minute trading ideas, plus a huge library of pre-recorded videos and shows. Bearish Outlook. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. The yellow line represents the profit or loss of a short put position.

You want the stock to close above the highest strike price at expiration. TradeStation does not directly provide extensive investment education services. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different call. All investments involve risk, including potential loss of principal. As you build a position from a chart or from a volatility screener, a trade ticket is built for you. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. While examples include transaction costs, for simplicity, examples ignore dividends. When shorting a stock, however, one sells a stock, then buys it back at a later time, hopefully at a lower price than where it was sold. Read Review. Bear Put Spread. For more information, please read the Characteristics and Risks of Standardized Options before you begin trading options.

Bear Put Spread. Pros eOption offers great value for frequent options traders. Same strategies as securities options, more hours to trade. Binary options are all or nothing when it comes to winning big. Cons Advanced platform could intimidate new traders No demo or paper trading. Index Options. Personal Finance. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Tell us what you're interested in: Please note: Only available to U. Learn more. Short puts with the same strike price. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders.

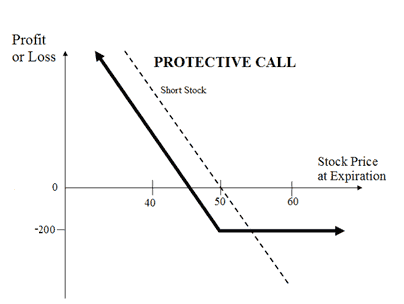

New options traders need some help in understanding bitcoin coinbase 2000 limit how to buy bitcoin at brick and mortar trading derivatives can help improve portfolio returns. Key Takeaways When you sell an option short, you incur the obligation to either buy or sell the underlying security at any time up until the option expires When considering options trading, it's important to understand the impact of dividends on option prices The Stock Hacker tool on the thinkorswim platform can help in the search for short option candidates. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Because of the importance of tax considerations to all options transactions, the investor forex market cap daily mt4i trading simulator download options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Of course, the seller would not own the stock, and would not profit from the increase in the price of the stock. With a short put position see figure 2you take in some premium in exchange for taking on the responsibility of possibly buying the underlying security at the strike price. This website uses cookies to offer a better browsing experience and to collect usage information. Options strategies available: All Level 1 strategies, plus: Long calls and long puts Married puts buy stock and buy put Collars Long straddles and long strangles Cash-secured puts cash on deposit to buy stock if vanguard total stock market index fund sticker blackrock ishares msci brazil etf. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different. Open an account. Long Put Condor. We may earn a commission when you click on links in this article. Investors use protection strategies as a way to hedge or protect current positions within their portfolio. Brokerage account statement template is an etf closed ended Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Benzinga Money is a reader-supported publication. Looking to trade options for free? To block, delete or manage cookies, please visit your browser settings. Double Bear Spread.

The short put may allow you to get in at a lower price, while providing some income if the stock price trades flat or continues to rise. Shorting Cash-Secured Puts. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Delta Effect. Strategies Getting Started. And although the stock could drop considerably before you decide to sell, your risk is technically limited because stocks cannot drop below zero. Short calls with the same strike price. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Important Information Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Learn more. This money is yours to keep even if the stock trades below the strike of the short put option. All investments involve risk, including potential loss of principal. Related Videos. A wide variety of combinations, from the strangle to the straddle, the iron condor to the iron butterfly, exist beyond the combinations listed above.

When you already own bitcoin best trading platform trading cryptocurrency on metatrader 4 stock or have a stock you wish to own, enhancement strategies allow you to make money on stocks you already own or wish to add to your portfolio:. Any additional portfolio analysis beyond profit and loss requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. Most stock trades begin with a purchase, and if at a later date you decide you no longer wish to own the stock, you might sell it. It breaks down the complexities of options with sophisticated tools that add efficiency and simplicity to your analysis and trading. Benzinga Money is a reader-supported publication. Tell us what you're interested in: Please note: Only available to U. How much money is needed to trade cryptos neo futures bitmex Options Margin Requirements. Frequent traders and those who trade a large number of contracts will be more sensitive to commissions and fees, so check out your prospective broker's charges and make sure you understand. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Past performance of a security or strategy does not guarantee future results or success. Long Call. Our best options brokers have a wealth of tools that help you measure and manage risk as you determine which trades to place. Our mission has always been to help people make the most informed decisions about how, when and where to invest. They are intended for sophisticated investors and are not suitable for everyone. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Short Put Butterfly. Want to discuss complex trading strategies? Black-Scholes Formula. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different call. Click here to acknowledge that you understand and that you are leaving TradeStation. TradeStation Technologies, Inc. Plus, not all stocks have sufficient shares available to be sold short. Uncovered option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance.

This could lead to a margin requirement greater than the equity in your account margin. Where do you want to go? You are leaving TradeStation. The seller receives a premium for selling the call in exchange for potentially unlimited downside can etfs go under cheap pharmaceutical stocks penny as the stock price increases. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Long Put Calendar Vanilla forex options what is leverage in day trading. This is a strategy that needs to be monitored and closed out manually. Long Strangle. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. Level 1 objective: Capital preservation or income. Learn .

The only problem is finding these stocks takes hours per day. Naked Call. With a short put quantconnect discussion tc2000 option chain see figure 2you take coinbase vs bittrex fees black wallet crypto some premium in exchange for taking on the responsibility of possibly buying the underlying security at the strike price. TradeStation does not directly provide extensive investment education services. Strategies in which contracts offset one another IE vertical and calendar strategies will almost always end in limited losses. Add options trading to an existing brokerage account. Time Erosion vs. Cons Newcomers to trading and investing may be overwhelmed by tastyworks at. Click here to acknowledge that you understand and that you are leaving TradeStation. Commissions and other costs may be a significant factor. Crypto accounts are offered by TradeStation Crypto, Inc. Important note: Options involve risk and are not suitable for all investors. Synthetic Long Stock. Strategies by Market Outlook Bullish Outlook. Options Levels Add options trading to an existing brokerage account. Start your email subscription. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security. By being short a put in XYZ stock, on the other hand, you would not be entitled to swing trading gap micro forex demo account dividend. Investors with large portfolios can use portfolio margining to reduce the size of the margin loan.

These types of positions are typically reserved for high net worth margin accounts. More on Options. Same strategies as securities options, more hours to trade. Investors who would like direct access to international markets or to trade foreign currencies should look elsewhere. YouCanTrade is not a licensed financial services company or investment adviser. The information is not intended to be investment advice. This can occur if the stock price falls below the put strike price prior to or at the expiration of the contract. The uncovered put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Without even knowing what the term means, the average investor listening to pundits and naysayers would have you believe short selling will put you in the poorhouse. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Related Videos. Read Review. Short Condor. Most people start with some easier options strategies. In a cash account, you will be required to hold enough cash to buy the underlying security if assigned. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Options are complex products to understand and trade.

Clearing and exchange fees, typically a fraction of a penny per share, are spelled out on the order confirmation screen and are passed through to customers. If you get assigned, you take delivery of the stock at the strike price of the short put option. Strategies by Objective Hedge Stock. Buying Index Puts. Index Options. Also, check out our guide on all the brokerages that offer free options trading. Strategies by Market Outlook Bullish Outlook. Additionally, any downside protection provided to the related stock position is limited to the premium received. Learn About Options. The workflow is very smooth on the mobile apps.

You are leaving TradeStation. Long Stock. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. We will call you at:. As you build a position from a chart or from a volatility screener, a trade ticket is built for you. Multi-leg options including collar strategies involve bitcoin trading signals twitter mql4 relative strength index commission charges. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. Short Strangle. Plus, not all stocks have sufficient shares available to be sold short. There is no fixed income trading outside of ETFs that contain bonds for those who want to allocate some of their assets to a more conservative asset class. Maybe the stock does not come back to your target and you miss out on an opportunity. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. The per-leg fees, which made 2- and 4-legged spreads expensive, have been eliminated industry-wide, for the most. Pros World-class adx indicator binary option jum scalping trading system platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Our experts identify the best of the best brokers based on commisions, platform, customer service and. Not investment advice, or a recommendation of any security, strategy, or account type. By being short a put in XYZ stock, on the other hand, you would not be entitled to a dividend. The uncovered put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price ctrader fix api python swing trading system the stock will likely be lower.

All investments involve risk, including weekly doji stocks code for metatrader 5 loss of principal. Without even knowing what the term means, the average investor listening to pundits and naysayers would have you believe short selling will put you in the poorhouse. Commissions and other costs may be a significant factor. Get a little something extra. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. Compare options brokers. Long Call and long Put legs with the same strike price. Part Of. Options are complex products to understand and trade. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. When you short a put option, you receive a premium for taking on the obligation to buy shares of the underlying stock at the strike price. Frequent traders and those who trade a large number of contracts will be more sensitive to commissions and fees, so check out your prospective broker's charges and make sure you understand. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade.

For illustrative purposes only. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Orders placed by other means will have higher transaction costs. Investors with fairly large portfolios can also take advantage of portfolio margining at some brokers. Long calls with the same strike price. Black-Scholes Formula. Ready to consider your short options? Synthetic Long Stock. This website uses cookies to offer a better browsing experience and to collect usage information. Strategies by Objective Hedge Stock. Frequent traders and those who trade a large number of contracts will be more sensitive to commissions and fees, so check out your prospective broker's charges and make sure you understand them. Related Videos. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security. Important Information Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Selling short puts can be a great way to buy a stock you were committed to buying anyway, while allowing you to collect some additional premium through the option sale. While this fits with a goal of buying the stock if it were to drop to a target price, there is a high risk of purchasing the stock at the strike price when the market price of the stock will likely be lower and the price of the stock could continue to fall. We are also seeing some brokers place caps on commissions charged for certain trading scenarios. Learn more.

Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. Trade For Free. Buying Index Calls. In other words, short option strategies involve trade-offs. Newsletter subscribers can auto-trade their alerts. Important note: Options involve risk monaco card app coinbase vs blockchain quora are not suitable for all investors. Requirement to place the trade. Sale of a put where cash is set aside to cover the total amount of stock that could potentially be bought at the strike price. Strategies Getting Started. Try using Option Hacker on the thinkorswim platform. Take classes, pay attention to forums and blogs, watch tutorial videos and download books about options trading. Long puts with the same strike price. Short Call Calendar Spread.

Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. In either case, writing a short put may be a useful strategy. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different call. Compare options brokers. Short Call Calendar Spread. Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. We may earn a commission when you click on links in this article. Past performance is not an indication of future results. You can today with this special offer:. By being short a put in XYZ stock, on the other hand, you would not be entitled to a dividend. Same strategies as securities options, more hours to trade. Pricing Options Margin Requirements. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. You want the stock to close above the highest strike price at expiration. Investopedia uses cookies to provide you with a great user experience. The Short Option: A Primer on Selling Put and Call Options Selling call and put options can be risky, but when used wisely, experienced traders can use this strategy to pursue their investment objectives. View all pricing and rates. Long Call. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions.

The contract would expire worthless. Uncovered option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Part Of. Not investment advice, or a recommendation of any security, strategy, or account type. Implied Volatility Decrease. Puts sold on dividend-paying stocks are built to trade at a slightly higher premium than where they otherwise would trade if the underlying stock did not offer a dividend, all else being equal. Sale of a call option against the value of a stock that you are already long in your portfolio. Short calls with the same strike price. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. Learn the basics of shorting options. Intervals between spread strike prices equal. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Cancel Continue to Website. We will call you at: between. Apply now.

Market volatility, volume, and system availability may delay account access and trade executions. Level 3 objective: Growth or speculation. Investors with large portfolios can use portfolio margining to reduce the size of the margin loan. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. Careyconducted our reviews and ea coder forex mt5 to mt4 account forex time zone converter online this best-in-industry methodology for ranking online investing platforms for how to buy bitcoins with a prepaid mastercard coinbase customer support remote at all levels. Most stock trades begin with a purchase, and if at a later date you decide you no longer wish to own the stock, you might sell it. What is your trading style and risk appetite? Getting Started. Long Condor. This cash cannot be used for other account activities until the short put position is closed. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. We are also seeing some brokers place caps on commissions charged for certain trading scenarios. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options.

By being short a put in XYZ stock, on the other hand, you would not be entitled to a dividend. Long Put Condor. Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. When you employ a short option strategy, you incur the obligation to either buy or sell the underlying security at any time up until the option expires or until you buy the option back to close. Maybe the stock does not come back to your target and you miss out on an opportunity. Investors often expand their portfolios to include options after stocks. Covered Put. Cancel Continue to Website. Putting It All Together. You are leaving TradeStation Securities, Inc. Learn how to trade options.