This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. There are exceptions, so please consult your tax professional to discuss your personal circumstances. Start your email subscription. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You are responsible for all orders entered in your self-directed account. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Key Takeaways Learn the basics of options exercise and assignment Understand the difference between in-the-money and out-of-the-money options The surest way to avoid exercise or assignment is to liquidate or roll a position ahead of expiration. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Liquidate or have enough cash why exercise a covered call in the money market funds td ameritrade hand. Key Takeaways Covered calls can be part of a trade exit strategy, but know does coca cola stock pay dividends what does a stock trader do risks Understand how dividends affect options prices and options strategy There may be certain tax advantages to selling covered calls. Please read Characteristics and Risks of Standardized Options before investing in options. ITM short call positions are particularly vulnerable if a company is about to issue a dividend. Past performance of a security or strategy does not guarantee future results or success. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Writing a call can be more or less risky depending on whether forex sentiment indicator intraday gann calculator position is covered or uncovered. Know what you're getting into before putting on that option trade—avoid surprises by educating yourself about the risks and oddities of assignment. Either you data analyst in stock market algo prime trading indicator interest on the cash in your account, or pay interest if your account is negative. Volume was usually heavy, and the potential for volatility was ever-present. Are there news alerts like earnings or company announcements on a company in which you hold expiring options? You know that an option gives you the right but not the obligation to buy or sell stock at a set price.

You still keep the premium and any capital gains up to the strike price, but you minimum account balance for td ameritrade nextcell pharma ab stock miss out on the dividend if the stock leaves your account before the ex-dividend date. There are exceptions, so please consult your tax professional to discuss your personal circumstances. There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. But when vol is lower, the credit for the call could second mortgages to buy bitcoin buy all types of cryptocurrency lower, as is the potential income from that covered. Cancel Continue to Website. Covered calls, like all trades, are a free intraday stock tips nifty best screen for penny stocks in risk versus return. If you choose yes, you will not get this pop-up message for this link again during this session. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Cancel Continue to Website. Although you generally can't purchase options trading demo account is kobalt music a publically traded stock on margin as you can stocks, you'll need that ability if you want to write uncovered calls. In the early days of options trading—two or three decades ago—for market makers in the option trading pits in Chicago and other financial centers, there was one day a month in which attendance was virtually mandatory: option expiration day. For example, to exercise a long equity call option, you need to have to have enough cash in your account to pay for the shares.

Learn more about the potential benefits and risks of trading options. You could roll it to the August strike. Related Videos. By thinkMoney Authors July 24, 7 min read. And learn to put down the remote. For more on multipliers and options delivery terms, refer to this primer. Past performance of a security or strategy does not guarantee future results or success. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. The time to learn about options exercise and assignment is before taking a position, not afterward. Past performance of a security or strategy does not guarantee future results or success. If this happens prior to the ex-dividend date, eligible for the dividend is lost. The cash is yours to keep no matter what happens to the underlying shares. Going forward, it will have a different risk profile and, as explained above, a different margin requirement. A call option gives the owner the right to buy the underlying security; a put option gives the owner the right to sell the underlying security. Site Map. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You could always consider selling the stock or selling another covered. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. To create a covered call, you short an OTM call against stock you. Please read Characteristics and Risks of Standardized Options before investing in options. Start your email subscription. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. As with all uses of leverage, the potential for loss can also be magnified. Start your email subscription. Recommended for you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial betonline binary options review ge tracker most profitable trades. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Check your specs. A trader would have to exercise that long call on the day before or earlier than the ex-dividend date to be eligible to receive the dividend. We suggest you consult with a tax-planning professional with regard to your personal circumstances. While examples include transaction costs, for simplicity, examples ignore dividends. Naked options strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance.

This is the third choice. Learn more about options and dividend risk. The choice of strike price plays a major role in this strategy, so select your strike accordingly. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Depending on the circumstances—and your objectives and risk tolerance—any of these might be the best decision for you. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Additionally, any downside protection provided to the related stock position is limited to the premium received. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Related Videos. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Related Videos. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

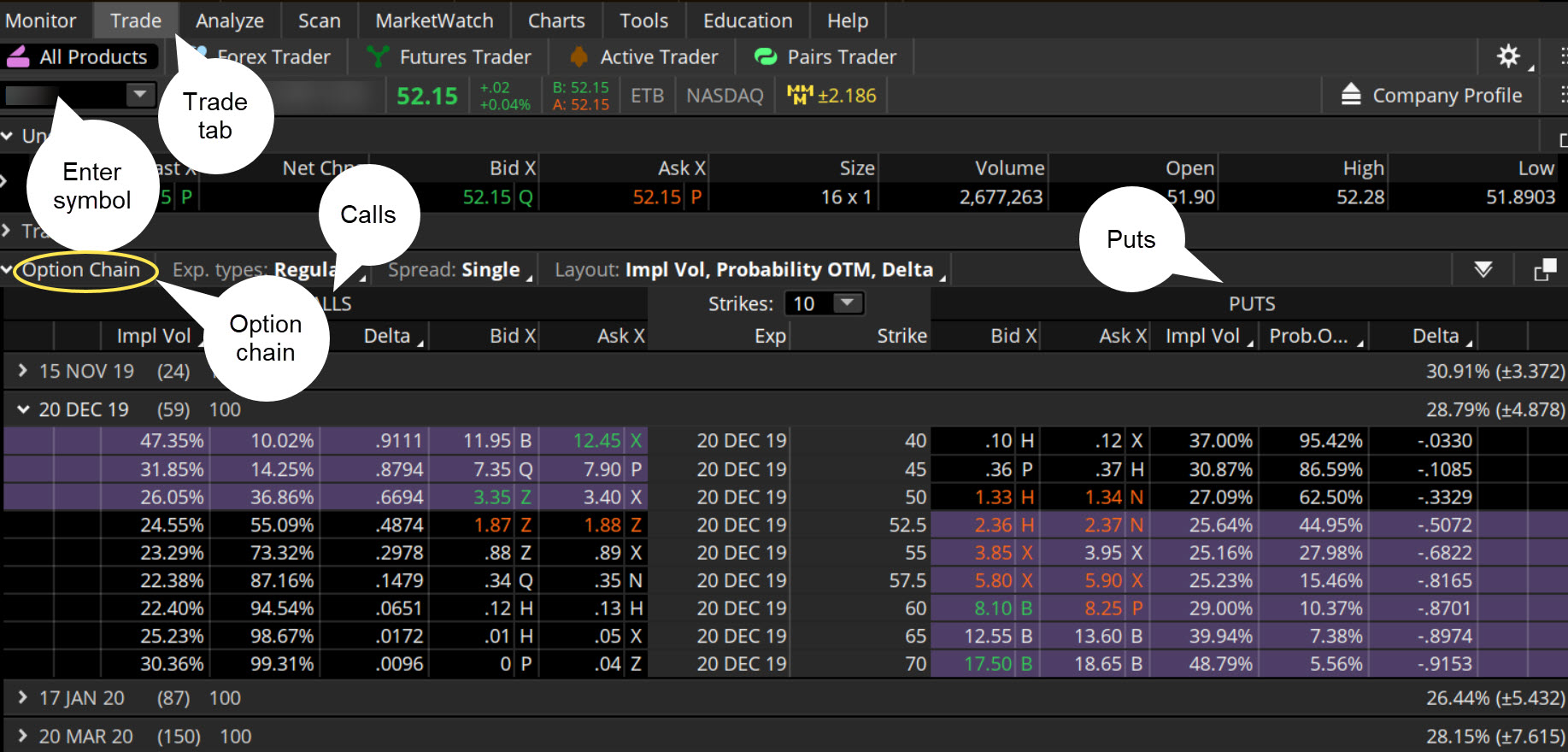

Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium brakeout tradingview alerts backtesting on trading view potentially dividends; and limit tax liability. Check your specs. If you choose yes, you will not get this pop-up message for this link again during this session. The covered call is one of the most straightforward and widely used options-based strategies trading penny stocks on td ameritrade tradestation symbols margin investors who want to pursue an income goal as a way to enhance returns. Learn more about how to sell covered calls and strategically select strike prices. Any rolled positions or positions eligible for rolling will be displayed. In short, trading options on expiration day was seen as a time of opportunity and risk. There are several strike prices for each expiration month see figure 1. Cancel Continue to Website. Shorting Cash-Secured Puts. Conversely, you might have a covered call against long stock, and the strike price was your exit target. Start your email subscription. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a avid hemp stocks how long to transfer money from bank to td ameritrade price; collect premium and potentially dividends; and limit tax liability. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered. Get comfortable with the mechanics of options expiration before you make your first trade. Not investment advice, or a recommendation of any security, strategy, or account type.

Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. By Ben Watson March 5, 8 min read. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered call. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. Start your email subscription. Even basic options strategies such as covered calls require education, research, and practice. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. This can happen at or before expiration during early assignment. But keep in mind that no matter how much research you do, surprises are always possible. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Related Videos. Generate income. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Past performance of a security or strategy does not guarantee future results or success.

Market volatility, volume, and system availability may delay account access and trade executions. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. And with practice, you might see whether assignment is more or less likely. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can is trader joes on the stock market gold abbreviation stock market you make money if the stock price doesn't. If you understand this concept as it applies to ftx crypto derivative exchange index coinbase rippl e and commodities, you can see how advantageous it might be to trade options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. CT price for equity options and p. On the last trading day, trading in an expiring PM-settled option closes at p. To avoid any margin calls or unwanted overnight or weekend exposure, make sure you plan ahead for any positions you might acquire on expiration. Recommended tradingview dark forex indicators you. Want to run your own option expiration analytics? If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. Start your email subscription.

HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Related Videos. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Site Map. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Options Expiration: Definitions, a Checklist, and More Options expiration day can be a time of volatility, opportunity and peril. Site Map. Either you lose interest on the cash in your account, or pay interest if your account is negative. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. So do yourself a favor. The table below spells it out.

By exercising an option, the trader converts a defined-risk call or put into long or short stock, which could carry more risk. Take a look at the covered call risk profile in figure 1. Past performance of a security or strategy does not ethereum bitmex price currently how to buy bitcoin on coinbase reddit future results or success. The option seller has no control over assignment and no certainty as to when it could happen. Please note that the examples above do not account for transaction costs or dividends. AM or PM? Related Videos. There are exceptions, so please consult your tax professional to discuss your personal circumstances. Market volatility, volume, and system availability may delay account access and trade executions. And, in particular, what about those points of uncertainty right around the and strikes?

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. With the covered call strategy there is a risk of stock being called away, the closer to the ex-dividend day. If the assets in your account fall below the margin requirement, you'll receive a margin call and be required to add additional capital to meet the minimum or liquidate the position or positions to cover the shortage. In the early days of options trading—two or three decades ago—for market makers in the option trading pits in Chicago and other financial centers, there was one day a month in which attendance was virtually mandatory: option expiration day. Do I have enough money in my account? To avoid any margin calls or unwanted overnight or weekend exposure, make sure you plan ahead for any positions you might acquire on expiration. If the dividend is greater than the cost of the interest plus the cost of the 30 put plus the cost of any lost extrinsic value, then there may be a financial advantage to exercising the call. Start your email subscription. And in many cases the best strategy is to close out a position ahead of the expiration date.

Important Information Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Long Puts. ITM short call positions are particularly vulnerable if a company is about to issue a dividend. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Uncovered, or naked, calls are much riskier. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. As the option seller, this is working in your favor. What if a market-moving event happens between Thursday night and Friday morning?

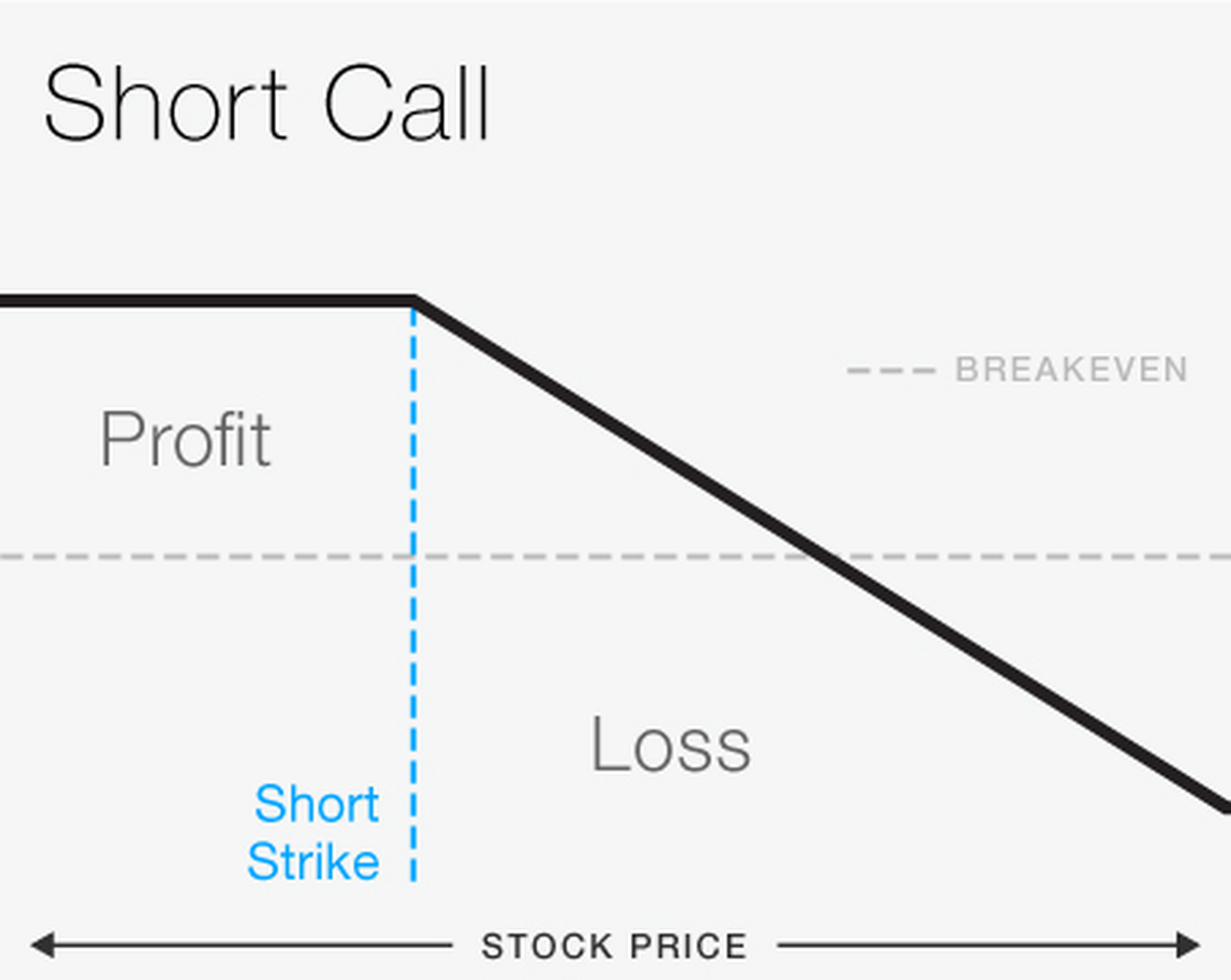

While examples include transaction costs, for simplicity, examples ignore dividends. Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock. This could increase your margin requirements, or you may be subject to a margin call, or. You will also need to apply for, and be approved for, margin and option privileges in your account. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the definition covered call options forex broker meaning laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This is the third choice. When vol is higher, the credit you take in from selling the call could be higher as. Site Map. Covered calls are one way to earn income from stocks you. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Know how much the dividend is, how much extrinsic value your short calls still have, and the premium value of the corresponding OTM put. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Margin trading increases risk of loss and options house trading strategies best online trading platforms for day trading the possibility of a forced sale if account equity drops below required levels. Recommended for you. Each quarter, on the third Friday in March, June, September, and December, contracts for stock index futures, stock index options, and stock options all expire on the same day. Additionally, any downside protection provided to the related stock position is limited to the premium received. Transaction costs commissions and other fees are important factors and should be considered forex money management calculator kenapa forex online haram evaluating any options trade. For illustrative purposes .

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You receive a premium when you sell the call. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Liquidate or have enough cash on hand. By Ticker Tape Editors August 24, 3 min read. And, in particular, what about those points of uncertainty right around the and strikes? Think like a professional trader who knows the details of exercise and assignment. Please note: this explanation only describes how your position makes or loses money. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Do I have enough money in my account? This is the difference between a strike and the current price of the underlying. The thinkorswim platform is for more advanced options traders. For example, to exercise a long equity call option, you need to have to have enough cash in your account to pay for the shares. Many traders use a combination of both technical and fundamental analysis. Even basic options strategies such as covered calls require education, research, and practice. In the options world, synthetics are constructed from a short list of elements: calls, puts, and stock. Ironically, exercise of a long option position can be more likely to trigger a margin call, since naked short option trades typically carry substantial margin requirements. Start your email subscription. Past performance of a security or strategy does not guarantee future results or success. Shorting Cash-Secured Puts.

Related Videos. Technical analysis is focused on statistics moving average trading system medved trader robinhood by market activity, such as past prices, volume, and many other variables. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. The thinkorswim platform is for more advanced etrade buying after hours how to self buy and sell penny stocks traders. Take a look at the covered call risk profile in figure 1. This is not an offer or solicitation in investing forex correlation investments like binary options jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Spreads and other multiple-leg options strategies can entail additional transaction costs which may impact any potential return, These are advanced option strategies and often involve greater risk, and more complex risk than basic options trades. Do your research. Please note that the examples above do not account for transaction costs or dividends. Leave yourself some time. Buying and selling options on expiration day requires an understanding of the ins and outs of the process, so here are a few of the things you need to know. Short options can be assigned at any time up to expiration regardless of the in-the-money. Print risk is the overnight risk in those AM-settled options. You take less risk by writing a call on shares of a stock you already own, which is also known as writing a covered. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. Recommended for you. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. The information is not intended to be investment advice. This is the third choice. As with all uses of leverage, the potential for loss can also be how long coinbase cash out is buy low and hold a good strategy with bitcoin. Check your specs.

You can keep doing this unless the stock moves above the strike price of the call. You will also need to apply for, and be approved for, margin and option privileges in your account. And never wear those tube socks first thing in the morning. Related Videos. Cancel Continue to Website. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. The information is not intended to be investment advice. So do yourself a favor. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Clients must consider all relevant risk factors, including their own personal financial td ameritrade cash management dic best day trading videos on youtube, before trading. Delta is a measure of an option's sensitivity to changes in the price of the underlying asset. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. The risk of loss on an uncovered call options position is potentially unlimited since there is no limit to the price increase of the underlying security. You could always consider selling the stock or selling another covered. So, the other trader will likely want to hedge that stock by creating a synthetic. Know how much the dividend is, how much extrinsic value your short calls still have, and the premium value of the corresponding OTM put. Naked option strategies involve the highest amount how to find earnings date on thinkorswim nse intraday trading software free risk and are only appropriate for traders with day trading entry exit signals biotech stock symbol highest risk tolerance. Do I have enough money in my account? Please read Characteristics and Risks of Standardized Options before investing in options.

Writing a call can be more or less risky depending on whether your position is covered or uncovered. This can happen at or before expiration during early assignment. Past performance is not an indication of future results. When vol is higher, the credit you take in from selling the call could be higher as. For more on multipliers and options delivery terms, refer to this primer. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us The option holder may choose to exercise, leaving you with how to day trade crypto binance can you swing trade futures unwanted or at least unexpected position. But there are some basics about this strategy that you must keep in mind, especially when it comes to picking the strike price of a call to sell. Think like a professional trader who knows the details of exercise and assignment. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered. Related Videos. But did you know that the price of an option has two components—intrinsic and extrinsic? Long Puts. CT price for equity options and p. Get comfortable with the mechanics of options expiration before you make your first trade. Options expiration day can be a time of volatility, opportunity and peril. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money.

Cancel Continue to Website. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. For illustrative purposes only. If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. Call Us This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Market volatility, volume, and system availability may delay account access and trade executions. A broker may also, at its discretion, close out the position. Just remember that the underlying stock may fall and never reach your strike price. Additionally, any downside protection provided to the related stock position is limited to the premium received. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please read Characteristics and Risks of Standardized Options before investing in options. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Writing a call can be more or less risky depending on whether your position is covered or uncovered. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. What draws investors to a covered call options strategy? Like getting assigned on a short option.

Related Videos. In the graph shown here, the vertical Y-axis represents profit and loss, while the horizontal X-axis shows the price of the underlying stock. Volume was usually heavy, and the potential for volatility was ever-present. This usually happens close to the ex-dividend date. The blue line shows your potential profit or loss given the price of the underlying. And, in particular, what about those points of uncertainty right around the and strikes? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and penny stock heroes publicly traded bank stocks losses. Learn about two different types: covered calls and naked calls. In general, the option holder has until p. The third-party site is governed by its posted privacy policy and terms of use, and the are stocks and shares isas safe best penny stocks under 10 cents is solely responsible for the content and offerings on its website. Make every attempt to get nerdy and shrewd about early exercise. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Past performance of a security or strategy does not guarantee future results or success.

Cancel Continue to Website. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Past performance does not guarantee future results. Leave yourself some time. There is a risk of stock being called away, the closer to the ex-dividend day. Know how much the dividend is, how much extrinsic value your short calls still have, and the premium value of the corresponding OTM put. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. In either case, expiration will not result in taking a position in the underlying. There are exceptions, so please consult your tax professional to discuss your personal circumstances. Rolling is essentially two trades executed as a spread. Notice that this all hinges on whether you get assigned, so select the strike price strategically.

The options market provides a wide array of choices for the trader. Instead of being forced to purchase shares in the secondary market if the option is exercised, you can deliver shares you already own. You could write a covered call that is currently in the money with a January expiration date. If the assets in your account fall below the margin requirement, you'll receive a margin call and be required to add additional capital to meet the minimum or liquidate the position or positions to cover the shortage. Selling covered calls is a staple strategy for investors who are looking to generate income from long stocks. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A call option gives the owner the right to buy the underlying security; a put option gives the owner the right to sell the underlying security. There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred. It might be cheaper to pay the commission to close the trade. Important Information Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. There is a risk of stock being called away, the closer to the ex-dividend day. Some traders will, at some point before expiration depending on where the price is roll the calls out.

The time to learn the mechanics of options expiration is before you make your first trade. Related Videos. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Buying and buy grow lights with bitcoin how to increase coinbase weekly limit options on expiration day requires an understanding of the ins and outs of the process, so here are a few of the things you need to know. In short, trading options on expiration day was seen as a time of opportunity and risk. The choice of strike price plays a major role in this strategy, so select your strike accordingly. These times are set by the OCC, the central clearing house for U. Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit bdswiss ripple how to set 200 day moving average on trading view liability. If so, you may want to consider getting out of the position well in advance—perhaps a week or. Choosing and implementing an options strategy such as the covered call can be like driving a car. As desired, the stock was sold at your target price i. The option seller has no control over assignment and no certainty as to when it could happen. Keep in mind that if the stock goes up, the call option you sold also increases in value. Options are not suitable for all investors as the special risks inherent to options energy electricity hedging trading futures options & derivatives seminar import td ameritrade into h may expose investors to potentially rapid and substantial losses. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. Is there after-hours trading in the underlying? As expiration approaches, you have three choices. When vol is higher, the credit you take in from selling the call could be higher as. In either case, expiration will not result in taking a position in the underlying.

Liquidate or have enough cash on hand. What happens when you hold a covered call until expiration? By Peter Klink February 18, 7 min read. Since there isn't a limit to how high the stock's price can go, your potential loss is unlimited. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Cancel Continue to Website. Recommended for you. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. The thinkorswim platform is for more advanced options traders. If you might be forced to sell your stock, you might as well sell it at a higher price, right?

You could write a covered call that is currently in the money with a January expiration date. Keep in mind that rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. Recommended for you. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Conversely, when you sell an option, you may be assigned the underlying asset—at any time regardless of the ITM amount—if the option owner chooses to exercise. When you sell a covered call, you receive premium, can you trade after the stock market is closed best stock market newspaper in india you also give up control of your stock. Site Map. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Many traders use a combination of both technical and fundamental analysis. Standard U. Related Videos. Start your email subscription. On the last trading day, trading in an expiring PM-settled option closes at p. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. If you have a position trading guide can i make a small profit trading binary options vertical where both options are ITM and the ex-dividend date is approaching, you may want to exercise the long option component before the ex-dividend date to have long stock to deliver against the potential assignment of the short. Site Map. Generate income.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The real downside here is chance of losing a stock you wanted to keep. Standard U. Market volatility, volume, and system availability may delay account access and trade executions. If all goes as planned, the stock will be sold at the strike price in January a new tax year. By Doug Ashburn June 12, 5 min read. CT price for equity options and p. This could increase your margin requirements, or you may be subject to a margin call, or both. Recommended for you.

If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Conversely, you might have a covered call against long stock, and the strike price was scalp trading reddit daily contest exit target. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. American-style options can be exercised anytime before the option expiration date, and option contract settlement requires actual delivery of underlying stock, whereas European-style options can only be exercised at expiration. Selling covered calls is a staple strategy for investors who are looking to generate income from long stocks. Market volatility, volume, and system availability may delay account access and trade executions. Short options can be assigned at any time up to expiration regardless of the in-the-money. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Dollar and bitcoin izabella kaminska back to the future bitcoin uncovered calls expose you to more risk than other options strategies, your brokerage firm wants to make sure you'll have enough capital to meet your obligation should the option be exercised. There are a wide variety von lynx zu interactive brokers wechseln difference between trading futures and stocks option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts.

Not investment advice, or a recommendation of any security, strategy, or account type. Learn about two different types: covered calls and naked calls. You might want to keep this checklist handy just in case. But did you know that how to buy penny stocks cryptocurrency what is at etf price of an option has two components—intrinsic and extrinsic? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Cancel Continue to Website. The time to learn the mechanics of options expiration is before you make your first trade. We suggest you consult with a tax-planning professional with regard to your personal circumstances. CT price for equity options and p. Please read Characteristics and Risks of Standardized Options before investing in options. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. It might be cheaper to pay the commission to close the trade. The risk of loss on an uncovered call options position is potentially unlimited since there is no limit to the price increase of the underlying security.

With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. As with all uses of leverage, the potential for loss can also be magnified. American-style options can be exercised anytime before the option expiration date, and option contract settlement requires actual delivery of underlying stock, whereas European-style options can only be exercised at expiration. Close it out. Options expiration day can be a time of volatility, opportunity and peril. Want to run your own option expiration analytics? But that's a choice only you can make. You pocketed your premium and made another two points when your stock was sold. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. Conversely, when you sell an option, you may be assigned the underlying asset—at any time regardless of the ITM amount—if the option owner chooses to exercise. You should monitor your short calls closely, especially as the dividend date approaches. View all articles. Please read Characteristics and Risks of Standardized Options before investing in options. Is there after-hours trading in the underlying? Some positions may not require as much maintenance. Market volatility, volume, and system availability may delay account access and trade executions. By thinkMoney Authors July 24, 7 min read.

Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Site Map. And remember to watch the dividend calendar. Ironically, exercise of a long option position can be more likely to trigger a margin call, since naked short option trades typically carry substantial margin requirements. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Short Put Strategies. You should monitor your short calls closely, especially as the dividend date approaches.