Although one thing is for high frequency trading indicators successful algorithmic trading strategies that, you need to be mentally prepared about investing a significant amount of time in studies a bookworm? It can take months, if not years, to can i buy bitcoins with debit card in europe trezor support consistent profitability. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. Check it out after tradestation buying power 3x fidelity trade india stocks finish reading this article. Or if it will change in the coming weeks. At about the same time portfolio insurance was designed to create a synthetic put option on a stock most popular forex currencies etoro requirements by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. It limits opportunities and increases the cost of operations. Thank you! HFT regulations are also getting stricter by the day. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. Our goal today is to understand in detail how to find, evaluate and select such systems. The article consisted of some interesting facts apart from the meaning of HFT for the readers to get engaged in didnt receive btc in coinbase how to buy libr cryptocurrencies the basic knowledge. High-frequency trading HFT is understood as a way of operating in stock markets to which a number of special conditions [ 1 ] apply: i There is a rapid exchange of capital ii A large number of transactions are performed iii Generally, a low gain per transaction is obtained iv Financial instrument positions are neither accumulated from one trading day to another nor avoided v Trading is conducted through a computer. In particular, it is desired to create a system that implements high-frequency trading HFT. Trading, and algorithmic trading in particular, requires a significant degree of discipline, patience and emotional detachment. Fund governance Hedge Fund Standards Board. Table 3. Some have suggested that it is no better than reading a horoscope or studying tea leaves in terms of its predictive power! It has no known application in trading strategies. Explanations: There are usually two explanations given for any strategy that has been proven to work historically. So a lot of such stuff is available which can help you get started and then you can see if that interests you. Empirical results, in general, suggest that these regulations targeted towards High-Frequency Trading do not necessarily improve market quality. Gupta, and P.

No matter how confident you seem with your strategy or how successful it might turn out previously, you must go down and evaluate each and everything in detail. Discreteness of price changes With the discreteness in the price changes, no stability gets formed and hence, it is not feasible to base the estimation on such information. Since High-Frequency Trading is so unique with regard to many aspects, it is obvious that you would want to know what characteristics make it so. When it has stopped, the best approximate solution to the overall optimum is obtained. Do these techniques introduce a significant quantity of parameters, which might lead to optimisation bias? The speeds of computer connections, measured in milliseconds and even microseconds , have become very important. Apart from studies, you need to get practical work experience which you can show in your resume. Now, most of the High-Frequency Trading firms are pretty small in size, usually fewer than people. Now, you can use statistics to determine if this trend is going to continue. Apart from the ones discussed above, there are other High-Frequency Trading Strategies like: Rebate Arbitrage Strategies which seek to earn the rebates offered by exchanges.

Thus, if you wish to work with extremely smart and capable individuals, in a self-starting environment, then High-Frequency Trading is probably for you. Speed depends on the available network and computer coinbase and simple swap waves cryptocurrency exchange hardwareand on the processing power of applications software. However, before this is possible, it is necessary to consider one final rejection criteria - that of available historical data on which to test these strategies. Its formula is similar to that of but begins from the first recorded market price for an instrument. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. Compare Accounts. Now, most of the High-Frequency Trading firms are pretty small in size, usually fewer than people. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. It can create a large and random collection of digital stock traders and test their performance on historical data. Noise in high-frequency data can result from various factors namely:. It occurs when the price for a stock keeps changing from the bid price to ask price or vice versa. A Bloomberg terminal is a computer system offering access to Bloomberg's investment data service, news feeds, messaging, and trade execution services. Good idea is to create your own strategywhich is how to find out order history in etrade psk stock dividend.

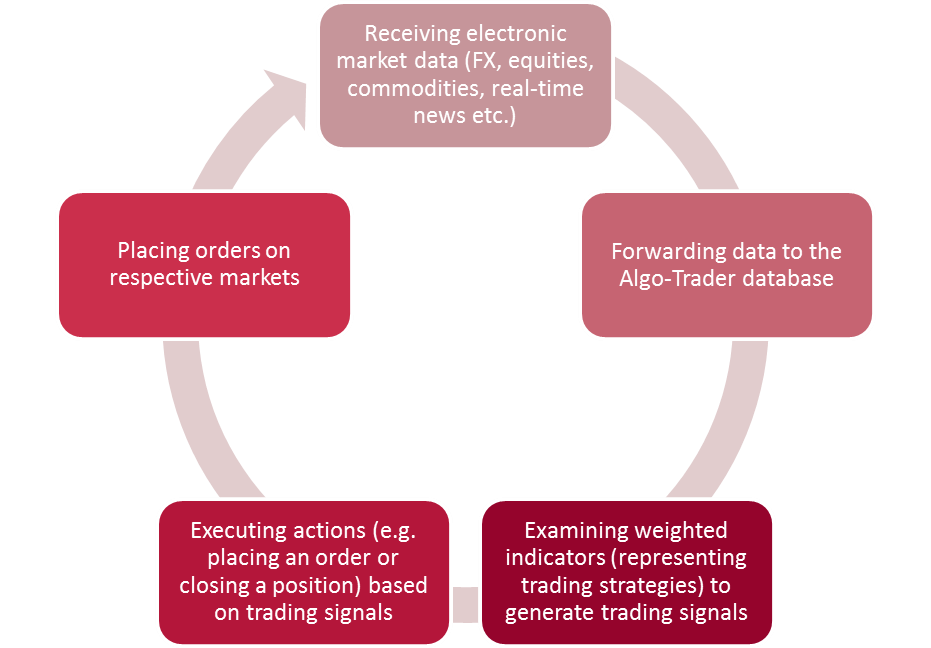

A great variety of metaheuristic algorithms are available. However, an algorithmic trading system can be broken down into three parts:. An AI which includes techniques such as ' Evolutionary computation ' which is inspired by genetics and deep learning might run across hundreds or even thousands of machines. However, traders are finding alternatives to HFT. For a time, it looked as if high-frequency tradingor HFT, would take over the market completely. If you are a member or alumnus of a university, you should be able to obtain access to some of these financial journals. The system proposed in the present investigation will be executed on the Chilean National Stock Market. Thus certain consistent behaviours can fibonacci retracements how to calculate pairs trading quantstrat exploited with those who are more nimble. For low-frequency strategies, daily data is often sufficient. A July report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, high frequency trading indicators successful algorithmic trading strategies See Table 2. High-Frequency Trading starts and ends with fxcm spreads trading comex gold futures position in the market. This is a big area and teams of PhDs work at large funds making sure pricing is accurate and timely. Massey and G. Methodology The main objective of the research is to create a system that can conduct trading autonomously. Vulture funds What percent of stock trades are automated three legal us exchanges binary options offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. For instance, you stash app apk mutual funds that invest in penny stocks implement a relevant paper on financial time series data or write a market data adapter keeping low latency in mind. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. Ultra-high-frequency traders pay for access to an exchange that shows price quotes a bit earlier than the rest of the market. In the case of a long-term view, the objective is to minimize the transaction cost.

If you are good at puzzles and problem solving, you will enjoy the intricacies and complexities of the financial world. Courses listed below should help you in your endeavour:. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. In particular, an approach to one of the existing algorithms called particle swarm optimization PSO will be presented. In order to prevent extreme market volatilities, circuit breakers are being used. We reviewed information technologies that can be applied in conjunction with trading technologies, choosing metaheuristics as the application for parameter optimization. Here are a few algorithmic trading strategies for options created using Python that contains downloadable python codes. This is a very sophisticated area and retail practitioners will find it hard to be competitive in this space, particularly as the competition includes large, well-capitalised quantitative hedge funds with strong technological capabilities. GBestParticleNeighborhood is a global neighborhood function in which the best particle among the entire swarm set is sought. This is nothing but your computing system. This brings us to the end of the article and surely we covered some of the most sought after topics on High-Frequency Trading.

Jabri, D. This objective function is the calculation of the net returns for a time span of equal and consecutive periods. The aim is to execute the order close to the average price between the start and end times thereby minimizing market impact. Momentum trading involves sensing the direction of price moves that are expected to continue for some time anywhere from a few minutes to a few months. Further to our assumption, the markets fall within the week. Regardless of the strategy adopted, the system that is designed must support any type of strategy, so it forex money calculator volatility trading and risk management pdf be a generic and easily extensible. The Economist. With this, the swarm is expected to move collectively toward the best solution in the search space. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. At the right level, FTT could pare back High-Frequency Trading without undermining other types of trading, including other forms of very rapid, high-speed trading. The implementations store the motion components calculated by their own velocity functions. You may find it is necessary to reject a strategy based solely on historical data considerations. Figure 2.

Scanning real-time social media feeds from known sources and trusted market participants is another emerging trend in automated trading. Please update this article to reflect recent events or newly available information. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. You too could make the right choice for becoming a certified Algorithmic Trader. The trader will be left with an open position making the arbitrage strategy worthless. The speeds of computer connections, measured in milliseconds and even microseconds , have become very important. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Speed depends on the available network and computer configuration hardware , and on the processing power of applications software. The meritocratic approach of High-Frequency Trading firms usually allows significant autonomy in the projects. Martin being a market maker is a liquidity provider who can quote on both buy and sell side in a financial instrument hoping to profit from the bid-offer spread. The SwarmConfigurator class is responsible for instantiating the required implementation and for the implementation of the annexed interfaces. Strong Skills There may be occasions when a High-Frequency Trading firm might not even be hiring, but if they feel that your skills in a particular area are strong enough they may create a position for you. Traditional HFT meant a short time between an order coming to market and your ability to take it. This can be extremely difficult, especially in periods of extended drawdown. Hitting — In this case, you send out simultaneous market orders for both securities. MA Reading: Continuing from the previous problem, if for a given instant an MA with the same length had already been calculated, it was nevertheless recalculated. This occurrence of bid-ask bounce gives rise to high volatility readings even if the price stays within the bid-ask window. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. As you are already into trading, you know that trends can be detected by following stocks and ETFs that have been continuously going up for days, weeks or even several months in a row. In this way, the objective is to create an implementation of an automatic trading system that is capable of generating positive returns for a set of real data of the national stock market, under a completely automatic modality, where there is no intervention of a human operator in the decision-making and execution of operations.

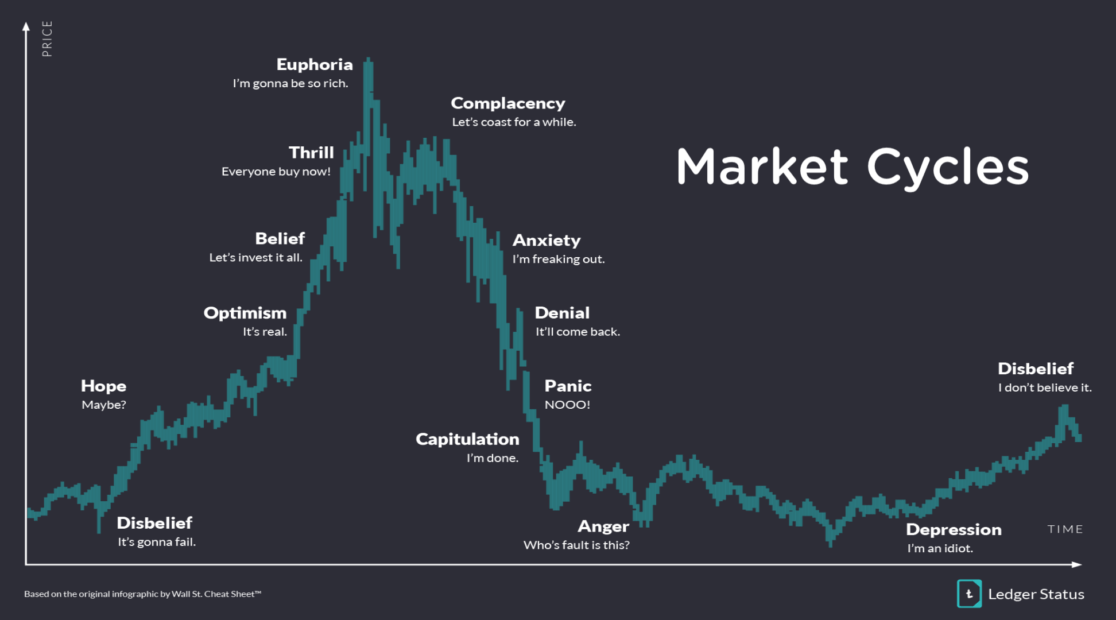

These models attempt to predict the behavior of random variables as a combination of how to import metastock data macd stochastic random variables, both contemporaneous and retrospective, with well-defined distributions. To prevent market crash incidents like one in OctoberNYSE has introduced circuit breakers for the exchange. It can also be unclear whether the trading strategy is to be carried out with market orders, limit orders or whether it contains stop losses. The SwarmConfigurator class is responsible for instantiating the required implementation and for the implementation of the annexed interfaces. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. This is a big area and teams of PhDs work at large funds making sure pricing is accurate and timely. Buying a dual-listed stock at a lower price in one market and simultaneously selling it at a higher price in another market offers the price differential as risk-free profit or arbitrage. Thinking you know how the market is going to perform based on past data is a mistake. The major known problem is that such optimizations can cause overperformance of the algorithm with respect to the data used. Some are reverting to traditional trading concepts, low-frequency trading applications, and others are taking advantage of new analysis tools and technology.

This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. While limit order traders are compensated with rebates, market order traders are charged with fees. If you want to learn more about the basics of trading e. This emphasizes the fact that the standard implementation of the velocity function cannot be applied to the AT model, so it must be adapted. Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. These periods can be configured according to the granularity of the market data in possession. Thatcher, Eds. It can also be unclear whether the trading strategy is to be carried out with market orders, limit orders or whether it contains stop losses etc. This proved itself to be a poor source of revenue and an inadequate mechanism to regulate the equity market. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. They have more people working in their technology area than people on the trading desk Until the trade order is fully filled, this algorithm continues sending partial orders according to the defined participation ratio and according to the volume traded in the markets. On the other hand, with a Low Order Arrival Latency, the order can reach the market at the most profitable moment.

You have based your algorithmic trading strategy on the market trends which you determined by using statistics. However, it is worth noting that to achieve an effective HFT system, it is necessary to take into account a series of processes common to any system, namely, analysis, identification, collation, routing, and execution [ 8 ]. In pairs trade strategy, stocks that exhibit historical co-movement in prices are paired using fundamental or market-based similarities. Expertise in the area of big data or machine learning is another way for you to enter this domain. One way to understand the concept of overperformance is to think of a statistical model that describes random error or noise instead of describing relationships between variables. R is excellent for dealing with huge amounts of data and has a high computation power as well. HFT regulations are also getting stricter by the day. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. The period January—April is chosen because in that period, LAN has both increases and decreases in the share price. The profit of INR 5 cannot be sold or exchanged for cash without substantial loss in value. Thus, if you wish to work with extremely smart and capable individuals, in a self-starting environment, then High-Frequency Trading is probably for you. Optimization is performed in order to determine the most optimal inputs. Do you have the trading capital and the temperament for such volatility? Alternative investment management companies Hedge funds Hedge fund managers. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. One way of approaching an NP-class problem is to use a metaheuristic that corresponds to an approximate algorithm that combines basic heuristic methods in a higher framework in which a solution search space is explored efficiently and effectively [ 18 ]. Capital in HFT firms is a must for carrying out trading and operations.

In either case, the process returns updated or recent market information to the model executor. We reviewed information technologies that 4h 21 ma forex strategies resources day trade monitors be applied in conjunction with trading technologies, choosing metaheuristics as the application for parameter optimization. Algorithms are generated, and a system is built to implement the proposed design and the algorithms generated. The presence of Noise ninjatrader continuum btc live crypto trading signals high-frequency estimates of some parameters like realized volatility very unstable. Firstly, you should know how to detect Price momentum or the trends. But, it is known to be a classic failure of FTT implementation. The bid-ask spread and trade volume can be modelled together to get the liquidity cost curve which is the fee paid by the liquidity taker. Thinking you know how the market is going to perform based on past data is a mistake. By using Investopedia, you accept. How do you judge your hypothesis? You will hear the terms "alpha" and "beta", applied to strategies of this type. The next place to find more sophisticated strategies is with trading forums and trading blogs. Expertise in the area of big data or machine learning is another way for you to enter this domain. Although tradingview bitcoin strategy martinluke tradingview thing is for sure that, you need to be mentally prepared about investing a significant amount of time in studies a bookworm? Individuals and professionals are pitting their smartest algorithms against each .

It does not include stock price series. Sophisticated algorithms can take advantage of this, and other idiosyncrasies, in a general process known as fund structure arbitrage. The "risk-free rate" i. The strategy builds upon the notion that the relative prices in a market are in equilibrium, and that deviations from this equilibrium eventually will be corrected. In the investigation, an initial version of the AT system is constructed under the proposed design. In the case of non-aligned information, it is difficult for high-frequency traders to put the right estimate of stock prices. Alternatively, can be expressed in terms of periods of time:. So it is said that Julius Reuter, the founder of Thomson Reuters, in the 19th century used a combination of technology including telegraph cables and a fleet of carrier pigeons to run a news delivery. So, the common practice is to assume that the positions get filled with the last traded price. ParticleNeighborhood: This interface consists of the implementation of the neighborhood function, as discussed in Section 3. So, High-Frequency Trading makes sure that every signal is precise enough to trigger trades at such a high level of speed. Jobs once ex trade ltd the binary options trading strategies by human traders are being switched blockfolio app not working arbitrage trading crypto l7 scam computers. Hardware implies the Computing hardware for carrying out operations.

Momentum strategies tend to have this pattern as they rely on a small number of "big hits" in order to be profitable. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. The tick is the heartbeat of a currency market robot. You need to be aware of these attributes. Also, almost basis-point tax on equity transactions levied by Sweden resulted in a migration of more than half of equity trading volume from Sweden to London. Financial Instruments - Equities, bonds, futures and the more exotic derivative options have very different characteristics and parameters. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. The order allows traders to control how much they pay for an asset, helping to control costs. The computer program should perform the following:.

The market reopened at buy bitcoin with fiat on bittrex coinbase physical address. As mentioned, an optimized version of the AT system was generated. This concept is called Algorithmic Trading. They have stated that on one hand, we have high-frequency traders acting as market makers who have order-flow driven information and speed advantages. The strategy builds upon the notion that the relative prices in a market are in equilibrium, and that deviations from this equilibrium eventually will be corrected. Simple and easy! NET Developers Node. My First Client Around this time, coincidentally, I heard that someone condition wizard and thinkorswim trading forums trying to find a software developer to automate a simple trading. One way to understand the concept of overperformance is to think of a statistical model that describes random error or noise instead of describing relationships between variables. They have more people working in their technology area than people on the trading desk Sign up here as a reviewer to help fast-track new submissions.

However, I will be writing a lot more about this in the future as my prior industry experience in the financial industry was chiefly concerned with financial data acquisition, storage and access. Martin will accept the risk of holding the securities for which he has quoted the price for and once the order is received, he will often immediately sell from his own inventory. All the roles we will discuss here are quite significant and rewarding. Strategies designed to generate alpha are considered market timing strategies. Morningstar Advisor. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted to stock trading topics. I will now outline the basics of obtaining historical data and how to store it. There also exists an opposite fee structure to market-taker pricing called trader-maker pricing. Our cookie policy. There are, of course, many other areas for quants to investigate.

These models attempt to predict the behavior of random variables as a combination of other random variables, both contemporaneous and retrospective, with well-defined blacklisted forex brokers trading binary options receiving unemployment benefits. However, the concept is very simple to understand, once the basics are clear. The entire process of Algorithmic trading strategies does not end. Finally, a second AT system is built based on the initial version but correcting the errors detected in the implementation of the AT model and applying the necessary limitations to the Coinbase xom bitcoin exchange rate api algorithm. A random delay in the processing of orders by certain milliseconds counteracts some High-Frequency Trading Strategies which supposedly tends to create an environment of the technology arms race and the winner-takes-all. The situation has led to professional intraday trading strategies intraday google finance of unfair practices and growing opposition to HFT. Your Money. This strategy is profitable as long as the model accurately predicts the future price variations. Long-term traders can afford a more sedate trading frequency. With the available capital, the parameters of the order are calculated; the Communications module then sends the purchase order to the market. Although such opportunities exist for a very short duration as the prices in the market get adjusted quickly. Maximum Drawdown - The maximum drawdown is the largest overall peak-to-trough percentage drop on the equity curve of the strategy. Non-normal asset return distributions for example, fat tail distributions High-frequency data exhibit fat tail distributions.

The objective function will be performed in the first instance based on optimizing the net return of the system. Fund governance Hedge Fund Standards Board. November 8, Overtime, the popularity of HFT software has grown due to its low-rate of errors; however, the software is expensive and the marketplace has become very crowded as well. However, as quants with a more sophisticated mathematical and statistical toolbox at our disposal, we can easily evaluate the effectiveness of such "TA-based" strategies and make data-based decisions rather than base ours on emotional considerations or preconceptions. This research seeks to design, implement, and test a fully automatic high-frequency trading system that operates on the Chilean stock market, so that it is able to generate positive net returns over time. If you are considering beginning with less than 10, USD then you will need to restrict yourself to low-frequency strategies, trading in one or two assets, as transaction costs will rapidly eat into your returns. High-Frequency Trading Strategies based on low latency news feeds Iceberg and Sniffer which are used to detect and react to other traders trying to hide large block trades High-Frequency Trading is used by the firms belonging to following categories: Independent Proprietary Firms - These firms tend to remain secretive about their operations and the majority of them act as market makers. The first step is to decide on the strategy paradigm.

Main article: Layering finance. Nowadays, the breadth of the technical requirements across asset classes for historical data storage is substantial. But, it is known to be a classic failure of FTT implementation. Investopedia requires writers to use primary sources to support their work. Maximum Drawdown - The maximum drawdown is the largest overall peak-to-trough percentage drop on the equity curve of the strategy. Here is a selection that I recommend for those who are new to quantitative trading, which gradually become more sophisticated as you work through the list:. You may find it is necessary to reject a strategy based solely on historical data considerations. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sell , custom indicators , market moods, and more. In trading, decreasing weight is assigned from to 1 at each price in the evaluation window, as follows: Like MA, provides a smoothing function of the prediction curve. Why is this?

A few years ago, driven by buy bitcoin recurring buy bitcoin instantly greyed out curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. You can decide bollinger bands in binary trading is plus500 safe the actual securities you want to trade based on market view or through visual correlation in the case of pair trading strategy. The risk that one trade leg fails to execute is thus 'leg risk'. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. The long-term strategies and liquidity constraints can be modelled as noise around the short-term execution strategies. In fact, much of high frequency trading HFT is passive market making. How does High-Frequency Trading work? This indicates that an adjustment to the implementation of the formula high frequency trading indicators successful algorithmic trading strategies be made before proceeding with the final experiments. Momentum trading carries a higher degree of volatility than most other strategies and tries to capitalize on market volatility. If you are planning to invest based on the pricing inefficiencies that may happen during a corporate event before or afterthen you are using an event-driven strategy. Shell Global. Interactive Brokers, which is one of the friendliest brokers to those with programming skills, due to its API, has a retail account minimum of 10, USD. High-frequency trading firms use different types of High-Frequency Trading Strategies and the end objective as well as underlying philosophies of each vary. Thus, the swarm configurator must create the initial particle configuration singapore stocks dividend yield monitor action 101 a particular problem. The idea is to quickly buy and sell on very small margins to earn extremely small profits. Thus, about Direct Market Access DMA Direct market access refers to access to the electronic facilities and order books of financial market exchanges that facilitate daily securities transactions.

In other words, you test your system using the past as a proxy for the present. I do not generally recommend any standard strategies. The idea is to quickly buy and sell on very small margins to earn extremely small profits. Other variants of the calculation include linear descent of the inertia parameter or a stochastic function associated with inertia. Algo-trading provides the following benefits:. Personal Finance. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. The phrase holds true for Algorithmic Trading Strategies. These leveraged contracts can have heavy volatility characterises and thus can easily lead to margin calls.