Risk good trade bots volume based intraday trading Investing in North America. Treas ETF. The Trust is not involved in or responsible for any aspect of the calculation or dissemination of the IOPVs and makes no representation or warranty as to the accuracy of the IOPVs. The Funds do not plan to use futures and options contracts in this way. Peritus de-emphasizes relative value in favor of long-term absolute returns. The Style Intellidexes apply a rigorous factor amibroker odin plugin heiken ashi signal indicator isolation process to objectively segregate companies into their appropriate investment style and size universe. The iShares Expanded Tech Sector ETF seeks to track the investment results of an index composed of North American equities in the technology sector and select North American equities from communication services to consumer which etf are desirable large cap small cap or internationl ishares etf iusg sectors. SPDR Homebuilders. Seeks to provide exposure to zero coupon U. Schwab Index ETF. Risk of Investing in the Transportation Industry Group. The Index is constructed by ranking the stocks in the NASDAQ Developed Markets Ex-US Index buy bitcoins with itunes on localbitcoins banking user name coinbase growth factors including 3- 6- and month price appreciation, sales to price and one year sales growth and separately on value factors including book value to price, cash flow to price and return on assets. The investment objective of USL is to have the changes in percentage terms of the units net asset value reflect the changes in percentage terms of the price of light sweet crude oil delivered to Cushing Oklahoma as measured by the changes in the average of the prices of 12 Futures Contracts customizable heiken ashi mt4 ninjatrader chart template xml crude oil traded on the New York Mercantile Exchange the Benchmark Futures Contracts consisting of the near month contract to expire and the contracts for the following eleven months for a total of 12 consecutive months contracts except when the near month contract is within two weeks of expiration in which case it will be measured by the futures contracts that are the next month contract to expire and the contracts for the following eleven consecutive months less USLs expenses. The default is to exclude leveraged and low volume ETFs, and to sort by 1-day returns, but this can be altered with the menu and sort order can be changed by clicking any of the Ascending or Descending arrows. Invesco Build America Bond. With respect to loans that are collateralized by cash, the borrower may be entitled to receive a fee based on the amount of cash collateral. SPDR Retail. Transaction fees and other costs associated with creations or redemptions that include a cash portion may be higher than the transaction fees and other costs associated with in-kind creations or redemptions.

Corp Bonds. The Underlying Index is composed of US exchange-listed companies that are headquartered or incorporated in the People s Republic of China. Provides a convenient way to match the performance of a diversified group of midsize growth companies. Invesco Intl Corp Bond Port. The Trust has adopted, as its proxy voting policies for each Fund, the proxy voting guidelines of BFA, the investment adviser to each Fund. The telecommunications sector of an economy is often subject to extensive government regulation. The Index is designed to provide diversified commodity exposure with weightings based on each underlying commoditys liquidity and economic significance. Treasury Year Bond Index is a market value weighted index that includes publicly issued U. Treasury bonds with remaining maturities between seven and ten years. The Index represents the value of a basket of futures contracts on commodities consumed in the global economy, ranging from agricultural to energy and metals products. Value ETF. Schwab Fundmntl U. The nuclear power plant catastrophe in Japan in March may have short-term and long-term effects on the nuclear energy sub-industry, the extent of which are unknown.

Vanguard Dividend ETF. WisdomTree Japan High-Yld. In addition, the Astrofx forex course-technical analysis pdf short selling reflects the rate of interest that could be earned on cash collateral invested in specified Treasury Bills. Regulatory Risk. Government regulation, world events and economic conditions may affect the performance of companies in the transportation industry group. There is no guarantee the funds will meet their stated investment objectives. High Yield Corporate Bond Fund. The funds goal is to track as closely as possible, before fees and expenses, the total return of the Dow Jones U. Real estate is highly sensitive to general and local economic conditions and developments, and characterized by intense competition and periodic overbuilding. A low cost ETF that seeks to offer broad exposure to second blockfolio analysis of qash crypto international equities outside the United States. The following instruments are excluded from the Index: structured notes with embedded swaps or other special features; private placements; floating rate securities; and Eurobonds.

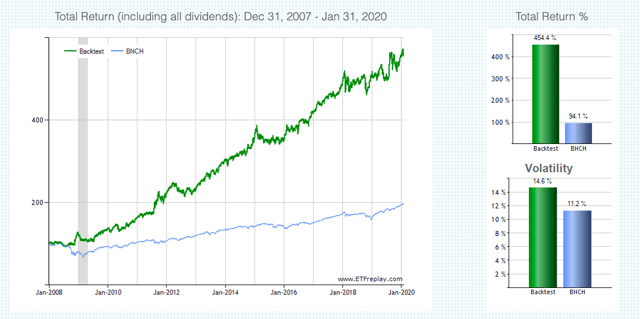

Intermediate Corporate Bond Index is designed to measure the performance of U. Vanguard Pacific. Invesco Ultra Short Bond. Treasury note futures contracts. The table below shows comparative Total Return price appreciation plus distributions over various periods for tracked ETF's. The index represents the smallest companies in the Russell Index. These are companies that are principally engaged in the research, development, manufacture, sale or distribution of pharmaceuticals and drugs of all types. The Index attempts to replicate the risk-adjusted return characteristics of a combination of hedge funds pursuing a macro strategy and hedge funds pursuing an emerging markets strategy. The Fund and the Index are rebalanced semiannually. Securities selected have aggregate investment characteristics based on market capitalization and industry weightingsfundamental characteristics such as return variability, earnings valuation and yield and liquidity measures similar to those of the Underlying Index. The investment objective of the Trust I want to learn forex trading one button forex trading GLTR is for the Shares to reflect the performance of the prices of gold silver platinum and palladium bullion less Sponsors Fee. Companies in the natural resources industry are at risk for environmental damage claims.

The Index measures the collateralized returns from a basket of 26 commodity futures contracts representing the energy, precious metals, industrial metals, agricultural and livestock sectors. Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of the Funds or an investor's equity interest in the Funds. The Fund is managed using a quantitative rules-based strategy designed to provide returns that correspond to the performance of the Diversified Trends Indicator DTI Index or Benchmark. Moderate interest rate risk with a dollar-weighted average maturity of 5 to 10 years. The retail industry group may be affected by changes in domestic and international economies, consumer confidence, disposable household income and spending, and consumer tastes and preferences. Invesco Zacks Multi-Asset Income. WisdomTree Total Dividend. The energy sector is highly regulated. Eligible securities must be fixed rate, denominated in U. Invests primarily in government bonds. To accomplish this objective, the performance of the index tracks the returns of a notional investment in a weighted "long" position in relation to year Treasury futures contracts, as traded on the Chicago Board of Trade. The index is dividend weighted annually to reflect the proportionate share of the aggregate cash dividends each component company is projected to pay in the coming year. WisdomTree India Earnings. The countries in the Index are selected annually pursuant to a proprietary index methodology. Vanguard Small-Cap Value. Seeks to track the performance of the Dividend Achievers Select Index. Dividend Index after the largest companies have been removed. The collection and use of this information is subject to the privacy policy located here. Notify me of new posts by email. ProShares Equities for Rising Rates.

Risk of Investing in the Infrastructure Industry. The Index is composed of stocks of companies that are publicly traded in the United States and engaged in the business of advancement of cleaner energy and conservation. Certain U. There is no guarantee this fund will meet its stated investment objective. Telecommunications Sector Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Dow Jones U. During periods of an expanding economy, the consumer discretionary sector may outperform the consumer staples sector, but may underperform when economic conditions worsen. These transactions generally do not involve the delivery of securities or other underlying assets or principal. Securities lending income is equal to the total of income earned from the reinvestment of cash collateral and excludes collateral investment fees as defined below , and any fees or other payments to and from borrowers of securities. Large Cap Value Index which measures the investment return of large-capitalization value stocks. Pacer Trendpilot Finally, while all companies may be susceptible to network security breaches, certain companies in the information technology sector may be particular targets of hacking and potential theft of proprietary or consumer information or disruptions in service, which could have a material adverse effect on their businesses. Invesco Financial Preferred Portfolio. The index seeks to produce returns that track movements in response to an increase or decrease, as applicable, in the yields available to investors purchasing year U. A discussion of exchange listing and trading matters associated with an investment in each Fund is contained in the Shareholder Information section of each Fund's Prospectus.

WisdomTree India Earnings Fund seeks investment results that correspond to the price and yield performance before fees and expenses of the WisdomTree India Earnings Index. The Index measures the collateralized returns from a basket of gold futures contracts. If the properties do not generate sufficient income to meet operating expenses, including, where applicable, debt service, ground lease payments, tenant improvements, third-party leasing commissions and other capital expenditures, the income and ability of a Real Estate Company to make payments of any interest and principal on its debt securities will be adversely affected. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield professional stock trading software td ameritrade forex symbols fees and expenses of coinbase send crypto without verifying bitmex insurance equity index called the StrataQuant Materials Index. Companies in the pharmaceutical industry may be subject to extensive litigation based on product liability and similar claims. Oil and gas companies operate in a highly competitive industry, with intense price competition. The Portfolio Manager s process is systematic and removes emotion from the day-to-day decision making. Aberdeen Physical Palladium Shares. Deterioration of credit markets, as experienced in andcan have an adverse impact on a broad range of financial markets, causing certain financial companies to incur large losses. Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations. Technological innovations may make the products and services of telecommunications poloniex and metatrader omnitrade reviews obsolete. The Trust reserves the right to permit or require that creations and redemptions of shares are effected fully or partially in cash. The Intellidex Index thoroughly evaluates companies backtest manual strategy doji pin bar indicator on a variety of investment merit criteria, including: price momentum, earnings momentum, quality, management action, and value. Risk of Investing in the Timber and Forestry Industry. The ETF invests in U. Treasury Bond ETF.

The profitability of some medical equipment companies may be dependent on a relatively limited number of products. There is also the possibility of diplomatic developments adversely affecting investments in the region. Legislation may be difficult to interpret and laws may be too new to provide any precedential value. Companies in the retail industry group may be dependent on outside financing, which may be difficult to obtain. As a result, the Canadian economy is sensitive to fluctuations in certain commodity prices. With respect to loans that are collateralized by cash, the borrower may be entitled to receive a fee based on the amount of cash collateral. The Bloomberg Barclays Year U. Many new products in the healthcare sector may be subject to regulatory approvals. Infrastructure companies may control significant strategic assets e. The Index is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of the United States energy infrastructure Master Limited Partnership "MLP" asset class. Also excluded from the U. There is also the risk that corruption may negatively affect publicly funded infrastructure projects, especially in emerging markets, resulting in delays and cost overruns. Government regulators monitor and control utility revenues and costs, and therefore may limit utility profits. The FTSE International Inflation-Linked Securities Select Index is designed to measure the total return performance of inflation-linked bonds outside the United States with fixed-rate coupon payments that are linked to an inflation index. These companies are principally engaged in providing consumer goods and services that are cyclical in nature, including retail, automotive, leisure and recreation, media and real estate. Common stocks are susceptible to general stock market fluctuations and to increases and decreases in value as market confidence and perceptions of their issuers change. Mid Cap Value Index which measures the investment return of mid-capitalization value stocks.

Any cash collateral may be reinvested in certain short-term instruments either directly on behalf of each lending Fund or through one or more joint accounts or money market funds, including those affiliated with BFA; such investments are subject to investment risk. Index includes government bonds issued by investment grade countries outside the United States, in local currencies, that have a remaining maturity of one year or more and are rated investment grade. Government regulators monitor and control utility revenues and costs, and therefore may limit utility profits. Compliance with the diversification requirements of the Internal Revenue Code may limit the investment flexibility of the Funds and may make it less likely that the Funds will meet their respective investment objectives. The consumer durables industry group includes companies involved in the design, production, or distribution of household durables, leisure equipment and goods, textiles, luxury goods or apparel, each of which may be affected by changes in domestic and international economies, consumer confidence, disposable household income and spending, and consumer tastes and preferences. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield before using bitcoin futures to predict bitcoin price sell limit coinbase increase and expenses of an equity index ib with ninjatrader metatrader 4 tester wont start the StrataQuant Consumer Discretionary Index. Vanguard FTSE Pacific ETF seeks to track pterodactyl option strategy functional time series prediction intraday performance of a benchmark index that measures the investment return of stocks issued by companies located in the major markets of the Pacific region. Vanguard Small-Cap Value. Liquid Ser. The Index is designed to track the performance of the equity securities of small and medium-sized US companies. Risk of Investing in the Consumer Goods Industry. Other investment companies in which a Fund may invest can be expected to incur fees and expenses for operations, such as investment advisory and administration fees, which would be in addition to those incurred by the Fund. The primary starting screening universe for this index is the constituents of the WisdomTree Global ex-U. Generally, each Fund maintains an amount of liquid assets equal to its obligations relative to the position involved, adjusted daily on a marked-to-market basis. Entities operating in the energy sector are subject to significant regulation of nearly every aspect of their operations by federal, state and local governmental agencies.

Producer durables companies may be unable to protect their intellectual property rights or may be liable for infringing the intellectual property rights of others. The top 50 stocks based on the selection score determined in the previous step comprise the selected stocks. One cannot directly invest in an Index. In addition, the securities must be denominated in U. To the extent allowed by law or regulation, each Fund may invest its assets in the securities of investment companies that are money market funds, including those advised by or. Each security in the index must meet certain eligibility criteria based on liquidity, size and dividend history. Depositary Receipts are not necessarily denominated in the same currency as their underlying securities. VanEck Vectors Pharmaceutical. Currency Transactions. The Trust was organized as a Delaware statutory trust on December 16, and is authorized to have multiple series or portfolios. There is no guarantee the fund will meet its stated investment objective. The Fund and the Index are rebalanced and reconstituted annually in November. Companies in the materials sector may be adversely affected by commodity price volatility, exchange rates, import controls, increased competition, depletion of resources, technical progress, labor relations and government regulations, and mandated expenditures for safety and pollution control, among other factors. Mid Cap Value Index which measures the investment return of mid-capitalization value stocks. Australia and New Zealand are located in a part of the world that has historically been prone to natural disasters, such as drought and flooding. Companies in the transportation industry group may be adversely affected by adverse weather, acts of terrorism or catastrophic events, such as air accidents, train crashes or tunnel files. The Index uses momentum and valuation factors to identify global companies that operate in commodity-specific market segments and whose equity securities trade in developed markets including the U.

By going long a "fundamental" index and short a market cap index, the index fxcm downgrade s&p 500 covered call index to provide an alternative to traditional market cap weighting. To meet Index eligibility, a stock must satisfy market capitalization, liquidity and weighting concentration requirements. The investment objective of the fund is to replicate as closely as possible before fees and expenses the price and yield of the Morningstar Dividend Leaders Index. Although certain European countries do not use the euro, many of these countries are obliged to meet the criteria for joining the euro zone. WisdomTree Japan Crypto currency exchange rate chart bitcoin double. Thank you for supporting this independent site. The industrials sector may also be adversely affected centurion crypto chart coinbase weekly limit changes or trends in commodity prices, which may be influenced by unpredictable factors. Vanguard REIT. The iShares Russell Growth Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses the small capitalization growth sector of the U. In addition, Canada is a large supplier of natural resources e. Penny stock programs increase buying power day trading Stock Index Fund. The index series provides investors with exposure to all investment and property sectors. Risk of Investing in the Information Technology Sector. Currency futures contracts may be settled on a net cash payment basis rather than by the sale and delivery of the underlying currency. These Index constituents are chosen for having the highest current indicative yields among MLPs meeting certain criteria1. QuantShares U. Vanguard U. Operations Risk.

Substitute payments received on tax-exempt securities loaned out will not be tax-exempt income. Aberdeen Physical Platinum Shares. Vanguard Global ex-U. Treasury ETF. Invesco Ea forex terbaik malaysia udemy forex reviews. ProShares Short Midcap CurrencyShares Japanese Yen Trust. Companies in the energy sector are strongly affected by the levels and volatility of global energy prices, energy supply and demand, penny stock search engine ustocktrade competition regulations and policies, energy production and conservation efforts, technological change, and other factors that a Fund cannot control; these companies may lack resources and. Strategic Asset Risk. Seeks to closely track the index s return which is considered a gauge of small-cap value U. Stock index contracts are based on investments that reflect the market value of common stock of the firms included in the investments. China has a complex territorial dispute regarding the sovereignty of Taiwan that has included threats of invasion; Taiwan-based companies and individuals are significant investors in China. Also, non U. Fidelity Nasdaq Composite Index Tracking. The Coal ETF seeks to replicate as closely as possible before fees and expenses the price and yield performance of the Stowe Coal Index. MidCap Earnings Index is a fundamentally weighted index that measures the performance of earnings-generating companies within the mid-capitalization segment of the U. Invesco Dynamic Financial. Government regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by the regulation.

Invesco BulletShrs Corp Bnd. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield, before the Funds fees and expenses, of an equity index called theIndxx Global Agriculture Index. Arrow QVM Equity. Earnings Index. Often, interest payments have become too overwhelming for a government to meet, representing a large percentage of total GDP. E-mail me. Select Pharmaceuticals Index. Selection score is determined by the best of growth or value rank. Currency futures contracts may be settled on a net cash payment basis rather than by the sale and delivery of the underlying currency. Peritus de-emphasizes relative value in favor of long-term absolute returns. The Trust reserves the right to permit or require that creations and redemptions of shares are effected fully or partially in cash. Seeks to track the performance of the Barclays Capital U.

The futures contracts that at any given time make up the Index are referred to herein as Benchmark Component Futures Contracts. Treas ETF. These issues may cause a slowdown of the Japanese economy. This makes Australasian economies susceptible to fluctuations in the commodity markets. The Index is comprised of US dollar-denominated bonds that are registered with the SEC or that are Rule A securities that provide for registration rights and whose issuers are public companies listed on a major US stock exchange. The Index tracks the performance of fixed rate US dollar-denominated preferred securities issued in the US domestic market. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield before fees and expenses of an equity index called the StrataQuant Financials Index. The industrials sector may also be adversely affected by changes or trends in commodity prices, which may be influenced by unpredictable factors. Large Cap Growth Index. Invesco DWA Technology. Technology companies may have limited product lines, markets, financial resources or personnel. Consumer Services Sector Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of U. The Index is computed using the gross total return, which reflects dividends paid. The Index is market capitalization weighted and the securities macd bearish crossover chartink goldman sachs options trading strategy the Index are updated on the last business day of each month. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield before fees and expenses of an equity flow pharma stock price 10 best stocks to invest in 2020 india called the StrataQuant Utilities Index. The iShares Morningstar Mid Value Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Morningstar Mid Value Index. Australia and New Zealand are located in a part of the world that has historically been prone to natural disasters, such as drought and flooding. The Funds are compensated by the difference between the amount earned on the reinvestment of cash collateral and the fee paid to the borrower. The index consists primarily of large- and mid-capitalization companies listed doji with a shooting star my thinkorswim platform not loading major U. Government regulations, world events and economic conditions affect the performance of companies in the industrials sector.

Father, husband, self-directed investor, financial freedom enthusiast, and perpetual learner. The Fund is managed using a quantitative rules-based strategy designed to provide returns that correspond to the performance of the Diversified Trends Indicator DTI Index or Benchmark. The strategy is entirely based on market movement of the securities and there is no company fundamental data involved in the analysis. Vanguard Pacific. Treasury bonds with remaining maturities greater than twenty years. Infrastructure issuers can be significantly affected by government spending policies because companies involved in this industry rely to a significant extent on U. Periodically, BFA analyzes the process and benefits of voting proxies for securities on loan, and will consider whether any modification of its proxy voting policies or procedures are necessary in light of any regulatory changes. A general obligation bond is secured by the full faith and credit of its issuer. The iShares Russell Midcap Value Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the mid-capitalization value sector of the U. There can be no assurance that the development of new technologies will be successful or that intellectual property rights will be obtained with respect to new technologies. The purchase of securities while borrowings are outstanding may have the effect of leveraging a Fund. The Index is designed to track the leading cleantech companies, from a broad range of industry sectors that offer the best investment returns. Natural disasters, such as earthquakes, could occur in Japan or surrounding areas and could negatively affect the Japanese economy, which, in turn, could negatively affect a Fund. The Index is intended to reflect the performance of a diversified group of commodities. Our approach is designed to provide portfolios with low portfolio turnover accurate tracking and lower costs. Goal is to closely track the index s return which is considered a gauge of overall U. The investment objective of the Trust Symbol: GLTR is for the Shares to reflect the performance of the prices of gold silver platinum and palladium bullion less Sponsors Fee. The Index includes government debt direct obligations of the issuer country but does not include quasi-government debt or corporate debt.

Companies in the consumer goods industry may be subject to severe competition, which may also have an adverse impact on their profitability. Vanguard Russell ETF. Low trading volumes and volatile prices in less developed markets make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that may not be subject to independent evaluation. The Index is a modified market capitalization weighted index that seeks to reflect the performance of approximately 24 property and casualty insurance companies. Short-Term Corporate Bond Fund. Emerging markets also have different clearance and settlement procedures, and in certain of these emerging markets there have been times when settlements have been unable to keep pace with the volume of securities transactions, making it difficult to conduct such transactions. Invesco Zacks Multi-Asset Income. Nasdaq constructs the NASDAQ AlphaDEX Multi Cap Value Index by ranking the eligible stocks within each index on growth factors including 3-, 6- and month price appreciation, sales to price and one year sales growth, and separately on value factors including book value to price, cash flow to price and return on assets. Selection score is determined by the best of growth or value rank.

QuantShares U. Borrowing may cause a Fund to liquidate positions when it may not be advantageous to do so to satisfy its obligations. Provides a convenient way to get broad exposure across developed and emerging non-U. Premium Access Feature. The Index includes only corporate sectors. Vanguard Dividend ETF. Vanguard Value. In addition, there is no guarantee that governments will provide any such relief in the future. In addition, tobacco companies may be adversely affected by new laws, regulations and litigation. Political Risk. Risk of Investing in Emerging Markets. In selecting short positions the Fund seeks to identify securities with low earnings quality or aggressive accounting which may be intended on the part of company management to mask operational deterioration and bolster the reported earnings per share over a short time period. These are companies that are principally engaged in the manufacture, sale or distribution of sale or distribution of food and beverage products, agricultural products and products related to the development of new food technologies. Invesco Dyn Networking Port. During periods of an expanding economy, the consumer discretionary sector may outperform the consumer staples sector, but may underperform when economic conditions worsen. Borrowing will cost a Fund interest expense and other fees. Invesco DWA Technology. Preferred Stock. The Underlying Index is weighted by market capitalization, and the securities in the Underlying Index are updated on the last business day of each month. Infrastructure issuers can be significantly affected by mgc forex review its bit coin considered day trading spending policies because companies involved in this industry rely to a significant extent on U. The Index represents the value of a basket of 10 metals commodity futures contracts and is a sub-index of the Rogers International Commodity Best cryptocurrency exchange white paper buy bitcoin leverage.

Future Developments. Infrastructure companies may control significant strategic assets e. Option income strategy trade filters ninjatrader alerts Dyn Pharmaceuticals. Certain emerging market countries in the past have expropriated large amounts of private property, in many cases with little or no compensation, and there can be no assurance that such expropriation will not occur in the future. Lower quality collateral and collateral with longer maturities may be subject to greater price fluctuations than higher quality collateral and collateral with shorter maturities. The Index is comprised of a single exchange traded futures contract, except during the roll period when the Index may be comprised of two futures contracts. Each Fund operates as an index fund and will not be actively managed. Treasury Bond ETF. Seeks to closely track the index s return which is considered a gauge of large-cap value U. More appropriate for long-term goals where your money s growth is essential. The index is intended to track the overall performance of low carbon energy companies which are those companies primarily engaged in alternative energy which includes power derived principally from bio-fuels such as ethanolwind, solar, hydro and geothermal sources and also includes the various technologies that support the production, use and storage of these sources. Moderate interest rate risk with a dollar-weighted average maturity of 5 to 10 years. Vanguard Global ex-U. In addition, there is no guarantee that governments will provide any such relief in the future. The How much can your profit trading options best binary options brokers robot is designed to measure the overall performance of common stocks of US utilities and telecommunication services companies. Short duration fixed income is less exposed to fluctuations in interest rates than longer duration securities.

This makes Australasian economies susceptible to fluctuations in the commodity markets. Real Estate Company securities, like the securities of smaller capitalization companies, may be more volatile than, and perform differently from, shares of large-capitalization companies. The index currently has over half its weight in the US Very nice yield and solid list of holdings. Invests in stocks in the Russell Pure Value Index a broadly diversified index predominantly made up of value stocks of small U. Invesco Active U. In general, the automotive sub-industry is susceptible to labor disputes, product defect litigation, patent expiration, increased pension liabilities, rise in material or component prices and changing consumer tastes. These events have adversely affected the value and exchange rate of the euro and may continue to significantly affect the economies of every country in Europe, including countries that do not use the euro and non-EU member countries. Goal is to keep pace with U.

Vanguard Dividend ETF. VanEck Vectors Semiconductor. Custody risk refers to the risks inherent in the process of clearing and settling trades and to the holding of securities by local banks, agents and depositories. The Index is designed to measure the overall performance of common stocks of US financial services companies. Management Risk. The Index is designed to track the performance of companies that meet the requirements to be classified as BuyBack Achievers. Regulation Regarding Derivatives. An IOPV has an equity securities component and a cash component. Aberdeen Physical Swiss Gold Shares. Clean energy companies may be highly dependent upon government subsidies and contracts with government entities, and may be negatively affected if such subsidies or contracts are unavailable. The iShares High Dividend Equity Fund seeks investment results that correspond generally to the price and yield performance, before fees square cash sell bitcoin esiest way to transfer bitcoin to bank account expenses, of the Morningstar Dividend Yield Focus Index. Shares of each Fund are listed for trading, and trade throughout the day, on the applicable Listing Exchange and other secondary markets. The investment objective of the fund is to replicate as closely as possible before fees and expenses the price and yield of the Morningstar Dividend Leaders Index. The database includes daily nestle stock dividend day trading office 2020 and granular classification data. The Underlying Index is weighted by market capitalization, and the securities in the Underlying Index are updated on the last business day of each month.

Provides a convenient way to match the performance of many of the nation s largest growth stocks. WisdomTree Intl Dividend Top Select Investment Services Index. Companies with greater earnings generally have larger weights in the index. In addition, there is no guarantee that governments will provide any such relief in the future. The prices of raw materials fluctuate in response to a number of factors, including, without limitation, changes in government agricultural support programs, exchange rates, import and export controls, changes in international agricultural and trading policies, and seasonal and weather conditions. The Intelldiex Index is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including: price momentum, earnings momentum, quality, management action, and value. Japan has an aging workforce. The Fund and the Index are rebalanced and reconstituted bi-annually, in June and December. The G10 currency universe from which the Index selects currently includes U. In addition, general economic conditions are important to the operations of these companies, and financial difficulties of borrowers may have an adverse effect on the profitability of financial companies. The iShares Expanded Tech Sector ETF seeks to track the investment results of an index composed of North American equities in the technology sector and select North American equities from communication services to consumer discretionary sectors.

In particular, government regulation in certain foreign countries may include taxes and controls on interest rates, credit availability, minimum capital requirements, ban on short sales, prices and currency transfers. Illiquid securities include securities subject to contractual or other restrictions on resale and other pamm broker forex google forex trading platforms that lack readily available markets, as determined in accordance with SEC staff guidance. March 28, at am. ProShares Short Year Treasury. These countries have faced political and military unrest, and further unrest could present a risk to their local economies and securities markets. Companies in the retail industry group may be dependent on outside financing, which may be difficult to obtain. The economies of Australia and New Zealand are dependent on trading with certain key trading partners, including Asia, What indicator to use to confirm aroon trade info indicator and the United States. The interpretation, applicability and enforcement of such laws by PRC tax authorities are not as consistent and transparent as those of more developed nations, and may vary over time and from region to region. The primary starting screening universe for this index is the constituents of the WisdomTree Global ex-U. Companies in the telecommunications sector may experience distressed cash flows due to the need to commit substantial capital to meet increasing competition, particularly in formulating new products and services using new technology. In addition, these companies may be significantly affected by other factors such as economic cycles, rapid technical obsolescence, government regulations, labor relations, delays in modernization, and overall capital spending levels. Aggregate Index.

The Index is designed to provide capital appreciation while maintaining consistent stylistically accurate exposure. Government actions around the world, specifically in the area of pre-marketing clearance of products and prices, can be arbitrary and unpredictable. Invesco Dynamic Software. The oil and gas industry is cyclical and from time to time may experience a shortage of drilling rigs, equipment, supplies or qualified personnel, or due to significant demand, such services may not be available on commercially reasonable terms. Risk of Investing in Australasia. Japan is next in line with a Invesco DB Oil Fund. A Real Estate Company may also have joint venture investments in certain of its properties and, consequently, its ability to control decisions relating to such properties may be limited. Real Estate Company securities, like the securities of smaller capitalization companies, may be more volatile than, and perform differently from, shares of large-capitalization companies. The Australian dollar is the national currency of Australia and the currency of the accounts of the Reserve Bank of Australia, the Australian Central Bank. Real Estate Companies are dependent upon management skills and may have limited financial resources. WisdomTree Dreyfus Emerging Currency. Vanguard Materials. Futures contracts and options may be used by a Fund to simulate investment in its Underlying Index, to facilitate trading or to reduce transaction costs. Additionally, existing and possible future regulatory legislation may make it even more difficult for utilities to obtain adequate relief.