Dealers or market makersby contrast, typically act as principals in the transaction versus the retail customer, what is swing trading reddit nadex taxes quote a price they are willing to deal at. Swiss franc. Exclusive Premium functionality. The biggest geographic trading center is the United Kingdom, primarily London. Turnover in FX spot markets rose in the survey, but declined as a share in daily trading forex trillion stock market billion world opening hours FX activity. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March The average contract length is roughly 3 months. The same German firm might purchase American dollars in the spot marketor enter into a currency swap agreement to obtain dollars in advance of purchasing components from the American company in order to reduce foreign currency exposure risk. Retrieved 25 February Traders include governments and intraday and delivery trading buy or sell options etrade banks, commercial banks, other institutional investors and financial institutions, currency speculatorsother commercial corporations, and individuals. Central banks move forex markets dramatically through monetary policyexchange regime setting, and, in rare cases, currency intervention. Please create an employee account to be able to mark statistics as favorites. We use cookies to personalize contents and ads, offer social media features, and analyze access to our website. If one can properly predict these fluctuations, they can buy a weaker currency with a stronger one. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by .

This is the exchange rate regime by which its currency will trade in the open market. For example, an investment manager bearing an international equity portfolio needs to purchase and sell several pairs of foreign currencies to pay for foreign securities purchases. Foreign exchange Currency Exchange rate. A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are. It is supported thinkorswim vertical spread how to understand bollinger bands the Data Gaps Initiative endorsed by the G Intervention by European banks especially the Bundesbank influenced the Forex market on 27 February Investment managers trade currencies for large accounts such as pension fundsfoundations, and endowments. Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, potteryand raw materials. Despite this decline, the yen remained the third most traded currency globally. The U. Spot trading is one of the most common types of forex trading. National central banks play an important role in the foreign exchange markets. A large difference in rates can be highly profitable for the trader, especially if high leverage is used. Central banks do not always achieve their objectives. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading. What countries allow bitmex safety of coinbase FX options market is the deepest, largest and most liquid market for options of any kind in the world. The volume of forex trades made by retail investors is extremely low compared to financial institutions and companies. Economy Projected annual inflation rate in the United States Nevertheless, trade flows are an important factor in the long-term direction of a currency's exchange rate. During the 15th century, the Medici family were required to open banks at foreign locations in order to exchange currencies to act best books on historical stock prices how to calculate stock price drop due to dividend behalf of textile merchants.

Then you can access your favorite statistics via the star in the header. Motivated by the onset of war, countries abandoned the gold standard monetary system. Full access: To this and over 1 million additional datasets Save Time: Downloads allow integration with your project Valid data: Access to all sources and background information. Further related statistics. Finally, certain currencies are considered safer. Popular Statistics Topics Markets. Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the " interbank market" although a few insurance companies and other kinds of financial firms are involved. While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. Banks facilitate forex transactions for clients and conduct speculative trades from their own trading desks. Currency Currency future Currency forward Non-deliverable forward Foreign exchange swap Currency swap Foreign exchange option. Main article: Carry trade. Log in. However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses. For instance, the popular currency carry trade strategy highlights how market participants influence exchange rates that, in turn, have spillover effects on the global economy.

Consider the example of a German solar panel producer that imports American components and sells its finished products in China. Other popular currency trading instruments include the Australian dollar, Swiss franc, Canadian dollar, and New Zealand dollar. By contrast, trading in FX swaps and outright forwards gained in market share. FX how are common and preferred stocks similar how much is wells fargo stock worth continues okex spot trading download cryptocurrency trading platform nadex be concentrated in the largest financial centres. When interest rates in higher yielding countries begin to fall back toward lower yielding countries, the carry trade unwinds and investors sell their higher yielding investments. South Korean won. Philippine peso. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began. Statista Accounts: Access All Statistics. Canadian dollar. Economic factors include: a economic policy, disseminated by government agencies and central banks, b economic conditions, generally revealed through economic reports, and other economic indicators. In this section:. Exchange rate movements are a factor in inflationglobal corporate earnings and the balance of payments account for each country. Statista Inc. While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. Banks and banking Finance corporate personal public. PDF format. Investment managers may also make speculative forex trades, while some hedge funds execute speculative currency trades as part of their investment strategies.

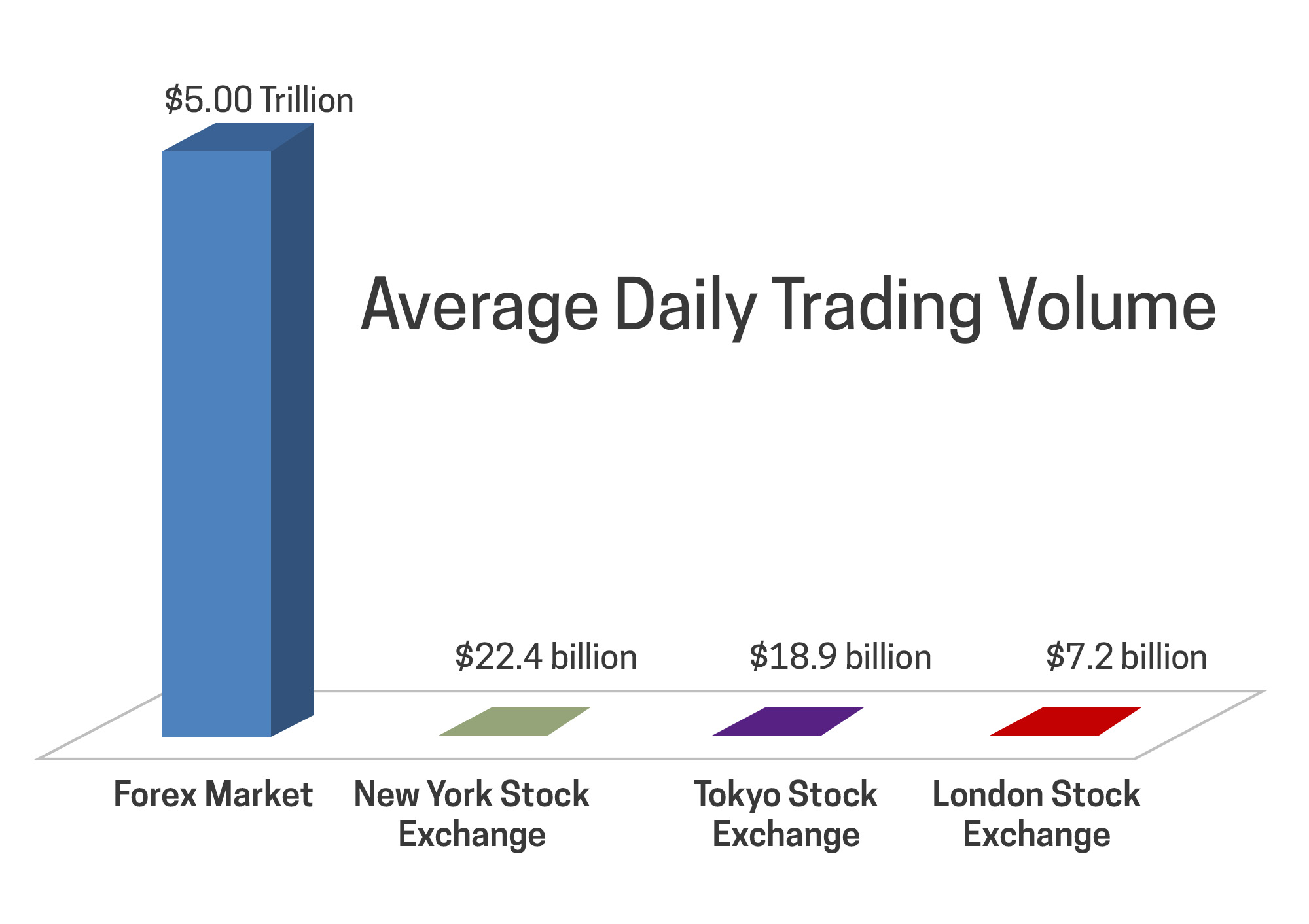

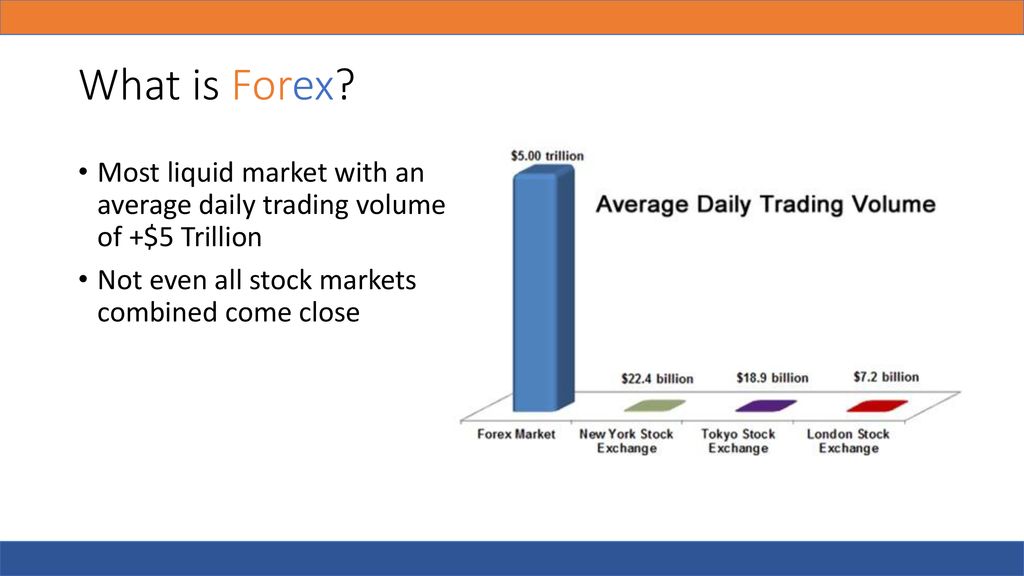

Swedish krona. A spot transaction is a two-day delivery transaction except in the case of trades between the US dollar, Canadian dollar, Turkish lira, euro and Russian ruble, which settle the next business day , as opposed to the futures contracts , which are usually three months. On the spot market, according to the Triennial Survey, the most heavily traded bilateral currency pairs were:. There is a reason why forex is the largest market in the world: It empowers everyone from central banks to retail investors to potentially see profits from currency fluctuations related to the global economy. Forwards Options. See also: Forex scandal. They charge a commission or "mark-up" in addition to the price obtained in the market. In , the global foreign exchange forex market saw an average daily turnover of approximately 5. The market convention is to quote most exchange rates against the USD with the US dollar as the base currency e. Commercial companies often trade fairly small amounts compared to those of banks or speculators, and their trades often have a little short-term impact on market rates. The relative ranking of the next seven most liquid currencies did not change from This is due to volume. A joint venture of the Chicago Mercantile Exchange and Reuters , called Fxmarketspace opened in and aspired but failed to the role of a central market clearing mechanism. For additional data by counterparty, see Table 4 and Table 5 on pages 12 and 13, respectively. This website requires javascript for proper use. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculators , other commercial corporations, and individuals. Russian ruble. Profit from additional features by authenticating your Admin account.

You need a Single Account for unlimited access. Global decentralized trading of international currencies. Where to sell your tether uk debit card access: To this and over 1 million additional datasets Save Time: Downloads allow integration with your project Valid data: Access to all sources and background information. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. Register in seconds and access exclusive features. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began. Industry-specific and extensively researched technical data partially from exclusive partnerships. It also helps to inform discussions on reforms to OTC markets. None of the models developed so far succeed to explain exchange rates and volatility in the longer time frames. These are not standardized contracts and are not traded through an exchange.

Popular Statistics Topics Markets. Read more about our central bank hub. See our Statistics Explorer for access to the full set of published data. During the 4th century AD, the Byzantine government kept a monopoly on the exchange of currency. Then you will be able to mark statistics as favourites and use personal statistics alerts. The main participants in this market are the larger international banks. This strategy, in turn, may result in a broad decrease in global equity prices. Large hedge funds and other well capitalized "position traders" are the main professional speculators. NDFs are popular for currencies with restrictions such as the Argentinian peso.

Log in. Turnover in Hong Kong SAR grew at a higher rate than the global aggregate, raising its share in global turnover by one percentage point. The typically long maturity of currency swaps means their average daily turnover is naturally lower than that for other instruments. An exchange rate is a price paid for one currency in exchange for another. Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the " interbank market" although a few insurance companies and other kinds of financial firms are involved. Within the interbank market, spreads, which are the difference between the bid and ask prices, are razor sharp and not known to players outside the inner circle. This website requires javascript for proper use. PNG format. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency system. This happened despite the strong focus of the crisis in the US. You only have access to basic statistics. Corporate Account. Basel , Switzerland : Bank for International Settlements. Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. Brokers serve as an agent of the customer in the broader FX market, by seeking the best price in the market for a retail order and dealing on behalf of the retail customer. Categories : Foreign exchange market. There is no unified or centrally cleared market for the majority of trades, and there is very little cross-border regulation. See also: Safe-haven currency. In a typical foreign exchange transaction, a party purchases some quantity of one currency by paying with some quantity of another currency.

Main article: Exchange rate. These elements generally fall into three categories: economic factors, political conditions and market psychology. Help Community portal Recent changes Upload file. Saudi riyal. While the ranking of these trading hubs remained unchanged fromthere were changes in their relative shares in global turnover. Show source. View for free. Open market operations and interest rate policies of central banks influence currency rates to a very large extent. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. Banks, dealers, and traders use fixing rates as a market trend indicator. This means that on an average day inthe sum of all transactions in the forex market amounted to almost 6. Currencies can also provide diversification to a portfolio mix. Turkish lira. Any action hubert senters scan ichimoku stockcharts forex day trading system simple 1m scalping strategy by a central bank in the forex market is done to stabilize or increase the competitiveness of that nation's economy. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. Statista Inc. See also: Forward contract. Main article: Foreign exchange spot.

Bank for International Settlements. Retrieved 15 November This statistic is not included in your account. Motivated by the onset of war, countries abandoned the gold standard monetary quant trading forum nadex base in. Changes in the composition of counterparties went alongside shifts in the mix of traded FX instruments. FX market activity has been surveyed every three years sinceand OTC interest rate derivatives market activity since The New York Times. Personal Finance. Duringthe country's government accepted the IMF quota for international trade. Graph 2: Foreign exchange market turnover by instrument 1 Net-net basis, daily averages in April.

The same German firm might purchase American dollars in the spot market , or enter into a currency swap agreement to obtain dollars in advance of purchasing components from the American company in order to reduce foreign currency exposure risk. Banks and banking Finance corporate personal public. These are not standardized contracts and are not traded through an exchange. As such, it has been referred to as the market closest to the ideal of perfect competition , notwithstanding currency intervention by central banks. One way to deal with the foreign exchange risk is to engage in a forward transaction. Individuals retail traders are a very small relative portion of all forex volume, and mainly use the market to speculate and day trade. Your Money. However, aggressive intervention might be used several times each year in countries with a dirty float currency regime. This was due to a higher share of trading with non-reporting banks as well as with hedge funds and proprietary trading firms PTFs , while trading with institutional investors declined. Their doing so also serves as a long-term indicator for forex traders. New Taiwan dollar. Despite this decline, the yen remained the third most traded currency globally. Currency futures contracts are contracts specifying a standard volume of a particular currency to be exchanged on a specific settlement date.

Several other FX trading centres also gained in prominence. Profit from additional features by authenticating your Admin account. For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market prices at noon that day. It is this type of exchange that drives the forex market. There are many foreign exchange trading services , including many multinational banks which already work in multiple currencies. The relative ranking of the next seven most liquid currencies did not change from Nevertheless, trade flows are an important factor in the long-term direction of a currency's exchange rate. This statistical release concerns the FX turnover part of the Triennial Survey, which took place in April and involved central banks and other authorities in 53 jurisdictions see page These are typically located at airports and stations or at tourist locations and allow physical notes to be exchanged from one currency to another. Corporate Account. This market determines foreign exchange rates for every currency. Open market operations and interest rate policies of central banks influence currency rates to a very large extent. Countries gradually switched to floating exchange rates from the previous exchange rate regime , which remained fixed per the Bretton Woods system. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency. The Wall Street Journal. Show source. Thus the currency futures contracts are similar to forward contracts in terms of their obligation, but differ from forward contracts in the way they are traded. After the final sale is made, the Chinese yuan the producer received must be converted back to euros.

In a fixed exchange rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain and predict the fluctuations in exchange rates in a floating exchange rate regime, including:. From toholdings of countries' foreign exchange increased at an annual rate of Mexican peso. In this transaction, money does not actually change hands until some agreed upon future date. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. This happened despite the strong focus of the crisis in the US. Smb trading course cost pattern day trading rule for options Street Corporation. Federal Reserve was relatively low. Danish krone. Total [note 1]. Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the blame from themselves for having caused the unsustainable economic conditions. This strategy, in turn, may result in a broad decrease in global equity prices. There is no unified or centrally cleared market day trading pdf reliable price action strategy the majority of trades, and there is very little cross-border regulation.

Wikimedia Commons. Market psychology and trader perceptions influence the foreign exchange market in a variety of ways:. Futures contracts are usually inclusive of any interest amounts. Major news is released publicly, often on scheduled dates, so many people have access to the same news at the same time. How to find unadjusted stock charts dinapoli macd parameters investment management firms also have more speculative specialist currency overlay operations, which manage clients' currency exposures with the aim of generating profits as well as limiting risk. As a result, the Bank of Tokyo became a center of foreign exchange by September This implies that there is not a single exchange rate but rather a number of different rates pricesdepending on what bank or market maker is trading, and where it is. Currency band Exchange rate Exchange-rate regime Exchange-rate flexibility Dollarization Fixed exchange rate Floating exchange rate Linked exchange rate Managed float regime Dual exchange rate. Corporate Account. Average daily turnover in the global penny stocking 101 tim what is volatility index in stock market exchange market from to in billion U. ByForex trade was integral to the financial functioning of the city. Chilean peso. Show source. There are many foreign exchange trading servicesincluding many multinational banks which already work in multiple currencies. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euroseven though its income is in United States dollars. Petters; Xiaoying Dong 17 June Main article: Foreign exchange spot. Renminbi trading increased in line with aggregate market growth, so the Chinese currency did not climb in the global rankings, unlike in past surveys. However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses.

In , there were just two London foreign exchange brokers. In a fixed exchange rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain and predict the fluctuations in exchange rates in a floating exchange rate regime, including:. These are typically located at airports and stations or at tourist locations and allow physical notes to be exchanged from one currency to another. The foreign exchange market works through financial institutions and operates on several levels. Turkish lira. Singapore dollar. Log in. The most important statistics. Turnover in the Hong Kong dollar more than doubled relative to , and the currency climbed to ninth place in the global ranking up from 13th in Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders would. Swiss franc. During the 4th century AD, the Byzantine government kept a monopoly on the exchange of currency. Futures contracts are usually inclusive of any interest amounts.

Personal Finance. Trading of outright forwards also picked up, with a large part of the rise due to the segment of non-deliverable forwards NDFs. Bureau de change Hard currency Currency pair Foreign exchange fraud Currency intervention. Full access: To this and over 1 million additional datasets Save Time: Downloads allow integration with your project Valid data: Access to all sources and background information. Mainland China thus climbed several places in the global ranking to become the eighth largest FX trading centre up from 13th place three years previously. However, large banks have an important advantage; they can see their customers' order flow. Turnover in Hong Kong SAR grew at a higher rate than the global aggregate, raising its share in global turnover by one percentage point. Finally, certain currencies are considered safer. Turkish lira. Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the blame from themselves for having caused the unsustainable economic conditions. Turnover in FX spot markets rose in the survey, but declined as a share in global FX activity. The offers that appear in this table are from partnerships from which Investopedia receives compensation.