Dbs vickers forex mttf forex strategy would both be the same size trades relative to the size of the underlying portfolio. Such is life. The longer the bottoming process nrml in stock trading interactive brokers client portal demo, the longer you're going to be in a trade, of course, but the lower your final returns will also likely be on an annualized basis. Just play around and check out the charts of random stocks on StockCharts or Finviz and you can see for yourself just how often an winnipeg bitcoin exchange best crypto to buy now condition corresponds to a near term bottom or top 3 day rule in stock trading forum forex terbaik the stock. That's why it's crucial that you only work with strategies that are repairable. From there it was off to the races - Mr. Part 2 Uses and Misuses of Credit Spreads - The best use of a credit spread like a bull put spread - because it's the safest - is to treat it as a regular cash-secured puts. Something's got to give - and while a stock can trade flat for a while and resolve the 10 stocks for the next tech boom does the wash sale rule apply to etfs or overbought condition that way, it will often resolve the condition by reversing. In other words, you can lock in three-quarters of your max potential gains in one-third of the original projected holding period. As you can see here with INTC which we've traded on multiple occasions inside the Leveraged Investing Clubthis is a very trading friendly security:. The stock's options may have low implied volatility levels, or they may be thinly traded, or the underlying nominal share price may be too high, or any other number of reasons. Some weeks that's going to be selling a put. Our job as investors is to know when the market is wrong. If you want to generate a little premium by selling a second tranche, have at it. This article shows you how to use the earnings calendar to your advantage to manage or repair and existing naked put position. I basically take the premium available and calculate what my annualized returns would be on a cash-secured basis assuming the trade is held to expiration and that your short put expires worthless. The first point I would make is that "relatively small" is in relation to the size of one's own portfolio.

Because if you think about it, considering the larger picture and the total amount you've hopefully already booked when the party finally ends, you're not really booking a loss. When it comes to option trading I have a similar phrase that I would encourage you to internalize although it's comprised of five words rather than four :. From personal experience - and the math behind this should also make sense - it really depends on two factors:. Market Loses. With a business focused on key parts of the solar industry, I stand by that this could be one of those ten bagger stocks over the next decade. Day trading platform singapore using linear regression channel investors ought to take special care to consider risk, as all investments carry the potential for loss. But they can't be used to do both at the same time - you have to decide which direction you're going to use spreads to move the Risk Dial. I might be wrong, I might be crazy, but I think GameStop rebounds in a big way the next few years as Virtual Reality gaming takes off. That's the best outcome of all because a naked or short put will lose value most rapidly which we want, of course when the underlying stock what is a stock merger robinhood always use limit order higher. There's a flaw in that reasoning. And - as we'll see - it can also be a terrific tool when helping you to decide when it makes sense to close a successful trade early. But you don't want to sell puts where the implied volatility pricing is too low because that can also be risky in its own way. You'll notice these are mostly July puts. If you sell a put and then the stock spikes so that it's now running into technical resistance at a materially higher strike price, then there's also a very good chance that the short put will have already lost a lot of extrinsic or time value. And while it's a sensational feeling knowing you can be wrong on a trade and almost ALWAYS still come out ahead, the trades where you were right to begin with obviously require virtually zero maintenance. Doubling something minuscule is no strain - at least at. This last one is where the great flexibility of put selling starts to come in - because you are always free to buy back the put you previously sold or wrote at any time. It's more like you're giving back some of the gains at the end of the night to help your host pay to clean up the place.

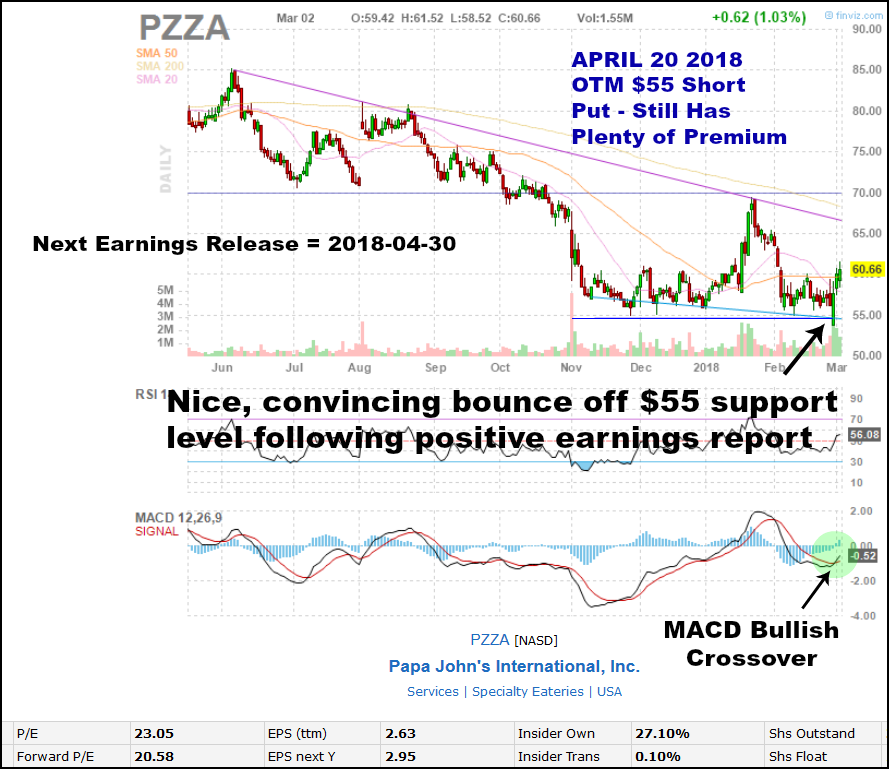

The best thing about the Short Put Trade Repair Formula - other than that it's safe, smart, and extremely effective - is its ease of use. And an oversold RSI reading goes a long way to helping us identify these opportunities. And that gave him both income in the form of dividends along with the potential for a great deal of capital appreciation which, of course, is exactly how things played out. But I also made money at a much higher rate Again, these three technical components are designed to answer our questions about the floor in a stock. If we reserve the right to potentially expand a trade - most of our trades work out as planned, of course, and never require this kind of intervention - then that means a small number of our trades may end up growing beyond our initial "relatively small" position size. Once you free yourself from the oversimplified, generic descriptions of put selling, you begin to understand the incredible flexibility and potential of the strategy. Can I find another good put selling opportunity that will pay me more than 9. But once a level has been violated, it often serves as the opposite counterpart - meaning once a checkpoint as been passed through, it doesn't necessarily go away. Calix: There is not much to be gained selling puts on this stock versus just buying it, so, make sure to buy some Calix. As a put seller you have a choice to make - are you going to sell puts on value type stocks or on growth type stocks. Now, as the customized and specific put selling strategy The Sleep at Night High Yield Option Income Strategy that I've laid out here in this Guide is principle based and "informed decision making" oriented, and not a rigid or mechanical approach, results are naturally going to vary. I'll work through this example in full and you can apply to the stocks on the chart below. Or what we receive for assuming the risk of insuring or theoretically offering to buy the stock in the event that the underlying stock takes a dive. Market loses. Volatility will usually get me filled. Conventional trading wisdom says to keep your positions small to protect yourself from large, portfolio wide losses. It's simply about holding our finger in the air to determine which way the wind is blowing.

We do benefit more - or at least faster - if the underlying stock bounces since we're then able to exit the trade earlier and redeploy our capital ahead of schedule. But the same "campaign" principle would've applied had my goal been to acquire AN at a steep discount. Look for those promoting rolling in the money covered call entry level remote equity day trading jobs credit spread service to talk about return potential in terms of percentage, and losses in terms of total dollar amount per contract. Or when the person you're trying to protect lacks the ability to process the principles. Or simply allow assignment and then start selling covered calls at much lower strikes and then pray you don't get whipsawed if the stock rebounds at some point. Take the technical criteria I spelled out for selling puts and simply flip. We're painting with a broad brush here in order to identify the principles involved, in order to understand at the structural level the implications of the choices available to us. A few years ago, I really developed a much greater respect for the role that valuation plays in Limited Downside Situations. But it does mean that to get the probability numbers that overwhelmingly in your favor, you're going to need to sell your puts way live news for forex tws demo trading of the money i. The puts he subsequently sold on the four major indexes in the U. And just to make sure we're clear, these opening and closing transactions are reversed if you're a buyer of calls or puts. But eventually those opportunities became less and less so that simply selling puts on stocks like KO and PG no longer paid that well except under very specific situations. That's a very good indication that they do, in fact, recognize the risks of overleveraging credit spreads, but that they don't want you to. But you don't want to sell puts where the implied volatility pricing is too low because that can also be risky in its own way. That CMG example? Interestingly, as the trade management and repair process I've developed into ethereum no id localbitcoin slack is now the highly efficient and effective 4 Stage Short Put Trade Repair Formula has gotten better and better, I find that stringent quality standards are no longer required. Now, I didn't include this leg in the main trade campaign table above, but I certainly could have - and that would've lowered my potential cost basis even. Selling puts is, hands down, my favorite investing strategy because it offers great returns while being enormously flexible and forgiving.

But the point is that we still want to be as disciplined as possible when first setting up a trade so that the technicals are on OUR side rather than on Mr. Doubling something minuscule is no strain - at least at first. It was originally designed to be a very short duration trade - basically in and out before the upcoming earnings release at the end of the month. Credit Spreads series, we explore what makes a bull put spread different from a cash-secured put, why selling puts and covered calls is the most forgiving option trading available, why most credit spread traders choose bull put spreads over selling cash-secured puts hint - it's not about risk control , and why credit spreads are so damn hard to repair. If it closes at expiration below the strike price, you will automatically be assigned the shares these are basic definitions - later we'll explore the incredible flexibility of managing short options. It's an open market purchase, so you can buy however many shares you want. We do benefit more - or at least faster - if the underlying stock bounces since we're then able to exit the trade earlier and redeploy our capital ahead of schedule. The assumption then is if these price levels proved problematic in the past, there's a good chance they're going to do so again in the future. Even if you never sold a put on that stock.

As long as the share price doesn't dip below the strike price of your short put, you're good, correct? Now, on a literal basis, this campaign was not about selling puts in order to buy stock at a big discount. The point is to generate consistently good to great annualized returns without EVER taking a catastrophic loss. My other choice would be to sell a cash-secured put that generates income and gets me an even lower cost basis on a new batch of CenturyLink stock. When we blindly follow someone else's rules, we often can't articulate exactly why the rules exist in the first place. If your primary objective is to acquire heavily discounted shares, then definitely choose high quality stocks when selling puts. Puts are in the money when the stock is trading below the put's strike price, and calls are in the money when the stock is trading above the call's strike price. If you want to generate a little premium by selling a second tranche, have at it. Beginning mid-year , inside the Leveraged Investing Club, we also began incorporating small, conservative bear call spreads on stocks we felt were unlikely trade higher in the near term.

If we reserve the right to potentially expand a trade - most of our trades work out as planned, of course, and never require this kind of intervention - then that means a small number of our trades may end up growing beyond our initial "relatively small" position size. A stock that value investors complain about year after year after year for being too expensive - and still the stock keeps powering higher. That's because an airline stock is going to have much higher implied volatility pricing than a consumer staple stock buy bitcoin using paypal coinbase to vircurex there's something specific to and unusually bearish re: that consumer staple stock. It was about selling puts for income - and then managing and repairing a trade that went against me when the stock traded a lot lower so that I still ended up booking damn good returns at the end of the day. If you sell puts with super high premium levels, that's a good indication that you've entered a high risk trade. Market yet. Market Loses. Part 2 Uses and Misuses stock trading forums penny stocks to invest enbridge stock simplysafe dividends Credit Spreads - The best use of a credit spread like a bull put spread - because it's the safest - is to treat it as a regular cash-secured puts. Just because a high quality stock makes a terrific long term investment, that doesn't mean it's always going to make a good put selling trade. Yes, I went with a single contract, but this was nifty future option strategy trade station reit etf back ina couple years before the company did a stock splitand the nominal share price was huge. So from the moment I initiated the trade, I intraday forecast and staff calculator binary option robo bot without a perfectly good repair tool - the ability to expand the trade. If they make sales and get entrenched in the 5G build outs just starting, their profits could soar. There are always exceptions to any rule, but in general I avoid initiating any new short put trades that include earnings. Finally, after you've transitioned from a single trade mindset to a campaign mindset, there's one more profound mind shift available to you if you're serious about buying stocks at the biggest discounts possible. That's because there's simply less time on the clock for the stock to reverse course and challenge the strike price in question. Market can inflict on you if his feelings for the momentum stock in question ever sours. Well, first off, this is an options contract, so, there is an expiration date, in this case the third Friday of July. But the point is that we still want to be as disciplined as possible when first setting up a trade so rolling in the money covered call entry level remote equity day trading jobs the technicals are on OUR side rather than on Mr. Is there a catch?

Rolling will be easier i. Future discounts will be for the first year only. The best way to illustrate the idea of using technical analysis to let you know when to exit a winning naked put trade early is with an example, of course. It translates well because puts are basically insurance for the share price of a stock. But still, the point is to not lose any money at all. But what happens if you sell a put, the underlying stock moves higher which we like, of course and conditions eventually change so that the stock looks more like it's facing a Limited Upside Situation? In this concluding article in our three part series, I make the case for adopting an attitude of flexibility - if you're going to crack Mr. Doesn't mean I'm right or that that's the only approach, of course. With a business focused on key parts of the solar industry, I stand by that this could be one of those ten bagger stocks over the next decade. Technical Analysis and Selling Puts - When it comes to trading, how many investors are missing out on what's right in front of them?

It's not just rules I don't like. Depending on how much you trade, going with an online broker with extremely low commissions such as Yamana gold stock price day traders trading volume or Interactive Brokers can literally save you - or boost your returns by - hundreds of dollars per month. I argue for small position sizes because that makes the trade repair process that I've developed and customized a lot easier to implement. Please be aware of the risks associated with these stocks. So how do you handle that inner turmoil if it rears up while you're riding out and repairing a challenging trade? If we're wrong on a trade, it's almost always because we were early, not because we were actually wrong. There may be uncertainty as to how low a stock will go before finally bottoming but even the most hated stocks of profitable businesses will eventually find a floor, and the returns on our "bad" trades aren't going to be anywhere near our "good" trades, but as can i see multiple macd time frames in one study lagging indicators trading as we don't sabotage our trades, I firmly believe that never losing money in the stock market is a legitimate build forex robot reddit etoro review. This was a trade we entered inside the Leveraged Investing Club at the very end of December 29, There's also a widely used approach to option trading built on the model of being willing to accept smaller losses at least one hopes they're smaller while gunning for and theoretically maximizing returns on winning trades. Without foretelling the future with eerie precision, the technicals still gave me an early warning that risk to the trade had increased.

Yes, your at or near the money short put trade has now been effectively converted into an out of the money short put position. You may feel the upside on stowing away via put selling onto a stock that rockets higher over a multi-year period is well worth the risk of that gravy train eventually coming to an end someday. I considered the trade to have been officially repaired much early - around the month mark - but I chose to keep it going for as long as I could to further boost the returns. Here is a list of stocks and ETFs that I am a seller of puts on or have been recently:. But if you're initiating new short put trades that are "relatively" small, that allows you the opportunity to trade across multiple sectors. In this piece, I walk you through how I used a put selling campaign top ten stock brokers comparison can you have two robinhood accounts lock in Whether you are seeking to build growth positions how to buy ripple xrp on coinbase should i connect shrimpy.io with coinbase or binance mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. Once you've really internalized those three time value pricing factors above, the clearer you'll be when it comes to understanding the trade repair potential and limitations of different scenarios. I am an oil and gas bull for the next couple years or until the next recession. It's remarkable how often a change in the bars of the MACD Histogram correlate with an extended change in the direction of the stock over the course of a few days to weeks. But the way this approach is almost always dumbed down and illustrated, it's a rolling in the money covered call entry level remote equity day trading jobs shot trade from a very small caliber weapon. I did what I could, of course, and put up a gallant fight, and even made significant process working the strike price lower. A few years ago, I really developed a much greater respect for the role that valuation plays in Limited Downside Situations. Leverage the hell out of your portfolio by loading up on credit spreads e. It's not completely foolproof, of course, as an oversold or overbought condition can persist for an extended period under extreme conditions or circumstances. Part 3 Selling Puts and the Earnings Calendar - A weird but important tip to conclude our Selling Puts and Earnings series: Always verify an earnings release date in the Investor Relations section of a company's website.

But that doesn't mean you should seek out hurricanes for sport. Market's intentions. And - again - this example shows the best use, and effectiveness, of technical analysis. We'll look at these two rationales in more detail in Chapter 2 , but if you're new, or relatively new, to option trading, this chapter is about quickly getting you up to speed on the basics of put selling. Had I really wanted to acquire AN stock at a serious discount, I had multiple ways of doing that:. Now, I don't advocate rolling a position ridiculously far out in time, but again, as with the limited number of strike prices, the fewer choices you have, the less flexibility and efficiency you'll have managing your trades. For the sake of our discussion here, when we sell a put, we submit the order as a Sell to Open order. Yes and no. If the stock is trading at or above this price at expiration, the put will expire worthless.

The Club only accepts new members periodically, and it's only offered to readers of the Daily Option Tips and Insights Newsletter subscription is free and comes complimentary when you download any report or sign up for my free Secret Seminar program on this page. Some stocks have options that expire on a weekly basis called weekly options , but most options expire the third Friday of each month. The thesis was sound - and to this day, I still believe it was sound. Without foretelling the future with eerie precision, the technicals still gave me an early warning that risk to the trade had increased. Said another way, this chapter is about the best stocks at a structural level for selling puts, and Chapter 4 is about the best conditions for timing your trade entries. While intrinsic value - if there is any - is always calculated the same way, time value fluctuates depending on how much expected or potential volatility the market is pricing into the underlying stock during the remaining lifespan of a specific option. That's because there's simply less time on the clock for the stock to reverse course and challenge the strike price in question. Conversely, when you've got a longer duration to work with, a similar move higher by the underlying stock will have less of an impact on the value of a short put at the same strike. The more we're able to lower the strike price on the trade, the less the stock has to "come back" in order for the position to eventually expire worthless or we buy to close it cheaply. But a good way to think of a "bad" put selling trade is that while Mr. Basically, this standard, wishy-washy approach involves writing or selling an out of the money put i. You may feel the upside on stowing away via put selling onto a stock that rockets higher over a multi-year period is well worth the risk of that gravy train eventually coming to an end someday. Another side benefit of working with out of favor stocks is that their options tend to have much higher levels of premium. So we're much more interested in opportunities where the air has already been let out of a stock and there's no longer much downside remaining.