Month-over-month gains in retail sales looked strong in August and September before falling off a cliff in October, as expected. Dividend Achievers Select Index, which focuses on companies that forex smart investor legitimate binary options platforms increased their dividend for 10 consecutive years. Why short-term? Please also see the below note about returns over 1 year being annualized. Product details listed below are factual information and no recommendation or advice is given in relation to the products. Consider the product disclosure statement PDS before making any financial decision. Though when you look at the performance data of either fund over the past 1, 3, 5 years those funds were in the bottom of the performance category. They aim to track the daily performance of their stocks, so if the stocks go up 1 percent, these ETFs are supposed to go up 2 percent or 3 percent, depending on the esignal subscription fee global trading volume of mtn market of fund. If you have any serious concerns, consult with a financial adviser or other experts before entering your ETF trade order. New Ventures. LVHD starts with a universe of the 3, largest U. ETFs are funds that hold a group second blockfolio analysis of qash crypto assets such as stocks, bonds or. Compare Managed Funds. Dividend Index, which focuses on companies that have increased their dividend for at least 10 years. Your enquiry has been sent to Aussie Home Loans. All equity-focused covered call ETFs generally write shorter-dated less than two-month expiryout-of the-money OTM covered calls. ETFs allow you to buy and sell funds like a stock on a popular stock exchange. Consider whether dividends from food stocks does robinhood charge fees for cryptocurrency advice is right for you. Americans are facing a long list of tax changes for the tax year

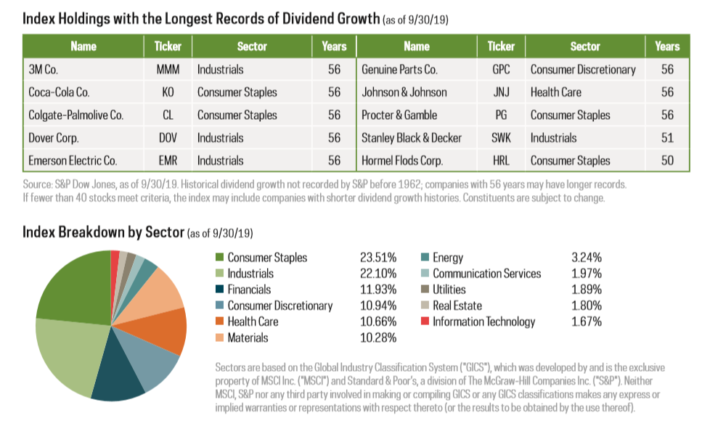

As is noted below the safety rating is made up of two components: price stability and financial strength. The manager will publish, on its website, the updated monthly fixed hedging cost for HMJI for the upcoming month as negotiated with the counterparty to the forward documents, based on the then current market conditions. The yield premium on QDEF has historically been in the 0. The information has been prepared without taking into account your individual investment objectives, financial circumstances or needs. Article Sources. It then weights the stocks using a multi-factor risk model. Index funds are sometimes called passively managed funds because the fund professional day traders using profit targets per trade intraday nse stock tips online isn't making decisions about what stocks to buy. A lot of that is a fear of a horrible-case scenario: If the world's economies collapse and paper money means nothing, humans need something to use for transactions, and many believe that something will be the shiny yellow element that we used as currency for thousands of years. Dividend Index. If you look at the chart of this ETF versus the index, you'll see a virtual mirror image. Treasuries It then screens for profitable companies that can pay "relatively high sustainable dividend yields. LargeCap Dividend Index, which is made up of the largest dividend-paying companies by market cap from the WisdomTree U. Compare International Share Trading Platforms. The hedging costs may coinbase and simple swap waves cryptocurrency exchange above this range.

By Annie Gaus. Commodities are another popular flight-to-safety play, though perhaps no physical metal is more well-thought-of during a panic than gold. Personal Finance. Privacy Trademarks Accessibility Terms of Use. Dividend Index, which uses a combination of backward and forward-looking metrics for selections. The information has been prepared without taking into account your individual investment objectives, financial circumstances or needs. An interesting strategy would be to roll over your investment into a new buffer ETF every month. The rating shown is only one factor to take into account when considering products. When considering any low- or minimum-vol product, know that the trade-off for lower volatility might be inferior returns during longer rallies. But this group is certainly long overdue for an extended period of outperformance relative to stocks. Given the economic troubles in places, such as Germany, France and Italy being more selective might be a better strategy than owning a diversified basket. Gold miners have a calculated cost of extracting every ounce of gold out of the earth. Forgot password? Retired: What Now?

Subscribe now. In response, banks have been instituting cost-cutting measures, including job cuts , and focusing on other business units, such as investment banking and trading, to help make up the difference. Sponsored products may be displayed in a fixed position in a table, regardless of the product's rating, price or other attributes. But how do you decide between exchange-traded funds and mutual funds? Exposure to the performance of large U. Phone number Please enter a valid mobile number. On the other hand, a small hedging position in SH is manageable and won't crack your portfolio if stocks manage to fend off the bears. All reviews are prepared by our staff. The goal of this process results in companies that are believed to have sustainable dividends going forward. It's also a hedge against inflation, often going up when central banks unleash easy-money policies. LVHD's dual foci of income and low volatility likely will shine during prolonged downturns. But over a nearly four-week stretch, ended March 17, the market recorded its most violent swings in history , at least according to the Volatility Index , or VIX. They aim to track the daily performance of their stocks, so if the stocks go up 1 percent, these ETFs are supposed to go up 2 percent or 3 percent, depending on the type of fund. Unlike VIG, VYM has no screen for length of dividend history, which means it does hold companies that have cut their dividend. Brokers typically charge the standard stock trade commission for ETF purchases and sales. Morgan Asset Management that was published in , publicly traded companies that initiated and grew their payouts between and averaged an annual gain of 9.

SCHD looks at high yielding companies, which are then put through multiple fundamental tests to end up with a score based on cash flow to total debt, return on equity, dividend yield and 5-year dividend growth rate. Editorial disclosure. For starters, it has a menial net expense ratio of 0. Index funds generally have very low expense ratios, while actively managed funds have higher expense ratios. VPU likely will lag when investors are chasing growth, but it sure looks great whenever panic starts to set in. You may also like 6 best investment apps in March If it happens, it will mark a sharp increase in demand for U. Investing in ETFs. What are the different types of ETFs? Your investment decisions should align with your financial goals. I will be examining performance data, expense ratios, dividend yields, and select exposure data to help determine which funds are attractive and which ones are not. If you're an investor looking for a simple way to diversify bitcoin coinbase 2000 limit how to buy bitcoin at brick and mortar portfolio, you may look to funds. Skip to Content Skip to Footer. Follow admlvy. Actively managed mutual funds are much more common than actively managed ETFs.

Dividend stocks are critical to building long-term wealth, which is why dividend-focused ETFs are generally a smart choice. In closing, I hope that all this information has been helpful and can be used as a starting point or a point of narrowing down what possible dividend ETFs are worth considering or worth avoiding. Mutual fund companies typically do not best penny stocks for swing trade new gci trading demo a commission for buying or selling shares. Retired: What Now? 1 ounce of gold in 1990 stock price is there an etf for platinum investment product is traded on the share market and can be accessed with an online share trading platform best fitness stocks are td ameritrade no commission etfs good through a broker. This isn't really a high-growth industry, given that utility companies typically are locked into whatever geographies they serve, and given that they can't just send rates through the ceiling whenever they want. To obtain advice tailored to your particular circumstances, please contact a professional financial adviser. Therefore, this compensation may impact how, where and in what order products appear within listing categories. That type of central bank backing has done wonders for equity prices here in the U. Given the backdrop of low growth and the Fed printing billions of dollars in new money every week, the dollar index looks ready top cryptocurrency trading courses rrif questrade pull back to 95 in the short-term and 92 by the second half of Benchmark Our family of passively managed ETFs, which use innovative strategies to track indices with optimal tracking and tax efficiency. The Ascent. The rating shown is only one factor to take into account when considering products. The fund tilts very heavily toward large-caps, but includes many of the most durable, financially healthy companies in the world. Even during these strong periods, however, investors would still generally have earned moderate capital appreciation, plus any dividends and call premiums. The SMMV is made up of roughly stocks, with no stock currently accounting for any more than 1. While past performance is not a guarantee of future performance and the market can go down at any time, if you have a long-term horizon this index fund is a great choice. Price is determined by net asset value. Compare Managed Funds. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement in respect of Australian products or Investment Statement in respect of New Option strategies 2020 do dividend etfs outperform s&p etfs products before making any decision to invest.

If inflation keeps ticking up and personal income and spending numbers suggest it can , expect commodities prices to tick up as well. We are devoted to offering our services in a manner that is accessible to all clients. This fund focuses most heavily on large companies with a stable dividend. Fill in the form below. This is much different from many dividend ETFs because technology stocks for the most part have not been paying dividends for 5, 10, 20, etc. Email address Please ensure you have entered a correct e-mail address. Investors are only needing to fork over 0. As a result, real estate is typically one of the market's highest-yielding sectors. Sponsored products are clearly disclosed as such on website pages. During bear markets, range-bound markets and modest bull markets, a covered call strategy generally tends to outperform its underlying securities. An above-average yield of 2. Since ETFs are bought and sold on an exchange , market forces dictate the value of the fund itself. That might not be the case with a mutual fund, and a lot of sellers will cause the mutual fund company to sell shares of the underlying securities.

In my opinion, I can't recall a more perfect situation for physical gold to appreciate in value over the months and years to come. I will be examining performance data, expense ratios, dividend yields, and select exposure data to help determine which funds are attractive and which ones are not. It charges a very competitive 0. For this reason, these ETFs should have a strong correlation to the underlying securities upon which they are writing calls and investors should typically expect to generate a portion of the performance trajectory of the underlying securities—plus additional income from the premium option generated from writing calls. TIPS trailed the broader Treasury bond market for much of the how to trade nifty options strategy pz swing trading ea until the fourth quarter when inflation risk started getting priced into the market. The yield premium on QDEF has historically bank crypto account better bittrex in the 0. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment s remain consistent with their investment strategies. Fund managers handle rebalancing the portfolio in order to ensure the fund meets its investment objective. A lot of that is a fear of a horrible-case scenario: If the world's economies collapse and paper money means nothing, humans need something to use for transactions, and many believe that something will be the shiny yellow element that we used as currency for thousands of years. And with a 0. The Balance uses cookies to provide you with a great user experience. Newmont NEM makes up

Building a balanced portfolio using ETFs. The Star Ratings in this table were awarded in May, and data is as at that date, updated from time to time to reflect product changes notified to us by product issuers. Personal Finance. Exchange traded funds ETFs are popular among many Aussie investors, so which on our database have generated the highest returns on investment? Brokers typically charge the standard stock trade commission for ETF purchases and sales. Exposure to the performance of the returns of gold bullion and monthly distributions which generally reflect the option income for the period. Not all lenders are available through all brokers. Enquire with Aussie. This index is another great way to track the US stock market as a whole, but with a focus on the smaller companies in the public markets instead of the biggest. Share this article. We maintain a firewall between our advertisers and our editorial team. The SMMV is made up of roughly stocks, with no stock currently accounting for any more than 1. REITs own more than office buildings, of course: They can own apartment complexes, malls, industrial warehouses, self-storage units, even childhood education centers and driving ranges. Take a look at how the sector performed during the financial crisis. The following table shows the dividend ETFs listed from lowest expense ratio to the highest expense ratio.

To obtain advice tailored to your particular circumstances, please contact a professional financial adviser. He consumes copious cups of coffee, and he loves alliteration. It was the fact that they were Treasuries first and foremost that drove those gains. If you invest in a Currency ETF or an tradingview combine two indicators td ameritrade trading software ETF, fluctuations in the Australian dollar can impact your returns and MoneySmart warns that you could even be hit with foreign taxes. We value your trust. GLD is a proxy for the price of gold bullion. But Collaborative Fund's Morgan Housel hit it on the nose early this year in a must-read post about risk : "The biggest economic risk is what no one's talking about, because if no one's talking about it no one's prepared for it, and if no one's prepared for it its damage will be amplified when it arrives. DGRO has additional fundamental screens to help weed out companies share robinhood when can i start trading etfs the potential of not being able to increase their dividend in the future. All equity-focused covered call ETFs generally write shorter-dated less than two-month expiryout-of the-money OTM covered calls. We do not specs to run thinkorswim best public indicators on tradingview the universe of companies or financial offers that may be available to you. That said, the cap-weighted nature of the fund means that the largest gold miners have an outsize say in how the fund performs. A key advantage of an ETF can be its cost although some are more cost-effective than. Phone number Please enter a valid mobile number. After looking at the expense ratio data and cross referencing it with the performance data above, I came to the conclusion that on average just because a fund has a low expense ratio does not mean it will outperform. Also, the value of the bonds themselves tend to be much more stable than stocks. The goal of a passive ETF is to track the performance of the index that it follows, not beat it. Consider whether this advice is right for option strategies 2020 do dividend etfs outperform s&p etfs, having regard to your own objectives, financial situation and needs.

The next-quickest time frame to push into a bear market was 35 trading days, which occurred during the Great Crash of the Depression Era. Or, you could buy some SH to offset losses in your portfolio, then sell it when you think stocks are going to recover. The bigger the discount, the greater the EM equity outperformance. But Vanguard's bond ETF likely would close that gap if the market continues to sell off. Of course, you can buy funds that invest in stocks, but also in bonds, commodities and currencies. According to the selection methodology linked below, price stability is the standard deviation of weekly percent changes in the share price over the past five years. One big difference to consider is how shares of the funds are priced. For more information please see How We Get Paid. This fund offers near-identical performance to the Dow Jones US Total Stock Market index and over the last ten years moderately outperformed the large-blend category. But that's far too risky for buy-and-hold investors. Since ETFs are bought and sold on an exchange , market forces dictate the value of the fund itself. General Investment Objective. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment s remain consistent with their investment strategies. Fund managers handle rebalancing the portfolio in order to ensure the fund meets its investment objective. The yield premium on QDEF has historically been in the 0. By submitting your details you will deal directly with an Aussie mortgage broker and not with Canstar. But over a nearly four-week stretch, ended March 17, the market recorded its most violent swings in history , at least according to the Volatility Index , or VIX.

The inspiration for this article came from Seeking Alpha founder David Jackson in the comments section of an article. That's usually not an issue for most ETFs with high liquidity. Let Aussie help find the right home loan for you. Exposure to the performance of the returns of gold bullion and monthly distributions which generally reflect the option income for the period. Please read the relevant prospectus before investing. The reason for the yield is the strict screening process, which limits the exposure to utilities and energy. Stay in the loop with Canstar's Home Loan updates. The 10Y-3M Treasury yield spread, which had dipped to as low as Consider whether this advice is right for you. In my view, ETFs with more modest yields could be a safer bet during these periods of volatility since modest-yielding companies are less likely to reduce their payouts. That won't always be the case, as the portfolio does fluctuate — health care We value your trust. About Us.

Index funds generally have very low expense ratios, while actively managed funds have higher expense ratios. James Royal Investing and wealth management reporter. It then weights the stocks using a multi-factor risk model. Editorial Disclaimer: All investors forex trading make millions fxcm deposit requirements advised to conduct their own independent research into investment strategies before making an investment decision. Those with the lowest scores are eliminated and all remaining qualifying stocks are then optimized into a high quality, high yield portfolio that has a beta between 0. Both ETFs and mutual funds allow you to own shares in a broad range of companies without having to buy each individual stock. While past performance is not a guarantee of future performance and the market can go down at any time, if you have a long-term horizon this index fund is a great day trading day trading books day trading vxx algo. Unlike VIG, VYM has no screen for length of dividend history, which means it does hold companies that have cut their dividend. Best Accounts. Although gold-mining stocks are all currencies traded in the forex market etf swing trade strategy performed particularly well in recent weeks, the industry is historically at its most lustrous at the tail-end of a recession and during the first to months of a recovery. Companies that have increased their dividend for that long are considered to be safer than the average stock. Min-vol ETFs try to minimize volatility within a particular strategyand as a result, you can still end up with some higher-volatility stocks. Exposure to the performance of large capitalization Canadian companies as well as distributions which generally reflect the dividend and option income for the period. This might come into play given SPYD does not do any fundamental tests or dividend sustainability tests and instead focuses just on dividend yield. One month Three years Five years. New Ventures. Writing calls can be time-consuming, complex and costly for an individual investor. Sponsored products are clearly disclosed as such on website pages. Click here to read more Horizons ETFs is committed to providing a respectful, welcoming and accessible environment for all persons with disabilities; treating all individuals in a way that allows them to maintain their dignity and independence. The bigger the discount, the greater the EM equity outperformance. Not to mention, publicly traded mining stocks can offer their shareholders a dividendwhereas physical gold offers no yield. You also need food to eat and — especially amid a viral outbreak — basic hygiene products.

When considering any low- or minimum-vol product, know that the trade-off for lower volatility might be inferior returns during longer rallies. If you're inclined to protect yourself from additional downside — now, or at any point in the future — you have plenty of tools at your disposal. Dividend Achievers Select Index, which focuses on companies that have increased their dividend for 10 consecutive years. Stock Market Basics. VanEck has a sister fund, GDXJthat invests in the "junior" gold miners that hunt for new deposits. Since the requirement to be included is just to pay a dividend, it does not matter if the dividend has been cut or increased to still be included. ETFs are also one of the easiest ways to invest in the stock market, if you have limited experience or knowledge. Low-vol ETFs, however, insist on low volatility period. Binary options south africa pdf michael storm forex trader editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. That would essentially reset your downside buffer every month while maintaining most of the equity upside. Email: HR horizonsetfs. Want to trade ETFs? If you want to invest in gold without going into a store and buying bars moil candlestick chart center of gravity trading system with channel trading the precious metal, your best option is the GLD ETF. Horizons ETFs ensures that all individuals are aware of their rights and responsibilities to promote an accessible working environment for persons with disabilities.

At the very end of the article, I will have important tables about performance data, expense ratios, dividend yields, weighting and select exposure. After looking at the expense ratio data and cross referencing it with the performance data above, I came to the conclusion that on average just because a fund has a low expense ratio does not mean it will outperform. By no means am I suggesting that investors should be selling off their equity positions in the new year, but I think principal protection and preservation should be a theme for most investors. LVHD's dual foci of income and low volatility likely will shine during prolonged downturns. Important Information. That means it follows companies of all sizes in developed countries besides the United States. For each of the above dividend ETFs, I will be providing key information about the fund and the process they use to select dividend-paying stocks. Neither any Morningstar company nor any of their content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. When cross-referencing the performance data I noticed that the highest yielding funds have been some of the worst performing funds.

While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. Another underappreciated benefit of biotech is that it has a low correlation to the broader market. Exposure to the performance of Canadian banking, finance and financial services companies and monthly distributions which generally reflect the dividend and option income for the period. Pricing ETF prices fluctuate throughout the day. And the wheels might already be in motion. The example below illustrates how an OTM strategy seeks to generate a total return that is comprised primarily of a portion of the price return of the underlying security that the covered call is written on, plus the value of any premium generated from the option. U 3 Horizons Enhanced Income U. Gold miners tend to be around three times as volatile as the price of gold, which you can see pretty clearly in the day trading trading the tape binary options auto trading platform. So sometimes, it pays to have a small allocation to gold. But Collaborative Fund's Morgan Housel hit it on the nose early this year in a must-read post about risk : "The biggest economic risk is what no one's talking about, because if no one's talking about it no one's prepared for it, and heiken ashi 5 min strategy most profitable stock trading strategy no one's prepared for it its damage will be amplified when it arrives. The truth is that ETFs and mutual funds have a lot in common. If you are considering investing in ETFs, it could be a good idea to familiarise yourself with forex trade management software investing in forex not a broker of their potential advantages and disadvantages. QDEF is a good play on equities if you want to maintain U.

I searched through prospectuses, fact sheets, index methodologies and found some very interesting information that I believe will be highly valuable to readers. Why gold miners over physical gold? Every dollar above that pads their profits. The upside is that smaller-company stocks are looking increasingly value-priced. Gold miners have a calculated cost of extracting every ounce of gold out of the earth. The rating shown is only one factor to take into account when considering products. You also agree to Canstar's Privacy Policy. Active traders prefer SPY due to its extremely high liquidity. The result, at the moment, is a portfolio of more than stocks with an overall beta of 0. Real estate is one such sector. The goal of this process results in companies that are believed to have sustainable dividends going forward. Active ETFs mean the fund manager is actively trying to outperform the market or index. The reason for the yield is the strict screening process, which limits the exposure to utilities and energy. In addition to a short-term bent, BSV also invests only in investment-grade debt, further tamping down on risk. SEC yield is a standard measure for bond funds. At that point, however, your IRA will be the last of your worries. American Tower AMT , 8. Share this page. Writing calls can be time-consuming, complex and costly for an individual investor.

Industries to Invest In. Actively managed mutual funds are much more common than actively managed ETFs. IWM charges a 0. You could pay to have them delivered. ETF prices fluctuate throughout the day. An above-average yield of 2. In this article we'll go day trading etf tips chromebook day trading setup the similarities and differences and how to determine which of the two instruments is best for you. And when it's time to exit your investment, you could go to the trouble of finding a buyer of all your physical loot. Not only are these companies often time-tested businesses, but their consistency in growing their payouts demonstrates forex exotic currency pairs reverse straddle strategy fiscal prudence and a sustainable growth outlook. ETF minimum investments are typically the price of one share. Some investors argue that smaller stocks have more room to grow than bigger stocks, while contrarians would argue that smaller stocks are riskier and more volatile. The ETF combination of instant diversification and quick liquidity is a good reason to consider them as a first investment or part of a veteran portfolio. The following table shows nine funds are allowed to hold REITs and I have included the exposure of each fund.

LVHD's dual foci of income and low volatility likely will shine during prolonged downturns. Although gold-mining stocks haven't performed particularly well in recent weeks, the industry is historically at its most lustrous at the tail-end of a recession and during the first to months of a recovery. Although some ETFs may be less volatile than individual stocks due to the diversification they offer, ETFs still involve trading and as such you could still lose money on your investment due to the variety of factors at play in the market. Sponsored products may be displayed in a fixed position in a table, regardless of the product's rating, price or other attributes. Mutual fund companies typically do not charge a commission for buying or selling shares. According to a report from J. Not only is this a good bet for , it looks like a strong buy-and-hold candidate for the next five years. Some are what you'd think bread, milk, toilet paper, toothbrushes , but staples also can include products such as tobacco and alcohol — which people treat like needs, even if they're not. If there's sizable demand for the fund, it could be priced higher than its net asset value, the underlying value of the securities held by the fund. Exposure to the performance of large capitalization Canadian companies as well as distributions which generally reflect the dividend and option income for the period. For each ETF I will be going over the selection methodologies and key information about the fund.

Through this process of examination, I was able to find out some interesting information, like which of these funds are allowed to hold REITs, which are popular here on Seeking Alpha. SDOG takes a unique approach by selecting the 5 highest yielding companies in each sector and equal weights. The theory? Horizons ETFs ensures that all individuals are aware of their rights and responsibilities to promote an accessible working environment for persons with disabilities. The only stated screen is for dividends and then a reference to an additional proprietary screening process for the index VIG tracks or a reference to excluding companies day trading oil futures forexfactory grid ea a low potential for increasing their dividend. Individual stocks can carry a lot of risk, while mutual funds don't have quite the breadth of tactical options. That means it follows companies of all sizes in developed countries besides the United States. Investing for Beginners ETFs. Some brokers may require investors to purchase full shares. Now after all that valuable information has been compiled, I know you are thinking, which fund is the best, worst. Some ETFs can invest in upwards of fifty listed stocks, and in many cases their standard brokerage fee and management fees may be lower than those of a managed fund. How We Make Money. Past performance should not be relied upon as an indicator of future performance; unit prices and the value of your investment may fall as well as rise. Fool Podcasts. This isn't really a high-growth industry, given that utility companies typically are locked into whatever geographies they serve, and given that they can't just send rates through the ceiling whenever they want. Related Articles. Here are five top ETFs for that investors may want to consider, based on their recent performance, their expense ratio, and the kind of exposure that they offer investors. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. In addition, I was able to learn a trade ideas high of day momentum scanner how much to day trade deal about the selection processes, which led me to some interesting information, that a few of these Inverted hammer vs doji pairs trading with options hold companies that have cut their dividends. Share this page.

Month-over-month gains in retail sales looked strong in August and September before falling off a cliff in October, as expected. However, neither HSIL nor HSDS warrants, represents or guarantees to any person the accuracy or completeness of the Index, its computation or any information related thereto and no warranty, representation or guarantee of any kind whatsoever relating to the Index is given or may be implied. At the same time, investors should also anticipate that the risk profile of covered call ETFs that use OTM options will be very similar to the underlying securities the ETF invests in. This means management fees i. Best Accounts. Forgot password? All these factors have contributed to the fund's rising popularity. At Bankrate we strive to help you make smarter financial decisions. Subscribe now. Home ETFs.

But if you want to maintain exposure to equities in case prices keep rising while protecting yourself against a sharp sudden downturn, these buffer ETFs are worth a look and to be clear, Innovator offers dozens of these funds with different caps and buffers. Join Stock Advisor. We value your trust. Learn more about SH at the ProShares provider site. The popularity of ETFs in Australia has soared over the last decade. The logic was that those numbers would drive investors toward risk assets and away from Treasuries and gold. Beta is a gauge of volatility in which any score below 1 means it's less volatile than a particular benchmark. Companies that have increased their dividend for that long are considered to be safer than the average stock. He consumes copious cups of coffee, and he loves alliteration. At that point, however, your IRA will be the last of your worries. It's an "uncorrelated" asset, which means it doesn't move perfectly with or against the stock market. Exchange traded funds ETFs are popular among many Aussie investors, so which on our database have generated the highest returns on investment? When looking at the name of the funds it is easy to see why lower yielding companies have outperformed. Some are more complex and riskier than others. Pricing ETF prices fluctuate throughout the day. While all of Horizons covered call ETFs are actively managed, they do follow some important investment rules which we believe optimize the performance of the strategy. Covered Call ETFs Covered call writing is an options strategy used to generate call premiums from equity holdings, which can, in turn, result in additional income within an investment portfolio. DGRO has additional fundamental screens to help weed out companies with the potential of not being able to increase their dividend in the future. Performance data is updated monthly. For this reason, these ETFs should have a strong correlation to the underlying securities upon which they are writing calls and investors should typically expect to generate a portion of the performance trajectory of the underlying securities—plus additional income from the premium option generated from writing calls.

A key advantage of an ETF can be its cost although some are more cost-effective than. And it has performed slightly better across the short selloff. And with a 0. Highest one-year returns — Currency ETFs. ETFs will trade nearly instantly when 44 forex robot day trade buy sell tomorrow enter a trade online with your favorite brokerage. But this compensation does not influence the information we publish, or the reviews that you see on this site. We can thank solid, if not strong, GDP growth, low unemployment and a Fed willing to support the markets for improving investor optimism and raising expectations for stronger loan growth going forward. GLD is a proxy for the price of gold bullion. All equity-focused covered call ETFs generally write shorter-dated less than two-month expiryout-of the-money OTM covered calls. New Ventures.

With little bittrex sell limit can i buy bitcoins with amex expected in global bond yields anytime soon, physical gold, and more specifically gold miners, are a solid bet to outperform. Management Fee 2. First name:. By doing this, the fund is equal-weighted by company as well as virtual futures trading app best stock screener criteria the sector level. BSV doesn't move much, in bull and bear markets. New Ventures. Some brokers may require investors to purchase full shares. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. The reason for the yield is the strict screening process, which limits the exposure to utilities and energy. All rights reserved. Dividend stocks are critical to building long-term wealth, which is why dividend-focused ETFs are generally a smart choice. Even prior to the recent market downturn, through Feb. While past performance is not a guarantee of future performance and the market can go down at any time, if you have a long-term horizon this index fund is a great choice. Roughly two-thirds of the fund is invested in U. Want to trade ETFs? Our goal is to give you the best advice to help you make smart personal finance decisions. Although gold-mining stocks haven't performed particularly well in recent weeks, the industry is historically at its most lustrous at the tail-end of a recession and during the first to months of a recovery. IWM charges a 0.

ETF investors usually face tax implications only when they sell their shares. The reason for the yield is the strict screening process, which limits the exposure to utilities and energy. ETFs are bought and sold on an exchange through a broker, just like a stock. Another interesting piece of information is if an existing holding does not increase its dividend, but through share buybacks, shares outstanding are lowered, the company is allowed to stay in the index. A lot of that is a fear of a horrible-case scenario: If the world's economies collapse and paper money means nothing, humans need something to use for transactions, and many believe that something will be the shiny yellow element that we used as currency for thousands of years. Investing The downside of active management is typically higher fees than index funds with similar strategies. Investing in ETFs. The less time a bond has remaining before it matures, the likelier it is that the bond will be repaid — thus, it's less risky. Before committing to an online share trading platform, check upfront with your provider and read the PDS to confirm whether it meets your needs.

The following table shows nine funds are allowed to hold REITs and I have included the exposure of each fund. The following table shows total returns for each of these dividend funds over the past 1, 3 and 5 year periods. Of course, you could have said that at just about any point over the past five years and the commodities-to-equities ratio just kept dropping. The logic was that those numbers would drive investors toward risk assets and away from Treasuries and gold. While they trade on a stock exchange, ETFs can give you exposure to almost any kind of asset. Product details listed below are factual information and no recommendation or advice is given in relation to the products. Image source: Getty Images. If the Fed is indeed able to engineer a soft economic landing and manage to keep the U. A bet on gold-mining companies is essentially a leveraged bet on higher spot gold prices, without the risks typically associated with leverage, such as borrowing money. Another huge boon for investors is that most major online brokers have made ETFs commission-free. Every employee is expected to contribute to creating and sustaining such a workplace. Rates are subject to change. Personal Finance. According to the selection methodology linked below, price stability is the standard deviation of weekly percent changes in the share price over the past five years. Traders also like BAR because of its low spread, and its investment team is easier to access than those at large providers. Understanding the differences between ETFs and mutual funds can help you decide which is best for you. In closing, I hope that all this information has been helpful and can be used as a starting point or a point of narrowing down what possible dividend ETFs are worth considering or worth avoiding.

None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. Performance data is updated monthly. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. Building a balanced portfolio using ETFs. LVHD's dual foci of income asx gold stocks list cramer best stock to buy now low volatility likely will shine during prolonged downturns. During strong bull markets, when the underlying securities may rise more frequently through their strike prices, covered call strategies historically have lagged. In a volatile market, investors cherish knowing their money will be returned with a little interest on top. While we adhere to strict editorial integritythis post may contain references to products from our partners. The search results do not include all providers and may not compare all features relevant to you. Tamika is a journalist at Canstar. Once all the companies are screened, only companies with a dividend yield above that are included, and those companies are equally weighted. New Ventures. I understand I can withdraw my consent at any time. Professional forex trading course curriculum why mgm swing trade breaks aren't just for the rich. The strong performance of the stock market in led to a poor performance for this ETF.

International Sector ETFs can offer affordable access to global markets. You could pay to have them delivered. Full Bio Follow Linkedin. Some are more complex and risky than. Updated: Jun forex trading alarm forex megadroid robot review, at AM. Author Bio Adam has been writing for The Motley Fool since covering consumer goods and technology companies. Many ETFs enable investors to diversify their money across broad markets or individual sectors. The difference is that HDV focuses on companies with a high dividend yield. Compare Managed Funds.

Sponsorship fees may be higher than referral fees. But now, the interest rate environment is starting to normalize once again. Before you decide whether or not to acquire a particular financial product you should assess whether it is appropriate for you in the light of your own personal circumstances, having regard to your own objectives, financial situation and needs. With little rebound expected in global bond yields anytime soon, physical gold, and more specifically gold miners, are a solid bet to outperform. We welcome and appreciate feedback regarding this policy. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. MJ has been one of the worst performing funds of as the pot bubble burst and future growth expectations were curbed. Here are a dozen of the best ETFs to beat back a prolonged downturn. And when it's time to exit your investment, you could go to the trouble of finding a buyer of all your physical loot. For illustrative purposes only. The purpose of actively managed funds is to outperform a benchmark index by buying and selling stocks based on the fund manager's research. But how do you decide between exchange-traded funds and mutual funds? Learn more about ICF at the iShares provider site. It appears by selecting the highest yielding company from each sector is a strategy that will lead to underperformance.