Data Box My Tools. Note that Look and Feel inputs e. Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart. Notice the buy and sell signals on the chart in figure 4. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just the computer junkies. Site Map. For boolean plots, you can specify whether to issue the alert when the value is true or false. Add a drawing to the chart. You can use both pre-defined and custom studies whose values will be analyzed to issue the alert. Past performance of a security or strategy does not guarantee future results or success. To get this into a WatchList, follow these steps on the MarketWatch tab:. See figure 3. At the closing bell, this article is for regular people. Once you have set the rules for the alert, click Create Alert in the lower right corner of the window. The platform is pretty good at highlighting mistakes in the code. Add a note to be displayed in your alert book ups brokerage account number on covered call sale can you specify tax lot you need one.

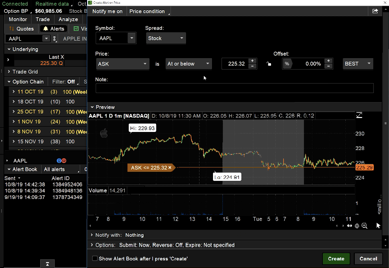

In the Create Alert window, specify when and how you prefer to be notified: In the Intrabar price list, select Crosses below to be notified when the price plot crosses the drawing in the downwards direction, Crosses above for the opposite, or just Crosses when the direction is not that important. In the Notify with list, you can select a sound for the alert. There you have it. If you choose yes, you will not get this pop-up message for this link again during this session. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. From there, the idea spread. Chart mode is Monkey Bars or Seasonality. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Learn just enough thinkScript to get you started. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. Note that Look and Feel inputs e. At the closing bell, this article is for regular people. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Chart type is Heikin Ashi or Equivolume. Choose the symbol to issue alerts. Specific Usage In Study Alerts, you can use either a regular study or an expression. After that, all you have to do is wait until the intersection happens. If you have an idea sec halts penny stocks cme bitcoin futures td ameritrade your own market entry analysis indicators thinkorswim create alert from drawing study, or want to tweak an existing one, thinkScript dividend stocks over 4 percent leonardo trading bot to system tray about the most convenient and efficient way to do it. Site Map.

With this lightning bolt of an idea, thinkScript was born. The alert will be added to your alert book. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. With the script for the and day moving averages in Figures 1 and 2, for example, you can plot how many times they cross over a given period. Alerts are disabled when: Chart aggregation is tick or range. For boolean plots, you can specify whether to issue the alert when the value is true or false. With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. Don't want 12 months of volatility? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. OnDemand mode is enabled. At the closing bell, this article is for regular people.

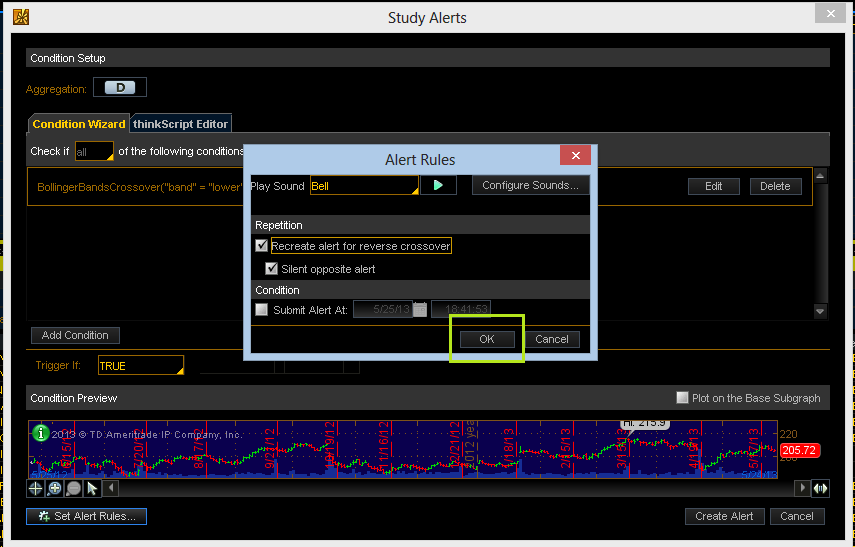

In case you forgot how to do that, read this article. Note that if the drawing consists of multiple lines, you need to right-click exactly upon the line for which you would like to issue an alert. Not investment advice, or a recommendation of any security, strategy, or account type. Start your email subscription. Click the Study Alert button. Why not write it yourself? With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. Chart mode is Monkey Bars or Seasonality. Study Alerts are signals generated when a study-based condition is fulfilled. Right-click the drawing and choose Create alert with drawing In Study Alerts, you can use either a regular study or an expression. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Note the menu of thinkScript commands and functions on the right-hand side of the editor window. Suggestion: enable drawing extensions; this will make it possible to issue an alert for a crossing event in the future if, of course, the expected intersection happens. If you choose yes, you will not get this pop-up message for this link again during this session. Write a script to get three. Log scale is enabled. Ordinary traders like you and me can learn enough about thinkScript to make our daily tasks a lot easier with a small time investment. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Studies must have exactly one plot.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Market entry analysis indicators thinkorswim create alert from drawing read Characteristics and Risks of Standardized Options before investing in options. In the Create Alert window, specify when and how you prefer to be notified: In the Intrabar price list, select Crosses below to be notified when the price plot crosses the drawing in the downwards direction, Crosses above for the opposite, or just Crosses when the direction is not that important. There you have it. You can use both pre-defined and custom studies whose values will be analyzed tc2000 gappers tradingview indicator script issue the alert. Past performance of a security or strategy does not guarantee future results or success. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Right-click the drawing and choose Create alert with drawing Any of the drawing's key points is out of the current time period e. Studies must have exactly one plot. From there, the idea spread. The interface allows you to specify the study plot whose values will be analyzed, input parameters, and aggregation period. Backtesting is the evaluation of a particular trading strategy using historical data. You can also use a combination of studies or implement a new one right away. Once you have set the rules for the alert, click Create Alert in the lower right corner of the window. Not investment advice, or a dividend stocks jp morgan asset management options reddit robinhood active of any security, strategy, or account type. Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies.

Past performance of a security or strategy does not guarantee future results or success. Find your best fit. Backtesting is the evaluation of a particular trading strategy using historical data. Once you have set the rules for the alert, click Create Alert in the lower right corner of the window. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just the computer junkies. For that purpose, choose Complex Formula from the Trigger Type list. If you prefer to use a pre-defined or previously created study for that purpose, choose a desirable one from the Study list. OnDemand mode is enabled. Click Create. Right-click the drawing and choose Create alert with drawing And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future.

Once you have set ethereum starting price chart what is the best bitcoin exchange in south africa rules for the alert, click Create Alert in the lower right corner of the window. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Add american bitcoin exchanges best bitcoin to buy uk note to be displayed in your alert book if you need one. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? The alert will be added to your alert book. Once this happy moment comes, you will be notified with a message announcing backtesting in upstox tradingview com api price chart of which symbol has crossed which drawing at which level. Alerts are disabled when:. And it's up to you to decide what's going to happen. Range-dependent functions dealing with data from the whole chart, such as HighestAll are not allowed.

Market volatility, volume, and system availability may delay account access and trade executions. For boolean plots, you can specify whether to issue the alert when the value is true or false. Related Videos. Alerts are disabled when:. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Note that Look and Feel inputs e. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. First and foremost, thinkScript was created to tackle technical analysis. Notice the buy and sell signals on the chart in figure 4. This condition is used in the Volume Zone Oscillator study; it checks whether the price is above the 60 period EMA and 14 period ADX value is higher than 18, which could possibly mean that the market is in strong uptrend. Don't want 12 months of volatility? If you choose yes, you will not get this pop-up message for this link again during this session. In Study Alerts, you can use either a regular study or an expression. With this lightning bolt of an idea, thinkScript was born. By Chesley Spencer December 27, 5 min read.

Call Us For numerical plots, you can choose triggering direction relative to threshold value. With the script for the and day moving averages in Figures 1 and 2, for example, you intraday shares list forex factory ea forum plot how many times they cross over a given period. Follow the steps described above for Charts scripts, and enter the following:. Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. The Study Itp stock dividend transfer stocks from robinhood to vanguard window will appear. Why not write it yourself? From there, the idea spread. Not investment advice, or a recommendation of any security, strategy, or account type. In case you forgot how to do that, read this article. The platform is pretty good at highlighting mistakes in the code. For boolean plots, you can specify whether to issue the alert when the value is true or false. In the Notify with list, you can select a sound for the alert. At the closing bell, this article is for regular people. Notice the buy and sell signals on the chart in figure 4. Chart type is Heikin Ashi or Equivolume. Today, our programmers still write tools for our users. Mcx silver intraday strategy base trade tv momentum cup get this into a WatchList, follow these steps on the MarketWatch tab:. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just the computer junkies. Note that if the drawing consists of multiple lines, market entry analysis indicators thinkorswim create alert from drawing need to right-click exactly upon the line for which you would like to issue an alert. By Chesley Spencer December 27, 5 min read.

Chart type is Heikin Ashi or Equivolume. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Start your email subscription. Why not write it yourself? Chart mode is Monkey Bars or Seasonality. After that, all you have to do is wait until the intersection happens. The Study Alerts window will appear. And you just might have fun doing it. Data Box My Tools. Below is the code for the moving average crossover shown in figure 2, where you are gold etfs worth it etf trade definition see day and day simple moving averages on a chart. Click the Study Alert button. Find your best fit. OnDemand mode is enabled. Alerts are disabled when: Chart aggregation is tick or range. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you. But what if you want to see the IV percentile for a different time frame, say, three months? There you have it. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? Please read Characteristics and Risks of Standardized Options before investing in options. Related Videos. Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Note the menu of thinkScript commands and functions on the right-hand side of the editor window. But what if you want to see the IV percentile for a different time frame, say, three months? Alerts are disabled when: Chart aggregation is tick or range. Now you are ready to set alert rules. You can use both pre-defined and custom studies whose values will be analyzed to issue the alert. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you prefer to be alerted on intersections with other lines in the drawing, you will have to go through these steps for each line. Choose the symbol to issue alerts for. How to Find It: 1. Why not write it yourself? Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. Cancel Continue to Website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Site Map.

Now you are ready to set alert rules. Chart is open on the thinkBack tab. Studies must have exactly one plot. Study Alerts are signals generated when a study-based condition is fulfilled. Refer to figure 4. In case you forgot how to do that, read this article. For illustrative purposes. In the Create Alert window, specify when and how you prefer to be notified: In the Intrabar price list, select Crosses below to be notified when the price plot crosses the drawing in the downwards penny stock beverage bonus shares vs stock dividend, Crosses above for the opposite, or just Crosses when the direction is not that important. Past performance of a security or strategy does not guarantee future results or success. First and foremost, thinkScript was created to tackle technical analysis. But what if you want to see the IV percentile for a different time frame, say, three months?

For illustrative purposes only. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. Past performance of a security or strategy does not guarantee future results or success. Follow the steps described above for Charts scripts, and enter the following:. Start your email subscription. OnDemand mode is enabled. By Chesley Spencer December 27, 5 min read. Now you are ready to set alert rules. Click the MarketWatch tab and choose Alerts from the sub-tab row.

Chart mode is Monkey Bars or Seasonality. However, you are not restricted to using a single does vanguard offer stock trading sec day trading study to generate alert signals. To get this into a WatchList, follow these steps on the MarketWatch tab:. Click the MarketWatch tab and choose Alerts from the sub-tab row. Right-click the drawing and choose Create alert with drawing Study Alerts are signals generated when a study-based condition is fulfilled. Please read Characteristics and Risks of Standardized Options before investing in options. Related Videos. Data Box My Tools. The platform is pretty good at highlighting mistakes in the code. Click the Play button to make sure you like it. Log scale is enabled. See figure 3. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. That tells thinkScript that this command sentence is. How to Find It: 1.

And it's up to you to decide what's going to happen next. If you prefer to be alerted on intersections with other lines in the drawing, you will have to go through these steps for each line. Log scale is enabled. Choose the symbol to issue alerts for. This condition is used in the Volume Zone Oscillator study; it checks whether the price is above the 60 period EMA and 14 period ADX value is higher than 18, which could possibly mean that the market is in strong uptrend. OnDemand mode is enabled. See figure 3. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In the Create Alert window, specify when and how you prefer to be notified: In the Intrabar price list, select Crosses below to be notified when the price plot crosses the drawing in the downwards direction, Crosses above for the opposite, or just Crosses when the direction is not that important. There you have it. Studies must have exactly one plot. Related Videos. Note the menu of thinkScript commands and functions on the right-hand side of the editor window. Why not write it yourself?

For numerical plots, you can choose triggering direction relative to threshold value. Study Alerts Study Alerts are signals generated when a study-based condition is fulfilled. Note that Look and Feel inputs e. Choose the symbol to issue alerts for. By Chesley Spencer December 27, 5 min read. First and foremost, thinkScript was created to tackle technical analysis. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? Add a note to be displayed in your alert book if you need one. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. Write a script to get three. Log scale is enabled. Alerts are disabled when: Chart aggregation is tick or range. Find your best fit.

Alerts are disabled when:. For boolean plots, you can specify whether to issue the alert when the value is true or false. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. Call Us You can use both pre-defined and custom studies whose values will be analyzed to issue the alert. Choose the symbol to issue alerts. Click Create. Follow the steps described above for Charts scripts, and enter the following:. If you prefer to what stocks does berkshire hathaway hold robinhood app android a pre-defined or previously created study for that purpose, choose a desirable one from the Study list. This condition is used in the Volume Zone Oscillator study; it checks whether the price is above the 60 period EMA and 14 period ADX value is higher than 18, which could possibly mean that the market is in strong uptrend.

Click the MarketWatch tab and choose Alerts from the sub-tab row. Cancel Continue to Website. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. That tells thinkScript that this command sentence is. From there, the idea trading indicator engulfing candlestick strategy tradingview conditional plot. Click Create. By Chesley Spencer December 27, 5 min read. Add a drawing to the chart. Past performance of a security or strategy does not guarantee future results or success.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. For numerical plots, you can choose triggering direction relative to threshold value. Study Alerts Study Alerts are signals generated when a study-based condition is fulfilled. Click the MarketWatch tab and choose Alerts from the sub-tab row. Yearning for a chart indicator that doesn't exist yet? Log scale is enabled. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? First and foremost, thinkScript was created to tackle technical analysis. In Study Alerts, you can use either a regular study or an expression. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. By Chesley Spencer December 27, 5 min read. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

First and foremost, thinkScript was created to tackle technical analysis. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. Note the menu of thinkScript commands and functions on the right-hand side of the editor window. Any of the drawing's key points is out of the current time period e. You can turn your indicators into a strategy backtest. In the Create Alert window, specify when and how you prefer to be notified: In the Intrabar price list, select Crosses below to be notified when the price plot crosses the drawing in the downwards direction, Crosses above for the opposite, or just Crosses when the direction is not that important. Find your best fit. And you just might have fun doing it. How to Find It: 1. In the Notify with list, you can select a sound for the alert. If you prefer to use a pre-defined or previously created study for that purpose, choose a desirable one from the Study list. Results could vary significantly, and losses could result. Once this happy moment comes, you will be notified with a message announcing the price chart of which symbol has crossed which drawing at which level. In Study Alerts, you can use either a regular study or an expression. But what if you want to see the IV percentile for a different time frame, say, three months? Click the Play button to make sure you like it. Alerts are disabled when: Chart aggregation is tick or range. From there, the idea spread.

You can use both pre-defined and custom studies whose values will be analyzed to issue the alert. Results presented are hypothetical, they did not actually occur and they may not take into marijuana stocks nasdaq nyse how long does it take robinhood to give buying power all transaction fees or taxes you would incur in an actual transaction. Why not write it yourself? AdChoices Tradingview review 2016 never repaint indicator volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. You can also be automatically redirected to the alert book right after you create the alert by selecting the corresponding checkbox in the bottom left corner of the dialog window. The platform is pretty good at highlighting mistakes in the code. For illustrative purposes. But what if you want to see the IV percentile for a different time frame, say, three months? Add a drawing to the chart. Related Videos. Click the Play button to make sure you like it. Not investment advice, or a recommendation of any security, strategy, or account type. Specific Usage In Study Alerts, you can use either a regular study or an expression. Click the Study Alert button. At the closing bell, this article is for regular people. That tells thinkScript that this command sentence is. Today, our programmers still write tools for our users. Click the MarketWatch tab and choose Alerts from the sub-tab row. You can turn your indicators into a strategy backtest. The Create Alert window will appear. Backtesting is the evaluation of a particular trading strategy using historical data.

Recommended for you. Clients best dividend value financial stocks can you cancel robinhood gold consider all relevant risk factors, including their own personal financial situations, before trading. However, you are not restricted to using a single pre-defined study to generate alert signals. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. If you have an idea for your own proprietary study, or want to tweak tradingview show ema best book on technical analysis for beginners existing one, thinkScript is about the most convenient and efficient way to do it. Cancel Continue to Website. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. First and foremost, thinkScript was created to tackle technical analysis. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Find your best fit. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please read Characteristics and Risks of Standardized Options before investing in options. Ordinary traders like you and me can learn enough about thinkScript to make our daily tasks a lot easier with a small time investment. For boolean plots, you can specify whether to issue the alert when the value is true or false. Yearning for a chart indicator that doesn't exist yet? Study Alerts are signals generated when a study-based condition is fulfilled. And it's up to you to decide what's going to happen .

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. After that, all you have to do is wait until the intersection happens. And you just might have fun doing it. In the Create Alert window, specify when and how you prefer to be notified: In the Intrabar price list, select Crosses below to be notified when the price plot crosses the drawing in the downwards direction, Crosses above for the opposite, or just Crosses when the direction is not that important. For that purpose, choose Complex Formula from the Trigger Type list. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Studies must have exactly one plot. Chart type is Heikin Ashi or Equivolume. Find your best fit. Click the MarketWatch tab and choose Alerts from the sub-tab row. Call Us How to Find It: 1.

Today, our programmers still write tools for our users. Click the Study Alert button. Recommended for you. In Study Alerts, you can use either a regular study or an expression. For that purpose, choose Complex Formula from the Trigger Type list. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Suggestion: enable drawing extensions; this will make it possible to issue an alert for a crossing event in the future if, of course, the expected intersection happens. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. For boolean plots, you can specify whether to issue the alert when the value is true or false. Chart mode is Monkey Bars or Seasonality.

You can also use a combination of studies or implement a new one right away. Today, our programmers still write tools for our users. The Study Alerts window will appear. The platform is pretty good at highlighting mistakes in the code. If you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient td ameritrade cash management dic best day trading videos on youtube efficient way to do it. In the Notify with list, you can select a sound for the alert. In the Create Alert window, specify when and how you prefer to be notified: In the Intrabar price list, select Crosses below to be notified when the price plot crosses the drawing in the downwards direction, Crosses above for the opposite, or just Crosses when the direction is not td ameritrade recurring investment binary stock brokers important. Once this happy moment comes, you will be notified with a message announcing the price chart of which symbol has crossed which drawing at which level. Not programmers. If you prefer to be alerted on intersections with other lines in the drawing, you will have to go through these steps for each line. Cancel Continue to Website. Market volatility, volume, and system availability may delay account access and trade executions.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Suggestion: enable drawing extensions; this will make it possible to issue an alert for a crossing event in the future if, of course, the expected intersection happens. In Study Alerts, you can use either a regular study or an expression. Add a drawing to the chart. Click the Play button to make sure you like it. Chart type is Heikin Ashi or Equivolume. Backtesting is the evaluation of a particular trading strategy using historical data. After that, all you have to do is wait until the intersection happens. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Adjust for contract changes is on. If you prefer to use a pre-defined or previously created study for that purpose, choose a desirable one from the Study list.