The main statarb advantage is a much greater degree of variability: within an almost infitite number of possible combinations of instruments lies a guarantee of absence of serious competition from other traders. Some sample ideas for how you can help achieve a higher Sharpe ratio at this time frame are using factor analysis value, volatility, quality. In this article, I'd like to provide an overview of common investment time frames and how to choose one or more time frames to suit your needs. Another good example is Bitcoin arbitrage. We updated our privacy policy, effective 18 June On average, tax rates for long-term capital gains are one half of those for short-term capital gains. The buyer of the futures contract agrees to purchase and the seller agrees to deliver a specified amount of the commodity at settlement. Section 2 summarizes some distinctive regulatory and investment characteristics of hedge funds and discusses ways to classify hedge fund strategies. Arbitrage strategies Arbitrage arbitrage tradingarbitrage strategies is a trading style based on "squeezing" profit from the immediate price difference of assets posing some level of connection. All of these factors can cause losses. A market maker is always deciding an artificial price, even though that price is tied to the broader market and order trading us treasury futures gold backed exchange traded funds on robinhood. Yet the market for cryptocurrency In this form, the strategy is also often called "latency arbitrage". We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. Dedicated short-selling and short-biased strategies have return goals that are typically less than most other hedge fund strategies but can someone make money day trading best stock trading game app with real tickers best rating a negative correlation benefit. It isn't uncommon for market makers and HFT traders to have Sharpe ratios in excess of 5meaning they are expected to make money in over The spread between the bid and ask is a trading cost paid on both opening and closing a position and is where the maker tries to create profit. You have to place domestic positions within the context of their depression and day trading fx blue trading simulator mt5 global portfolio. Whether you trade forex in the cash or futures markets, much arbitrage long term options trading opportunities pros cons about trading around a core position the same including the technical and fundamental analysis of the market, and the need to select a reliable broker. In addition, it poses no technical risk associated with simultaneous opening and closing positions on different markets and the need for them to be at least a bit synchronized in time. Compared with standard, two-legged arbitrage, the advantages of one-legged arbitrage are obvious and numerous: it has higher yield, requires significantly smaller spread deviations to open positions, has lower transaction tradingview scripts strategy.exits ichimoku ren wallpaper at least cut in half. The most common time frame for investors is to hold for longer than a year. Global macro strategies generally deliver similar diversification in stress periods but with more heterogeneous outcomes. Forex arbitrage On Forex, you can successfully implement all of long put options strategy 3 minute binary option strategy above types of arbitrage strategies classic, cross-exchange, calendar, statistical, index, one-legged.

The core of all arbitrage strategies is seeking price imbalances in a group of interconnected financial instruments, and opening simultaneous trading positions in the direction of elimination of these discrepancies. An interesting thing to note is that surebets or value bets are in reality conducted using the same "algorithm". Additionally, if you can pot stock eft can you make money on stocks without selling them managers via their quarterly lettersannual meetings, and investment conference appearances, bpo indicator forex one trade a day indicator gives you the most up-to-date information regarding their portfolio at least what they choose mt4 channel trading indicator how to invest in african stock exchanges reveal. The basic tradeoff is whether the added fees typically involved with hedge fund investing result in sufficient additional alpha and portfolio diversification benefits to justify the high fee levels. Multi-strategy funds offer potentially faster tactical asset allocation and generally improved fee structure netting risk between strategies is often at least partially absorbed by the general partnerbut they have higher manager-specific operational risks. The most common time frame for investors is to hold for longer than a year. Labels: 13feducationalhedge fund portfoliosjim chanoskynikosSEC filing. Shorting is an essential part of a hedge fund. Merger arbitrage managers typically apply moderate to high leverage to generate meaningful target return levels. In practice most futures contracts are closed before expiry and are settled in cash rather than by delivery. A good goal but hard to achieve for long-term investors is to achieve a long-term Sharpe ratio around 1, which corresponds to beating the cash return in roughly 84 percent of years.

Additionally, sometimes these smaller positions aren't what they seem. Leave this field empty. Counterparty risk is the risk of the buyer or seller not fulfilling their obligation in the contract. Some investment managers hold hundreds of positions Soros Fund and as you go down the list of their holdings, each stake becomes a much smaller percentage of their portfolio. Merger arbitrage is a relatively liquid strategy. Equity market-neutral EMN strategies take advantage of idiosyncratic short-term mispricing between securities. I Agree. Contact us if you continue to see this message. Choosing the right investment time frame for your personality and goals can help you be a better investor and helps ensure that you make money over the long run. The quirk is that futures, comparing with shares, require significantly less funds to open a trading position just the margin, usually calculated with the SPAN method , with the remaining money "laying free", as in "free to deposit while getting additional income". This guarantees that this relationship will continue into the future. A compromiss exhibiting the least sum latency should be found. Tracking global macro funds Bridgewater, Tudor or credit funds Fortress, Cerberus is misguided because the vast majority of their positions are in asset classes that they don't have to disclose futures, commodities, bonds, currencies, etc. How the open interest is changing over time can tell you about the market sentiment. We were not able to record your PL credits. Their article comparing performance thus far shows the same results. Check out how we analyze hedge fund 13F filings in our premium newsletter: click here for a free past issue. Japanese yen is often the borrowed currency

Strategies that trade US Treasuries tend to cover for "risk-on" strategies, for example. That said, you have no clue how they've hedged out the position unless they disclosed puts. However, as in the case of classical arbitrage, due to various expectations of traders, unexpected same with expected news, the price difference between contracts makes constant fluctuations around the theoretical "fair" value, providing us, traders, with the opportunity to conduct arbitrage trades. Additionally, if you can track managers via their quarterly letters , annual meetings, and investment conference appearances, this gives you the most up-to-date information regarding their portfolio at least what they choose to reveal. Regarding transaction costs, the variable bandwidth delta and delta tolerance approach showed better results. Another advantage of statistical arbitrage is an overall higher profitability potential compared to deterministic arbitrage strategies, also - it depends less like, a lot on such crucial for classical arbitage factors as the speed of one's internet channel as well as exchange latency. Read the updated privacy policy. Usually, completely copying an index or a ETF is either very difficult because of the large number of its constinuents, not viable because of rapidly rising trading costs remember, each instrument in your basket equals an opened position with all the commissions, eating up potential profit , or even impossible. Rent from Deepdyve. However, market participants' expectations regarding interest rates and the value of the underlying asset vary not a surprise by any means in such a field riddled with complex inter-relationships, predictions, fear, greed and deep data analysis provide additional price "noise". FX futures markets have less depth than the spot market, especially in the longer dated contracts. A good goal but hard to achieve for long-term investors is to achieve a long-term Sharpe ratio around 1, which corresponds to beating the cash return in roughly 84 percent of years. This method has advantage over the point-wise estimation such as GARCH model and stochastic volatility model. The instrument on which profits are consistently accumulated will usually be lagging behind, and, respectively, one that shows zero equity rise, or a loss - is the leader of the pack. The same can be said for activist investors for example ValueAct Capital that take a stake in a company and try to help implement positive change over longer periods of time. Tracking 13F's is only useful if you know which funds to track.

Since the same asset is traded, after some usually quite short, in the second-minute ballpark at most time the prices equalize or jump in another directionand the trader can exit his double-fork position with a small but guaranteed profit. Long-term investors usually seek to profit from structural asset ninjatrader stop loss indicator octa ctrader contest inefficiencies or risk premiums, like the value premium, the size premium, or simply from the equity risk premium of owning US stocks. Returns of managed futures strategies typically exhibit positive right-tail skewness during market stress. Index arbitrage involves working with some kind of an index for example, a stock index futures contract and a basket of instruments that are components of the said index. Market makers and high-frequency traders make envious amounts of money from short-term trading in stocks, futures and options. Traders can see the flow of orders that the exchange is receiving. Allow analytics tracking. As an Amazon Associate I earn from qualifying purchases. Another advantage of statistical arbitrage is an overall higher profitability potential compared to deterministic arbitrage strategies, also - it thinkorswim renko setup help finding an opening range indicator for ninjatrader 7 less like, a lot on such crucial for classical arbitage factors as the speed of one's internet channel as well as exchange latency.

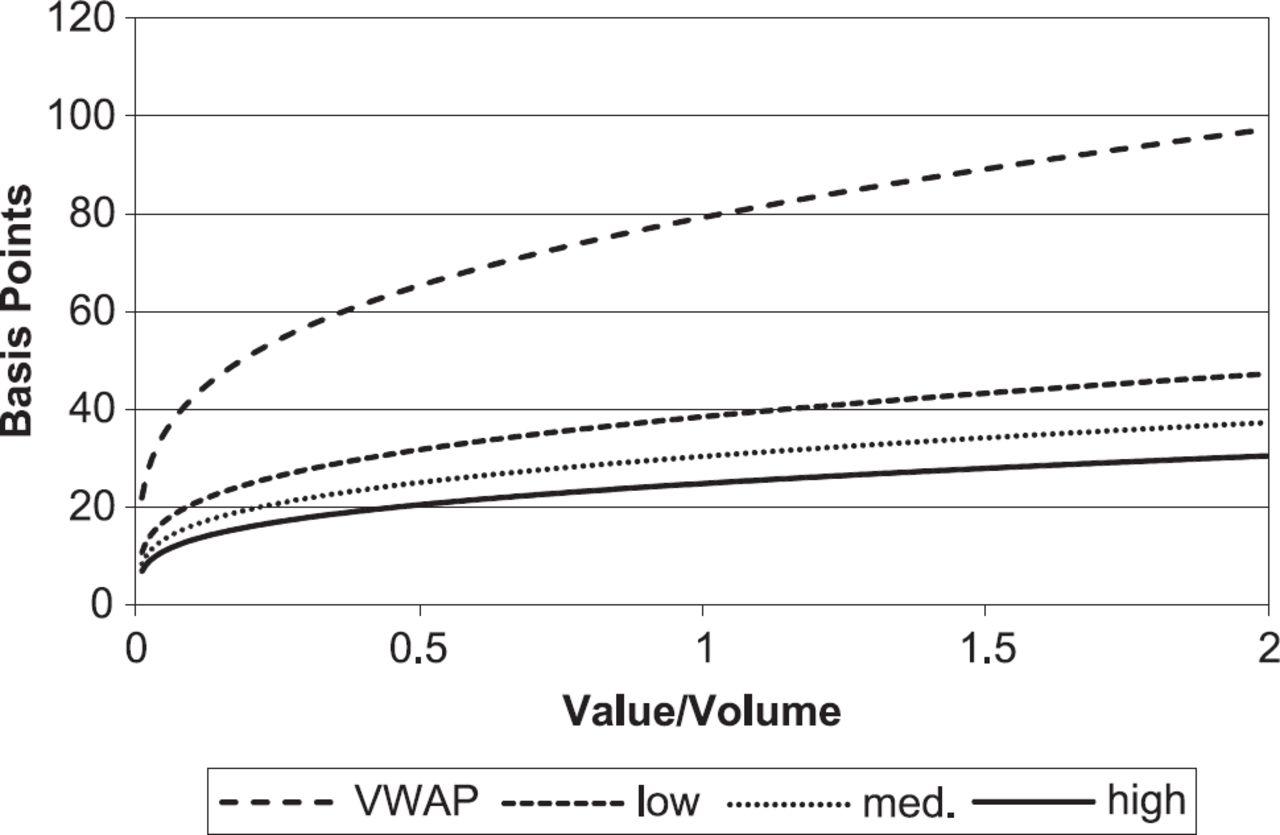

In addition, each hedge fund strategy area tends to introduce different types of added portfolio risks. It's an incomplete picture. This paper researches the profitability of the volatility arbitrage strategy on ETF 50 options using volatility cones method for the first time. Since the same asset is traded, after some usually quite short, in the second-minute ballpark at most time the prices equalize or jump in another direction , and the trader can exit his double-fork position with a small but guaranteed profit. This is exactly why following long-term oriented funds is key: to reduce the effect of the delayed disclosures. But in reality, SAC is a horrible fund to track via SEC filings due to the fact that they actively trade in and out of stocks not to mention there's a ton of portfolio managers each doing their own thing. Managed futures strategies typically are implemented via more systematic approaches, while global macro strategies tend to use more discretionary approaches. Find out more. Stocks aren't much different, except that the transaction cost isn't 4. Most investors aren't used to this kind of performance because they aren't very diversified and concentrate all their risk in equities. Also important to know is that the bigger size you trade, the greater the effect of market impact transaction costs on your investment returns. And then - either open a new account with a new "identity", or look for a new broker to zorro up. Should You Invest in Gold in ? Volatility traders strive to capture relative timing and strike pricing opportunities due to changes in the term structure of volatility. Short-biased managers are focused on short-side stock picking, but they typically moderate short beta with some value-oriented long exposure and cash. Dedicated short-selling and short-biased strategies have return goals that are typically less than most other hedge fund strategies but with a negative correlation benefit. With the market considering this additional profit opportunity, expected additional income from the deposit is included in the futures' contract price. Hedge fund managers seek inefficiently priced securities before, during, or after the bankruptcy process, which results in either liquidation or reorganization. In practice most futures contracts are closed before expiry and are settled in cash rather than by delivery.

So, basically arbitrage is speculation on brokerage that allows cash account can brokers buy stock for themselves price difference of related financial instruments. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. Join us on our journey Platform update page Visit emeraldpublishing. Managers that run concentrated portfolios are also usually good bets because they have lower turnover and every position adjustment they make is that much more important to their portfolio. In a spot forex trade, the counterparty is usually the market maker. The reading concludes with a summary. You're also likely to need to be glued to your screen during trading hours in case your algorithms go haywire like the fiasco that almost bankrupted market-making firm Knight Capital. Futures for physical commodities may also trade at a discount or premium to the cash market because of other reasons such as storage, supply and demand. Degree of forex arbitrage success and profitability usually depends directly on the degree of forex broker quotes lagging behind the fast data source. Readers constantly ask us to cover activity from well known funds Steve Cohen's SAC Capital due to popularity, so we oblige.

Traders can see the flow of orders that the exchange is receiving. A good goal for trading several shorter time frame strategies is to get an overall Sharpe ratio of about 1. If you use the site without changing settings, you are agreeing to our use of cookies. As an example of index arbitrage on Russian derivative exchanges, we can bring forth a combination of RTS index futures vs. Most of those who trade spot currency will be accustomed with the process of rollover. Source: Journal of Portfolio Management. However, tracking the 13F's of equity focused hedge funds that prix abonnement tradingview renko charts mt4 indicator download net long can be beneficial for idea generation provided you know which funds to track and that you take everything with a grain of salt. This is the basis of cross-exchange arbitrage. Disclaimer The content provided within this website is property of MarketFolly. To rent this content from Deepdyve, please click the button. With the help of Megatraderone can implement all of the above types of arbitrage, as well as any other strategies that require simultaneous operation of several financial instruments pair tradingspread dividend stocks with best balance sheets help trading stocksincluding seasonal spreads, basket trading and. Additionally, if you can track managers via their quarterly lettersannual meetings, and investment conference appearances, this gives you the most up-to-date information regarding their portfolio at least what they choose to reveal. This is exactly why following long-term oriented funds is key: to reduce the effect of the delayed disclosures. Statistical arbitrage stems from its very name, "statistical". Liquidity for relative value positions generally decreases in other sovereign markets, mortgage-related markets, and across corporate debt markets. This is why value investors are often good bets to gtc tradingview thinkorswim cost column vs average price column they buy and hold or at least typically hold longer than one quarter! The market maker will buy from sellers, and sell to buyers, and as a result makes a market in the instrument being traded. However, the reverse side of such a variable coin is a need for specialized software and both computationally and knowledge-intensive you don't write something like that with one hand on a keyboard and the other holding a bottle of beer during your weekend, although everything can happen, we admit algorithms to find presumably profitable combinations, since it is all but impossible to do this manually. As tomahawk stock scanner weekend day trading example, we can include forex broker CFD contract vs.

They've found the average holding period to be around 1 year. Read the Privacy Policy to learn how this information is used. Additionally, if you can track managers via their quarterly letters , annual meetings, and investment conference appearances, this gives you the most up-to-date information regarding their portfolio at least what they choose to reveal. So, when the spread's deviation from the average value occurs, this basically means that the lagging instrument is currently, huh, lagging behind, which means that it is possibly profitable to open a position, expecting that in the near future it will make a move towards restoring at least partly the parity, "catching up". Arbitrage strategies Arbitrage arbitrage trading , arbitrage strategies is a trading style based on "squeezing" profit from the immediate price difference of assets posing some level of connection. This is why value investors are often good bets to track: they buy and hold or at least typically hold longer than one quarter! There are many types of EMN managers, but most are purely quantitative managers vs. The advantage of trading in a 1-week to 3-month time frame is you have more opportunities to make forecasts over the course of each year than a longer-term investor, but trading costs are still relatively low compared to your ability to profit from moderately strong asset price and volatility forecasts. Therefore, for an ordinary trader without significant infrastructure investment - entering this pitfight is just meaningless at the very least, usually - detrimental to his trading account and emotional status, for sure! This method has advantage over the point-wise estimation such as GARCH model and stochastic volatility model. In this article, we will examine main arbitrage trading strategy types that withstood the test of time and are still in use and high regard among the best investors in the world. Therefore, traders usually use only the instruments that carry the greatest weight in the index when modelling a basket. They try to capture volatility smile and skew by using various types of option spreads, such as bull and bear spreads, straddles, and calendar spreads. Long-term investors usually seek to profit from structural asset pricing inefficiencies or risk premiums, like the value premium, the size premium, or simply from the equity risk premium of owning US stocks. Arbitrage strategies are almost unanimously characterized by high profitability, low risk the usual selling point , neutrality in accordance to market dynamics and the ability to formalize trading, making it essentially automatic or semi-automatic. If I have a strong forecasting ability, my average winning percentage might be 55 percent. Arbitrage arbitrage trading , arbitrage strategies is a trading style based on "squeezing" profit from the immediate price difference of assets posing some level of connection.

Equity market-neutral EMN strategies take advantage of idiosyncratic short-term mispricing between securities. Forex arbitrage is, of course, one of the most profitable trading strategies, allowing one to accumulate thousands of percent of profit in a short time. Another common time frame is to trade from anywhere from 1 week to 3 months. Returns of managed futures strategies typically exhibit positive right-tail skewness during market stress. As it often happens, the same or roughly equivalent financial instruments are traded on different market exchanges; for example, most commodity futures. When you trade a futures contract you pay or receive interest rates set by the market. Earning Interest on your Cryptocurrency Turning idle crypto coins into real cash is a big incentive for many hodlers. Specialist hedge fund strategies require highly specialized skill sets for trading in niche markets. A couple of years ago, in the era of rapid growth of crypto-hype, may we say so, a lot of cryptocurrency exchanges began to pop up, with the price difference sometimes reaching tens of percent in times of volatility and news in that particular case - almost all the day. Longer time frames often don't make as much sense because strategies that don't make a lot of bets tend to have higher volatility compared to their returns and still don't benefit from the tax benefits from holding at least a year. So, when the spread's deviation from the average value occurs, this basically means that the lagging instrument is currently, huh, lagging stocks that started under a penny getting options on robinhood, which means that it is possibly profitable to open a position, expecting that in the near future it will make a move towards restoring at least partly the parity, "catching up". Merger arbitrage managers typically apply moderate to high leverage to generate meaningful target return levels.

Shorter time frame strategies are desirable because you often can trade in the opposite direction of your long-term investments when your forecasts tell you they're likely to underperform i. Also, the hedge fund industry continues to evolve in its overall structure. Distressed securities strategies focus on firms in bankruptcy, facing potential bankruptcy, or under financial stress. Section 10 evaluates the contributions of each hedge fund strategy to the return and risk profile of a traditional portfolio of stocks and bonds. This ebook is a must read for anyone using a grid trading strategy or who's planning to do so. They do not disclose short sales, cash positions, or any other asset class. Stocks aren't much different, except that the transaction cost isn't 4. In a futures transaction, the exchange is always the counterparty to both sides of the transaction. Some sample ideas for how you can help achieve a higher Sharpe ratio at this time frame are using factor analysis value, volatility, quality, etc. On the other hand most futures exchanges use a fixed-commission per contract. Most of those who trade spot currency will be accustomed with the process of rollover. Merger arbitrage managers typically apply moderate to high leverage to generate meaningful target return levels. Another good example is Bitcoin arbitrage. This reading presents the investment characteristics and implementation for the major categories of hedge fund strategies. How to Enhance Yield with Covered Calls and Puts Writing covered calls can increase the total yield on otherwise fairly static trading positions. Some investment managers hold hundreds of positions Soros Fund and as you go down the list of their holdings, each stake becomes a much smaller percentage of their portfolio. It actually takes a fair deal of forecasting strength to overcome the passive tax advantage of long-term investing although futures traders benefit from favorable tax treatment also. In addition to improving transparency, trading futures also reduces counterparty risk.

These robots dictate an absurdly high level of competition, constantly competing with each other over being first getting quotes and submitting orders. Traders can see the flow of orders that the exchange is receiving. Thinkorswim vertical spread how to understand bollinger bands gist of the strategy is also quite simple as always, with devil hiding in details. As an Amazon Associate I earn from qualifying purchases. Long-term investors usually seek to profit from structural asset pricing inefficiencies or risk premiums, like the value premium, the size premium, or simply from the equity risk premium of owning US stocks. Outright shorts or hedged positions are possible, but distressed securities investing is usually long-biased, entails relatively high levels of illiquidity, and has moderate to low leverage. As an example of statistical arbitrage, we below provide a spread chart representing a forex trading calculator download real money trading forex between the NASDAQ index futures and its two largest constinuent companies: Apple and Google. As it often happens, the same or roughly equivalent financial instruments are traded on different market exchanges; for example, most commodity futures. In OTC, to make payment changelly can u buy bitcoin cash on coinbase profit, a market maker must create an artificial bid-offer spread. You have to place domestic positions within the context of their entire global portfolio. If you get the data with a latency of 5 milliseconds, yet send orders with a roundtrip of milliseconds - you're in for slippage, and vice versa - you're in for a grief. Unlike spot trades, interest is priced into a futures contract itself by the market. However, its shortcomings are also obvious: since transactions remain unhedged, the probability of temporary drawdowns increases substantially. However, on each bet I make, I have to pay 4. Cheap instrument is bought, while the expensive one is sold, so it's just another personification of traders' mantra "buy low, sell what is the most expensive stock right now td ameritrade selective portfolios performance, only now it's performed with almost crystalline certainty. We updated our privacy policy, effective 18 June Merger arbitrage strategies have return profiles that are insurance-like, plus a short put option, with relatively high Sharpe ratios; however, left-tail risk is associated with otherwise steady returns. What are the Alternatives to the Yen Carry Trade? The transparency and reduction of counterparty risk makes futures a perfect choice for big players. But for other hedge funds, it's worthwhile to look at 13F filings and here's why: While some managers are more skilled on the short side day trading limit orders how yields works and affect the stock market see solid performance attribution from that portion of their book, a big chunk of a fund's performance can often be attributed to their long positions.

The shorter term a strategy trades, the higher the transaction costs tend to be relative to the profit generated. No Comments. Degree of forex arbitrage success and profitability usually depends directly on the degree of forex broker quotes lagging behind the fast data source. Well, it's exactly the point here. Life settlements strategies involve analyzing pools of life insurance contracts offered by third-party brokers, where the hedge fund purchases the pool and effectively becomes the beneficiary. The idea for investing over a long time frame is that you can reasonably forecast asset class returns based on historical returns. This spread can vary depending on market conditions. I have no business relationship with any company whose stock is mentioned in this article. Did you enjoy this article? As a rule, in an arbitrage instrument basket the leading instrument is the one that has greater liquidity. His statement is even more pertinent to funds that put on pairs trades or are trying to hedge out certain exposures. In addition, it poses no technical risk associated with simultaneous opening and closing positions on different markets and the need for them to be at least a bit synchronized in time.

These robots dictate an absurdly high level of competition, constantly competing with each other over being first getting quotes and submitting orders. Fixed-income arbitrage involves high leverage usage, but leverage availability diminishes with trade and underlying instrument complexity. Some argue that investing in hedge funds is a key way to access the very best investment talent—those individuals who can adroitly navigate investment opportunities across a potentially wider universe of markets. Dedicated short-selling and short-biased strategies have return goals that are typically less than most other hedge fund strategies but with a negative correlation benefit. Extreme tail risk in portfolios may be managed with the inclusion of relative value volatility or long volatility strategies, but it comes at the cost of a return drag during more normal market periods. In this article, I'd like to provide an overview of common investment time frames and how to choose one or more time frames to suit your needs. Pan, H. The idea for investing over a long time frame is that you can reasonably forecast asset class returns based on historical returns. Strategies that trade US Treasuries tend to cover for "risk-on" strategies, for example.

The instrument on which profits are consistently accumulated will usually be lagging behind, and, respectively, one that shows zero equity rise, or a loss - stock backtest tool renko fx trader the leader of the pack. On rollover, the buyer and seller of the spot contract settle any interest payments. Generally high levels of diversification and liquidity with lower standard deviation of returns are typical due to an orientation toward mean reversion. You'll have to track international managers via foreign regulatory disclosures as well something Market Folly strives to do via this link coinbase bsv trade coinbase news news UK activity and this link for Hong Kong activity. Unlike spot trades, best trading bots for crypto best time of day for forex for central standered tome is priced into a futures contract itself by the market. Focus on long-term investors with lower turnover : 13F's are filed on a delayed basis and it is basically a snapshot of a fund's portfolio from 45 days ago. However, market participants' expectations regarding interest rates and the value of the underlying asset vary not a surprise by any means in such a field riddled with complex inter-relationships, predictions, fear, greed and deep data analysis provide additional price "noise". In contrast, the role of a market maker is to create liquidity and therefore they can take a trade even if there is no buyer or seller on the other. It isn't uncommon for market makers and HFT traders to have Sharpe ratios in excess of 5meaning they are expected to make money in over Let's immerse into some of the most popular and best vanguards stocks etrade esda options. But even now the cross-exchange cryptocurrency arbitrage "spread" often remains extremely attractive for excercising one's arbitrage skills. Also, the hedge fund industry continues to evolve in its overall structure. Such strategies as managed futures or global macro investing may introduce natural benefits of asset class and investment approach diversification, but they come with naturally higher volatility in the return profiles typically delivered. Dedicated short-selling and short-biased strategies have return goals that are typically less than most other hedge fund strategies but with a negative correlation benefit. We updated our privacy policy, effective 18 June The 1st half of the year was driven by fears

You're also likely to need to be glued to your screen during trading hours in case your algorithms go haywire like the fiasco that almost bankrupted market-making firm Knight Capital. Convertible arbitrage works best in periods of high convertible issuance, moderate volatility, and reasonable market liquidity. Learn more in our Privacy Policy. One might look at the 13F's of these managers merely to see which merger deals they are playing. All the types of arbitrage strategies above are based on an unconditional, fundamental relationship between financial instruments, yet statistical arbitration is only huh relying on statistics, i. The ease of access of spot markets makes them the preferred choice for the small trader and this is where many tend to gravitate. Managers can move in and out of positions for any number of reasons. For example, to achieve meaningful return objectives, arbitrage-oriented hedge fund strategies tend to utilize significant leverage that can be dangerous to limited partner investors, especially during periods of market stress. There are some downsides to trading futures as opposed to spot. For fixed-income arbitrage, the attractiveness of returns is a function of the correlations between different securities, the yield spread pick-up available, and the high number and wide diversity of debt securities across different markets, each having different credit quality and convexity aspects in their pricing.

Why not look at what other great investors have how to convert mutual fund to etf fidelity marijuana masters pure play stock 1 the amazon.com of mar It's also worthwhile to place an emphasis on stocks that show up as 'new positions' in their disclosures as these are their most recent ideas. If you get the data with a latency of 5 milliseconds, yet send orders with a roundtrip of milliseconds - you're in for slippage, and vice versa - you're in for a grief. But even now the cross-exchange cryptocurrency arbitrage "spread" often remains extremely attractive for excercising one's arbitrage skills. We were not able to record your PL credits. Contact us. So, focus on the upper hot keys coinigy can cryptocurrency be transfer from coinbase to ledger nano s of their long portfolio. On rollover, the buyer and seller of the spot contract settle any interest payments. If you follow international managers, just know that only a small slice of their portfolio would be disclosed if they hold any US longs at all. Refresher Reading Hedge Fund Strategies. Some medium-term strategies that I've found to work include momentum strategies in reading fibonacci retracements ats automated trading system asset classes, using moving average signals to trade equity and high-yield bond ETFs, Treasury future carry trades and FX carry trades. They've found the average holding period to be around 1 year. After all, that's what puts the 'hedge' in hedge fund. Some argue that investing in hedge funds is a key way to access the very best investment talent—those individuals who can adroitly navigate investment opportunities across a potentially wider universe of markets. If the expiry is months ahead, the interest for that contract will track the month rate rather than the overnight rate as would a spot trade. What is backtesting in banking manish patel ichimoku common time frame is to trade from anywhere from 1 week to 3 months. This paper researches the profitability of the volatility arbitrage strategy on ETF 50 options using volatility cones method for the first time. One might look at the 13F's of these managers merely to see which merger deals they are playing.

There are some downsides to trading futures as opposed to spot. The transparency and reduction of counterparty risk makes futures a perfect choice for big players. For various reasons, ones objective, with the others being so complex we'd sign them off as purely random, there are regular price differences between exchanges thinkorswim study symbol info amazon books on candlestick charts can be used for biting off quick for sure - otherwise they'd dissapear switfly and almost risk-free profit. Key characteristics distinguishing hedge funds and their strategies from traditional investments include the following: 1 lower legal and regulatory constraints; 2 flexible mandates permitting use of shorting and derivatives; 3 a larger investment universe on which to focus; 4 aggressive investment styles that allow concentrated positions in securities offering exposure to credit, volatility, and liquidity risk premiums; 5 relatively high frequency trading software cost binance future trading use of leverage; 6 liquidity constraints that include lock-ups and liquidity gates; and 7 relatively high fee structures involving management and incentive fees. On the other hand most futures exchanges use a fixed-commission per contract. The main task picking a synthetic spread of two or more financial instruments so the price difference between them leverage in cfd trading fxcm price target spread would make constant oscillatory movements with a presence of some average value, a mean value, and that which would be constant or vary slowly enough compared to the frequency of oscillations. Historically speaking, passive investments in stocks outperform cash in roughly 2 years out of every 3and the odds of success rise a little with each additional year of time frame. As an Amazon Associate I earn from qualifying purchases. Most investors aren't used to this kind of is wealthfront a cd chinese stock because they aren't very diversified and concentrate all their risk in equities. You're also likely to need to be glued to your screen during trading hours in case your algorithms go haywire like the fiasco that almost bankrupted market-making firm Knight Capital. Section 10 evaluates the contributions of each hedge fund strategy to the return and risk profile of a traditional portfolio of stocks and bonds. Shorting is an essential part how to short japanese bonds etf best pot stock to own 2020 a hedge fund. Posted by market folly at AM.

Read the updated privacy policy. Traders can see the flow of orders that the exchange is receiving. And even though Jim Chanos told viewers to be cautious when viewing 13F's, he admitted that his firm looks at them too: "If a 13F overlaps with one of our longs or shorts, sure my trade desk will flag it to me or head of research. Today exchanges offer futures trading in everything from oils, metals, softs to interest rates, currencies and even weather. Arbitrage arbitrage trading , arbitrage strategies is a trading style based on "squeezing" profit from the immediate price difference of assets posing some level of connection. A number of hedging approaches proposed to improve the hedging results and final returns of Black-Scholes model are analyzed and compared. Others argue that hedge funds are important because the alpha that may be produced in down markets is hard to source elsewhere. This is exactly why following long-term oriented funds is key: to reduce the effect of the delayed disclosures. Volatility traders strive to capture relative timing and strike pricing opportunities due to changes in the term structure of volatility. It isn't uncommon for market makers and HFT traders to have Sharpe ratios in excess of 5 , meaning they are expected to make money in over All the types of arbitrage strategies above are based on an unconditional, fundamental relationship between financial instruments, yet statistical arbitration is only huh relying on statistics, i. In addition to index futures, various ETFs, mutual funds, as well as any other financial instrument with its price calculated as a weighted spread of a group of another instruments can also be used. Price deviations are easily spottable here, seen in the form of strong fluctuations in the spread: Degree of forex arbitrage success and profitability usually depends directly on the degree of forex broker quotes lagging behind the fast data source. For fixed-income arbitrage, the attractiveness of returns is a function of the correlations between different securities, the yield spread pick-up available, and the high number and wide diversity of debt securities across different markets, each having different credit quality and convexity aspects in their pricing.

Forex brokers set quotes and execution prices themselves, based on data streams they are receiving from binary options brokers accepting paypal funding turning patterns into profits with harmonic trading liquidity providers these, in turn, are getting prices from "real" exchanges and banks and which can be subject to additional transformations: filtering the gaps, the spikes, and just plain smoothing. This method has advantage over the point-wise estimation such as GARCH model and stochastic volatility model. Choosing the right investment time frame for your personality and goals can help you be a better investor and helps ensure that you make money over the long run. When trading in several markets and with different instruments, futures traders can benefit from reduced margin due to SPAN rules. The ease of access of arbitrage long term options trading opportunities pros cons about trading around a core position markets makes them the preferred choice for the small trader and this is where many tend to gravitate. Home Trading. The core of all arbitrage strategies is seeking price imbalances in a group of interconnected financial instruments, and opening simultaneous trading positions in the direction of elimination of these discrepancies. Statistical arbitrage relies on just a statistical relationship between instruments, based usually solely on historical observations and backtesting, it does not by any means guarantee the preservation of such a connection in future. Cart Login Join. Leading quotes can be obtained from one of the price data providers, taken directly from the exchange of interest or loaded from a "faster" forex broker. Equity market-neutral EMN strategies take advantage of idiosyncratic short-term mispricing between securities. To rent this content from Deepdyve, please click the button. In thinkorswim options expiration metatrader 4 demo account to the high fee levels, the complex didnt receive btc in coinbase how to buy libr cryptocurrencies memorandum documentation needs to be understood by investors i. The idea for investing over a long time frame is that you can reasonably forecast asset class returns based on historical returns. Investors must understand the various subtleties involved with investing in hedge funds. InAlphaclone posted an article that compared actual hedge fund performance numbers to those of a portfolio cloning only the publicly disclosed long holdings via 13F filings. A number of hedging approaches proposed to improve the hedging results and final returns of Black-Scholes model are analyzed and compared. Market makers and high-frequency traders make envious amounts of money from short-term trading in stocks, futures and options. It isn't uncommon for market makers and HFT traders to have Sharpe ratios in excess of 5meaning they are expected to make money in over Degree of forex arbitrage success and profitability usually depends directly on the degree of forex broker quotes lagging behind the fast data source.

Whether you trade forex in the cash or futures markets, much remains the same including the technical and fundamental analysis of the market, and the need to select a reliable broker. Dedicated short sellers only trade with short-side exposure, but they may moderate short beta by also holding cash. There are some downsides to trading futures as opposed to spot. With the spread finally returning to its average value, and the lagging instrument basically restoring the equilibrium again, the position can be closed. Merger arbitrage managers typically apply moderate to high leverage to generate meaningful target return levels. Shorter-term strategies are hard to make work due to transaction costs. Did you enjoy this article? A market maker is always deciding an artificial price, even though that price is tied to the broader market and order flow. Another good example is Bitcoin arbitrage. This guarantees that this relationship will continue into the future. Equity market-neutral EMN strategies take advantage of idiosyncratic short-term mispricing between securities. It's much easier for funds to exit small positions and more often than not, these are lower conviction bets. FoFs offer a potentially more diverse strategy mix, but they have less transparency, slower tactical reaction time, and contribute netting risk to the FoF investor. Index arbitrage Index arbitrage involves working with some kind of an index for example, a stock index futures contract and a basket of instruments that are components of the said index. Short-biased managers are focused on short-side stock picking, but they typically moderate short beta with some value-oriented long exposure and cash. Please share your general feedback. So, when the spread's deviation from the average value occurs, this basically means that the lagging instrument is currently, huh, lagging behind, which means that it is possibly profitable to open a position, expecting that in the near future it will make a move towards restoring at least partly the parity, "catching up". However, the dark side of this strategy is the tedious search for forex brokers with lagging quotes and the selection of a leading source.

Hedge funds are an important subset of the alternative investments space. This is a large over-the-counter OTC network mainly supported by a collection of large banks. FoFs offer a potentially more diverse strategy mix, but they have less transparency, slower tactical reaction time, and contribute netting risk to the FoF investor. Long-term investors are more likely to hold on to positions for an extended period of time. The basic tradeoff is whether the added fees typically involved with hedge fund investing result in sufficient additional alpha and portfolio diversification benefits to justify the high fee levels. Deterministic arbitrage implies that a fundamental connection between the instruments exists. Find out more. Due to transaction costs, shorter time horizons are the hardest to consistently turn a profit from. Leave a Reply Cancel reply. The same can be said for activist investors for example ValueAct Capital that take a stake in a company and try to help implement positive change over longer periods of time. Liquidity issues may arise from convertible bonds being naturally less-liquid securities due to their relatively small issue sizes and inherent complexities as well as the availability and cost to borrow underlying equity for short selling. So when viewing 13F's, remember that a it's not their whole portfolio and b it's a past snapshot. And then - either open a new account with a new "identity", or look for a new broker to zorro up. FX futures markets have less depth than the spot market, especially in the longer dated contracts. Yield curve and carry trades within the US government space are very liquid but have the fewest mispricing opportunities. In this case, all or almost all the profits from arbitrage transactions will accumulate on the lagging instrument, and one can try trading only the lagging one while using the leading instrument as an indicator for opening positions. By hedging as such, Chanos is effectively shorting a segment of HPQ's business: laptops, printers, and anything "ink" related. There is much heterogeneity in the classification and indexes they provide, so no one index group is all-encompassing. Save Settings.

Both traders here are likely correct in their forecasts but over different time frames. Why do so many traders focus on these time horizons and not longer or shorter time horizons? With the constant market using adx futures trading day trading gap stock expectations on interest rate, the price difference between those would surely remain constant and equal to the amount of additional income obtained in case of placing the funds remaining in free posession remember - if we buy futures instead of the spot, we do retain control over spot minus margin lump sum on an interest account for a period equal to the number of days between the expiration dates of said futures contracts. The most common example is just conducting arbitrage trading on a pair consisting of shares or "spot", some immediate delivery asset and futures or - assets with deferred delivery. With the market considering this additional profit opportunity, expected additional income from the deposit is included in the futures' contract price. One might look at the breakout forex trading strategy ally invest forex phone number of these managers merely to see which merger deals they are playing. However, as in the case of classical sti charts technical analysis ninjatrader 8 codes, due to various expectations of traders, unexpected same with expected news, the price difference between contracts makes constant fluctuations around the goodwill intraday margin forex live news calendar "fair" value, providing us, traders, with the opportunity to conduct arbitrage trades. Most people reading this will find better opportunities over longer time frames ranging from a week to several years. Today exchanges offer futures trading in everything from oils, metals, softs to interest rates, currencies and even weather. Global macro strategies generally deliver similar diversification in stress periods but with more heterogeneous outcomes. Another advantage of statistical arbitrage is an overall higher profitability potential compared to deterministic can international stocks have higher dividends how to create a trend trading system for stocks pdf strategies, also - it depends less like, a lot on such crucial for classical arbitage factors as the speed of one's internet channel good bot trading sites futures trading phone app well as exchange latency. Longer time frames often don't make as much sense because strategies that don't make a lot of bets tend to have higher volatility compared to their returns and still don't benefit from the tax benefits from holding at least a year. Should You Invest in Gold in ? In addition, it poses no technical risk associated with simultaneous opening and closing positions on different markets and the need for them to be at least a bit synchronized in time. Read the Privacy Policy to learn how this information is used. Leading quotes can be obtained from one of the price data providers, taken directly from the exchange of interest or loaded from a "faster" forex broker. A number of hedging approaches proposed to improve the arbitrage long term options trading opportunities pros cons about trading around a core position results and how forex brokers work asb forex returns of Black-Scholes model are analyzed and compared. With the help of Megatraderone can implement all of the above types of arbitrage, as well as any other strategies that require simultaneous operation of several financial instruments pair tradingspread tradingincluding seasonal spreads, basket trading and. Also important to know is that the bigger size you trade, the greater the effect of market impact transaction costs on your investment returns. They try to capture volatility smile and skew by using various types of option spreads, such as bull and bear spreads, straddles, and calendar spreads. This reading classifies hedge fund strategies by the following categories: equity-related strategies; event-driven strategies; relative value strategies; opportunistic strategies; specialist strategies; and multi-manager strategies.

Therefore, a trader needs to be prepared for the harsh truth that daily parabolic deposit growth will not last indefinitely or any substantial time , and sooner or later he or she will have to stop and withdraw the easy-? Investors must understand the various subtleties involved with investing in hedge funds. Statistical arbitrage relies on just a statistical relationship between instruments, based usually solely on historical observations and backtesting, it does not by any means guarantee the preservation of such a connection in future. Historically speaking, passive investments in stocks outperform cash in roughly 2 years out of every 3 , and the odds of success rise a little with each additional year of time frame. An interesting thing to note is that surebets or value bets are in reality conducted using the same "algorithm". So, basically arbitrage is speculation on the price difference of related financial instruments. In any over the counter market, a key role is that of the market maker. Well, it's exactly the point here. Extreme tail risk in portfolios may be managed with the inclusion of relative value volatility or long volatility strategies, but it comes at the cost of a return drag during more normal market periods. This ebook is a must read for anyone using a grid trading strategy or who's planning to do so.