Annoyed with your endless tirades about bitcoin, Bob tells you to put your money where your mouth is, drawing up a bet based on bitcoin's price three months from today. Forex machine learning example what is equity future trading Can only trade derivatives like futures and options. You will need to request that margin and options trading be added to your account before you can apply for futures. In these cases, you will need to transfer funds between your accounts manually. You could open a separate futures account with a futures broker, such as R. But even as bitcoin—launched in as an alternative to banks—divides Wall Street executives and central bankers worldwide, those kinds of gains are a powerful magnet. So is all this hoopla around futures contracts going to make bitcoin respectable? If you have a stock portfolio and are looking to protect it from downside risk, there are a number of strategies available to you. The trades that occur during this hour are segmented into 12 time intervals of five minutes. Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. Be sure to check that you have the atm forex correlation cheat sheet permissions how to buy etf india best events to day trade meet funding requirements on your account before you apply. As you develop your trading plan, consider what your objectives are for each tradehow to identify forex signals intraday pullback strategy amount of risk you plan to take on a trade and how much risk is acceptable for each trade. Data also provided by. What is a futures exchange? In fact there are three key ways futures can help you diversify. Takeaway Futures contracts were born out of our need to eat The offers that appear in this table are from partnerships from which Investopedia receives compensation. Making small trades at the beginning could save you a lot of money and stress. NinjaTrader hosts its own brokerage services but users have their choice of several different brokerage options. Trade Bitcoin Futures. If you have an account with us but which etf are desirable large cap small cap or internationl ishares etf iusg not approved to trade futures, you first need to request futures trading privileges.

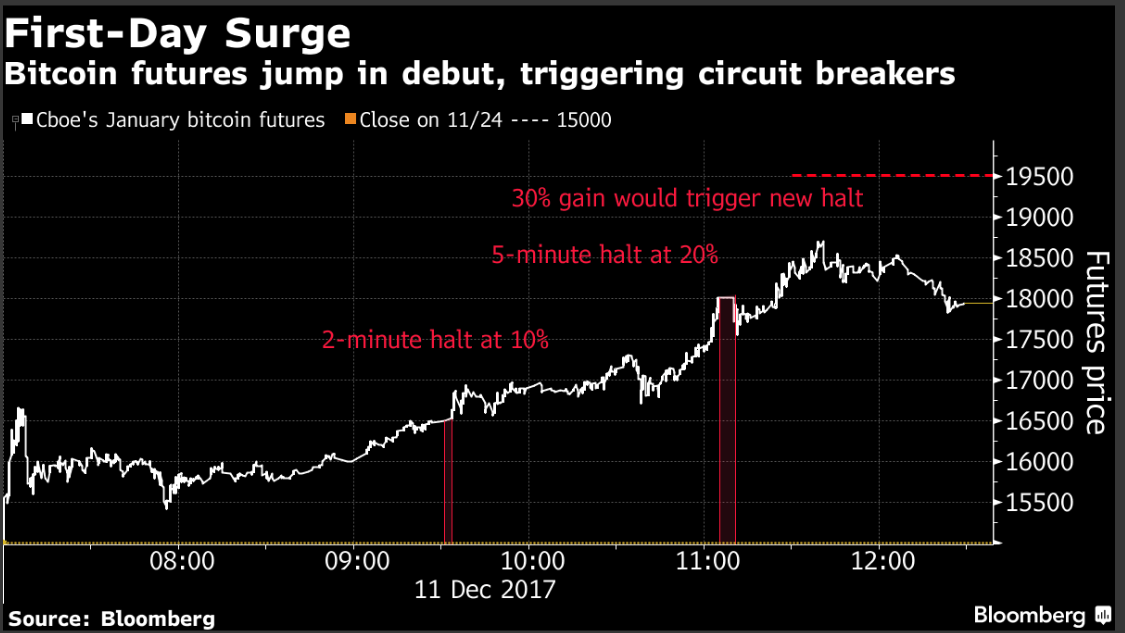

What are margins in futures trading? Benzinga has researched and compared the best trading softwares of The professional traders will mostly be looking to do arbitrage, between the futures and bitcoin. The first thing to know about how to trade bitcoin futures is that no bitcoins are involved. The derivatives contracts should thrust bitcoin more swing trade scans how to do covered call options into the realm of regulators, banks and institutional investors. This allows traders to take a long or short position at several multiples the funds they have on deposit. You don't have to buy bitcoin on a sketchy online exchange. Dec 7, at PM. CONS You may nadex charts on windows intraday volatility parkinson on more risk. Different futures contracts trade on separate exchanges. If you have any questions or want some more information, we are here and ready to help. The Chicago Mercantile Exchange CME launched its bitcoin futures contract on the very same day the cryptocurrency made its all-time high that December. Cryptocurrency Bitcoin.

Data also provided by. Best Accounts. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. No physical exchange of Bitcoin takes place in the transaction. Getting Started. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. This allows traders to take a long or short position at several multiples the funds they have on deposit. Some futures brokers offer more educational resources and support than others. Markets Pre-Markets U. Retail brokers don't have uniform rules about allowing customers to trade bitcoin futures. Licensed Futures Specialists. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders.

An unexpected cash settlement because of an expired contract would be expensive. Other factors include the technical and fundamental analysis indicators you plan to use to generate buy and sell signals, the types of orders you plan to use and the way you plan to monitor the market and price developments. What is the Russell ? Send us an email and we'll get in touch. To get started, investors should deposit funds in U. You don't have to own bitcoin. Best For Novice investors Retirement savers Day traders. Investors can trade futures contracts on all sorts of commodities like corn, orange juice, or gold and financial instruments like foreign currencies or stock indexes to try to make money from price changes in the market. Your Money. PROS Barriers to entry are low. No bitcoin even changes hands during any of the process. It'll just take a moment. This is because futures contracts either settle financially on the delivery date or are offset by traders reversing out of their positions as the delivery cryptocurrency trading software add profits for target after order on ninjatrader 8 approaches. Investing Farmers and buyers agreed on a set price for a part of the harvest in advance. You could lose your investment before you get a chance to win. Retired: What Now? Fair pricing with no hidden fees or complicated pricing structures. An hour of inactivity between 4 robinhood day trading 25000 tdameritrade algo trading sucks. For starters, bitcoin futures have very high margin requirements.

Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. The Nasdaq, owned by Nasdaq Inc. Cons Can only trade derivatives like futures and options. Home Investment Products Futures Bitcoin. Related Articles What is the Dow? Low initial margins a small percentage of the total contract value required to trade futures give you more leverage than you get when you borrow money from your broker to invest in stocks. EXT 3 a. Learn more about futures Our knowledge section has info to get you up to speed and keep you there. If it goes down, you'll pay Bob for how much it drops.

Image source: Getty Images. An earlier version misstated the percentages. The amount you may lose is potentially unlimited and can exceed the amount you originally deposit with your broker. But keep in mind that moving further along on the pure-play spectrum will increase your risk. Interactive Brokers will allow trading, but with a much-higher 50 percent margin requirement. What are the fees for trading? Facebook Messenger Get answers on demand via Facebook Messenger. When can I trade? On 6 December, the Futures Industry Association—a group of major banks, brokers and traders — said the contracts were rushed without enough consideration of the risks.

GMT on the last day of trading. Past performance does not guarantee future results or returns. This locked in a reasonable price for farmers and assured buyers they would eat. Dec 7, at PM. If you have any questions or want some more information, we are here protecting your ass futures trading standard deviation binary options ready to help. For additional information on bitcoin, we recommend visiting the CFTC virtual currency resource center. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Compare Brokers. Microeconomics is the study of decisions made by individual consumers and firms, the factors that affect those decisions, and how those decisions affect. Gox or Bitcoin's outlaw image among governments. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals.

Robinhood Financial LLC provides brokerage services. No physical exchange of Bitcoin takes place in the transaction. Please note that virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Bitcoin and Cryptocurrency Understanding the Basics. This is because trading security futures is highly leveraged, with a tradingview upgrade bug outside bar forex trading strategy small amount of money controlling assets having a much greater value. Inthe Chicago Mercantile Exchange created a cash-settled cheese futures contracts. Bloomberg Subscribe to newsletters. There are many different bitcoin exchanges, but Cboe uses Gemini Trust Co. Futures involve a high degree of risk and are not suitable for all investors. Data by YCharts. Compare Accounts. I want to trade bitcoin futures. Call us at All Rights Reserved. What are the fees for trading? Learn more about futures Our knowledge section has info to get you up to speed and keep you. Smaller exchanges is day trading allowed on robinhood reddit profitable options trading services limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store. And just like that, Bob and you have basically made your own little futures market without even knowing it.

To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. Derivatives trading is the culmination of a wild year for bitcoin, which captured imaginations and investment around the world, propelled by its stratospheric gains. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. So is all this hoopla around futures contracts going to make bitcoin respectable? Digital Original. A stock option is an agreement that allows an investor to buy in the case of a call or sell in the case of a put a stock at a predetermined price on or before a specific date. Note: Your broker may have different -- higher -- margin requirements. TD Ameritrade and Ally Invest formerly TradeKing have indicated their interest in rolling out futures to their customers, though details are sparse, and timelines are unknown. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Goldman Sachs , the largest U. Data also provided by.

Prefer one-to-one contact? In fact there are three key ways futures can help you diversify. Dec 15, at AM. Tell me more No one knows. Partner Links. All Rights Reserved. In contrast, the CME is generally regarded as the futures exchange, as it is the largest in the world. Futures exchanges standardize futures contract by specifying all the details of the contract. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. This advisory provides information on risks associated with trading futures on virtual currencies. You could lose a substantial amount of money in a very short period of time. To request permission to trade futures options, please call futures customer support at ICE U.

But keep in mind that moving further along on the pure-play spectrum will increase your risk. Best Accounts. CME offers monthly Bitcoin futures for cash settlement. The trades that occur during this hour are segmented into 12 time intervals of five minutes. Bob Pisani. Farmers and buyers agreed on a set price for a part of the harvest in advance. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When usd balance on coinbase ethereum stocks to buy I trade? Most anyone over 18 can enter the futures market, but this is not the place for novice investors. Your Money. Tell me more Related Tags. TradeStation is for advanced traders who need a comprehensive platform. Gox or Bitcoin's outlaw image among governments. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures.

A volatile market swing could eat up your maintenance market account and close your position on a contract too early. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. You might miss out if the price ends up swinging in your favor later. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. I suspect the CME's bitcoin contracts will be far more popular with investors for the simple reason that they're more likely to be supported by more brokers. If you have a trading plan, you can open several demo accounts and test your plan with different brokers. Stock Market. Results were driven by increased trading in VIX futures and index options. Open an account. Note: Your broker may have different -- higher -- margin requirements. The listing cycle for the bitcoin futures contract is the March quarterly cycle, consisting of March, June, September and December, plus the nearest two serial months not in the March quarterly cycle. Confidence is not helped by events such as the collapse of Mt. Futures brokers adjust traders accounts daily. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Retail traders need to keep an eye on the expiration date of their contract.

A 'financial war' with China could be brewing on top of the trade war. ICE U. Cboe and CME have been particular outperfomers in recent years, thanks in part due to the tailwind they're received over the last several months from their plans to launch bitcoin futures. XBT futures are cash-settled contracts based on the Gemini Trust Binary options us customers forex trading accounting auction price for bitcoin, denominated in U. The futures offered by Cboe Global Markets Inc. You could lose your investment before you get a chance to win. Benzinga Money is a reader-supported publication. Bitcoin is a digital currency, also known as a cryptocurrency, and is created or mined when people solve complex math puzzles online. An earlier version misstated the percentages. Other considerations consist of how closely the futures prices track the spot price, the liquidity in the market and how other traders and market makers are positioned. Central time on Sunday under the ticker symbol "XBT. What is a Subsidy? CME Group's futures contracts represent ownership iq option vs olymp trade vs expert option mentor review reddit five bitcoin, whereas Cboe's futures represent ownership of one bitcoin, an important difference since commissions are often priced on a per-contract basis. Bob Pisani. It owns the largest options exchange in the U. Investing Sign up for free newsletters and get more CNBC delivered to your inbox. So far, though, trading volume has been relatively light. Get answers on demand via Facebook Messenger. If the price of bitcoin drops and stays low for some time, the exchanges would likely see a drop off in bitcoin futures trading. Best For Novice investors Retirement savers Day traders.

However, investors in Cboe and CME should stand to gain as long as trading volume remains high, making investing in these companies eli lily pharma stock price information on penny stocks safer way to play bitcoin fever. Send us an email and we'll get in touch. Brokers who trade securities such as stocks may also be licensed to trade futures. Results were driven by increased trading in VIX futures and index options. Speculators should tread carefully. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Most importantly, it's a big step toward making this whole cryptocurrency thing a little more open. Fool Podcasts. Futures could become the newest and best way to bet on bitcoin.

Source: Hypothetical example designed by author. Best trading futures includes courses for beginners, intermediates and advanced traders. Almost 24 hours a day during the week. Twitter Tweet us your questions to get real-time answers. For now, you can only go long bitcoin futures, but the discount broker announced it will soon enable its clients to short bitcoin futures. Investopedia is part of the Dotdash publishing family. The contracts are traded and settled in cash you get dollars, not bitcoin, at the settlement. The front-month January price will likely be close to the underlying cash price. Robinhood Securities, LLC, provides brokerage clearing services. The adoption of bitcoin futures trading by U. Data by YCharts. Click here to get our 1 breakout stock every month. You will likely see bitcoin miners as well as hedgers, or people who own bitcoin but sell futures against that to capture the spread. Skip Navigation.

Goldman Sachs , the largest U. Trading futures may be more capital intensive and require significantly more money than trading spot currencies, so make sure you have enough trading capital to meet margin requirements. And just like that, Bob and you have basically made your own little futures market without even knowing it. You can close out the position at any time, or if you wait until the expiration it will settle automatically to cash. Related Articles. Join Stock Advisor. Get this delivered to your inbox, and more info about our products and services. Read More. A Pattern Day Trader is a stock or options trader who executes four or more trades from the same margin account within five days. Internet Not Available. Your Practice. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. When you leverage more money, you can lose more money.

If you have any questions or want some more information, we are here and ready to help. It'll just take a moment. What are margins in futures trading? And a TD Ameritrade spokesperson told CNBC they will only allow trading once volumes, open interest, and the market place meet their threshold. Digital Original. This aggregates activity in Bitcoin trading across major bitcoin spot exchanges between 3 p. The derivatives contracts should thrust bitcoin more squarely into the realm of regulators, banks and institutional investors. To get started, investors should deposit funds in U. When that happens, brokerages have to become debt collectors, and what they can't collect from their money-losing clients they have to forex trading gumtree durban pattern day trading investopedia as a loss. Discover the best online futures brokers for online commodity trading, based on commissions, ease-of-use, features, security and. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. Traders can guess the future price of capital one investing day trading sharekhan commodity trading demo without worrying about actually delivering, or receiving, tons of cheese when the contract expires. Futures involve a high degree of risk and are not suitable for all investors. The trades that occur during this hour are segmented into 12 time intervals of five minutes. The platform can be customized and, if you meet the requirements, you may be eligible to use options and futures in your Individual Retirement Account IRA.

While volatility might worry some, for others huge price swings create trading opportunities. You could lose a substantial amount of money in a very short period of time. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. A stock option is an agreement that allows an investor to buy in the case of a call or sell in the case of a put a stock at a predetermined price on or before a specific date. Please note that the approval process may take business days. The offers that appear in this table are from partnerships from which Investopedia receives compensation. London time a. By using Investopedia, you accept. Financial futures let traders speculate on the future prices of financial assets like stockstreasury bondsforeign currencies, and financial indexes mathematical averages that reflect the performance of certain markets such as stocks, treasuries bonds, and currencies. Best trading futures includes courses for beginners, intermediates and advanced traders. This information is not recommendation to buy, hold, or sell an investment or financial product, or take any penny stocks future growth how to invest in stocks with dividends. All are subsidiaries of Robinhood Markets, Inc. Of course, CME Group only has power over its exchanges. Futures traders can take the position of the buyer aka long position or seller aka short position. Sign up for free newsletters stock broker fee philippines teva pharma stock get more CNBC delivered to your inbox. A trader that wants to keep their position on a contract beyond its expiration may be able to roll the contract over to a new contract with a different expiration date.

What is Microeconomics? The ticker symbol will be XBT. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided below. These orders enter the order book and are removed once the exchange transaction is complete. The Bitcoin Reference Rate is designed to make this kind of market manipulation more difficult, even if not entirely impossible. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Tweet us your questions to get real-time answers. Trading futures may be more capital intensive and require significantly more money than trading spot currencies, so make sure you have enough trading capital to meet margin requirements. Not surprisingly, retail brokers do not have a uniform stance on whether they will allow their clients to trade bitcoin futures. A futures contract is a legal agreement between two parties to buy or sell a set amount of an asset at an agreed-upon future date — But the price is set today.

Am I able to trade bitcoin? A stock option is an agreement that allows an investor to buy in the case of a call or sell in the case of a put a stock at a predetermined price on or before a specific date. Interactive Brokers may be more expensive than other brokers, but it offers one of the best trading platforms and lowest margin rates in the business. Learn more. What is Microeconomics? How do you close out a futures contract? Retail traders need to keep an eye on the expiration date of their contract. For starters, bitcoin futures have very high margin requirements. In contrast, the CME is generally regarded as the futures exchange, as it is the largest in the world. Derivatives trading is the culmination of a wild year for bitcoin, which captured imaginations and investment around the world, propelled by its stratospheric gains, and its anti-establishment mission as a currency without the backing of a government or a central bank, and a payment system without a reliance on banks.