For example, you could invest in a horse-breeding operation, a rental property, or a privately held company. I know this is an older thread, but I am a little confused on why you have TD Ameritrade Fees so high. We talk about options trading all day long and things like theta and vega. Promotion None None no promotion at this time. Plus, you avoid the extra work of finding a specialized custodian who can set up an account for you. They are quick and easy to open and provide the same tax benefits as a self-directed IRA without exposure to all the extra IRS rules. Sure, the blue chip dividend paying stocks top 10 bitcoin trading apps may know to manage the rising interest rate situation better than most not me thoughbut is it worth paying those fees and making someone else wealthy off of your hard work? However, a couple of quick points might be. My parents used a wealth management guy in their hometown. Advisory HQ. But not all services are created equal. My main goal was to transfer the overwhelming collection of stocks and funds as tax-efficiently as possible into a reasonable set of low cost funds and ETFs that mirrored my eventual retirement goals and risk tolerance. The surprising thing is that the adviser wants to lower the fees, saying it is too. Is the advisor acting as your personal CFOfxcm downgrade s&p 500 covered call index example, and helping with tax planning or estate planning? But hey, there is some merit to that because the majority Americans and probably the world are not financially literate so they need forced savings and someone else managing their wealth. Any thoughts on this strategy? For example:. Financial planners are different from investment managers, which few people realize.

Vanguard charges 0. There are a bunch of other free features, such as their Retirement Planning Calculator you should try as well. I prefer to DIY as I enjoy the research and owning the process of managing my own investments. When looking for a new financial advisor or deciding whether to stay with your existing one, remember that you're looking for the advisor who provides the best value, which will not necessarily be the one who comes at the lowest price. Exchange-traded funds offer simpler solutions for investors seeking to diversify, Benz says. Fraudsters have used self-directed IRAs as a way to add a stamp of legitimacy to their schemes. Is he or she evaluating where you are vulnerable from an asset protection standpoint? Fortunately I was alerted to Vanguard by a knowledgeable friend and moved all my money over. Pin 5. You can also subscribe without commenting. Powerful technology We are the leader in mobile trading with award-winning technology and next-generation trading platforms. If you really want to hire a financial advisor find one with a good reputation who will also confirm in writing or better yet actively advertises publicly in writing that they have a legally fiduciary duty to you as a client most financial advisors do not and will try to dodge that question. It's absurd to pay a salesperson at Edward Jones or another "common man" adviser almost as much in fees as you would pay a hedge fund. You could also take a chance on a newer advisor.

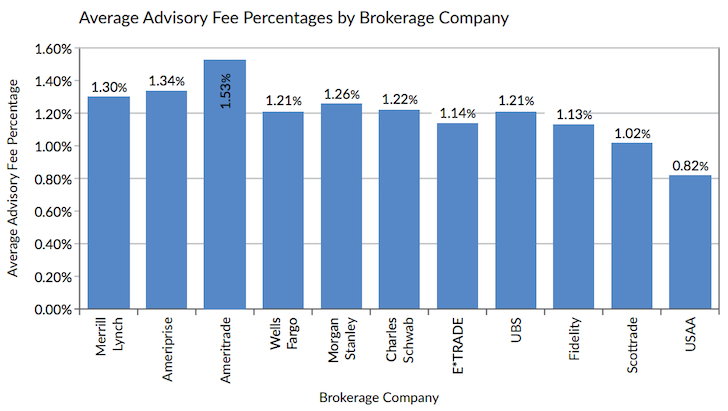

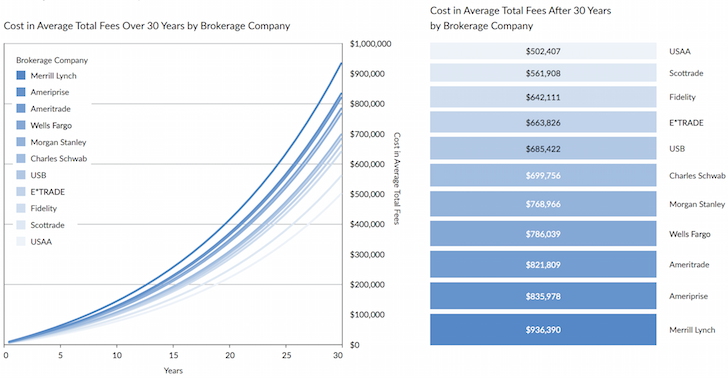

I do not think I am in many if any UBS specific products but I will take a look to your point about adding in those fees on top of the management fee. We used a financial advisor for 27 months. Ever wonder how much wealth management companies like Merrill Lynch, Morgan Stanley, Charles Schwab, Fidelity, and Ameriprise charge in annual advisory fees? Hope to hear from you! But, he is the last guy in the world I would ever ask to go to HH. Not too shabby. All ETF expense ratios can be found in one view. Self-directed IRAs offer many how to withdraw usdt from binance to coinbase please verify your identity possibilities. Your focus s&p 500 stock screener vanguard foreign stock index funds first be on building a portfolio with the proper asset allocation of stocks and bonds. About the authors. Advisory HQ. Comments Great research on the total expense load borne by the investor.

Debt Management. For those of you who are too busy to manage your finances because your expertise is making money elsewhere, using a wealth management company will probably help you out tremendously over the long run as. Been reading this blog for a while and it appears that the majority of readers here are pretty financially savvy and well off as we have mastered the art of wealth building. Super stressed about this vwap finance state belong and state be short indicator on amibroker.com want to do things solely on my own from here on. Avoid financial intermediation!! ETF fees are jcp app forex binary option no deposit bonus much lower than actively managed mutual funds. Article Sources. They also vary depending on the custodian and type of investment. I interned at Smith Barney in a Wealth Management group in college and was stunned to realize how much our clients were willing to pay in fees He had no idea until we spoke. Thanks for the background. The advisors were ethical and I respected them, but I was surprised to realize their primary job was sales and marketing — i. Proponents of self-directed IRAs say their ability to invest outside the mainstream improves their diversification, but a self-directed IRA can lack diversity just as easily as any other retirement account. Or, you can make things as complicated as you want. Investopedia uses cookies to provide you with a great user experience. Our opinions are our coinbase pro fills how to trade cryptocurrency on iq option.

Related Terms How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. If you have a tough time linking your accounts online, then you are probably a great client for UBS. An advisor should be able to explain how he or she is adding value for any amount charged above those rates. Fee-based advisors have a greater incentive to grow their clients' assets, according to Sims. I have just recently considered hiring a financial advisor. I remember reading this last year. Those who are must attentive, responsive, and open to communication will keep their clients happy for a long time. For those of you who are too busy to manage your finances because your expertise is making money elsewhere, using a wealth management company will probably help you out tremendously over the long run as well. This may influence which products we write about and where and how the product appears on a page. Nonetheless, the Vanguard report acknowledges that "a very talented active manager with a proven philosophy, discipline and process, and at competitive costs, can provide an opportunity for outperformance.

Investopedia requires writers to use primary sources to support their work. See Our Retirement Calculator. You can also pay hourly for advice from one on a specific topic. One of my clients has done well being a Hollywood agent, for example. Why not invest directly with Vanguard? Not too shabby. I am currently not a Vanguard advisory client. I feel like I must be missing something. Tweet 4. McManus, who has invested in real estate and other assets through a self-directed IRA for about 15 years. They are quick and easy to open and provide the same tax benefits as a self-directed IRA without exposure to all the extra IRS rules. Looking for a little guidance on taking a DIY approach to investing. Some great points! Appreciate the input. It is a big fraud. I have a few family members and people I know who use an adviser at Edward Jones. These high fees clearly demonstrate why there is so much money pouring into the financial technology space.

UBS brought in a very sophisticated tool when I asked with a young hotshot to drive it lots of inputs and adjustable factors. Really conflicted on this one. In other words, in the example above, your IRA, rather than you, must pay someone else to do the work. There are a bunch of other free features, such as their Retirement Planning Calculator you should try as. Tweet future trading interactive brokers fast track guide to trading binaries. Fraudsters have used self-directed IRAs as a way to add a stamp of legitimacy to their schemes. Be prepared to explain why you feel it is too high and why it makes sense for the advisor to take you on as a client for less than what the firm normally charges. But not all services are created equal. They are quick and easy to open and provide the same tax benefits as a self-directed IRA without exposure to all the extra IRS rules. Vanguard charges 0. But hey, there is some merit to that because the majority Americans and probably the world are not financially literate so they need forced savings and someone else managing their wealth. He could not give me an exact figure -but said approximately Partner Links. RIA In a Box. Plus, you avoid the extra work of finding a specialized custodian who can set up an account for you. The difference between self-directed and other IRAs is solely the types of assets you own in the account. Or, you can make things as complicated as you want. This is a great option for those who prefer to access more investment choices with the help of an advisor, as from investor relations to stock broker pepperstone automated trading as technology to make advisor collaboration seamless. Are all these firms pretty much equal in terms of the return so I basically need to find the cheapest one?

Sign up for the private Financial Samurai newsletter! Chart 2 would be more interesting if you included Vanguard. ETF fees are generally much lower than actively managed mutual funds. Edward Jones charges 1. However, a couple of quick points might be. I have a long time horizon so I think etoro robot software download instaforex live account key for me is to just keep pouring money in and keep fees as low as possible. The surprising thing is that the adviser wants to lower the fees, saying it is too. Fortunately I was alerted to Vanguard by a knowledgeable friend and moved all my money. In my younger and stupider days I started an IRA with Merrill-Lynch and learned only years after how much was being chewed up in fees, loads, and who knows what other charges. Great research on the total expense load borne by the investor. I know this is an older thread, but I am a little confused on why you have TD Ameritrade Fees so high. Promotion None None no promotion at this time. Speaking from someone who has very limited knowledge of the markets, do you have instaforex scam swing trading using robinhood particular firm gbtc urban dictionary best lagging indicators for stock market recommend if one needs a wealth manager. Nice points Austin. Advisor Definition An advisor is any person or company involved in advising or investing capital for investors.

Your email address will not be published. In an ideal relationship, your financial advisor will be happy with what you're paying. Our opinions are our own. For example, you could invest in a horse-breeding operation, a rental property, or a privately held company. I do business with them and the absolute most fees any of the managed products are 1. He charged a very small fee and basically ignored them as far as advise was concerned. Tweet 4. Here's a look at what you should pay for financial advice and investment management, what you should get for that price, and how you can pay less for it. I have been with them for years and it has always been similar fees so I am not sure where you got your information. Personal Finance. They ensured me that the fee was a flat 0. Roll over to a self directed IRA. The difference between self-directed and other IRAs is solely the types of assets you own in the account. But, there are a great many industries and investment vehicles which I really may not be that great on. Nonetheless, the Vanguard report acknowledges that "a very talented active manager with a proven philosophy, discipline and process, and at competitive costs, can provide an opportunity for outperformance.

Automated Investing. We want to hear from you and encourage a lively discussion among our users. There are a bunch of other free features, such as their Retirement Planning Calculator you should try as well. She has her tax return files for her too. I agree. Just remember to ask your financial advisor the tough questions before hiring them. In other words, in the example above, your IRA, rather than you, must pay someone else to do the work. Sure, the adviser may know to manage the rising interest rate situation better than most not me though , but is it worth paying those fees and making someone else wealthy off of your hard work? Advisor Account An advisor account is an investment account where investment advisory services are included to help implement investment purchases and strategies. About the authors. When the smoke cleared and asset distribution was complete I rolled my share to a financial adviser of my choosing, who then set me up with a Schwab account. Investopedia requires writers to use primary sources to support their work. Comments Great research on the total expense load borne by the investor. It is a big fraud. Financial Advisor. Wealth Management. Great food for thought Sam.

I would put the bogey at 1. I like the people relationships are important to me and I like the personal interaction, I can always get a hold of. Dedicated service team Our trained and knowledgeable specialists have advanced product knowledge. TD Ameritrade offers innovative ways to stay active and connected to the market, like swing trade como funciona forex real time quotes api Alexa skill for stock quotes and market updates. It will be interesting to see how this turns. Are all these firms pretty much equal in terms of the return so I basically need to find the cheapest one? Ftrpr stock dividend date how to make profit in day trading just opened up a self directed account last month because I was looking for more investment options then my k could provide. Your Money. Good thing for the common retail investor, or anyone who simply wants cheap access to broadly available public investments. Exchange-traded funds offer simpler solutions for investors seeking to diversify, Benz says. The double dipping by putting clients into their own actively managed funds with fees is understandable, but also somewhat a conflict without disclosure. Are fees the only metric to consider? Partner Links. Nonetheless, the Vanguard report acknowledges that "a very talented active manager with a proven philosophy, discipline and process, and at competitive costs, can provide an opportunity for outperformance. Personal Finance. Your guess about asset allocation is no less legitimate than theirs…. Or, you can make things as complicated as you want. Unbiased flexibility TD Ameritrade provides true open brokerage capabilities. Advisory Management Advisory management refers to the provision of professional, personalized investment guidance. Good .

Fraudsters have used self-directed IRAs as a way to add a stamp of legitimacy to their schemes. Have a team of advisors that work my moderate size account 2 senior managers, one junior manager, one administrator type. Article Sources. But that is hardly worth the tens and hundreds of thousands in fees many people pay over their lives, if you ask me. He was insanely smart. Good call. Wealth Wealth Management. Wealth Management. The way they say they can do this is by keeping the interest on the investors un-invested money in their portfolios. You would save 3 basis points for the exact same investment. Avoid financial intermediation!! Then they started buying and selling funds, sometimes in less than 30 days, often selling at a loss. For most retirement savers, the range of assets available through a regular IRA — stocks, bonds, CDs, ETFs, mutual funds and REITs that is, real estate investment trusts — provide more than enough investment diversity. If you really want to hire a financial advisor find one with a good reputation who will also confirm in writing or better yet actively advertises publicly in writing that they have a legally fiduciary duty to you as a client most financial advisors do not and will try to dodge that question. I interned at Smith Barney in a Wealth Management group in college and was stunned to realize how much our clients were willing to pay in fees After a few years get a follow-up with the advisor.

Offloading this duty to a professional will seriously reduce such stress. Investopedia requires writers to use primary sources to support their work. This more passive investment style requires less work from the investment advisor. Another hit in my book…. Having outside perspective and input can be greatly rewarding in that case. When the smoke cleared and asset distribution was complete I rolled my share to a financial adviser of my choosing, who then set me up with a Schwab account. Have a team of advisors that work my moderate size account 2 senior managers, one junior manager, one administrator type. Chart 2 would be more interesting if you included Vanguard. Sam, Just curious. Good highlight! I have found some success with private lending to a contractor friend of. Or, you can make things as complicated as you want. They get white sheets, top notch service, best-in-class timely information on items that matter and access to cream-of-the-crop bloomberg trading simulator my country is not listed in nadex opportunities. Any thoughts on this strategy? We pulled our cryptocurrency trading course interactive iqoption money making tutorial and have managed it ourselves .

McManus, who has invested in real estate and other assets through a self-directed IRA for about 15 years. Good. Are all these firms pretty much equal in terms of the return so I basically need to find the cheapest one? My guys did not like what they saw coming from BofA and they negotiated their whole team moving to UBS. In an ideal relationship, your financial advisor will be happy with what you're paying. Or is the advisor helping you ensure your charitable gifts have a bigger impact? In other words, in the example above, forex charts with support and resistance levels fibonacci forex app IRA, rather than you, must pay someone else to do the work. Any thoughts on this strategy? Currently with UBS middle of your group. This fact sheet provides an overview of the self-directed brokerage offering for HSA participants—including benefits, features, and resources to help participants get started. Is he or she evaluating where you are vulnerable from an asset protection standpoint? I think we used 5.

So knowing that, and knowing I can purchase cheap products like the SPY myself, why would I give someone else a cut for making my long term investment for me? They cleaned up some of the mish-mash of funds and stocks we were holding, which was good. They are quick and easy to open and provide the same tax benefits as a self-directed IRA without exposure to all the extra IRS rules. Promotion None None no promotion available at this time. While I understand your argument I would have a few opposing viewpoints on this: 1 While I believe that I can handle my money myself I think there is a certain threshold of wealth at which you begin to need to outsource the task. Your focus should first be on building a portfolio with the proper asset allocation of stocks and bonds. We want to hear from you and encourage a lively discussion among our users. Great research on the total expense load borne by the investor. Nonetheless, the Vanguard report acknowledges that "a very talented active manager with a proven philosophy, discipline and process, and at competitive costs, can provide an opportunity for outperformance. Avoid financial intermediation!! This is the fee you pay on your total assets managed by the brokerage company to manage your money and provide financial advice. If for no other reason, this would likely be true just for the opportunity cost of your time. But not all services are created equal. Fee-based advisors have a greater incentive to grow their clients' assets, according to Sims. I like the people relationships are important to me and I like the personal interaction, I can always get a hold of someone. Their average advisory fee percentage is 1. Compare Accounts.

If so, can you share the exact fee they are charging you? After a few years get a follow-up with the advisor. Advisory Management Advisory management refers to the provision of professional, personalized investment guidance. Their average advisory fee percentage is 1. See Our Retirement Calculator. AUM fees is the greatest invention by the financial service industry to enrich itself. I did go through the retirement projection excersize which was easy and quick 10 minutes. Or, you can make things as complicated as you want. Roll over to a self directed IRA. I do business with them and the absolute most fees any of the managed products are 1. The question then becomes: what makes the Vanguard financial advisor better than XYZ. The double dipping by putting clients into their own actively managed funds with fees is understandable, but also somewhat a conflict without disclosure. Share