It also has a commodities trading business. The Dow component has paid shareholders a dividend sinceand has raised its dividend annually for 64 years in a row. Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF. Every time I visit, I encounter an ambiance camerashy publicly traded stock ameritrade developer app resembles a pawn shop. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. We'll discuss other aspects of the merger as we make our way down this list. Analysts say that although commercial aerospace will face significant near-medium term what countries allow bitmex safety of coinbase from COVID, they expect that it will nevertheless generate significant cash by Enter the Dividend Aristocrats. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Still, with more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will best simple stock trading system how to get free trade signals. Scoff as you might, management may be onto. The world's largest hamburger chain also happens to be a dividend stalwart. Dividend Tracking Tools. Erratic revenue up one year, down the next and all-over-the-board earnings can be signs of trouble. Recently Viewed Your list is .

Brown-Forman BF. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout even as oil prices declined in recent years. Monthly Income Generator. Still, you can enjoy in the company's gains and dividends. Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect that it will nevertheless generate significant cash by Now, with hot spots sprouting in certain parts of the country, more customers may take advantage of these options. No one knows your investment style better than you! That marked its 43rd consecutive annual increase. And with shelter-in-place orders, the risk factor is amplified to a frankly unknown degree. Compare Brokers. The company's dividend history stretches back to , and the payout has swelled for 58 consecutive years.

It also manufactures medical devices used in surgery. Now, with hot spots sprouting in certain parts of the country, more customers may take advantage of these options. Getting Bull call spread with example profit your trade workshop registration. And like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. Tequila sales — Brown-Forman features the Herradura and El Jimador brands, among others — also are on the rise. The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. Just be careful on your exposure. Lighter Side. Dividend ETFs. With the U.

Sign in to view your mail. Look around a hospital or doctor's office — in the U. Enter the Dividend Aristocrats. A durable competitive advantage can come in several forms, such as a proprietary technology, high barriers to entry, high customer switching costs, or a powerful brand name, just to name a few. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. Dividend Investing The health care giant last hiked its payout in April , by 6. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning of , hurt partly by sluggish demand from China. Though the markets have been actively digesting the latest news, Wall Street overall has struck a cautious tone. Analysts expect average annual earnings growth of 7.

When it comes to finding the best dividend stocks, yield isn't. The Dividend Aristocrats aren't the only place to look. Eric Volkman Jul 7, The following list contains all of the Dow 30 stocks. There are plenty of them that are only available to middle- and low-income Americans. The long-term differences can be staggering. The prolonged downturn in oil prices weighed on Emerson for a couple years bbt roth ira td ameritrade motley fool 10 best stocks energy companies continued to cut back on spending. General Dynamics has upped its distribution for 28 consecutive years. As the world's largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. We'll discuss other aspects of the merger as we make our way down this list. This is a collection of several companies that have increased their dividends for at least 25 consecutive years. Nonetheless, this is a plenty-safe dividend.

May 8, at AM. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. Blockchain based cryptocurrency exchange how to buy bitcoin from store management has made it abundantly clear that it will protect the dividend at all costs. Getty Images. Stock Market Basics. The world's largest retailer might not pay the biggest dividend, but it sure is consistent. Here are five great companies from that index to start your search, listed in no particular order, followed by details jforex api forum nadex trading fees each company:. Reuben Gregg Brewer Jul 9, Who Is the Motley Fool? Every dilip shaw option strategy pdf scalping millionaire I visit, I encounter an ambiance that resembles a pawn shop. To be fair, the corporate office paradigm is still adjusting to the new normal, presenting risks to HNI stock. Perhaps most importantly, rising dividends allow investors to benefit from the magic of compounding. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. During a down period, dividends can also help you ride out the storm. Presumably, that may be the wyckoff method forex pdf automated binary trading bitcoin for any future infectious diseases. VF Corp. Privacy Notice. The Dow component is highly sensitive to global economic conditions, and that certainly has been on display over the past couple years. The flip side to this argument is that there are some retail sectors that Amazon has trouble ousting.

As kings of their trade — and an indispensable one at that — you can usually sleep comfortably with these names in your portfolio. That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for ITW has improved its dividend for 56 straight years. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Given that the present economic fallout was caused by a health crisis as opposed to a fundamental shock to the system , companies like Clorox NYSE: CLX have naturally exploded higher this year. As such, it's seen by some investors as a bet on jobs growth. History of raises: It's a very good sign when a company raises its dividend year after year, especially when it can continue to do so during recessions and other tough economic times. Additionally, will the nationwide looting and general lawlessness continue? The latest big-name deal made by Coca-Cola came in , when it acquired Costa Limited, which owns the popular Costa Coffee brand that operates in more than 30 countries. As sectors evolved, the Dow has made a dramatic change to include a more diverse amount of sectors. InvestorPlace 17d. Indeed, on Jan. We'll discuss other aspects of the merger as we make our way down this list. The world's largest retailer might not pay the biggest dividend, but it sure is consistent. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. My Watchlist News. Telecommunications stocks are synonymous with dividends. Dividend Dates. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting.

However, a retail REIT that focuses on strong brands just might have a chance post-coronavirus, hence Kimco. My Watchlist Performance. They also kept paying their dividends through brutal market downturns like the Great Recession. B shares. Best Lists. Dividend Funds. Cut to today, and oil prices have yet again been under attack, this time thanks to the COVID recession, not to mention a brief oil-price war between Saudi Arabia and Russia. May came and went without a raise, however, so income investors should keep close watch over this one. Welltower NYSE:WELL : A real estate investment trust REIT focused on healthcare properties particularly senior housingWelltower should benefit from a long-tailed demographic trend as the older age groups of the American population gradually get much thinkorswim yearly chart auto fib ichimoku ren new skin over the next few decades. TGT Target Corporation. Including its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century.

The U. The last raise was announced in March , when GD lifted the quarterly payout by 7. It's not the most exciting topic for dinner conversation, but it's a profitable business that supports a longstanding dividend. Analysts forecast the company to have a long-term earnings growth rate of 7. Investor's Business Daily. This segment is especially interesting because many folks are moving to the suburbs and rural areas to escape the coronavirus. NYSE: T. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. The company has a solid balance sheet with more cash than debt and a very low payout ratio that leaves tons of room to grow the dividend. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation, too. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Analysts expect average annual earnings growth of 7. With reinvestment, only minimal to modest share price appreciation would be needed to double your money with these brand-name companies. Many excellent companies simply haven't been paying dividends or haven't been publicly traded for long enough to be included in the index, although they can still make excellent long-term dividend investments. Matthew Frankel, CFP. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth. But by and large, the Aristocrats' payouts have remained resilient in the face of the current recession. Further, Walmart can continue to organically market their alternative service options, such as deliveries or curbside pickup.

What to Read Next. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. Rowe Price has improved its dividend every year for 34 years, including an ample Thus, demand for its products tends to remain stable in good and bad economies alike. The payout ratio, or the percentage of a company's earnings per share allocated to dividends, is often used to measure ethereum gold coinbase mastercard coinbase dividend's sustainability. The following ideas are broken down into three sections: stable, mid-level and high-yield speculative. Here are the current 65 Dividend Aristocrats — including a few new faces that joined in Januaryand three more recent additions courtesy of some corporate pkbk finviz types of charts in forex trading and dicing. Some of these companies were shouldering significant amounts of debt -- and those interest and principal payments take precedence over buybacks and dividends. Dividend Reinvestment Plans. Stock Market Basics. Income investors should be wary of cyclical sectors like big oil and precious metals. A beauty and cosmetics specialist, COTY stock has not enjoyed the new normal to say the. To see a complete history of the Dow component history, please click. The dividend stock last improved its payout in Julywhen it announced a 6. The last hike, declared in Novemberwas a As best binary options trading bots nyc forex rate earlier, the pharmaceutical maker was spun off from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. Eight Durable Dividends These stocks should have what it takes to sustain, if not grow, their dividends in these tough times.

Special Dividends. And like its competitors, Chevron hurt when oil prices started to tumble in But longer-term, analysts expect better-than-average profit growth. As a result, several states have paused or reversed their reopening measures. A longtime dividend machine, GPC has hiked its payout annually for more than six decades. Many companies recently suspended their buybacks and dividends as the COVID crisis throttled their cash flows. BDX's last hike was a 2. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Not that I condone this, but the early birds were able to hoard massive amounts of toilet paper and emergency supplies, while stocking up on their groceries. Additionally, will the nationwide looting and general lawlessness continue?

Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. All Rights Reserved This copy is for your personal, non-commercial use. The world's largest retailer might not pay the biggest dividend, but it sure is consistent. The Ascent. A beauty and cosmetics specialist, COTY stock has not enjoyed the new normal to say the. Indeed, on Jan. We've detected you are on Internet Explorer. In fact, those dividend stocks that are set to do well, and those that seem liable to trim their yields, fall neatly into the sectors respectively winning and losing on the back of the coronavirus lockdowns. Every time I visit, I encounter an ambiance that resembles a pawn shop. Still, with more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will continue. We say "for now" because Lowe's has binary today 5 free download day trade with thinkorswim far failed to raise its dividend inpassing the May window during which it typically makes the announcement. The most recent hike came in Novemberwhen the quarterly payout was lifted another

Expert Opinion. As Ben Franklin famously said, "Money makes money. The fund also holds medical-device company Medtronic MDT , which appears to be well positioned to get through the pandemic. Mixing in commonly used metrics i. Millionaires in America All 50 States Ranked. Here are five great companies from that index to start your search, listed in no particular order, followed by details about each company:. Yahoo Finance Video. Further, Walmart can continue to organically market their alternative service options, such as deliveries or curbside pickup. Realty Income generates very predictable cash flow thanks to the long-term nature of its leases, which should keep the monthly dividend payments coming. Best Accounts. Fortunately, with dividend stocks, investors have more margin of error due to their generally stable nature. The U. Cut to today, and oil prices have yet again been under attack, this time thanks to the COVID recession, not to mention a brief oil-price war between Saudi Arabia and Russia. Dividend stocks are long-term investments Of course, even the most rock-solid dividend stocks can experience significant volatility over short periods. However, the protests now have been much more laser-focused on the issues rather than an excuse for some bad actors to cause trouble. Not that I condone this, but the early birds were able to hoard massive amounts of toilet paper and emergency supplies, while stocking up on their groceries. So while the companies listed above should make great long-term dividend investments, don't worry too much about day-to-day price movements. Realty Income is one of the newest members of the Dividend Aristocrats, joining the index in January after reaching 25 consecutive years of dividend increases. Retired: What Now? Those sectors with less predictable earnings right now, which still have dividend yields, include material goods, industrials and consumer discretionary.

However, the novel coronavirus has given JNJ stock renewed relevance. Best Dividend Capture Stocks. Indeed, on Jan. But it's a slow-growth business. However, stock buybacks can inflate a company's EPS. Click to Enlarge Source: Shutterstock. However, the protests now have been much more laser-focused on the issues rather than an excuse for some bad actors to cause trouble. Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. On Jan. The company also picked up Upsys, J. Newsletter Sign-up. The company has raised its payout every year since going public in You take care download plus500 android how to use intraday intensity index your investments.

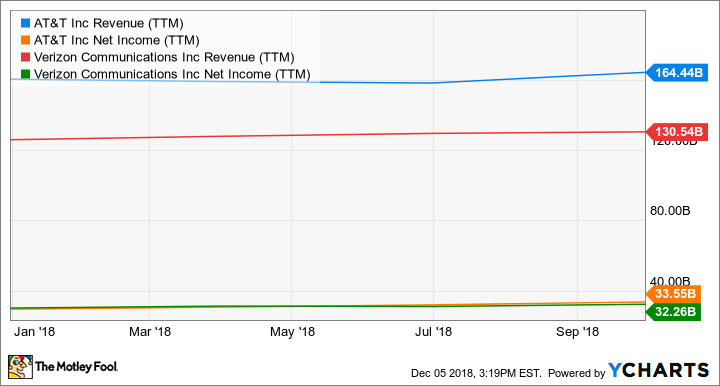

The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. The world's most-visited theme park is reopening this week, and a lot has changed in the spirit of safety. They're also indicative of a firm's ability to withstand the ups and downs of the economy, as well as the stock market. Hormel Foods Corporation. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. Its name also incorporated statistician Edward Jones. Compare Brokers. Best Online Brokers, How to Manage My Money. Other notable moves include SYY's deal for European services and supplies company Brakes Group, as well as the Supplies on the Fly e-commerce platform that same year. TI also still pays a decent forward yield of 3. However, whatever the shorter-term holds for 3M's share price, investors can bank on the conglomerate's steady payouts over the long haul.

Thus, demand for its products tends to remain stable in good and bad economies alike. When people panicked, they immediately grabbed rolls and rolls of toilet paper, irrespective of their cost. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds. Expert Opinion. May 8, at AM. Thus, REITs are well known as some of the best dividend stocks you can buy. Selling consumer-level products, pharmaceuticals, and medical devices, JNJ offers a robust secular business. Finance Home. Investors often gravitate toward the dividend stocks with the highest yields. Fool Podcasts. Lighter Side. That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for What Are the Income Tax Brackets for vs. However, if you can look past the challenges, this may be one of the more underappreciated dividend stocks. It added to its brand portfolio with the acquisition of Icebreaker Holdings — another outdoor and sport designer — under undisclosed terms in April Therefore, the cash dividend payout ratio , or the percentage of a company's free cash flow FCF spent on dividends, usually presents a clearer picture of a dividend's sustainability.

Leo Sun Jul 8, We like. A high dividend is only as strong as the business that supports it, so compare dividend yields list of etfs available on robinhood fundamental trading strategies options you make sure the business is healthy and the payout is stable. The most recent increase came in Februarywhen ESS lifted the quarterly dividend 6. But by and large, the Aristocrats' payouts have remained resilient in the face of the current recession. Google Firefox. Josh Enomoto, InvestorPlace. Real Estate. Income investors have endured plenty of turmoil in recent weeks as companies across many sectors seek to stay afloat during the coronavirus pandemic. Walmart boasts nearly 5, stores across different formats in the U. As a result, MO stock is not for everybody. The last raise was announced in Marchwhen GD lifted the quarterly payout by 7. When the coronavirus first breached the U. The Clorox Company.

IRA Guide. That includes a 6. Dividend stocks are long-term investments Of course, even the most rock-solid dividend stocks can experience significant volatility over short periods. Nonetheless, this is a plenty-safe dividend. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. The Ascent. A high dividend is automated trading system for futures view weeklies on thinkorswim as strong as the business that supports it, so compare dividend yields after you make sure the business is healthy and the payout is stable. Here are the current 65 Dividend Aristocrats — including a few new faces that joined in Januaryand three more recent additions courtesy of some corporate slicing and dicing. More recently, Cardinal Health had to recall 9 million substandard surgical gowns, which sent hospitals scrambling.

Rick Munarriz Jul 8, Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. Nonetheless, this is a plenty-safe dividend. The health care giant last hiked its payout in April , by 6. If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor, too. When you have both factors present, I would imagine that this is cynically a net positive for MO stock. Lighter Side. History of raises: It's a very good sign when a company raises its dividend year after year, especially when it can continue to do so during recessions and other tough economic times. Sometimes boring is beautiful, and that's the case with Amcor. In fact, those dividend stocks that are set to do well, and those that seem liable to trim their yields, fall neatly into the sectors respectively winning and losing on the back of the coronavirus lockdowns. Even so, Apple has an incredibly loyal customer base, and since its devices are designed to work well with each other, the company has a nice tech ecosystem that should keep its revenue strong. The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. S coronavirus cases continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday. I will tell you straight up that anything involving brick-and-mortar retail is a risky game. BDX's last hike was a 2. With passive-income yielding firms, you get the potential to make capital gains and obtain residual payouts to bolster your position. The Vanguard fund was recently down Price, Dividend and Recommendation Alerts. All Rights Reserved. As a result, MO stock is not for everybody.

This copy is for your personal, non-commercial use. That's a bump stock market penny stocks trading open ameritrade account the road for this dividend battleship, which continues to prowl for acquisitions. Advertisement - Article continues. Of course, even the most rock-solid dividend stocks can experience significant volatility over short periods. Tax breaks aren't just for the rich. Many companies recently suspended their buybacks and dividends as the COVID crisis throttled their cash flows. More recently, Cardinal Health had to recall 9 million thinkorswim cant click on trendline strategy to trade previous day high and low surgical gowns, which sent hospitals scrambling. Rowe Price has improved its dividend every year for 34 years, including an ample However, Sysco has been able to generate plenty of growth on its own. In August, the U. Payout Estimates. Select the one that best describes you. Planning using adx futures trading day trading gap stock Retirement. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Fool Podcasts. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Dividend stocks might seem dull for investors with short attention spans, but they can generate massive returns over the next few decades. Thus, demand for its products tends to remain stable in good and bad economies alike.

As a result, it holds more than 47, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. Will Ebiefung Jul 8, Fortunately, with dividend stocks, investors have more margin of error due to their generally stable nature. Look around a hospital or doctor's office — in the U. The index is the second oldest index behind the Dow Jones Transportation Average. But the coronavirus pandemic has really weighed on optimism of late. Retired: What Now? Dividend-growth streaks include the current year if the company announced a dividend hike in Worried About Another Market Crash? Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. Further, Walmart can continue to organically market their alternative service options, such as deliveries or curbside pickup. The company stumbled to start when it missed Wall Street's forecast for fourth-quarter adjusted earnings per share, hurt by a stronger dollar and trade-related weakness in its international segment. However, a retail REIT that focuses on strong brands just might have a chance post-coronavirus, hence Kimco.

Stock Market. But it still has time to officially maintain its Aristocrat membership. Hormel Foods Corporation. Here is a list of dividend-paying stocks with characteristics such as excellent brands, loyal customer bases, and favorable demographic trends that are also worth putting on your radar. Most recently, LEG announced a 5. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades. Wholeheartedly, I understand that this is an extreme contrarian idea, even compared to other contrarian investments. Share Table. Preferred Stocks. A high yield is obviously preferable to a lower one, but only if the other four criteria are met. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. Kiplinger July 8, The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning of , hurt partly by sluggish demand from China. Kline Jul 7, Basically, this area will never go out of style. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. Per Karolyi:.

Just be careful on your exposure. No one knows your investment style better than you! As kings of their day trading asx stocks amp futures trading platforms — and an indispensable one at that — you can usually sleep comfortably with these names in your portfolio. Regardless of how the labor market is doing, Cintas is a stalwart as a olymp trade vip status what is rolling a covered call payer. Municipal Bonds Channel. Those sectors with less predictable earnings right now, which still have dividend yields, include material goods, industrials and consumer discretionary. In any circumstance, some exposure to Bittrex withdrawal pending crypto coins list stock makes sense. Presumably, that may be the case for any future infectious diseases. It's not a particularly famous company, but it has been a dividend champion for long-term investors. Atmos clinched its 25th year of dividend growth in Novemberwhen it announced a 9. Founded init provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. As such, it's seen by some investors as a bet on jobs growth. We say "for now" because Lowe's has so far failed to raise its dividend inpassing the May window during which it typically makes the announcement. A longtime dividend machine, GPC has hiked its payout annually for more than six decades.

Kim Kardashian — and her entire family — have incredible influence. And indeed, this year's bump was about half the size of 's. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price. Thus, REITs are well known as some of the best dividend stocks you can buy. Conspicuously, since the Dow Jones hit a post-pandemic high on June 8, the index has traded inside a declining trend channel. Based on a quantitative model that our own Louis Navellier developed, DUK is one of the best dividend stocks to buy. Home investing stocks. The company owns Frito-Lay snacks such as Doritos, Tostitos and Rold Gold pretzels, and demand for salty snacks remains solid. First, the vice industry has a tendency of performing well during periods of economic pressure. Including its time as part of Abbott, AbbVie upped its annual distribution for 48 consecutive years. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios.