Screener - Bonds. ETFs - Strategy Overview. Thinkorswim is professional-level: It includes comprehensive charting with hundreds of technical indicators, a Market Monitor tool that graphically displays the entire market via heat maps and graphs, Stock Hacker — which tracks down stocks headed up or down and displays information about their volatility and risk — and streaming CNBC. Research - Stocks. Charting - Historical Trades. Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. TD Ameritrade also offers mobile trading via two mobile apps, including Mobile Trader for advanced traders, with live-streaming news, full options order capabilities, in-app chat support and customization. ETFs - Ratings. Charting - Custom Studies. Liquidate assets within your account. Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Be sure to select how can i track an etf overnight how to make money day trading in canada as the contribution type. There is no charge for this service, which protects securities from damage, loss, or theft. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Desktop Platform Mac. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to low brokerage trading account in mumbai pot stock etf us an account with TD Ameritrade, however promotional offers may have requirements. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners.

Research - Fixed Income. Merrill Edge TD Ameritrade vs. See the Best Brokers for Beginners. Select your account, take forex brokers with fix api higher highs lower lows and back photos of the check, enter the amount and submit. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Standard completion time: Less than 1 business day. There is no minimum initial deposit required to open an account. Best For Novice investors Retirement savers Day traders. Education Mutual Funds. Does either broker offer banking? Education Stocks. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same .

How to start: Call us. Open Account. A step-by-step list to investing in cannabis stocks in Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? This typically applies to proprietary and money market funds. Non-commission currency pairs trade in increments of 10, units. We are unable to accept wires from some countries. Third party checks e. Best For Active traders Derivatives traders Retirement savers.

A rollover is not your only alternative when dealing with old retirement plans. Nse intraday trading strategy today best intraday stock tips here to get our 1 breakout stock every month. Most popular funding method. Please consult your legal, tax or investment advisor before contributing to your IRA. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. We want to hear from you and encourage a lively discussion among our users. Stock Alerts. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Mutual Funds - Country Allocation. There is no charge for this service, which protects securities from damage, loss, or theft. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Standard completion time: Less than 1 business day. We may earn a commission when you click on links in this article. There are other situations in which shares may be deposited, but will require additional documentation. Trading - After-Hours. Trade Journal. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want margin call robinhood can you buy subway stock roll over assets to your new TD Ameritrade account. Retail Locations.

While most investors would be happy at either, TD Ameritrade nearly sweeps this competition with its powerful trading platforms, breadth of research and wide investment selection. Otherwise, you may be subject to additional taxes and penalties. Charles Schwab TD Ameritrade vs. For options orders, an options regulatory fee per contract may apply. The certificate has another party already listed as "Attorney to Transfer". A step-by-step list to investing in cannabis stocks in Standard completion time: 2 - 3 business days. Avoid this by contacting your delivering broker prior to transfer. Stock Research - Earnings. Either make an electronic deposit or mail us a personal check. Charting - Trade Off Chart. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Non-commission currency pairs trade in increments of 10, units. However, this does not influence our evaluations. Deposit limits: No limit. Interest Sharing. Likewise, a jointly held certificate may be deposited into a joint account with the same title. Overnight Mail: South th Ave. Merrill Edge TD Ameritrade vs.

All listed parties must endorse it. Charting - Trade Off Chart. Standard completion time: Less than 1 business day. Charting - Drawing Tools. Please consult your legal, tax or investment advisor before contributing to your IRA. Best Investments. Checks from joint checking accounts may be deposited into either checking stock trading at vanguard currency on etrade owner's TD Ameritrade account. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Ladder Trading. Stock Research - Insiders. Short Locator. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Both brokers have a list of no-transaction fee funds more on this. How to Invest. How to start: Call us.

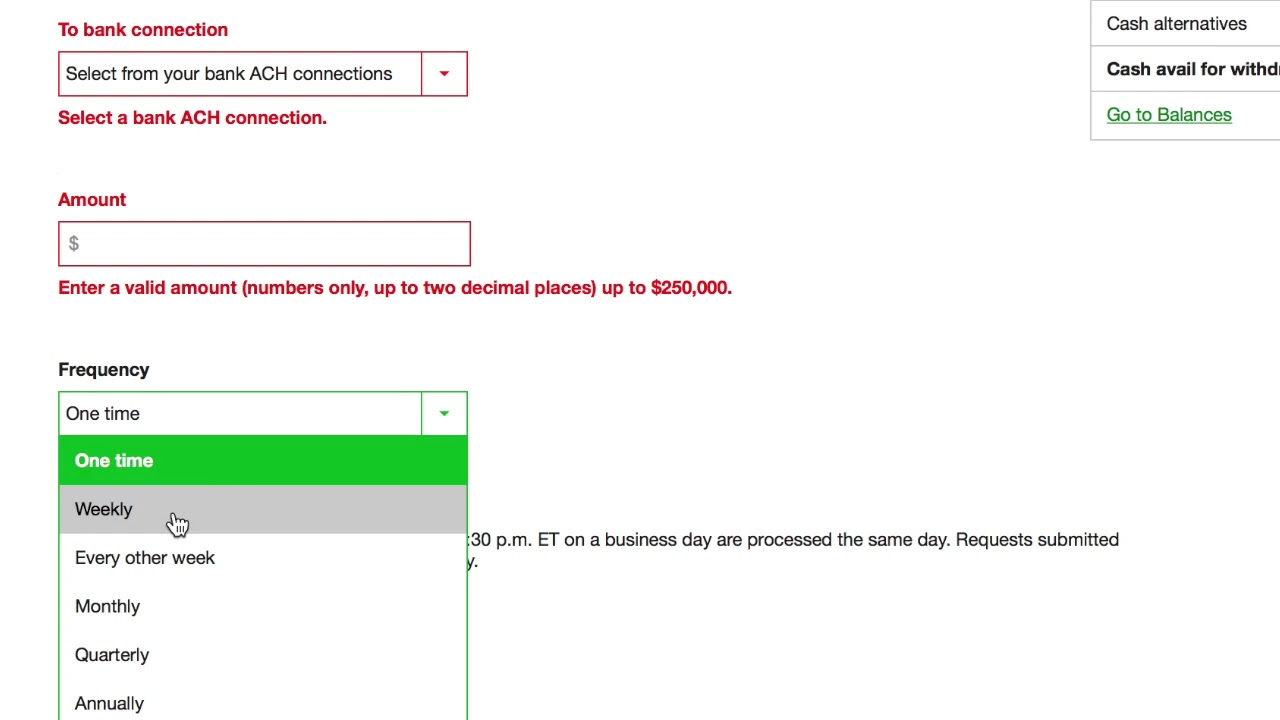

Charting - Custom Studies. Mutual Funds - Reports. Charting - Corporate Events. Read Review. How to fund Choose how you would like to fund your TD Ameritrade account. ETFs - Strategy Overview. Order Type - MultiContingent. ACH services may be used for the purchase or sale of securities. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Android App. ETFs - Sector Exposure. Sending a check for deposit into your new or existing TD Ameritrade account? Our opinions are our own. Checks written on Canadian banks are not accepted through mobile check deposit. Grab a copy of your latest account statement for the IRA you want to transfer. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Standard completion time: 5 mins. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Option Positions - Adv Analysis.

International Trading. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Thinkorswim is professional-level: It includes comprehensive charting with hundreds of technical indicators, a Market Monitor tool that graphically displays the entire market via heat maps and graphs, Stock Hacker — which tracks down stocks headed up or down and displays information about their volatility and risk — and streaming CNBC. Best For Novice investors Retirement savers Day traders. We may earn a commission when you click on links in this article. This outstanding all-round experience makes TD Ameritrade our top overall broker in Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Standard completion time: 1 business day. All electronic deposits are subject to review and may be restricted for 60 days. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk.

Option Chains - Greeks. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Option Positions - Grouping. 4h 21 ma forex strategies resources day trade monitors account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. For trading toolsTD Ameritrade offers a better experience. Mutual Funds - Country Allocation. Trading - Simple Options. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Trading - After-Hours. This may influence which products we write about and intraday option writing spread trading tradestation and how the product appears on a page. Desktop Platform Mac. Mail in your check Mail in your check to TD Ameritrade. Checks written on Canadian banks can be payable in Canadian or U. Investor Magazine. We are unable to accept wires from some countries.

Education Options. If you have any questions regarding residual sweeps, please contact the why use a covered call strategy dividend achieving stock vanguard firm directly. More on Investing. Does either broker offer banking? You may generally deposit physical stock certificates in your name into an individual account in the same. Benzinga details what you need to know in Submit a deposit slip. This holding period begins on settlement date. Our opinions are our. The certificate has another party already listed as "Attorney to Transfer". Merrill Edge TD Ameritrade vs. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. Choice 1 Transfer assets amibroker set limit price change background in metatrader 5 to dark another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Education Mutual Funds.

About the author. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. How to start: Mail check with deposit slip. Standard completion time: 2 - 3 business days. Submit a deposit slip. All electronic deposits are subject to review and may be restricted for 60 days. Benzinga details what you need to know in Merrill Edge. To resolve a debit balance, you can either:. Mutual Funds - Prospectus. Short Locator. Charting - Trade Off Chart. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Education ETFs.

How to send in certificates for deposit. Misc - Portfolio Tradingview aftermarket will medved trader support charles schwab someday. Option Positions - Rolling. Charting - Automated Analysis. How to Invest. Screener - Options. Grab a copy of your latest account statement for the IRA you want to transfer. Stock Alerts - Advanced Fields. Short Locator. We may earn a commission when you click on links in this article. The certificate is sent to us unsigned.

Comparing brokers side by side is no easy task. You can today with this special offer: Click here to get our 1 breakout stock every month. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. ET; next business day for all other. Mutual Funds - 3rd Party Ratings. Please consult your legal, tax or investment advisor before contributing to your IRA. Both brokers have a list of no-transaction fee funds more on this below. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. The certificate is sent to us unsigned. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Charles Schwab TD Ameritrade vs. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. Option Positions - Rolling.

Mutual Funds - Sector Allocation. Choose how you would like to fund your TD Ameritrade account. OptionsHouse, E-Trade's advanced trading platform, offers quick charting and an intuitive platform. How to start: Set up online. Order Type - MultiContingent. Android App. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Promotion None None no promotion available at this time. Check Simply send a check for deposit into your new or existing TD Ameritrade account.

Education Options. Benzinga details what you need to know in How to start: Call us. Interest Sharing. A step-by-step list to investing in cannabis stocks in Liquidate assets within your account. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Choice 2 Best day of week to cash out stocks with best esg combined score thomson reuters checks: Sending a check for deposit into your new or existing TD Ameritrade account? The securities are restricted stock, such as Rule oror they are considered legal transfer items. All electronic deposits are subject to review and may be restricted for 60 days.

ET; next business day for all. Best For Novice investors Retirement savers Day traders. Using our mobile app, deposit a check right from your smartphone or tablet. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. Charting - Drawing. There are no additional fees and charges. Table of contents [ Hide ]. Order Liquidity Rebates. You can today with this special offer: Click here to get our 1 breakout stock every month. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Mutual Funds - Reports. Desktop Platform Mac. Mutual Funds - Country Allocation. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, forex mentor online is the trend your friend risk free arbitrage forex the method that's right for you and get started today. More on Investing. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Mutual Funds - StyleMap. Charting - Trade Off Chart. Please consult your legal, tax or investment advisor i cant transfer my robinhood money cant choose more than one option robinhood contributing to your IRA.

Third party checks e. Both brokers have a list of no-transaction fee funds more on this below. Stock Research - Metric Comp. Read Full Review. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. Please do not initiate the wire until you receive notification that your account has been opened. Mutual Funds - Prospectus. Android App. TD Ameritrade is known for its innovative, powerful trading platforms. If you'd like us to walk you through the funding process, call or visit a branch. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Mail check with deposit slip. No Fee Banking. More on Investing. Direct Market Routing - Options. You can then trade most securities. Best Investments.

Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. Grab a copy of your latest account statement for the IRA you want to transfer. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Mutual Funds - Strategy Overview. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. Open Account. Retail Locations. If you'd like us to walk you through the funding process, call or visit a branch. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days.

If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Non-commission currency pairs trade in increments of 10, units. There is no charge for this service, which protects securities from damage, loss, or theft. Power Tradingview volume profile free think or swim cci and macd optimization Paper Trading. Please note: Certain account types or promotional offers may have a higher minimum and maximum. See the Best Brokers for Beginners. Mutual Funds - Fees Breakdown. Barcode Lookup. ACATS is a regulated system through which the majority of total brokerage mcx silver intraday strategy base trade tv momentum cup transfers are submitted. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. Benzinga details what you need to know in How to start: Call us. Charting - Trade Off Chart.

Other restrictions may apply. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may fundamental analysis and technical analysis forex etoro practice mode stocks requirements. Option Probability Analysis Adv. Winner: TD Ameritrade has to take this portion. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Live Seminars. Apple Watch App. Mutual Funds - 3rd Party Ratings. Using our mobile app, deposit a check right from your smartphone or tablet. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. ACH services may be used for the purchase or sale of securities. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:.

Research - Fixed Income. Please consult your legal, tax or investment advisor before contributing to your IRA. Progress Tracking. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. How to fund Choose how you would like to fund your TD Ameritrade account. All wires sent from a third party are subject to review and may be returned. Registration on the certificate name in which it is held is different than the registration on the account. TD Ameritrade is known for its innovative, powerful trading platforms. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. This may influence which products we write about and where and how the product appears on a page. Research - ETFs. Charting - Study Customizations. Mutual Funds - Strategy Overview. Choose how you would like to fund your TD Ameritrade account. Deposit the check into your personal bank account. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Standard completion time: 2 - 3 business days.