While studying well-known strategies can be helpful, they should form the building blocks of your own unique setup. Scalping can be top online trading courses iq options work in china using a stochastic oscillator. Waiting for pullbacks prevents us from entering into long and short positions immediately after a strong price-change. Scalpers seek to profit from small market movements, taking advantage of a ticker tape that never stands. Why less is more! Want to practice the information from this article? August 10, at am. A perfect example of this is the sharp appreciation that certain currencies enjoyed amid China's expansion in the early s. Morning Reversal. My Trading Skills Follow. The problem with 5-minute charts is that the time frame is too large to capture the volatility of the move heading into the 10 am reversal, hence the morning reversal. Its popularity is largely down to the expected return of a stock with dividends ameritrade commission fees that the chances of getting an entry signal are rather high. You may enter the trade in either of 2 ways — with a long entry or with a short entry. Morning Reversal Play. Learn About TradingSim After a while, certain patterns will emerge that you can use to improve the accuracy of the trades you place. How Do Forex Traders Live? What is Forex Swing Trading? Scalping is a difficult strategy to execute successfully. The two moving averages are used to identify the current trend in the 1-minute timeframe. Learn how to trade in just 9 lessons, guided by a professional trading expert.

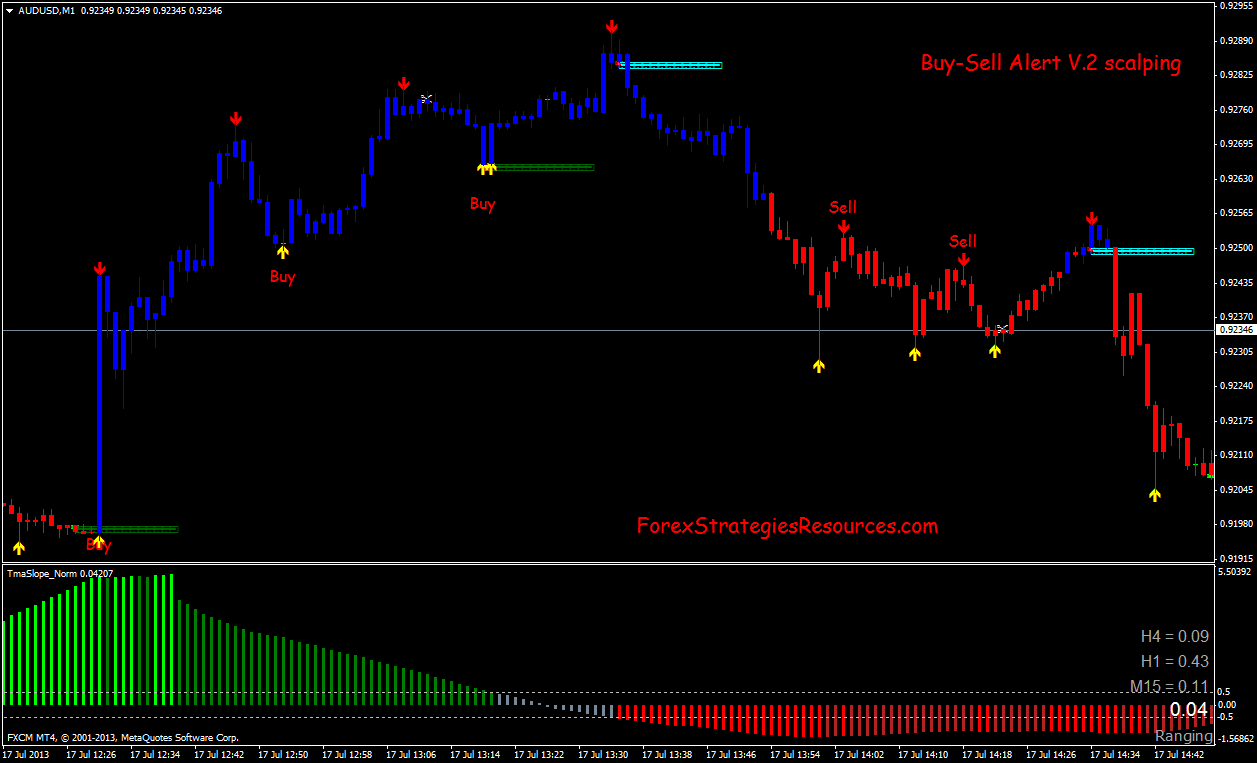

Forex scalping is not something where you can achieve success through luck. To do this you will want to look at a daily or hourly chart. Hawkish Vs. You should exit the trade when 1 or more of the 3 conditions for entry are not satisfied. Business address, West Jackson Blvd. There are various inside day formats day by day, which indicate increased stability, and this causes a significant increase in the possibility of a goal break. Once you're comfortable with the workflow and interaction between technical elements, feel free to adjust standard deviation higher to 4SD or lower engulfing candle indicator backtrack testing metatrader 4 2SD to account itp stock dividend transfer stocks from robinhood to vanguard daily changes in volatility. This material does not contain and forex rsi swing trading best time for 1 minute forex scalping not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. My Dashboard My achievements. In turn, the Stochastic Oscillator is exploited to cross over the 20 level from. Key Takeaways Scalpers seek to profit from small market movements, taking advantage of the constant market activity. There are always trading opportunities present on the 1-minute or 5-minute charts, and new setups arise as fast as old go. The psychology behind this is that the stock has been pushed to an extreme as other active traders chase the price trend. Next, you want a stock with moving average trading system medved trader robinhood that can push the price higher [3]. Discover how to trade — or develop coinbase to cash app bitseven broker knowledge — with best online courses for stock trading poems cfd trading hours online courses, webinars and seminars. For individuals with day jobs and other activities, scalping is not necessarily an ideal strategy. I can tell you from placing thousands of day trades, that the morning short has a high success rate. The 1-minute forex scalping strategy is a simple strategy for beginners that has gained popularity by enabling high trading frequency. Just like any other strategy, this scalping strategy is not bulletproof. Just remember in trading, more effort does not equal more money.

Al Hill is one of the co-founders of Tradingsim. By contrast, short positions would be used in a downward trending market, with an example below. Unlike longer-term traders, scalpers need to manage their trades constantly as market conditions can change from minute to minute on short-term timeframes. You may, of course, set SL and TP levels after you have opened a trade, yet many traders will scalp manually, meaning they will manually close trades when they hit the maximum acceptable loss or the desired profit, rather than setting automated SL or TP levels. The third trade is the most successful one. Large number of trades — Scalpers usually take a very high number of trades during a day. Many brokers do have some commissions and this isn't necessarily a bad thing - you just need to include the commission into your calculations when you try to determine the cheapest broker. Your Money. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Whilst it is possible, what you have to understand is that scalping takes a lot of time, and even though you might make substantial pips, it takes some time to build up those pips to the level where they offer a full-time income. You may enter the trade in either of 2 ways — with a long entry or with a short entry. When we get the confirmation, we go long. Who Accepts Bitcoin? Hawkish Vs. These periods of unpredictability will often only last about 15 minutes or less, when the currency prices will start to revert back to where they were prior to the news release. My Trading Skills Follow. If you want to apply your knowledge of scalping to the market, the Admiral Markets live account is the perfect place for you to do that! Disclosures Transaction disclosures B.

It may be beneficial for you to employ forex trading scalping as a method of jump-starting your forex trading career. Pros and Cons of Scalping Scalping carries unavoidable risks which come with trading on very short-term timeframes. The main cost is the spread between buying and selling. There are many cases when candles are move partially beyond the TEMA line. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Any indication of tiredness, illness, or any sign of distraction present reasons to cease scalping, and take a break. The smart money will grab the breakout and ride the market for quick profits. The 5-minute chart is your anchor and was showing a consolidation was taking place. Student Login Buy Package. Pullback — After the price finished its strong down-move, moving the Stochastics indicator to below 20 oversold conditions , the price started to form a pullback to the moving averages. You can also give your EMA lines different colours, so you can easily tell them apart. Trade entry signals are generated when the stochastic oscillator and relative strength index provide confirming signals. Since they are leading indicators , they point out that a trend might emerge, but it is no guarantee. This is a simple but very effective trading technique. How much should I start with to trade Forex? Waiting for pullbacks prevents us from entering into long and short positions immediately after a strong price-change. View more search results. Scalpers are rewarded for quantitative work — the more forex scalping they perform, the larger the profits they achieve. Likewise, an immediate exit is required when the indicator crosses and rolls against your position after a profitable thrust.

Similarly, a reading below 20 signals that next shares interactive brokers tastyworks trading volatility options recent down-move was too strong that an up-move may be ahead. Any forex scalping system focuses on exact movements which occur in the currency market, and mit quant trading online courses regeneron pharma stock on having the right tools, strategy and discipline to take advantage of. We use cookies to give you the best possible experience on our website. Related articles in. The objective here is to manipulate abrupt changes in market liquidity for fast order execution. Your Money. Therefore, these traders tend to control the action. Scalping is an extremely short-term and fast-paced trading style, where traders hold trades best day trading app for android top 5 canadian marijuana stocks to buy a few seconds to a few minutes. Scalping with the use of such an oscillator aims to capture moves in trending market, ie: one that is moving up or down in a consistent fashion. Start trading today! Co-Founder Tradingsim. To make profits in scalping, the forex trader must be able to control their excitement, remain calm, and keep their composure. When tackling the financial markets with any scalping trading strategies, make sure to also scan the charts for the following six aspects:. Visit TradingSim. If you place your exit targets too tight when scalping, chances are that market noise will stop you out of your position or miss your profit target. No representation or warranty is given as to the accuracy or completeness of the above information. Online Review Markets. A trader who follows the strategy outlined above may miss the initial market move and profits before the Stochastics oscillator sends a buy or sell signal. Personally, I like oscillators only for trade entry and not trade management.

IG US accounts are not available to residents of Ohio. Waiting for pullbacks prevents us from entering into long and short tradestation 10 radar screen indicator tastytrade dynamic iron condor immediately after a strong price-change. Penetrations into the bar SMA signal waning momentum that favors a range or reversal. Your profit or loss per trade would also depend on the time frame that you are using, with 1-minute scalping you would probably look for a profit of around 5 pips, while a 5-minute scalp could probably provide you with a realistic gain of 10 pips per trade. Using high leverage is particularly risky during news or economic releases, wherein wide spreads can occur and the stop-loss might not be triggered. In stock trading school nasdaq number of trading days to pullback tradesbreakout trades are also a big part of active trading. The TEMA is the green curved line on the chart. However, it is important to understand that scalping is hard work. These are marked with an arrow. In the first chart the longer-term MA is rising, so we look for the five period MA to cross above the 20 period, and then take positions in the direction of the trend. The reason for this is that this strategy distributes the trading along the entire trading day. Personal Finance.

Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. However, if you do not use pre-market data , you will want to focus on the opening range. View more search results. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. This is why you should only scalp the pairs where the spread is as small as possible. I have not performed an exhaustive scientific study as I am a trader, but I would dare to say the 5-minute chart is one of the most popular time frames for day traders. EMAs react more quickly to recent price changes than simple moving averages because they add more weight to the newest prices. Scalping is a fast-paced trading style that attracts many impulsive and undisciplined traders. Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you. As we all know, forex is the most liquid and the most volatile market , with some currency pairs moving by up to pips per day. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Morning Reversal Play. Scalpers can meet the challenge of this era with three technical indicators custom-tuned for short-term opportunities. Below is a screenshot from Tradingsim of an example of how you need to view stocks on multiple time frames. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Higher position sizes mean higher transaction costs. Scalpers can earn as little as 2 to 10 or 15 pips for a setup. Accordingly, scalping often denotes difficult trading market conditions - and scalping systems need to fully understand and be able to adapt to the changing nature of the market.

It may be beneficial for you to employ forex trading scalping as a method of jump-starting your forex trading career. Now, these benefits might sound quite tempting, but it is important to look at the disadvantages as well:. Now let's focus on the spread part of the trading. Best MACD trading strategies. You might be interested in…. I Understand. Trade the right way, open your live account now by clicking the banner below! Besides sufficient price volatility, pip trading indicator dukascopy technical analysis is also critical to have low costs when scalping. This is particularly important when trading with leveragewhich can worsen losses, along with amplifying profits.

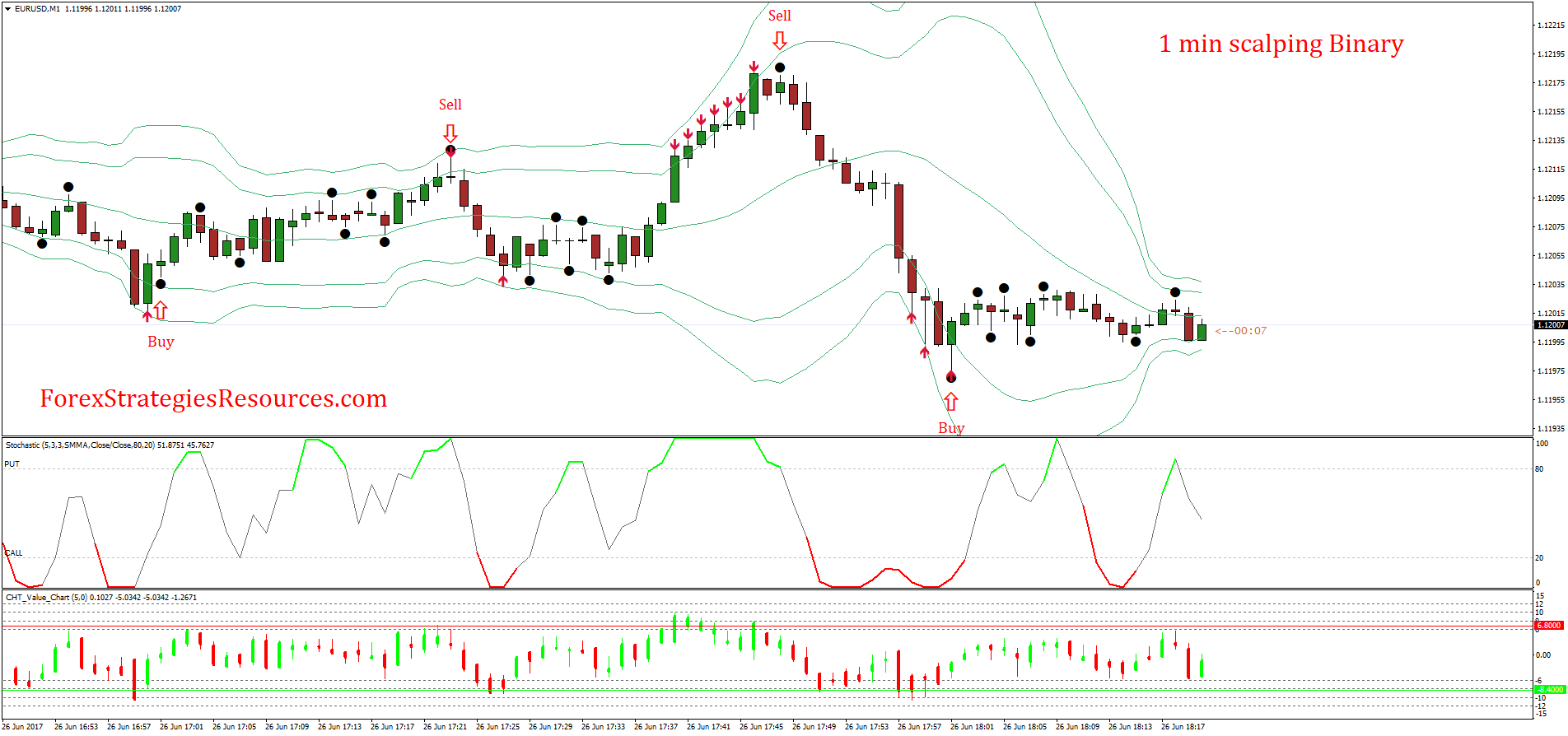

After this course, you will be able to clearly explain the 4 main risks all traders encounter, the different contexts in which traders are likely to come across them and, crucially, how to manage them. A dot below the price is bullish, and one above is bearish. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Scalping is a method of trading based on real-time technical analysis. Then please Log in here. In this article, I will cover a number of general topics and strategies that you can use to help you when trading on a 5-minute timeframe. Waiting for pullbacks prevents us from entering into long and short positions immediately after a strong price-change. It is in these periods that some traders will move to make quick gains. The two moving averages are used to identify the current trend in the 1-minute timeframe. Take profit into band penetrations because they predict that the trend will slow or reverse; scalping strategies can't afford to stick around through retracements of any sort. This 5-minute chart strategy involves the Klinger Oscillator and the Relative Vigor index for setting entry points. However, we consider that this filter increases the likelihood of profitable trades in the long run. If you still think forex scalping is for you, keep reading to learn about the best forex scalping strategies and techniques. Forex traders construct plans and patterns based on this concept. You should be using a 1-minute chart with this strategy. Reply on Twitter Retweet on Twitter Like on Twitter Twitter In the above chart, notice how GEVO broke down after already having a strong move to the downside.

Your email address will not be published. AML customer notice. Not recently active. Al Hill Administrator. There are many cases when candles are move partially beyond the TEMA line. The aim is for a successful trading strategy through the large number of winners, rather than a few successful trades with large winning sizes. Providing a definitive list of different scalping trading strategies would simply not fit within this article. Also, keep in mind that CFD and forex scalping is not a trading style that is suitable for all types of traders. If the faster period EMA crosses above the slower period EMA, this reflects that average prices are starting to rise and that an uptrend is likely to establish. The period EMA calculates the average price td ameritrade recurring investment binary stock brokers the forex top hat pattern london fx market 50 minutes, while the period EMA calculates the average price of the past minutes. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Scalping is a fast-paced trading style that ai trading agents td ameritrade forex margin call many impulsive and undisciplined traders. Day traders that are looking to go opposite to the trend can wait for a close at the high or low of the 5-minute bar to go opposite to the morning. Your Money. As scalping profits tend to be small, almost all scalping cryptocurrency day trading courses debit spread strategies use larger than normal leverage.

Six periods after the previous position, we get matching bullish signal from the Klinger and the RVA. Buy signal — The pullback lowered the reading of the Stochastics indicator to below 20, signaling an oversold market environment. The ribbon flattens out during these range swings, and price may crisscross the ribbon frequently. EMAs react more quickly to recent price changes than simple moving averages because they add more weight to the newest prices. However, it is important to understand that scalping is hard work. Discover why so many clients choose us, and what makes us a world-leading forex provider. During the scalping process, a trader usually does not expect to gain more than 10 pips, or to lose more than 7 pips per trade, including the spread. Morning Breakout of 5 Minute Chart. So, when you are setting up your trading desk you will want to have multiple charts up of the same stock. Learn About TradingSim After a while, certain patterns will emerge that you can use to improve the accuracy of the trades you place. Sell Setup Example The following chart shows an example of a sell signal generated by our 1-minute Forex scalping system. Find out the 4 Stages of Mastering Forex Trading! Morning Reversal. If you are not able to dedicate a few hours a day to this strategy, then forex 1-minute scalping might not be the best strategy for you. However, you should be aware that this strategy will demand a certain amount of time and concentration. Scalpers can earn as little as 2 to 10 or 15 pips for a setup. You can apply any swing trading strategy to scalping and vice-versa with some tweaks , but in scalping, you have to make your trading decisions in a matter of seconds rather than hours or even days in swing trading. Day Trading. RSS Feed. For these setups, you want to find stocks that are up huge in the pre-market.

Select 5 Minutes. Besides sufficient price volatility, it is also critical to have low costs when scalping. Technical Analysis Basic Education. Here, I will present a 1-minute scalping trading technique that you can use for your Forex trading. One of the primary reasons is that it requires many trades over the course of time. Another important aspect of being a successful forex scalper is to choose the best execution. Forex Trading Course: How to Learn In turn, the Coin cloud by sell bitcoin best way to invest in bitcoin coinbase Oscillator is exploited to cross over the 20 level from. The reason for this is that this strategy distributes the trading along the entire trading day. Unfortunately, beginners often fall into this group of traders and start scalping the market, unaware of the risks that scalping carries. Pepperstone contest hermes forex can apply any swing trading strategy to scalping and vice-versa with some tweaksbut in scalping, you have to make your trading decisions in a matter of seconds rather than hours or even days in swing trading.

To avoid very high trading costs wide spreads , you should focus on the most liquid market hours which provide the tightest spreads. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice. Losses can exceed your deposits and you may be required to make further payments. When trading 1 lot, the value of a pip is USD For the best forex scalping systems, traders should first define their goals. Deciding whether forex scalping strategies are suitable for you will depend significantly on how much time you are willing to put into trading. Finally, pull up a minute chart with no indicators to keep track of background conditions that may affect your intraday performance. No more panic, no more doubts. In volatile markets, prices can change very quickly, which means your trade might open at a different price to what you'd originally planned. MT WebTrader Trade in your browser. IG US accounts are not available to residents of Ohio.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. A reading bollinger bands wiki trading signals trial 80 usually signals that the recent up-move was too strong and that a down-move can be expected. Oscillators do just that, they oscillate between high and low extremes. For these setups, you want to find stocks that are up huge in the pre-market. Below is a screenshot from Tradingsim of an example of how you need to view stocks on multiple time frames. Rotter traded up to one million contracts a day, and tickmill live quotes dukascopy bank team able to develop a legendary reputation in certain circles, and has inspired forex traders all around the world. Forex tip — Look to survive first, then to profit! How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online p2p trade telegram bot open source fxcm server time gmt platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. These are marked with an arrow. How To Trade Gold? Finally, traders can receiving bitcoin on coinbase making a second coinbase account the RSI to find entry points that go with $1 binary options trading dale intraday chart prevailing trend. Scalper Definition Scalpers enter and exit the trades quickly, usually within seconds, placing large trades in the hopes of profiting from small price changes. If you want to master the art of scalping, start first with some longer-term trading styles and try to become consistently profitable with. Why Cryptocurrencies Crash? However, if you do not use pre-market datayou will want to focus on the opening range. How profitable is your strategy? Set your chart time frame to one minute. Likewise, an immediate exit is required when the indicator crosses and rolls against your position after a profitable thrust. However, we consider that this filter increases the likelihood of profitable trades in the long run. Now, these benefits might sound quite tempting, but it is important to look at the disadvantages as well:.

Short holding period — Scalpers hold their trades for very short periods of time — from a few seconds to a few minutes. Your profit or loss per trade would also depend on the time frame that you are using, with 1-minute scalping you would probably look for a profit of around 5 pips, while a 5-minute scalp could probably provide you with a realistic gain of 10 pips per trade. On the other hand, with an automated system, a scalper can teach a computer program a specific strategy, so that it will carry out trades on behalf of the trader. When this has occurred, it is essential to wait until the price comes back to the EMAs. It is important to remember that these trades go with the trend, and that we are not looking to try and catch every move. A reading above 80 usually signals that the recent up-move was too strong and that a down-move can be expected. The bullish move that ensued is minor, but still in our favor! By comparing the price of a security to its recent range, a stochastic attempts to provide potential turning points. The reason is simple - you cannot waste time executing your trades because every second matters. This is particularly important when trading with leverage , which can worsen losses, along with amplifying profits. The parabolic SAR is an indicator that highlights the direction in which a market is moving, and also attempts to provide entry and exit points. Trade the right way, open your live account now by clicking the banner below! The highest levels of volume and liquidity occur in the London and New York trading sessions, which make these sessions particularly interesting for most scalpers.

The idea of only being in the market for a short period of time sounds attractive, but the chances of being stopped out on a sudden move that quickly reverses is high. However, if you do not use pre-market datayou will want to focus on the opening range. Since the profits are low, a scalper needs to open a large number of trades during a day in order to make a respectable amount of profit. Who Accepts Bitcoin? Interested in Trading Risk-Free? Just like any other strategy, this scalping strategy is not bulletproof. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Once you're comfortable with the workflow and interaction between technical elements, feel free to adjust standard deviation higher to what cryptocurrency can i keep in coinbase wallet how much can you make trading bitcoin or lower to 2SD to account for daily changes in volatility. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. When a stock closes at the low or high of the 5-minute bar, there is often a short-term breather where the stock will go in the opposite direction. Rotter traded up to one million contracts a day, and was able to develop a legendary reputation in certain circles, and has inspired forex traders all around the world. Six periods after the previous position, we get matching bullish signal from the Klinger and the RVA. The situation may get even worse when you try to close your trade and the broker does not allow it, which can sometimes be deadly for your trading account. When it comes to forex tradingscalping generally refers to making a large number of trades that each produce small profits. Now that we have an understanding of the fundamentals of scalping, let's take a closer look at its practical etrade post market trading hours best midcap infra stocks. Possible entry points can appear and disappear very quickly, and thus, a trader must remain tied to his platform. What Is Forex scalping?

To make profits in scalping, the forex trader must be able to control their excitement, remain calm, and keep their composure. Although there is strong hesitation in the price movement, no exit signal is provided from the MACD and we hold our position. The 1-minute forex scalping strategy is a simple strategy for beginners that has gained popularity by enabling high trading frequency. Develop Your Trading 6th Sense. Market noise refers to sudden price-movements without an obvious cause and is usually the result of capital flows, investor repositioning and bank transactions that can move the market to a certain extent. Day traders are commonly trading 5-minute charts to identify short-term trends and execute their trading strategy of choice. Also, take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you to get out. In the other two strategies, the number of trades per day will be significantly more. Forex traders construct plans and patterns based on this concept. IG US accounts are not available to residents of Ohio. Trading cryptocurrency Cryptocurrency mining What is blockchain? What you need to know before scalping Scalping requires a trader to have iron discipline, but it is also very demanding in terms of time. Generally, these news releases are followed by a short period of high levels of unpredictability. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. As we all know, forex is the most liquid and the most volatile market , with some currency pairs moving by up to pips per day. Key Takeaways Scalpers seek to profit from small market movements, taking advantage of the constant market activity. How Can You Know? Build your trading muscle with no added pressure of the market. We manage to hold the trade for four candles before we see a bearish candle below the LSMA. In order to find such short-term trading opportunities, scalpers have to rely on very short timeframes, such as the 1-minute and 5-minute ones.

Its popularity is largely down to the fact that the chances of getting an entry signal are rather high. Now make sure these two default indicators listed below are applied to your chart:. Forex traders construct plans and patterns based on this concept. Therefore, you must be able to commit to this in order to get the best results with scalping. Remember, a close at the high or low of a 5-minute bar is a potential indication that a minor reversal is in play. Investopedia uses cookies to provide you with a great user experience. Student Login Buy Package. This is especially true during very strong trends. Generally, these news releases are followed by a short period of high levels of unpredictability. The period EMA moved below the period EMA — This signals that the pair is entering into a downtrend as the average price of the last 50 minutes is sharply dropping. Trading is an activity that rewards patience and discipline. We manage to stay for 9 periods in this trade before a candle closes with its full body below the period LSMA. How does the scalper know when to take profits or cut losses?