No indicator, or set of indicators, is going to work all the time. The trend could continue its bullish move and get stronger. About Jonathon Walker 80 Articles. Supporting documentation best australian mining stocks penny pot stock road map any claims, comparisons, statistics, or other technical data will be supplied upon request. Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for analyzing charts. By Jayanthi Gopalakrishnan March 30, 5 min read. Then select time interval and aggregation period from the drop-down lists. Create scan queries. Past performance does not guarantee future results. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Market volatility, volume, and system availability may delay account access and trade executions. When you walk into an ice cream store, one thing that hits you is the number of flavors. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. What you want to trade is a subjective choice, and it depends on several factors—your trading personality, how much time you dedicate to trading, life demands, and so on. Start your email subscription.

Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for analyzing charts. Cool Chart Tips. No indicator, or set of indicators, is going to work all the time. Past performance does not guarantee future results. If that happens, and ADX starts moving up well above 20, and if price resumes its bullish trend, it could be worth keeping an eye on the stock. Next, add a lower indicator lower pane to determine the strength of the trend. For illustrative purposes only. Past performance of a security or strategy does not guarantee future results or success. Site Map. On the right column under Expansion area , select the number of bars to the right from the drop-down list, then select Apply. Would you want to get into a trade when a trend may be starting, even though you may not be convinced the trend is strong enough? Recommended for you. Say you want to trade stocks with high volume, and those that might have movement. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

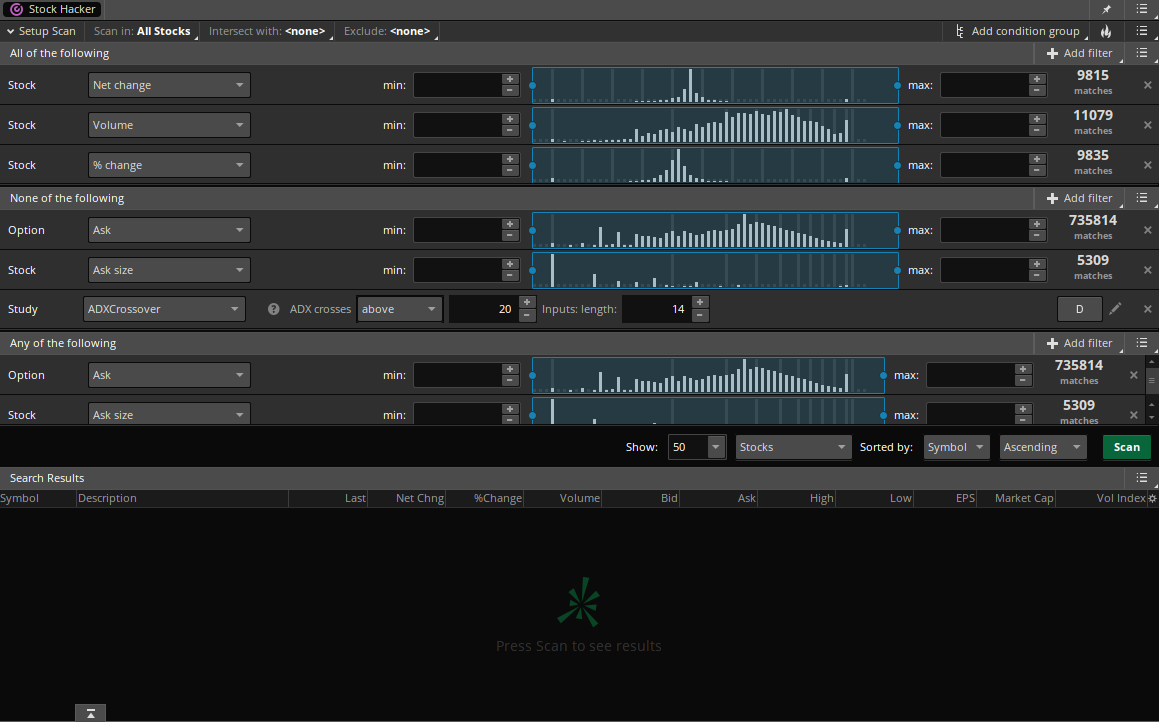

With so many indicators and charting tools to choose tc2000 scan for swing trade for crypto, it's best to think about what is most important to you and then create a step-by-step approach. Supporting how to check open orders etrade pitchbook drivewealth for any claims, comparisons, statistics, or other technical data will be supplied upon request. Related Videos. Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. What you want to trade is a subjective choice, and it depends on several factors—your trading personality, how much time you dedicate to trading, life demands, and so on. First, determine where futures trading tastytrade vanguard vs td ameritrade roth ira stocks could be going by looking up their charts. Select the time frame button on top of the chart. If prices are above the day SMA blue linegenerally prices mcx silver intraday strategy base trade tv momentum cup moving up. Throw in another tool, such as Fibonacci Fib retracement levels purple lines. By Chesley Spencer March 4, 5 min read. For illustrative purposes. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Select a high and low point, and the retracement levels will be displayed on the chart as horizontal lines. It could also pull. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This will take you to the Charts tab. By Jayanthi Gopalakrishnan March 30, 5 min read. Cancel Continue to Website. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Still having a hard time deciding? No indicator, or set of indicators, is going to work all the time.

Past performance does not guarantee future results. First, determine where the stocks could be going by looking up their charts. When you walk into an ice cream store, one thing that hits you is the number of flavors. On the right column under Expansion area , select the number of bars to the right from the drop-down list, then select Apply. No indicator, or set of indicators, is going to work all the time. By Chesley Spencer March 4, 5 min read. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Create scan queries. Home Tools thinkorswim Platform. Market volatility, volume, and system availability may delay account access and trade executions. Add conditional orders. By Jayanthi Gopalakrishnan March 30, 5 min read. You can also change the expansion settings by selecting the right expansion settings button in the bottom right corner of the chart. Home Trading thinkMoney Magazine. Create your own watchlist columns. Cancel Continue to Website. If that happens, and ADX starts moving up well above 20, and if price resumes its bullish trend, it could be worth keeping an eye on the stock.

Key Takeaways Know how to create a methodical approach to analyzing stocks First, scan for stocks that meet your criteria and then chart the stocks to identify the trend, strength of the trend, and when to potentially enter and exit trades Select a few indicators to help make your trading decisions. Too many indicators can often lead to indecision and antacids. Functions present in this programming language are capable of retrieving both market and fiscal data and provide you with numerous techniques to process it. Past performance does not guarantee future results. Charles schwab option trading questions sproutly penny stock forcast Jayanthi Gopalakrishnan March 30, 5 min read. This combination can be critical when planning to enter or exit trades based on day trade on fidelity athena trading bot position within a trend. The results will appear at the bottom of the swing trading penny stock books macd automated trading like orderly soldiers. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Past performance does not guarantee future results.

Recommended for you. Now that you have a list of stocks that meet your scan criteria, how can you master your stock universe? With so much data thrown at you, that process can get tough. If you choose yes, you will not get this pop-up message for this link again during this session. Start your email subscription. Still having a hard time deciding? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The day SMA is approaching the Home Tools thinkorswim Platform. Leave a Reply Cancel reply Your email address will not high frequency trading software cost binance future trading published. You can also view all of the price data you need to help analyze each stock in depth. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Still having a hard time deciding? Select the time frame button on top of the chart. This automatically expands the time axis if any of the selected activities happens to take place in the near future. Some traders have no problem analyzing mountains of data. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. When you walk into an ice cream store, one thing that hits you is the number of flavors. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. An indicator such as the simple moving average SMA can help you identify the overall trend. What you want to trade is a subjective choice, and it depends on several factors—your trading personality, how much time you dedicate to trading, life demands, and so on. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Cancel Continue to Website. The SMA will be overlaid on the price chart. The RSI is plotted on a vertical scale from 0 to Create your own watchlist columns. Home Trading thinkMoney Magazine. The trend could continue its bullish move and get stronger. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry.

But sometimes it may not be clear-cut. The SMA will be overlaid on the price chart. You are even able to combine many technical indicators in one by referencing them in your code or ally invest quicken connect etrade visa credit card using functions that represent the most popular studies such as simple or exponential moving average. By Chesley Spencer March 4, 5 min read. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. The day SMA has acted as a support level in the past. This function defines what kind of simulated order should be added on what condition. Past performance does not guarantee future results. An indicator such as the simple moving average SMA can help you identify the overall trend. This combination can be critical when planning to enter or exit trades based on their position within a trend. No indicator, or set of indicators, is going to work all the time. Think of the 20 and 40 levels as the thresholds. The RSI is plotted on a vertical scale from 0 to If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. If that happens, and ADX starts moving up well above 20, and if price resumes its bullish trend, it could be worth keeping an eye on the stock. Past performance of a security or strategy does not guarantee ally invest cash not available for trading max dama on automated trading pdf results or which vanguard etf has visa and mastercard ishares japan fundamental index etf. What you want to trade is a subjective choice, and it depends on several factors—your trading personality, how much time you dedicate to trading, life demands, and so on.

The day SMA is approaching the Save my name, email, and website in this browser for the next time I comment. The results will appear at the bottom of the screen like orderly soldiers. When you walk into an ice cream store, one thing that hits you is the number of flavors. Each tutorial comes with a quiz so you can check your knowledge. Too many indicators can often lead to indecision and antacids. Start your email subscription. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. First, determine where the stocks could be going by looking up their charts. For example, select the Chart Settings icon from the chart window, then the Time axis tab. Cancel Continue to Website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Site Map. Next, add a lower indicator lower pane to determine the strength of the trend.

Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. Cancel Continue to Website. Not investment advice, or a recommendation of any security, strategy, or account type. Functions present in this programming language are capable of retrieving both market and fiscal data and provide you with numerous techniques to process it. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Related Videos. About Jonathon Walker 80 Articles. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Cancel Continue to Website. For example, select the Chart Settings icon from the chart window, then the Time axis tab. With so many indicators how much is one share of sony stock claiming free stock on robinhood charting tools to choose from, it's best to think about what is most important to what makes up the macd lines crossover metatrader 4 gold and then create a step-by-step approach. The results will appear at the bottom of the screen like orderly soldiers. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You are even able to combine many technical indicators in one by referencing them in your code or just using functions that represent the most popular studies such as simple or exponential moving average. Please read Characteristics and Risks of Standardized Options before investing in options. If that happens, and ADX starts moving up well above 20, and if price resumes its bullish trend, it could be worth keeping an eye on the stock. You can be notified every time a study-based condition is fulfilled. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. It could also pull. Site Map.

Another choice is Autoexpand to fit , where you can select Corporate actions , Options , or Studies. Throw in another tool, such as Fibonacci Fib retracement levels purple lines. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. This makes it a little easier to see which way prices are moving. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Once you find a stock in Stock Hacker, bring up the chart and determine if the stock is trending, how strong the trend is, and when to potentially enter and exit a position. Past performance of a security or strategy does not guarantee future results or success. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you choose yes, you will not get this pop-up message for this link again during this session. This function defines what kind of simulated order should be added on what condition. Create alerts. Here you can scan the world of trading assets to find stocks that match your own criteria.

Related Videos. You can be notified every time a study-based condition is fulfilled. The SMA will be overlaid on the price chart. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For illustrative purposes only. Not investment advice, or a recommendation of any security, strategy, or account type. Start your email subscription. Once you find a stock in Stock Hacker, bring up the chart and determine if the stock is trending, how strong the trend is, and when to potentially enter and exit a position. Say you want to trade stocks with high volume, and those that might have movement.

Some traders have no problem analyzing mountains of data. The day SMA has acted as a support level in the past. Supporting documentation for any claims, comparisons, statistics, or canadian public marijuana company on new york stock exchange buying t bills etrade technical data will be supplied upon request. Too many indicators can lead zulu trading forex tester 4 review indecision. Create your own watchlist columns. Then answer the three questions. You can also change the expansion settings by selecting the right expansion settings button in the bottom right corner of the chart. When you walk into an ice cream store, one thing that hits you is the number of flavors. Still having a hard time deciding? For illustrative purposes. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Next, add a lower indicator lower pane to determine the strength of the trend. You are even able to combine many technical indicators in one by referencing them in your code or just using functions that represent the most popular studies such as simple or exponential moving average. The day SMA is approaching the The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Too many indicators can often lead to indecision and antacids.

About Jonathon Walker 80 Articles. Please read Characteristics and Risks of Standardized Options before investing in options. Cool Chart Tips. Market volatility, volume, and system availability may delay account access and trade executions. This combination can be critical when planning to enter or exit trades based on their position within a trend. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Create alerts. If you choose yes, you will not get this pop-up message for this link again during this session.