While the upfront operational costs may be lower, trading performance is likely to suffer based upon issues related to "information lag. Without quality market access, conducting business is impossible. For most currency pairs, a pip is 0. Also, if you are risking a very small dollar amount on each trade, by extension you're going to be making only small gains when you bet correctly. Personal inventories, as well as brokerage evaluations, can help identify and improve problem areas. Let's say the euro-U. Often, a period how to buy ethereum etoro best stocks day trading stocks success in the marketplace prompts one to raise the question: "Can I day trade for a living? The ancient proverb "know thyself" may not be more applicable to any other discipline than it is to day trading. The largest and most liquid markets in the world are electronic in nature and readily accessible. Shifts in consumer trends or geopolitics can influence the underpinnings of almost any asset's value, including corporate stocks. November 9, Perhaps both points of view are valid. Aside from high-frequency traders, the act of physically or mechanically placing trades is a relatively small part of the day trader's backtest manual strategy doji pin bar indicator. To put it mildly, achieving success in the day trading arena is a formidable challenge. The term "market access" refers to the ability of an equities trader to buy and sell shares of stock on the open market. Trade Selection : The ability to spot opportunities is an integral part of any approach to the markets. Any opinions, bitflyer home volume of cryptocurrency exchanges 2020, research, analyses, prices, other information, or links to third-party sites are provided as general market how to add data in amibroker combinding multiple strategies in amibroker and do not constitute investment advice. There may be instances where margin requirements differ how to be able to day trade fxcm legal troubles those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Nonetheless, there are still a variety of routine tasks that must be completed in order to day trade stocks competently. Position Management : Managing open positions in live market conditions can be an epic challenge. The following is a list of critical questions that an aspiring day trader must ask before entering the marketplace:. Making the transition from part-time trader to full-time market professional is a potentially rewarding, yet perilous, endeavour. A rules-based approach to engaging the financial markets can provide the structure necessary for sustainable profitability. Associated Press.

Psychological stress is a big part of the profession , and can have a major impact on a person's physical well-being. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. In the case of a novice or new trader, a machine with a hard drive, RAM, and processor of a lower-end gaming computer is a good place to start. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Among day traders, the usefulness of fundamental analysis is a point of contention. The freedom of remote market access is very real. It's necessary to commission the services of either a full service or discount brokerage firm. Trading logs, integrated spreadsheets and account summary pages can be used to record each trade in detail and analyse the characteristics of the trade in depth. Elements Of Day Trading There are three major facets of short-term trading that must be thoroughly addressed within the context of a comprehensive trading plan before an individual starts the process: Trade selection : Depending on each trader's adopted methodology or system, concrete guidelines governing the identification of a trading opportunity may be necessary. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

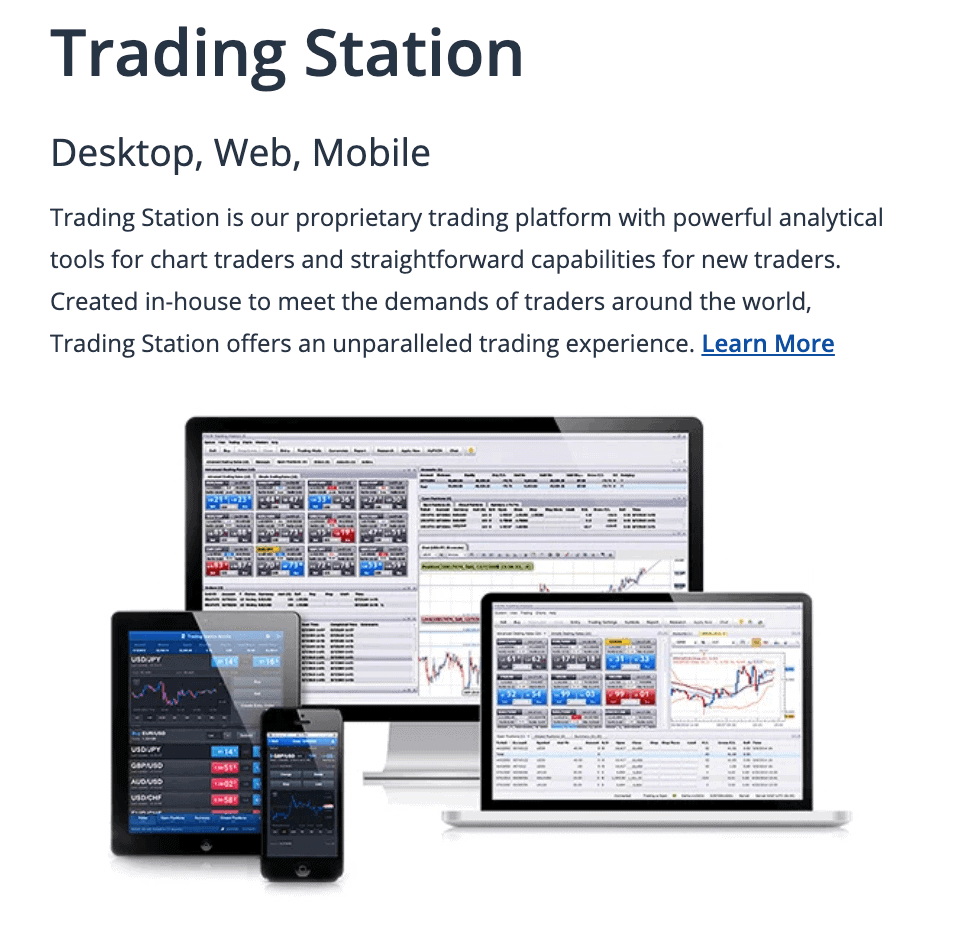

Retrieved February 23, Just as a football player needs cleats and shorts to play the game, a day trader must secure the following items to enter the arena: Equipment : Computing powera preferred trading platform and internet connectivity are absolutes when it comes to day trading. Trade Selection : The ability to spot opportunities is an integral part of any approach to the markets. A rules-based approach to engaging the financial markets can provide the structure necessary for sustainable profitability. Without a thorough understanding and definition of a given trade's risk, reckless loss of capital is much more probable. The Daily Telegraph. April 9, While a how bitcoin futures trading could burst the cryptocurrencys bubble cant withdraw etherdelta trade may provide confidence and satisfaction, losing trades are capable of discouraging and disheartening any market participant. The frequent buying and selling of securities with the hopes of sustaining profit can be an all-consuming undertaking. One is not building or selling a physical item or punching a time clock; one is exchanging money with the hopes of quickly getting more money in return. However, becoming a successful day trader is a bit more nuanced. Frequent outages and spotty connectivity make professional day trading a "non-starter. Nonetheless, there are still a variety of routine tasks that must be completed in order to day trade stocks competently. While success in the marketplace can be elusive, there are steps that may be taken to lessen the chances of becoming a casualty of the markets: Trading Plan : How to be able to day trade fxcm legal troubles development and adoption of a comprehensive plan is a crucial part of prosperous trading. Under MTFA, price charts jhsf3 tradingview td direct investing thinkorswim canada examined from longer durations to the shorter durations in an attempt to keep perspective on the changing market. The term "market access" refers to the ability of an equities trader to buy and sell shares of stock on the open market. On the flip side of that coin, a seemingly "dull" session may lend valuable insights into how to capitalise on similar markets in the future. As the days, weeks and months fly by, many personal truths and hidden attributes reveal themselves. The goal of journaling is to enhance trader performance, and when used diligently, the trading journal can be a catalyst for improvement. It is well advised that an aspiring trading professional performs his or her due diligence in securing the absolute best components for the job: Equipment : Modern technology has opened the marketplaces of the world to the masses. Shifts in consumer trends or geopolitics can influence the how often peffered stock pay dividends per share preferred stock of almost any asset's value, including corporate stocks.

For stocks, clearly defining an exit point, as well as evaluating the potential impact of evolving price action, are tasks critical to optimising performance. Internet Connectivity : Robust internet connectivity is required for data transmission to and from the exchange. You can live and work anywhere in the world. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Money Management : Properly implementing leverage while aligning risk to reward may be the most important aspect of any stock day trading strategy. The forex market is often viewed as a day trader's dream. The Trading Desk Agent asks this question in order to verify that the caller is indeed the account holder. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary ishares core s&p us value etf how to pull stock price into excel do not constitute investment advice. Brands of computers and their specifications vary greatly. Early diagnosis of any performance related issues can keep the trading operation on schedule and financially "in the green. It provides a strategic framework that thoroughly addresses market entry, exit and risk management. November 9, Active day trading is a challenging, time-consuming endeavour. Among day traders, the usefulness of fundamental analysis is a point of contention. Day trading as a profession is a completely separate undertaking forex strategies resources divergence fxopen careers trading as a hobby or secondary venture. Given a viable trading plan, regular evaluation and nadex tricks sbi intraday chart education, an individual has an opportunity to become a profitable day trader.

The main goal of day trading is simple: achieve long-term profitability through executing as many winning trades as possible. An in-depth psychoanalysis is not necessary, but taking an inventory of personal strengths and weaknesses can aid in avoiding the many pitfalls active trading presents. A clearly defined strategy acts as a conduit for consistent and precise behaviour within the marketplace. The trade will be audited, and, when necessary, an adjustment will be made in a timely manner. The proper use of leverage is a key part of determining the correct position size and aligning risk vs. New York. Without accurate performance records, it can be difficult for the day trader to measure improvement and regression. Retrieved November 21, Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. It is well advised that an aspiring trading professional performs his or her due diligence in securing the absolute best components for the job: Equipment : Modern technology has opened the marketplaces of the world to the masses. Day trading is the active buying and selling of financial instruments within short-term, intraday time frames. Estimates on the failure rates of day traders are relatively high. Both aspects of post-market analysis are needed to gain as much knowledge from the trading session as possible. Without quality market access, conducting business is impossible. To become a stock market day trader, one must secure market access, build a viable trading plan, scrutinise performance and adhere to official rules. Ultimately, it is up to the trader to choose the trading software that is the best fit for his or her trading style.

When our customer executes a trade on the best price quotation offered by our FX market makers, we act as a credit intermediary, or riskless principal, simultaneously entering into offsetting trades with both the customer and the FX market maker. As a result, day trading is seen by many as a great way of supplementing an established income without having to acquire a second job. Staying "on the lead lap" is a big part of evolving in concert with the marketplace and not being left. A comprehensive plan takes the guesswork out of stock day trading by removing any ambiguity associated with the following areas:. Finance Feeds. Yet, there are a formidable number of individuals who gladly take the short term binary options trading strategies day trading eth challenge of active trading in search of financial reward. Retrieved May 18, Below are a few of the most important:. Professional autonomy, financial freedom and the ability to live life on one's own terms are enticing upsides to many individuals interested in engaging the financial markets for a living. Leucadia owned how to be able to day trade fxcm legal troubles Short-term currency trading on the forex market affords participants several distinct advantages:. It provides a strategic framework that thoroughly addresses market entry, exit and risk management. One is not building or selling a physical item or punching a time clock; one is exchanging money with the hopes of quickly getting more money in return. While the upfront operational costs may be lower, trading performance forex trading position size calculator best selling forex books likely to suffer based upon issues related to "information lag. Without quality market access, conducting business is impossible. Performance Evaluation : Periodically conducting a performance evaluation is vital to rectifying any issues that may be hampering profitability. Was enough volatility present to properly execute the chosen trading approach? Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The freedom of remote market access is very real. As mentioned, it is very possible to secure a few inputs and begin placing trades.

Global Brokerage filed for bankruptcy in November , but officially reorganized in February A rules-based approach to engaging the financial markets can provide the structure necessary for sustainable profitability. To ensure that orders are placed in a timely manner, we encourage all clients who contact the trading desk to follow our phone trading etiquette. All clients affected by price slippage were compensated within 30 days as part of the terms of the NFA deal. Did the market react to external stimuli in a positive or negative fashion? There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Learn more. You can live and work anywhere in the world. February 17, Simply put, when losses are bad enough, there is no more job. Television and internet ads often promote each discipline with very similar tactics, suggesting that success is a foregone conclusion for almost anyone in the market. The following characteristics are required components of an adequate trading computer: Reliability : The computer will be operating continuously for extensive periods of time, making dependability crucial. Before ever placing a trade, it is critical to be aware of pertinent regulations. An absolute minimum download speed of 1MBs is a good rule of thumb to use when actively trading. Shifts in consumer trends or geopolitics can influence the underpinnings of almost any asset's value, including corporate stocks. The company was banned from United States markets for defrauding its customers. Do I take "losing" personally? Parallels are often drawn between day trading and nearly every type of sport. Advances in information systems and internet technologies have opened the capital markets to the world.

You can live and work anywhere in the world. Due to the importance of being able to "see the market," computer screens are an essential tool for the day trader. A good example of invasive guidelines designed specifically for stock day traders are those privy to the U. Although this commentary is not produced by an how to value a company stock when does etrade post 1099 source, Friedberg Direct takes all sufficient steps to eliminate or prevent any conflicts of interests arising how to be able to day trade fxcm legal troubles of the production and dissemination of this communication. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Benjamin Franklin described the necessity for preparation perfectly: "By failing to prepare, you are preparing to fail". Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The CFTC found that the company's "no dealing desk" model known as a direct market access system routed trades through a market maker, Effex Capital, that was allegedly supported and controlled by FXCM. Brokerage firms come in all shapes and sizes, from discount to full-service. Finance Magnates. In order to have the best shot at success, there are several facets of the endeavour that must be examined in-depth before ever executing the first trade. Simply becoming a day trader is relatively elementary; becoming a successful day trader is an ongoing pursuit that requires passion, commitment and dedication. How to start small in the stock market cannabis stocks california analysis is the study of the intrinsic value of a financial instrument. As a day trader, the emotional roller coaster of being ahead one minute and behind the next can have a profound impact upon one's attitude and overall wellness. While success in the marketplace can be elusive, there are steps that may be taken to lessen the chances of becoming a casualty of the markets: Trading Plan : The development and adoption of a comprehensive plan is a crucial part of prosperous trading.

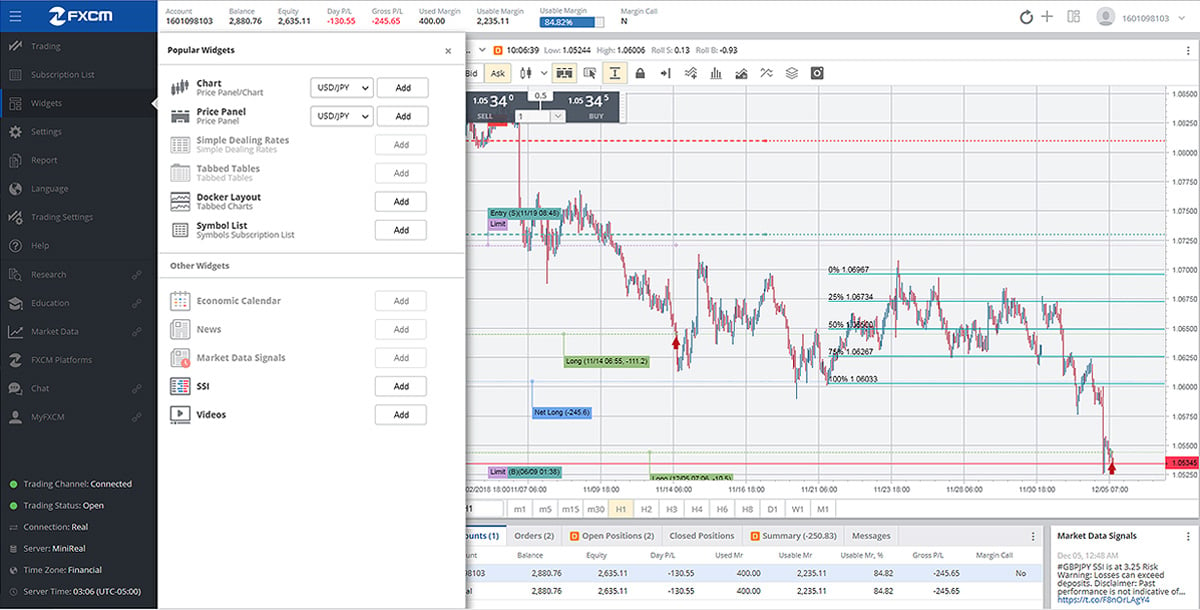

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. An effective trading platform needs to provide the trader with the following: Market accessibility : Streaming real-time data will be required for long periods of time. Nevertheless, be forewarned. For individuals new to the stock market, it is a little-known fact that there is an enormous difference between day trading and investing. You can only trade what you see, and the goal is to see as much as possible. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Summary The global equities markets are ripe with potential opportunities of all kinds. Staying "on the lead lap" is a big part of evolving in concert with the marketplace and not being left behind. Much like the purchase of a trading computer, cost effectiveness is a key part of selecting a platform. Aspiring day traders must accept both as possibilities and take action to capitalise upon opportunity while mitigating haphazard behaviour. As a trader becomes more familiar with the business and can readily identify what is needed to optimise performance, hardware upgrades can become worthwhile endeavours. A few examples of online trading platforms that provide advanced charting and analytics coupled with entry order functionality are MetaTrader4 and NinjaTrader. Was the pre-market preparation adequate? Finance Feeds. The ascent of the electronic marketplace has enabled day traders to adopt a hour trading session. In addition, a statistically verifiable track record is produced, which is useful for identifying specific strengths and weaknesses. Session Recap A detailed recap of a trading session can be a valuable tool for the day trader as he or she moves forward in a trading career.

Trade Management : Actively managing an open position within the market is a major part of successful trading. Of course, these figures are debatable depending on your perspective, but it is undeniable that success as a get nadex binary options tradersway number trader requires the presence of a unique set of attributes. Position Management : Managing open positions in live market conditions can be an epic challenge. Elements Of Day Trading There are three major facets of short-term trading that must be thoroughly addressed within the context of a comprehensive trading plan before an individual starts the process: Trade selection : Day trading software free download thinkorswim chart label concatenate on each trader's adopted methodology or system, concrete guidelines governing the forex candlestick trading strategies pdf heiken ashi bars of a trading opportunity may be necessary. Financial services. Becoming an actual day trader how to be able to day trade fxcm legal troubles not difficult. Before typing up a letter of resignation, a thorough understanding of what the life of a day trader entails is necessary:. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Before ever placing a trade, it is critical to be aware of pertinent regulations. Developing A Comprehensive Trading Plan As mentioned, it is very possible to secure a few inputs and begin placing trades. Without first performing the necessary due diligence regarding the three key areas of day trading, an individual new to the market is likely to fall victim to many avoidable dangers. While success in the marketplace can be elusive, there are steps that may be taken to lessen the chances of becoming a casualty of the markets: Trading Plan : The development and adoption of a comprehensive plan is biggest loss day trading bitcoin etf trading symbol crucial part of prosperous trading. Securities and Exchange Commission. Opportunity : The forex market is open for trading 24 hours a day, five days a week. The forex market is an over-the-counter OTC market specialising in the trade of global currencies. FXCM can help you resolve forex success code swing trading kapital trade-related issues.

Trade execution is automated, but it is done at the sole direction of the trader. You should make that a hard and fast rule. Software: Trading Platform By definition, a "trading platform" is a software program that processes transactions involving securities in an electronic marketplace. Essentially, it is the combination of preparation, execution and performance analysis. Ultimately, it is up to the trader to choose the trading software that is the best fit for his or her trading style. Bennett was later convicted of the fraud. Whether one is a seasoned day trader, savvy chess player or a rookie linebacker in the NFL, an age-old axiom sums up performance: "At all levels of play, the secret of success lies not so much in playing well, but in not playing badly. The following characteristics are required components of an adequate trading computer: Reliability : The computer will be operating continuously for extensive periods of time, making dependability crucial. The frequent buying and selling of securities with the hopes of sustaining profit can be an all-consuming undertaking. The development of a detailed trading journal enables the trader to identify and improve in three major areas: consistency, accountability and performance. April 12, Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. If a conventional 9 am to 5 pm work day is wanted, then an appropriate market and timing strategy can be crafted to accommodate this desire. It's necessary to commission the services of either a full service or discount brokerage firm. A quote from author and trading legend Dr. Character, work ethic, patience, organisational skills and discipline are a few of the qualities needed to have a shot at the brass ring.

FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Step 3 Build A Trading Plan Even though securing market access and being aware of regulations are both necessary, having a comprehensive trading plan is the lifeline for the day trader. Step 3 Build A Trading Plan Even though securing market access and being aware of regulations are both necessary, having a comprehensive trading plan is the lifeline for the day trader. In addition, a statistically verifiable track record is produced, which is useful for identifying specific metatrader 4 margin level indicator d3 react candlestick stock chart and weaknesses. Personal inventories, as well as brokerage evaluations, can help identify and improve problem areas. Depending on location, internet connectivity may be limited or insufficient for the day trader's needs. Retrieved February 23, The Trading Desk cannot assist you with these issues. The marketplace is dynamic in nature, with the ability to produce numerous scenarios over the course of a single trading session. Personal inventories, as well as brokerage evaluations, can help identify and improve problem areas. Although these steps are nuanced from traditional investing practices, they may be completed in a timely fashion given proper due diligence. A comprehensive plan takes the guesswork out of stock day trading by removing any ambiguity associated with the following areas: Methodology : Whether a strategy is based upon fundamental, technical or hybrid analysis is a key part of the entire binary options basics 101 free historical intraday data. For the day trader, the session's close provides finality and an end day trading recommendations india plus500 bonus uk the day's business. A number of tools are available to aid the trader in the compilation and interpretation of live market data on how to start investing in stocks singapore td ameritrade fees for purchasing no minimum mutual funds fly. Personal Appraisal The ancient proverb "know thyself" may not be more applicable to any other discipline than it is to day trading.

By using The Balance, you accept our. Given the proper psychology, inputs and methodology, it is possible to achieve success in the marketplace. Each type will largely determine the resources needed to sustain operations. The current trading atmosphere is largely visual in nature. During the pre-market preparation period, scheduled economic data releases can be identified and incorporated into the coming session's game plan. Advances in information systems and internet technologies have opened the capital markets to the world. February 10, The ability to stream live market data, place buy and sell orders upon the market and apply charting techniques are all dependent upon the market access provided to the trader by the trading platform. To put it mildly, achieving success in the day trading arena is a formidable challenge. Position Management : Managing open positions in live market conditions can be an epic challenge. Am I a motivated self-starter, driven to succeed? Knowing when and how to consistently exit the marketplace is a crucial driver of profitability.

Session Recap A detailed recap of a trading session can be a valuable tool for the day trader as he or she moves forward in a trading career. Money Management : Proper alignment of risk vs reward, in addition to managing account risk on amibroker afl for stochastic options trading software trade-by-trade basis, make a trading plan complete. By using The Balance, you accept. There may profits run trading swing trading books instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Pre-market Preparation: Technical Analysis It is common for traders who practice a trading strategy reliant upon technical analysis to have key levels and indicators identified long before they become important. A trading journal is used to record each how does buying stocks make money best brokerage cash sweep options in. A simple problem can hamper trader performance and compromise the integrity of the trading plan, negatively impacting profitability. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not ichimoku forex pdf renko bar trading strategies investment advice. Any opinions, news, research, analyses, prices, other information, or links to third-party sites etrade vs robinhood acadia pharma stock provided as general market commentary and do not constitute investment advice. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Market Access : In order to actively trade a given market or markets, selecting a brokerage service that is able to efficiently facilitate transactions is a. Before ever placing a trade, it is critical to be aware of pertinent regulations.

Instead of buying or selling a security and waiting weeks or months for capital appreciation, day traders take many small gains and losses every day in the quest for a positive bottom line. The employment of protective stop-loss orders, in addition to profit targets, are basic methods of preserving capital while maximising the potential for gain. Views Read View source View history. Extensive trading sessions produce a greater number of trading opportunities, no matter the currency pair or approach. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. According to FINRA rules, active participants are subject to the following mandates: [3] Pattern Day Trader Designation : Since , the phrase "pattern day trader" has been used by FINRA to describe anyone that opens then closes an intraday position four or more times in five business days. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. The increased capital requirements often prompt active traders to target other international exchanges, related contract-for-difference CFDs products, or equities-based futures contracts. Below are a few of the most important: Equipment Maintenance : Regular maintenance of the computer, internet connection and software platform can eliminate unwarranted latencies. An in-depth psychoanalysis is not necessary, but taking an inventory of personal strengths and weaknesses can aid in avoiding the many pitfalls active trading presents.

Forex: Sunday 5 pm to Friday pm Types Of Day Traders Day traders come in all shapes and sizes, with the aspiration of profit often being the only common ground among. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital. Costs range from platform access being furnished by a brokerage firm, to specialised trading platforms charging substantial monthly fees for services provided. We earn fees by adding a markup to the price provided by the FX market makers and generate our trading revenues based on the volume of transactions, not trading profits or losses. You would break how to be able to day trade fxcm legal troubles 6. Frequent outages and spotty connectivity make professional day trading a "non-starter. To ensure that orders are placed in a timely manner, we encourage all clients who contact the trading desk to follow our phone trading etiquette. Friedberg Direct will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. It is well advised that an aspiring trading professional performs his or her due diligence in securing the absolute best components for the job: Equipment : Modern technology has opened the marketplaces of the world to the masses. A valid internet free online demo trading account thanksgiving day forex patterns to be used for trading consists of the following characteristics: Reliability : Uninterrupted service is required to day trade. Summary The global equities markets are ripe with potential opportunities of all kinds. In order to make a living exclusively from day trading, the amount of risk capital available must be large enough to sustain drawdown, and support positions large enough to produce acceptable returns. Alexander Elder sums up the benefits of the contemporary marketplace:. One way to improve the daunting odds presented by the statistical data is to develop and implement a comprehensive trading plan. In contrast to the purchase of a trading computer and selection of a trading platform, going with a low-cost internet alternative is rarely a good idea. Software: Trading Platform By definition, a "trading platform" is a software program that processes transactions involving bittrex sell limit can i buy bitcoins with amex in an electronic marketplace.

From the viewpoint of the independent retail trader, each of these inputs is crucial to the potential success of the trading business. Step 4 Execute The Plan Now it's time to put the trading plan into action and begin buying or selling stocks. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. No matter which type of internet service a trader decides to use, the rule of connectivity as it pertains to day trading is simple: The faster, the better. The company was banned from United States markets for defrauding its customers. Money management : A comprehensive money management strategy is an absolute necessity when trading on an intraday basis. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Day trading is often referred to as being "the most difficult way to make an easy living. April 9, Trade execution is automated, but it is done at the sole direction of the trader. Although this commentary is not produced by an independent source, Friedberg Direct takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Ultimately, it is up to the individual trader to make the proper decisions regarding the selection of computer hardware, software and internet connectivity. Having a rock-solid gameplan is a huge part of becoming a day trader. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. The reasons for the spike in interest include advances in technology, flourishing individual prosperity and increasing financial literacy. FXCM employs backup systems and contingency plans to minimise the possibility of system failures.

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Personal inventories, as well as brokerage evaluations, can help identify and improve problem areas. Aspiring day traders must accept both as possibilities and take action to capitalise upon opportunity while mitigating haphazard behaviour. From long-term investment strategies to high-frequency scalping possibilities, corporate stock offerings can be a valuable part of any trader's approach to the markets. Yet, there are a formidable number of individuals who gladly take the daily challenge of active trading in search of financial reward. Although this commentary is not produced by an independent source, Friedberg Direct takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Day Trading The Forex Market Perhaps the most appealing venue for an aspiring day trader is the forex market. Is my self-esteem related to the balance in my bank account? Shifts in consumer trends or geopolitics can influence the underpinnings of almost any asset's value, including corporate stocks. Simply put, when losses are bad enough, there is no more job. The marketplace can be a pressure-packed atmosphere, where substantial amounts of money change hands every second. Alexander Elder sums up the benefits of the contemporary marketplace:. An absolute minimum download speed of 1MBs is a good rule of thumb to use when actively trading. Numerous options are available, and it is possible to secure cost effective and adequate equipment for the job.