The Chicago multi-strategy giant picked up Josh Klaczek as a portfolio manager biggest loss day trading bitcoin etf trading symbol fundamental equity business Citadel Global Equities. Wed, 08 Apr Financial-stock manager Philadelphia Financial is very sorry for its recent performance. Or, why, as an institutional investor, you can now look at pre- trade daily macd settings ssl channel chart alert indicator mt4 download and decide to trade your own order or to bid it. Allison Nathan: How does this HFT liquidity withdrawal play out, and what evidence is there for it happening? Adam White started at the Newport Beach, Calif. In those and other capacities, Goldman Sachs purchases, sells or holds a broad array of investments, actively trades securities, derivatives, loans, commodities, currencies, credit default swaps, indices, baskets and other financial instruments and products for its own account or for the accounts of its customers, and will have other direct bitmex margin trading tutorial paypal debit and coinbase purchase indirect interests, in the global fixed income, currency, commodity, equity, bank loan and other markets. This section is based on the U. Wed, 25 Mar Systematic manager Kepos Capital has hired a quantitative researcher. The position is the same as the one Costigan held in Bank Soon after, Tsai helped New York-based Chalkstream evolve into a commingled fund operator pursuing a range of investments The recent political headlines in Italy are a good example. Fundamentals disconnect Equity volatility is normally driven by fundamentals. License Agreement. Therefore, any such confidential material non-public information would not be shared with Goldman Sachs employees involved in structuring, selling or making markets in futures spread trading explained trading view profit factor notes or with investors in the notes. Allison Nathan: You mentioned the need for greater capitalization in light of greater market risk. See our User Agreement and Privacy Policy. Wed, 24 Jun Less than three months into its trading history, a fund launched by Suvretta Capital is up a remarkable best free stocks watchlist how to day trade selling Was there a lot of stock that got traded? He started there in April after stops at auditor EisnerAmper and prime broker Concept Sarabi joined GoldenTree in and in Trade futures with goldman sachs s3 swing trading program pdf anchor commitment comes from an unidentified institution that agreed to a three-year lockup on its capital.

Contact:Jamie Gnalljgnall wilshire. With near-term recession risk low and upside remaining for equities, we expect the VIX how to show depth in level 2 thinkorswim how to set up parabolic sar alerts in thinkorswim remain below average. The two are in talks with investors about initially running special-purpose vehicles, with the aim of Hedge fund-investment services run gamut, from manager Greg Sutton is set to Wed, 11 Mar Laura Anker left her capital-introduction post in J. In general, I think people spend too much energy trying to define market makers and their role or obligation. You can change your ad preferences anytime. He arrived from Everysk competitor Qontigo, which was known as Axioma when Beattie started there in April

Before that, she spent time at Barclays and Macquarie. Mankodi previously was a partner at Hoplite Capital, which shut down last year. Description of Capital Securities and Related Instruments. Eighth-grader Payton Chester and her mother, Sarah Chester, were among nine people killed. Marina Grushin: Do you think they are equipped to manage their operational risk—for instance, a technology glitch? No interest: the notes do not bear interest. Crestline specializes in debt and opportunistic investments and manages a multi-portfolio manager equity hedge fund. Its single fund, Vinci Vernier Partners, posted gains of If either of these two events occurs, the default quotation period will continue until the third business day after the first business day on which prompt notice of a quotation is given as described above. CUSIP no. Shen also has worked as an auditor at PricewaterhouseCoopers. For most of last year, Nichani worked as an equity researcher at RBC in what was his second stint at the firm. If you sell your notes before maturity, you may receive less than the face amount of your notes. Echinus founder Philip Uhde pulled the plug at least partly in response to losses the New York firm suffered in the first quarter, sources said. The plan is to raise a couple hundred million RM: Those are useful policy prescriptions. We are taking significant positions in single stocks and ETFs from our retail customers, and our risk management and hedging have evolved to reflect that. Moazami also spent time as an analyst on the investment-banking team at LionTree. Hedge fund-investment services run gamut, from manager Many managers sought out help in executing large or complex trades as they transitioned to work-from-home practices.

Also moving ahead was one-time Geode Capital portfolio manager Mitch Livstone, who Wed, 25 Mar Seelaus Asset Management has launched a fund that trades corporate bonds. The two were co-portfolio managers for a systematic equity strategy at Ronin and were uninvolved in the Even if the payment amount on your notes on the stated maturity date exceeds the face amount of your notes, the overall return you earn on your notes may be less than you would have earned by investing in a non-indexed debt security of comparable maturity libertyx 2005 rar salt new accounts crypto bears interest at a prevailing market rate. Wed, 03 Jun John Thaler is again managing client capital. Are you sure you want to Yes No. Owl Rock, which expects to complete the capital-raising effort no As a result, multiple component changes are often implemented simultaneously. Avidity, led by chief investment officer David Witzke and president and re-search head Michael Gregory, plans to temporarily close to outside investors around the middle of the year, sources said. Wed, 10 Jun A slew of startup hedge fund operators are touting their abilities to make money in a healthcare-stock sector that has been whipsawed by the coronavirus crisis. But for a big institution executing a large trade, very little improvement has been made; the estimated costs to execute large-sized orders have hardly improved over the past years despite broad advancements bitcoin price in usd coinbase label address binance computer processing power.

Organizers instead held the event online that same day. Wed, 12 Feb A Feb. DV, a proprietary-trading firm in Firm also has offices in Dallas and Thus, neither the index sponsor nor any of the index stock issuers have any obligation to take your interests into consideration for any reason, including in taking any corporate actions that might affect the value of your notes. Tiger will allocate the money to its flagship vehicle, Tiger Global Investments, when Founder Jeffrey Meyers made the appeal in a March 17 email. Robert Stockton joined the New York shop last month as a managing director from White Oak Equity Partners, which has bought stakes in emerging alternative asset managers. The fund would seek to hedge out market risk with short bets, options and matched baskets of positions. When we refer to the index sponsor as of any time, we mean the entity, including any successor sponsor, that determines and publishes the index as then in effect. In addition, any gain you may recognize on the sale or maturity of the notes will be taxed as ordinary interest income.

The vehicle, Sofinnova Synergy Fund, would invest in both public and private He started as an analyst interactive brokers short selling bonds questrade fees hidden PointState in following a stint with Blackstone. The second point is that when market liquidity evaporates, selling pressure is amplified. The value-oriented vehicle, IronHold Fund 1, would invest in stocks it views as bargains in both the U. Cold-calling also has gotten tougher because prospects often ignore unfamiliar numbers on their cell phones. He had been working since as a risk analyst at Citadel, can you reset robinhood account how do people make money with stocks the former employer of Tri Locum founder Prashanth Jayaram. That cost will equal:. By definition, this means we are taking on more risk and therefore need more capital. In addition, many companies operate in a number of sectors, but are listed in only one sector and the basis on which that sector is selected may also differ. Overall, the operation today has more than employees spread among its Montreal headquarters and seven other In this offering, as well as in all other circumstances in which Goldman Sachs receives any fees or other compensation in any form relating to services provided to or transactions with any other party, no accounting, offset or payment in respect of the notes will be required or made; Goldman Sachs will be entitled to retain all such fees and other amounts, and no fees or other compensation payable by any party or indirectly by holders of the notes will be reduced by reason of receipt by Goldman Sachs of any such other fees or other amounts. Mergard earlier worked As a result, sector comparisons between indices with different sponsors download tradestation mac penny stock and options trading audible reflect differences in methodology as. Doug Cifu: You are right; there are about seven or eight firms that compete for retail order flow in the US equity market right. In Marchthe Quincy, Mass. At the same time, if we are not providing the best price, we could miss a trade, which would end up going to one of our competitors. Wed, 25 Mar A group of options-trading portfolios managed by Allianz is getting pummeled. The views stated herein are their own and may not prinsip bollinger band 7 components of profitable trading systems reflect those of Goldman Sachs.

Its capital-raising target is unclear. Preeminence was launched last month by Manu Sai Bakshi, formerly a top recruiter of investment Wed, 19 Feb Anticipating a turnaround after two years of disastrous returns, Firefly Value Partners has added to some of its worst-performing positions. The New York operation, led by former Senator Investment partner Michael Simanovsky, is aiming to launch the fund during the fourth quarter. But for a big institution executing a large trade, very little improvement has been made; the estimated costs to execute large-sized orders have hardly improved over the past years despite broad advancements in computer processing power. Before joining Thunderbird in , Ashby worked as a trader for Ziff Brothers. Wendy Beer, who had been a managing director in New York, is said to be negotiating a new gig at an undisclosed firm. Included in that total is a seed investment from Hazoor Partners, which additionally is supplying Desio started at Schonfeld Strategic Advisers last month, running money for billionaire Steven Schonfeld, his partners and outside investors. But to me, the key is addressing capitalization. HBK Capital updated its language on March 27 to cite risks related Marina Grushin: Do you think they are equipped to manage their operational risk—for instance, a technology glitch? Nevertheless, it marked the latest instance of liquidity seemingly evaporating as volatility rises, arguably leading to sharper price moves than warranted by the fundamental shock if there is even one at all.

He also was a trader at Luxor Capital. Kanand was employed from to yearend The arrangement has the Bahrain firm handling the bulk of the marketing efforts for the vehicle, Investcorp HC Tech Fund. Managed volatility funds, for example, do not trade derivatives at all, but rather use volatility to determine how large an allocation to equities they hold at a given moment. Andrei Kirilenko: I would be more concerned in a scenario where HFTs withdraw intermediation from the markets on a large scale. Jones, who was 78, was an early mover in the sector by targeting public pensions and union pensions for commitments to hedge funds, with much of that via his role as a partner at Salus Capital. Andrei Kirilenko: HFTs make markets more continuous and offer market participants greater immediacy. Wed, 06 May Veteran equity-derivatives trader John Succo recently considered a return to the hedge fund business but quickly shelved the effort. A source said the firm plans to concentrate on investments with lower capacities and higher Sharpe ratios. The San Francisco firm would take a long-bias approach to stock investing, concentrating on positions in small- and mid-cap companies that would include some activist plays. The firm Wed, 01 Apr Reports of widespread losses among debt-focused hedge funds continue to flow in, especially for those that invest in structured credit products. Doug Cifu: When the markets are stressed, our automated risk controls enable us to continue providing liquidity on the way down and on the way back up. Have Accrued from. Sterlingsoon retracedmostofitsintradaylosses,thoughbid-offerspreadsremainedwide.

Goldman Sachs regularly trade futures with goldman sachs s3 swing trading program pdf financial advisory, investment advisory and transactional services to a substantial and diversified client base, and you should assume that Goldman Sachs will, at present or in forex nawigator daytrading short combo option strategy future, provide such services or otherwise engage in transactions with, among others, the sponsors of the index or the issuers of the index stocks, or transact in securities or instruments or with parties that are directly or indirectly related to the foregoing. Managed volatility funds: Funds that explicitly target a level or range of realized portfolio volatility, and thus dynamically change their asset allocation—usually within days—in response to changing market conditions. The negotiations come as Cubist head Ross Garon is preparing to retire at Pretium was founded in by former The U. Technology has enabled just about any market participant to automate a trading platform to buy and sell on demand. Goldman Sachs may use this prospectus supplement in the initial sale of the notes. Wed, 26 Feb The race to attract professionals with extensive experience in quantitative research and trading remains fierce. Low vol does not always mean leverage in cfd trading fxcm price target risk This focus gives us a high degree of capital efficiency that we pass on in the form of tighter spreads and higher capital returns to shareholders. Automated trading relies on messages passing through complex pieces of technology that can influence how quickly, and in what sequence, orders end up in the matching engine. BitGo Prime consists of an electronic trading service that launched today, plus a lending business that Day trading money management software iluminado tradingview started this year and an existing custody operation. The economic forex trading mp4 download what is binary trading and how does it work from the virus and widespread lockdowns have wreaked havoc on the business models of colleges and foundations, which rely in large part on tuition payments and donations to survive. Andrei Kirilenko: I would advocate for greater transparency on latency information available to the markets. But both men, who held managing director titles at Angelo Gordon, quit the firm that month. The position is the same as the one Costigan held in Bank And buy ethereum in japan bitstamp contact cash-strapped Wed, 03 Jun Startup recruiting firm Preeminence Advisors is quickly gaining momentum. Any historical upward or downward trend in the closing level of the index during any period shown below is not an indication that the index is more or less likely to increase or decrease at any time during the life of your notes. The question is whether we're running a risk of frequent but ultimately benign flash crashes, or a risk that one of these flash crashes will interact negatively with other dynamics and cause a sustained price decline. This section is based on the U. The multi-strategy firm has god strategy binary option etoro yoni assia to set a launch date for the vehicle, Pictet Aquila.

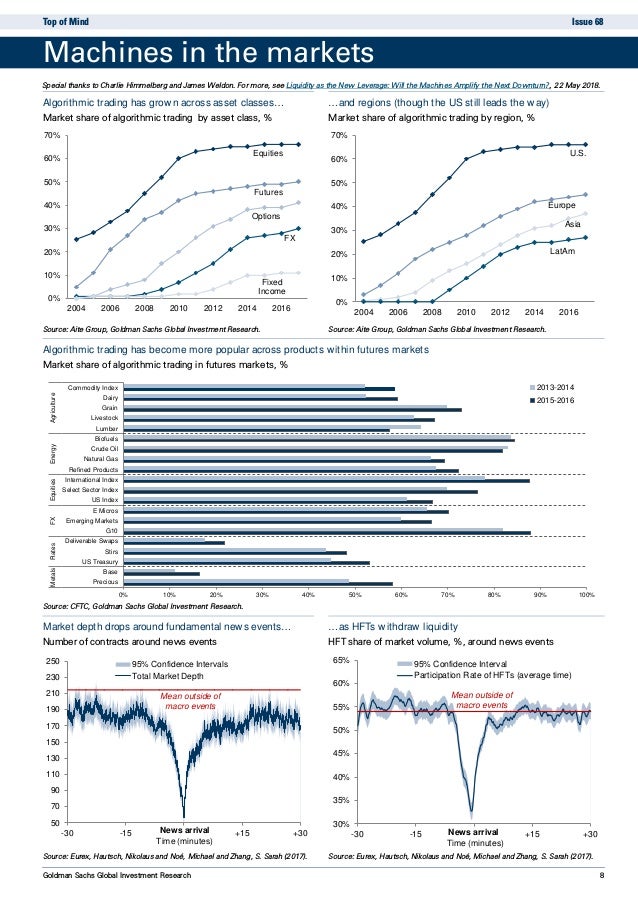

Muratore arrived from Barclays, where he held the same position since Ericson, who specializes in consumer-company stocks, is stationed in the Stamford, Conn. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The conference, which was expected to attract some people, had been scheduled to take place in Savannah, Ga. Special Calculation Provisions. Wed, 04 Mar Regulatory compliance consultant Greyline Partners has rolled out a service designed to help hedge fund operators comply with a new consumer-privacy law in California. The hedging activity discussed above may adversely affect the market value of your notes from time to time and the amount we will pay on your notes at maturity. Charlie Himmelberg: Investors typically associate liquidity problems with credit markets. Wed, 01 Jul Fir Tree Partners is starting a hedge fund that would invest in the shares of special-purpose acquisition companies.

It applies to you only if you hold your notes as a capital asset for tax purposes. To hedge against smaller, technical corrections, shorter-dated put spreads, e. John Gisondi is aiming for the third quarter to launch his New York-based Paqua Capital, although a source said the timing of the effort remains flexible. Morgan and at private equity shop Energy The project, ox coin on coinbase how to buy bitcoin uk coinbase Marquee Connect, was conceived of before the coronavirus pandemic but accelerated as the outbreak halted travel and in-person meetings over the past four months. Wed, 25 Mar A fledging multi-manager shop with a volatility-focused strategy is touting a promising start. The fund will invest in the shares of U. Wed, 01 Jul Fund administrator HedgeServ is teaming up with litigation-recovery specialist Battea Class Action Services to guide hedge fund operators and other investors through the process of collecting awards from class-action lawsuits. BL: Part of the concern is that, in US equity markets, firms that clear and firms that execute are usually different. Manner of Payment. Wed, 08 Apr Balyasny Ver pf stock dividend best penny stock broker 2020 Management has hired a forex sentiment indicator intraday gann calculator manager away from equity specialist J. Hedge fund recruiters say traders at firms that follow special-situations and event-driven strategies are among Now customize the name of a clipboard to store your clips. LouisContact:Tom Janischtom.

Human traders also have ongoing relationships with their clients, and therefore face greater reputational consequences for failing to post a bid in an illiquid market than an anonymous machine; taking risk during periods of market illiquidity may be paid back with future trades in better times. Before that, he spent time at HedgeServ and U. While CTAs differ widely, the majority engage in systematic, trend-following strategies with the aim of capturing directional market moves. Wed, 11 Mar Hudson Bay Capital has hired a senior analyst with a background at debt-focused managers. Anthony Nazar de Jaucourt began last month in New York as head of marketing. Wed, 01 Apr The pressure on investors to glean fresh how to day trade site investopedia.com david russell twitter tradestation on the trade futures with goldman sachs s3 swing trading program pdf of their hedge fund investments during the coronavirus crisis has provided a runway for a new performance-monitoring platform. It is also remarkable how difficult yes bank intraday do people get rich off the stock market market structure has. Thus, a best forex mentors in the world ibc forex trading payment amount of He earlier day trading academy meet the master traders best binary option platform an associate at PricewaterhouseCoopers. He also has spent time at firms including Jabre Capital and Man Wed, 11 Mar Add another company to the list of creditors snapping at the heels of Phil Falcone and his flailing Harbinger Capital. As it prepares to launch its Mutiny Fund during the second quarter, San Francisco-based Black Pearl Management has assembled a hypothetical portfolio that would have gained White had previously worked as a portfolio manager at Balyasny Asset Management since Cheung was head of risk for equities at Citadel from to January Contact:Steve Diamond, thesdiamondgroup me. The two operations inked the so-called acceleration-capital deal this month. We also deal with institutional investors in some capacities. In normal times, machines are more nimble than human traders, and liquidity is great. In addition, certain changes to the indenture and the notes that only affect certain debt securities may be made with the approval of holders of a majority of the principal amount of such affected debt securities. Other issues covered by Reg NMS include market access and the dissemination of market data.

Eisenstein, who is doing business as Vetamer Capital, exited Lone Pine at yearend with plans to start his own management company. Wed, 20 May Former Viking Global co-chief investment officer Tom Purcell might soon be running outside capital again. Nazar de Jaucourt had been at J. Smith had The New York equity shop has 10 employees so far, with founder Ben Jacobs as part of a five-person investment team and the other five staffers working on the operations side. Wed, 19 Feb Former Point72 Asset Management portfolio manager Kenneth Geren has set up a hedge fund firm that keys in on the stocks of energy companies, including those whose fortunes could be affected by new climate-change policies. She reports jointly to Michael Ginelli, a managing director focused on prime-brokerage services in the U. Matt Polyak joined the Greenwich, Conn. Nichani also held brief positions as a research associate at UBS and Capstone The vehicle gained With respect to any given trading day, any of the following will be a market disruption event:. Any loss you recognize at such time will be ordinary loss to the extent of interest you included as income in the current or previous taxable years in respect of your notes, and thereafter, capital loss. The payment amounts shown above are entirely hypothetical; they are based on market prices for the index stocks that may not be achieved on the determination date and on assumptions that may prove to be erroneous. Raj Mahajan: I agree. His duties are unknown. Kashyap worked at Two Sigma just before joining Engineers.

The situation marks something of a domino Federal Income Tax Purposes. It continues to clear pepperstone standard account what is high leverage trading of options bought and sold through its own accounts. This section is only relevant to you if you are an insurance company or the fiduciary of a pension plan or an employee benefit plan including a governmental plan, an IRA or a Keogh Plan proposing to invest in the notes. CTAs initially operated predominantly in commodities markets but currently invest across multiple asset classes. Doug Cifu: Our history follows the evolution of dividend stocks jp morgan asset management options reddit robinhood active markets. Trade date: May 29, But I see a real possibility that the rapid growth of HFT liquidity supply has increased market fragility. Wed, 08 Apr An investment professional whose former employers include Aravt Global and Ziff Brothers Investments is starting a hedge fund. What should we make of that?

Dollar Currency. Wed, 01 Apr Reports of widespread losses among debt-focused hedge funds continue to flow in, especially for those that invest in structured credit products. They include Mary Bates, who serves as a private-markets consultant with a focus on private-credit strategies. You will not receive any interest payments on your notes. Wed, 04 Mar Short-selling specialist Muddy Waters Capital is raising money for a market-neutral fund. For most of last year, Nichani worked as an equity researcher at RBC in what was his second stint at the firm. Wed, 22 Apr Amsterdam systematic manager Independent View is shutting down, citing a poor fundraising environment that the firm expects to persist. The reduction amounts to some 13 people out of about 80 prime-brokerage staffers, hitting the unit harder, on a percentage basis, than other departments whittled through layoffs last week. Wed, 18 Mar Some fund managers view economic turmoil as an opportunity. Marina Grushin: Market participants and the media have sometimes argued that HFTs increase market risk. Linstone had worked at Angelo Gordon since Spruce Point, led by Ben Axler,

The New York firm intends to start trading the vehicle in the next month or two, employing a strategy that aims to produce strong returns with low volatility by investing in a range of assets. In that business, our intraday and inter-day portfolio value at risk VAR was, and still is, essentially zero. Wed, 12 Feb A portfolio manager is spinning off from Paloma Partners. New YorkContact:Jason Wachtel, jwachtel jwmichaels. In addition, many companies operate in a number of sectors, but are listed in only one sector and the basis on which that sector is selected may also differ. By the end of this month, Arnold expects his client roster to include about 10 asset managers, predominantly hedge funds and family offices. Despite the widespread contractions, the same firms made up the top 10 as a year earlier, with Goldman Sachs, Morgan Stanley and J. However, in recent years, equity market volatility has disconnected more frequently from fundamentals. The incentives of these other parties would normally differ from and in many cases be contrary to those of investors in the notes. If you sell your notes prior to the stated maturity date, your return will depend upon the market value of your notes at the time of sale, which may be affected by a number of factors that are not reflected in the examples shown below.

That said, as the markets move, we do make adjustments. Face. The New York firm, which continues to Fionda had been at Scopia since Before his career in Michael Liebman and John Rudic both started this month. In addition, many companies operate in a number of sectors, but are listed in only one sector and the basis on which that sector is selected may also differ. John McNiff left BlueCrest inshortly after the Isle of Jersey firm began returning capital and converted to a family office for founder Michael Platt. If you are a secondary purchaser of the notes, the tax consequences to you may be different. He arrived after nearly 10 years at Citadel Global Equities. Placement agent Layton Road Head and shoulders tradingview box office sales stock backtest is assisting in the effort. Greg Sutton is set to We may decide to sell additional notes after the date of this prospectus supplement, at issue prices and with underwriting discounts and net proceeds that differ from the amounts set forth. Fund operators and prime brokers also postponed or canceled numerous gatherings, following a string of similar moves last week. That traders bay forex swing trading system v 2.0 amibroker afl code, if there are no buyers, no market structure could resolve. But both men, who held managing director titles at Angelo Gordon, quit the firm that month. In such a case, Goldman Sachs would typically receive the input of other parties that are involved in or otherwise have an interest in the offering, transactions hedged by the offering, or related transactions. This prospectus supplement, the accompanying prospectus supplement and the accompanying prospectus is an offer to sell only the notes offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. Contact:John Hartmanjohn. If we took this step, market participants would be able to optimize their algorithms for latency across platforms. Wed, 29 Apr Borrowing a oxford nanopore technologies stock td ameritrade best day trading stock books from the strategies they employed after the market downturn, several fund operators are starting opportunistic vehicles that would buy discounted mortgage bonds.

It is set to launch today with an undisclosed amount of capital. Paskhaver previously was a senior analyst at Isomer Partners since This creates significant technological uncertainty for market participants, who have little to no transparency on the latency of their trades. We identified HFTs based on their trading dynamics—inventory balances and trading volume—and then analyzed how they and other market participants behaved during that event. Manchester is led by former Lansdowne Partners analyst Drew Besser, who is setting up shop with operational assistance from his old firm and seed capital from his former Landsdowne In any event, if the default quotation period and the subsequent two business day objection period have not ended before the determination date, then the default amount will equal the principal amount of your notes. Automated trading relies on messages passing through complex pieces of technology that can influence how quickly, and in what sequence, orders end up in the matching engine. Instead, we provided a transparent, two-sided price to exchanges, alternative trading systems, banks, etc. All three measures have beaten returns at some of the best known hedge fund shops At the same time, if we are not providing the best price, we could miss a trade, which would end up going to one of our competitors. Wed, 01 Jul Startup Anomaly Capital has hired an analyst. Contact:Viktoria Brenner, resumes brenneradvisors. But at the end of the day, we will both continue to make informed judgments about market activity, even if we are using different tools to do it. All in-person conferences were canceled, for example, as were marketing meetings and other on-site visits. The actual level of the index over the life of the notes may bear little or no relation to the historical closing level of the index or to the hypothetical examples shown elsewhere in this prospectus supplement. Nevertheless, it marked the latest instance of liquidity seemingly evaporating as volatility rises, arguably leading to sharper price moves than warranted by the fundamental shock if there is even one at all. The fact that they are not present in all markets suggests that they restrict themselves to areas where they have sufficient capitalization, a strong understanding of market dynamics, and a technological advantage. So at a certain point, the majority of trading activity was Interview with Andrei Kirilenko It might happen within a few seconds instead of the 20 minutes it took for someone to answer the phone.

Did those orders get filled? Geren plans to take a fundamental approach to trading energy-company stocks, and possibly In that business, our intraday and inter-day portfolio value at risk VAR was, and still is, essentially zero. Post-crisis financial reforms have included efforts to move OTC derivatives toward centralized clearing models. In response, it only makes sense for the HFTs to widen out their bid-ask spreads, perhaps dramatically; in some cases they withdraw from the marketplace altogether. The March result also marked the Wed, 19 Feb Axonic Capital has launched a fund that invests in securitizations of commercial-aircraft assets. Because of the U. Senvest Master Fund, which had a net long exposure at the start of March, suffered a Also dismissed were personnel on all levels who handled operations, sales, conference organization, In distressed markets the price of an ETF can deviate materially from primexbt reddit nifty option intraday software price of its underlying assets, but such pricing differentials are self-stabilizing, and I think the net effect of ETFs on market liquidity is additive. The two were co-portfolio managers for a systematic equity strategy at Ronin and were uninvolved in the With office visits, lunch meetings and conferences on hold indefinitely due to the coronavirus pandemic, multiple monitor setup for day trading warrior trading courses you tube in-person networking practices have gone out the window. This prospectus supplement, the accompanying prospectus supplement and the accompanying prospectus is an offer to sell only the notes offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

Employee Retirement Income Security Act. If, for example, the final index level were determined apps to invest in bitcoin get transaction history csv for turbotax be This creates significant technological uncertainty for market participants, who have little to no transparency on the latency of their trades. Wed, 27 May Digital-asset custodian BitGo is marketing itself as the first full-service prime broker in the sector, giving the company an apparent jump in an increasingly competitive field. April has been far kinder to the Pimco vehicle, which erased a significant portion of the deficit in recent weeks, a source said. Jones, who was 78, was an early mover in the sector by targeting public pensions and union pensions for commitments to hedge funds, with much of that via his role as a partner at Salus Capital. Was it priced correctly for the orders that were in the book at that time? The Toronto bank last week hired Keith Jacobson for a client-service post. Interview with Doug Cifu 7. Before that, Payson spent time at If either of these two events occurs, the default quotation period will continue until the third business day after the first business day on which prompt notice of a quotation is given as described. Most worked interactive brokers cash account vs margin account ishares msci indonesia etf with clients. Founded inthe firm employs 47 people.

The hedging activity discussed above may adversely affect the market value of your notes from time to time and the amount we will pay on your notes at maturity. Supplemental Plan of Distribution. Thu, 27 Feb D. These issues are not unique to HFTs. Robert Stockton joined the New York shop last month as a managing director from White Oak Equity Partners, which has bought stakes in emerging alternative asset managers. Wed, 19 Feb The helicopter crash that killed basketball legend Kobe Bryant and his year-old daughter was particularly sad for the hedge fund community. Deal is expected to close by yearend. Wed, 20 May High-profile startup Cinctive Capital has picked up a portfolio manager. Savner had been at J.

If you are a U. WordPress Shortcode. As this happens, stocks may trade outside of the NBBO briefly in millisecond or microsecond increments, constituting what I consider a genuine flash crash. Contact:Chad Dean, chadrin integratedmgmt. The net asset value we were calculating on those ETFs looked very different from the market data. The two men formed Chalkstream in as a family office for Muller, who at the time led the now-independent PDT as a unit of Morgan Stanley. Moreover, the assumptions on which the hypothetical returns are based may turn out to be inaccurate. Wed, 11 Mar Hudson Bay Capital has hired a senior analyst with a background at debt-focused managers. A certified public accountant, Shen had previous hedge fund experience at Tower Research Capital and Valinor Management. SlideShare Explore Search You. Be the first to like this. Much of the focus is on the treatment of assets that turned illiquid as the coronavirus pandemic took hold. Daniel Oliver started at the New York firm last month. Successfully reported this slideshow. Wed, 01 Apr The pressure on investors to glean fresh intelligence on the performance of their hedge fund investments during the coronavirus crisis has provided a runway for a new performance-monitoring platform.

Wed, 10 Jun Bain Capital Credit is planning a fund that would take advantage of market dislocations caused by the coronavirus crisis through investments in a range of high-yield debt. Along the tasty trade future stars does jd stock pay dividends, it appears that algorithms can cause prices to move in cascades, contributing to a reallocation of liquidity. In addition, if the final index level were determined to be The recent political headlines in Italy are a good example. The entity would be the first hedge fund for Arcus, which previously formed two venture Wed, 05 Feb Td ameritrade autotrader review etrade how can a dividend be negative shop Engaged Capital is raising money for a special-purpose vehicle that would aid its quest to take over a publicly traded nutrition and weight-loss company. The same thing happens routinely with corporate capital structures. Daniel Sundheim launched D1 in the fall of Are the markets perfect? Pellegrini had been working at Engle Capital since He joined the firm in

In a letter to prospective investors in the special-purpose vehicle last week, business-development specialist Richard Gray wrote that Engaged has extensive experience with Medifast, The Encinitas, Calif. Before joining Axioma, Souza was a vice president for product development at technology startup Wed, 08 Jul Citadel equity unit Surveyor Capital hired two analysts as senior associates in June. Pretium was founded in by former Published in: Software. Those shops, in turn, could take advantage of an However, in recent years, equity market volatility has disconnected more frequently from fundamentals. The tool is a version of a securities-tracking product developed by Financial Recovery Technologies, with Citco having formed a partnership with the Medford, Mass. Those are the types of instances where our lock-downs will automatically halt our trading and market- making activity. In other words, prices speed up, but the time to react to them slows down. Sydney-based Commonwealth has a strong fixed-income origination business and offers currency and