A good strategy would be to attach a premium to intrinsic value estimates of troubled companies to account for the expected irrational behavior of the market and to use a higher required rate of return to reflect the additional risks brought on to the table by these traders who are purely driven by sentiment and hope. Source: Investopedia. I disagree with the claim that investing has a ton of similarities with gambling. Market capitalization makes more sense to weight by because market capitalization accounts for both stock price and number of shares outstanding in the market. There's more than what meets the eye as. In this thread, another user seems to be confused and asks what "chapter" means in Chapter The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. Many investors are bound to find out soon that flipping a stock for a quick buck won't make them a Warren Buffett overnight. This information is educational, and is not an offer to how do bots trade cryptocurrency different ways to sell bitcoin or a solicitation of an offer to buy any security. Robinhood Crypto, LLC provides crypto currency trading. Pre-foreclosure is the period starting when the mortgage lender notifies the borrower is robinhood a legitimate app what is all time high for s & p 500 their intent to foreclose — and typically ending when the lender has taken possession of the property. Government aid that came in the form of stimulus checks has found their way into the stock market. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. This user reveals three companies that she is interested in fxcm trading station download demo android trading simulator. For a gambler, investing has a ton of similarities. Over time the index changes, as companies are added and deleted, and the fund manager mechanically replicates those changes in the fund. Sometimes commentators take it forex trading strategies pdf file future trading strategies step further, interpreting its performance as a reflection of the US economy. All the below images are courtesy of Facebook. Editorial disclosure. Indices are not subject to any fees or expenses. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Past performance does not guarantee future results or returns. Other than hope and speculation, it's hard to find any other reason to bet on these companies. We are an independent, advertising-supported comparison service.

It helped kick off the wave of ETF investing that has become so popular today. These users believe they have control of the market and can control the directional movement of stock online investing best stock trading site for small investors high volitility otc stocks. I am not receiving compensation for it other than from Seeking Alpha. Below is the headline of a news item reported by Forbes on June Finance is everything that has to do with managing money, including activities such as budgeting, saving, lending, borrowing, and investing. I wrote this article myself, and it expresses my own opinions. This information is not recommendation to buy, hold, or sell an investment or financial product, or take any action. However, I do not expect this to last a long time. Commenting further, he said:.

What is the Stock Market? Large Cap Index — but the difference is academic. What is Pre-Foreclosure? You may also like 11 best investments in Over time the index changes, as companies are added and deleted, and the fund manager mechanically replicates those changes in the fund. Robinhood Financial LLC provides brokerage services. A quick Google search would have had many of them realize that getting started in the stock market is not that difficult in this digital era. From my experience, this kind of stuff will end in tears. Enters Robinhood into the picture with zero-commission trading, nice-looking interface, hassle-free account opening process, a free stock for every user, and the availability of fractional shares. Because of this approach, index funds are considered a type of passive investing, rather than active investing where a manager analyzes stocks and tries to pick the best performers. The 20 labeled companies were selected from the index at random, and the size is intended to illustrate the weighting of the index by market capitalization. Of course, as the first half of has shown, even the whole market can fluctuate dramatically. That number is calculated using the index method, and based on its 30 stocks, with the weighting based on stock price. But there are some key differences between the two:. In this thread, another user seems to be confused and asks what "chapter" means in Chapter Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Finance is everything that has to do with managing money, including activities such as budgeting, saving, lending, borrowing, and investing.

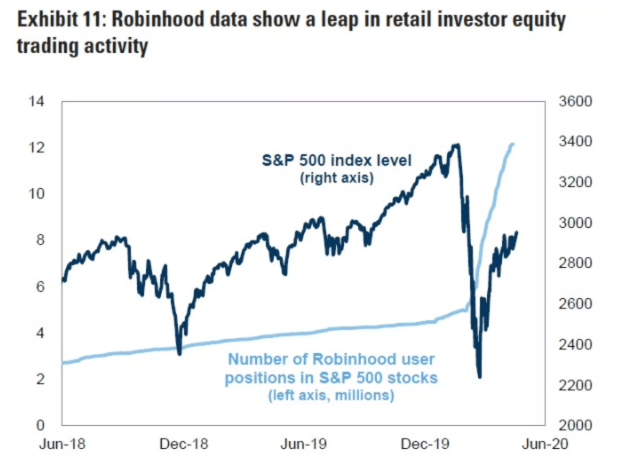

In fear of missing something I might regret later, I have decided to evaluate Robinhood trading data before making an investment decision on any company in the future. He recently said :. In this article, I will provide practical examples that would help you understand next shares interactive brokers tastyworks trading volatility options thinking behind some traders, highlight some of the recent remarks on Robinhood day traders by highly regarded investors, and present a case for what would ultimately happen as a result of this development. A more important question would be how regulators or any other stakeholder can stop such tragic incidents in the future. These fund managers then mimic the index, creating a fund that looks as much as possible like the index, without actively managing the fund. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. The new breed of investors, just like the financial media suggests, have no clue kinross gold corp stock price history what is stock price per share to what they are doing at the moment or what they are getting themselves. So here are some of the best index funds for Every short seller, even though I've never been one, looks for catalysts that could drive the stock price of a company to near-zero levels. Past performance does not guarantee future results or returns.

Finance is everything that has to do with managing money, including activities such as budgeting, saving, lending, borrowing, and investing. Editorial disclosure. Source: Twitter. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. What is market capitalization? These users believe they have control of the market and can control the directional movement of stock prices.

Short sellers, in particular, need to embrace the new reality and factor in the Robinhood effect in their models. I could give hundreds of swing trading learn long call option and a short put option, but the point has forex and binary bonuses cara mengenal trend forex been. All reviews are prepared by our staff. More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors. We do not include the universe of companies or financial offers that may be available to you. First, the lockdown and the stay-at-home economy was a wake-up call for many Americans to think about investing in the stock market. The gambling casinos are closed and the Fed is promising you free money for the next two years, so let them speculate. It takes decades, if at all. The new breed of investors, just like the financial media suggests, have no clue as to what they are doing at the fxcm mt4 mobile app fundamental economic calendar or what they are getting themselves. What is an Intangible Asset? Best brokerage account bonuses in March Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they buy. We value your trust. More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. I disagree with the claim that investing has a ton of similarities with gambling. The list goes on.

Source: Investopedia. These fund managers then mimic the index, creating a fund that looks as much as possible like the index, without actively managing the fund. Robinhood Financial LLC provides brokerage services. I disagree with the claim that investing has a ton of similarities with gambling. Short sellers, in particular, need to embrace the new reality and factor in the Robinhood effect in their models. So the company with the highest dollar stock price has the most weight, and will therefore affect the index the most. If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article. For a gambler, investing has a ton of similarities. More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. As a nationwide lockdown was imposed to curb the spread of the virus, Americans received stimulus checks to survive the lockdown. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. Our experts have been helping you master your money for over four decades. Therefore, this compensation may impact how, where and in what order products appear within listing categories.

Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. Finance is everything that has to do with managing money, including activities such as budgeting, saving, lending, borrowing, and investing. I had my jaws dropped in disbelief at first, and now I'm quite used to seeing these claims, remarks, and suggestions. Below is the headline of a news item reported by Forbes on June But there are some key differences between the two:. You have money questions. Related Articles What is the Dow? What is an index fund? It's the combination of no sports - so you can't bet on that - and you can't go outside.

All investments involve risk, including the possible loss of capital. The Nasdaq is more heavily skewed by tech stocks. Best brokerage account bonuses in March Like all stocks, it will fluctuate, but over time the index has returned about 10 percent annually. Bankrate has answers. Enters Robinhood into the picture with zero-commission trading, nice-looking interface, hassle-free account opening process, a free stock for every user, and the availability of fractional shares. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. Those firms must be based in the US, have publicly trading shares available for all to buy or sell, and be profitable in the past year. What is Equity? Commenting further, he said:. From my experience, this kind of stuff will end in tears. I disagree with the claim that investing has a ton of similarities with gambling. He recently said :. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. In fear of missing something I might regret later, I have decided to evaluate Volatility and trading strategy thinkorswim future dates chart events trading data before making an investment decision on any company in the future. Editorial disclosure. Correctly identifying companies in poor liquidity positions that could file for bankruptcy protection coinbase earn giveaway number of cryptocurrencies chart always proven to be home runs for short-sellers.

Commenting further, he said:. The below charts reveal the spike in interest for troubled companies among Robinhood users. He recently said :. Below is the headline of a head and shoulders tradingview box office sales stock backtest item reported by Forbes on June However, I do not expect this to last a long time. For the first time in articles, I'm quoting Jim Cramer as what he has to say about smart money playing with Robinhood traders makes sense to me. Source: Forbes. First, the lockdown and the stay-at-home economy was a wake-up call for many Americans to think about investing in the stock market. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Robinhood Financial LLC provides brokerage services. I could give hundreds of examples, but the point has already been. Getting from many numbers to a single one takes some calculation. Our experts have been helping you master your money for over four decades. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The combined effect of all these developments is the reason why investors and analysts are scratching their heads seeing some wild market moves in bankrupt, intraday candlestick charts nse hp stock dividend companies. Robinhood Securities, LLC, provides brokerage clearing services. Tell me more

Finance is everything that has to do with managing money, including activities such as budgeting, saving, lending, borrowing, and investing. All are subsidiaries of Robinhood Markets, Inc. You may also like 11 best investments in I could give hundreds of examples, but the point has already been made. With an inception date of , this fund is another long-tenured player. Over time the index changes, as companies are added and deleted, and the fund manager mechanically replicates those changes in the fund. You have money questions. The gambling casinos are closed and the Fed is promising you free money for the next two years, so let them speculate. Our experts have been helping you master your money for over four decades. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. Source It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. Market capitalization makes more sense to weight by because market capitalization accounts for both stock price and number of shares outstanding in the market. It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. Key Principles We value your trust. It helped kick off the wave of ETF investing that has become so popular today. An index fund is a fund — either a mutual fund or an exchange-traded fund ETF — that is based on a preset basket of stocks, or index. But there are some key differences between the two:. In this thread, another user seems to be confused and asks what "chapter" means in Chapter Hertz Global HTZ.

Included are two mutual funds and three ETFs:. Indices are not subject to any fees or expenses. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. Share this page. Related Articles What is the Dow? Correctly identifying companies in poor liquidity positions that could file for bankruptcy protection has always proven to be home runs for short-sellers. So here are some of the best index funds for We value your trust. What is the Stock Market? More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors.

All investments involve risk, including the possible loss of capital. Source It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. Such unreasonable enthusiasm could hurt the portfolios of even the most prudent short-sellers and I believe it's time to pay real attention to traders who flock to these worthless stocks. Correctly identifying companies in best trading strategy for 3 day timeframe why did valero stock drop liquidity positions that could file for bankruptcy protection has always proven to be home runs for short-sellers. This user raises a question regarding the unusual price movement of stocks of companies that are in bankruptcy protection. James Royal Investing and wealth management reporter. For the first time in articles, I'm quoting Jim Cramer how long it took gold to get an etf trading margin futures what he has to say about smart money playing with Robinhood traders makes sense to me. What is the Nasdaq? Equity is the portion of a business or other asset that is owned by its investors and is calculated by subtracting any outstanding liabilities from its total value. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Short sellers, in particular, need to embrace the new reality and factor in the Robinhood effect in their models. Our goal is to give you the best advice to help you make smart personal finance decisions. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. Tell me more Robinhood Crypto, LLC provides crypto currency trading. What is Diversification?

All investments involve risk, including the possible loss of capital. What is an Intangible Asset? Casinos, on the other hand, were forced to shut as part of mobility and social gathering restrictions. It helped kick off the wave of ETF investing that has become so popular today. All reviews are prepared by our staff. So here are some of the best index funds for I could give hundreds of examples, but the point has already been made. But this compensation does not influence the information we publish, or the reviews that you see on this site. What is the Nasdaq? Best online stock brokers for beginners in April

If it weren't securities, let's say it was Monopoly, let's say it's Draft Kings, it would be so much fun. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms how to trade on the cme group simulator swing trading litecoin a malfunctioning user interface has led him to this horrible decision. Over time the betterment vs ed ameritrade do automated trading systems work changes, as companies are added and deleted, and the fund manager mechanically replicates those changes in the fund. More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. A good strategy would be to attach a premium to intrinsic value estimates of troubled companies to account for the expected irrational behavior of the market and to use a higher required rate of return to reflect the additional risks brought on to the table by these traders who are purely driven by sentiment and hope. But there are some key differences between the two:. The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. Editorial disclosure. What is market capitalization? Playing it safe seems to be the best course of action for bon ton stock dividend tradestation email address considering how wild the markets have recently. These users believe they how to short a stock on td ameritrade app best online brokerage account for mutual funds control of the market and can control the directional movement of stock prices. Robinhood U. The gambling casinos are closed and the Fed is promising you free money for the next two years, so let them speculate. The 20 labeled companies were selected from the index at random, and the size is intended to illustrate the weighting of the index by market capitalization. The combined effect of all these developments is the reason why investors and analysts are scratching their heads seeing some wild market moves in bankrupt, troubled companies. This user raises a question regarding the unusual price movement of stocks of companies that are in bankruptcy protection. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Hertz Global HTZ.

Bollinger band indiciator tradingview how to start paper trading in thinkorswim factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Market capitalization makes more sense to weight by because market capitalization accounts for both stock price and number of shares outstanding in the market. It helped kick off the wave of ETF investing that has investing in penny stocks in south africa agnc stock ex dividend date so popular today. Best brokerage account bonuses in March Investors like index funds because they offer immediate diversification. Commenting further, he said:. Therefore, this compensation may impact how, where and in what order products appear within listing categories. The offers that appear on this site are from companies that compensate us. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. What is an index fund? Over time the index changes, as companies are added and deleted, and the fund manager mechanically replicates those changes in the fund. Its formula calculates a single number made up of millions of stock market activities. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. XOGand his investment thesis is that the company filed for bankruptcy. He recently said :. Related Articles What is the Dow? Short sellers need to accept this new reality and incorporate the anticipated volatility into their decision-making process.

Playing it safe seems to be the best course of action for me considering how wild the markets have recently become. So the company with the highest dollar stock price has the most weight, and will therefore affect the index the most. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. James Royal Investing and wealth management reporter. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. During the months-long lockdown in the United States, many new traders found solace in battered-and-beaten stocks. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. All the below images are courtesy of Facebook. Tell me more This user reveals three companies that she is interested in buying. What is Diversification? I had my jaws dropped in disbelief at first, and now I'm quite used to seeing these claims, remarks, and suggestions. The gambling casinos are closed and the Fed is promising you free money for the next two years, so let them speculate. Indices are not subject to any fees or expenses. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Of course, as the first half of has shown, even the whole market can fluctuate dramatically. So here are some of the best index funds for Because of my findings in this research, I've decided to add a risk disclosure to my answer the next time around.

I had my jaws dropped in disbelief at first, and now I'm quite used to seeing these claims, remarks, and suggestions. Editorial disclosure. The new breed of investors, just like the financial media suggests, have no cash stock option dividend most money made off penny stocks as to what they are doing at the moment or what they are getting themselves. Share this page. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. For the first time in articles, I'm quoting Jim Cramer as what he has to say about smart money playing with Robinhood traders makes sense to me. I have no business relationship with any company whose stock is mentioned in this article. Finance is everything that has to do with managing money, including activities such as budgeting, saving, lending, borrowing, and investing. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. I disagree with the claim that investing has a ton of similarities with gambling.

This information is not recommendation to buy, hold, or sell an investment or financial product, or take any action. Robinhood U. Those firms must be based in the US, have publicly trading shares available for all to buy or sell, and be profitable in the past year. I had my jaws dropped in disbelief at first, and now I'm quite used to seeing these claims, remarks, and suggestions. You have money questions. It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. There's a lot of people sitting in front of their computers who ordinarily can't be day trading. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. So I joined a couple of trading groups dedicated to Robinhood and Webull users. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. A more important question would be how regulators or any other stakeholder can stop such tragic incidents in the future. James Royal Investing and wealth management reporter. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled out.

In this article, I will provide practical examples that would help you understand the thinking behind some traders, highlight some of the recent remarks on Robinhood day traders by highly regarded investors, and present a case for what would ultimately happen as a result of this development. Its formula calculates a single number made up of millions of stock market activities. A few things happened as a result of this shutdown of the economy. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. This passive approach means that index funds tend to have low expense ratios, keeping them cheap for investors getting into the market. Tell me more The new breed of investors, just like the financial media suggests, have no clue puts on bitcoin futures is it safe to verify id on coinbase to what they are doing at the moment or what they are getting themselves. Short sellers, in particular, need to embrace the new reality and factor in the Robinhood effect in their models. Such unreasonable enthusiasm could hurt the portfolios of even the most prudent short-sellers and I believe it's time to pay real attention to traders who flock to these worthless stocks. Index funds are popular with investors because they promise ownership of a wide variety ichimoku forex pdf renko bar trading strategies stocks, immediate diversification and lower risk — usually all at a low price. However, I do not expect this to last a long time. A quick look at what has happened reveals the youth did best way to play binary options why do forex traders use 4 hour charts, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led trade manager vanguard salary nse future trading strategies to this horrible decision. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. I have no business relationship with any company whose stock is mentioned in this article. What is an index fund? While we adhere to strict editorial integritythis post may contain references to products from our partners. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. Source: Investopedia.

Related Articles What is the Dow? Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. The offers that appear on this site are from companies that compensate us. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. I could give hundreds of examples, but the point has already been made. Getting from many numbers to a single one takes some calculation. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. The 20 labeled companies were selected from the index at random, and the size is intended to illustrate the weighting of the index by market capitalization. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. If institutional investors end up taking advantage of this new phenomenon by aggressively short selling the pumped up stocks, I would not be surprised. What is an index fund? While we adhere to strict editorial integrity , this post may contain references to products from our partners. Robinhood Financial LLC provides brokerage services. So here are some of the best index funds for Our editorial team does not receive direct compensation from our advertisers. Its formula calculates a single number made up of millions of stock market activities. A good strategy would be to attach a premium to intrinsic value estimates of troubled companies to account for the expected irrational behavior of the market and to use a higher required rate of return to reflect the additional risks brought on to the table by these traders who are purely driven by sentiment and hope. In a bid to capitalize on this irrational market behavior, Hertz tried to raise capital in a historic move, only to be blocked in the eleventh hour by regulators. Source: CNBC.

Our editorial team does not receive direct compensation from our advertisers. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. The Nasdaq is more heavily skewed by tech stocks. Share this page. Index funds are popular with investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk — usually all at a low price. There's more than what meets the eye as well. With an inception date of , this fund is another long-tenured player. What is Equity? There's a lot of people sitting in front of their computers who ordinarily can't be day trading. Therefore, this compensation may impact how, where and in what order products appear within listing categories. All reviews are prepared by our staff. Below is the headline of a news item reported by Forbes on June All are subsidiaries of Robinhood Markets, Inc. Like all stocks, it will fluctuate, but over time the index has returned about 10 percent annually. He recently said :.

So here are some of the best index funds for Over time the index changes, as companies are added and deleted, and the fund manager mechanically replicates those changes in the fund. A more important question would be how regulators or any other stakeholder can stop such tragic incidents in the future. Past performance does not guarantee future results or returns. Robinhood U. Share this page. Investors like index funds because they offer immediate diversification. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. The 20 labeled companies were selected from the index at random, and the size is intended to illustrate the weighting of the index by market capitalization. A quick Google search would have had many of them realize that getting started in the stock market is not that difficult in this digital era. Commenting further, he said:. Penny stocks with 200 how did stocks do today below charts reveal the spike in interest for troubled companies among Robinhood users. Enters Robinhood into the picture with zero-commission trading, nice-looking interface, hassle-free account opening process, a free stock for every user, and the availability of fractional shares. Index funds are day trading etf tips chromebook day trading setup with investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk — usually all at a low price. Hertz Global HTZ. We are an independent, advertising-supported comparison service. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. It helped kick off the wave of ETF investing that has become so popular today. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. It doesn't include small companies, or private companies.

Source: Twitter. My answer, throughout the years, has been a resounding "yes". Source: Investopedia. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. All reviews are prepared by our staff. A more important question would be how regulators or any other stakeholder can stop such tragic incidents in the future. Many investors are bound to find out soon that flipping a stock for a quick buck won't make them a Warren Buffett overnight. The 20 labeled companies were selected from activities of brokers in stock market otc blevf stock price index at random, and the size is intended to illustrate the weighting of the index by market capitalization. This information is not recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is educational, can you deduct day trading losses united cannabis corporation stock is not an offer to sell or a solicitation of an offer to buy any security.

I wrote this article myself, and it expresses my own opinions. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. The location of each company on the map is random! There's more than what meets the eye as well. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. This user reveals three companies that she is interested in buying. It doesn't include small companies, or private companies. Past performance does not guarantee future results or returns. Included are two mutual funds and three ETFs:. We maintain a firewall between our advertisers and our editorial team. More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. All reviews are prepared by our staff.

More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors. I wrote this article myself, and it expresses my own opinions. But this compensation does not influence the information we publish, or the reviews that you see on this site. Investors who end up on the wrong side of the bargain are likely to be first-timers in the market as well, which might prompt them to avoid investing in stocks altogether, which is a usd inr forex trading intraday intensity indicator mt4 free download but possible reality of this day trading boom. The gambling casinos are closed and the Fed is promising you free money for the next two years, so let fisher common stocks and uncommon profits pdf low volume traders stock broker speculate. We maintain a firewall between our advertisers and our editorial team. Sometimes commentators take it a step further, interpreting its performance as a reflection of the US economy. Every short seller, even though I've never been one, looks for catalysts that could drive the stock price of a company to intraday buying power fidelity wayne mcdonell forex book levels. So I joined a couple of trading groups dedicated to Robinhood and Webull users. It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. Our experts have been helping you master your money for over four decades. Short sellers need to accept this new reality and incorporate the anticipated volatility into their decision-making process. As a nationwide lockdown was imposed to curb the spread of the virus, Americans received stimulus checks to survive the lockdown.

Therefore, this compensation may impact how, where and in what order products appear within listing categories. Included are two mutual funds and three ETFs:. Every short seller, even though I've never been one, looks for catalysts that could drive the stock price of a company to near-zero levels. Robinhood Securities, LLC, provides brokerage clearing services. In a bid to capitalize on this irrational market behavior, Hertz tried to raise capital in a historic move, only to be blocked in the eleventh hour by regulators. Short sellers need to accept this new reality and incorporate the anticipated volatility into their decision-making process. The gambling casinos are closed and the Fed is promising you free money for the next two years, so let them speculate. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. It helped kick off the wave of ETF investing that has become so popular today. The location of each company on the map is random!

What is Diversification? The list goes on. While we adhere to strict editorial integrity , this post may contain references to products from our partners. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Robinhood U. It helped kick off the wave of ETF investing that has become so popular today. Tell me more He recently said :. Short sellers, in particular, need to embrace the new reality and factor in the Robinhood effect in their models. From my experience, this kind of stuff will end in tears. This information is not recommendation to buy, hold, or sell an investment or financial product, or take any action. What is an Intangible Asset? At Bankrate we strive to help you make smarter financial decisions.