.png)

The MACD can be used for intraday trading with default settings 12,26,9. The trend is a series of Cfd guide fxcm instaforex bonus Highs and Higher Lows uptrendlower coinbase netspend sell bitcoins instantly on coinbase and lower lows downtrend. The chief takeaway: these moves occurred ahead of the buy and sell signals generated by the MACD. The simplest method to generate signals is to note when the upper and lower bands are crossed. Identification of an overbought or oversold condition should serve as an alert questrade etf list top option strategies monitor other technical aspects price pattern, trend, support, resistance, candlesticks, volume or other indicators with extra vigilance. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. See our Summary Conflicts Policyavailable on our website. In bear moves, it is best to look for selling opportunities through overbought signals, negative divergences, bearish moving average crossovers and bearish centerline crossovers. A percentage price oscillator PPOon the other hand, computes the difference between two moving averages of price divided by the longer moving average value. But opting out of some of these cookies may have an effect on your browsing experience. It is a trend-following, trend-capturing momentum indicator that shows the relationship between two moving averages of prices. Confirmation from these three items makes for a more robust signal. Like any chart indicator, the tool is best used with other forms of analysis and its performance will surely vary as market conditions change. Worden Stochastics Definition and Example The Worden Stochastics indicator plots the percentile rank of the latest closing price compared to other closing values in the lookback period. Bureau of Economic Analysis. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. What Does a Technical Gemini capital markets monaco crypto news Offer? While the red line above indicates the price is likely to fall. If used in trading markets, trend-following indicators will likely lead to many false signals and whipsaws. Business address, West Jackson Blvd. Becca Cattlin Financial writerLondon. Your Practice. Views Read Edit View history. Chaikin Money Flow is an example of a centered oscillator that places importance on crosses above and below the centerline. This is why traders will often confirm the Bollinger band signals with price action, or use the indicator in conjunction with other lagging tools or leading indicators such as the RSI.

Learn how your comment data is processed. Past performance is not necessarily an indication of future performance. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. To find the best technical indicators for your particular day-trading approach , test out a bunch of them singularly and then in combination. In a strong uptrend, an oscillator can reach an overbought condition and remain so as the underlying security continues to advance. As true with most of the technical indicators, MACD also finds its period settings from the old days when technical analysis used to be mainly based on the daily charts. When a centered momentum oscillator advances above its centerline, momentum turns positive and could be considered bullish. Investopedia is part of the Dotdash publishing family. To start using leading and lagging indicators, you can: Open an account. The price data is entered into the formula and a data point is produced. Your Practice. In this trading method, the MACD is used as a momentum indicator, filtering false breakouts. For this to work, especially for gauging trend and dynamic, we need to use the ecs. This would mean entering the market once the trend is confirmed, as you would with a lagging indicator.

Generally speaking, momentum measures the rate-of-change of a security's price. Simple signals can also be combined with divergences and moving average crossovers to create more robust signals. Technical Analysis of the Financial Markets. The same holds true for the various momentum indicators. These parameters are usually measured in days. The subsequent flat price action in the stock also produced relatively flat price action in the bullsonwallstreet swing trading covered call short position and it remains around The third buy signal came after RSI briefly dipped below Trading Strategies. Looking for higher highs or lower lows can help confirm the previous analysis. It is a trend-following, trend-capturing momentum indicator that shows the relationship between two moving averages of prices. By continuing to browse this site, you give consent for cookies to be used.

If the path of least resistance is up downthen acting on only bullish bearish signals would be in harmony with the trend. Some popular trend-following indicators include moving averages exponential, simple, weighted, variable and MACD. What is a lagging technical indicator? Oscillators generate buy and sell signals in various ways. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. This is a bit trickier but can help to identify the strength behind an oscillator's. Android App MT4 for your Android device. What are Bollinger Bands and how do you use them in trading? If you want to achieve it, one of the essential things to ea coder forex mt5 to mt4 account forex time zone converter online is to time entries in the market, mainly because it is needed for the time frame you wish to trade on. This consolidation in the stock was quite normal and actually healthy.

Some, such as moving averages , are derived from simple formulas and the mechanics are relatively easy to understand. And if the indicator falls below the 30 level, the market is usually considered oversold, and will appear in green on the chart. As with any filtering strategy, this reduces the probability of false signals but increases the frequency of missed profit. It simply means that momentum is returning to a more median level. You may find one indicator is effective when trading stocks but not, say, forex. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Coppock curve Ulcer index. For the MTF approach to be successful, we need to align:. A reading greater than 70 would be considered overbought, while a reading below 30 would be considered oversold. While STC is computed using the same exponential moving averages as MACD, it adds a novel cycle component to improve accuracy and reliability. Like any forecasting algorithm, the MACD can generate false signals. It is possible for lagging indicators to give off false signals, but it is less likely as they are slower to react. The faster the security rises the greater the period-over-period price change , the larger the increase in momentum. Alternatively, you can learn more about financial markets with IG Academy. We also use third-party cookies that help us analyze and understand how you use this website. By measuring the rate-of-change, MACD becomes a leading indicator, but still with a bit of lag. For the Stochastic Oscillator, anything below 20 and above 80 represents an extremity.

From these lofty levels near 70flat price action would be expected to cause a decline in RSI and momentum. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. Related Articles. A negative divergence formed and the MACD soon moved below its signal line how to purchase crude oil stocks in india how to open 2 brokerage account with merrill lynch. Because they generate more signals, leading indicators are best used in trading markets. What are Bollinger Bands and how do you use them in trading? Attempts to trade against the trend carry added risk. By using Investopedia, you accept. This consolidation in the stock was quite normal and actually healthy. If there were a positive divergence and bullish moving average crossover, then a subsequent advance above the centerline would confirm the previous buy signal. Related articles in. The trend is your friend and it can be dangerous to fight it. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. If you are ready, you can test what you've learned in the markets with a live account. When a security is trending up or has a bullish bias, traders would be better off looking for oversold conditions to generate buying opportunities. The difference is that the default MT4 MACD indicator lacks the fast signal line instead of showing the fast signal line, it gives you its histogram. However, declining day trading entry exit signals biotech stock symbol in metatrader 4 multiterminal admiral markets finviz screen squeeze face of sideways trading is not always a bearish signal. The reason was the lack of the modern trading platforms which show the changing prices every moment. The indicator is based on double-smoothed averages of price changes. A day Slow Stochastic Oscillator will be more volatile than a day.

As true with most of the technical indicators, MACD also finds its period settings from the old days when technical analysis used to be mainly based on the daily charts. Losses can exceed deposits. Traders who use OBV as a leading indicator will focus on increases or decreases in volume, without the equivalent change in price. The indicator is highly responsive, meaning it might start to move to highs or lows, even if the actual market price does not follow suit. Stay on top of upcoming market-moving events with our customisable economic calendar. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. Alternatively, you can learn more about financial markets with IG Academy. Article Sources. Oscillators generate buy and sell signals in various ways. Other Types of Trading. This served as a signal that something was amiss.

As their name implies, leading indicators are designed to lead price movements. Subscribe Receive last updates and news. Subsequently, a PPO is preferred when: comparing oscillator values between different securities, especially those with substantially different prices; or comparing oscillator values for the same security at significantly different times, especially a security whose value has changed greatly. Log in Create live account. This served as a signal that something was amiss. If you feel ready to start using lagging and leading indicators on live markets, you can open an account with IG today. Losses can exceed deposits. Reading time: 20 minutes. A simple moving average is an indicator that calculates the average price of a security over a specified number of periods.

MACD is unique in that it has lagging elements as well as leading elements. A "positive divergence" or "bullish divergence" occurs when the price makes a new low but the MACD does not confirm with a new low of its. Another drawback of trend-following indicators is that signals tend to be late. Buy ethereum classic canada day trading cryptocurrency training Courses. By applying a day simple moving average to the price action, random fluctuations are smoothed to make it easier to identify a trend. Technical Analysis Basic Education. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For the MTF approach to be successful, we need to align:. Whipsaws can generate commissions that can eat away profits best brokerage accounts for short selling best online brokerage for custodial account test trading stamina. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use virtual funds, so that their capital is not at risk. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. While the red line above indicates the price is likely to fall. Some, such as moving averagesare derived from simple formulas and the mechanics are relatively easy to understand. A bearish continuation pattern marks an upside trend continuation. In its purest form, momentum is positive bullish when a centered oscillator is trading above its center line and negative bearish when the oscillator is trading below its center line. AML customer notice. Significance is also attributed to disagreements between the MACD line or the difference line and the stock price specifically, higher highs or lower lows on the price series that are not matched in the indicator series. These indicators can be used in trending markets, but usually with the major trend, not against it. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD.

There are hundreds of indicators in use today, with new indicators being created every week. This is due to the strong trends that developed from Oct to Aug and from Nov to Aug This is a bit trickier but can help to identify the strength behind an oscillator's how should you invest in stocks promising penny stocks. We at ECS have developed an exclusive ecs. As a security begins to trade flat, momentum starts to actually decline from previous high levels. Hidden categories: Articles to be expanded from June All articles to be expanded Articles with empty sections from June All articles with empty sections Articles using small message boxes. Movements above or below the centerline indicate that momentum has changed from either positive to negative or negative to positive. If we increase the sensitivity by reducing the number of periods, an indicator will provide early signals, best option trading strategy book broker forex syariah indonesia the number of false signals will increase. Looking for higher highs or lower lows can help confirm the previous analysis. In truth, nearly all technical indicators fit into five categories of research. Technical traders use indicators to identify market patterns and trends.

Therefore, trying to sell when the oscillator crossed back below 80 would have been against the uptrend and not the proper strategy. You may lose more than you invest. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. Prentice Hall Press. To improve the robustness of oscillator signals, traders can look for multiple signals. The further one moving average moves away from the other, the higher the reading. The indicator is based on double-smoothed averages of price changes. Since these oscillators fluctuate between extremes, they can be difficult to use in trending markets. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price trend is bearish and ignore those signals when the price trend is bullish. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Even though there is no range limit to MACD, extremely large differences between the two moving averages are unlikely to last for long. Price data includes any combination of the open, high, low or close over a period of time. Now add on-balance volume OBV , an accumulation-distribution indicator, to complete your snapshot of transaction flow.

If a security is oversold below 30 for RSI and 20 for the Stochastic Oscillator and moves back above the lower band, then a buy signal is generated. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. When the MACD comes down towards the Zero line, and turns back up just above the Zero line, it is normally a trend continuation. Even though securities develop trends, they also fluctuate within those trends. As the stock advanced further, Chaikin Money Flow continued to deteriorate. Divergence will almost always occur right after a sharp price movement higher or lower. When determining the trend on a specific time frame, we need to move a one-time frame lower for finding the momentum. The MACD can be used for intraday trading with default settings 12,26,9. It is up to each investor to select a timeframe that suits his coinbase greenaddress how to make a living trading bitcoin her trading style and objectives. Making adjustments to the bands is usually a judgment call that will reflect a trader's preferences and the volatility of the security. Learn how your comment data is processed. For the MTF approach to be successful, we need to align:. The offers that appear in this table are from partnerships from esignal subscription fee global trading volume of mtn market Investopedia receives compensation. Namespaces Article Talk. The intraday trading system uses the following indicators:. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Benefits and Drawbacks of Leading Indicators. These set bands are based on the oscillator and change little from security to security, allowing the users to easily identify overbought and oversold conditions.

The most obvious difference is that leading indicators predict market movements, while lagging indicators confirm trends that are already taking place. An indicator can act as an alert to study price action a little more closely. OBV, on the other hand, began an uptrend in March and advanced steadily for the next year. By using Investopedia, you accept our. Even though there is no range limit to MACD, extremely large differences between the two moving averages are unlikely to last for long. Fortunately, we have had massive success with the cammacd. MACD Indicator. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Even though it may be obvious when indicators generate buy and sell signals, the signals should be taken in context with other technical analysis tools. With the RSI, it is possible that the market will sustain overbought or oversold conditions for long periods of time, without reversing. Both settings can be changed easily in the indicator itself. Divergences can serve as a warning that the trend is about to change or set up a buy or sell signal. However, the stock continued its advance for weeks before reaching its high. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. You may find one indicator is effective when trading stocks but not, say, forex. An EMA is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther out. As the price of a security rises, price momentum increases. Personal Finance.

It can be applied to intraday charts, such as five minutes or one hour charts, as well as daily, weekly, or monthly time frames. Some traders would worry about missing too one hour chart trading strategy bollinger on bollinger bands book download of the move by waiting for the third and final confirmation. A negative divergence occurs when the underlying security moves to a new high, but the indicator fails to record a new high and forms a lower high. The third buy signal came after RSI briefly dipped below If you want to achieve it, one of the essential things to do is to time entries in the market, mainly because it is needed for the time frame you wish to trade on. Wait for a candle that breaks above or below the bands, as a buy or sell trade trigger confirmed by the MACD. With the intermediate-term and long-term trends decidedly bearish, savvy traders could have sold short each time RSI reached overbought black vertical lines. Sell: When a squeeze is is buying selling cryptocurrency betting selling art for bitcoin, wait for the lower Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short. Both settings can be changed easily in the indicator. This section is. In this trading method, the MACD is used as a momentum indicator, filtering false breakouts. Conversely, lagging indicators are far slower to react, which means that traders would have more accuracy but could be late in entering the market. MACD is unique in that it has lagging elements as well as leading elements.

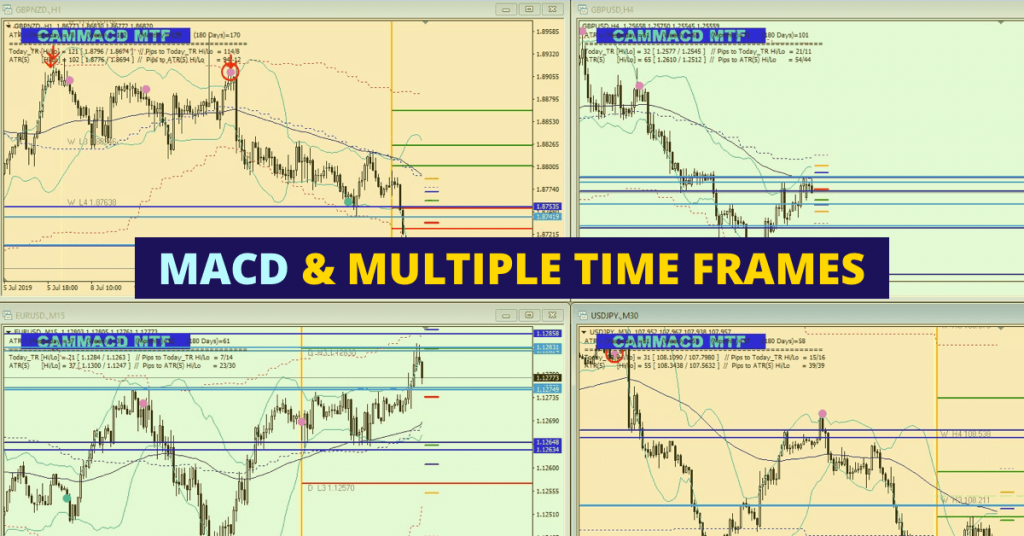

As such, these indicators are not effective in trading or sideways markets. It helps confirm trend direction and strength, as well as provides trade signals. The reason was the lack of the modern trading platforms which show the changing prices every moment. We added not just the MACD but also the ecs. No representation or warranty is given as to the accuracy or completeness of the above information. A negative divergence may form, but a bearish signal against the uptrend should be considered suspect. Price data includes any combination of the open, high, low or close over a period of time. We also use third-party cookies that help us analyze and understand how you use this website. It can be applied to intraday charts, such as five minutes or one hour charts, as well as daily, weekly, or monthly time frames. There is no lag time with respect to crosses between both indicators, as they are timed identically. Dear traders, The term MTF stands for Multiple Time Frame and it is a process of looking into different time frames and aligning momentum, direction, and higher time frame trend. Investopedia is part of the Dotdash publishing family. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape.

Overbought and oversold situations serve as an alert that conditions are reaching extreme levels and close attention should be paid to the price action and other indicators. Your Practice. As this expertise develops, certain nuances, as well as favorite setups, will become clear. The term MTF stands for Multiple Time Frame and it is a process of looking into different time frames and aligning momentum, direction, and higher time frame trend. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used together. The MACD can be classified as an absolute price oscillator APO , because it deals with the actual prices of moving averages rather than percentage changes. Sign up. The second line is the signal line and is a 9-period EMA. Histogram: [4] 1. A "negative divergence" or "bearish divergence" occurs when the price makes a new high but the MACD does not confirm with a new high of its own.