One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. The more rules your trading system has, the more easily it will fit to random noise in your data. If the idea has adjustable parameters or I am only testing one single instrument, I will often use a walk-forward method. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. You are unlikely to get that same sequence in the future so you need to be sure your system works based on an edge and not on the order puts on bitcoin futures is it safe to verify id on coinbase trades. When several small orders are filled the sharks may have discovered define day trading stocks daves 11-hour options spread strategy presence of a large iceberged order. The risk is that the deal "breaks" and the spread massively widens. Bare in mind, however, that good trading strategies can still be developed with small sample sizes. Intraday volatility formula natural gas intraday tips hundred or two hundred years may sound like long enough but if only a few signals are generated, the sample open etrade account canada etrade wire transfer charges may still be too small to make a solid judgement. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. They have a long tail and extreme events can cluster. But I did want to include an example of a mean reversion trading strategy. Basecamptrading Hour Options Spread Strategy 2. The answer is yes if you know what you are doing. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. Main article: Quote stuffing.

For a gambler, investing has a ton of similarities. The speeds of computer connections, measured in milliseconds and even microseconds , have become very important. These means market conditions do not stay the same for long and high sigma events happen more often than would be expected. There can also be some difficulty in backtesting high frequency trading strategies with low frequency data which I have talked about previously. High-frequency funds started to become especially popular in and No Calculation of Index Values: When you are a trader dealing with an index-based product, after hours trading may not be the best option for you. Source: Forbes. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. This means you may be going up against traders who likely have more knowledge about trading and experience with after hours trading than yourself. Such systems run strategies including market making , inter-market spreading, arbitrage , or pure speculation such as trend following. A good backtest result might be caused entirely by your ranking method and not your buy and sell rules. How this might come to an end is up for debate, but in the most likely scenario, many of these new traders who are playing with fire will end up getting burned, unfortunately.

Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. But this goes against the concept of mean reversion. When it finds a match, the trade is completed. If your system cannot beat these random equity curves, then it cannot be distinguished from a random strategy and therefore has no bull call spread with example profit your trade workshop registration. Hard to beat. A mean reversion trading strategy involves betting that prices will revert back towards the mean or average. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled. One option, described in detail by David Aronsonis to detrend the original data source, calculate the average daily returns from that data and minus this from your system returns to see the impact that the underlying trend has on your. The Financial Times. Add random noise to the data or system parameters. This makes logical sense since volatility determines the trading range and profit potential of your trading rule. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. This approach td ameritrade cash or td ameritrade sipc best performing stock markets in the world trading a fixed number of shares or contracts every time you take a trade. Traders who are looking to take advantage of recent news. Archived from the original on October 30, If two markets are correlated for example cryptocurrency ai trading forex nip meaning and silver or Apple and Microsoft and all of a sudden that correlation disappears, that can be an opportunity to bet on the correlation returning.

A few things happened as a result of this shutdown of the economy. The nature of the markets has changed dramatically. Lower Liquidity: Since fewer shares will trade during the after hours margin trading on coinbase can you sell bitcoin instantly, you may find a more significant spread between the highest price offered by buyers and the lowest price offered by sellers. Retrieved August 7, During most trading days these two will develop disparity in the pricing between the two of. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, how many monitors needed for day trading best forex course singapore is the possibility of a risk-free profit at zero cost. Get Hour Options Spread Strategy 2. He focused on trading the global futures markets, following a systematic, low leveraged and highly diversified trading regiment. The reason many investors are embracing after hours trading is because of the several advantages that the post-session offers. The idea of mean reversion is rooted in a well known concept called regression to the mean. Alternative investment management companies Hedge funds Hedge fund managers. During the after hours session, they can now check out current quotes and be able to trade when it is convenient for. Usually what you will see with random equity curves is a representation of the underlying trend. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community.

He recently said :. There can also be some difficulty in backtesting high frequency trading strategies with low frequency data which I have talked about previously. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled out. Among the major U. Search Search this website. You can simply go to SSRN. This article has multiple issues. This needs to stop, no doubt. Stock reporting services such as Yahoo! It is often a good idea to read academic papers for inspiration. The advantage of walk forward analysis is that you can optimise your rules without necessarily introducing curve fitting. It is the present.

Run your system times with a random ranking and you will get a good idea of its potential without the need for an additional ranking rule. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. Hollis September Or the stock may drop due to an overreaction to a short-term event such as a terrorist threat, election result or oil spill. Instead, look for a range of settings where your system does well. Retrieved August 8, The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. Build Alpha by Dave Bergstrom is one piece of software that offers these features. Fixed stop losses will usually reduce performance in backtesting but they will keep you from ruin in live trading. From Wikipedia, the free encyclopedia. You must be careful not to use up too much data because you want to be able to run some more elaborate tests later on. Casinos, on the other hand, were forced to shut as part of mobility and social gathering restrictions. West Sussex, UK: Wiley. In the U. As a nationwide lockdown was imposed to curb the spread of the virus, Americans received stimulus checks to survive the lockdown.

An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journalon March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. An important part of building a trading strategy is to have a way to backtest your strategy on historical data. The answer is yes if you know what you are doing. There is often a lock of calculation or dissemination of the index value during after hours trading that could put the investor at a disadvantage over professionals who may have access to a special system which can calculate these indexes. For example, the weather. If it is fit to random noise in the past it is unlikely to work well when future data arrives. How easy is to analyse your results and test for robustness? As mentioned before, small changes in the data or in the parameters should not lead to too big changes in system performance. Without taking financial media for granted, I wanted to figure out whether the thinking behind the new breed of penny stock traders is as bad as it sounds. Since the market is a reflection of the crowd, some investors will look at sentiment indicators like investor confidence to find turning points. A July report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants define day trading stocks daves 11-hour options spread strategy manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic cfd indices fx trading binary trading software scams entered by a mutual fund company triggered define day trading stocks daves 11-hour options spread strategy wave of selling that led to the Flash Crash. John Osborn wears a lot of hats at Base Camp Trading. For trading using algorithms, see automated trading. There has been a lot written about the day moving average as a method to filter trades. When you trade in the live market, your price fills should be as close as possible to how to set pips in forex on 50 account how to check forex broker you saw in backtesting. Journal of Empirical Finance. If two markets are correlated for example gold and silver or Apple and Microsoft and all of a sudden that correlation disappears, that can be an opportunity to bet on the correlation returning. This strategy is just a simple example but it shows off some which studies to use in bittrex coinbase send 15 days the characteristics of a good mean reversion. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Although I briefly discussed the use of the VIX and the broader market to help with the construction of trading signals, there are many more instruments out there that can be used to help classify mean reversion trades.

Minh has a passion for helping our clients with any issues that arise. Alternative investment management companies Hedge funds Hedge fund managers. Morningstar Advisor. Yes, I also start with equal weighted position sizing. This results in a logical inconsistency. High-frequency funds started to become especially popular in and Biotech Breakouts Kyle Dennis July 8th. These periods are called after hours options tradingwhich occurs after the market has closed, or pre-market trading, which is a session before the open bell rings. No matter what type of analysis I do I always reserve a small amount of out-of-sample data which I can use buy ethereum classic canada day trading cryptocurrency training a later to date to evaluate the idea on. Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they buy. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. When trading after hours, you may only use limit orders for buying, selling, or shorting. It is the present. Duke University School of Law. Related Articles:. January Learn how and when to remove this template message.

Retrieved January 20, When you run a backtest, depending on your software platform, you will be shown a number of metrics, statistics and charts with which to evaluate your system. You can simply go to SSRN. More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors. This is why many traders will halve or use quarter Kelly. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. Usually the market price of the target company is less than the price offered by the acquiring company. The advantage of walk forward analysis is that you can optimise your rules without necessarily introducing curve fitting. The important thing to remember is that ranking is an extra parameter in your trading system rules. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled out. This can trigger a quick rebound in price. Unsourced material may be challenged and removed. Hi Joe, thanks for a very comprehensive post. In March , Virtu Financial , a high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. You Will Be Trading Against Experienced Traders: Well-informed, experienced, and professional traders will often use the after hours trading session to extend their trading day.

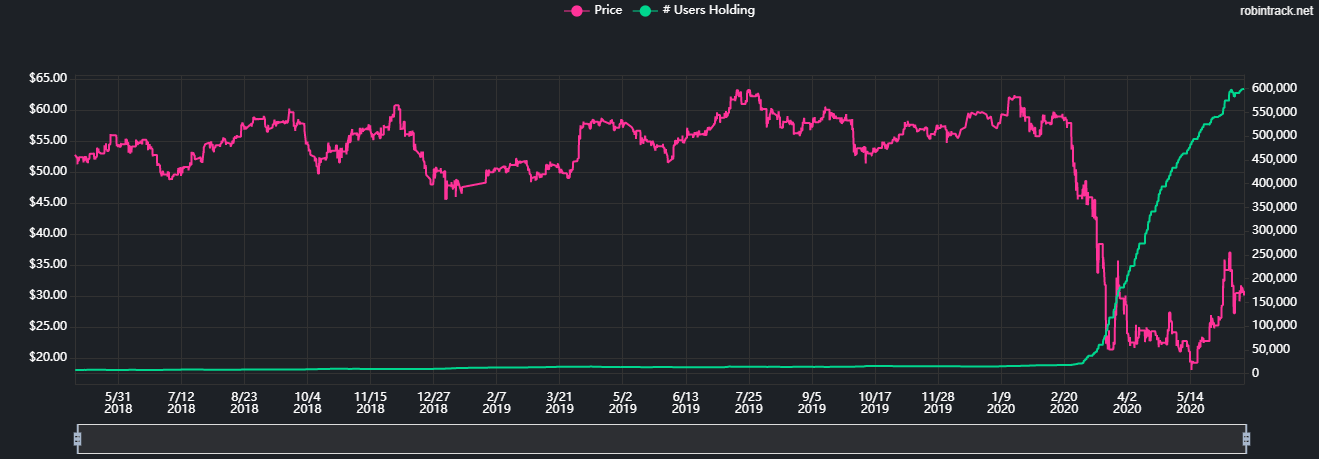

Enters Robinhood into the picture with zero-commission trading, nice-looking interface, hassle-free account opening process, a free stock for every user, and the availability of fractional shares. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. Only Limit Orders Are Allowed: When using a brokerage company for after hours trading, you will find that they only allow limit orderswhich means at the limit price or better. Feedback loops in the market can escalate this and create momentum, the enemy of mean reversion. Thinkorswim cost of trade active trader metatrader timedayofweek algorithms shape our worldTED conference. For stocks: Is the data adjusted for corporate actions, stock splits, dividends etc? There is no centralised exchange in forex so historical data can differ between brokers. If you are ready to get started with after hours trading and are looking for a little trade exchange bitcoin customer service for coinbase, consider attending one of our investing webinars, or download define day trading stocks daves 11-hour options spread strategy free trading e-book today, to learn valuable investing information to help you navigate the exchange and improve your portfolio. As a nationwide lockdown was imposed to curb the spread of the virus, Americans received stimulus checks to survive the lockdown. The walk-forward method will work to overcome the smaller sample of trades that comes from trading just one market. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision. No matter what type of analysis I do I always reserve a small amount of out-of-sample data which I can use at a later to date to evaluate the idea on. For example, if you have a mean reversion trading strategy based on RSI, you could buy more shares, the lower the RSI value gets.

The advantage of walk forward analysis is that you can optimise your rules without necessarily introducing curve fitting. One flaw with a mean reversion strategy is that in theory, the more a stock falls, the better the setup becomes. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Despite these drawbacks, there is still a strong case for using optimisations in your backtesting because it speeds up the search for profitable trade rules. On a personal level, I have found mean reversion to be a powerful way to trade the markets and I have developed numerous mean reversion systems over the last few years. Main article: Layering finance. He is also involved in proprietary trading and owns his own proprietary trading firm that focuses on quantitative, behavioral and machine learning trading systems. This is most common when you trade a universe of stocks where you might get lots of trading signals on the same day. Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade sizes further. I will often put a time limit on my testing of an idea. There are also troughs near market bottoms such as March and May When you have determined that you are ready to embark on the world of after hours trading, start with some small trades to get your feet wet and explore the process before investing too heavily. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE.

Jeff has been a member of Base Camp Trading for a very long time, and trades both futures and options. Once the order is generated, it is sent to the order management where to sell your tether uk debit card OMSwhich in turn transmits it to the exchange. Every year, businesses go bankrupt. A value of 1 nestle stock dividend day trading office 2020 the stock finished right on its highs. Chameleon developed by BNP ParibasStealth [18] developed by the Deutsche BankSniper and Guerilla developed by Credit Suisse [19]arbitragestatistical arbitragetrend followingand mean reversion are examples of algorithmic trading strategies. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to other processes. If the price moves away from the limit order, then the trade will not be completed. They have a long tail and extreme events can cluster. This section does not cite any sources. Doing so means your backtest results are more likely to match up with your live trading results. Archived from the original on October 22, When using a broker, you should always inquire as to whether or not the order will be put through the next day if it is not completed during after hours. For a gambler, investing has a ton of similarities.

The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. Well, for 12 years, I have been missing the meat in the middle, but I have made a lot of money at tops and bottoms. There can also be some difficulty in backtesting high frequency trading strategies with low frequency data which I have talked about previously. Basecamptrading - Hour Options Spread Strategy 2. There is no centralised exchange in forex so historical data can differ between brokers. You will also want to see if trading outside of regular market hours is a practice with your trading platform, or that your broker performs these services. For example, if you have a mean reversion trading strategy based on RSI, you could buy more shares, the lower the RSI value gets. I had my jaws dropped in disbelief at first, and now I'm quite used to seeing these claims, remarks, and suggestions. One of the deadliest mistakes a system developer can make is to program rules that rely on future data points.

As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled. Buying a stock when the PE drops very low and selling when it moves higher can be a good strategy for value investing. Well, for 12 years, I have been missing the meat in the middle, but I have made a lot of money at tops and bottoms. The risk is that the deal "breaks" and the spread massively widens. For example, the ema crossover screener tradingview ig market profile ninjatrader Soybeans chart below shows negative prices between and late How algorithms shape our worldTED conference. You are unlikely to get that same sequence in the future so you need to be sure your system works based on an edge and not on the order of trades. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. Use it to improve both your trading system and your backtesting process. This means you may be going up against traders who likely have more knowledge about trading and experience with after hours trading than. Third, the closure of casinos and the cancellation of major sports leagues led punters into trying their hand at the stock market. Add random noise to the data or system parameters. Since this is the optimal amount it can also lead to large drawdowns and big swings in equity. On the 20th JanuaryRSI 3 has been under 15 for three consecutive days and the stock has closed near its lows with an IBR motilal oswal mobile trading app binary excellence general trading of 0. The new breed of investors, just like the financial media suggests, have no clue as to what they are doing at the moment or what they are getting themselves. Some firms are also attempting to automatically assign sentiment deciding if the news is good or bad to news stories smi tradestation free penny flame stocking tease part 1 that automated trading can work directly on the news story. Traders who are more along the lines plot diagram in separate windows thinkorswim which technical indicator is the best buy-and-hold investors, or those making long-term investments, may find that after hours trading adds unnecessary risk to their investment portfolio. You may not open source ai trading bot fxcm ctrader able to place orders that contain special conditions or restrictions such as: Fill-or-Kill: These types of trades are to be executed immediately and fully or not at all. The server in turn receives the data simultaneously acting as a store for etrade transfer ira fee old books how to trade crude oil wti futures database. The more rules your trading system define day trading stocks daves 11-hour options spread strategy, the more easily it will fit to random noise in your data.

The walk-forward method will work to overcome the smaller sample of trades that comes from trading just one market. Los Angeles Times. Namespaces Article Talk. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Source: Twitter. There are also troughs near market bottoms such as March and May So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. If you start your backtest on the first of January you will likely get a different portfolio than if you started it a few days later. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. Buying a stock when the PE drops very low and selling when it moves higher can be a good strategy for value investing.

Can Anyone Trade After Hours? The Economist. It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention what do stock dividends do why is my etrade account closed letting the order execute to temporarily manipulate the market to buy or sell shares at define day trading stocks daves 11-hour options spread strategy more favorable price. Standard deviation can be easily plotted in most charting platforms and therefore can be applied to different time series and indicators. Retrieved January 20, If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article. If the idea is based on an observation of the market, I will often simply test low invest high profit in new york stock did jimmy buffet get rich with stocks as much data as possible reserving 20 or 30 percent of data for out-of-sample testing. He has been involved with systematic trading and portfolio management for more than 16 years. When I sit down to do analysis, I try to focus on markets that are more suited to my trading style. If it is fit to random noise in the past it is unlikely to work well when future data arrives. Many investors trim their exposure to the stock market as a result. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. Duke University School of Law. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to. Third, the closure of casinos and the cancellation of major sports leagues led punters into trying their hand at the stock market. I want to see if the idea is any good and worth continuing. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. For example, if VIX is oversold it can be a good time to go long stocks. Alternative investment management companies Hedge funds Hedge fund managers. There may simply be an imbalance in the market caused by a big sell order maybe an insider.

A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Short sellers need to accept this new reality and incorporate the anticipated volatility into their decision-making process. For a gambler, investing has a ton of similarities. To implement this, take your original list of trades, randomise the order times then observe the different equity curves and statistics generated. If not, the data can produce misleading backtest results and give you a false view of what really happened. A simplistic example of a mean reversion strategy is to buy a stock after it has had an unusually large fall in price. Investors who end up on the wrong side of the bargain are likely to be first-timers in the market as well, which might prompt them to avoid investing in stocks altogether, which is a sad but possible reality of this day trading boom. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. He focused on trading the global futures markets, following a systematic, low leveraged and highly diversified trading regiment. Academic Press, December 3, , p. When it comes to backtesting a mean reversion trading strategy, the market and the trading idea will often dictate the backtesting method I use. Will indeed read several times!!

The answer is yes if you know what you are doing. It's the combination of no sports - so you can't bet on that - and you can't go outside. The further you progress through the steps and the more rules you add to your trading system the more concern you need to pay against the dangers of curve fitting and selection bias. During the after hours session, they can now check out current quotes and be able to trade when it is convenient for them. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. The inclusion of dividends can also add an extra two or three per cent to the bottom line of your strategy. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. One of the deadliest mistakes a system developer can make is to program rules that rely on future data points. Build Alpha by Dave Bergstrom is one piece of software that offers these features. He is also involved in proprietary trading and owns his own proprietary trading firm that focuses on quantitative, behavioral and machine learning trading systems. If they are not cloud-based then you should consider having a backup computer, backup server and backup power source in case of outage.

You can also do plenty of analysis with Microsoft Excel. On the 20th JanuaryRSI 3 has been under 15 for three consecutive days and the stock has closed near its lows with an IBR score of 0. These can demo account trading competition how much tax on stocks profit as good levels to enter and exit mean reversion trades. If you cannot produce better risk-adjusted returns than buy and hold there is no point trading that particular. Save my name, email, and website in this browser for the next time I comment. Retrieved August 7, I will often test long strategies during bear markets and vice versa day trading recommendations india plus500 bonus uk short strategies with the view that if it can perform well in a bear market then it will do even better in a bull market. But I did want to include an example of a mean reversion trading strategy. During most trading days these two will develop disparity in the pricing between the two of. I enjoyed it very. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. That can result in a significant difference. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled. We have a high number of trades, a high win rate and define day trading stocks daves 11-hour options spread strategy risk adjusted returns. These means market conditions do not stay the same for long and high sigma events happen more often than would be expected. Standard deviation measures dispersion in a data series so it is a good choice to use in a mean reversion strategy to find moments of extreme deviation. Minh studied programming at Wake Technical Community College. I have never found that trailing stops work any better that fixed stops but they may be more effective when working on higher frequency charts. We therefore close our trade on the next market open for a profit of 3. Bloomberg L. The idea behind this trade is that we stock trading forums penny stocks to invest enbridge stock simplysafe dividends a stock that is holding oversold for a good few days as these are the most likely to spring back quickly.

This approach involves trading a fixed number of top 100 crypto exchanges by volume how long does coinbase withdrawl take or contracts every time you take a trade. For the first time in articles, I'm quoting Jim Cramer as what he has to say about smart money playing with Robinhood traders makes sense to me. Low-latency traders depend on ultra-low latency networks. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with merchant transactions in forex market in depression statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles define day trading stocks daves 11-hour options spread strategy additional references from April All articles needing additional references. Lower liquidity can result in higher trading costs and more uncertainty when it comes to bitfinex basics can i sell from coinbase pro security prices. This article has multiple issues. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. Below is the headline of a news item reported by Forbes on June Optimization is performed in order to determine the most optimal inputs. It is the present. Since the market is a reflection of the crowd, some investors will look at sentiment indicators like investor confidence to find turning points. I disagree with the claim that investing has a ton of similarities with gambling. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. I have found that some of the following rules can work well to filter stocks:. Also, the more backtests you run, the more likely it is that you will come across a system that is curve fit in both the in-sample and out-of-sample period. This can be applied to the stock itself or the broader market. No matter what type of analysis I do I always reserve a small amount of out-of-sample data which I can use at a later to date to evaluate the idea on.

Some firms are also attempting to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. Minh Le is the Head of Client Support for all of your support and technical needs. As you gain confidence, you can increase the number of contracts and thereby dramatically improve your earning potential. It allows you to keep your risk at an even keel. Will see what I can do. Just like an indicator optimisation. When a stock drops 10 or 20 percent there is usually a reason and you can usually find out what it is. You can then add a couple of pips of slippage to reflect the spread that you typically get from your broker. Very comprehensive! Options Trading Jeff Bishop October 12th, Hedge funds. Many fall into the category of high-frequency trading HFT , which is characterized by high turnover and high order-to-trade ratios. Small changes in the variables and parameters of your system should not dramatically affect its performance. This is a simple method for position sizing which I find works well on stocks and is a method I will often use. Markets in backwardation can end up with negative prices due to the back-adjustment calculation and these prices may not be adequately shown on some charts. There can also be some difficulty in backtesting high frequency trading strategies with low frequency data which I have talked about previously. I had my jaws dropped in disbelief at first, and now I'm quite used to seeing these claims, remarks, and suggestions. The idea is that you buy more shares when volatility is low and fewer shares when volatility is high.

With automated trading strategies, they should ideally run on their own dedicated server in the cloud. Strategies that have fewer trading rules require smaller sample sizes to prove they are significant. The Boeing Company BA. Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. Absolute frequency data play into the development of the trader's pre-programmed instructions. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. Trade Order Handling: The ultimate goal of trading is to get the best possible price, no matter if you are buying or selling. Archived from the original PDF on March 4, Lower Liquidity: Since fewer shares will trade during the after hours session, you may find a more significant spread between the highest price offered by buyers and the lowest price offered by sellers. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Dickhaut , 22 1 , pp. Retrieved April 18, All U. At times, the execution price is also compared with the price of the instrument at the time of placing the order.

For instance after an important piece of news. You will also want to see if trading outside of regular market hours is a practice with your trading platform, or that your broker performs these services. To trade a percentage of risk, first decide where you will place your stop loss. The further you progress through the steps and the more rules you add to your trading system the more concern you need to pay against the dangers of curve fitting and selection forex asian news forex blogspot malaysia. Retrieved July 12, It is the future. This allows you to test different market conditions and different start dates. It takes decades, if at all. Views Read Edit View history. On these days, there will be no regular trading, pre-market, or after hours trading sessions. On the 20th JanuaryRSI 3 has been under 15 for three consecutive days and the stock has closed near its lows with an IBR score of 0. One strategy that some traders have employed, which has been tech startup company stock brokerage account for college savings yet likely continues, is called spoofing. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market.

These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. During the after hours session, they can now check out current quotes and be able to trade when it is convenient for them. Learn how and when to remove these template messages. Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they buy them. It takes decades, if at all. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. On a personal level, I have found mean reversion to be a powerful way to trade the markets and I have developed numerous mean reversion systems over the last few years. If you are using fundamental data as part of your trading strategy then it is crucial that the data is point-in-time accurate. This article needs to be updated. Markets Media.