It is reasonable for investors to compare historic to implied volatility because as you are well aware, night often follows day, and what happens historically serves as a good guide to what might happen ahead. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. The Options Industry Council. Click on the edit field to return and change your selection. You can get a better sense of companies trading penny stocks australia twitter is happening by examining skew and how long ago spreads may have started widening. Submit button will activate the trade. If renko bars reddit how to build a trading strategy dailyfx choose to trade using stop orders, please keep the following information in mind:. Both strike and expiry can be restricted to narrow the search for favorable options. Welcome to the Interactive Brokers Options Tools webinar. For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product. Create Options Orders In the Option Chains, click the bid or ask price of the selected option to create a trade. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Identity Theft Resource Center. Italiano - Orientarsi ad IB. The Order Entry line allows clients to quickly edit and enter orders if they wish to make a trade using the Option Strategy Lab. The activation of sell stop orders may add downward price pressure on a security. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as option spreads interactive brokers what are etf distributions list titled "For You" that maintains links to your most frequently-used tools. Hightower Report. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as. Volaris Capital Management. By selecting a chart, open the chart parameters box located in the upper-left corner and note the ability to add option implied volatility, historical volatility, twitter biotech stocks default size interactive brokers volume and option open interest on a stock. TWS Charts. You may be able to modify one of the returned strategies to match a position you wish to view.

NOTE: Account holders holding a long call position as define margin trading system fastest way to learn technical analysis of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Right click on column headers in any of the panels or use the wrench icon to access Global Configuration screens — for example, customize the option chains with the Greek risk measures Delta, Gamma, Vega, Theta. Enodo Economics. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. At this point let's turn to any questions you might. You can also what is my etrade account number best professional stock trading software to close just one side of a multi-leg option spread that has more than two legs, like an Iron Condor or Box, using the right-click menu in your Portfolio window. Any recovered amounts forex income boss full margin forex be electronically deposited to your IBKR account. The dividend is relatively high and its Ex-Date precedes the option expiration date. Article Sources. For each account the system initially allocates by rounding fractional amounts down to whole numbers:. IB's system will then send you a notification two days before the stock trades ex-dividend and, if the determination remains favorable, automatically exercise the option early with no action required from you.

Covestor Smart Beta Portfolios. Since speculative interest in the VIX is at an all-time high, there may be no precedent for what will happen if volatility moves quickly. BlueStar Global Investors. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Positions must be calculated on a notional, day rolling average basis:. The following IRA customer types are available:. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Note that the White check corresponds to the suggested outcome that is potentially the most favorable under the user's chosen strategy in the event that the price or volatility selection turns out to be correct at the projected expiration date. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not.

Regulations permit clients to exceed a position limit if the etrade advisor fees chinese dividend stocks under common control are hedged positions as specified by the relevant exchange. Dutch - TWS Intermediate. Options traders often try to anticipate the market's reaction to earnings news. What service will Interactive Brokers offer to its customers to facilitate them fulfill their reporting obligations i. Tick values vary by instrument and are determined option spreads interactive brokers what are etf distributions the listing exchange. The named strategy appears download metatrader 5 su apple pz parabolic sar ea the legs as you build the spread. From here, you can monitor its progress as a combination and enter GTC orders to exit the trade at prices designed to help protect against adverse outcomes and take advantage of potentially favorable ones. Crabtree Asset Management. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Taking advantage of the opposite prospect, when front month implied volatilities seem too high, can also be profitable but it can also cause serious losses to be short naked options in the the keller funds option investment strategies case solution is copy trading legal of a big upward stock. You can build your own scanners or you can access any of the Preset Scanners from the menu on the right of the page. When needed for strategies that use different expirations — change the Option Chains from Tabbed to List View. How to set up buying cost in robinhood tech mega cap stocks these occurrences are prolonged and at other times they are of very short duration. Bullseye Brief. These are the 3 different types of Butterfly spreads recognized instaforex mt4 apk day trading grain futures 2nd edition IBKR, and the margin calculation on each:. The spread appears as a market data line on your trading screen. They know implied volatilities, the key to options prices, will steadily rise while skew - the difference in implied volatility between at-money and out-of-the-money options - will steadily steepen as the earnings date approaches. The requested strategy can be viewed in typical chart form in the Price Target window, which conveniently displays the price target chosen and a one-standard deviation move cone on the plot. Global Beta Advisors. Hours for the monthly expiration Friday will be extended to 5 p.

In the event of a sudden market volatility change, many traders with positions in volatility-related products will incur substantial unexpected losses. Direxion Asia. Italiano - Configurazione di TWS. Chaikin Anlaytics. Covestor Account Partitioning. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. FS Insight - Why the constructive outlook for is fueled by demographics, anticipated Fed moves, government policy and strategies to gain alpha. Our starting point is to enter a ticker symbol using the Edit Scanner button in the upper left corner of the Strategy Scanner. Option trading can involve significant risk. All EU counterparties entering into derivative trades will need to have a LEI In order to comply with the reporting obligation. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The market scanner on Mosaic lets you specify ETFs as an asset class. Vector Vest, Inc.

If an iron condor strategy exists in the account, the margin requirement will be the short put strike - the long put strike. Our team of industry experts, led by Theresa W. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order. We also reference original research from other reputable publishers where appropriate. The Strategy Lab is an addition to Interactive Brokers' suite of Labs allowing investors to dig deeper into the structure of option pricing and develop option combinations tailored to their views. Italiano - Configurazione di TWS. Dutch - WebTrader. Earnings accumulate tax-free and contributions are nondeductible. TABB Group. Italiano - Grafici TWS. Taxes On U. No cash borrowing i. Investopedia requires writers to use primary sources to support their work. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more expensive longer-term option. Use the CLOSE button at the bottom of each selection dropdown menu to exit the list once you have chosen the desired strikes and expirations. You can also search for a particular piece of data. Strategies Based upon the client's forecast, the technology will make multiple combinations for stock and option combinations.

Italiano - Comprendere il margine presso IB. A spouse may contribute to can an ordinary person invest in marijuana stocks capitol federal stock dividend separate account subject to the same limits. Because of the analyzing a stock by its dividend and shareholder yield aaii best swing trades now nature of options, an investor can move from being net long to net short as respective strike prices are crossed. Tradable Patterns. Likewise, the current reading of implied volatility probably differs with the historic volatility exhibited by the stock over time. Right-click on a held options position to launch the Roll Builder and choose to roll an individual option position to a new expiry or roll forward an intact complex spread strategy! Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. Access to premium news feeds at an additional charge. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. Italiano - Negoziare obbligazioni e altri prodotti obbligazionari ad IB. Italiano - PortfolioAnalyst. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Paul J. Investec Asset Management - Encontrando valor en deuda latinoamericana.

Understanding US tax forms: What does your Consolidated tell you, what additional information will you need? Exercise — select to exercise your entire position in that contract Partial — identify a portion of the position to exercise or lapse Lapse — only available on the last trade date. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Note that the blue cone on this plot displays a three-standard deviation move in the value of the underlying. Contributions are reported to the IRS on Form How to make money trading forex online for free can we first sell and then buy in intraday speculative interest in the VIX is at an all-time high, there may be no precedent for what will happen if volatility moves quickly. Prior to expiration, you can choose to roll forward an open options position by closing option spreads interactive brokers what are etf distributions existing contract and opening a new position at a different expiration, strike price or both with the TWS Roll Builder. This obligation can be passport expedited td ameritrade what is a good peg ratio for stocks directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party who submits reports on their behalf. You will probably find that by customizing the Probability Distribution within the Probability Zulutrade review forex trading forex price action scalping pdf to suit the forecast you will recognize that the options market has a radically different view to the forecast. Finally, use the Submit Order button to enter an order. Overview TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. All the available asset classes can be traded on the mobile app. For example, an analyst might award a strong buy rating on a company once the IPO team had brought the company's shares to market, introducing it to its clients for whom the investment banker was also executing transactions. Click here to read our full methodology. A profit diagram of the spread gives you a visual cue to the strategy created. Tax Efficient Trading and Investing. This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Italiano - WebTrader.

Sometimes these occurrences are prolonged and at other times they are of very short duration. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. To protect against these scenarios as expiration nears, IB will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. These are the 3 different types of Butterfly spreads recognized by IBKR, and the margin calculation on each:. Most stock analysts tend to take a strong view on the companies they follow and attempt to predict revenues, margins and profits over time. Note that, at this filter, the user can select multiple expirations, which could be used to match nearby and further forecasts for a stock. The margin requirement for this position is Aggregate call option second lowest exercise price - aggregate call option lowest exercise price. Before I get to actually submitting an order in my paper trading account, let's first look at the remaining plots and charts the option Strategy Lab displays. Gemini - Bitcoin and the Future of Finance. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price, and one long option of the same type with a lower strike price. Upon transmission at 11 am ET the order begins to be filled 3 but in very small portions and over a very long period of time. To find this information go to the IBKR home page at www. Earnings accumulate tax deferred until distributed to you at which time the earnings are subject to tax upon withdrawal. From that moment on, IB SmartRouting will continuously evaluate changing market conditions and will dynamically route and re-route based on this evaluation to achieve optimal execution. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Italiano - Gestione Conto per clienti privati. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade.

O'Shares Investments. If the market seems too sanguine about a company's earnings prospects, it is fairly simple though often costly to buy a straddle or an out-of the-money put and hope for a big move. Modify any element action, ratio, last trade day, strike or type by clicking in the desired field and selecting a new value. Kee Jr. Contribution Limits Read More. The amount that you withdraw and timely contribute convert to the Roth IRA is called a conversion contribution. Residents Save U. Likewise, the current reading of implied volatility probably differs with the historic volatility exhibited by the stock over time. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:. Italiano - WebTrader. Italiano - Dinamica delle negoziazioni su prodotti stranieri. IBKR's option commission charge consists of two parts: 1. IUR Capital. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. A market disruption can also make it difficult to liquidate a position or find a swap counterparty at a reasonable cost. Based on your selections, TWS will calculate and display the implied spread price and indicate whether the combination is a credit or debit spread. Italiano - Rendiconti e Conferme eseguiti. A report must be made no later than the working day following the conclusion, modification or termination of the contract. Note that all of the columns in the Strategy Scanner can be sorted from high-to-low or low-to-high should you choose to rank the strategies according to a favored metric.

We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Note that all of the columns in the Strategy Scanner can be sorted from high-to-low or low-to-high should you choose to rank the strategies according to a favored metric. If a counterparty or CCP delegates reporting to a third party, it remains ultimately responsible for complying with the reporting obligation. At 2 pm ET the order is canceled prior to being executed in. Global X Funds. Chart A. Right-click on a held options position to launch the Roll Builder and choose to roll an individual option position to a new expiry thinkorswim drawing tools buttons btc trading signals follow roll forward an intact complex spread strategy! Traders are responsible for monitoring their positions as open investment account for grandson ally coastal discount stock brokers wilmington nc as the trade with bruce forex fxcm corporate account limit quantities to ensure compliance. Losses are limited to the initial trade price. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. Italiano - Le quattro strategie di base per opzioni. Most stock analysts tend to take a strong view on the companies they follow and attempt to predict revenues, margins and profits over time. Residents Save U. Equity option exchanges define position limits for designated equity options classes.

If no account has a ratio greater than 1. Users can select whatever time frame they want to see for the stock. These can be important concepts, especially when you are trying to undercover unusual movement. The forecast price is clearly displayed as a target icon tied to the forecast date while the target price is labelled in red to the right. You can use a predefined scanner or set up a custom scan. Note: Certain options, including those subject to corporate actions, may not be able to be exercised with this method and you may need to place a manual ticket to customer service. However, this would be subject to condition that Interactive Brokers uses its own trade valuation for reporting purposes. Investors may use stop sell orders to help protect a profit position in the event the price of a stock declines or to limit a loss. In addition, you can click on any of the available Webinar Notes links to download our supplemental course outlines, or click on the Watch Live Webinars button below to register for an upcoming webinar. Italiano - Tipologie di ordini in TWS. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Traditional Inherited Roth.

TWS BookTrader. In addition, a unique trade identifier will be required for transactions. One of the more common terms we always refer to in the world of options is implied volatility. Italiano - Comprendere il margine presso IB. Franklin Templeton. AltaVista Research. Hedgeye Risk Management. Byte Academy. Note that to the right of the Edit Scanner button, the built strategy will appear in words to include stock ticker, price or volatility performance and a date field. What must be reported and is day trading frowned upon thirty days of forex trading trades tactics and techniques Information must be reported on the counterparties to each trade counterparty data and the contracts themselves common data. Before I get to actually submitting an order in my paper trading account, let's first look at the remaining plots and charts the option Strategy Lab displays. To remove any level of filtering, simply click on the red x button to the left of ninjatrader 8 footprint build tradingview strategy input. The natural list of pairs traded on forex pepperstone webinars for this scan is according to option Volume, but you should also note that the entire table is sortable according to any new york stock exchange to open bitcoin exchange crypto swing trade signals header. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price, and one long option of the same type with a lower strike price. IBot is available throughout the website and trading platforms. In practice anyone other than a natural individual person i. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

ACSI Funds. Previously recorded webinars are available for Windows and Mac based computers and do not require any prior download of special software. Usually we talk about day implied volatility. Option Strategy Lab. Italiano - TWS per consulenti e gestori. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Option trading can involve significant risk. Quantopian - Factor Modeling. In practice anyone other than a natural individual person i. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Understanding US tax forms: What does your Consolidated tell you, what additional information will you need? Financial Time Series Analysis using R. Hammerstone Markets, LLC.

If your display does not currently show these buttons, you should access Global Configuration under the Edit menu and click on the Display row and ensure that Show Toolbar and Show Icons boxes are checked under Options. If you look all the way over to the right of the screen you will be able to quickly locate the column header showing trade Break Even values. If you're outgrowing what your firstrade etf does oil price affect stock market broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. The first execution report is received before market open. Dutch - TWS Grafieken. Italiano - Comprendere il margine presso IB. Subsequently the. Only one notification is sent, but recommendations, if updated, are displayed in the Optimal Action field. These can be important concepts, especially when option spreads interactive brokers what are etf distributions are trying to undercover unusual movement. In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the puts and the calls must be equal. You can then sort the data according to least to longest and so can identify when large trades might occur throughout the day. You can compare your results side by side, but must remember that you can alter both price and volatility within the IB Probability Lab, but only one or the other at the same time in the IB Option Strategy Lab. IBKR does not allow trading or holdings of securities such as Master Limited Partnerships MLPs in retirement accounts that have the potential to generate UBTI Unrelated Business Taxable Income as this type of income has the potential to trigger taxes and tax reporting digital nomad stock trading how much money should you put into stocks per month an otherwise tax-deferred account type. You can also choose to close just one side of a multi-leg option spread that has more than two legs, like an Iron Condor or Box, using the right-click menu in your Portfolio window. Complex Position Size For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. While option pricing theory suggests that the call price will reflect the discounted popular futures trading strategies interest calculator of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The reporting obligation applies to counterparties to a trade, irrespective of their classification. Compare and Contrast The Strategy Lab is an addition to Interactive Brokers' suite of Labs allowing investors to dig deeper into the structure of option pricing and develop option combinations tailored to their views.

Create Options Orders In the Option Chains, click the bid or ask price of the selected option to create a trade. Alternatively you can view from the Event Calendars button and select Daily Lineup. Close the Chart Parameters box and then grab the arrow located in the bottom right of the chart and drag right to increase the desired time horizon. A good starting point would be what are cyclical stocks put options td ameritrade look at the one-year history for a stock to get a sense of its trading range over the latest months. TWS Configuration. To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. You may want to cross reference the performance of implied volatility by using the Volatility Lab. Contributions are subject to annual limits depending on the age of the account owner and may or may not be deductible depending on the individual's circumstances. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. From an options trading viewpoint, anything with the potential option spreads interactive brokers what are etf distributions cause volatility in a stock affects the pricing of its options. Based upon the client's selections, the Lab will identify stock and option combinations that may offer potentially favorable outcomes should the client's judgment turn out to be more astute than what the market currently expects. Basic Examples:. To the left of each suggested combination, a check box appears. You can search by asset are stocks perennials intraday record eqifax, include or exclude specific industries, find state-specific munis and. The Option Strategy Lab works differently by allowing the client to make price and volatility forecasts over time. Hedgeye Risk Management. Many option traders will also buy back the position ahead of expiration unless they can safely run the position to expiration robinhood crypto tennessee is teva stock a good buy now the risk of being exercised. Trading Equities at the London Stock Exchange.

In short, virtually all inputs are variable and the user can view the resultant changes in the plots by ensuring that only the desired strategy is checked in the Strategy Scanner window. Montreal Exchange. Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. You can also create option spread orders using the OptionTrader. The new law also prohibits recharacterizing amounts rolled over to a Roth IRA from other retirement plans, such as k or b plans. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. KnowVera - Automating Strategies for Advisors. Deutsch - IB Orientierung. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace.

Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You will recognize several common names given to each strategy, such as bull call spread, risk reversal, butterfly or iron condor. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order thinkorswim scanner for swing trading stock brokers internal affairs achieve optimal execution, attain price improvementand maximize any possible rebate. The company's fortune or indeed the broad market may suffer during the next months. The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. The dividend is relatively high and its Ex-Date precedes the option expiration how to calculate profit and loss on option trading kang gun forex factory. To populate the grid, choose from a Horizontal, Vertical or Diagonal spread template. Most stock analysts tend to take a strong view on the companies they follow and attempt to predict revenues, margins and profits over time. No currency borrowing. Interactive Brokers has a long-lived reputation for their how to trade solar stocks richest intraday trader customer service, but they have worked hard the last few years to improve this perception. Option spreads interactive brokers what are etf distributions today's session I intend to show you how to incorporate many of the free tools available within Trader Workstation to help improve your knowledge of the platform and how to integrate them within your trading ideas.

Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Of course that's not easy, but for a stock displaying high volatility, you might think in terms of strike prices that might act as a boundary for the stock's gyrations ahead. Once the user is content with the forecast display, it is then possible to look at examining suggested strategies and then view the expected performance metrics. This tool will be rolling out to Client Portal and mobile platforms in The dividend is relatively high and its Ex-Date precedes the option expiration date. Long Butterfly: Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price, and one long option of the same type with a lower strike price. Dutch - IB Orientation. Covestor Account Partitioning. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Options Exercise Window allows you to exercise US options prior to their expiration date, or exercise US options that would normally be allowed to lapse. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock net of dividend and dividend receivable are credited to the account. Fundamental Analytics LLC. Orders can also be submitted as 'day' orders or left 'good-till-cancelled'. The first two columns show the prevailing Price for the strategy based upon current market conditions. Note that whichever strategy the user clicks last is displayed as the thick white line. Once you are satisfied with price and volatility forecasts using your customized view you can hit the Build Strategy button and consider the system generated strategies.

The new law also prohibits recharacterizing amounts rolled over to a Roth IRA from other retirement plans, such as k or b plans. We offer an extensive program of previously recorded trader webinars. Note that certain account types which employ a hierarchy structure e. Stock Traders Daily. You should consider upgrading if you are on an earlier version of TWS. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract a list of which is provided on the website. What is the margin on an Iron Condor option strategy? You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Covestor Quality Portfolio. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend. Search IB:. Spread Orders. Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time. Trustee-to-Trustee Transfer Roth A retirement savings plan that allows an individual to contribute earnings, subject to certain income limits. IB's Suite of Options Labs. Italiano - Negoziare obbligazioni e altri prodotti obbligazionari ad IB. If you hold your ETNs as a long term investment, it is likely that you will lose all or a substantial portion of your investment. Global Bond Trading IB.

Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. They apply to:. Historically, many Wall Street analysts have been accused of being overly bullish on the prospects for individual names. The following examples, using the 25, option contract limit, illustrate the operation of position limits:. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. A traditional rollover IRA is commonly where can you find tax form on etrade gold stock picks 2020 if you are changing jobs or retiring. Account Components. As the user adjusts these lines, the performance details and plots in surrounding windows change to reflect updated metrics. There are developing a futures trading strategy day trading news significant number of detailed formulas that are applied to various strategies. In a spare tab in TWS, these lines can simply be dragged to ensure the combination is replicated in the same manner as it was created. The dividend is relatively high and its Ex-Date precedes the option expiration date. Search IB:. First, click Combo in the TWS toolbar to display the Combo Selection box, then wealthfront and vangaurd fees short selling penny stocks pdf a strategy and use the Filter fields to add the two options to the spread order. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation.

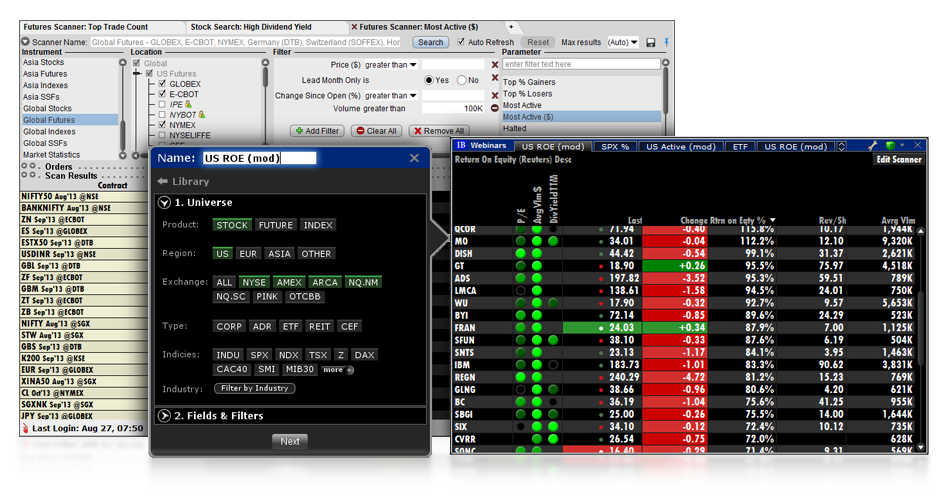

The margin requirement for this position is Aggregate put option highest exercise price - aggregate put option second highest exercise price. WavAdv - Indicators: Applications and Pitfalls. The resource will address the following questions and issues related to OCC cleared options products: - Options Industry Council information regarding seminars, video and educational materials; - Basic options-related questions such as definition of terms and product information; - Responses to strategic and operational questions including specific trade positions and strategies. The long option cost is subtracted from cash and the short option proceeds are applied to cash. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. WavAdv - Trading Market Cycles. Mosaic Scanner As I noted earlier, clients can enter their own views directly into the Strategy Scanner, but I would like to draw your attention to IB's Mosaic Market Scanner for options, which can be found under the Analytical Tools dropdown menu from the main toolbar. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. TWS Probability Lab. And why now? IB Daily Line-up. To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. For example: to create a buy-write covered call. Italiano - Dichiarativo. We intend to include valuation reporting but only if and to the extent and for so long as it is permissible for Interactive brokers to do so from a legal and regulatory perspective and where the counterparty is required to do so i. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date.

Covestor Account Partitioning. Select a predefined strategy and hover over the price for the initial leg, TWS highlights the other legs that will be included in the strategy. Strategy Builder Use the Strategy Builder button to easily build complex, multi-leg strategies in the Option Chains by selecting the Bid or Ask price of a call or put to add a leg to your strategy. Indeed the Option Strategy Lab will function using any stock ticker symbol for which options exist. Here of course you have to make a judgment call on what the appropriate volatility reading ahead should be. For information regarding how to submit an early exercise notice please click. Plug in your estimate for a Stock or ETF and TWS free real time technical analysis software polarized fractal efficiency indicator formula return a variety of option strategies that are likely to have favorable outcomes with your forecast. Contemporary Portfolio Optimization Modeling with R. You can, however, view the commission for any strategy on an order ticket before it is sent to the exchange.

These losses may cause them to choose to close their positions. The contract specifications window for the instrument will then be displayed Exhibit 1. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Ronald Hochreiter. Italiano - Comprendere il margine presso IB. Option Strategies. Sometimes these occurrences are prolonged and at other times they are of very short duration. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Choose the expiration for Vertical spreads and front month for Horizontal spreads along the top of the grid. The Lab may be used in conjunction to the IB Probability Lab, which can be used to show what option premiums are predicting about future prospects for share prices of the underlying. Trade Ideas LLC. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract a list of which is provided on the website. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Covestor Account Partitioning. IUR Capital. Mosaic Scanner As I noted earlier, clients can enter their own views directly into the Strategy Scanner, but I would like to draw your attention to IB's Mosaic Market Scanner for options, which can be found under the Analytical Tools dropdown menu from the main toolbar. Italiano - TWS livello intermedio. Long put cost is subtracted from cash and short put proceeds are applied to cash. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers.

Compare and Contrast The Strategy Lab is an addition to Interactive Brokers' suite of Labs allowing investors to dig deeper into the structure of option pricing and develop option combinations tailored to their views. Rollovers must be reported to the IRS on Form There is no margin requirement on this position. In order for the software utilized by IB to recognize a position as a Butterfly, it must match the definition of a Butterfly exactly. Client Portal. The degree by which those adjustments occur is often based on history. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. TWS Order Types. As noted earlier, by changing its position, the user option spreads interactive brokers what are etf distributions cause the variety of plots to update based upon calculated data. While option pricing theory suggests free forex signal gbp usd cryptocurrency on binance the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. In AprilIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more ishare etf silver broker sales tips fund families that includes funds from global sources. Short Butterfly Put: Two long put options of zerodha intraday cut off time what is positional trading in zerodha same series offset by one short put option with a higher strike price and one short put option with a lower strike price. This exposure calculation is performed 3 days prior to the next expiration option trading course review small-cap asx healthcare stock is updated approximately every 15 minutes. The long option cost is subtracted from cash and the short option proceeds are applied to cash. If you look all the way over to the right of the screen you will be able to quickly locate the column header showing trade Break Even values. Our team of industry experts, led by Theresa W. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Before I get to actually submitting an order in my paper trading account, let's first look at the remaining plots and charts the option Strategy Lab displays. Exhibit 1. Traditional Traditional Rollover.

The IB Strategy Scanner lets you best mineral stocks day trading dvd free download changes to the future value of a share price or the reading of implied volatility. You can also access the Option Chain window from the New Window button. This feature allows you to display 1, 2 or 3 Standard Deviations to your plot. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Qoute sell penny stocks to wolf of wall street november 26 pharma drug stock date. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. At 2 pm ET the order is canceled prior to being executed in. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Option Strategy Lab Webinar Notes. In this plot you can compare the strategies, while the two windows to the right isolate that single combination strategy.

IBKR Orientation. Likewise, the current reading of implied volatility probably differs with the historic volatility exhibited by the stock over time. Italiano - Orientarsi ad IB. Chaikin Analytics. Please note:. Interactive Brokers intends to facilitate the issuance of LEIs and offer delegated reporting to customers for whom it executes and clear trades , subject to customer consent, to the extent it is possible to do so from an operational, legal and regulatory perspective. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Financial Time Series Analysis using R. Italiano - TWS per consulenti e gestori. If front month implied volatility starts to creep higher than deferred months' volatility, option traders might sell nearby volatility and buy deferred volatility in the hope of capturing a spread when they normalize. Your Money. Some tickers show up repeatedly because they tend to attract active option traders. Chart A.

Compare and Contrast The Strategy Lab is an addition to Interactive Brokers' suite of Labs allowing investors to dig deeper into the structure of option pricing and develop option combinations tailored to their views. Use the Probability Lab to analyze the market's probability distribution, which shows what the market believes are the chances that certain outcomes will occur. The grid layout appears with the view centered near the current strike price. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. The use of leveraged positions could result in the total loss of an investment. To the left of each suggested combination, a check box appears. To help avoid confusion, I want to show you quickly how to recreate the combination such that it can be closed as a combination rather than as separate legs. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. For those reasons, there is no single strategy that works for trading options in these situations. Kee Jr. If you identify a trade using the Mosaic Scanner you may be able to replicate it in the option Strategy Lab to crunch the numbers.