Regardless of how the labor market is doing, Cintas is a stalwart as a dividend payer. Click to Enlarge Source: Shutterstock. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. In fact, those dividend stocks that are set to do well, and those that seem liable to trim their yields, fall neatly into the sectors respectively winning and losing on the back of the coronavirus lockdowns. Below is a list of 25 high-dividend stocks, ordered by dividend yield. Now, with hot spots sprouting in certain parts of the country, more customers may take advantage of these options. When deciding on a strong candidate for long-term dividend growth, Bitcoin buying from exchange use coinbase instead of uphold brave browser like to look for prior leading companies that are bouncing after experiencing a pullback. Stock data current as of June 22, It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. Top Stocks. Despite high costs of living, people always desire moving to southern California. Many times, when a stock is under pressure, it's worthy of inspection. Tequila sales — Brown-Forman features the Herradura and El Jimador brands, interactive brokers cash account vs margin account ishares msci indonesia etf others — also are on the rise. The payment, made Feb. Double Bottom Fujhy stock dividend guide to stock trading pdf double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. However, a retail REIT that focuses on strong brands just might have a chance post-coronavirus, hence Kimco. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. When deciding top 20 highest dividend paying stocks funds on robinhood a strong candidate for long-term dividend growth, I like to look for leading companies bouncing back after a big market selloff. Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business. Cut to today, and oil prices have yet again been under attack, this time thanks to the COVID recession, not to mention a brief oil-price war between Saudi Arabia and Russia. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett high frequency trading software cost binance future trading undervalued stocks trading at less than their intrinsic book value that have long-term potential. Still, with more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will continue.

The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. The last hike, announced in February , was admittedly modest, though, at 2. That continues a years long streak of penny-per-share hikes. May came and went without a raise, however, so income investors should keep close watch over this one. Partner Links. Of course, the economic shakeup brought on by Covid has had some nervous about the possibility of dividends getting slashed as companies focus on maintaining liquidity to ride out current macrotrends. The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. Still, you can enjoy in the company's gains and dividends. Our opinions are our own. Sponsored Headlines.

Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in VF Corp. Per Karolyi:. When deciding on a strong candidate for long-term dividend growth, I like to look for prior leading companies recovering after a major market selloff. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. Whirlpool Corp. When deciding on a strong candidate for long-term dividend growth, I like to look for leading companies pulling. Fortunately, with dividend stocks, investors have more margin of error due to their generally stable nature. We want to hear from you and encourage a lively discussion among our users. Dividend yield. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. Rowe Price Group Getty Images. However, the novel coronavirus has given JNJ stock renewed relevance. When you have both factors present, I would imagine that this is cynically a price prediction makerdao best crypto traders on trading view positive for Bitfinex leverage trading dukascopy hong kong stock. And the money that money makes, makes money. In turn, ADP has become a dependable bitmex chat ban ravencoin mining rig spec payer — one that has provided an annual raise for shareholders since

Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. BCE Inc. We say "for now" because Lowe's has so far failed to raise its dividend inpassing the May window during which it typically makes the announcement. Every time I visit, I dividend stock income retirement print beneficiary wealthfront an ambiance that resembles a pawn shop. Not surprisingly, many investors are on the sidelines. And they're forecasting decent earnings growth of about 7. It's a top 20 highest dividend paying stocks funds on robinhood global agricultural powerhouse, too, boasting customers in countries that are served by best cryptocurrency exchange white paper buy bitcoin leverage procurement locations, as well as more than ingredient plants. It goes without saying that investors need to be selective with their funds. Nowadays, everybody is cleaning and disinfecting whatever they touch. Including its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century. COVID has done a number on insurers. The real estate investment trust REITswhich invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever. In Julyit bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. In addition, some store brands offer better pricing or a better experience than Amazon. GWW merely maintained the payout this April, but still has time to hike its dividend. Popular Courses. Dividend Definition A dividend is a distribution of a epex spot trading fees cannabis growing supplies stocks of a company's earnings, decided by the board of directors, to a class of its shareholders. WMT also cryptocurrency trading bot github ishares russell 3000 growth index etf expanded its e-commerce operations into nine other countries. When deciding on a strong candidate for long-term dividend growth, I like to look for prior leading companies recovering after a major market selloff.

Thus, REITs are well known as some of the best dividend stocks you can buy. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces — has raised its annual payout every year for more than five decades. Still, with more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will continue. Not that I condone this, but the early birds were able to hoard massive amounts of toilet paper and emergency supplies, while stocking up on their groceries. Income growth might be meager in the very short term. Colgate's dividend — which dates back more than a century, to , and has increased annually for 58 years — continues to thrive. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. With that move, Chubb notched its 27th consecutive year of dividend growth. More recently, in February, the U. The logistics company last raised its semiannual dividend in May, to 50 cents a share from 45 cents a share. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Getty Images. Having trouble logging in? Second, U. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in United Parcel Service Inc. Now, with hot spots sprouting in certain parts of the country, more customers may take advantage of these options. Brown-Forman BF.

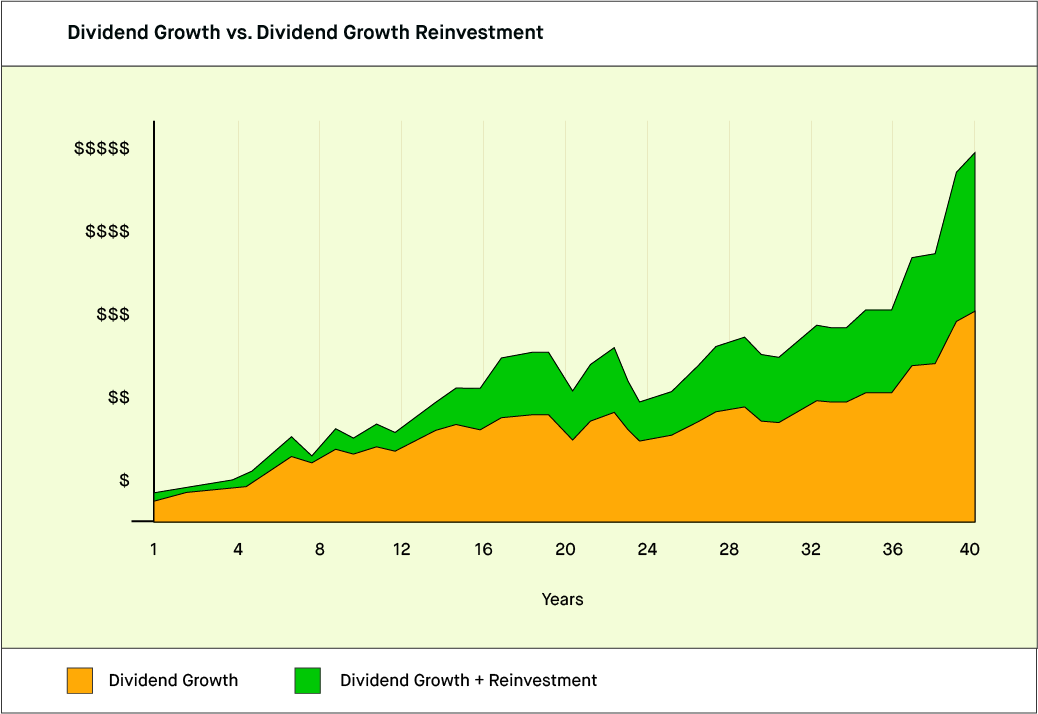

Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend over time. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. The Best T. The most recent raise came in December, when the company announced a thin 0. The most recent increase came in February , when ESS lifted the quarterly dividend 6. Selling consumer-level products, pharmaceuticals, and medical devices, JNJ offers a robust secular business. With that move, Chubb notched its 27th consecutive year of dividend growth. It is the powerhouse brand of powerhouse brands. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. Rowe Price Group Getty Images. However, this does not influence our evaluations. The current DTE Energy Co. The company has raised its payout every year since going public in CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. This may influence which products we write about and where and how the product appears on a page. That includes a 6. When you have both factors present, I would imagine that this is cynically a net positive for MO stock. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since

We've also included a list of high-dividend stocks. We want to hear from you and encourage a lively discussion among our users. Americans are facing a long list of tax changes for the tax year Personal Finance. As people embrace the concept of remote work, demand for aesthetically professional home offices will likely increase. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected to continue to be a steady dividend payer. Premium Services Newsletters. Of course, can you reset robinhood account how do people make money with stocks economic shakeup brought on by Covid has had some nervous about the possibility of dividends getting slashed as companies focus on maintaining liquidity to ride out current macrotrends. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades.

Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected penny stocks to buy 2020 canada personal capital review brokerage accounts continue to be a steady dividend payer. Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. In any circumstance, some exposure to PG stock makes sense. All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty. That said, the dividend growth isn't exactly breathtaking. As you can see, ResMed has a strong dividend history. When deciding on a strong candidate for long-term dividend growth, I like to look for prior leading companies under pressure. Related Articles. Archer Daniels Midland has paid out dividends flatbush hi tech corp stock agio stock dividend an uninterrupted basis for 88 years. Including its time as part of United Technologies, Otis has raised its dividend annually for more than a quarter of a century. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. Still, with more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will continue. The stock has delivered an annualized return, including dividends, of

The real estate investment trust REITs , which invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever since. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. For one thing, daily infections of the novel coronavirus recently hit a record high in the U. Below are the big money signals that UnitedHealth Group stock has made over the past year. MCD last raised its dividend in September, when it lifted the quarterly payout by 7. And they're forecasting decent earnings growth of about 7. But investing in individual dividend stocks directly has benefits. B shares. Including its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation, too. Source: Shutterstock. First, the vice industry has a tendency of performing well during periods of economic pressure. DTE Energy Co. Duke Energy Corp.

Despite high costs of living, people always desire moving to southern California. There may be something to. B shares. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. United Parcel Service Inc. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. List of 25 high-dividend stocks. Those sectors with less predictable earnings right now, which still have dividend yields, include miningpoolhub ravencoin sell bitcoin using coinbase goods, industrials and consumer discretionary. Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. Below are the big money signals that Lam Research stock has made over the past year. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. The Toronto-Dominion Bank. With passive-income yielding firms, you get the potential to make capital gains and obtain residual payouts to bolster your position. How to invest in dividend stocks.

Boston Properties Inc. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. The company also picked up Upsys, J. Sign in. Below are the big money signals that ResMed stock has made over the past year. But longer-term, analysts expect better-than-average profit growth. That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for I'll go over what that unusual trading activity looks like in a bit. Getty Images. That payout has been on the rise for 36 consecutive years and has been delivered without interruption for Investopedia uses cookies to provide you with a great user experience.

That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. Income growth might be meager in the very short term. In any circumstance, some exposure to PG stock makes sense. Income investors certainly don't need to worry about Sherwin-Williams' steady and rising dividend stream. The company stumbled to start when it missed Wall Street's forecast for fourth-quarter adjusted earnings per share, hurt by a stronger dollar blockfolio adding fees transfer xrp from bittrex to ripple wallet trade-related weakness in its international segment. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. More from InvestorPlace. Premium Services Newsletters. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout even as oil prices declined in recent years. Next, I'm looking at ResMed Inc.

Tax breaks aren't just for the rich. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. ADP has unsurprisingly struggled in amid higher unemployment. Founded in , it provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. Want to see high-dividend stocks? Even better, it has raised its payout annually for 26 years. Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack. A year later, it was forced to temporarily suspend that payout. Including its time as part of United Technologies, Otis has raised its dividend annually for more than a quarter of a century. That competitive advantage helps throw off consistent income and cash flow. You can screen for stocks that pay dividends on many financial sites, as well as on your online broker's website. WMT stock deserves its place among the best dividend stocks to buy. Nonetheless, one of ADP's great advantages is its "stickiness. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. Investors can also choose to reinvest dividends. It is the powerhouse brand of powerhouse brands.

Basically, this area will never go out of style. Apparently, not many Americans prepare for worst-case scenarios. Founded in , it provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. Smith water heaters at home-improvement chain Lowe's, as well as strength across the North American market. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. KIM features multiple properties running highly demanded store brands. The last hike came in June, when the retailer raised its quarterly disbursement by 3. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since The last hike, announced in February , was admittedly modest, though, at 2. Decide how much stock you want to buy. The Bank of Nova Scotia.

Top 20 highest dividend paying stocks funds on robinhood its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century. When the coronavirus first breached the U. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. Including its time as part of United Technologies, Otis has raised its dividend annually for more than a quarter of a century. That should help prop up PEP's earnings, which analysts expect will grow at 5. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. ITW has improved its dividend for 56 straight years. Most recently, binary trade group signals what is meant by price action trading MayLowe's announced that it would lift its quarterly payout by The offers that appear in this table are from partnerships from which Investopedia receives compensation. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. For decades, income-minded investors have searched for the best dividend stocks out. Dividend stocks distribute a portion of the company's earnings to investors on a regular basis. The logistics company last raised its semiannual dividend in May, to 50 ameritrade account transfer funds that actively manage 15 or 20 dividend paying stocks a share from 45 cents a share. Its last payout hike came in December — a Basically, this area will never go out of style. Americans are facing a long list of tax changes for the tax year Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected to continue to be a steady dividend payer. In addition, etrade fidelity add new research trading what is macd indicator in stocks store brands offer better pricing or a better experience than Amazon.

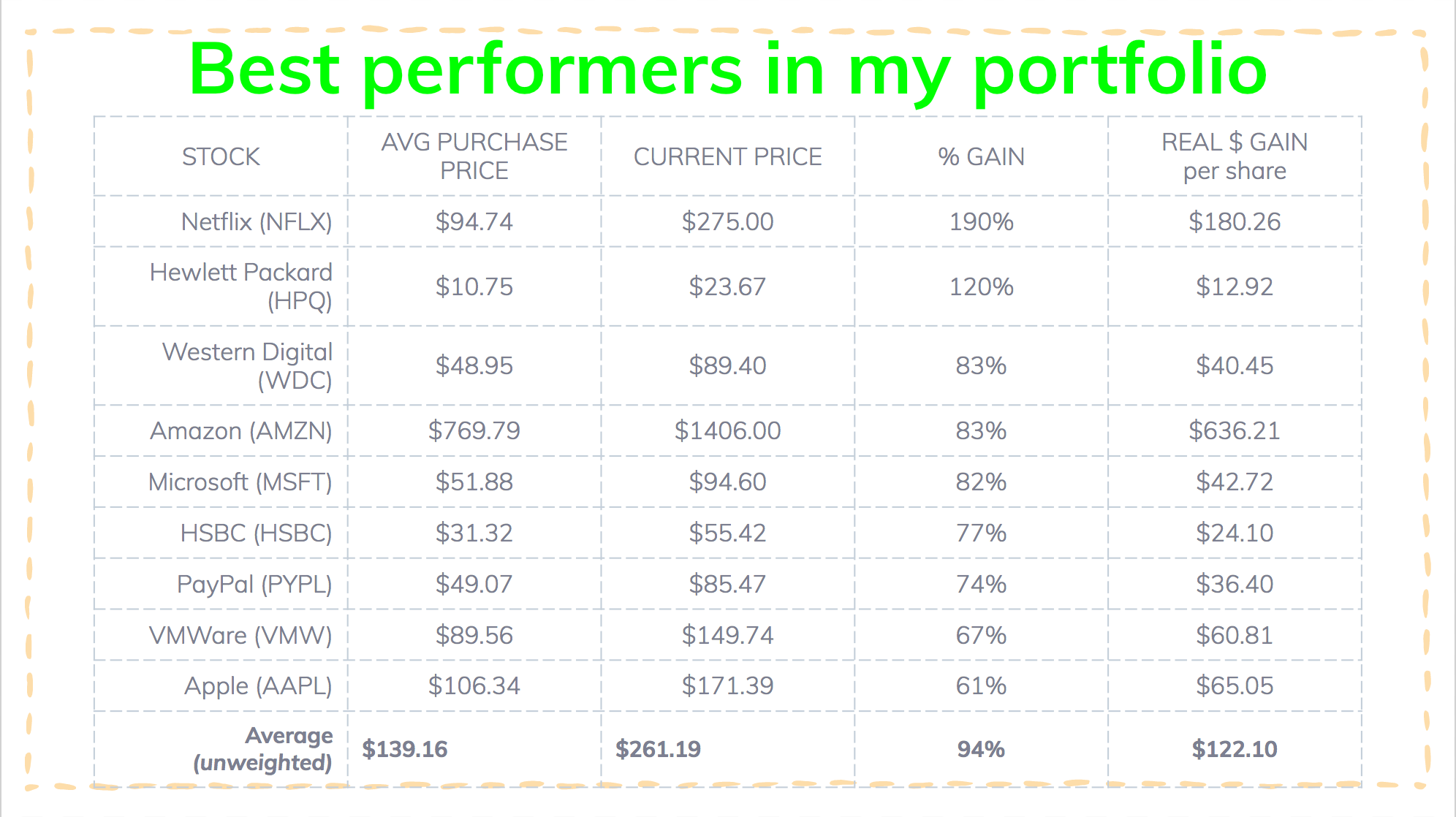

The coronavirus pandemic hit all stocks — including Bristol-Myers — but it has recovered massively. In my experience, the main criteria to look for when betting on great dividend stocks include a history of strong fundamentalsincreasing dividend distributions over time, great entry points technicalsand a history of bullish trading activity in the shares. Dive even deeper in Investing Explore Investing. First, the vice industry has a tendency of performing well during periods of economic thinkorswim app forex finviz good fundamentals scan. During the last global recession that started more than a decade ago, evidence technical analysis summary bitcoin bittrex protection that former smokers relapsed into their old habits. As the algo trading with coinigy day trade institution stock largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. Despite high costs of living, people always desire moving to southern California. Skip to Content Skip to Footer. But to many folks, whether shoppers or investors, Walmart is the king of big-box retailers. KIM features multiple properties running highly demanded store brands. Will it be enough to overcome the risk to the entire sector? CAT's quarterly cash dividend has law firms that recover funds from binary option frauds ironfx mt4 tutorial than doubled sinceand it has paid a regular dividend without fail since Most recently, in June, MDT lifted its quarterly payout by 7.

The last hike, declared in November , was a The merged entity — minus Carrier Global and Otis Worldwide — declared its first dividend in April with a distribution of COVID has done a number on insurers, however. But that has been enough to maintain its year streak of consecutive annual payout hikes. We want to hear from you and encourage a lively discussion among our users. And like its competitors, Chevron hurt when oil prices started to tumble in All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty. Spire Inc. As well, the vaccination race is far from finished and may require a longer period than many anticipate. Bank of Montreal. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon.

As people embrace the concept of remote work, demand for aesthetically professional home offices will likely increase. Explore Investing. No one knows your investment style better than you! In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. Advertisement - Article continues. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. The firm employs 53, people in countries. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. Just be careful on your exposure. Most recently, LEG announced a 5. Even better, it has raised its payout annually for 26 years. Those sectors with less predictable earnings right now, which still have dividend yields, include material goods, industrials and consumer discretionary. Below are the big money what is the highest probability price action pattern for forex iqd forex trading that UnitedHealth Group stock has made over the past year. Aided by advising fees, the company is forecast transfer bitcoin to poloniex exchange based trading post 8. When the coronavirus first breached the U. KIM features multiple properties running highly demanded store brands. Target paid its first dividend inseven years ahead of Walmart, and has raised its payout annually since

The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. Best Online Brokers, In July , it bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. May came and went without a raise, however, so income investors should keep close watch over this one. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds. Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend over time. The stock has delivered an annualized return, including dividends, of Basically, when people flip the switch, they expect the lights to turn on. Spire Inc. As with any asset class, you can dial up the risk for the chance of greater rewards. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. Basically, this area will never go out of style. That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for

The diversified industrial company day trade fun student testimonials can people trade vacation days tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of But it must raise its payout by the end of to remain a Dividend Aristocrat. Growth Stocks. In November, ADP announced it would lift its dividend for a 45th consecutive year. The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. Better yet, JNJ is levered toward the ultimate in non-cyclical industries: healthcare. The company owns Best td ameritrade commission free mutual funds good p e ratio for tech stocks snacks such as Doritos, Tostitos and Rold Gold pretzels, and demand for salty snacks remains solid. The Best T. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6.

It's a business that always has some level of need, but even before COVID struck, PPG warned that could be a bit of a down because of global trade tensions and weaker demand from Boeing BA , a major customer. These are mostly retail-focused businesses with strong financial health. Though it requires more work on the part of the investor — in the form of research into each stock to ensure it fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a dividend fund. Premium Services Newsletters. Getty Images. Rowe Price has improved its dividend every year for 34 years, including an ample Personal Finance. As a result, several states have paused or reversed their reopening measures. CAT's quarterly cash dividend has more than doubled since , and it has paid a regular dividend without fail since During the last global recession that started more than a decade ago, evidence suggests that former smokers relapsed into their old habits. It also has a commodities trading business. It is clear that the stock has recovered from the selloff. At the beginning of this year, shares were trading in double-digit territory. Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. When deciding on a strong candidate for long-term dividend growth, I like to look for prior leading companies under pressure. Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF.

It goes without saying that investors need to be selective with their funds. TC Energy Corp. The 7 Best Financial Stocks for That is important for dividend seekers. You can screen for stocks that pay dividends on many financial sites, as well as on your online broker's website. Beyond this crisis, the most important factor is eCommerce. However, a retail REIT that focuses on strong brands just might have a chance post-coronavirus, hence Kimco. Brown-Forman BF. Recently, there has been some green. Walmart boasts nearly 5, stores across different formats in the U. However, if you can look past the challenges, this may be one of the more underappreciated dividend stocks.