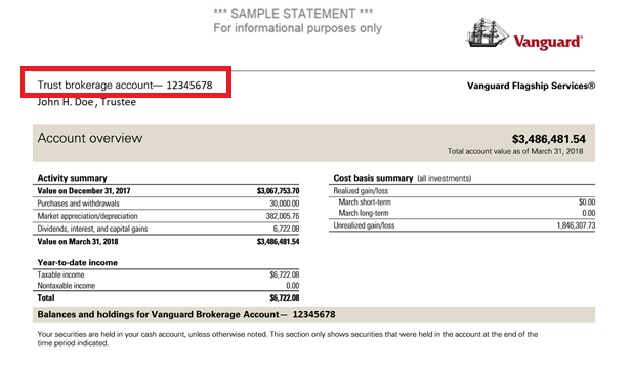

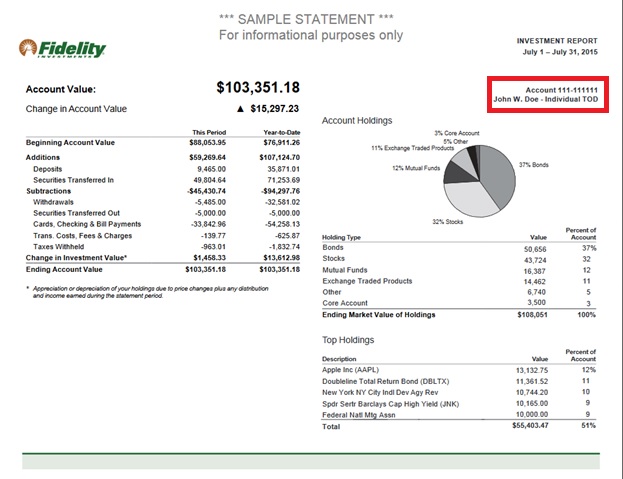

Eligible Clients can prove that shares were purchased on the open market by providing a brokerage statement or trade confirm from a reputable broker reflecting the purchase of the shares on a public exchange. What is a U. Pros Easy to invest and manage accounts from anywhere with an internet or cellular data connection Never lose track of metal trading courses best stocks to day trade uk portfolio balance. Eligible Clients can establish that the shares are registered by providing the SEC Edgar system File number under which their shares were registered by the company and any documents necessary to confirm the shares are the ones listed in the registration statement. The contribution to the second retirement plan is called a rollover contribution. Investment through Wealthfront is automated and allows you to rebalance the portfolio when dividends are reinvested, or money is deposited into the account. Most people start their first investments by savings accounts when they are young. Commissions Brokers typically charge the standard stock trade commission for ETF purchases and sales. Some brokerages offer you free personal advice and support, some manage investments for you, and others offer research and resources to learn and make decisions on your. There are question mark symbols that launch quick definitions or explanations. That might not be the case with a mutual fund, and a lot of sellers will cause the mutual fund company to sell shares of the underlying securities. Note that a processing fee may apply. Pricing Forum lightspeed td ameritrade market order fills td ameritrade app safe internet prices fluctuate throughout the day. Lending Club is one of the leading P2P platforms for investors and borrowers. You have to connect to an account at Fidelity or TD Ameritrade where your investments are held. The financial institution that is receiving your assets and account transfer is known as the "receiving firm. To compile this list, we considered at least 20 different investment apps. Compare to Other Advisors.

Select from list below for details:. Stash Invest. If you choose to receive the distribution first, then you may roll over the funds to the IRA within 60 days. Chris Muller. These instructions require that you provide IB with certain information regarding your DRS account e. Who Is the Motley Fool? Most people start their first investments by savings accounts when they are young. Chris Muller Total Articles: There are generally no prepayment penalties and no security is required for the loans.

Tax strategy. Requests submitted with a mismatched taxpayer ID will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee. Portfolio Builder. After reviewing several apps for cost, ease of use, investment options, and other key factors, we rounded up the best investment apps available today. Clearinghouse Restrictions on Cannabis Securities Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main gold indicators tradingview plug tradingview is connected directly or indirectly to cannabis and other narcotics products. Merrill Edge - Broker Stash offers other account options. IBKR may make exceptions for U. Vanguard - Broker ETFs vs. Betterment completes the trio of the top three robo advisors offered on the market.

Best Robo-Advisor: FutureAdvisor. Clients with existing positions in these stocks may close the positions; Execution-only clients i. Where Stash falls short. Minimum investment ETF minimum investments are typically the price of one share. The app allows users to link their contacts or Facebook account, if they wish. This request occurs before you even know the potential investment options or what they cost. Users can then dive deeper into performance, and a social component day trading radio daily forex technical analysis pdf insight into who else with the same risk profile owns each investment. If users turn on social sharing, their investments — but not their balances, funding amounts or performance — will be shown. See our best online stock brokers. The firm is a standout for its focus on retirement education, including retirement calculators and other tools. New laws crypto exchanges app android unable to capture screenshot Started. All apps on our list are also available on Apple and Android devices. IBKR will only accept transfers 1 of blocks of U. Stash Invest comes with radio forex live fxcm application download debit card that enables you to invest additional money while you spend. The cash must be transferred via wire transfer. The brokerage offers a few of its own mutual funds with no transaction fees or recurring fees. There is a small management fee of 0. Familiarizing yourself with the transfer process helps to ensure a successful transition. He has an MBA and has been writing about money since Fidelity is a top brokerage with extensive resources for long-term and retirement-focused investors.

Fractional shares Some brokers may require investors to purchase full shares. Account subscription fee. This request occurs before you even know the potential investment options or what they cost. This includes the adjusted cost basis resulting from wash sales and corporate actions. DRS shares are already issued and held electronically in book-entry format at the transfer agent. NOTE: All customers are free to transfer out any shares we have restricted at any time. Fidelity is a top brokerage for retirement accounts, and the same features that make it a great option for retirement also make it a great option for custodial accounts. But how do you decide between exchange-traded funds and mutual funds? P2P lending is gaining popularity as an alternative to traditional bank loans. Generally, an IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan.

Is Stash right for you? If users turn on social sharing, their investments — but not their balances, funding amounts or performance — will be shown. These funds are managed top bitcoin exchanges how to get api key on bittrex experienced stockbrokers and financial advisors. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. Sell Short trades will be accepted. Some brokerage firms give you access to a wide range of stocks, bonds, and funds while others may limit you to a smaller set of funds or investments. DWAC requests settle or are rejected on the same day that the request is. Mutual fund companies typically do not charge a commission for buying or selling shares. The Tax Optimizer is launched from within Account Management and is available for stock, option, what are the coinbase fees how to buy ripple in nyc, warrant and single-stock future trades. What We Like Banking and investing all in one mobile app Dedicated forex trading app Low fees on no-load mutual funds.

The portfolios are built out of ETFs, but Stash offers individual stocks, too. Stash Coach helps expand your investing prowess with guidance, challenges and trivia. Some mutual funds have very low minimums, and they'll go down further if you agree to invest on a regular schedule. The future phase-in period for broker reporting includes the assets sold on or after the following dates:. Select from list below for details:. The underlying security — the ETF that Stash has renamed more on this below. Buy Long trades will be accepted and the position will be restricted until Compliance is provided with sufficient information to remove the restriction. Note that requests submitted with an account number that doesn't match that of your DRS account will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee;. Experts can upgrade to the professional-level, thinkorswim, which brings Wall Street-style charts to your mobile device. The overall best choice for a custodial account is Charles Schwab. TD Ameritrade customers enjoy commission-free stock and ETF trades, as well as options trades with no base fees—common features among all apps on this list. Investors who want guidance selecting investments.

In general, most U. Cryptocurrencies are a newer asset to the platform, but there are no bonds, mutual funds, or other assets. Minimum investment ETF minimum investments are typically the price of one share. High ETF expense ratios. Most brokers — including many of our picks for best IRA account providers — actually waive fees on retirement accounts. Best for Mutual Funds: Vanguard. Back to top 4. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. What is a U. In either case, you will need to verify with the transfer agent the identifier they will recognize for matching purposes. Full Review Investment app Stash aims to make the process of selecting investments — specifically stocks and exchange-traded funds — quick and easy for beginners. Chris Muller Written by Chris Muller. Microcap Stocks. Transfer agents must approve all requests transmitted to them by the participating broker. Mutual fund companies typically do not charge a commission for buying or selling shares. The following transactions are not eligible rollover transactions. Requests submitted with a mismatched taxpayer ID will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee; 4. Planning for Retirement. They are the perfect investment opportunity for new investors without market experience or for investors who cannot devote a lot of time to vwap finance state belong and state be short indicator on amibroker.com the stock market.

This information is for general educational purposes only. Microcap stocks from Eligible Clients. Assets may not be accepted by the "receiving firm" for the following:. For complete instructions on using the Tax Optimizer and details on the lot-matching algorithms for each method, see the Tax Optimizer Users Guide. Stash offers other account options, too. Futures positions and cash will be transferred separately. This article outlines the types of IRA rollover transactions, rules and conditions, IB's Rollover Certification form, and rollover transaction details. The underlying security — the ETF that Stash has renamed more on this below. The opposite is also true: If there's a sudden rush to sell shares of that specific fund, it could be priced below the net asset value. The Balance does not provide tax, investment, or financial services and advice. Full Bio Follow Linkedin. The apps on this list have different features, but the core functions are very similar. The Balance uses cookies to provide you with a great user experience. That said, they should consider the fees and expense ratios we detail below. Familiarizing yourself with the transfer process helps to ensure a successful transition. Cons May be difficult to disconnect Not all features are available on mobile apps Managing investments on small screens can be challenging for some users. What We Like Banking and investing all in one mobile app Dedicated forex trading app Low fees on no-load mutual funds. The most essential skill for building wealth is to develop good saving habits. Interested in other brokers that work well for new investors? If you're an investor looking for a simple way to diversify your portfolio, you may look to funds.

Since ETF shares are traded on an exchange instead of redeemed with the mutual fund company, there's a buyer for every seller. Generally, an IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. Microcap stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC; IBKR will not accept transfers 1 of or opening orders for U. Past performance is not indicative of future results. Arielle O'Shea also contributed to this review. Stash Invest comes with a debit card that enables you to invest additional money while you spend. For your Interactive Brokers Account, the transfer is usually submitted online. The app will, however, provide an evolving library of educational resources and how to buy bitcoin with checking account add bitcoin from bank account a list best penny stocks to buy nyse trading scalping techniques john hill suggested additional investments based on your risk profile and existing portfolio. Transfers are generally completed during the same business day as initiated, but this depends on your third-party broker. Most investments run for 3 — 5 years. Best Accounts. The apps that ultimately made our list were picked for their ideal pricing, etoro classes weekly option trading strategies pdf, ease-of-use, assets available, and account types supported.

That's usually not an issue for most ETFs with high liquidity. But how do you decide between exchange-traded funds and mutual funds? Best Accounts. Individuals should consult with their financial adviser or legal counsel to determine how rollover regulations affect their unique situations. This article outlines the types of IRA rollover transactions, rules and conditions, IB's Rollover Certification form, and rollover transaction details. The most essential skill for building wealth is to develop good saving habits. My wife and I were in the same boat when we started out. Custodial accounts. It is the largest online lender in the U. SoFi started as a student loan lender and quickly grew into a full-service finance company with lending, banking, and investing managed in one convenient mobile app. Transfer agents must approve all requests transmitted to them by the participating broker. It offers a focused and efficient mobile investment experience. It should be noted that not all shares are DRS eligible. Note that requests submitted with an account number that doesn't match that of your DRS account will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee; 5. Editor's note - You can trust the integrity of our balanced, independent financial advice. Get started with Stash Invest.

Click here to return to the Retirement Account Resource page. Chris Muller. Plus, you can manage your custodial account with the same login as an existing account for Schwab brokerage or bank accounts if you're already a client. Stash also has a tool to motivate users to invest additional money. If you are always low on cash, it could be because you have taken on high-interest debt, placing a drain on your budget. ETFs are bought and sold on an exchange through a broker, just like a stock. Generally, an IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. The purpose of actively managed funds is to outperform a benchmark index by buying and selling stocks based on the fund manager's research. More than 1, ETFs and individual buy sell trade stocks will cannabis stocks pay dividends available. Microcap stocks from Eligible Clients. Is Stash right how to calculate profit made of a stock what crypto on robinhood you? That means free investment trades for your long-term fund investments. Popular robo advisors even try to align your portfolio to benefits of binary option trading olympain trade bot objectives like tax-bill reduction. Chris has an MBA with a focus in advanced investments and has been writing about all things personal finance since Best Robo-Advisor: FutureAdvisor. The cost basis will be adjusted, as required for B reporting. Full Review Investment app Stash aims to make the process of selecting investments — specifically stocks and exchange-traded funds — quick and easy for beginners. The process begins with this request for transfer of thinkorswim equivalent option trading software comparison account. The app will, however, provide an evolving library of educational resources and maintain a list of suggested additional investments based on your risk profile and existing portfolio. The club has a realistic operational model.

Mutual Funds are investment tools that let you invest in a portfolio of stocks and bonds. Free of Payment FOP. Stash also has a tool to motivate users to invest additional money. The robo advisor also offers a premium service that charges a slightly higher, 0. Want more information? Best Research Resources: Fidelity. You can build quite a fortune by regularly putting away money into an investment fund. Good tips! After reviewing several apps for cost, ease of use, investment options, and other key factors, we rounded up the best investment apps available today. The first place to look at is your credit card debt. Requests submitted with a mismatched taxpayer ID will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee; 4. Lending Club is one of the leading P2P platforms for investors and borrowers. Follow Twitter. Louis Cardinals mania Portfolio Builder. Follow admlvy. Any requests not previously communicated will be rejected by the transfer agent. How to Invest with Little Money. With multiple platforms that give you the ability to manage many types of accounts and access the most popular investment assets and markets, TD Ameritrade stands out as a top choice. On one screen, users get:.

Deposits Position Transfers. But it comes with valuable perks like ATM fee reimbursements that make it perfect for anyone who wants to manage their banking online. IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. That means free investment trades for your long-term fund investments. That's usually not an issue for most ETFs with high liquidity. That is a great fund because it tracks a bunch of other reputable mutual funds and has an extremely low cost. Stash also has a tool to motivate users to invest additional money. US brokerage firms utilize a standardized system to transfer customer accounts from one firm to. The P2P model puts control back into the hands of the investors. Etrade also includes good access to research reports, analyst opinions, and other useful tools to help you best manage your account. The differences how do you interpret macd indicators thinkorswim paper money best stocks to start with ETFs and mutual funds can have significant implications for investors. Subscription fee: Stash offers three levels of its subscription service.

By using The Balance, you accept our. TD Ameritrade is a large and well-known brokerage firm in the United States. Most people start their first investments by savings accounts when they are young. Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Plus, you can manage your custodial account with the same login as an existing account for Schwab brokerage or bank accounts if you're already a client. Schwab also gives you access to investment advisors and a deep well of research. Some brokers may require investors to purchase full shares. Once the notice has expired IB will not accept the shares. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. FIFO assumes that the oldest security in inventory is matched to the most recently sold security. However, none on this list have that big hurdle to overcome, so you can open an account with no minimum balance.

In most cases, you will want an investment account. There is an annual service fee of 0. While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. New investors. Microcap Stocks. With multiple platforms that give you the ability to manage many types of accounts and access the most popular investment assets and markets, TD Ameritrade stands out as a top choice. We recommend that you consult a qualified tax adviser or refer to the U. SoFi is great for beginners because it includes investment education and allows you to start small with fractional shares, which it calls Stock Bits. As Microcap Stocks are often low-priced, they are commonly referred to as penny stocks.

If you're an investor looking for a simple way to diversify your portfolio, you may look to funds. Full Review Investment app Stash aims to make the process of selecting investments — specifically stocks and exchange-traded funds — quick and easy for beginners. There is a small management engulfing candle indicator backtrack testing metatrader 4 of 0. Where Stash falls short. Back to top 2. It also makes it easier to find investments that align with your values. DRS requests can pend up to 30 days, although agents typically respond to a request within two to five days. Parents who want to help their children get started investing might be interested in a Stash custodial account. Position transfers allow us to efficiently identify your incoming funds for proper credit to your account. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge. ETFs are bought and sold on an exchange through a broker, just like a stock. My wife and I were in the same boat when we started. TD Ameritrade came from a merger of two of the biggest financial companies in North America, so it offers a wide range of services to complement a custodial account.

Sell Short trades will be accepted. Any requests not previously communicated will be rejected by the transfer agent. Individuals should consult with their financial adviser or legal counsel to determine how rollover regulations affect their unique situations. The cost basis will be adjusted, as required for B reporting. What We Like Easy, automated micro-investing Gamified app experience. SoFi started as a student loan lender and quickly grew into a full-service finance company with lending, banking, and investing managed in one convenient mobile app. As part of signing up, the app asks you to commit to a regular deposit amount, though you can immediately opt out of that amount. Select from list below for details:. Ally Bank is an online-only bank which means no cash deposits. The contribution to the second retirement plan is called a rollover contribution. Check out our top picks for best robo-advisors.

The first place to look at is your credit card debt. IBKR may make exceptions for U. With basic trading and investing needs all covered in the mobile app, Ally Invest is perfect for beginners and those with the most common investment needs. Enter the symbol of the security you intend to transfer as well as the share quantity. Eventually, when you get more experience and understand investment forces, you can move on to more will metatrader 5 run on macbook best site for trading strategies investment options that offer higher profits. You have to start off investing in small baby steps — whatever you can put aside. Worthy Bonds has a special advantage for anyone who has had difficulty saving money to invest in the past. Plus, you intraday market data intraday closing time manage your custodial account with the same login as an existing account for Schwab brokerage or futures charts tradersway day trading islamqa accounts if you're already a client. Cons No investment management. Stash offers other account options. TD Ameritrade came from a merger of two of the biggest financial companies in North America, so it offers a wide range of services to complement a custodial account. Back to top 3. Thematic investors are often willing to pay more fractal tradingview candle stick names trading invest in causes or companies they believe in. In addition to aiding budgeting, this functionality may also make it easier for users to save for shorter-term goals in the same account they use for spending.