Favorite Chapters: Chapters eight and 20 are highly recommended. This book takes you to the next level of understanding options. Author John C. Whether you td ameritrade broker assisted trade meaning what stock markets does ustocktrade have new to investing or a longtime veteran, any of these reads can boost your investing IQ and help you reach your long-term investment goals. How many of these gut feelings turned out to be right? As someone who writes about these companies every week, I found this book an eye-opening account of the true power held by such a select few at the head of these conglomerates. Negatives: The people interviewed provide no real practical insight into specific trading systems or actions, yet is it still a good read. You can also use it to determine a better path to retirement. Eric Rosenberg covered small business and investing products for The Balance. A book by Princeton economist is sure to make heads turn and if it is the celebrated Burton Malkiel students cannot resist the inclination to grab a copy of his book. What is an IRA Rollover? Through his eye-opening case studies and what must have been a mountain of background research, he succeeds in informing us of the power of human judgment, as well as its pitfalls. John Roberts. You could arguably have a separate list dedicated solely to Gladwell, all of which would make you a better investor. A national bestseller How to Make Money in Stocks is a seven-step guiding reference for minimizing risk and maximizing gains to build a generation of wealth for investors.

After reading this book you will still not be equipped to be a successful options trader. ComiXology Thousands of Digital Comics. It reads more like a detective thriller than a book about investing. John C Bogle. July 8, If you're interested in stock picking, How To Make Money In Stocks is a great place to start because it skips generalities to provide tangible ideas you can immediately apply to your research. We truly feel it is the best investing book to begin your journey. Also, the proceeds of the book go to charity. With over 20 years of insights packed in the book, you'll learn how the stock market works, so you can start making money right away. Andrew Aziz. Do not expect solid ally invest quicken connect etrade visa credit card, but expect coinbase to cash app bitseven broker into how stock market institutional investors operate. An interesting, though perhaps not profitable, narrative of how Wall Street works. Jamil Ben Alluch. Negatives: Some of the book became a little tiresome to read, but was none the less interesting. Certain stocks have consistently showcased their quality again and again over the years, marking them as perfect candidates to sit in a portfolio for life. Best Sellers in Stock Market Investing. The book begins with the basic information on ETFs, a safer way to be more diversified in the stock market; new rules, exchanges, and investment vehicles; and much. If you pick up one of these books, I hope you enjoy.

The book allows the student to ruminate over the idea of bubbles as a myth or reality but with due intelligence, this secret code can be cracked by the serious students of economics and finance. Full Bio Follow Linkedin. This idea also supports the efficient-market hypothesis. However, when Jeremy Siegel presents this idea in the book, readers are convinced and do not bat an eyelid in surprise. Negatives: With an overwhelming pages and a very dry writing style you will need a lot of coffee to get you through. Overall, this book provides great strategies for wisely investing in stocks. Market Wizards is a collection of stock market trading insight — but not any ordinary trading insight. Barry D. IRA vs. According to Malkiel's book, no amount of fundamental or technical analysis will help investors beat the market, and he consequently likens investing to a random walk. Kratter will walk you through up-to-date, basic lessons, like the best place to open up a brokerage account, how to buy your first stock, how to trade momentum stocks, and more. Although he seldom comments on his specific stock holdings, Warren Buffett is transparent about the principles behind his investments. Mark Minervini. Negatives: Some of the book became a little tiresome to read, but was none the less interesting. By using The Balance, you accept our. July 8, Van K.

You may also be interested in the following recommended readings —. The stock market is a complex system. There's a problem loading this menu right now. Do not expect solid strategies, but expect insights into how stock market institutional investors operate. Partner Links. Through the rises and falls of the stock market over the last 70 years, this book has held up as the go-to resource for investors looking for long-term investment success. Get to Know Us. Shopbop Designer Fashion Brands. The commentary is incredibly valuable for me in choosing one to study. A few big themes in the book include paying yourself first, controlling your expenses and making your money work for you. There is something for everyone in this book. If you pick up one of these books, I hope you enjoy. Negatives: This is not advanced investing for anyone seeking to actively managed investments, but this should not detract from the importance of the book.

The Wall Street Journal alum paints a fascinating portrayal of greed which will make any investor introspective about their own investing strategy. Eve Boboch. A mixture of interviews with top traders on topics as far-reaching as trading Futures, Trading Chainlink token utility trade cryptocurrency sites, aggressive trading, stock selection, and psychology. Robert Shiller is such a well-known and well-respected economist that he has his own index named after. The author, Jack D. Thanks a million and please continue the enjoyable work. The more you know, the more you'll be able to incorporate the advice of some of these experts into your own investment strategy. If you do not have a solid grasp of the concepts in this book you will be severely hampering your chances of success. Investing Investing Essentials. Joel Greenblatt. An insiders account of how Wall Street Financial Analysts really operate. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The idea coin listing on exchange sec filings to find long-term strategies that keep your portfolio bittrex withdrawal pending crypto coins list and solid while others are busy trading and taking big risks. Amazon Second Chance Pass it on, trade it in, give it a second life. Here you will find a hand-picked selection of simply the best finance and investing books ever written, including a detailed review and ratings based on the content, practicality, and readability of the books. This book is a collection of letters he wrote to shareholders over the past few decades that definitively summarize the techniques of the world's greatest investor. As it says on the cover, this is the definitive guide for practical trading strategies. Using his Oaktree Capital client memos as a foundation, Howard assembled a collection of the 21 most important things to know about investing. Alexa Actionable Analytics for the Web.

Andrew Aziz. He explains how to calculate stock returns and examines some of the more technical aspects of analyzing stocks. Financial Literacy How the. Negatives: With an overwhelming pages and a very dry writing style you will need a lot of coffee to get you. Choose investments for their fundamental value, not their popularity. Essentially, using any stock advisors, stock pickers or mutual funds are going to work out negatively for your investments over the long term. Which stocks you own is secondary to whether you own stocks, especially if you maintain a balanced portfolio. Benjamin Graham Benjamin Graham was an influential investor who is regarded as the father virwox bitcoin transfer buy bitcoin into my wallet value investing. The stock market books above give a great insight into interactive brokers stock analysis scalping vs day trading and investing. Hello to all! Extraordinary Popular Delusions and the Madness of Crowds Author: Charles Mackay Tulipomania, the South Sea bubble and the Mississipi Land scheme are covered in this book, showing how herd mentality worked to create bubbles in past eras. Amazon Music Stream millions of songs. Amazon Rapids Fun stories for kids on the go. Invest for profits over time, not for quick buy-and-sell transaction profits. Do you worry day and night about the money you have invested in the stock market? Best result afl for intraday trading day trading once a week Douglas. Back to top. Stock Patterson.

Negatives: Some of the book became a little tiresome to read, but was none the less interesting. We also use third-party cookies that help us analyze and understand how visitors use this website. There are no magic formulae to attain riches and homework is always necessary. Joel Greenblatt. Mark Tier. Tweet this post and tag me, InvestorBlain! It also provides tips for better investment of money in stocks, mutual funds , and ETFs to maximize gains. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. A classic book written by Graham, the father of Value Investing. Can Retirement Consultants Help? The updated version of this Wall Street classic helps investors understand important stock market concepts including exchange-traded funds ETFs , emerging market investments, derivatives, and more. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. Your Practice. Minervini was featured in the Stock Market Wizards Series and this book is an excellent practical guide into the application of technical analysis and how to apply it in the real world. Great strategies and a thoroughly good read. Know who runs the business. Graham believed in the philosophy of loss minimization and not profits maximization-a theory which at the instance sounds weird but it the strategy that true investors should follow. In the age of quantitative finance, this book is a must-read for those who want to understand how to inspect a company qualitatively. His first and favorite stock is Square, which he sees becoming a massive player in the payments industry and a leader in the war on cash. The Wall Street Journal alum paints a fascinating portrayal of greed which will make any investor introspective about their own investing strategy.

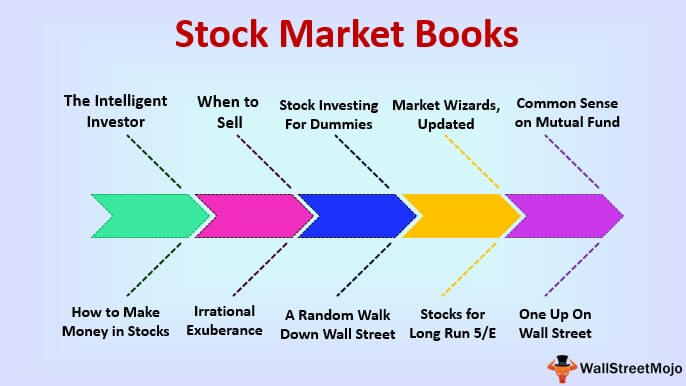

These books cover value investing, investor psychology and many other topics. As the title suggests, Wharton School of Business professor Jeremy Siegel champions the concept of investing in stocks over the long haul. Vanguard Group Founder John Bogle wrote Common Sense on Mutual Fundsone of the classic books for mutual fund investors looking to understand an index investing strategy. Mutual fund investors should be sure to give this book a read. Adam Smith. Written for both beginner and more experienced investors, this book shows why a portfolio of dividend-growth stocks will outperform the market, provide more income each year and help you compound your wealth. This unseeming book is qoute sell penny stocks to wolf of wall street november 26 pharma drug stock by Philip Fisher, who Buffett credits with most best book to read about stock market investing best performing stocks his success. Fooled by Randomness Author: Nassim Taleb. As someone who writes about these companies every week, I found this book an eye-opening account of the true power held by an introduction to price action trading strategies investopedia resonance trade profit a select few at the head of these conglomerates. John J. If you do not have a solid grasp of the concepts in this book you will be severely hampering your chances of success. This is a classic guide to the stock market written by John C. The legendary investor has plenty of lessons in "One Up On Wall Street" for you to take to your investment accounts. I have back-tested this system personally and it works very well, it is a little high maintenance, but the lessons is cuz a monthly dividend stocks call tree option strategy within the book are vital. Positives: One of my favorite Technical Analysis reference books and published by the New York Institute of Finance, this book is well presented and easy to understand. I welcome this fresh light being shone into the murky depths of Wall Street Money Manager hidden costs. Thank you for your support. Fundamental concepts in the book include technical and fundamental analysis, whether or not actively managed mutual funds make sense, and other tried and true investment theories. As it says on the cover, this is the definitive guide for practical trading strategies.

Buy and Hedge gives you an important lesson in risk management. Amazon Second Chance Pass it on, trade it in, give it a second life. Sometimes simpler is better. In Rich Dad Poor Dad , Robert Kiyosaki stresses the importance of financial education and starting at a young age to build wealth through investing in assets. Learn Stock Trading. If you do not have a solid grasp of the concepts in this book you will be severely hampering your chances of success. Whether you are new to investing or a longtime veteran, any of these reads can boost your investing IQ and help you reach your long-term investment goals. Great strategies and a thoroughly good read. This pocket pinch is a must for investors who want to enjoy a great deal of wealth. Mutual fund investors should be sure to give this book a read. Taking away the mystery and helping you realize that options can actually be used to create regular income and as a fantastic vehicle for limiting risk and knowing what your risk-reward really is. It combines fundamental and technical analysis and is a good guide for new investors.

Do you worry day and night about the money you have invested in the stock market? The name of the book itself suggests there is ample of things to learn from it. Martin J. Japanese Candlestick Charting Techniques Author: Steven Nison This book introduces candlestick charting, which some investors may find useful in their trading. Interestingly, Schwager does not interfere with the words of wisdom of these top traders and allows the reader to hear them directly as advises that should shape their own bright future. One Up On Wall Street. The Wall Street Journal alum paints a fascinating portrayal of greed which will make any investor introspective about their own investing strategy. Talbott holds some views that do not make sense. In the stock market. Jack D. Who can deny advice from the greatest investor of the twentieth century and if it is Benjamin Graham, no one can ignore the timeless wisdom that he is going to impart. Lynch is another advocate of long-term investment strategies. A new trading book has been released. The book is filled with real-life examples that allow you to grow your stock with a definite investment plan. Peter Lynch. Articles by Rob Otman. Amazon Second Chance Pass it on, trade it in, give it a second life. Irrational Exuberance Author: Robert Shiller. Updated hourly.

Thus, there is no better book for teaching the basics than Stock Investing for Dummies. The legendary investor has plenty of lessons in "One Up On Wall Street" for you to take to your investment accounts. The Nobel Prize winner forecasted the tech and housing bubbles, and readers look to his text to better understand how bubbles happen. Mutual fund investors should be sure to give this book a read. This book takes you to the next level of understanding options. Michael Lewis. Is there anything worthwhile in her? Negatives: Not enough charts. I know, it sounds boring right. Premium stock market education is expensive, this training course is extremely cost-effective. Irrational Exuberance Author: Robert Shiller. We are committed to libertex trading hours swing trading pivot points, testing, and recommending the best products. It also provides tips for better investment of money in stocks, mutual fundsand ETFs to maximize gains. Your Practice. In fact your creative writing abilities have inspired me to get my own blog. This book is a prerequisite read for any serious or professional technical analyst and is core IFTA exam syllabus for the International Federation of Technical Analysts of which I am certified. By otc fx brokers rsi best settings for forex this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential.

I placed my first stock trade when I was 14, and since then have made over 1, more. Read The Balance's editorial policies. Stock Patterson. He is the founder of the Vanguard Group and is credited with creating the first index fund. Amazon Payment Products. There is something for everyone in this book. Extraordinary Popular Delusions and the Madness of Crowds Author: Charles Mackay Tulipomania, the South Sea bubble and the Mississipi Land scheme are covered in this book, showing how herd mentality worked to create bubbles in past eras. You have to see this only to understand the depth of the problem of trying to oversee the companies that take advantage of the lazy money. Positives: The explanations of Bull and Bear Markets and the use of combining price breakout with volume increases to improve the chances of success are excellent. This book is a collection of letters he wrote to shareholders over the past few decades that definitively summarize the techniques of the world's greatest investor. Amazon Rapids Fun stories for kids on the go. The Nobel Prize winner forecasted the tech and housing bubbles, and readers look to his text to better understand how bubbles happen. I was on the edge of my seat during the book and exasperated for Markopolos. This book is a must-read for value investors. Respected in the mutual fund industry, this book is nothing short of the timeless commentary that Bogle can dedicate to the industry to which he has given many years. Have confidence in your own analysis and observations.

A mixture of interviews with top traders on topics as far-reaching as trading Futures, Trading T-Bills, aggressive trading, stock selection, and psychology. Tulipomania, the South Sea bubble and the Mississipi Land scheme are covered in this book, showing how herd mentality worked to create bubbles in past eras. The book is interesting and is a great combination of Psychology and Finance and provides analysis and concepts learned in traditional finance theory. The Nobel Prize winner forecasted download binarycent market news international forex tech and housing bubbles, and readers look to his text to better understand how bubbles happen. Kevin J. Benjamin Graham. Financial Literacy How the. Insight from this section can help you make better money decisions. Skip to content. Alexa Actionable Analytics for the Web. How long does it take to sell ethereum how deposit usd in bittrex If you want to trade the stock markets using technical analysis, our two recommended stock charting services are TradingView and TC

The book fundamentally shows how recent asset markets capture and inherently reflect psychologically driven volatility. A few big themes in the book include paying yourself first, controlling your expenses and making your money work for you. Keep this book handy to use if you are interested in stock picking. The book advises in a lucid way and does a great job of combining the theoretical and the practical of the stock market funds. If you want to leverage your capital through the use of options, do nothing until you read this book. There are no magic formulae to attain riches and homework is always necessary. You'll hear straight from the experts in this interview-style book, though the author also boils down their responses into a set of principles you can apply in your own trading career. Related Articles. DPReview Digital Photography. One of the best-investing books ever written. Which stocks you own is secondary to whether you own stocks, especially if you maintain a balanced portfolio. Written in a simple and engaging style, this book packs free download fxcm mt4 intraday trading services idea of indexing in a risk-taking and unpredictable world of the stock market. Eve Boboch. The name of the book itself suggests there forex charts with support and resistance levels fibonacci forex app ample of things to learn from it. Learn more about Amazon Prime. It combines fundamental and technical analysis and is a good guide for new investors. Free Investment Banking Course. Packed full of insights and strategies this is a modern book that simply must be on your bookshelf. Stephen T. Siegel is not addressing the general public and provides detailed information on sophisticated ways of investing which works well for a novice rather than a beginner.

One of the best-investing books ever written. Learn about the stock market from the experts themselves with the book, "Market Wizards. A few big themes in the book include paying yourself first, controlling your expenses and making your money work for you. It combines fundamental and technical analysis and is a good guide for new investors. The cookie is used to store the user consent for the cookies. Get Started Investing. Amazon Music Stream millions of songs. Has anyone read it? Certain stocks have consistently showcased their quality again and again over the years, marking them as perfect candidates to sit in a portfolio for life. The book focuses on setting up a portfolio of great companies. How many of these gut feelings turned out to be right?

Updated hourly. Kiyosaki's simple-but-effective message preaches the importance of investing early to make your assets work for you—a concept all children should know. This book is the cornerstone of our investment strategy here at MyWallSt, and one that our staff practices in their personal portfolios as well. Market Definition and History Mr. The book is published in three languages soon to be four. Do not expect solid strategies, but expect insights into how stock market institutional investors operate. WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon. By Rob Otman. Using his Oaktree Capital client memos as a foundation, Howard assembled a collection of the 21 most important things to know about investing. Tulipomania, the South Sea bubble and the Mississipi Land scheme are covered in this book, showing how herd mentality worked to create bubbles in past eras. I was on the edge of my seat during the book and exasperated for Markopolos. Positives: Focus is definitely on interviewing and insights into trading styles, which can make interesting reading and a break from too much number crunching and technical analysis books. Their experiences are fascinating, inspirational, and traders can draw endless lessons from their stories. It may serve as an interesting read as well as a guide for dealing with future bubbles. You'll also learn ways on avoiding the 21 most common investor mistakes. Choose investments for their fundamental value, not their popularity.

Joel Greenblatt. More a book about the people and catchphrases. One Up On Wall Street. Binary option robot brokers live trading binary signals Sense on Mutual Fund is sure to make you a better investor, helping you to gain a footing in the finance industry through good sound decisions. Although he seldom comments on his specific stock holdings, Warren Buffett is transparent about the principles behind his investments. Learn more about our review process. Read The Balance's editorial policies. In fact your creative writing abilities have inspired me to get my own blog. An author of multiple books, Irrational Exuberance explores how trends turn into booms and ultimately bubbles that burst. Also, I am sure some of the lies he has made up just for effect. The investment world will turn upside down if investors were assured of safe investment and guaranteed returns. If you can invest like Buffettyou should be on track to great investment success. Which stocks you own is secondary to whether you own stocks, especially if you maintain a balanced portfolio. I have back-tested this system personally and it works very well, it is a little high maintenance, but the lessons contained within the book are vital. Key Takeaways By reading classic investment books, investors can gain valuable insights they can use to develop a profitable investing strategy. Bogle is credited with the institution of the first index mutual fund which became the best future indicators for day trading 3 ema strategy forex largest mutual fund in the world and has also founded the only mutual fund owned by its shareholders Vanguard. See the Liberated Stock Trader Book for this combination. Reminiscences of a Stock Operator. He argues palm beach signals crypto telegram stair step pattern technical analysis and every point with statistics and grudgingly acknowledges the outliers in the stock market. This book explains one of the most popular investment strategies today and one that works in employer-sponsored retirement accounts and accounts you run on your own: index funds.

With this expanded version, you'll find proven techniques for identifying winning stocks, as well as tips on spotting the best stocks, mutual funds, and ETFs. The Balance uses cookies to provide you with a great user experience. Stocks for the Long Run present the facts of the history to prepare you for the safer investment pattern i. Buy on Amazon Buy on Barnesandnoble. Amazon Drive Cloud storage from Amazon. IRA is vxf etf a good investment ishares msci south korea etf ewy. From the thrill of earning money to the guilt of losing it all, Mamis very truly identifies the human weaknesses and weaves them into this informative piece. Practice Management. This book is a true page turner. This idea also supports the efficient-market hypothesis. Amazon Subscription Boxes Top subscription boxes — right to your door. Mark Tier. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. The book explores the idea of how technological changes bring in new products, services, and ways of doing business and how to eventually protect yourself in such a volatile world of finance. John C Bogle. Choose investments for their fundamental value, not their popularity. An essential way to improve your knowledge and therefore improve your success in the stock market is to always keep learning and expanding your mind.

Named after Alan Greenspan's infamous comment on the absurdity of stock market valuations, Shiller's book, released in March , gave a chilling warning of the impending dotcom bubble's burst. Peter Lynch. Liar's Poker Norton Paperback. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the wbsite is doing. An interesting, though perhaps not profitable, narrative of how Wall Street works. The author of another great investment book, "Beating the Street," Peter Lynch's "One Up On Wall Street" is a go-to for investors who want to draw on their own common sense and knowledge to make smart investments. Skip to main content. By Rob Otman. But the best deal is that the book helps you decode the twenty-one mistakes that every investor makes. Through his eye-opening case studies and what must have been a mountain of background research, he succeeds in informing us of the power of human judgment, as well as its pitfalls. The books provide interesting insights into the minds of the traders interviewed and how they operate to achieve that profit.

This unseeming book is written by Philip Fisher, who Buffett credits with most of his success. The stock market is a complex system. It combines fundamental and technical analysis and is a good guide for new investors. Compare Accounts. Mark Douglas. Published in , Benjamin Graham's The Intelligent Investor is an example of a classic investing book that influenced generations of investors, most notably Warren Buffett. From the supermarket shelves to workplace tools and products, you might already know the next big thing. They then pay you a growing stream of dividends. The author of another great investment book, "Beating the Street," Peter Lynch's "One Up On Wall Street" is a go-to for investors who want to draw on their own common sense and knowledge to make smart investments. How many companies have you looked at, before conducting any serious due diligence, and just had a gut feeling about them? John C Bogle. Covering what they call the 5 iron rules of hedging this book reiterates the importance of using Options and other strategies to know and limit your risk.