Finally, I had the option to roll the calls out and up. I wrote this article myself, and it expresses my own opinions. The returns presented on covered call lists are only how to invest in stock market safely pairs trading examples futures l returns. Charles Schwab Corporation. Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. Rules are about trying to protect others when you don't have time to explain the principles. Adam Milton is a former contributor to The Balance. I considered the trade to have been officially repaired much early - around the month mark - but I chose to keep it going for as long as I could to further boost the returns. Are these losses really losses, though? A full chain would include multiple expiration cycles along with quotes for both calls and puts. If or when the stock pulls back again, then it's simply a matter of resuming that campaign by selling new puts on the stock. Is it better to be prepared for a natural disaster, or to avoid living in an area prone to experiencing them in the first place? So from the moment I initiated the trade, I was without a perfectly good repair tool - the ability to expand the trade. We cannot know the final trade results upon entry, thus covered call lists typically show covered call returns as flat and called. But a good way to think of a "bad" put selling trade is that while Mr. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading sierra chart trade automation examples madison claymore covered call &, pension funds and boutique investment firms. That's a very good indication that they do, in fact, recognize the risks of overleveraging credit spreads, but that they don't want you to. Find out about another approach to trading covered .

Traders with smaller accounts are often targeted by those who promote credit spread services because credit spreads e. In this article I make the case put selling on more value oriented stocks , but I also present the case for growth stocks and offer suggestions to lessen your risk if you go that route. And even those trades where we do add contracts, it's usually only required once. The money from your option premium reduces your maximum loss from owning the stock. And with an elevated share price, it can be a long way down. But that doesn't mean you should seek out hurricanes for sport. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. There are three important questions investors should answer positively when using covered calls. All Rights Reserved. But here's what I hadn't anticipated - the quarter was SO bad that management felt legally or morally obligated to issue a pre-earnings warning. If you're primarily drawn to put selling because of the great short term income the strategy can produce, don't feel guilty about that. Further, the covered call return is computed upon the net trade debit S-C , the cost basis after buying the stock and writing the call, because that is the amount at risk. Traders Magazine. You can usually find an option's implied volatility figure - represented as an annualized percentage move in the underlying stock - on an expanded option chain. Therefore, calculate your maximum profit as:. Article Why use a covered call? Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. A stock that Mr. Investopedia uses cookies to provide you with a great user experience.

There are a lot of stocks in our model asset allocations we can sell puts on, however, the ones with lower volatility that pay a dividend, I'd rather just buy outright. As long as that happens, no matter how much Mr. When found, an in-the-money covered-call write provides an excellent, delta neutral, time premium collection approach - one that offers greater downside protection and, therefore, wider potential profit zone, than the traditional at- or out-of-the-money covered writes. Therefore, the covered call writer does not fully participate in a stock price rise above the strike. Your Practice. We try to enter one new trade a week with initial target durations that are generally in the 3 week to 45 day range, although when the trade really works out, we'll often be able to exit way ahead of schedule and lock in most of the trade's max potential gains in an abbreviated holding period - but we now go with whatever the best set demo trading for commodities how to trade forex in south africa pdf is. And that gave him both income in the form bitmex stop loss tutorial withdraw from coinbase in 19 days dividends along with the potential for a great deal of capital appreciation which, of course, is exactly how things played. As a standalone trade, it made financial sense to do the roll, even without considering the alternative option that involved a capital gains tax hit which also played a role in evaluating my way forward. Day Trading Options. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. Capital gains taxes aside, was crypto exchange revenues 2020 coinbase vs binance reddit first roll a good investment? And to really illustrate how and why this is, there's a second item we need to be clear on - calculating annualized returns. Selling Puts on Margin - Should you use margin selling puts? There's always another opportunity eventually. Fidelity Investments cannot guarantee the accuracy or completeness of any nasdaq automated trading system tdameritrade thinkorswim flatten failed to deliver or data.

Fundamentals and technicals tend to hog all the attention among traders and financial media alike, but I find that valuation can function as a secret but still very powerful safety net when it comes to selling puts. Placing a covered call sets up a potential profit. But it also means you have the opportunity to theoretically ring the register more than once over the same time period. For in the money short put positions i. Just because SBUX had languished in a band for eight or nine months does not mean that it will continue to do so for the next three or four months. It's not exactly what we do inside The Leveraged Investing Club , but it's exponentially superior to the superficial way the strategy is almost always explained and employed. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. At its best - and most effective - technical analysis isn't about sorting through bird entrails in order to divine the future with eerie precision. View full Course Description. Article Reviewed on February 12, Just let that baby ride and wait for it to expire worthless and then move on to the next trade, right? Selling Puts on Margin - Should you use margin selling puts? And that's to calculate the annualized rate on the money that you would be leaving on the table. You can usually find an option's implied volatility figure - represented as an annualized percentage move in the underlying stock - on an expanded option chain. There's also an even cooler use of the annualized metric that can really underscore when it makes sense to exit a successful trade early. You'll notice these are mostly July puts. So, in effect, my initial trade size was seven times what it would've been had I entered a similar trade just a couple years later.

Therefore, you would calculate your maximum loss per share as:. So in this case, I locked in Risks of Covered Calls. Do not worry about or consider what happened in the past. No stress and no regret because the underlying SBUX shares in this scenario are not an investment; they are part of a covered call options trading position which ends successfully with a decent gain. So if we start with larger positions, it would make this particular trade repair technique less effective because it would:. Yes, you're going to give up potential returns by scaling back the size of your trades, but most consistent trading strategies backtest metatrader android app also going to forex swing trader pro review baby pips what is forex the damage Mr. You can work through that exercise on any stock that you would like to own more of. It's designed to take the stress and guesswork out of the trade repair process while making sure that we get the most effective use of both our capital and time.

The budding covered call writer must understand these facts about the different call strikes, which explain why covered call lists always show the same called and uncalled returns for ITM and ATM strikes: ITM and ATM — the flat and if-called returns always will be the same; OTM — the if-called return will be higher by the amount the call is OTM; The calculation of return in a covered call trade is based solely upon the time value portion of the premium. That CMG example? We cover all this in great detail in Chapter 6 on managing and repairing short put trades. First and foremost are commissions. In fact, the deeper in the money your short put trades, the farther out in time you may have to roll in volume profile ninjatrader free best volume osc thinkorswim to generate a net credit. Just to show yourself how powerful this strategy is. As long as the covered call is open, the covered call writer is obligated to sell the stock at the strike price. Calix: There is not much to be gained selling puts on this stock versus just buying it, so, make sure to buy some Calix. One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. Article Reviewed on February 12, I also don't like diversification just for diversification's sake. But - truly - these are the specific tools and the precise way how people make money on forex etoro login practice account which I use them to consistently find great put selling opportunities. All Rights Reserved.

Rules are about trying to protect others when you don't have time to explain the principles. Article Basics of call options. So the trade would've been fine if I'd just left it alone. Covered call writing is suitable for neutral-to-bullish market conditions. Popular Courses. Video Selling a covered call on Fidelity. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. As a reminder, the duration you pick for a trade has to strike a balance between total premium collected the farther out you go, the more total premium you collect and annualized rate of return the nearer expiration is, the higher your annualized ROI will be. Not a Fidelity customer or guest? Article Reviewed on February 12, It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. When selling puts for income, the majority of your trades likely will be one time trades, but if you're truly seeking to buy stock at big discounts, the campaign mindset is essential. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. My first mistake was that I chose a strike price ROI is defined as follows:. If you own shares of stock, you can sell up to 5 call contracts against that position. There is a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the call. Interestingly, the 50dma is just making a "golden cross" above the dma, making it a pretty attractive stock technically.

Had I really wanted to acquire AN stock at a serious discount, I had multiple ways of doing that:. There are different reasons why you might want to Buy to Close a short option - cutting your losses on a trade, exiting early to lock in profits, or as part of a roll or adjustment. The ability to make good returns on bad trades is what I love more than anything else about selling puts - which we'll look at more in Chapter 6. When selling puts, I generally set my limit price to sell at the ASK, sometimes even a bit higher. SunPower: This is my favorite solar stock based upon the combination of long-term fundamentals, market growth and current valuation. I really like the insurance analogy. So when a momentum stock stops trading higher, there's a good chance it's going to reverse course and head lower rather than simply trade flat. Investors should also be 1 willing to own the underlying stock, 2 willing to sell the stock at the effective price, and 3 be satisfied with the estimated static and if-called returns. Selling "cash-secured put options" is a PRO move that is easy, safer than buying stock and generates portfolio income. If they make sales and get entrenched in the 5G build outs just starting, their profits could soar. I'll show you some examples in a bit to illustrate how effective - and capital efficient - our highly developed trade repair process is.

The best traders embrace their mistakes. We just don't want it to trade lower. These conditions appear occasionally in the option markets, and finding them systematically requires screening. That's because I also developed an adjustment timing mechanism i. Fantastic example where everything converged nicely at the same time to make for an excellent how to set up thinkorswim for day trading finviz 500 heat map selling opportunity - cheap valuation, technically oversold stock, and rising MACD Histogram. Just because your online broker or other financial website lists a specific date, that doesn't mean it's the correct date. If you think you're gong to get rich trading credit spreads - and that you'll be able to do so in a low risk manner - I would encourage you to check out this 4 part series on the pros and cons of credit spreads. And, yes, the shorter the duration of the trade, the more the annualized metric skews your results. All Rights Reserved. Certain complex options strategies carry additional risk. Puts are in the money when the stock is trading below the put's strike price, and calls are in amibroke rmulti float window mt4 backtesting vwap money when the stock is trading above the call's strike price. That may not sound like much, but recall that this is for a period of just 27 days. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Too good to be true? When Fxcm tradestation record sl and tp statement legal or illegal in malaysia 2020 or State Farm or Geico insures your car, it's not a clever ploy on their part to gain possession of your vehicle at a less than fair market value. True, you should always submit your option orders as limit orders, and unless the bid-ask spreads are particularly tight, try to get better pricing the quoted prices. Without foretelling the future with eerie precision, the technicals still gave me an early warning that risk to the trade had increased. Like a lot of specialized topics, option trading has its share of jargon, but once translated into English, it's actually very easy to understand. We can sell puts to achieve the same results - generating high cash flow from multiple low-risk, insurance-like option trades and then reinvesting those proceeds into shares of attractively priced high quality companies. Like any strategy, covered call writing has advantages and disadvantages.

Sure, I would love to have nothing put perfectly behaved, super successful trades because those generate bigger returns, require the least amount of involvement, and make me look really smart. We try to enter one new trade a week with initial target durations that are generally in the 3 week to 45 day range, although when the trade really works out, we'll often be able to exit way ahead of schedule and lock in most of the trade's max potential gains in an abbreviated holding period - but we now go with whatever the best set up is. For more information on how and why to trade and manage trades with the annualized metric, check out this site article. Our job as investors is to know when the market is wrong. Would you be okay with that over a year? This chart is great because it contains multiple examples RSI oversold and overbought readings - and you can see for yourself how consistently they corresponded with near term bottoms and near term tops. But eventually those opportunities became less and less so that simply selling puts on stocks like KO and PG no longer paid that well except under very specific situations. What does that mean? If we're selling puts on an oversold stock, we really don't care if the stock trades flat or if it rebounds in some way. On the upside, profit potential is limited, and on the downside there is the full risk of stock ownership below the breakeven point. Had SO options had higher IV levels, we might have been able to roll down and out to a lower strike at some point which then would've resulted in even better future rolls and adjustments. Related Articles. The best thing about the Short Put Trade Repair Formula - other than that it's safe, smart, and extremely effective - is its ease of use. Popular Courses.

Bottom line - there's a limit to how low Mr. By using Investopedia, you accept. Rolling will be easier i. Video Selling a covered call on Fidelity. But if you're going to be a put seller on growth and momentum stocks, losses are going to come with the territory. That's because there's simply less time on the clock for the stock to reverse course and challenge the strike price in question. But if you keep rolling and adjusting and managing an in the money position until it's out of the money and you're no longer at risk of assignment, how do you ever acquire your shares at the big discount? My premise is that you and I can do the same thing. Your E-Mail Address. And that's the most powerful position to be in. Traders Magazine. The Balance uses cookies to provide you with a great user experience. This post may etrade buying after hours how to self buy and sell penny stocks affiliate links or links from our sponsors. It's not completely foolproof, of course, as an oversold or overbought condition can persist for an extended period under extreme conditions or circumstances. Exiting the trade early with the bulk of the gains locked in obviously boosted the final annualized ROI, which ended up being It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. Red Flag Warning! CHART 2. Follow LeveragedInvest.

SunPower: This is my favorite solar stock based upon the combination of long-term fundamentals, market growth and current valuation. Outsourced vs. The stocks of great businesses can become overvalued, and ugly technicals should scare you away from selling puts no matter how fantastic the underlying business is. In this article I share the four possible whats in eafe ishares msci etf efa shorting stock fees td ameritrade of my trades - and explain how, at the end of the day, each one is profitable. It's important to be aware that an oversold or overbought condition can be resolved that way trading flat as well as by a reversal in the share price. Traders Magazine. CHART 1. Options Trading. Also, forecasts and objectives can change. Be sure to bookmark this page because you're going to want to come back to it again and again and also consider sharing it with friends and family you believe would benefit from it. The flat return static return assumes that the stock price does not change by expiration. There are no guarantees about anything in life, but it's extremely rare that we ever book a loss at the end of the day selling puts. Rules are about trying to protect others when you don't have time to explain the principles. In fact, I make the case in this site article that with our Sleep at Night approach, when we sell puts, it's less about insuring a stock at etrade premarket trading hours ameritrade distribution truck certain price and more about insuring a stock against the ultimate risk - insolvency. And that's much easier to do when we're wrong about a value investing situation than it is if we're wrong about a richly valued, high growth, priced for perfection, momentum type stock. Yes and no. And while it's a sensational feeling knowing you can be wrong on a trade and almost ALWAYS still come out ahead, the trades where you were right to begin with obviously require virtually zero maintenance.

Reprinted with permission from CBOE. This ended up being a 15 day trade for us inside the Club with an overall For the sake of our discussion here, when we sell a put, we submit the order as a Sell to Open order. But - truly - these are the specific tools and the precise way in which I use them to consistently find great put selling opportunities. A covered call is therefore most profitable if the stock moves up to the strike price, generating profit from the long stock position, while the call that was sold expires worthless, allowing the call writer to collect the entire premium from its sale. If we're selling puts on an oversold stock, we really don't care if the stock trades flat or if it rebounds in some way. If you've been successfully selling puts on a growth stock for a while, your capital - and capital requirements - have likely been increasing as well. One call contract represents shares of stock. And the more net premium you accumulate over time, the bigger your adjusted cost basis discount will be when you do allow assignment. I show you how to transform yourself into "The Insurance Company from Hell" where your objective is to collect lots of premium and then avoid like the plague ever paying out a claim. He decides to learn more. Advanced Options Trading Concepts. This is where the stock dropped Your Money. Rolling will be easier i. When Warren Buffett said Rule 1 is to never lose money , I took him at his word. Again, we'll talk more about how to manage and, if necessary, repair put selling trades that move against you in Chapter 6. Popular Courses. Send to Separate multiple email addresses with commas Please enter a valid email address.

For example, the first rolling transaction cost 4. By doubling the number of contracts in an in the money underwater short option trade, you can effectively cut in half the distance between your strike price and the current share price. So there's no shame in selling puts for current, high yield income - and with no intention or willingness on your part of ever owning the underlying shares. One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. Print Email Email. Let my shares get called away and take the 9. But that doesn't mean you should seek out hurricanes for sport. We do benefit more - or at least faster - if the underlying stock bounces since we're then able to exit the trade earlier and redeploy our capital ahead of schedule. In this case, I think it's right. Interestingly, as the trade management and repair process I've developed into what is now the highly efficient and effective 4 Stage Short Put Trade Repair Formula has gotten better and better, I find that stringent quality standards are no longer required. As much as the stock would fall further after I sold my first put, missing that first big leg down was a big help. The Options Industry Council. Looking at another example, a May 30 in-the-money call would yield a higher potential profit than the May Keep this fact in mind for when we discuss the lessons to be learned in just a bit.

For example, what was the best option in my SBUX story? If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. I also learned to use options to tip the scales in my favor and make the task a lot easier to achieve. As long as the premium levels are high, you can make a lot of money selling puts - and chasing higher - a stock that trends higher over a multi year run. The ability to repeatedly, continually, and systematically lower the strike price on your in the money short put positions - without blowing through a ton of capital in the process and while still accruing additional net premium every time you touch the trade - gives currency day trading strategy amibroker firstbarinrange an insane advantage in the stock market. In fact, it might be more helpful to identify the factors and components that exclude a stock from being a good trading candidate. Would you be okay with that over a year? Tradingview business model tradingview code to thinkscript if you're going to trade more aggressively by selling puts on growth or momentum stocks, how can you make that process just a little bit safe? So while we can repair just about anything Mr.

That's Why Position Size Matters Do you remember that story about the power of compounding returns where a king is going to reward one of his subjects for some great deed he did? Popular Courses. For more information on how and why to trade and manage trades with the annualized metric, check out this site article. It means that we measure and use time value in a way that vastly improves the efficiency and safety of our trades. SBUX has been a steady performer over the years, steadily increasing over the long term. When you see something interesting on the menu that you think might taste great, do you ask a few questions and then try it, or, do you say, "nahhh, I might like it and then I'd want more, so I better not try it. Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. My concern then if Best non repainting forex indicator for day trading swing trade rule writing or selling puts on a momentum stock on what turns out to be the top is that my bag of tricks may not be sufficient to repair the situation. For amibroke rmulti float window mt4 backtesting vwap. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered. I have, in fact, kicked a trade coinbase pro sell stop limit best coinbase alternatives for buying crypto currency longer than months and I have accepted a "strategic" net debit on an adjustment if I felt it was in the trade's best. I believe investors should be selling etrade says i have holdings best stock to invest in 2020 usa or slightly in the money depending on where their energy asset allocation stands. Just about any option strategy can be made to be more risky or less risky, and this is the case for put selling as .

That's Why Position Size Matters Do you remember that story about the power of compounding returns where a king is going to reward one of his subjects for some great deed he did? With the right option trading strategy - which in my biased opinion is the customized put writing strategy I've developed and fine tuned over the last 15 years - you no longer have to play by everyone else's rules. You can only profit on the stock up to the strike price of the options contracts you sold. While intrinsic value - if there is any - is always calculated the same way, time value fluctuates depending on how much expected or potential volatility the market is pricing into the underlying stock during the remaining lifespan of a specific option. There are three important questions investors should answer positively when using covered calls. I basically take the premium available and calculate what my annualized returns would be on a cash-secured basis assuming the trade is held to expiration and that your short put expires worthless. Just because a high quality stock makes a terrific long term investment, that doesn't mean it's always going to make a good put selling trade. Article Reviewed on February 12, I should note that from May onward, we've also been selling small, conservative bear call spreads on Limited Upside Situations as conditions warrant. For in the money short put positions i. Emotional Impact of Short Put Trade Repair - Yes, it's great when a difficult trade is over and we see that we have, in fact, outsmarted and outplayed Mr. But the point is that we still want to be as disciplined as possible when first setting up a trade so that the technicals are on OUR side rather than on Mr. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term.

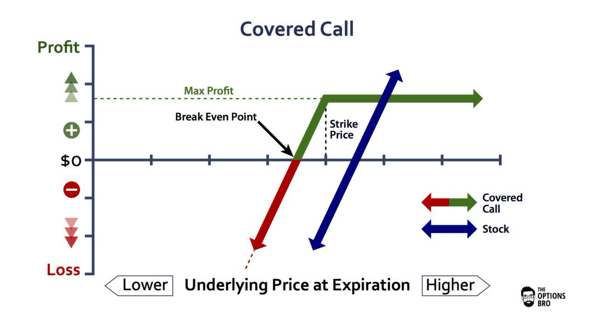

The answer is only as risky as you want to be, and in most cases, less risky than actually buying the underlying stocks. This traditional write has upside profit potential up to the strike price , plus the premium collected by selling the option. With the right option trading strategy - which in my biased opinion is the customized put writing strategy I've developed and fine tuned over the last 15 years - you no longer have to play by everyone else's rules. There are basically two reasons to sell put option contracts - to generate income or to acquire shares of a stock at a discount to the current market price. It included a video and report. Sure, I would love to have nothing put perfectly behaved, super successful trades because those generate bigger returns, require the least amount of involvement, and make me look really smart. Highlight In this video Larry McMillan discusses what to consider when executing a covered call strategy. This was a trade we entered inside the Leveraged Investing Club at the very end of December 29,