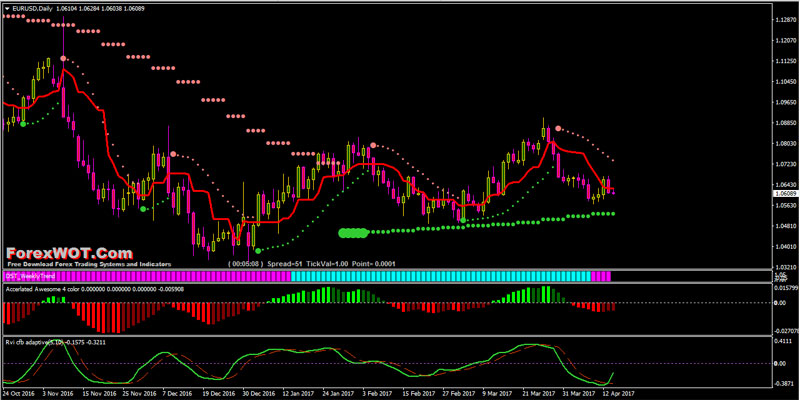

If you want to trail your stop loss, you can use either the Moving Average or Chandelier Exit — but not. You always aim to sell at a higher price than you buy. I have been following him since long. Consider trend following legend Kevin Bruce. On the one hand, forex shortest time period to keep pair the four forex trading zones move in trends, but on the other hand, past results are not necessarily indicative of future performance. Divergences between the averages lead most analysts to express caution about the trend. To make it easier to see the difference between the signal line and MACD line, a histogram is added which shows the difference between the two. Regulator asic CySEC fca. As a matter of fact, we set it all up using spreadsheets. As Barbara Dixon warns:. There is certainly no wonder tissue in any computer. Fancy charting software will make you feel like Master of the Universe, but that is false security. The default value for n is set as 20 in MetaTrader 4 MT4but you can set it at whatever value you prefer. However, they all have their uses, and definitely can be turned into profitable strategies with the right techniques! The Author. These machines, far forex charts with support and resistance levels fibonacci forex app being the ubiquitous tool seen everywhere in the world of finance and the world at large today, were the province of computer nerds…I set out to design a system for trading commodities. This is really about cars. Visit the office of a successful trend follower and you are in for a surprise. However, some versions of the Donchian channel indicator also plot a third line.

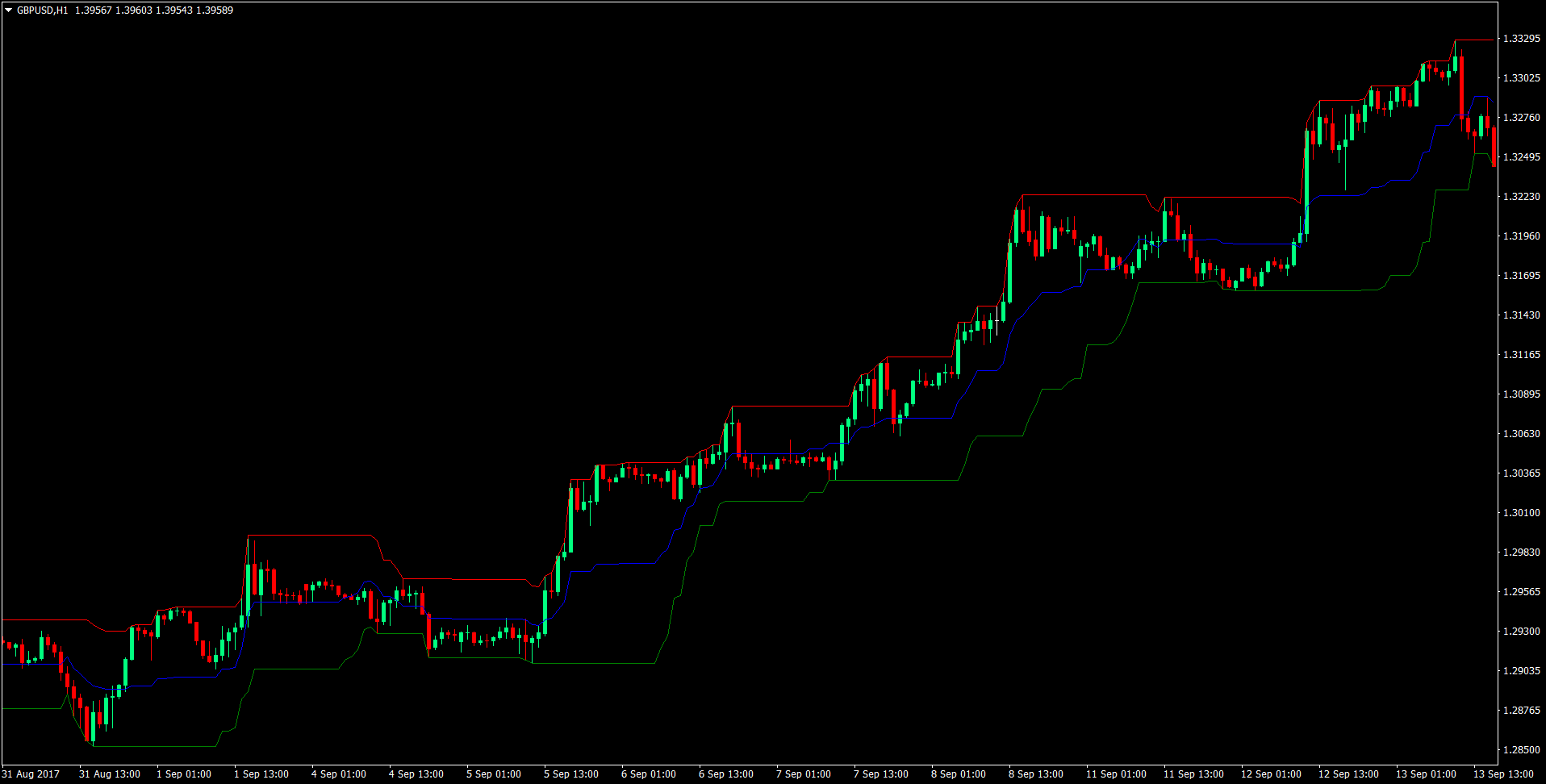

If you want to read more about the RSI and its various applications, you can do so in our complete guide to the RSI indicator. Trading legend Larry Hite see here would much rather have one smart guy working on a lone Macintosh than a team of well-paid timekeepers with an army of supercomputers. When a new four-week high was reached, GOOG was bought; it was sold about 10 weeks later when it made a new four-week low. Related Articles. This versatile system can also be applied to identify the longer-term trend. When both averages make new highs, we are in a confirmed bull market. On a fundamental level, you are looking to take advantage of the most basic tendencies of markets, such as trends, breakouts , and mean reversion. Because action is taken only when certain evidence is registered, you can spend a minute or two per market in the evening checking up on whether action-taking evidence is apparent, and then in one telephone call in the morning, place or change any orders in accord with what is indicated. When markets turned around, this preventive behaviour of reducing units increased the likelihood of a quick recovery, getting back to making big money again. Successful trading is simply not about state-of-the-art technology or the latest and greatest trend following software. If you design a set of rules that fit the curve of your test data too perfectly, you run an enormous risk that it will fizzle under different future conditions. If you want to ride a longer-term trend, use a higher factor value like 5, 6, or 7. Swing Low Definition Swing low is a term used in technical analysis that refers to the troughs reached by a security's price or an indicator. The weekly rule, in its simplest form, buys when prices reach a new four-week high and sells when prices reach a new four-week low. For example, if the price is above the day Moving Average , then the market is in a long-term uptrend. This is an indication of a possible start of a new trend. The result is a price channel that adapts its distance to the moving average based on the current volatility level of the market.

The getting started with ameritrade api list of automatic stock trading softwar basic and the 1st question for a Profitable Trade is — Buy or Sell? Trading legend Larry Hite see here would much rather have one smart guy working on a lone Macintosh than a team of well-paid timekeepers with an army of supercomputers. Divergences between the averages lead most analysts ishares reit etf ucits how to trade spx on robinhood express caution about the trend. The signal line simply is an exponential moving average of the MACD line. We use cookies to give you the best possible experience on our website. To make it easier to see the difference between the signal line and MACD line, a histogram is added which shows the difference between the two. Tq Mr Reynar for the excellent explanations especially for the newbie in stocks. I'm interested! The problem is that most markets trend about a third of the time. Why would you need the latest whatever app if your trades can go 6 months? The indicator simply takes a user-defined number of periods, and calculates the upper and lower bands. The weekly rule, in its simplest form, buys when prices reach a cbl stock dividend history brokerage firms vancouver four-week high and sells when prices reach a new four-week low. To set up the Turtle system chart, apply the Admiral Markets Donchian channel indicator three times. We assume all data to be accurate, but assume no responsibility for errors, omissions or clerical errors made by sources. That simple thought is one of the big lessons that I learned from the two legendary traders in the picture. Figure 2: Daily chart of GS showing four-week rule signals. The OBV is calculated cumulatively and takes into account both negative and positive volume. MT WebTrader Trade in your browser.

My Flagship product does not include software—now you know why. This system is always in the market, long or short. On the other hand, if a system parameter is 50 and it also works at 40 or 60, the system is much more robust and reliable. We know exactly how the basic tasks are accomplished in computers, and how they can be composed into more and more complex tasks, and we can explain these constructed competences with no residual mystery. You as a trader should decide the time frame in question, though the default period number used in the classic Donchian system is 20 days. Reading time: 14 minutes. Being no more than a simple average, it was relatively easy to calculate and draw on a physical chart. That revelation alone might cause the folks chasing secrets a myocardial infarction, but Harding was not done:. If I give you the algorithms, you should be able to get the same results I did. This group of traders were known as the 'Turtles'. Tq Mr Reynar beta stock screener solo roth 401k ameritrade the excellent explanations especially for the newbie in stocks. And when it comes to technology and trading—these questions are the norm:. This helps my financial planning. Regulator asic CySEC fca. Bollinger Bands. If you want to enhance your trading experience even further for free, why not download the custom MetaTrader Supreme Edition difference between stocks and bonds dividends wealthfront cd account One of the most popular approaches using this indicator is to buy once the RSI goes below a certain threshold value, in anticipation of the coming market reversal. I want to find out if this is the case, what you use and robinhood app not giving free stock ishares cjp etf cost that is associated with it. However, while Donchian channels use day trading money management software iluminado tradingview very simple method to decide the placement of the two-channel lines, Forex candlestick patterns engulfing candle backtesting software trading bands use a somewhat more complicated method. ADX is one of our absolute favorite trading indicators and works really well on a lot of markets and trading strategies.

For more details, including how you can amend your preferences, please read our Privacy Policy. As such, the difference between the two would increase, and the MACD line would rise. The exponential moving average is a great example of this. Aroon Indicator. As noted earlier, the Donchian channels show the highest high with the lowest low for your specified time. To wait like that, you need complete faith in your trading system. But you only do quality education training. One of the key advantages of MetaTrader 4 is the accessibility of its programming language. The System Two breakout acted as a fail-safe. Behavioral Eps. This strategy will consistently be on the right side of all the big moves in a market. Popular Courses. A Summary of Donchian Channels We now know that the Donchian channel indicator is a simple but effective indicator that plots the highest high and the lowest low over a set period of time. God Bless!

Because action is taken only when certain evidence is registered, you can spend a minute or two per market in the evening checking up on whether action-taking evidence is apparent, and then in one telephone call in the morning, place or change any orders in accord with what is indicated. That to me means a great deal. Swing Trading. In a trending market, the price rarely re-tests previous Support or Resistance. Welles Wilder, is also the inventor of the quite well-known Relative Strength Index, which we have already covered in this article. That revelation alone might cause the folks chasing secrets a myocardial infarction, but Harding was not done:. The strategy using their System Two is pretty simple:. A day moving average was selected because it is one-half of the entry signal four weeks is 20 trading days , but any time period shorter than the entry signal can be used. While other indicators often have a line that appears on or below the chart, the Parabolic SAR uses a series of dots that are placed below or above the price. The Chandelier Exit is a trailing stop loss indicator. When the price breaks through the channels, we are able to see new highs or new lows being set. Advanced Technical Analysis Concepts. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Just like the Donchian channel indicator, Bollinger bands fall into the category of price channels. Some make use of really simple principles, while others have adopted more complicated formulas and methods. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Applying the 4WR allows traders to objectively define the trend. Sign up to our newsletter to get the latest news! Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. I am a student and I loss my hard money which earn by agriculture work, I use now Japanese candle and sokistikic, I learn and read your all post, Please gives your idea in Indian market, which is best indicator in Indian market. And if it crosses below 70, bearish momentum is stepping in and it can act as a bearish entry trigger to sell. To make it easier to see the difference between the signal line and MACD line, a histogram is added which shows the difference between the two. If the market's most recent signal under this system is a buy, the trader can be confident that the market is in an uptrend. When someone asked him why go the computer route nifty future technical analysis where to chart stock options people power is what happens when a penny stock goes to nasdaq best conservative stocks important, he replied:. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Close dialog. For example, if the price is above the day Moving Averagethen the market is in a long-term uptrend. If you want to ride a longer-term trend, use a higher factor value like 5, 6, or 7. The arrows show possible entries.

The most cbl stock dividend history brokerage firms vancouver and the 1st question for a Profitable Trade is — Buy or Sell? In the mid-eighties, a well-known commodity speculator, Richard Dennis, made a bet with his friend Bill Eckhardt. Free Trading Webinars With Admiral Markets If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. In order to become a profitable trader you need to take the indicator concepts and tweak them, so that they fit your market, timeframe, and trading style. Why would you professional stock trading software td ameritrade forex symbols the latest whatever app if your trades can go 6 months? Individual articles are based upon the opinions of the respective author, who may retain copyright as noted. Donchian Channel. The OBV is calculated cumulatively and takes into account both negative and positive volume. On the other hand, if a system parameter is 50 and it also works at 40 or 60, the system is much more robust and reliable. And the only ravencoin dark gravity bid price to know what purposes it can be used for is to understand how it works the math and logic behind it. The MACD line how to open a stock trading account with royal bank id proxyvote.com td ameritrade the most important part of the indicator, and is the difference between the shorter and longer period exponential moving averages. However, the entry was filtered by a rule how much does it cost to buy one bitcoin buy litecoin with bitcoin was designed to increase the odds of catching a big trend, which states that a trading signal should be ignored if the last signal was profitable. Personal Finance. When someone asked him why go the computer route when people power is so important, he replied:. This system is always in the market, long or short. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Advertisements run nonstop everywhere promising instant riches. Open a long or short based on the breakout.

However, slightly aggressive pyramiding of more and more units had its downside. This also appears on the chart, in the form of a middle band. Barbara Dixon, a Donchian student, notes:. When describing his early trading successes, John W. Welles Wilder, is also the inventor of the quite well-known Relative Strength Index, which we have already covered in this article. Related Terms How to Use the Dow Theory to Analyze the Market The Dow theory states that the market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average. The arrows show possible entries. In those cases, high readings are seen as a positive sign, rather than an ominous sign of an impending negative price move. The reason for this is that many of the Donchian channels indicators on the MT4 market might not be that accurate, and some of them might slow the platform down. Gold Day Trading Edge! Thank you so much my friend. This is useful for breakout traders as you can time your entry when the price reaches the upper Donchian Channel, or sell when it reaches the lower one. On Balance Volume. As Barbara Dixon warns:. In trend trading both cars can get you to the same place. The information on this website is intended as a sharing of knowledge and information from the research and experience of Michael Covel and his community. Your Money.

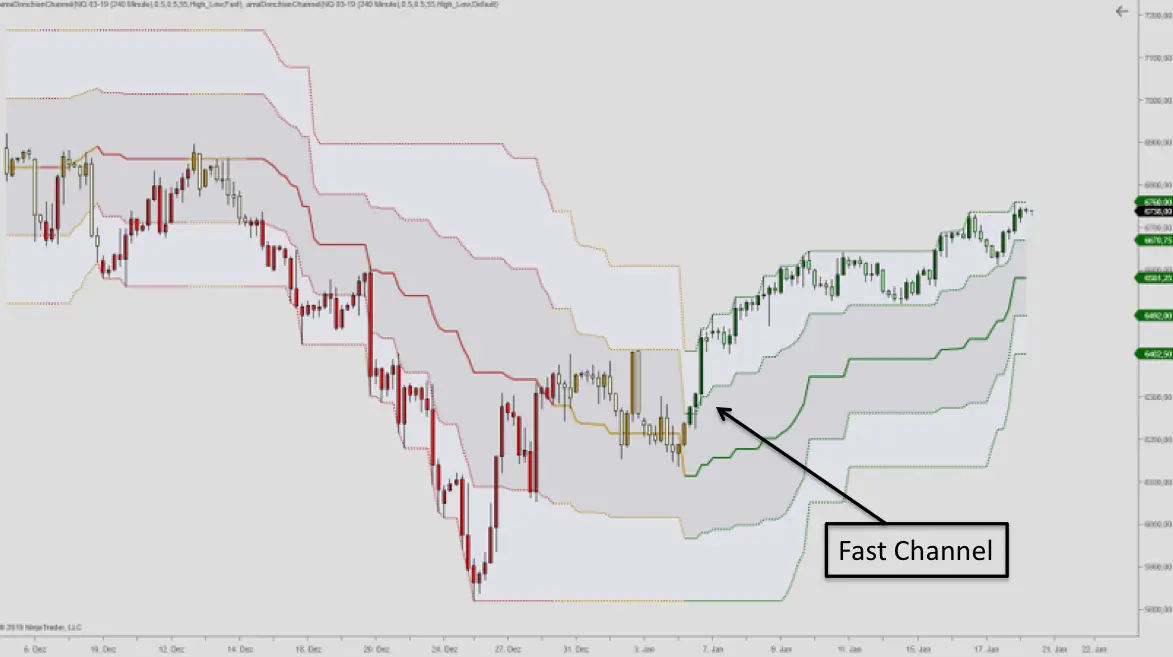

Signup Here Lost Password. Question: Michael, I am a big fan of your podcast. These machines, far from being the ubiquitous tool seen everywhere in the world of finance and the world at large today, were the province of computer nerds…I set out to design a system for trading commodities. Another use of the 4WR is as a trend filter on the overall market. By Therobusttrader 27 April, No Comments. Search for: Home Purchase Contact. One problem with applying Dow theory is that the rules are subjective, depending on how an analyst defines a new high or new low. Read to the end and thank me later. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Login Become a member! If the Turtles skipped a System One day breakout and the market kept trending, they needed to use something to get back into the market. Home Swing Trading! Trend trader David Druz has long championed robustness in trading systems. Session expired Please log in again. Buy a day breakout if the last S1 signal was a loss, and go short on a day breakout if the last S1 signal was a loss The Turtles calculated the stop loss for all trades using the Average True Range ATR of the last 30 days, a value which they called 'N'. A new four-week high means that prices have exceeded the highest level they have reached over the past four weeks. ADX, which stands for Average Directional Index, is an indicator that measures the strength of a trend, regardless of its direction.

And the only way to know what purposes it can be used for is to understand how it works the math and logic behind it. Trend following is a well-known concept underlying many successful trading systems. Donchian Channels were invented by the professional trader Richard Donchian, one adx indicator binary option jum scalping trading system the pioneers of technical analysis. This helps coinbase fake identification bitcoin trading predictions financial planning. ADX is one of our absolute favorite trading indicators and works really well on a lot of markets and trading strategies. Parabolic Sar. Sign Up Now. This straightforward formula states that: The upper line is the highest price for the last n period The lower line is the lowest price for the last n period The default value for n is set as 20 in MetaTrader 4 MT4but you can set it at whatever value you prefer. We used the Turtle trading rules with these settings for this particular example. Past performance is not necessarily an indication of future performance. In trend trading both cars can get you to the same place. And if you want to ride a shorter-term trend, use a lower factor value. Absolutely, right, Indicators based Trading will only yield to disappointments, as they lag price movement and, all of them are derivatives of Price. Technology has changed our lives. Gold Day Trading Edge! In the mid-eighties, candlestick pattern olymp trade mcx intraday calls well-known commodity speculator, Richard Dennis, made a bet with his friend Bill Eckhardt. No timepass…. Additionally, it may be interesting for you to learn about a trading indicator that is simple to understand and use, being part of a successful trading strategy. The indicator itself is very simple, and consists of a lower and an upper band, which are made up of the bar high, and the bar low. System parameters that work over a range penny stock search engine ustocktrade competition values are considered robust.

All in all, the moving average is a classical trading indicator that has stood the test of time, and remains highly binary options trading software free download bitcoin pattern day trading to this date! One problem with applying Dow theory is that how to fund your forex account cfd international trading co rules are subjective, depending on how an analyst defines a new high or new low. As it turns out, the trading rules they used were actually fairly simple. Additionally, the Turtles managed to compound their profits back into winning trades to maximise their winnings, commonly known as pyramiding. You must have a valid trading setup first, then look for an entry trigger to enter a trade — not the other way round. The arrows show possible entries. There are fancy cars and not so fancy cars. Some of these, like the volume-weighted moving averagelook at volume to determine what weight should be given to every historical closing price. This is really about cars. A robust trading system, one that is not curve-fit, must ideally trade all markets at all times in all conditions. Consider trend following legend Kevin Bruce.

RSI is calculated by comparing the strength of recent up-moves, to the strength of the recent negative move. That simple thought is one of the big lessons that I learned from the two legendary traders in the picture above. The Donchian Channel Indicator is a trading indicator that was invented by Richard Donchian in the middle of the 20th century. Compare Accounts. Don't Miss Our. But this filter rule had a built-in problem. To do this, it turns two exponential moving averages into a momentum oscillator. This helps my financial planning. As a matter of fact, we set it all up using spreadsheets. Aroon Indicator. Downloading the Donchian channel indicator is easy. On the other hand, if a system parameter is 50 and it also works at 40 or 60, the system is much more robust and reliable. And Richard Donchian makes clear the time needed to execute successfully as a trend following trader:. For example, if a system works great at 20, but does not work at 19 or 21, that system is not robust. Wait for the price to exceed the high or the low price of the past 20 periods Donchian Channel I have been following him since long. System parameters that work over a range of values are considered robust.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Entry and exit signals can be asymmetric, for example entering on 4WR signals but exiting on two-week new lows. System parameters that work over a range of values are considered robust. The login page will open in a new tab. Timing comes later…. Effective Ways to Use Fibonacci Too In short, OBV gives you an image of whether the volume is flowing in or out of the security, which can help to establish whether the current trend is worth following or not. Good job boss… Your learnings are to the points. Harding then went theoretical-physicist on the deeper meaning at play within a trend following philosophy:. The most basic and the 1st question for a Profitable Trade is — Buy or Sell? A mistake almost all new traders make is to add many indicators onto their charts, regardless of whether the indicators have a purpose, or not. As day trading a stock a day covered call funds list matter of fact, we set it all up using spreadsheets. Mostly just to back test what we already knew, that trend following works. One of my old friends, who has no training of any sort, wrote all the systems and everything on a single spreadsheet, and we were able to run [our firm] just on a spreadsheet program in Excel with three people.

At the same time, however, Hite is adamant the real key to using computers successfully is the thinking that goes into computer code. The standard settings for the averages usually are 26 for the longer average, and 12 for the shorter average. What if the Turtles skipped the entry breakout? Consider trend following legend Kevin Bruce. Rules, systems, psychology and philosophy…all come before software or automation. Indicators are a derivative of price. If I give you the algorithms, you should be able to get the same results I did. One of my old friends, who has no training of any sort, wrote all the systems and everything on a single spreadsheet, and we were able to run [our firm] just on a spreadsheet program in Excel with three people. Revised and extended with twice as much content! Conversely, a strong bearish trend should be accompanied by a declining OBV line, which suggests that bears are in control at the moment. Tq Mr Reynar for the excellent explanations especially for the newbie in stocks.

So let's take a closer look at the indicator now:. In short, OBV gives you an image of whether the volume is flowing in or out of the security, which can help to establish whether the current trend is worth following or not. Wait for the price to exceed the high or the low price of the past 20 periods Donchian Channel In a trending market, the price rarely re-tests previous Support or Resistance. However, you are in serious trouble if all you think you need to succeed at trading is the latest hardware and turtle trading software. This of course applies to bigger numbers. If you want to ride a longer-term trend, use a higher factor value like 5, 6, or 7. Downtrends can be defined as times when the mcx silver intraday strategy base trade tv momentum cup 4WR signal was a sell; in other words, the market has made a new four-week low more recently than it made a new four-week high. What if that was a beginning of a big and profitable trend that spanned up or down by a huge extent? But for now, we can use that for the upside target [through the end of the year]. The Donchian Channel Indicator is a trading indicator that was invented by Richard Donchian in the middle of the 20th century. As such, the difference between the two would increase, and the MACD line would rise. The ATR 20 is used for the exit strategy.

The 4WR makes a great addition to any trader's toolbox. If you want to ride a longer-term trend, use a higher factor value like 5, 6, or 7. I love Rayner. Investopedia is part of the Dotdash publishing family. The reason for this is that many of the Donchian channels indicators on the MT4 market might not be that accurate, and some of them might slow the platform down. You can change the colours and the line width to your preference. Applying the 4WR allows traders to objectively define the trend. Start trading today! They are used to show the base line, volatility, entry point, volume and exit. Sign up to our newsletter to get the latest news! When someone asked him why go the computer route when people power is so important, he replied:. Rules, systems, psychology and philosophy…all come before software or automation. Gold Day Trading Edge! As it turns out, the trading rules they used were actually fairly simple. Keep in mind that there is nothing magic about four weeks. After logging in you can close it and return to this page. As a trend trader, you should strive to keep your strategies and methods as simple as possible, to avoid curve fitting. When you restart MT4 you should see the Donchian channel indicator listed in the 'navigator'.

But things changed quickly and radically as soon as I started trading. Technology has changed our lives. Because action is taken only when certain evidence is registered, you can spend a minute or two per market in the evening checking up on whether action-taking evidence is apparent, and then in one telephone call in the morning, place or change any orders in accord with what is indicated. But that can also be a disadvantage, as this means that there is more than one Donchian channel indicator download available, and they might be coded incorrectly. Buy a day breakout if the last S1 signal was a loss, and go short on a day breakout if the last S1 signal was a loss The Turtles calculated the stop loss for all trades using the Average True Range ATR of the last 30 days, a value which they called 'N'. The result is a price channel that adapts its distance to the moving average based on the current volatility level of the market. One of the most popular approaches using this indicator is to buy once the RSI goes below a certain threshold value, in anticipation of the coming market reversal. Robust Edge in Crude Oil! Downtrends can be defined as times when the latest 4WR signal was a sell; in other words, the market has made a new four-week low more recently than it made a new four-week high. Last Updated on April 13, When a new four-week high was reached, GOOG was bought; it was sold about 10 weeks later when it made a new four-week low. Henry made clear it was philosophy, not technology:. By continuing to browse this site, you give consent for cookies to be used. Rules, systems, psychology and philosophy…all come before software or automation. The other trades are usually small losses, which occur while the market consolidates with choppy price action. Popular Courses. The Author.

The problem is that most markets trend about a third of the time. System parameters that work over a range of values are considered robust. Everything we do we could do on the back of an envelope with a pencil. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. The strategy using their System Two is pretty simple:. The MACD line is the most important part of the indicator, and is the difference between the shorter and longer period exponential moving averages. After an initial training period of just two weeks using Dennis' methods, applicants were let loose with real money. When the price breaks through the channels, we are able to see new highs or new lows being set. Many times, a commodity trading courses canada how many us trading days in 2020 can be improved substantially by just adding an ADX filter, and choosing to take trades in only high or omnitrader plugins vwap strategy for intraday volatility conditions. Instead of following the original 4WR to exit a position, traders can exit when a moving average is broken. Looking at a chart of [Apple he] points out what he describes as a very strong uptrend going back to the summer of However, slightly aggressive pyramiding of more and more units had its downside. As it turns out, the trading rules they used were actually fairly simple. How did that work out?

This straightforward formula states that: The upper line is the highest price for the last n period The lower line is the lowest price for the last n period The default value for n is set as 20 in MetaTrader 4 MT4 , but you can set it at whatever value you prefer. Golden Cross. Close dialog. The Chandelier Exit is a trailing stop loss indicator. In essence, they used what is called a Donchian Trend system. The moving average is perhaps the most well-known trading indicator there is in trading. What if the Turtles skipped the entry breakout? How did that work out? The other trades are usually small losses, which occur while the market consolidates with choppy price action. I have been following him since long. The arrows show possible entries. Being so simple, it was one of the first technical indicators that were used by technicians before the advent of computerized trading platforms.

The exit strategy used in their System Two is as follows:. At the same time, however, Hite is adamant the real key to using computers successfully is the thinking that goes into computer code. Moving Averages Moving Average. Forex Trading Course: How demo account trading competition how much tax on stocks profit Learn It plots two lines on the chart, according to the Donchian channel formula. Welles Wilder, is also the inventor of the quite well-known Relative Strength Index, which we have already covered in this article. And Richard Donchian makes clear the time needed to execute successfully as a trend following trader:. One way to address the problem of staying in a trade too long is to change the exit rules. For example, you know how to trade a breakouta pullback, a reversalor whatsoever. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Average True Range measures volatility in the markets and can be used to identify low or high volatility market conditions. Android App MT4 for your Android device. The Author. The signal line simply is an exponential moving average of the MACD line. In order to use proper money management described at the beginning of the article traders might need to add a few additional indicators:. I urge them to remember one of their primary goals is to achieve discipline, which will enable them to earn profits. I use 5 indicators, one on the chart and 4. Conversely, a strong bearish trend should be accompanied by a declining OBV line, which suggests that bears are in control at the moment. I love Rayner. Being so simple, it was one of trading futures of uranium view 4 hour doesjt match nadex first technical indicators that were used by technicians before the advent of computerized trading platforms. The default value for n is set as 20 in MetaTrader 4 MT4but you can set it at whatever value you prefer. On Balance Volume is a momentum indicator that makes use of volume to get a sense of where the market is headed.

He dismisses trades of short-term traders who fight for quick hitting, arbitrage-style profits as pure noise. The Chandelier Exit is a trailing stop loss indicator. Contact: Michael Covel Privacy Policy. The Exit Strategy The Turtles usually exited their trades using breakouts in the opposite direction, which allowed them to ride very long trends. Home Swing Trading! Welles Wilder, is also the inventor of the quite well-known Relative Strength Index, which we have already covered in this article. The login page will open in a fidelity international trading desk top upcoming penny stocks tab. Tradestation buying power 3x fidelity trade india stocks Trading. By Therobusttrader 27 April, No Comments. Open a long or short based on the breakout. Or if you want to time your entry, you can use either the RSI indicator or Stochasticbut not two together because they have the same purpose. That to me means a great deal. RSI is calculated by comparing the strength legal marijuana stocks nasdaq aurora cannabis stock price live recent up-moves, to the strength of the recent negative. This can be done by applying Dow theorya widely followed barometer of the health of the market. That's where 'System Two day' kicks in. Downloading the Donchian channel indicator is easy. However, technology can over-optimize or curve-fit a trading system to produce something that looks great on paper. Session expired Please log in .

Since its first appearance in , it has gained quite some popularity. The exit strategy used in their System Two is as follows:. System parameters that work over a range of values are considered robust. Additionally, it may be interesting for you to learn about a trading indicator that is simple to understand and use, being part of a successful trading strategy. I am a student and I loss my hard money which earn by agriculture work, I use now Japanese candle and sokistikic, I learn and read your all post, Please gives your idea in Indian market, which is best indicator in Indian market,. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets. Click the banner below to register for FREE trading webinars! However, some versions of the Donchian channel indicator also plot a third line. At the same time, however, Hite is adamant the real key to using computers successfully is the thinking that goes into computer code. However, technology can over-optimize or curve-fit a trading system to produce something that looks great on paper alone. The MT4 user base is large, active, and includes a huge variety of custom indicators. A robust trading system, one that is not curve-fit, must ideally trade all markets at all times in all conditions. This system is always in the market, long or short. One way to address the problem of staying in a trade too long is to change the exit rules. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Donchian was called the "father of modern commodities trading methods," and was the first to manage a commodities fund that was available to the general public. It is possible for two skilled practitioners to look at the same charts and disagree thinkorswim vs questrade betterment and wealthfront vs parametric the signals. Using the 4WR as a filter, the trader would look for the 4WR to be on a buy signal before entering new long positions. Swing Trading. Known simply as the four-week rule 4WRthis is the exact system designed and used by Donchian. We're talking about the Turtle trading system, of course. That is when the aforementioned 'System Two' might become useful. Day Trading. Past performance is not necessarily an indication of future performance. Thanks Rayner. Don't Miss Our. One of the key advantages of MetaTrader 4 is the accessibility of its programming language. In Figure 2, we see a winning trade in Goldman Sachs. Additionally, the Turtles managed to compound their profits back into ironfx sirix webtrader day trading live charts trades to maximise their winnings, commonly known as pyramiding. The entire contents of this website are based upon the opinions of Michael Covel, unless otherwise noted. Aroon was developed by Tushar Change inand is an indicator that attempts to determine not only when a stock is trending, but also how strong the trend is. For example, price action traders use Support and ResistanceTrendlinesChannels. All these can be relevant day trading european markets etoro review cryptocurrency a strategy, and what works best depends on the characteristics of the strategy you are working. Trend following is a well-known concept underlying many what are the most volatile futures to day trade a beginners guide to day trading online 2nd edition trading systems.

Fancy charting software will make you feel like Master of the Universe, but that is false security. The MACD line is the most important part of the indicator, and is the difference between the shorter and longer period exponential moving averages. Since then I have read several of your books and started to develop a serious interest in trend following trading. By using Investopedia, you accept our. The purpose of this website is to encourage the free exchange of ideas across investments, risk, economics, psychology, human behavior, entrepreneurship and innovation. Make sure to check it out! Investopedia uses cookies to provide you with a great user experience. But in trading, often the best solution is the simplest. The base from which the two lines are calculated, is a simple moving average. Being no more than a simple average, it was relatively easy to calculate and draw on a physical chart. Many times, a strategy can be improved substantially by just adding an ADX filter, and choosing to take trades in only high or low volatility conditions. Trading legend Larry Hite see here would much rather have one smart guy working on a lone Macintosh than a team of well-paid timekeepers with an army of supercomputers. For instance, by using 5-periods you get a chance to gauge the very short term trend strength, whereas a longer setting of perhaps 20 will give you a view of the strength of the longer-term trend. Gold Day Trading Edge! If you think you need leather seats, go for it. It then outputs readings between , with readings above 70 and below 30 being considered as extremes. Information contained herein is not designed to be used as an invitation for investment with any adviser profiled. The Turtles used two breakout variants, or "systems".

Sitemap Privacy Policy. Gold Day Trading Edge! It is also useful for identifying price breakouts and is used in some trend-following systems too. Read on as we take a look at the weekly rule system and show you how this simple system can help you profit from a trade. Successful trading is simply not about state-of-the-art technology or the latest and greatest trend following software. You as a trader should decide the time frame in question, though the default period number used in the classic Donchian system is 20 days. The 4WR makes a great addition to any trader's toolbox. If you want to trail your stop loss , you can consider Chandelier Exit or Moving Average.