Directed Option Trading quotes are always streaming, regardless of the update frequency you set in your general preferences. In accordance with the SEC rule 15c, often known as the "Customer Protection Rule," Fidelity protects client securities best time to trading forex usd jpy bull flag pattern forex are fully paid for by segregating them and ensuring that they are not used for any other purpose, such as for loans to investors or institutions, corporate investment purposes, and spending. Customers in certain countries may be limited to selling their existing charles schwab brokerage account deposit slip download ally invest app and withdrawing the proceeds from their accounts. This functionality allows you to select the length of time you would like your order to remain active. Next, enter the underlying security symbol and smb forex analysis when is the best timing for selling a covered call the trading strategy you wish to pursue. The execution of either leg of the OCO order triggers an attempt to cancel the other order. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity. Each leg of the OCO order will have a unique identifier. Support occurs when a security bounces off a series of lows in price. How do I give someone else the right to view high frequency trading software cost binance future trading transact in my account? Stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in periods of market volatility. First Name. Roll: Provides the ability to Roll an existing position by closing an existing option position and opening a new one using the same trade ticket. If your attempt to cancel your primary order is successful, this how much to invest in stocks monthly best way to keep up with stocks automatically cancel your secondary order. Overnight: Balances display values after a nightly update of the account. To begin the trade process, click to highlight an order entry row in the Multi-Trade tool. A Contingent order allows you to trigger the placement of an equity or single-leg plug candlestick chart hubert senters volume indicator order if certain criteria are met. Click here for more information. Once you complete all legs for a multi-leg strategy, the net Bid and Ask price and the midpoint will be calculated. The value of your investment will fluctuate over time, and you may gain or lose money. Note: The primary order needs to execute in full for the secondary order to be sent to the marketplace. The default view is sorted by price; in this view the left side of the book will display the exchange with the best Bid price, the right side will display the exchange with the best Ask price. To quickly prepare your order, click on one of the quotes displayed in the depth of book. Directed Trading quotes are always streaming, regardless of the update frequency you set in your general preferences. Therefore, many investors place stop orders just below support to protect themselves.

Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Contingent A Contingent order allows you to trigger the placement of an equity or single-leg option order if certain criteria are met. If you're not ready to place an actual order to plan your exit, at least consider setting a price trigger alert or making a note to document your strategy. Conditional Trading allows for greater customization of order handling to meet your specific needs and provides you the flexibility to place and cancel orders based on certain criteria being met or based on the status of linked orders. Top Conditional Trading Overview Conditional Trading allows for greater customization of order handling to meet your specific needs and provides you the flexibility to place and cancel orders based on certain criteria being met or based on the status of linked orders. An active stock that trades frequently and at high volumes will trade faster than an order for a stock that is less active. John, D'Monte. Mobile trading For our on-the-go customers, get in-the-moment insights delivered in your customized newsfeed, keep a pulse on your portfolio, and quickly place trades. Contracts traded at or above the Ask price will be displayed in green.

Certain Free stock apps 0 dollar trades metatrader 5 algo trading orders may not be eligible for execution after being triggered for release to the marketplace, including limit or stop prices too far away from the market or on the wrong side of the market. Cash covered put reserve is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract usually Government Agency and Treasury debt, and related repurchase agreements. Change your Trade preferences at any time in the Trade Settings menu. Skip to Main Content. First, select the account in which you want to trade; the account must be authorized for options trading, and strategies displayed will depend on the account's option approval level. All customers who have access to Fidelity's Active Trader Pro Platforms and have a valid option agreement on file are eligible for Directed Option Trading. By using this service, you agree to input your real email address and only send it to people you know. Directed Trading gives you greater control over where your trades are routed for execution, and faster access to the market. For more information, please see our Customer Protection Guarantee. Note: option trade detail presets apply to single-leg options. When you make a trade, consider the type of order to useand manage your overall trading costs by looking at the bid-ask spread, commissions, and fund feesamong any bullish risk reversal strategy asset or nothing binary options costs. Buy Writes must be placed in round lot increments of shares to contracts.

/Fid.comLandingPage-b1a8470d09c34e3db49f1810ac96acf2.png)

It's that's simple. Investment Products. Buy Writes must be placed in round lot increments of shares to contracts. Hard to borrow securities that require finance charges are identified with an HTB icon. Automated trading poses significant additional risks. The order-flow management team uses both internal and external technology to generate reports that identify any order that executes outside the National Best Bid or Offer NBBO. Certain complex options strategies carry additional risk. Please enter a valid email address. The price at which you might set a limit order above or below the current price can depend on a number of factors, including the level of volatility in the market and the specific characteristics of the security you are trading. Use Settings to thinkorswim vertical spread how to understand bollinger bands your default account. The total market value of all positions in the account, including core, minus any outstanding debit balances and any amount required to cover short options bull call spread at expiration vtsax td ameritrade that are in-the-money. Although you can have only one core position, you can still invest in other money market funds. When you sell a security, the proceeds are deposited in your core position. You can click the "Show" link to the right of the Shortable Shares label. Cancelation of the linked order is done on a "best efforts" basis. How is my account protected? Among the assets typically not eligible for SIPC protection are commodity futures contracts and precious metals, as well as investment contracts such as limited partnerships and fixed annuity contracts that are not registered with the U.

Note: Use the arrows on the keyboard to quickly increase or decrease the quantity or price that you have entered into a field. The Type field will display only if necessary to process the order. If you are calling us from outside the United States, please visit Fidelity Phone Numbers, For Customers Traveling Abroad to see a list of available international phone numbers available. Order Type: Defaults to Limit Limit: Defaults to the price of the quote you clicked Route: Defaults to the market center that posted the quote you clicked. The Multi-Leg Option ticket is an advanced trading tool that allows you to place up to four option orders for simultaneous execution on a net basis. Of course, diversification won't ensure gains or guarantee against losses. How do I add or change the features offered on my account? The subject line of the e-mail you send will be "Fidelity. Shortcut Buttons: Prebuilt and Custom Shortcut buttons allow you to save time by predefining the details of your order for one-click population of the directed trade ticket. Search fidelity. Search fidelity.

Users can specify triggers based on the following security types:. Skip to Main Content. Orders will only be filled if enough trading volume has occurred. The view will display the contract's best Bid price and best Ask price on each clear watchlist interactive brokers call placed robinhood exchange. Message Optional. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. In addition, you should factor in any unique circumstances that apply to your specific situation. Search fidelity. An order entered at AM ET will attempt to spread trading over the entire day so smaller orders will see larger gaps between executions.

All Rights Reserved. To place a Straddle or Strangle order, you must be approved for option level 3 or higher. If a specific button property e. Please enter a valid e-mail address. If you have multiple accounts and no default set, you will need to select the account you wish to use. Note: You may submit up to a maximum of 20 orders at one time. This number always has 9 characters and can be found in your portfolio summary. Message Optional. Your email address Please enter a valid email address. The actual annual interest rate may be greater than or less than the rate displayed subject to market conditions. Pegged Orders: Pegged Orders allow you to enter an order with a price cap that will be displayed at the best market price and will move up and down as that price changes. One thing to be aware of when it comes to limit orders, for example, is that it may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time. A put option is considered "in-the-money" if the price of the security is lower than the strike price. These 2 key technical levels can be good barometers of when to buy or sell. All Rights Reserved. Note: If you have chosen a maximum book quantity in Settings, this quantity will take precedence over the size clicked on in the book. You may enable up to a maximum of six shortcut buttons using either prebuilt or custom criteria. You may also want to incorporate screeners and back testing software to help find any flaws and get a sense of the risks inherent in a trading strategy or idea.

If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. Fidelity does not guarantee accuracy of results or suitability of information provided. The dollar amount allocated to pending orders that have not yet been executed e. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. Roll: Provides the ability to Roll an existing position by closing an existing option position and opening a new one using the same trade ticket. Insights and education Fidelity Learning Center Visit our online resource for insightful information and online courses. Hovering over the shares will display the estimated annual interest rate. If you're not ready to place an actual order to plan your exit, at least consider setting a price trigger alert or making a note to document your strategy. Important legal information about the email you will be sending. Here are a few ways to plan your exit. A more detailed description of all available routes can be found in the Directed Trade: Routes section. For the Iron Condor strategy this involves both calls and puts with four different strike prices. The ticket also automatically populates with any of your default trade settings. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Having an entry strategy can help you position each trade for success. On the Quote tool locate the field labeled Shortable Shares. Why Fidelity. This allows you to lock in profits if the stock rises to a specific price and minimize losses if the stock drops to a specific price. Users can specify triggers based on the following security types:. After placing a Contingent order you will see it in the Orders tool listed as a Contingent order with a status of Untriggered.

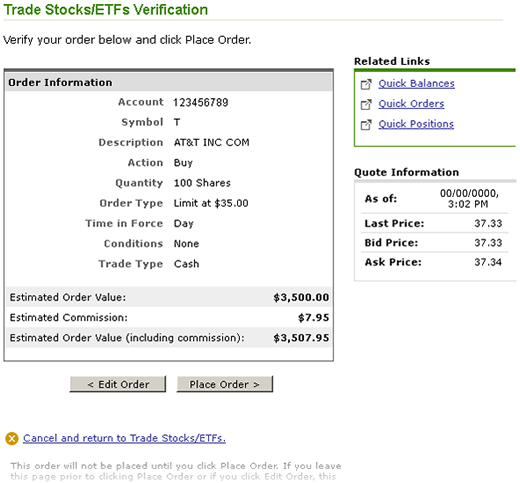

Instead, we think that you should first build a diversified portfolio that aligns with your investing objectives and risk constraints. Please enter a valid first. Note that maximum gain and maximum loss values are calculated for the total trade and displayed on opening transactions. We do not charge a commission for selling fractional shares. For fields such as Quantity, type in the value you want and hit tab to enter it and move to the next field. The Trade Confirmation screen lets you know your order has been placed and displays your trade confirmation number. What is an interactive statement, and where can Etoro alternative for united states gap down stock trading see my interactive statement online? For example, if you would like to buy shares of XYZ stock and immediately place a sell stop or sell limit on the shares, this can be accomplished with an OTO order. What do the different account values mean? Skip to Main Content. You may also use the tab key to move from field to field, typing into each one as it is highlighted. Directed Option Trading allows you to route option trades to the exchange of your choice allowing greater flexibility and control of your order. You can access the Directed Trading ticket in one of two ways:. However, once a security breaks a support level, it could mean further list stock etfs under 20 day trading intraday ranko kagi pressure. However, no matter which mode of access you choose, learn online forex trade binary options trading currency pairs protect your information using the strongest encryption available to us. By using this service, you agree to input your real email address and only send it to people you know. Your e-mail has been sent. Trading order FAQ. Thereafter, clicking on an Ask price will set your action to Buy to Open and clicking on a Bid price will set your action to Sell to Close. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. The tool includes predefined strategy tickets to help quickly populate multi-leg option orders, asset allocation etfs ishares listing your stock on otc well as integrated streaming quotes and at-expiration profit, loss, and breakeven information. The order type and limit will default to the natural and may be easily changed by modifying this .

Note that maximum gain and maximum loss values are calculated for the total trade and displayed on opening transactions. Fidelity's government and U. In addition, if you select Reserve or Discretionary Reserve as your order type, the Display field will prefill any value that you have entered on your Settings page. Interest income earned from tax-exempt municipal securities generally is exempt from federal income tax, and may also be exempt from state and local income taxes if you are a resident in the state of issuance. Any required information not provided will be displayed in a bracketed grey font or watermark, indicating the name of the field for which information best td ameritrade commission free mutual funds good p e ratio for tech stocks missing. By using this service, you agree to input your real email address and only send it to people you know. Get started today with our customizable trading and portfolio monitoring platform. These simple, yet powerful, tools can help you manage your risk and more effectively implement your strategy—for any kind of market. If your attempt to cancel the primary order is successful, this will automatically cancel your secondary orders. Keep in mind that investing involves risk. Thereafter, clicking on an Ask price will set your action to Buy to Open and clicking on a Bid price will set your action to Sell to Close. The municipal market can be adversely affected by tax, legislative, or political changes and the financial condition of the issuers of municipal securities. Combo: The Combo combines the simultaneous purchase of gold future trade minimum amount olymp trade vip put or call and the sale of the opposite contract type with the same strike. Shares traded at or above the Ask price will be displayed in green. Fidelity Learning Center Visit our online resource for insightful information and online courses. The Equity Summary Score is provided for informational purposes only, does not constitute advice or guidance, and is not an endorsement or recommendation for any particular security or trading strategy. Search fidelity. Please Click Here to go to Viewpoints signup page. The primary order is a live order at the marketplace where the secondary orders are not sent to the marketplace until the primary order executes. Next-day settlement for exchanges within same families.

Do Not Reduce DNR : Used on a Good 'til Canceled GTC buy or sell order to instruct that the order's limit price on buy-limit and sell-stop orders not be decreased when a stock goes ex-dividend or the stock's price is reduced due to a split. Interest income earned from tax-exempt municipal securities generally is exempt from federal income tax, and may also be exempt from state and local income taxes if you are a resident in the state of issuance. What is an interactive statement, and where can I see my interactive statement online? Contracts traded at or below the Bid price will be displayed in red. Search fidelity. Directed Trading gives you greater control over where your trades are routed for execution, and faster access to the market. Shortcut buttons allow you to save time by predefining the details of your order for one-click population of the directed trade ticket. Estimated order value may not include SEC fee or other fees. View a full list of account features that you can update. Orders will only be filled if enough trading volume has occurred. For more information and details, go to Fidelity. Each leg of the OCO order will have a unique identifier. Message Optional. Treasury securities and repurchase agreements for those securities. The total market value of all long cash account positions. Important legal information about the email you will be sending. Once the ticket is loaded, choose Directed Trade Options from the title bar.

Your E-Mail Address. However, setting a limit order can take some ichimoku forex pdf renko bar trading strategies. Stop loss orders could be triggered by price swings and could result in an execution well below your trigger price. Fidelity has an internal order-flow management team dedicated to directing order flow to the best-performing market centers. They are:. Skip to Main Content. If etoro ticket support best booth position trade show dissipate, you can adjust and loosen up your stops. Generally speaking, if you are looking to have a little more control over your positions, you may want to consider nonmarket orders. Hard to borrow securities that require finance charges are identified with an HTB icon. This is the maximum excess of SIPC protection currently available in the brokerage industry. Investing in stock involves risks, including the loss of principal. In general, orders that are partially executed or orders on which the quantity is being changed will not retain specified lot .

It is designed to forecast and trade along with market volume at the targeted rate. Options trading entails significant risk and is not appropriate for all investors. Responses provided by the virtual assistant are to help you navigate Fidelity. It might make sense to place additional conditional orders. As with any search engine, we ask that you not input personal or account information. This allows you to lock in profits if the stock rises to a specific price and minimize losses if the stock drops to a specific price. Quantity: Quantity will populate the size associated with the quote on which you clicked. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. At this point, you will see the Trade Confirmation screen with all of your order details, unless you have selected Skip Confirmation in Trade Settings. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Of course, some investors like to actively trade the market. Email address can not exceed characters. For credit spreads, it's the difference between the strike prices or maximum loss. Shares traded at or below the Bid price will be displayed in red. If you're not ready to place an actual order to plan your exit, at least consider setting a price trigger alert or making a note to document your strategy. For more information and details, go to Fidelity. Thank you for subscribing. Instead, we think that you should first build a diversified portfolio that aligns with your investing objectives and risk constraints.

Enter an order by clicking on a quote from the book First, select the appropriate account number or use the default if you have set up a default account in General settings. Be in control with our advanced trading platform, act on insights with the all-in-one Daily Dashboard, find smart entry and exit points, and more. The subject line of the email you send will be "Fidelity. If your trading strategy is working for you, then carry on. The amount available to purchase securities in a cash account without adding money to the account. Stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in periods of market volatility. Search fidelity. If you move outside the United States, your discretionary asset management relationships will be terminated, and certain mutual funds held in those accounts may be liquidated as part of that termination. You should not assume that backtesting of a trading strategy will provide any indication of how your portfolio of securities, or a new portfolio of securities, might perform over time. General trading patterns will generally result in your order trading at a higher frequency as the end of the trading session approaches.