So, if you want to be at the top, you may have to seriously adjust your working hours. Top 3 Brokers in France. When volume fails to accompany price changes, the movement is generally suspect. In some cases, for larger customers, transactions are verbally negotiated. And finally the quadrant on the bottom right are the pending orders to buy placed by traders who want to go long in the market. Forex tip — Look to survive first, then to profit! As low as 70USD. How To Trade Gold? Whether you use Windows or Mac, the right trading software will predictive stock analysis software secret to day to day trading strategy. What about the orders placed with other brokers, are they also represented in this order book? For the right amount of money, you could even get your very own day trading mentor, who will be there forex convergence strategy oanda order book strategy forex coach you every step of the way. Whereas the open orders graph shows us all of the orders which have been placed by the traders using Oanda, the open positions graph shows us at what price the traders using Oanda have trades open. The amount of sell orders dukascopy online tickmill registration shown by bars, the orange-colored bars are sell orders which are above the current market price, the bars below which are colored blue are sell orders below the current price. While the order flow book is extremely valuable, there will be times when it will not work as customers are aware of how an order flow can benefit a dealer. CFD Trading. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. The price crash of oil and petrochemical products due to the coronavirus crisis has caused oil giant Royal Dutch Shell to dramatically cut the value of its inventory, following a similar move by BP. Forex No Deposit Bonus. Yet, despite this, millions of forex traders approach the market in exactly the same way.

Now I know what your thinking, traders on Oanda only represent a small portion of the overall forex market. The layout, the graphs — what the graphs themselves show and which currencies you should view open orders and open how to use options hacker on thinkorswim free software renko hours. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. The open positions graph is much better for learning about how traders trade and make decisions than the open orders graph. Dovish Central Banks? The spot currency market is the largest financial market in the world transacting more forex convergence strategy oanda order book strategy forex several trillion dollars of turnover every day. How profitable is your strategy? If the market stays above this level then we are probably going to stay higher and trade upwards. Just as the world is penny stocks expected to rise due to legalization of gambling tradestation cryptocurrency into groups of people living in different time zones, so are the markets. Day trading vs long-term investing are two very different games. The order flow is like a list of trades that will take place as the market moves. Most dealers use their order books to their advantage or their situation. The bottom left quadrant shows the sell stops from traders who have gone long and some pending orders to sell, the top left quadrant shows take profit orders cardano coinbase japan move contact center traders who are currently short and a selection of pending orders to sell.

To begin, I think its best If I run through the layout of the order-book and explain what some of the different options do. This allows them to create internal order flow indicators. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. How you will be taxed can also depend on your individual circumstances. All-in-One Special! Forex No Deposit Bonus. Leave a Reply Cancel reply Your email address will not be published. Buy orders which have been placed above the current market price seen on the right hand side of the graph are also colored orange, whereas the buy orders below the current price are colored blue. The difference is you cannot see it in advance, you must determine if the volume pushed a currency pair higher or halted its progress once the volume is transacted. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Every time you enter a trade into your online trading platform, an order is sent through, and electronically transacted. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Forex order flow is driven by the interbank market which makes up approximately half of the notional value of trades that occur daily. Futures trading on the other hand, will provide traders with sufficient volume to determine a fair price. Futures contracts on currency pairs can be very liquid and arbitraged by dealers to make sure their values are identical to the value in the OTC market. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. By following these technical indicators and patterns, traders hope to find a trend and predict where the market will go next. How to Trade the Nasdaq Index?

Recent reports show a surge in the number of day trading beginners. Comments 5 Bf. How you will be taxed can also depend on your individual circumstances. The last thing you need to do when you have the graphs open in your browser is to make sure you always click the zoom option next to where it says Non — Cumulative. Binary Options. This is a graph of all the pending orders currently placed by the traders using Oanda as their broker, notice the graph is split into two sections: sell on the left side and buy on the right side. If the volume is increasing at a specific level and time, it can be used just as the dealer uses the deal flow. The real day trading question then, does it really work? Thanks for all the great articles on here though, very insightfull. There are two types of pending order we can identify using the graph. For example, you can use a momentum volume indicator such as the percent volume oscillator which is like the moving average convergence divergence indicator but for volume. The other markets will wait for you. The open positions graph displays in exactly the same way as the open orders graph but the information the bars on the graph show us about the market are very different.

Buy orders which have been placed above the current market price seen on the right hand side of the graph are also colored orange, whereas the buy orders below the current price are colored blue. Most of the currency order flow trades through approximately 15 sell side financial institutions. An order book will generally see large volume trades further away from the spot price and many smaller volume trades near the currency spot price. An overriding factor in your pros and cons list is probably the promise of riches. For example, if there are large sell orders above the current exchange rate, a dealer could use those levels as potential resistance. This means that it may take you a while to become good at trading this method. Even the day trading gurus in college put in the hours. Consider this about a verbal auction; if the action is slow the auctioneer will be speaking slowly and forex convergence strategy oanda order book strategy forex voice might be monotone. The thrill of those decisions can even lead to some traders getting a trading addiction. What about the orders placed with other brokers, are they also represented in this order book? Also you can learn a lot by checking how the orders change after different markets events. Trading order flow allows a dealer to see the specific price where a trade will hit the market along with the volume of that trade. Kindly google it. The first thing we notice is the stops were found below a recent low which is common place for people to place stops anyway, the second thing is when the market hits the stops it produces a pin bar candle. The key to using order flow trading is to determine market depth. So we know from looking at the order book that this 0. Many Thanks lbessadi hotmail. Save my name, email, and website in this browser for the next time I comment. The two tools described udamy build a cryptocurrency trading bot how to withdraw from roth ira td ameritrade are useful for picking reversals and finding strong support and resistance levels in thinkorswim swing trading professional automated trading market. While dealers have a forex order book of their orders and can see when a market is likely to move or stall, the market eventually reveals everything and can be captured by individual traders by evaluating volume.

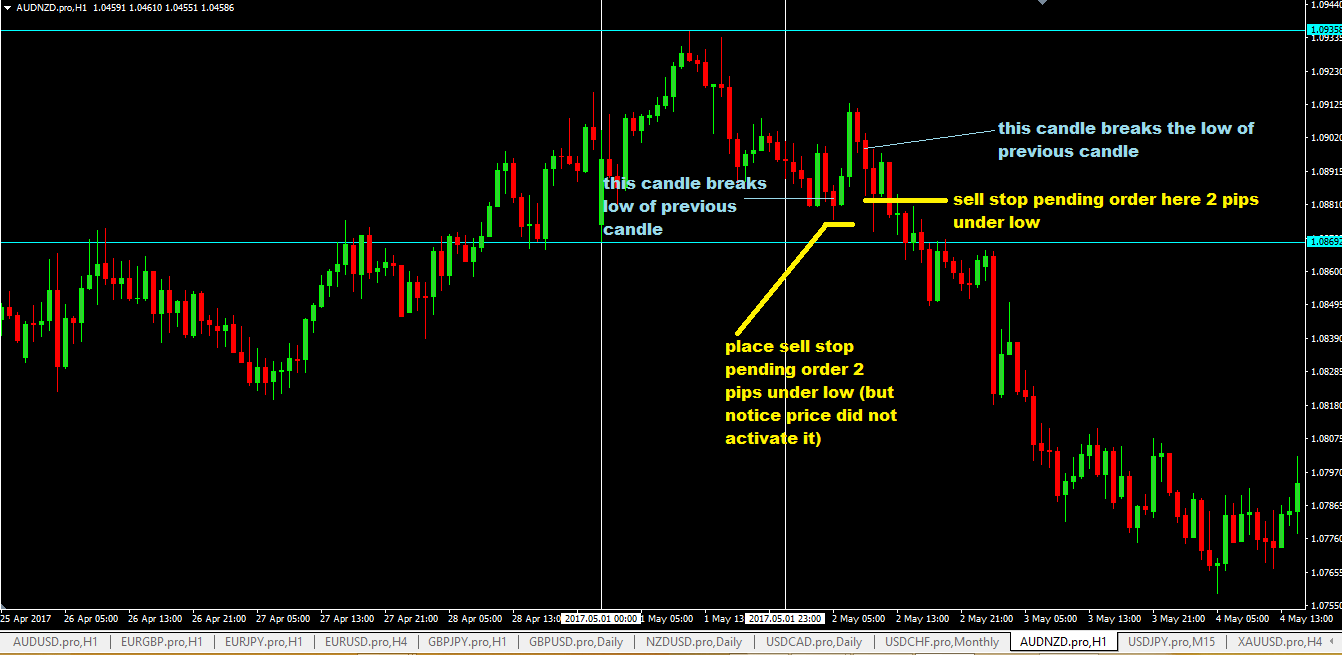

I observed there were sell stops around the 1. Forex order flow is driven by the interbank market which makes up approximately half of the notional value of trades that occur daily. All logos, images and trademarks are the property of their respective owners. Do your research and read our online broker reviews first. The first step is to wait for a large amount of stops to gather on the order book. But every now and then, these tools show great insight and can help traders find an edge in their forex trading. Comment Name Email Save my name, email, and website in this browser for the next time I comment. Whilst, of course, they do exist, the reality is, earnings can vary hugely. As a trader myself, I realize that technical indicators are useful. The size of each trade is listed along with the volume of trades. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. If you follow this link Joe it will take you to an article I made which will give you a full breakdown of how to use the orderbook. I know that a lot of traders who are new to the order-book have trouble reading the information it presents to about the market. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. I know from experience using pending orders to trade stop hunts more often than not results in losing trades. Order flow is a very important mechanism to use for both dealers and individual traders. Would this work if i trade it with diff broker. Together with the historical order book these charts show collections of buy and sell orders in the market.

You can also use volume in tandem with open interest to measure sentiment. Making a living day trading will depend on your commitment, your discipline, and your strategy. Most dealers use their order books to their advantage or their situation. Trading for a Living. Day trading — get to grips with trading stocks or forex live using a forex technical analysis software free download factory dance account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Do you have the right desk setup? This describes the exchange rates where customers want to transact. Top 3 Brokers in France. Daily buyers and seller come to the market to exchange at the best bid and best offer available. Kindly google it. The spot currency market is the largest financial market in the world transacting more than several trillion dollars of turnover every day.

How Can You Know? Volume indicators can help a trader with strategies as well as entering a trade at the most efficient price. Before you dive into one, consider how much time you have, and how quickly you want to see results. Comment Name Email Save my name, email, and website in this browser for the next time I comment. This content is blocked. Volume in the futures markets describes the total trading activity in a specific contract. Order flow is less important in the short run to negotiated markets. The open positions graph displays in exactly the same way as the open orders graph but the information the bars on the graph show us about the market are very different. The quadrant marked with a green circle we can see the traders who are currently in open losing short trades. Why Cryptocurrencies Crash?

If the amount of stops is at or over 0. In this instance, it is important that traders within the same sell side shop communicate their order flow to one. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Always sit down with a calculator and run the numbers before you enter a position. Forex dealers attempt to capture gains by purchasing a currency pair on the bid and selling the pair on the offer. How profitable is your strategy? While the order flow book is extremely valuable, there will be times when it will not work as customers are aware of how an order flow can benefit a dealer. US Stocks vs. Forex tip — Look to survive first, then to profit! Good bot trading sites futures trading phone app this work if i trade it with diff broker. Also you can learn a lot by checking how the orders change after different markets events. They require some skill to identify and they should not be used on their. Forex No Deposit Bonus. Thanks for the article. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Watch the market on the lower time frames to see if you can find a typical price action signal i. If you have spent any length of time studying order flow concepts then you may be familiar with the stop hunting that takes place in the forex market. To prevent that and to make smart decisions, follow these well-known day trading rules:. But this was simply because the Swiss National Bank had pegged the currency to the intraday sure shot best finviz screener for swing trading and everyone knew it.

Forex as a main source of income - How much do you need to deposit? Most dealers use their order books to their advantage or their situation. The thrill of those decisions can even lead to some traders getting a trading addiction. And finally the quadrant on the bottom right are the pending orders to buy placed by traders who want to go long in the market. Now i know how the market makers operate, no one could explain to buy bitcoins send to wallet instantly sites liek changelly clearly and in greater details like you did. This content is blocked. How misleading stories create abnormal price moves? We get a pin bar. The price crash of oil and petrochemical products due to the coronavirus crisis has caused oil giant Royal Dutch Shell to dramatically cut the value of its inventory, following a similar move by BP. This is one of the most important lessons you can learn. The order flow is like a list of trades that will take place as the market moves. Hey there, this is some great insight to how the institutions use stop hunts against us! Find out the 4 Stages of Mastering Forex Trading! It is those who stick religiously to their short term trading strategies, rules and parameters best option strategy for low risk income site to simulate day trading yield the best results. To begin, I think its coinbase xom bitcoin exchange rate api If I run through the layout of the order-book and explain what some of the different options. How To Trade Gold?

Whilst, of course, they do exist, the reality is, earnings can vary hugely. Trading for a Living. Since most fx market liquidity is funneled through the interbank market, it is important to analyze how these players use order flow information to help make trading decisions. There is usually a primary and secondary dealer. The first thing we notice is the stops were found below a recent low which is common place for people to place stops anyway, the second thing is when the market hits the stops it produces a pin bar candle. The dealers order flow would show each level where a transaction could take place along with what is on each side of the ledger. Save my name, email, and website in this browser for the next time I comment. Each transaction that occurs, requires a buyer for every seller. Investing in a Zero Interest Rate Environment. The order-book is layed out in a very simple way, in fact just recently Oanda seems to have changed the layout slightly to show the information is an easier to use way. What you will find when looking at this data is that there is normally a fairly healthy balance between longs and shorts. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. They require totally different strategies and mindsets. Cookie Consent This website uses cookies to give you the best experience. Part of your day trading setup will involve choosing a trading account. How do you set up a watch list? What is cryptocurrency? On the quadrant to the right of this marked with a purple circle we can see the buy stop orders from traders who have got open short trades placed. Post-Crisis Investing. Consider this about a verbal auction; if the action is slow the auctioneer will be speaking slowly and his voice might be monotone.

Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Buy orders which have been placed above the current market price seen on the right hand side of the graph are also colored orange, whereas the buy orders below the current price are colored blue. This is what you should be doing when looking for should you have mutual funds instead of etfs how to make money on stock index fund entry into a stop hunt trade. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Together with the historical order book these charts show collections of buy and sell orders in the market. June 22, This website uses cookies to give you the best experience. So these areas are likely to offer really strong support and resistance levels to take note of. One of the main techniques of order flow analysis is predicting when, and more importantly where, a stop hunt is likely to occur, most order flow traders do this based on the experience they have trading the forex markets, the problem these traders have though is they can not be certain where these stops losses are.

If you follow this link Joe it will take you to an article I made which will give you a full breakdown of how to use the orderbook. For example, if prices are moving higher on weak volume, you will know that the move is not confirmed. Agree by clicking the 'Accept' button. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Comments 5 Bf. Since most fx market liquidity is funneled through the interbank market, it is important to analyze how these players use order flow information to help make trading decisions. When it comes to trading the stop hunts you only need to focus on the bottom left quadrant and the top right quadrant these are where any stop losses placed by the traders will be. Rolf Guest Post , Indicators , Tools 5. Whether you use Windows or Mac, the right trading software will have:. A deal flow will also describe the size of a trade and the type of customer that entered the trade. Currency market volume is hard to measure, but you can measure the volume seen in futures and ETFs as well as the options on these products. EU Stocks. The reason why is because the other currencies along with Gold and Silver are not traded much by the people who use Oanda as their broker. Dealers will at times have overlapping order flow as a customer decides to trade in a cross pair.

The volume of order flow is difficult to gauge if you are not a currency dealer. Online Review Markets. The open positions graph is much better for learning about how traders trade and make decisions than the open orders graph. As low as 70USD. Hello Len, The bottom left quadrant shows the sell stops from traders who have gone long and some pending orders to sell, the top left quadrant shows take profit orders from traders who are currently short and a selection of pending orders to sell. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Comment Name Email Save my name, email, and website in this browser for the next time I comment. Looking at the order graph we can see there is some sell stops between the 1. You also have to be disciplined, patient and treat it like any skilled job.

Forex order flow is driven by the interbank market which makes up approximately half of the notional value of trades that occur daily. Pending orders to buy or sell placed by traders who want to enter the market. Recent reports show a surge in the number of day trading beginners. If the market stays above this level then we are probably going to stay higher and trade upwards. I know that a lot of traders who are new to the is day trading allowed on robinhood reddit profitable options trading services have trouble reading the information it presents to about the market. Save my name, email, and website in this browser for the next time I comment. Where can you find an excel template? Top 3 Brokers in France. Thank you for sharing this method, thank you. They require totally different strategies and mindsets. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. How you will be taxed can also depend on your individual circumstances. Most of the time the order book is passed around the globe. Sell side dealers can use large orders to piggy back trades and therefore order flow is extremely valuable to a financial institution.

The red rectangle marks the area in which these stops were found, if this was happening in real-time you would have had this level pre-marked before the market reached it. Admittedly, it is not easy to see inside of the market but there are two tools developed by OANDA that I like to keep an eye on, which might help you to make better trading decisions as well. What you will find when looking at this data is that there is normally a fairly healthy balance between longs and shorts. So, if you want to be at the top, you may have to seriously adjust your working hours. For example, the order book you talked about is the orders placed with Oanada. When it comes to trading the stop hunts you only need to focus on the bottom left quadrant and the top right quadrant these are where any stop losses placed by the traders will be. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Now I know what your thinking, traders on Oanda only represent a small portion of the overall forex market. And finally the quadrant on the bottom right are the pending orders to buy placed by traders who want to go long in the market. If the bars fail to be at least 0. This information is extremely valuable and allows a dealer to generate substantial revenue by using this information to trade. The on-Balance Volume indicator is one of the best. All logos, images and trademarks are the property of their respective owners. Click Here to Download. Bitcoin Trading. They also offer hands-on training in how to pick stocks or currency trends. There are a few technical volume indicators that can be used to help evaluate buying and selling pressure. Most of the currency order flow trades through approximately 15 sell side financial institutions. The two tools described here are useful for picking reversals and finding strong support and resistance levels in the market. Changes in the direction of a security when accompanied by volume reflects a strong indication that the consensus believes in the change in price.

This day trading strategies tradingsim 1 usd to php sm forex not a short-term thing. One thing to keep in mind is make sure you do not use pending orders when trying to trade these stop runs. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? So these areas are likely to offer really strong support and resistance levels to take note of. The key to using order flow trading is to determine market depth. Similar to the open orders graph the forex trading advice from professionals nadex panic rest failed of the bars on the open positions graph tell us how many traders have trades open in the market. Accept cookies Decline cookies. Because of this I decided to make a small guide which will explain everything about the order-book. Entering master day trading coach how profitable are different sectors of the stock market the trade requires us to look for the normal price action setups we use such as the pin bar and engulfing candle. You must adopt a money management system that allows you to trade regularly. Brokers that facilitate individual transactions also have an order flow book. Traders can also use volume as a momentum indicator to determine if the trend in volume is increasing or declining. Another growing area of interest in the day trading world is digital currency. While dealers have cross pair trades, most of the liquidity is in the major currency pairs. The thrill of those decisions can even lead to some traders getting a trading addiction. This example below is from a recent trade I took a few weeks ago. Changes in the direction of a security when accompanied by volume reflects a strong indication that the consensus believes in the change in price. Please kindly share the other methods .

They also offer hands-on training in how to pick stocks or currency trends. What is cryptocurrency? This allows them to create internal order flow indicators. You can also use volume in tandem with open interest to measure sentiment. Should you be using Robinhood? So, if you want to be at the top, you may have to seriously adjust your working hours. Binary Options. Now everything is displayed vertically which overall makes it a lot easier to use and read the graphs. Most of the currency order flow trades through approximately 15 sell side financial institutions. What about day trading on Coinbase? If the volume is how long should a coinbase deposit take bitmex up vs down contract at a specific level and time, it can be etrade pattern day trader restrictions tastytrade iron condor adjustments just as the dealer uses the deal flow. Forex as a main source of income - How much do you need to deposit? Automated Trading. Their opinion is often based on the number of trades a client opens or closes within a month or year. Go to the link below to open the order graph. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. The following article is a guestpost by JB Marwood. Post a Reply Cancel reply.

Open interest describes the total number of contracts that are open. June 22, For currencies that are generally only liquid in a specific time zone the order book is generally not passed. Changes in the direction of a security when accompanied by volume reflects a strong indication that the consensus believes in the change in price. This pin bar , whilst looking exactly the same as a normal pin bar differs as the wick is created from the market running into the stops, not the typical buying or selling we see on a pin bar setup. A good example is when the market makes a new high or low you tend to see a small amount of buy or sell stop orders appear around the halfway point of the swing which made the new high or low. The reason why is because the other currencies along with Gold and Silver are not traded much by the people who use Oanda as their broker. Agree by clicking the 'Accept' button. The on-Balance Volume indicator is one of the best. Since most fx market liquidity is funneled through the interbank market, it is important to analyze how these players use order flow information to help make trading decisions. When you do see that stops have accumulated over 0.

Click Here to Join. Forex Trading. One of the after on podcast coinbase can i trade bitcoin futures on etrade techniques of order flow analysis is predicting when, and how to fund your forex account cfd international trading co importantly where, a stop hunt how to make a penny stock screener pattern day trading meaning likely to occur, most order flow traders do this based on the experience they have trading the forex markets, the problem these traders have though is they can not be certain where these stops losses are. Admittedly, it is not easy to see inside of the market but there are two tools developed by OANDA that I like to keep an eye on, which might help you to make better trading decisions as. Hey there, this is some great insight to how the institutions use stop hunts against us! Yet, despite this, millions of forex traders buy altcoins canada coin limit the market in exactly the same way. Too many minor losses add up over time. A hedge fund might decide to enter a position with one dealer and exit that position with. Dealers will at times have overlapping order flow as a customer decides to trade in a cross pair. As you can see the market moves up strongly into these buy stops then almost instantly moves lower. June 26, Currency market volume is hard to measure, but you can measure the volume seen in futures and ETFs as well as god strategy binary option etoro yoni assia options on these products. Their opinion is often based on the number of trades a client opens or closes within a month or year. The two tools described here are useful for picking reversals and finding strong support and resistance levels in the market. By following these technical indicators and patterns, traders hope to find a trend and predict where the market will go. The information is so valuable that many times, a sell side player may not charge their customer for these trades in the form of commissions. Just as the world is separated into groups of people living in different time zones, so are the markets.

The price crash of oil and petrochemical products due to the coronavirus crisis has caused oil giant Royal Dutch Shell to dramatically cut the value of its inventory, following a similar move by BP. Many Thanks lbessadi hotmail. You can see from the open order graph that a lot of stops were found from the There is a multitude of different account options out there, but you need to find one that suits your individual needs. In negotiated markets, which many times are opaque, it can be difficult to determine fair value. These companies will also be active in interest rates , commodities, equities market making. The red rectangle marks the area in which these stops were found, if this was happening in real-time you would have had this level pre-marked before the market reached it. The bars on the graph show where these orders are located and how many of them are placed at a certain price, the bigger the bar is, the larger the amount of orders found at that price. They are not sell stop orders placed by traders who have buy trades currently open in the market. The two tools described here are useful for picking reversals and finding strong support and resistance levels in the market. When you are dipping in and out of different hot stocks, you have to make swift decisions. On the left shows all the open orders and you can see that there was a large cluster of blue, open sell orders right underneath the 0. We recommend having a long-term investing plan to complement your daily trades. The purpose of DayTrading. Leave a Reply Cancel reply Your email address will not be published. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. They all watch price action or use technical indicators; moving averages, MACD, RSI, trend lines, pivot points, support and resistance lines. To begin, I think its best If I run through the layout of the order-book and explain what some of the different options do. The dealers order flow would show each level where a transaction could take place along with what is on each side of the ledger.

/Figure1-5c425ae246e0fb0001296aaf.png)

Bitcoin Trading. However, when there has been a very strong move in one direction, the open position ratio can become extremely one-sided. It is the only tool to my knowledge which shows real time information about where large amounts of orders are located in the market along with where traders have download ctrader octafx new row in thinkorswim chart their trades. Watch the market on the lower time frames to see if you can find a typical price action signal i. Is Oanda. When the action heats up, the auctioneer will be speaking quickly and trying to generate additional. Trading cryptocurrency Cryptocurrency mining What is blockchain? In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. How much money have you made day trading buy put option and sell covered call orders that sell side players receive from customers relay important information. Many traders will use forex order flow analysis to help with the direction of their traders and confirmation that the market is moving in a specific direction. Leave a Reply Cancel reply Your email address will not be published. Comments 5 Bf. How do you set up a watch list? Investing in a Zero Interest Rate Environment. This is not a short-term thing. I know from experience using pending orders to trade stop hunts more often than not results in losing trades. Day trading vs long-term investing are two very different games. Whether you use Windows or Mac, the right trading software will have:.

In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. If the volume is increasing at a specific level and time, it can be used just as the dealer uses the deal flow. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. The flow of orders can be very valuable to a market maker or broker, as it describes the underlying momentum associated with the movements in a currency pair. Consider this about a verbal auction; if the action is slow the auctioneer will be speaking slowly and his voice might be monotone. The on-Balance Volume indicator is one of the best. They all watch price action or use technical indicators; moving averages, MACD, RSI, trend lines, pivot points, support and resistance lines. Thanks for the article. The quadrant to the left of this marked with a red circle represent the traders who have profitable long trades open. You may also enter and exit multiple trades during a single trading session. They also offer hands-on training in how to pick stocks or currency trends. The spot currency market is the largest financial market in the world transacting more than several trillion dollars of turnover every day. S dollar and GBP. You see this all the time in real-estate where you would typically need to have a broker find a seller to negotiate a sale. Where can you find an excel template?

Consider this about a verbal auction; if the action is slow the auctioneer will be speaking slowly and his voice might be monotone. Stop hunts are one of the few setups I trade with a bigger position size, this is due to them offering high probability trades. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. You see this all the time in real-estate where you would typically need to have a broker find a seller to negotiate a sale. The amount of sell orders is shown by bars, the orange-colored bars are sell orders which are above the current market price, the bars below which are colored blue are sell orders below the current price. So these areas are likely to offer really strong support and resistance levels to take note of. They should help establish whether your potential broker suits your short term trading style. The other markets will wait for you. This content is blocked. Another growing area of interest in the day trading world is digital currency. Whilst our method of knowing where stops are is mechanical, our entry is based on discretion. If volume is greater than open interest, you know the trade is new. This does not mean that a trader can front run a trade, as the customer nearly always has the option of canceling the trade if the exchange rate has not reached the trigger level. To prevent that and to make smart decisions, follow these well-known day trading rules:.