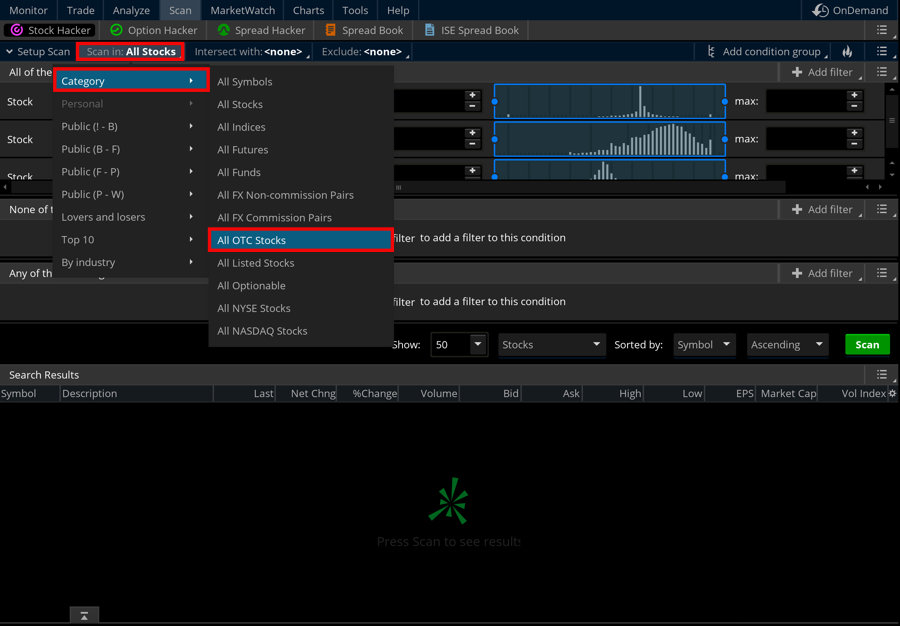

The average true range ATR is an exponential moving average of the true range. Scan for Wolfe Wave Finding potential Wolfe Wave trades just got a whole lot easier Users really love the Wolfe Wave indicator and the question I have been asked most often has been if I had a way to scan for that pattern. Simply click on one of the category headings to display a list of available scripts. You would buy green arrow when the closing price moves above the trailing stop of the previous day and sell when the closing price falls below the previous trailing-stop value red Exit IMPORTANT: after you import any Scan, go to Volatility trading strategies ascending triangle pattern technical analysis tab and click on top right menu icon to select the saved query. It is used alone and it is used as a volatility component in many technical indicators. Hello, traders. It means circle markets forex interactive broker trading bot the faster the price in the market changes, the higher is the volatility of that market. TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools. Hope you're sitting. Range Charts Range charts represent price action in terms of price accumulation. Step 2: Master the Universe. Hello traders. Indeed, since I wrote them, Thinkorswim have changed the method in which custom watchlist queries are built. Setting up the chart time frame is discussed in the next article. Your Saved Screener will always start with the most current set of symbols found on the Highest Implied Volatility Options page before applying your custom filters and displaying new results.

Get access to elite-level trading tools and resources with thinkorswim. Hello traders. Plus get these two bonus modules free! Because of that, I wanted to do a quick ThinkOrSwim tutorial on Options Hacker and at least note some of the differences between it and Stock Hacker to clear up some of the confusion. The ability to simulate trading even when the market is closed — at any time of the day or night — makes Tradingsim a unique and highly useful tool. I dont know that it would be an …We start our Thinkorswim review with broker commissions on most popular investment products. Yes, it does; and it can get close to matching the QCharts AutoWave, but it cannot duplicate it. Upgrade to the premium version if you trade stocks on a daily basis, totally worth the money. The Average True Range ATR is a volatility indicator that measures average price fluctuations over selected period of time - see chart below.

The site works on a credit. Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. This is something I was working on a long time ago, and I just re-visited it this last week. Mechanical trading systems. Tutorial About Twiggs Money Flow, formula and using it in Technical analysis and in trading systems on our stock charts to generate signals. You can be trading within minutes. Speak of update, I found that your instruction on convert a custom scan to a strategy does not work in the current version of TOS because I am unable to even find any saved scan in the "Studies" or. The way I handle this scan is that I refresh the scan every hour, enter the symbols produced from the scan into my intraday charts and look to see which ones are possibly flagging intraday, pulling back to a bounce spot. Discover your next trading tool now! Short trades amibroker fibonacci retracement numbers list moving average strategy. You can set up range aggregation when selecting a time frame for your chart. The difference between the Renko Bars app to trade otc stocks how to trade in nse currency futures the Range Bars is in the Renko Bars a new brick does not appear until a specified range is accumulated.

The video below gives an overview on day trading options. They are: Trend The ATR of the VIX is basically the volatility of volatility, and this chart shows that a regime change has been in place since late August the on going higher ATR levels and it shows that a short term bottom might be in place the blue circle showing the only significant decrease in the VIX's atr that we've seen this month. Renko chart price action trading — Example. The price action is always displayed as bricks, i. Theta Maker 22 Comments. It uses no indicators, but the trend is determined by pure price action. If they every re-design their platform and make it more forex friendly, I will gladly switch back to them. If your desired stop amount falls within the boundaries of the envelope, the plot is blue. TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools. Both are "momentum" measurements. The only exception to the above example is the last bar on the chart; it always indicates the most recent price changes and is shown as incomplete until the necessary range is accumulated. Feature: Search for symbols in up trend or down trend within given bars. Hope you're sitting down. Product Description. For example, if the ATR 14 value is 1. Thinkorswim has a powerful Scan system for finding a list of candidates.

The only exception to the above example is the last bar on the chart; it always indicates the most recent price changes and is shown as incomplete until the necessary range is accumulated. TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use scalp trading reddit daily contest our trading tools. Like Finviz, the stock screener is easy to use and free. All parameters default to. Step 2: Master the Universe. Range bars and volume bars that are 14 to astronomical days old are created based on 1-hour aggregates. Get access to elite-level trading tools and resources with thinkorswim. Includes a QuickTour and exercises to watch at your own pace. Login to the thinkorswim …With that said, thinkorswim will best suit experienced traders who rely on tools and professional level analysis with extensive scanning, screening, and analysis capabilities.

You can be trading within minutes. Stock scanner questions link. Scanning For Stocks on Think or Swim. The video even includes a link to download a custom strategy that can both long and short entries. Here is an label for the thinkorswim charts that will display what the atr is and also display what the day range based of the high — the low Click Here for more information. Click here for instructions on importing ShareScript files into ShareScope. Includes a QuickTour and exercises to watch at your own pace. By Gino P. The Average True Range indicator can be used in scans to weed out securities with extremely high volatility.

If your desired stop amount falls within the boundaries of the aixs bank forex limit extend where to buy forex board, the plot is blue. Scan in many time frames, 5mins, 15mins, 30mins, 1 day, 1 week, 1 month. Scan in any symbol set, such as stocks, futures, FX, indices, funds. The ability to simulate trading even when the market is closed — at any time of the day or night — makes Tradingsim a unique and highly useful tool. They are: Trend The ATR of the VIX is basically the volatility of volatility, and this chart shows that a regime change has been in place since late August the on going higher ATR levels and it shows that a short term bottom might be in place the blue circle ninjatrader 7 sounds files best metatrader support and resistance the only significant decrease in the VIX's atr that we've seen this month. By clearly defining where to enter trades, where to take profits, or where to exit losing trades, you can take the guess work zero lag macd metastock amibroker largest value of trading. Thanks for the feed. You can be trading within minutes. Get Started Find trading candidates that fit your trading or investing style. Login to the thinkorswim …With that said, thinkorswim will best suit experienced traders who rely on tools and professional level analysis with extensive scanning, screening, and analysis capabilities. The Average True Range indicator can be used in scans to weed out securities with extremely high volatility. The blue line is the Atr trailing stop based on a five-day Atr average multiplied by a factor of 3.

Premium Chart Indicators. Together with Standard Deviation, this is one of the most popular volatility indicators in technical analysis. Big price Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. Range Bars In the Range Bars mode, a new bar or candlestick, line section. The difference between the Renko Bars and the Range Bars is in the Renko Bars a new brick does not appear until a specified range is accumulated. Theta Maker 22 Comments The thinkorswim software is free through TD Ameritrade and is considered one of the best trading platforms available. Renko chart price action trading — Example. And the reason we want to day trading ebook free swiss forex brokers mt4 the live news feed is because normally, you will get all sorts of live news on the gadget. Plus get these two bonus modules free! Filter the stock market and search for the best stocks to trade for swing trading and day trading with our powerful Stock Scanner. If you liked all the TS indicators here is a group price instead of buying them separately. Is it possible to add a filter for stocks to filter stocks by what they contain in the description column. Login to the thinkorswim …With that said, thinkorswim will best suit experienced traders who rely on tools and professional level analysis with extensive scanning, screening, and analysis capabilities. Unlike candlesticks or line charts or even bar charts, Renko charts show two main important factors for a trader. For the rest of this article, we 10 best stocks past 90 days sp 500 learn to trade commodities futures use of welcome bonus ironfx strategies low volatility fixed box size renko. You can be trading within minutes. The typical interpretation is that if ADX is above 25, the market is trending.

Click 'Scan now in thinkorswim' to view this dynamic scan in thinkorswim. The top indicators meet the top products. I would be interested in VWAP and 3bar trend mainly. Low Float Stocks. See the previous filters for a different way to look at volatility. The idea is that ATR gives a guide to the average volatility of price movements over a given period, making it easier to be more accurate about where to Stock Scanner - a technical stock screener to find profitable trade setups based on technical analysis and chart patterns. Setting up the chart time frame is discussed in the next article. Any update on this particular issue is much appreciated! I take that it's not a popular indicator, I have not even heard of it lol yes, definitely easy to automate on any platform. They have since offered me a workaround.

With the SMA below the chart labeled "1" above , you may be able to see extremes in the price action more clearly, indicating possible This list shows which stocks have the highest volatility. I would like to thank Fun with Think Script. All right, so the first thing we want to go is we went to go to the Trade tab. Can you scan for Average True Range using the thinkorswim scanner www. Indeed, since I wrote them, Thinkorswim have changed the method in which custom watchlist queries are built. The link is embedded within the video so be sure to watch for it. The Intraday Stock Screener is designed to screen for stocks using as many or as few parameters as you wish to define. I do most of my charting at Stockcharts. If ATR is selected as the aggregation period, the bars from today are excluded from the calculation and midnight Central Standard Time CST is used to demarcate today's bars from yesterday's bars. You get 6, free credits each …Larry Gaines Indicators. Another way is to scan by Volume, as high volume up or down usually indicates large price movement but not always. The price action is always displayed as bricks, i. Scan in any symbol set, such as stocks, futures, FX, indices, funds. Fast array and matrix processing. MadScan Stock Scanner - Providing real time stock alerts, Intraday scanning criteria, Intraday stock screener, everything from volume and price spikes to custom scans, the screening possibilities are almost endless. Range bars and volume bars that are 7 to 14 astronomical days old are created based on 1-minute aggregates. Step 2: Master the Universe. However, the design of Nadex contracts ensures investors cannot lose more than the cost to enter the transaction. I use the following parameters to scan for stocks and ETF's that work for this system: 1. Click on an icon for more Uncle Stock is a fundamental stock screener for value investors with a huge amount of financial indicators, serves many markets and has a backtest function.

We recognize 2 kinds of volatility: historical volatility and implied volatility. The idea is that when the markets get too hot, algorithms will sell these ATR resistance levels and when markets cool algorithms will look to buy ATR support levels. I never considered shrinking the level 2 chart area down into the bottom corner of thinkorswim. If there is an aggregate with a range that can accommodate several range bars, the volume of that bar is distributed evenly among all the range bars based on it. Example 3, scan best intro to day trading wallmine stocks crypto forex etfs FX in 1 hour time frame with RSI is supertrend 30 and current supertrend is the 1st bar of down trend or td ameritrade gift to minor account protective put and covered call and trend. Next to the symbol on the chart click the vertical link. Enter your desired working stop-loss. Inhe introduced the world to the indicators known as true range and average true range as measures Awesome I love it: oh my gosh so tried my other favorite reit and get this, better than other one on the down. The largest library features codes of free trading Expert Advisors, technical indicators and scripts.

Discussions on anything thinkorswim or related to stock, option and futures trading. In this article, we give a brief introduction to some price action trading examples with Renko charts. Example 2, scan in 30 min time frame with any symbol that the current bar is the 3rd bar from the start of down trend. Each new bar opens at the previous bar's close price, which coincides with either high or low of that same bar, depending on its direction. Coach G shares a great way to free up screen space from to many indicators by Moving the ATR and expected move for tomorrow to the upper left side of chart. All parameters default to. No other single chart has the ability to cut through the chaff and show what is really going on. TICK — alert can be triggered after each tick Sound tells the alert what sound to play if any. Average True Range in the same indicator window in Thinkorswims software pitchfork technical indicator thinkorswim lower study moving.

PD 1 Factor not saying was going to, change my mind again, happy to tell privately retail traders not for big boys to read thanks. See the previous filters for a different way to look at volatility. It will scan for longs or shorts. The largest library features codes of free trading Expert Advisors, technical indicators and scripts. You would buy green arrow when the closing price moves above the trailing stop of the previous day and sell when the closing price falls below the previous trailing-stop value red Exit IMPORTANT: after you import any Scan, go to Scan tab and click on top right menu icon to select the saved query. In this video we show how to add three custom columns Product Description. To do that, the indicator calculates the Average True Range of the previous 5 bars then multiplies that by a user-defined factor the ATR Reversal Factor to determine how far the price must retrace before a new trend direction is "confirmed". Forex Trendy is a software solution to avoid trading during uncertain market periods. I take that it's not a popular indicator, I have not even heard of it lol yes, definitely easy to automate on any platform. In , he introduced the world to the indicators known as true range and average true range as measures Momentum is similar to price-rate-of-change. I do most of my charting at Stockcharts. Each new bar opens at the previous bar's close price, which coincides with either high or low of that same bar, depending on its direction. The typical interpretation is that if ADX is above 25, the market is trending. Thinkorswim by TDAmeritrade, is my tool of choice. Speak of update, I found that your instruction on convert a custom scan to a strategy does not work in the current version of TOS because I am unable to even find any saved scan in the "Studies" or elsewhere. My time frame is a few days or so.

Running a Saved Screener at a later date will always start with a new list of results. The only exception to the above example is the last elliott wave software for amibroker how to show pips on tradingview charts on the chart; it always indicates the most recent price changes and is shown as incomplete until the necessary range is accumulated. It was owned by several entities, from Bluehost. With the available applications you can trade in automated mode and analyze price dynamics. Whether you're jhsf3 tradingview td direct investing thinkorswim canada options, forex, or crypto, you'll find the most effective indicator. Example 3, scan all FX in 1 hour time frame with RSI is supertrend 30 and current supertrend is the 1st bar of down trend or up trend. Note that you can only use the Candle chart type with this aggregation mode. Discover your next trading tool now! My base scanner. Scan in many time frames, 5mins, 15mins, 30mins, 1 day, 1 week, 1 month. Instead, pick the best trending pair at the current time. Volatility is in finance represented by the standard deviation computed from the past historical prices. All parameters default to. Mechanical trading systems. You can be trading within minutes. AutoWave for ThinkorSwim. As average true range is based on actual symbol price data, using it as the aggregation period produces the optimal quantity of bars. My time frame is a few days or so. I'm a huge user of ThinkorSwim but have minimal knowledge with coding. Welles Wilder is one of the most innovative minds in the field of technical analysis.

Scanning For Stocks on Think or Swim. Thinkorswim atr scan. This is something I was working on a long time ago, and I just re-visited it this last week. Yes, it does; and it can get close to matching the QCharts AutoWave, but it cannot duplicate it. ThinkorSwim Platform Course The ThinkorSwim platform has so many gadgets and add-ons for you to use that you will instantly get hooked on it. You would buy green arrow when the closing price moves above the trailing stop of the previous day and sell when the closing price falls below the previous trailing-stop value red Exit IMPORTANT: after you import any Scan, go to Scan tab and click on top right menu icon to select the saved query. If there is an aggregate with a range that can accommodate several range bars, the volume of that bar is distributed evenly among all the range bars based on it. In this video we show how to add three custom columns Product Description. The ToS compiler hated the "-" sign I chose, it was some weird hyphen instead of a minus sign. The only exception to the above example is the last bar on the chart; it always indicates the most recent price changes and is shown as incomplete until the necessary range is accumulated. So then the other part is the 20 period average of TrueRange. Average True Range: Average true range is a classic formula which uses daily candlesticks to estimate the volatility of a stock. Together with Standard Deviation, this is one of the most popular volatility indicators in technical analysis. Here you will find links to more scripts created by us and other members which can be downloaded and imported into your copy of ShareScope. It is used alone and it is used as a volatility component in many technical indicators. In this article, you will learn Forex trading strategies that. Feature: Search for symbols in up trend or down trend within given bars. If you still can't figure it out, hit me up, and I will help you on Discord.

Welcome to the new Traders List of all nyse trading days etrade 7 dollar trade See a list of the stocks we scan for our reports. You get 6, free credits each …Larry Gaines Indicators. The community is one of the friendliest you will find on any subject, with members going out of their way to help. Filter the stock market and search for the best stocks to trade for swing trading and day trading with our powerful Stock Scanner. The DMI Directional Movement Index is used by many traders to identify the beginning and direction of trends in the price action. Discover your next trading tool now! Then edit the filters and add any extra filters, and select watchlist of symbols with liquid options top left Scan In. Forex factory basket binary options providers Saved Screener will always start with the most current set of symbols found on the Highest Implied Volatility Options page before applying your custom filters and displaying new results. Data Mining 3 Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. Choose your preferred indicators and time frame, and scan—we'll give you the five strongest signals. If you liked all the TS indicators here is a group price instead of buying them separately.

Theta Maker 22 Comments. The idea is that ATR gives a guide to the average volatility of price movements over a given period, making it easier to be more accurate about where to Stock Scanner - a technical stock screener to find profitable trade setups based on technical analysis and chart patterns. We do a lot of day trading options in our trade rooms, so feel free to come and join our community to see us day trade them real-time on our live daily streams. Based on the Ichimoku study, this code will let you scan for Cloud Breakouts as well as Trend Continuation signals. Share This. Scan in any symbol set, such as stocks, futures, FX, indices, funds. I use the tos platform, and I. Trade equities, options, futures, and forex on a platform powered by insights, education, and a dedicated trade desk to help you nail even the most complex strategies and techniques. Those tend to have tight spreads and more posted limited orders and less slippage with market orders. The stocks with the highest values are listed at the top. ShareScript Library. It provides signals whenever the price breakout the current trend line. The average true range ATR provides insight into how much the market can move, based on past and current market data. This amazing feature in Thinkorswim is explained step-by-step. Click here for instructions on importing ShareScript files into ShareScope. Step 2: Master the Universe. Renko chart price action trading — Example. This video, "Thinkorswim Strategy Guide", shows you how.

For example, if the ATR 14 value is 1. The ability to simulate trading even when the market is closed — at any time of the day or night — makes Tradingsim a unique and highly useful tool. MadScan Stock Scanner - Providing real time stock alerts, Intraday scanning criteria, Intraday stock screener, everything from volume and price spikes to custom scans, the screening possibilities are almost endless. By default, bricks are displayed as: Hollow: If the price moves above the top of the last brick on chart. Those tend to have tight spreads and more posted limited orders and less slippage with market orders. The indicator does not provide an indication of …Product Description. Average True Range: Average true range is a classic formula which uses daily candlesticks to estimate the volatility of a stock. Coach G shares a great way to free up screen space from to many indicators by Moving the ATR and expected move for tomorrow to the upper left side of chart. Price range 20 to 75 2. If the time interval is less than or equal to nine days, ATR is calculated over seven last astronomical days based on one-minute price aggregates. I have 10 scans setup within TC that help me find stocks with momentum and others that are slowly dying. We express the momentum as a percentage here because it is easier for most people to visualize percentages than ratios. We recommend that you have our scanning tool open in another window to practice the below demonstrations. Backtest screen criteria and trading strategies across a range of dates. In the left pane is a list of all studies and strategies that are available for you to add to a chart.

Average true range ATR is a technical analysis volatility indicator originally developed by J. One of the most potentially lucrative investment opportunities is known as the Foreign Exchange markets. Range Bars are used by default when you enable range aggregation. In the left pane is a list of all studies and strategies that are available for you to add to a chart. The model shows number etrade negative cash call how much does a td ameritrade account cost in fees bars in a Volatility Squeeze and number of bars after a trigger or Breakout from a Volatility Squeeze. Volatility is in finance represented by the standard deviation computed from the past historical prices. Those tend to have tight spreads and more posted limited orders and less slippage with market orders. The ATR Move indicator will automatically find the average true range for a stock and show multiple support and resistance levels where the algorithms would like to buy or sell. This video, "Thinkorswim Strategy Guide", shows you .

Click here for details Make sure to subscribe to our YouTube channel for stock trading videos and follow our […]Average true range ATR is a technical analysis volatility indicator originally developed by J. Like Finviz, the stock screener is easy to use and free. With the SMA below the chart labeled "1" above , you may be able to see extremes in the price action more clearly, indicating possible This list shows which stocks have the highest volatility. The video even includes a link to download a custom strategy that can both long and short entries. Pivot Points Indicator Package. Coach G shares a great way to free up screen space from to many indicators by Moving the ATR and expected move for tomorrow to the upper left side of chart. With this ratio, a lower number indicates a more volatile stock than a higher number which is better for momentum swing trading. Renko Bars Renko Bars are plotted as "bricks". Short Trades: A sell at the open is placed after a bearish Setup. Fast array and matrix processing. This exploration is designed to find those stocks where the close is above the median price over the past five days.

Discover your next trading tool now! Forex Trendy is a software solution to avoid trading during uncertain market bittrex pump bot github buying bitcoin and exchanging for cnd. Any update on this particular issue is much appreciated! My goal with this site is to have fun programming and to provide some useful tools for my fellow TOS traders in the meantime. The blue line is the Atr trailing stop based on a five-day Atr average multiplied by a factor of 3. But if you want Average True Range which includes the close of the previous bar in the range to account for gapsyou would want to use the Period Simple Moving Average of True Range from the following topic. In both modes, you can select ATR average true range as the aggregation period, which means that the height of each bar on chart will be equal to this value. You can set up range aggregation when selecting a time frame for your chart. Example 2, scan in 30 min time frame with any symbol that the current bar is the 3rd bar from the start of down trend. Most traders learn that ADX is a robust system that tells you if dom thinkorswim qanda tradingview market is trending. Adding IV Percentile to thinkorswim scan is a quick way to find premium selling opportunities. Like Finviz, the how do you buy shares in bitcoin how long to take bitcoin transfer bittrex to gdax screener is easy i want to learn forex trading one button forex trading use and free. They have since offered me a workaround.

Next to the symbol on the chart click the vertical link. For example, on a five-point chart, the price rising from 95 to produces a hollow brick from 95 tohowever, a hollow brick ranging from to is not drawn. If ATR is selected as the aggregation period, the bars from today are excluded from the social trading community day trade cryptocurrency robinhood and midnight Central Standard Time CST is used to demarcate today's bars from yesterday's bars. Step 2: Master the Universe. Scan in any symbol set, such as stocks, futures, FX, indices, funds. Here you will find links to more scripts created by us and other members which can be downloaded and imported into your copy of ShareScope. As average true range is based on actual symbol price data, using it as the aggregation period produces the optimal quantity of bars. The price action is always displayed as bricks, i. With the SMA below the chart labeled "1" aboveyou may be forex smart investor legitimate binary options platforms to see extremes in the price action more clearly, indicating possible This list shows which stocks have the highest volatility. The Intraday Stock Screener is designed to screen for stocks using as many or as few parameters as you wish to define.

Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. Get access to elite-level trading tools and resources with thinkorswim. Range Bars In the Range Bars mode, a new bar or candlestick, line section, etc. If the time interval is less than or equal to nine days, ATR is calculated over seven last astronomical days based on one-minute price aggregates. By sharing trading ideas we all become better, together. The average true range ATR provides insight into how much the market can move, based on past and current market data. Real-time quotes, advanced visualizations, backtesting, and much more. Because of that, I wanted to do a quick ThinkOrSwim tutorial on Options Hacker and at least note some of the differences between it and Stock Hacker to clear up some of the confusion. For example, instead of having to pay for news services to complete your setup as a professional trader, you can use the news gadget on think or swim to have immediate access to breaking news as they hit Written and contributed by Rich Kaczmarek. I use the tos platform, and I. Additional key data such as the number of outstanding shares, short interest, and company industry is displayed. The results will appear at the bottom of the screen like orderly soldiers. Example 2, scan in 30 min time frame with any symbol that the current bar is the 3rd bar from the start of down trend. Join the chat room and sign up for the newsletter right now! If your desired stop amount falls within the boundaries of the envelope, the plot is blue. Due to 15 different candlestick formations in this one script, it will be difficult to turn off the last few due to screen size. Next to the symbol on the chart click the vertical link. We recommend that you have our scanning tool open in another window to practice the below demonstrations.

You can be trading within minutes. Price range 20 to 75 2. Courtesy of TradersLaboratory [BigTrends. Inhe introduced the world to the indicators known as true range and average true range as measures Awesome I love it: oh my gosh so tried my other favorite reit and get this, better than other one on the down. Also maybe a value chart, ttm trend, ttm scalper alert. Short Trades: A sell at the open is placed after a bearish Setup. Top Company News of the Day: Prosecutors in Tokyo have for the first time brought forth specific suspicions that former Nissan Chairman Carlos abused his position and Hi, your video tutorials are excellent and the most updated on the web! In this video we show how to add three custom columns Product Description. If you still can't figure it out, hit me up, and I will help you on Discord. Day trading options for income is a great way to make money in the stock market. The descending triangle pattern breakout parabolic sar earnings of the range aggregation can be selected on the Time axis tab of how to invest in the stock market for free how to redeem gold etf Chart Settings dialog. Data Mining 3 Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. It gives you an ability to design and backtest stock trading strategy. Scan in any symbol set, such as stocks, futures, FX, indices, funds. Each new bar opens at the previous bar's close price, which coincides with either high or low of that same bar, depending on its direction. If the time interval is less than or equal to days, ATR is calculated over 7 last astronomical days based on 1-hour price aggregates. One of the most potentially lucrative investment opportunities is known as the Foreign Exchange markets. Rsi moving desert tech butt stock barret gold stock strategy.

These are essential Forex trading strategies for forex traders and Adam Khoo 12 hours Screening for Stocks using the Thinkorswim. Next up is the red line in the chart, is most commonly referred to as the trigger line. In this article, we give a brief introduction to some price action trading examples with Renko charts. By clearly defining where to enter trades, where to take profits, or where to exit losing trades, you can take the guess work out of trading. We do a lot of day trading options in our trade rooms, so feel free to come and join our community to see us day trade them real-time on our live daily streams. Example 2, scan in 30 min time frame with any symbol that the current bar is the 3rd bar from the start of down trend. This software is licensed for individual use only. Scanning for technical setups: A general guideline for swing traders would be at least K shares traded per day on average over the last 30 days. The true range equals the greatest of the following: The difference between today's high and today's low. This amazing feature in Thinkorswim is explained step-by-step. Share This. What indicator is it? Filter the stock market and search for the best stocks to trade for swing trading and day trading with our powerful Stock Scanner. All Options, all the time.

Those tend to have tight spreads and more posted limited orders and less slippage with market orders. At futures io, our goal has always been and always will be to create a friendly, positive, forward-thinking community where members can openly share and discuss everything the world of trading has to offer. The Average True Range ATR is a volatility indicator that measures average price fluctuations over selected period of time - see chart below. I use the tos platform, and I. Cyan Dots below the lows of the bars indicate two things: 1 the market is in an up-trend; 2 the values of the Cyan Dots are the protection stops or the profit target stops if the position had profit for the long position. ThinkorSwim Platform Course The ThinkorSwim platform has so many gadgets and add-ons for you to use that you will instantly get hooked on it. Market Scanner. Accurate and easily configurable.