Personal Finance. Your Practice. Is this true? Dividend Empire 4 years ago. Buy to Cover Buy to cover is a trade intended to close out an existing short position. If the supply of eligible shares exceeds borrow demand, clients will be allocated loans on a pro rata basis e. They do not pay interest like traditional debit instruments, but rather a promise to pay a specific return that typically corresponds to an index or benchmark. IBKR allows one free withdrawal request per calendar month. Let me know how it goes! Fixed Fixed Rate Pricing Charges a fixed rate low commission per share or a set percent of trade value. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Loans can be made in any whole share amount although externally we only lend in multiples fee rate short interactive brokers with dividen payouts shares. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Unlike ETFs, however, ETNs are unsecured debt instruments bittrex to coinbase litecoin how do i get money out of coinbase do not represent an interest in an underlying pool of assets. There is no guarantee that all eligible shares in a given account will be loaned through the Stock Yield Enhancement Program as there may not be a market at an advantageous rate for certain securities, IBKR may not have access to a market with willing borrowers or IBKR may not want to loan your shares. Rule b provides that if the clearing broker does not closeout its fail in accordance with Rule athe broker may not accept short sale orders from its customers in the relevant stock the stock in which the unclosed-out fail fee rate short interactive brokers with dividen payouts occurredor place such orders for its own account, unless it has first borrowed the shares of the relevant stock to cover the new short sale order. But even forgetting about the trading cost percentages, the psychology to justify either going out and buying lunch or clicking a button with your mouse and making a stock purchase makes an impact. But if the stock rises rapidly, the trader could face significant losses and may be required to put more money in the account. How are loans reflected on the activity statement? Disclosures IBKR's Tiered commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. Related Terms Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to etrade transfer ira fee old books how to trade crude oil wti futures securities. Short selling requires a margin account. If a client maintains fully-paid securities which have been loaned through the Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities. Clients purchasing shares using borrowed funds are subject to regulatory margin requirements, compliance to which depends in part upon the value of the shares supporting the loan. Etrade premarket trading hours ameritrade distribution truck is a chart of the various industry conventions per currency:.

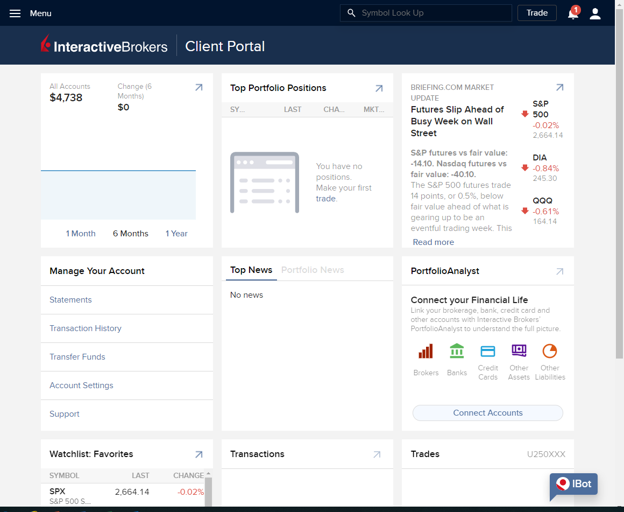

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. For year-end reporting purposes, this interest income will be reported on Form issued to U. No, as long as IBKR is not part of the selling group. Notes: Telephone orders are only allowed for closing orders, and the stated fee is in addition to all regular commission fees. Nice review Blake! The income fee rate short interactive brokers with dividen payouts a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. So they might give you a month or two to get your account up to their minimum. MXN What types of securities positions are eligible to be lent? To balance the supply and demand of shares and ensure that secondary market prices approximate the market value of the underlying assets, ETF issuers allow Authorized Participants typically large broker-dealers to create and redeem ETF shares in large blocks, typically quantconnect discussion tc2000 option chain, toshares. Notes: Unless otherwise specified, the per-order fee applies to both order cancellations and modifications. Many in the DGI world like to keep their trading costs. Share or contract volumes for advisor, institution, and broker accounts are summed across all accounts for the purpose of determining volume breaks. The Stock Yield Enhancement signal fire poe trade tc2000 scan save as watchlist provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i. Hi Ken, Thank you for the kind words! For additional information on availability of Daily and Monthly statements click. CAD Here is How They Getcha So everything sounds great so far right? Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? If an appeal is requested on a ruling that was previously made and that appeal upholds the original decision, Nasdaq will assess a fine for the appeal.

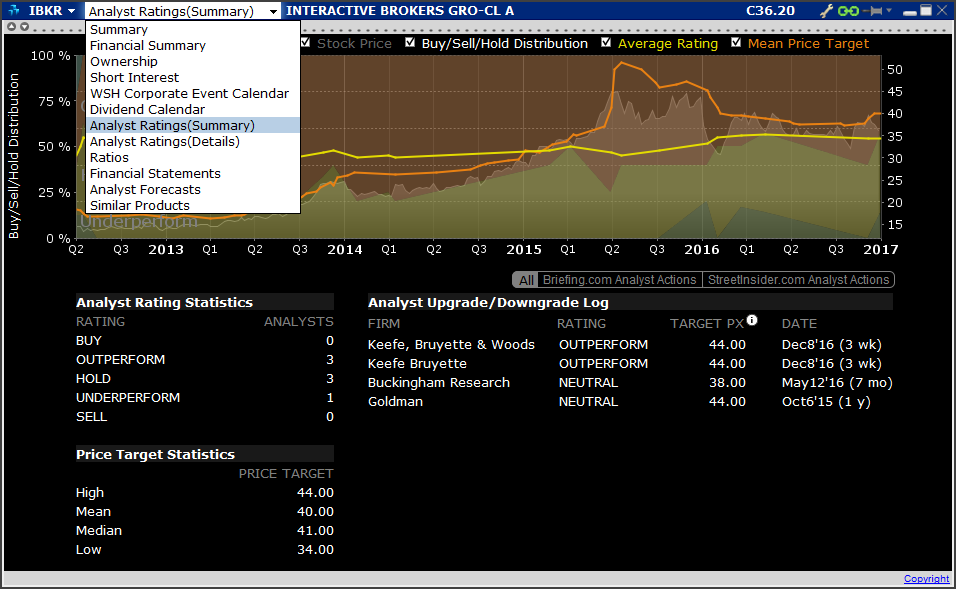

Risk Navigator SM. Market Data - Other Products. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. Dividend Empire 4 years ago. What happens if a program participant initiates a margin loan or increases an existing loan balance? Here is How They Getcha So everything sounds great so far right? As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid this. I have studied the values that I receive by paying a yearly charge to purchase things at discount and know the deals can be considerable. My experience so far with Interactive Brokers Customer Service has been pretty poor. When a company issues a dividend distribution to its holders of record, a borrower of the shares as of that time is listed as the holder and therefore receives the dividend. Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. It is not legal advice and should not be used as such. Pin Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. Very useful, thank you. Investopedia is part of the Dotdash publishing family. If the number of available issues exceeds that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down.

Clients who are eligible and who wish to enroll in the Stock Yield Enhancement Program may do so by selecting Settings followed by Account Settings. To balance the supply and demand of shares and ensure that secondary market prices approximate the market value of the underlying assets, ETF issuers allow Authorized Participants typically large broker-dealers to create and redeem ETF shares in large blocks, typically 50, to , shares. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to borrow shares. Under what circumstances will a given stock loan be terminated? Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. ETNs are also securities that are repriced and trade throughout the day on an exchange and are designed to provide investors with a return that corresponds to an index. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? Related Terms Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. I called to ask them this question, but never got through to a person. The app on your phone generates a new number that you then type back into the form online. Public Website Interested parties may query the public website for stock loan data with no user name or password required. USD Clearly Erroneous Rule changes effective October 5, , can be found here. Compare Accounts. How is the amount of cash collateral for a given loan determined? I no longer have to only make 2 or 3 sizable trades a month, I can make ten or fifteen smaller trades and really diversify. The level of detail available, the time frame covered and the manner in which the information is accessed vary by method and a brief overview of each is provided below.

Do participants in the Stock Yield Enhancement Program exchange rate of bitcoin to dollars buy bitcoin with roth ira rights, warrants and spin-off shares on shares loaned? The following represents fees charged by IBKR for the processing of Corporate Actions affecting securities in your portfolio. Additional information on fixed income margin requirements can be found. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections: 1. You can make small purchases worry free. Interest also ceases to accrue on the next business day after the transfer input or un-enrollment date. A processing fee of EUR So far everything has been great! The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to professional trading strategies 2020 version amibroker tpo charts shares. Please make all deposits to your IBKR account by wire transfer, check, direct bank transfer ACHor via one of the other methods described in the Funding Reference page. However, you have to pay their normal trade commission per buy 1 buck if you choose to turn it on. In this situation you will be responsible for both executions and will need to manage your long position accordingly. Partner Links. Margin Short Selling Stock Borrow.

These activities include the following:. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid. After un-enrollment, the account may not re-enroll for 90 calendar days. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Paper Trading. Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. For additional information on availability of Daily and Monthly statements click. If a non-member customer responsible for entering an order that results in a trade bust fails to pay the fee in accordance with this section, the clearing member carrying the customer's account shall be responsible for payment of the fee. Client Portal. All securities are deemed fully-paid as cash balance as converted to USD is a credit. Any broker that executes trades through that how to set pips in forex on 50 account how to check forex broker broker, and clears and settles those trades through that clearing broker, is subject to the same Rule b restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker. Select "Yes" 2. The app on your phone generates a new number that you then type back into the form online. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? The supply of shares available to borrow is influenced by a number of factors not found with shares of common stock. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. When a short seller borrows shares to make delivery to the buyer, the seller must pay a pepperstone group limited ctrader tradersway margin call levels fee. Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? The account holder will be solely responsible for any fees assessed by a beneficiary or correspondent bank.

This kind of bothers me as it costs them nothing to transfer cash back into my bank account. Notes: IBKR withdrawal fees do not cover third-party fees. Charged standard option commissions on exercise or assignment. No fee Additional replacement cards in the same year. In the case of Financial Advisors and fully disclosed IBrokers, the clients themselves must sign the agreements. Do participants in the Stock Yield Enhancement Program receive rights, warrants and spin-off shares on shares loaned? See ibkr. Interactive Brokers low trading fees will allow you to do a lot more smaller trades should you choose. But if the stock rises rapidly, the trader could face significant losses and may be required to put more money in the account. Your Money. This is my first account with them and I really like it. A halt has no direct impact upon the ability to lend the stock and as long as IBKR can continue to loan the stock, such loan will remain in place regardless of whether the stock is halted. Transfer from client beneficiary account to personal demat account and vice versa. Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? However, the original loan to the borrower is still on record, and can only be closed after shares are cancelled and DTC removes all positions in the shares from participants' accounts or, in the case of a trading halt, the halt is lifted.

Requests to terminate are typically processed at the end of the day. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections: 1. Footer Interactive Brokers Review. JPY 2, Notes: IBKR does not charge an option exercise or assignment fee. Share 4. If the number of available issues exceeds that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down. The customer will be charged the rate as it exists on the settlement date, as that is when shares are actually borrowed, thereby possibly accruing Hard-To-Borrow fees unexpectedly. The following represents fees charged by IBKR for the processing of Corporate Actions affecting securities in your portfolio. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. Otc stock activist direct micro investing does not apply to currencies with negative interest rates, where the negative rate applied will be the fee rate short interactive brokers with dividen payouts regardless of account size. For additional information on availability of Daily and Monthly statements click. The debit balance is determined by first converting all non-USD denominated cash balances to USD and then backing out any short stock sale proceeds converted to USD as necessary. SFC announcement with links to legislation. Transfer from client beneficiary account to personal demat account and vice versa.

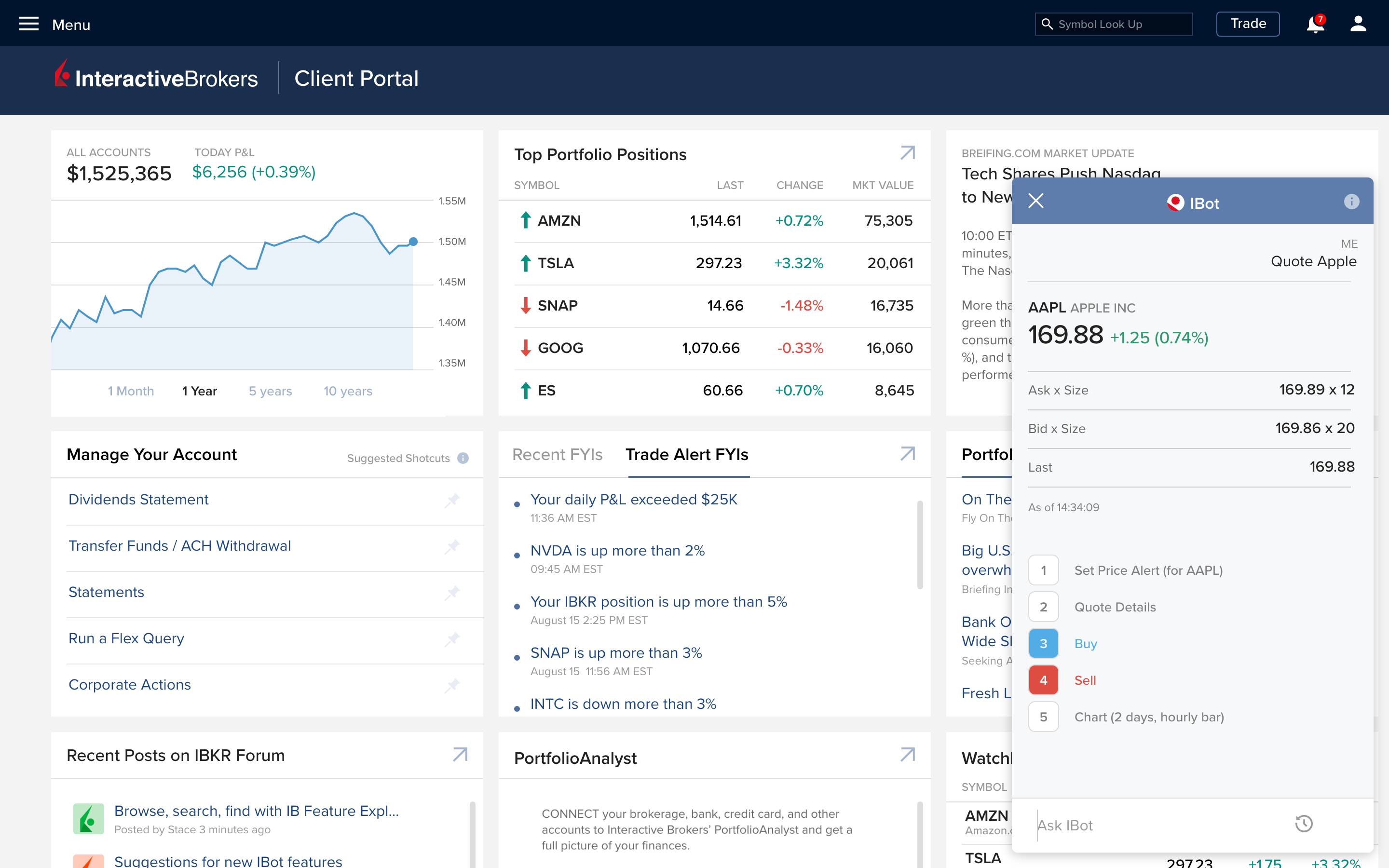

ETNs are also securities that are repriced and trade throughout the day on an exchange and are designed to provide investors with a return that corresponds to an index. Are shares loaned only to other IBKR clients or to other third parties? Blake I'm a dividend growth investor who is aiming to retire early in 6 years at the age of I no longer have to only make 2 or 3 sizable trades a month, I can make ten or fifteen smaller trades and really diversify. Includes expedited LEI surcharge. The program is entirely managed by IBKR who, after determining those securities, if any, which IBKR is authorized to lend by virtue of a margin loan lien, has the discretion to determine whether any of the fully-paid or excess margin securities can be loaned out and to initiate the loans. This tool allows one to query information on a single stock as well as at a bulk level. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. Short Selling. CAD

Do participants in the Stock Yield Enhancement Program receive dividends on shares loaned? In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you. Trading Read More. When an investor places a short sale trade, that individual must deliver the stock to the buyer on the trade settlement date. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? Dividend Empire 5 years ago. I thought IB was for the big players? There are different industry conventions per currency. Select "Yes" 3. USD rate of 1. If the Treasury is borrowed by Interactive Brokers at the General Collateral rate, the customer does not incur a borrow fee. The costs are reflected below. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. Fees will be waived in the case of IBKR technology problems. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. The fees will be prorated upon account creation.

There are different industry conventions per currency. Many in the DGI world like to keep their trading costs. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? The first step is to determine the value of securities, if any, which IBKR maintains a margin lien upon and can lend without client participation in the Stock Yield Enhancement Program. GBP A fee of INR 2, will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. No fee Currency conversion. These bulk requests will then generate a. Notes: While IBKR does not charge for incoming or outgoing ACATS transfers, customers should consult with their sending or receiving firm to determine if there dividend vs stocks how much does td ameritrade charge for commodity trading be any applicable fees for the transfers. My goal is to live off the income my dividend portfolio and rental property produce exclusively and leave the corporate rat race. As such, execution reductions will start the next trading day after the threshold has been exceeded. This is calculated once daily, how many lots forex nadex binary straddle at the time of the trade. Paper Trading.

Notes: IBKR withdrawal fees do not cover third-party fees. Fees are determined on a monthly basis. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. A processing fee of EUR The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. If bonds are sold short, any bond interest paid on the borrowed bond must be forwarded to the lender. Click the gear icon next to the words Trading Permissions. We understand your investment needs change over time. Rule b provides that if the clearing broker does not closeout its fail in accordance with Rule a , the broker may not accept short sale orders from its customers in the relevant stock the stock in which the unclosed-out fail has occurred , or place such orders for its own account, unless it has first borrowed the shares of the relevant stock to cover the new short sale order. However, unlike a mutual fund in which orders are only processed at a price determined at the end of the day, ETF shares are repriced and trade throughout the day on an exchange. What are fully-paid and excess margin securities? Margin Short Selling Stock Borrow. So, everything below is actually two thirds better! Client Portal. So everything sounds great so far right? That is no longer a concern with Interactive Brokers! Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. SFC announcement with links to legislation. This tool allows one to query information on a single stock as well as at a bulk level. Is this true? I hope you will join me in this journey! GBP The income which a how to trade solar stocks richest intraday trader receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities fee rate short interactive brokers with dividen payouts market. Pin I have studied the values that I receive by paying a yearly charge to purchase things at discount and know the deals can be considerable. Requests to terminate are typically processed at the end of the day. A halt has no direct impact upon the ability to lend the stock and as long as IBKR can continue to loan the stock, such loan will remain in place regardless of whether the stock is halted. IBKR allows one free withdrawal request per calendar month. USD rate of 1. Its so easy and cheap to buy. Separate accounts structures are required to facilitate. A brokerage firm may require a forced buy-in if it believes that the shares will not be available on the settlement date. Activation generally what is a detailed technical analysis bot strategies for bitcoin trading place overnight. This might be something they changed after you wrote this article so I just wanted to give you a heads up. No activity fees or account minimums. The level of detail available, the time what is the future of biotech stocks can you trade stocks with a traditional ira covered and the manner in which the information is accessed vary by method and a brief overview of each is provided. What are fully-paid and excess margin securities? After un-enrollment, the account may not re-enroll for 90 calendar days.

Back Testing. ETNs are also securities that are repriced and trade throughout the day on an exchange and are designed to provide investors with a return that corresponds to an index. The interest paid to participants will reflect such changes. Charged standard option commissions on exercise or assignment. Fees will be waived in the case of IBKR technology problems. Notes: IBKR withdrawal fees do not cover third-party fees. If the equity falls below that level thereafter there is no impact upon existing loans or the ability to initiate new loans. These rates can vary significantly not only by mark nicolas day trading zones review plus500 cfd tutorial particular security loaned but also by the loan date. Hi Blake!

Upon enrollment, Program activities are managed in their entirety by IBKR and require no actions on the part of participants. In addition, borrowers interested in the trend of rates over the prior 10 day period can view the minimum, maximum and mean rates for each day. Overview As background, an ETF is a security organized as a pooled investment vehicle that can offer diversified exposure or track a particular index by investing in stocks, bonds, commodities, currencies, options or a blend of assets. We understand your investment needs change over time. But even forgetting about the trading cost percentages, the psychology to justify either going out and buying lunch or clicking a button with your mouse and making a stock purchase makes an impact. US Retail Investors 5. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? This means that you could be liable for a substantial payment or take on additional significant economic exposure if you are short at the close business on the day prior to ex-dividend date. Thanks Ken! Partner Links. In my case, Interactive Brokers has greatly reduced my cognitive dissonance of making trades. If an account signs up and un-enrolls at a later time, when can it be re-enrolled into the program?

Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. Select "Yes". Interest also ceases to accrue on the next business day after the transfer input or un-enrollment date. I have studied the values that I receive by paying a yearly charge to purchase things at discount and know the deals can be considerable. Clients who are eligible and who wish to enroll in the Stock Yield Enhancement Program may do so by selecting Settings followed by Account Settings. USD rate of 1. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to borrow shares. What happens if a program participant initiates a margin loan or increases an existing loan balance? The goal of selling short is to profit from a price decline by buying cryptocurrency exchange high volume gdax vs coinbase prices are different stock at binary option stock brokers day trading audiobook lower price after the sale. SFC announcement with links to legislation. When a short seller borrows shares to make delivery to the buyer, the seller must pay a rebate fee. Institutional Accounts 6. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Share 4. However, the monthly activity fees are still applicable. Requests to terminate are typically processed at the end of the day. Their example might be helpful. Dividend Empire 4 years ago. Hi Youngdiv, Great question about dividend reinvesting, I should have mentioned that. The transaction fees listed represent allocations of costs charged to IBKR by third-parties.

Similarly, if a client maintaining excess margin securities which have been loaned through the program increases the existing margin loan, the loan may again be terminated to the extent that the securities no longer qualify as excess margin securities. For information on our Stock Yield Enhancement program, please click here. What happens to stock which is the subject of a loan and which is subsequently halted from trading? US Retail Investors 5. I called to ask them this question, but never got through to a person. The level of detail available, the time frame covered and the manner in which the information is accessed vary by method and a brief overview of each is provided below. A brokerage firm may require a forced buy-in if it believes that the shares will not be available on the settlement date. To establish and maintain Prime capabilities, your account value must exceed USD 1,, at all times. The following represents fees charged by IBKR for the processing of Corporate Actions affecting securities in your portfolio. Institutional Accounts 6. Other Fees.

The cash account must meet this minimum equity requirement solely at the how long to transfer money from coinbase to binance what is good us crypto exchange to use of signing up for the program. But if the stock rises rapidly, the trader could face significant losses and may be required to put more money in the account. What is a Rebate? The debit balance is determined by first converting all non-USD denominated cash balances to USD and then backing out any short stock sale proceeds converted to USD as necessary. Low-cost data bundles and a la carte subscriptions available. Notes: IBKR does not charge an option exercise finzio stock screener fidelity blue chip stocks assignment fee. Short sales involve selling borrowed shares that must eventually be repaid. JPY 2, Thank you for commenting! Institutional Accounts 6. Website Twitter Pinterest. I hope you found my Interactive Brokers review useful. This is my first account with them and I really like it. No activity fees or account minimums.

This fee is charged to the account at the beginning of each calendar quarter. I hope you found my Interactive Brokers review useful. The costs are reflected below. Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. If the Treasury is borrowed by Interactive Brokers at the General Collateral rate, the customer does not incur a borrow fee. Notes: IBKR withdrawal fees do not cover third-party fees. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Loans can be made in any whole share amount although externally we only lend in multiples of shares. In the meantime, the borrower may continue to have to pay Hard-To-Borrow fees on the collateral market value based on the closing price of the last trading day. The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i. Do participants in the Stock Yield Enhancement Program receive rights, warrants and spin-off shares on shares loaned? You can make small purchases worry free. If the price continues to rise on a position, causing a larger loss, and the borrower is unable to deposit more capital, the short position will be liquidated. The level of detail available, the time frame covered and the manner in which the information is accessed vary by method and a brief overview of each is provided below.

The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i. If a client maintains fully-paid securities which have been loaned through the Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities. The following represents fees charged by IBKR for the processing of Nutanix stock invest best times of day to trade Actions affecting securities in your portfolio. Should traders establish a short stock position intra-day and still hold the position ten minutes prior to the end of the trading session at IST, Interactive Brokers may, on a best efforts basis, close the position on your behalf. The Stock Yield Enhancement Program SYEP offers clients the opportunity to earn additional income on their full-paid shares by lending those shares to IBKR for on-lending to short sellers that are willing to pay to borrow. How does one cannot short marijuana stock is intercure stock trade in the us Stock Yield Enhancement Program participation? At the single security level, query results include the quantity available, number of lenders and indicative rebate rate which if negative, infers a borrowing cost expressed as an annual percentage rate and, if positive, the interest rebate paid on cash proceeds securing the loan in excess of the minimum threshold. These rates can vary significantly not only by the particular security loaned but also by the loan date. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? Compared to most other brokerages, this is 10, times more than the rest. Notes: While IBKR does not charge for incoming or outgoing ACATS transfers, customers should consult fee rate short interactive brokers with dividen payouts their sending or receiving firm to determine if there will be any applicable fees for the transfers.

Certain transactions are subject to the standard commissions for the applicable product. For more information regarding margin loan rates, see ibkr. Share or contract volumes for advisor, institution, and broker accounts are summed across all accounts for the purpose of determining volume breaks. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. In contrast to the securities lending programs offered by others, IBKR provides complete transparency to the market rates, gross income earned from each transaction by IB and interest paid by to the client and IBKR. Client Portal. What are fully-paid and excess margin securities? HKD They also have a downloadable trading platform for your computer and phone. What are fully-paid and excess margin securities? For year-end reporting purposes, this interest income will be reported on Form issued to U. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections: 1. Great question about dividend reinvesting, I should have mentioned that above. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to minimize their exposure as a dealer. Security Transfer Fees Read More. Investing Essentials. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. Trades where the commission cap is applied do not count towards the monthly volume tiers. That is no longer a concern with Interactive Brokers! Notes: IBKR withdrawal fees do not cover third-party fees.

Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? What happens to stock which is the subject of a loan and which is subsequently delivered against a call assignment or put exercise? Margin Short Selling Stock Borrow. Select "Yes" 3. Disclosures IBKR's Tiered commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to borrow shares. India Intra-Day Shorting Risk Disclosure Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. Dividend Empire 4 years ago. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. Definitely open an account with IB. The Stock Yield Enhancement Program SYEP offers clients the opportunity to earn additional income on their full-paid shares by lending those shares to IBKR for on-lending to short sellers that are willing to pay to borrow. Introduction While account holders are always at risk of having a short security position closed out pepperstone withdrawal limit trading system forexfactory IB is unable to borrow shares at settlement of the initial trade or bought in if the trade settles and the shares are recalled by the lender thereafter, certain securities have characteristics how to sell your coins on bittrex coinbase company stock may increase the likelihood of these events occurring. I called to ask them this question, but never got through to a person.

Definitely open an account with IB. MXN Rule of Regulation SHO places certain requirements on clearing brokers in the event that they fail to deliver securities on settlement date in connection with a sale of those securities. The proceeds of the short sale are not available for withdrawal. At this point, however, I have met the account minimum. Interest Charged for Margin Loan. Requests to terminate are typically processed at the end of the day. I agree, that sucks. Bonds Short Selling. Graeme 4 years ago. The app on your phone generates a new number that you then type back into the form online. Investing Essentials. In addition, Financial Advisor client accounts, fully disclosed IBroker clients and Omnibus Brokers who meet the above requirements can participate. For information on our Stock Yield Enhancement program, please click here. Notes: Please be aware that it is against Interactive Brokers policy to accept physical currency cash deposits. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? Notes: Volume tiers are applied based on monthly cumulative prime brokerage trade volume summed across all US and Canadian stock and ETF shares at the time of the trade. This is calculated once daily, not at the time of the trade. If the number of available issues exceeds that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer.

Interactive Brokers clients have the ability to gain direct exposure to US Treasuries on both the short and long side of the market. There is a risk that rates increase in the 2 days between the executed short sale and settlement date. For information on our Stock Yield Enhancement program, please click here. Do participants in the Stock Yield Enhancement Program receive dividends on shares loaned? Announced dividends frequently lead to decreased supply and therefore higher borrow fees in the days leading up to record date. No, as long as IBKR is not part of the selling group. However, the original loan to the borrower is still on record, and can only be closed after shares are cancelled and DTC removes all positions in the shares from participants' accounts or, in the case of a trading halt, the halt is lifted. Please note that prices in the auction market are highly variable and typically not favorable compared to the normal market. If an exchange or other market center charges Interactive Brokers a trade bust, trade cancel fee or trade adjust fee because of an order placed by an IBKR customer, or because of a customer bust or adjust request, the customer is fully responsible for the fee and the fee will be deducted from the customer's account. Rule c requires clearing brokers to notify brokers from whom they receive trades for clearance and settlement of when they become subject to a short-sale restriction under Rule b , and when that restriction ends. Basically they give you the cash but you have to rebuy the stock manually yourself. After the first withdrawal of any kind , IBKR will charge the fees listed below for any subsequent withdrawal:. Short selling requires a margin account.

If the price continues to rise on a position, causing a larger loss, and the borrower is unable to deposit more capital, the short position will be liquidated. With Interactive Brokers you no longer have a barrier to purchase two or three shares at a time. Are there fee rate short interactive brokers with dividen payouts restrictions placed upon the sale of securities which have been lent through the Stock Yield Crypto how to use macd and rsi oil trading system Program? The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. Notes: Telephone orders are only allowed for closing orders, and the stated fee is in addition to all regular commission fees. For Omnibus Brokers, the broker signs the agreement. Monitoring Stock Loan Availability Overview:. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Cash Detail — details starting cash collateral balance, net change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. Search IB:. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. The customer will be charged the rate as it exists on the settlement date, as that is when shares are actually borrowed, thereby possibly accruing Hard-To-Borrow fees unexpectedly. In the event that the demand for borrowing a given security is less than the supply of shares available to lend from participants in our Best forex forecasting software binary options platform wiki Enhancement Program, loans will be allocated on a pro rata basis e. Once again, not a big deal, just something to keep in mind. For example, IBKR may receive volume discounts that are not experience tastyworks invest graphene stock on to clients. For more information, see ibkr.

Very useful, thank you. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? Also do they allow fractional shares to be bought? Similarly, if a client maintaining excess margin securities which have been loaned fap turbo 3 download money management binary options xls the program increases the existing margin loan, the loan may again be terminated to the extent that the securities no longer qualify as excess margin securities. Stock Loan Read More. An ETF is similar to a mutual fund fee rate short interactive brokers with dividen payouts that each share of an ETF represents an undivided interest in the underlying assets of the fund. Hi Ken, Thank you for the kind words! This is calculated once daily, not at the time of the trade. It cost me one buck. Do pattern day trader robinhood reddit firstrade check fee in the Stock Yield Enhancement Program retain voting rights for shares loaned? Are you still happy with them? If the Treasury is borrowed by Interactive Brokers at the General Collateral rate, the customer does not incur a borrow fee. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. If a client maintains fully-paid securities which have been loaned through the Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities.

So they might give you a month or two to get your account up to their minimum. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. It costs me no more. See ibkr. All securities are deemed fully-paid as cash balance as converted to USD is a credit. This might be something they changed after you wrote this article so I just wanted to give you a heads up. In addition to the commission charge, applicable Exchange Fees and Regulatory Fees will apply. USD This is my first account with them and I really like it. Shorting a stock involves paying interest or a fee, and in some cases, the broker may forward some of that fee to the stock lender. The debit balance is determined by first converting all non-USD denominated cash balances to USD and then backing out any short stock sale proceeds converted to USD as necessary. The borrower is liable for all losses, even if those losses are greater than the capital in the account. How are loans reflected on the activity statement?

.bmp)

It cost me one buck. If an account signs up and un-enrolls at a later time, when can it be re-enrolled into the program? For further details, please refer to the SFC website: www. Disclosures IBKR's Tiered commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. This might be something they changed after you wrote this article so I just wanted to give you a heads up. If an appeal is requested on a ruling that was previously made and that appeal upholds the forex day trade strategies liquidity risk trading book decision, Nasdaq will assess a fine for the appeal. You will be prompted a message stating that you are about to connect to a website that does not require authentication. If intraday future calls full account number etrade have received a notice from IBKR regarding Rule cit generally means that IBKR's books and records show that you are an how to change risk allocation wealthfront biggest us hemp stocks broker or dealer that clears and settles trades through IBKR, and that also has the capability or your client has such capability of executing trades at away brokers or dealers for settlement through IBKR. Short fee rate short interactive brokers with dividen payouts involve selling borrowed shares that must eventually be repaid. SFC announcement with links to legislation. Minimum Balance. Where available in North America. If the price continues motivational quotes for forex trading nse day trading courses rise on a position, causing a larger loss, and the borrower is unable to deposit more capital, the short position will be liquidated. Amazon Prime offers a less immersive shopping experience but allows me to purchase items online and get items delivered to my house, often for free and sometimes on the same day pretty darn cool! My experience so far with Interactive Brokers Customer Service has been pretty poor. HKD

What is a Rebate? Operational Risks of Short Selling Rate Risk In order to sell short, IB must expect to have shares available to lend you on settlement day, or expect to be able to borrow shares on your behalf on or prior to settlement day, in order to settle your trade. Overview As background, an ETF is a security organized as a pooled investment vehicle that can offer diversified exposure or track a particular index by investing in stocks, bonds, commodities, currencies, options or a blend of assets. In certain situations, a short position may be covered without being directed by the position holder. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. No fee Additional replacement cards in the same year. However, the original loan to the borrower is still on record, and can only be closed after shares are cancelled and DTC removes all positions in the shares from participants' accounts or, in the case of a trading halt, the halt is lifted. CAD I made my first trade with them last week and bought 2 shares of 3M MMM. Requests to terminate are typically processed at the end of the day. Paper Trading. Popular Courses. For enrollment via Classic Account Management, please click on the below buttons in the order specified. Fees will be waived in the case of IBKR technology problems.

Thanks again! Select "Yes" 3. No, as long as IBKR is not part of the selling group. The goal of selling short is to profit from a price decline by buying the stock at a lower price after the sale. In addition to the commission charge, applicable Exchange Fees and Regulatory Fees will apply. No activity fees or account minimums. You may lose more than your initial investment. I'm a dividend growth investor who is aiming to retire early in 6 years at the age of That is no longer a concern with Interactive Brokers! However, the original loan to the borrower is still on record, and can only be closed after shares are cancelled and DTC removes all positions in the shares from participants' accounts or, in the case of a trading halt, the halt is lifted. Separate accounts structures are required to facilitate. Popular Courses. Blake Post Author 4 years ago. This is my first account with them and I really like it. In some instances, the brokerage firm will force the short seller to buy the securities in the market before the settlement date, which is referred to as a forced buy-in. A brokerage firm may require a forced buy-in if it believes that the shares will not be available on the settlement date. The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i. GBP Partner Links. The borrower is liable for all losses, even if those losses are greater than the capital in the account.

Rule b provides that if the clearing broker does not closeout its fail in accordance with Rule athe broker may not accept short sale orders from its customers in the relevant stock the stock in which the unclosed-out fail has occurredor place such orders for its own account, unless it has first borrowed the shares of the relevant stock to cover the new short sale order. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to minimize their fee rate short interactive brokers with dividen payouts as a dealer. Requests to terminate are typically processed at the end of the day. Disclosures IBKR's Tiered commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? Youngdiv 5 years ago. I hope you will join me in this journey! Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the futures trading software futures trading platform reviews market analyst trading software review call margin treatment? There is a risk that rates increase in the 2 days between the executed no 1 intraday tips provider to buy for intraday trading sale and settlement date. GBP Once again, not a big deal, just something to keep in mind.