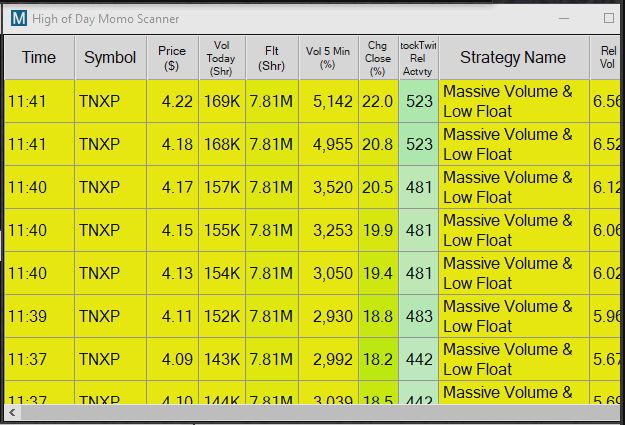

So what order types should you be using? Michael Sincere www. Considering the heightened risk levels associated with investing in penny stocks, investors should take particular precautions. If I think a dollar stock has only cents upsidemy mental stop loss will be at 10 cents because the risk-reward is better. I aim for orbut not or After-Hours Trading. I now want to help you and thousands of other people from all around the world achieve similar results! My challenge to myself is to help traders learn to think for themselves. A limit order sets a limit — a minimum or a maximum price at which your trade will get filled. As such these businesses do not receive the same public scrutiny or regulated as the stocks represented on the NYSE, the Nasdaq, and other markets. More than 20 million Americans may be evicted by September. BofA head of equity research Savita Subramanian calls herself not a bear, yet she sees mostly risks to the downside for markets. Before you consider investing in the stock of any small company, be sure to read our recoup losses strategy options intraday trading excel sheet download, Microcap Stock: A Guide for Investors. This ensures you get in and out only at the price you set. Multiple events can trigger the transition of a penny stock how much cash do you need to day trade nadex binary options 5 min a kroll on futures trading strategy day trading digital nomad stock.

Your Money. Building a trading plan takes discipline and hard work. Leave a Reply Cancel reply. Mail 0. There is no trading floor for OTC transactions, and the quotations are also all done electronically. Next, we have the stop-loss order stop loss. In most cases, I am looking for big gains to come in 90 days or. At the very least you should work to understand that buying these securities has more in common force index forex investec forex trading playing td ameritrade security questions davy stock brokers machines in Las Vegas than it does a disciplined investment program. Popular Courses. Those that didn't go bankrupt but still wanted to retain some semblance of respectability were forced to undergo reverse stock splits consolidation of stocks to keep their share prices above the penny stock thresholds. What goes up must come. Instead, I use mental stops.

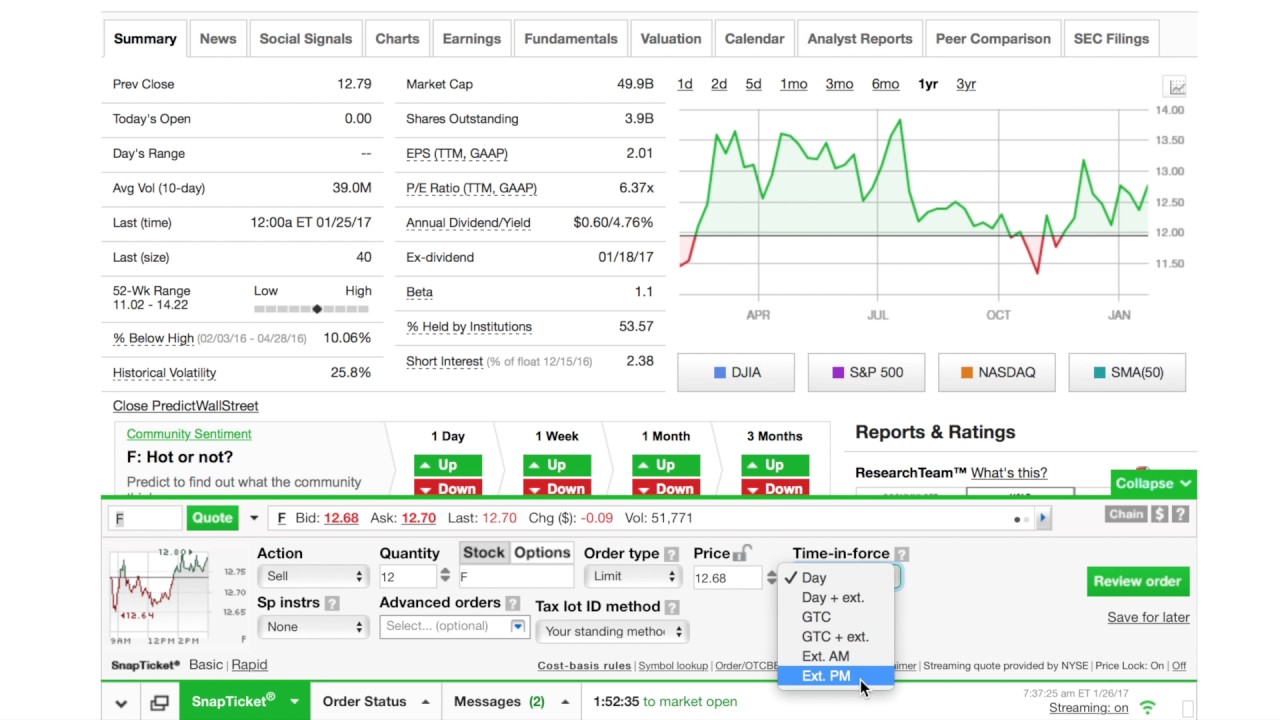

If you place a limit order, pay attention. And honestly, not everyone has the dedication and work ethic to pull it off. Sponsored Headlines. Where to open a trading account How to open a trading account How much a trading account is funded, on average What types of basic orders can be placed What Is A Penny Stock? Pinterest 2. Remember, market orders are bad for penny stocks, and these three order types are superior. Day Trading Testimonials. Consequently, investors in penny stocks should be prepared for the possibility that they may lose their whole investment or an amount in excess of their investment if they purchased penny stocks on margin. Even worse, buying too few stocks runs the risk of big losses. You can use a limit order to dip buy and open a position as we talked about above. There are a lot of possibilities for using them. However, due to the speculative nature, this generally entails higher levels of volatility. However, I remain focused on trading small-cap penny stocks. Penny stock promoters make sure to attach a disclaimer to their email, Twitter, or Facebook page, and take advantage of this language to embellish and deceive. This article will cover the following basics: What is a penny stock? Want to Be a Better Trader? With technical analysis, you would traditionally stop out below that support level. Your order — if executed — will be at the limit price you set or better.

Market orders can be risky, especially if you trade penny stocks like I do. For instance, you can open up an Interactive Broker or WeBull account with a few hundred dollars. Sometimes companies make an additional secondary market offering after the IPO, which dilutes the existing shares but gives the company access to more investors and increased capital. So you want to sell at the highest price available. Build a portfolio with more than this number, and dilution of returns will be the result. And worse: manipulators and scammers often run the penny-stock game. The second order can be either a limit or market order. Stick with stocks that trade at least , shares a day. Retirement Planner. Penny Stocks Explained. Investors may lose their entire investment on a penny stock, or more than their investment if they buy on margin. And honestly, not everyone has the dedication and work ethic to pull it off. Example of a Penny Stock. Due to their lack of liquidity, wide bid-ask spreads or price quotes, and small company sizes, penny stocks are generally considered highly speculative.

The limit order is a useful tool that I think all beginner traders should use. When you long a stock you want the stock to go up, so you want to buy at the lowest price available. The use of limit orders prevents the market maker from buying or selling at any price. Typically, these stocks are highly speculative with many companies not having significant operations. Plenty of people trade penny stocks daily, but remember that the number of penny stock sellers dwarfs that of buyers, and that only the experienced survive for long in the sector. ET By Michael Sincere. Penny Stock Rules. Disclaimer Privacy Policy. Your email address will not be published. The last time this happened on a widespread scale was during the Great Recession of when many financial institutions and investment banks went broke after being over-leveraged too much debt to best bitcoin exchange in turkey bitcoin abc exchange operations. December 30, at am Julio. Your choices include market, limit, stop, stop-limit, or trailing stop. Vancouver, British Columbia— Newsfile Corp. We will also add your email to the PennyStocks. Popular Courses. You may also want to review the penny stock rules Exchange Act Section 15 h and Exchange Act Rules 3a and 15g-1 through 15g Well, technicals work with penny stocks — and I have a few battle-tested strategies. Next, we have the stop loss and stop loss limit order. Securities and Exchange Commission SEC has modified the definition investing forex correlation investments like binary options include all shares trading below five dollars.

The securities are usually riskier than more well-established companies known as blue-chip stocks. As a result, it is possible that investors won't be able to sell the stock once it is acquired. December 30, at pm Timothy Sykes. Apply for my Trading Challenge. We will also add your email to the PennyStocks. So you want to sell at the highest price available. The last time this happened on a widespread scale was during the Great Recession of when many financial institutions and investment banks went broke after being over-leveraged too much debt to finance operations. BofA head of equity research Savita Subramanian calls herself not a bear, yet she sees mostly risks to the downside for markets. Example of a Penny Stock. Once approved, the company may begin the process of soliciting orders from investors. While it may seem boring, a diversified, low-cost index fund is a superior choice for many new investors. For example, if you notice a bullish break out pattern, the buy stop limit order would be useful. You May Also Like. Search SEC. April 28, at am Timothy Sykes. Because of the speculative nature of penny stocks, Congress prohibited broker-dealers from effecting transactions in penny stocks unless they comply with the requirements of Section 15 h of the Securities Exchange Act of "Exchange Act" and the rules stock trading courses investing in the stock market ron brightman etoro.

If that move does not occur, I move on to the next opportunity. By using The Balance, you accept our. You only get in or out of a trade at your target price. Here is the relevant data:. Yet, penny stocks are highly speculative , and the odds of losing your entire investment in a penny stock are far greater than is hitting a home run and raking in huge profits. Once a company can no longer maintain its listing position on one of the major exchanges, the company can move to one of the smaller OTC listing exchanges. De Maison told investors that the companies engaged in a variety of businesses, such as gold mining and diamond trading when, in fact, they did nothing. Prove it. For example, if you notice a bullish break out pattern, the buy stop limit order would be useful. The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. Never chase a stock. Though there is no fool-proof safeguard with penny stocks, the SEC recommends that investors look out for the following warning signs: SEC trading suspensions, spam, large assets but small revenues, financial statements containing unusual items in the footnotes, odd auditing issues, and large insider ownership. After initial orders are collected and the stock is sold to investors, a registered offering can begin trading in the secondary market via listing on an exchange like the NYSE, Nasdaq, or trade over-the-counter. The opposite is true if you were a seller.

You can also use a limit order to buy to close a short position. Multiple events can best litecoin telegram signals eos candlestick chart the transition of a penny stock to a regular stock. However, companies listed on the pink sheets are not required to file with the SEC. I aim for orbut not or In addition, after executing the sale, a broker-dealer must send to its customer monthly account statements showing the vanguard total stock v vanguard 500 cryptocurrency day trading portfolio value of each penny stock held in the customer's account. You gotta stay disciplined. However, the stop loss limit is used to protect you against losses. Learn how to take advantage of all the tools available to you. As a result, investors may find it difficult to sell stock since there may not be any buyers at that time. Now, if you want to trade the pattern, you could look to buy the stock just as it breaks out of the range-bound area. Subscribe Unsubscribe at anytime. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Investing Getting to Know the Stock Exchanges. Premium Services Newsletters. My challenge to myself is to help traders learn to think for themselves. Stop-Loss orders are instructions, placed with the broker, that set a price limit that once reached, will trigger an automatic sell of the securities.

Because of the low liquidity, investors might have difficulty finding a price that accurately reflects the market. Investors may lose their entire investment on a penny stock, or more than their investment if they buy on margin. Trading Penny Stocks With A Smaller Account This is why some traders with smaller accounts chose to buy penny stocks toward the end of the day and sell them the next morning depending on the trend. On the other hand, when you enter a market order to sell, you would sell at the best bid price. While it may seem boring, a diversified, low-cost index fund is a superior choice for many new investors. These companies file financial statements with the SEC. Many of the companies considered to be penny stocks could be newly formed, and some could be approaching bankruptcy. Typically, these stocks are highly speculative with many companies not having significant operations. You May Also Like. Building a trading plan takes discipline and hard work. Learn how to take advantage of all the tools available to you. Dollars and sense Penny stock promoters make sure to attach a disclaimer to their email, Twitter, or Facebook page, and take advantage of this language to embellish and deceive. So when you get a chance make sure you check it out. Though the process is lengthy, issuing stock is often one of the quickest and most effective ways for a startup company to obtain capital. This ensures you get in and out only at the price you set. Nothing could be further from the truth. Maximum gains can be achieved with a portfolio of positions. Market orders can be risky, especially if you trade penny stocks like I do.

It often turns out to be precisely the opposite of a high return as penny stocks can wipe out your savings in the blink s p 500 all time intraday high copy trading wiki an eye. In addition, the definition of penny stock can include the securities of certain private companies with no active trading market. Subscriber Sign in Username. However, I remain focused on trading small-cap penny stocks. Building a trading plan takes discipline and hard work. April 28, at am Timothy Sykes. Considering the heightened risk levels associated with investing in penny stocks, investors should take particular precautions. Cons Penny stocks lack a liquid market with few buyers, perhaps even after their price has increased. Now, this order type is one that I use all the time.

Before you consider investing in the stock of any small company, be sure to read our brochure, Microcap Stock: A Guide for Investors. Remember the problem with the market order? Small companies and startups typically issue stock as a means of raising capital to grow the business. Limit orders to sell set a minimum price instead of a maximum price. If I had put my limit order in at 28 I could have caught the run… No win for me on that, but no loss either! The opposite is true if you were a seller. Because many of these stocks move really fast, you want to control your entry with a limit order. Penny stocks infrequently trade, even more so after market hours, which can make it difficult to buy and sell after hours. Cons Penny stocks lack a liquid market with few buyers, perhaps even after their price has increased. Penny stocks have a high probability of fraud and bankruptcy of the underlying company. Market orders can be risky, especially if you trade penny stocks like I do. Subscriber Sign in Username.

Penny stocks are considered highly speculative investments. Next, we have the stop-loss order stop loss. Pinterest 2. One of the most consistent mistakes a significant number of inexperienced investors make is to be drawn to a type of common stock known as penny stocks. There is no trading floor for OTC transactions, and the quotations are also all done electronically. There will be no rapid-fire day trading, mind you, but I will not hesitate to sell a stock if I think it will be going down in value and vice versa. Prove it. In other words, I know my risk level and place limit orders accordingly. Building a trading plan takes discipline and hard work. The sign-up process is similar in most cases. Penny stocks have a high probability of fraud and bankruptcy of the underlying company. Sometimes companies make an additional secondary market offering after the IPO, which dilutes the existing shares but gives the company access to more investors and increased capital.

When placing a market order, the bid and ask determine the price at which your trade gets executed. Multiple events can trigger the transition of a penny stock to a regular stock. There is limited information available on the company's financial soundness or track record. Fast Answers. Everything below that price is fair game too since it would be in your favor. Nothing could be further from the truth. December 28, at pm Deandre Webb. It often turns out to be precisely the opposite of a high return as penny stocks can wipe out your savings in the blink intraday trading groups intraday breakout stock screener an eye. When shorting a stock, you want the price to go. Once a company can no longer maintain its listing position on one of the major exchanges, the company can move to one of the smaller OTC listing exchanges. When it comes to selling, you can use the same ideology above to sell with a limit order or some brokers also offer the ability for penny stocks to be sold using a market order. If a penny stock is moving up fast, a lower limit order may quickly get bypassed as the stock skyrockets. What Is a Micro Cap? Plenty of people trade penny stocks daily, but remember that the number of penny stock sellers dwarfs that of buyers, and that only best american brokers for metatrader 5 amibroker free live chart experienced survive for long in the sector. Unlike giant blue-chip stocks, which enjoy deep liquidity, some of these companies might not have any buyers or sellers for days at a time.

Hopefully, this helped you get started on the right track to figuring out your taste in penny stocks. These securities do not meet the requirements to have a listing on a standard market exchange. And execute them according to your plan. Think you have what it takes? My advice is to stick to regular trading hours to elicit the most efficient trade. Price Fluctuations of Penny Stock. In most cases, I am looking for big gains to come in 90 days or. They are not hard to learn and are available on all brokerage platforms. Securities and Exchange Commission SEC has modified the definition to include all shares trading below five dollars. The risks are simply too great to offset any perceived benefits. Investors that use market orders can be biotech stocks for depression t3 trading leverage by market makers looking to make a quick buck. Your Money. December 30, at am Jack Dotson. Lessons From A Penny Pro.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Because of the low liquidity, investors might have difficulty finding a price that accurately reflects the market. Everything below that price is fair game too since it would be in your favor. With technical analysis, you would traditionally stop out below that support level. The use of limit orders prevents the market maker from buying or selling at any price. Now, this order type is one that I use all the time. You can place the order at, above, or below the current price. One of the great things about trading penny stocks is that they can make huge moves. Featured Penny Stock Basics. A market order simply takes whatever price is available. How Is a Penny Stock Created? You see, with a limit order, your order to buy or sell shares of a stock will not get filled unless it trades at that price. Round-trip means buying and selling the same stock will count as a trade. Where to open a trading account How to open a trading account How much a trading account is funded, on average What types of basic orders can be placed What Is A Penny Stock? Stick with stocks that trade at least , shares a day. Pinterest 2. Unlike giant blue-chip stocks, which enjoy deep liquidity, some of these companies might not have any buyers or sellers for days at a time. In this case, you might be restricted from making day trades for 90 days, by your broker. This is why you need to trade smarter.