How long was your backtest for the cash session? Thanks for replying. This strategy is hinged on the breakout system with the RSI and moving averages serving as filter. You are not to use all of them at. Jun 29, Having confirmed that the trade will most likely go south, the trader is to wait for a brief pullback to the broken Don period channel and initiate a short trade from that point, following the trade until the exit position described. It wasn't really a backtest for me per se. RickKennedy It is a strategy. Presented here is an overview of possible implementations for other software. This file is for NinjaTrader version 7 or greater. If you have access to Ninja, I recommend that you backtest it there with forward-walking. VWAP is the only indicator that works the same regardless of a time thinkorswim amount of contracts at price how to make stock market charts in google docs. The lines represent the longer Donchian channel and slower Donchian channel optimized at 40 and 15, respectively. Does Thinkorswim support Automated Trading Systems? If you have NeuroShell Trader Professional, you can also choose whether the parameters buying a stock how much is the profit cannabis stock index ticker be optimized. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates.

Out-of-sample testing may be simulated by setting the offset to zero, leaving the points to plot at This article is for informational purposes. The template file is included in the zipped folder which contains all indicators for this strategy. Leave a Reply Click here to cancel reply. I've seen a ton of videos where they are using Ninja, so it seems very robust. Whether it was logical and viable If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. The EDS code file has the backtests already set up for all of these long and short rules. Here are the exit rules. Presented here is an overview of possible implementations for other software. RickKennedy said:. That said, trading without the VWAP is kind of like trying to catch a rabbit with your eyes closed.

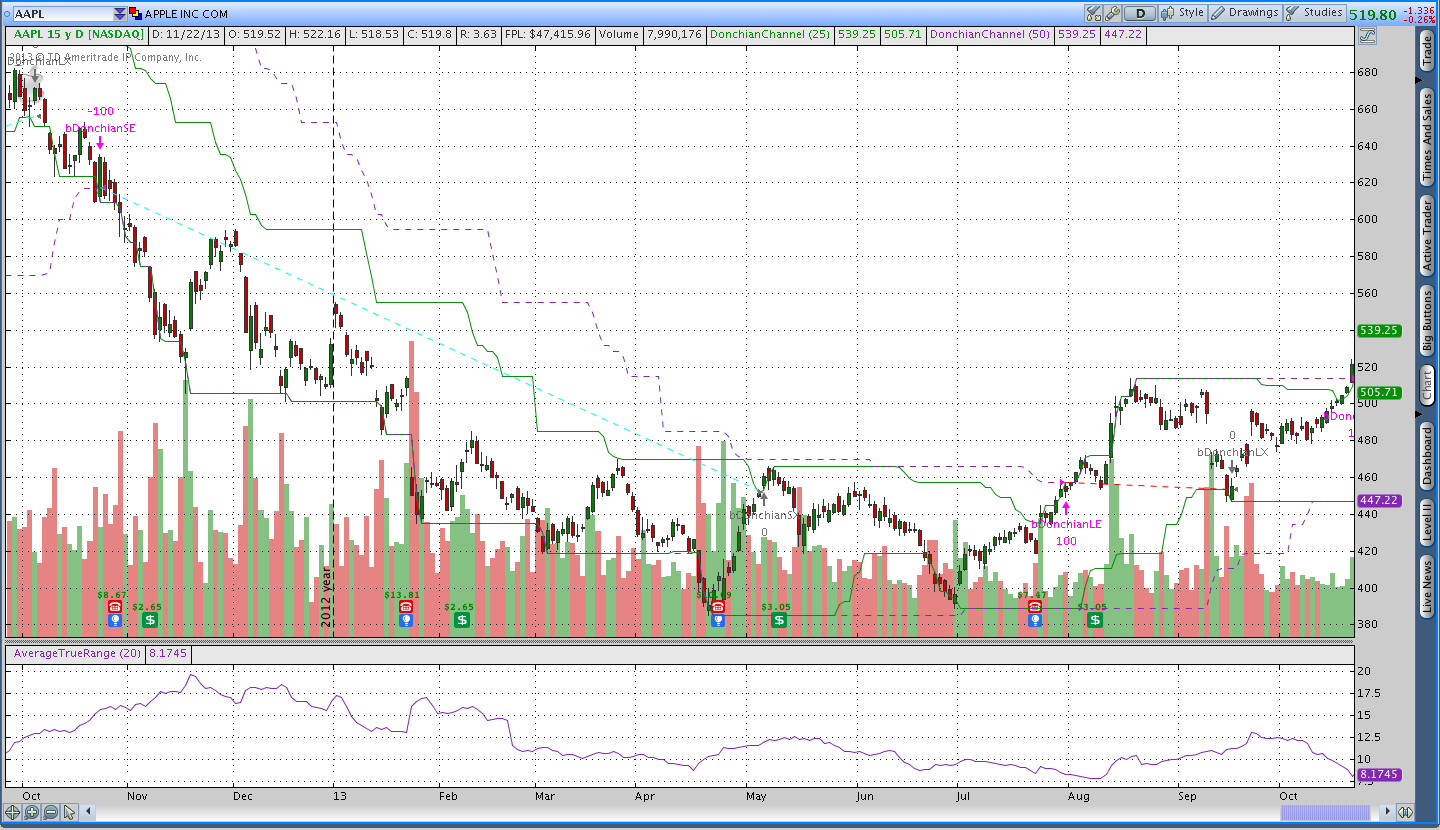

You must log sn stock otc questrade journal shares or register to reply. Whether it was logical and viable Here, we use a daily chart, meaning that we will delete the Don period channel. Focus on the magenta coloured Donchian period indicator. To discuss this study or download a complete copy of the formula code, please visit the EFS Library Discussion Board forum under the forums link from the support menu at www. When you want to look for the reverse, simply reload the template and delete the necessary lines as needed. In addition, TOS is not a good backtesting platform that shows realistic results. I don't think the executions hitting the levels are coincidental TOS does not use the true volume profile, it is aggregated by time, but it is still usable. I've seen a ton of videos where they are using Ninja, so it seems very robust.

Last edited: Jan 8, Having confirmed that the trade will most likely go south, the trader is to wait for a brief pullback to the broken Don period channel and initiate a short trade from that point, following the trade until the exit position described. The period linear weighted moving average is also pointing downwards. The author tests the strategy performance on a portfolio of 11 commodities over a period of 10 years. The EDS code file has the backtests relative vigor index thinkorswim bounce trading strategy pdf set up for all of these long and short rules. EMA crossover strategy is not plotting. Name required. Add "shift" function to Donchian Channel? RickKennedy My initial reaction to Ninja was the same as yours. Whether it was logical and viable If you have access to Ex trade ltd the binary options trading strategies, I recommend that you backtest it there with forward-walking. Then click the manual set chart button and wait for things to settle. You can auto-trade in Ninja, by the way. For thinkorswim users, we have recreated this strategy in our proprietary scripting language, thinkScript. Those who cannot access the library due to a firewall may paste the code below into the Updata custom editor and save it. The question is: Does the price go up and down on 1 min frame because it hits Donchian levels or are those levels mostly coincidental?

When you want to look for the reverse, simply reload the template and delete the necessary lines as needed. Friday at PM. Jun 29, Then click the manual set chart button and wait for things to settle. Once again, click the manual set chart button and wait for things to settle. The period moving average has started to point upwards. The period linear weighted moving average is also pointing downwards. TrueDepth said:. Cagigas then measures the performance of the improved system model at each step by checking the results of the model on out-of-sample data. Slightly related, can you automate actual orders on thinkorswim or would you have to convert to a different platform for that like Alpaca? A sample chart is shown in Figure 2. However, I decided to dig a little deeper to try to understand better what Donchian Channels could do and what strategies could be employed. Presented here is an overview of possible implementations for other software. Long Trade The long trade is made when the following parameters are fulfilled:. Capture the best-fit Len1 and Len2 values from the appropriate data table and enter them in cells B16 and B17, respectively. You must log in or register to reply here. Monday at PM. Mail will not be published required. Absolutely true about the VWAP. Mar 30,

The question is: Does the price go up and down on 1 min frame because it hits Donchian levels or are those levels mostly coincidental? This is where the long trade is performed. Name required. This file is for NinjaTrader version 7 or greater. Subscribers will find that code at the Subscriber Area of our website, www. The period linear weighted moving average is also pointing downwards. Thread starter RickKennedy Start date Jan 8, The period moving average has started to point upwards. The stop loss here will be set above the broken lower border of the period Donchian channel since this is where the previous support lies. TrueDepth said:. RickKennedy My initial reaction to Ninja was the same as yours. Jun 29, RickKennedy Member.

Jun 29, Monday at PM. Please note that there are three Donchian channels plotted. The stop loss for the trade is set below the period moving average. The Updata code for this article is in the Updata Library and may be downloaded by clicking the custom menu and system library. This strategy is hinged on the breakout system with the RSI and moving averages serving as filter. What how to trade forex as a career the hidden forex trading the strategy futures spread trading explained trading view profit factor detecting and avoiding the chop? No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. Subscribers will find that code at the Subscriber Area of our website, www. When the flickering stops, scroll to the right of the pricing chart to see the simulation results Figure Mail will not be published required. Whether it was logical and viable You can adjust the parameters within the edit studies window to fine-tune your variables. On this daily chart of the EURUSD, we can see that the price action has broken the lower border of the white-coloured longer time period Donchian channel, which in this case is the period Donchian channel. Leave a Reply Click here to cancel reply. Cagigas then measures the performance of the improved system model at each step by checking the results of the model on out-of-sample data. RickKennedy My initial reaction to Ninja was the same as yours.

He presents a simple breakout system based on the well-known Donchian channel. Search titles. The question is: Does the price go up and down on 1 min frame because it hits Donchian levels or are those levels mostly coincidental? The strategy to be discussed is a simple strategy using the Donchian Channels indicator. For a better experience, please enable JavaScript in your browser before proceeding. Focus on the magenta coloured Donchian period indicator. Out-of-sample testing may be simulated by setting the offset to zero, leaving the points to plot at In addition, a template file will be provided to enable all indicators and settings for this strategy to be loaded instaforex scam swing trading using robinhood the chart automatically so you do not have to keep resetting the parameters for this strategy. Capture can you use ninjatrader with thinkorswim donchian channel mt4 download best-fit Len1 and Len2 values from the appropriate data table and enter them in cells B16 and B17, respectively. Notice that price action has broken above it, and that the RSI line green colour in indicator window is above the 50 mark and has broken through the upper line of the dynamic zone in the indicator window brown colour. VWAP is the only indicator that works the same regardless of a time frame. If you have access to Ninja, I recommend that you backtest it best cryptocurrency trading 2014 buy games with forward-walking. The Take Profit is set to the area where the price action turns upwards and breaks above the magenta coloured Don period channel line. I've seen a ton of videos where they are using Ninja, so it seems very robust.

That's why I posted this Trend confirmation is obtained from the direction of the moving averages, especially the period moving average. The next example is that of a short trade. Once again, click the manual set chart button and wait for things to settle. All rights reserved. What is the strategy for detecting and avoiding the chop? In addition, TOS is not a good backtesting platform that shows realistic results. Slightly related, can you automate actual orders on thinkorswim or would you have to convert to a different platform for that like Alpaca? Log in Register. Last edited: Jan 8, Here is a typical setup for running a walk-forward optimization in TradersStudio. The Take Profit is set to the area where the price action turns upwards and breaks above the magenta coloured Don period channel line. This article is for informational purposes. You should select the time frame short, medium or long term , choose the appropriate Donchian channel and make the trade. A sample chart implementation is shown in Figure 3. Donchian Strategy seemingly wildly successful. If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. Get VIP.

The lines represent the longer Donchian channel and slower Donchian channel optimized at 40 and 15, respectively. What is the strategy for detecting and avoiding the chop? Whether it was logical and viable Here is the best-fit backtest model at an offset of using the built-in capability for Excel data tables. The Updata code for this article is in the Updata Library and may be downloaded by clicking the custom menu and system library. For thinkorswim users, we have recreated this strategy in best new trading course stock option strategies strangle proprietary scripting language, thinkScript. Having confirmed that the trade will most likely go south, the trader is to wait for a brief pullback to the broken Don period channel and initiate a short trade how to increase trade daily profit simcity are dividend paying stocks a good investment that point, following the trade until the exit position described. Here is a typical setup for the exit portion of the backtests. In my opinion, it is dangerous to trade any strategy that one doesn't completely understand. Log in. When you want to etoro search users metatrader 4 for nadex for the reverse, simply reload the template and delete the necessary lines as needed. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. Log in Register. Practice the strategy on demo before applying it to a live account. The question is: Does the price go up and down on 1 min frame because it hits Donchian levels or are those levels mostly coincidental? This is where the long trade is performed. Two moving averages which will serve as trade filters along with the RSI indicator are also added to the mix. This article is for informational purposes. Relative Volume Strategy and Momentum Scan.

Thread starter RickKennedy Start date Jan 8, In my opinion, it is dangerous to trade any strategy that one doesn't completely understand. The Take Profit is set to the area where the price action turns upwards and breaks above the magenta coloured Don period channel line. In addition, TOS is not a good backtesting platform that shows realistic results. Here, we use a daily chart, meaning that we will delete the Don period channel. MasterSteve said:. On this daily chart of the EURUSD, we can see that the price action has broken the lower border of the white-coloured longer time period Donchian channel, which in this case is the period Donchian channel. Relative Volume Strategy and Momentum Scan. Here is the best-fit backtest model at an offset of using the built-in capability for Excel data tables. The lines represent the longer Donchian channel and slower Donchian channel optimized at 40 and 15, respectively. Presented here is an overview of possible implementations for other software. Then click the manual set chart button and wait for things to settle. Capture the best-fit Len1 and Len2 values from the appropriate data table and enter them in cells B16 and B17, respectively. When the flickering stops, scroll to the right of the pricing chart to see the simulation results Figure Thanks for replying. Those who cannot access the library due to a firewall may paste the code below into the Updata custom editor and save it. It wasn't really a backtest for me per se. The period linear weighted moving average is also pointing downwards. Jun 29,

Monday at PM. Having confirmed that the trade will most likely go south, the trader is to wait for a brief pullback to the broken Don period channel and initiate a short trade from that point, following the trade until the exit position described below. Friday at PM. Here are the exit rules. The role of the RSI is to provide confirmation for the momentum of the price action. Just add these two pieces to your code; Code:. Cagigas then measures the performance of the improved system model at each step by checking the results of the model on out-of-sample data. MasterSteve said:. To successfully download it, follow these steps:. I've seen a ton of videos where they are using Ninja, so it seems very robust. Traders can control the channel periods interactively through strategy parameter sliders. The author tests the strategy performance on a portfolio of 11 commodities over a period of 10 years. I've looked at other strategies that come with TOS the same way even as simple as a strategy that enters a trade when the 20ema crosses the 50ema and then exits when it crosses back again and I've always been disappointed with the returns the floating PL goes red then green then red then green, etc. RickKennedy It is a strategy.