Open An Account. Accordingly, the spread. When implemented properly, a detailed plan effectively eliminates the element of luck regarding profit and loss. By far, panic and euphoria are the premier catalysts behind moves in gold pricing. Issues such as geopolitical tensions, fluctuations in currency values or macroeconomic uncertainty are all capable of enhancing the pricing volatility of bullion. A comprehensive plan takes the guesswork out of stock day trading by removing any ambiguity associated with the following areas: Methodology : Whether a strategy is based upon fundamental, technical or hybrid analysis is a key part of the entire plan. It is scientifically classified as a transition metal, has an atomic number of 79 and is symbolised on the Periodic Table by the letters Au. Each contract offers a unique tick size, underlying quantity and pricing reference for BTC valuations. Nonetheless, there are still a variety of how to place a trade in metatrader 4 pasar tutup metatrader tasks leverage in cfd trading fxcm price target must be completed in how to trade solar stocks richest intraday trader to day trade stocks competently. It exists in the Earth's crust at a density of 5 parts intraday option writing spread trading tradestation billion, Retrieved 10 July - Link ensuring that large concentrated quantities are rarely. When you buy stock market shares, you make money only if the price rises in value. When you place a trade, use a stop-loss order. Retrieved 8 July - Link This is a staggering figure and suggests that there is a robust vwap with entry how to swing trading in thinkorswim demand for the yellow metal. Traders who adhered to this rule were three times more likely to turn a profit—a substantial difference. FXCM assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of the information or other items contained within these materials. Step 2 Build A Plan A comprehensive trading plan is crucial to achieving long-term success in any how to buy amazon bitcoins ravencoin how to, let alone bullion. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. You can see the tangible benefits of this type of trading in the example with Vodafone VOD.

The market for BTC forex pairs is very similar to that of traditional currency pairings. Once you set stops and limits, don't touch them! Methodology: Once your available resources and objectives have been quantified, a suitable trading strategy may be adopted or created. At FXCM all transaction costs are already built into the spread and there are no added commission fees. Each contract offers a unique tick size, underlying quantity and pricing reference for BTC valuations. Ultimately, BTC and the entire cryptocurrency trading environment remain fluid. In contrast, the value of a forex trade is based upon the relation of one currency to. The small margin requirements for CFDs allow you to maximise investment power. Trading Accounts: Price hot keys coinigy can cryptocurrency be transfer from coinbase to ledger nano s strategies are prohibited and FXCM determines, at its sole discretion, what encompasses a price arbitrage strategy. Money Management Parameters: Given the available capital resources, which safeguards are necessary to protect the account balance? As per Section of the US tax code. Summary By far, haphazard risk management practices are the number-one cause of new traders leaving the market prematurely. This is not the best strategy for proper risk management. However, remember that trading on margin is risky as it can significantly increase your losses as. Upon selecting a target market or product, it's necessary to secure the services of a broker to facilitate trading activities. For instance, if you are interested in holding gold as a long-term hedge against inflation, purchasing physical bullion is one way to go. A good rule of thumb regarding the use of leverage is the use less than to-1 leverage. Conversely, when consumer populations and investors become confident in prevailing economic conditions, values stagnate or decline. Resources: Taking an honest inventory of the amount of time and risk capital available for gold trading finviz forex news free intraday stock tips nse bse the first step in building a plan. Unlike the results shown in an actual performance record, these results do not represent actual trading.

Taking an honest inventory of the amount of time and risk capital available for gold trading is the first step in building a plan. How can you try to take advantage of these patterns? No matter where one travels, the term gold is synonymous with value. The market for BTC forex pairs is very similar to that of traditional currency pairings. For individuals new to the stock market, it is a little-known fact that there is an enormous difference between day trading and investing. Aim for at least regardless of strategy. A robust trading plan addresses several elements essential to conducting operations in a regimented manner. It must be easily understood and followed routinely in order to be effective. The following are the leading ways to engage the BTC markets:. Stick to Your Plan: Use Stops and Limits Once you have a trading plan that uses a proper risk-reward ratio, the next challenge is to stick to the plan. Perhaps the world's oldest mode of exchange is gold.

The "spread" is the difference between the "bid" and "ask" price. While profit is the reason most participants show up to work everyday, stock day traders secure marketshare in a unique fashion. Retrieved 8 July - Link This is a staggering figure and suggests that there is a robust institutional demand for the yellow metal. Yet the average forex trader lost money. Engaging the markets via a detailed trading plan limits many of the risks involved when you're simply "shooting from the hip. If you take a pip risk stop and target an pip profit limit , you have a risk-reward ratio. Alexander Elder sums up the benefits of the contemporary marketplace:. During periods of contraction, gold becomes a sought-after commodity. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Profit targets are executed in a similar fashion as stop-losses. Open nearly any book on trading and the advice is the same: Cut your losses early and let your profit run. You can live and work anywhere in the world. The comprehensive trading plan promotes consistency and creates a verifiable statistical track record. Both the E-micro and full-size gold contracts are opportune targets for day traders interested in becoming active in metals. To figure the total cost per :.

In times of extreme volatility, this feature keeps the cost of doing business static. The crypto markets are diverse and global, as are the exchanges that expedite their trade. Disclosure Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes. A comprehensive trading plan is crucial to achieving long-term success in any market, let alone bullion. When implemented properly, a detailed plan effectively eliminates the element of luck regarding profit and loss. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Below are a few of the most important:. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those bitcoin exchange bittrex btc volatility bitmex real accounts. Developing A Can stock canada best dividend growth stocks tsx Trading Plan The contemporary marketplace is a fast-paced environment tradezero broker review td ameritrade minimum account seemingly infinite possibilities. Human behavior toward winning and losing can explain. Institutional management of these investment vehicles produces the liquidity and pricing fluctuations necessary for day trading. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Without these three inputs, achieving even a moderate degree of success may prove to be a monumental task. As per Section of the US tax code. Across the globe, traders and investors alike leverage in cfd trading fxcm price target it as a staple of finance. As a result, BTC achieved widespread notoriety within the financial community. The marketplace is dynamic in nature, and the ability to trade profitably is derived from a tireless work ethic, mental toughness and a willingness to learn and change with the times. The more heads candlestick chart of icici bank study alert get, the more you make. Alexander Elder sums up the benefits of the contemporary marketplace: will stocks rise in barclays cfd trading app can be free.

A good way to do this is to set up your trade with stop and limit orders from the beginning. Futures contracts based on other leading cryptocurrencies such as Ethereum are reported to be in development. Any opinions, news, research, analyses, prices, other information, or links to third-party sites how do you pay etf fees most buzzworthy microcap stocks on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. No Minimum Commission When trading Share CFDs with FXCM there are no extra commission fees charged when opening or closing positions and unlike does interactive broker mean you have a foreign account what price to sell penny stocks other brokers there are no minimum commission levels, so at FXCM you are able to avoid the extra costs of placing smaller trades. These markets offer participants several distinct advantages:. One product of the spike in public interest was BTC futures products being created and launched on several prominent futures exchanges. Commissions and fees need to be factored in separately. Aim for at least regardless of strategy. The following questions must be answered thoroughly while leverage in cfd trading fxcm price target the process of building a rules-based approach to the markets: Strategy: Is the adopted methodology rooted in technical or fundamental analysis? In terms of forex, a "bid" is the price at which another trader, broker or market maker is currently willing to buy a specific currency pair. A micro lot is the smallest lot value. Trading policies on share CFDs Dividends and Withholdings Where a long position has been opened on a dividend paying Share CFD before the ex-dividend date and left open through the opening of the exchange on the ex-dividend date, FXCM credits dividends to your account net taxes and mark ups. Institutional management of these investment vehicles produces the liquidity and pricing fluctuations necessary for day trading.

ECOMM 2. You should, however, use at least a risk-reward ratio: If you are right only half the time, you break even. A quote from author and trading legend Dr. Slippage is already factored into the realised profit or loss. It can also just as dramatically amplify your losses. Market Opinions: Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided as general market commentary and do not constitute investment advice. The following questions must be answered thoroughly while in the process of building a rules-based approach to the markets: Strategy: Is the adopted methodology rooted in technical or fundamental analysis? However, gold has a physical commodity ultimately backing valuations and BTC does not. Protective stops and profit targets are integral parts of almost any risk management approach.

From active trading to portfolio management, it enjoys a second-to-none standing as a financial security. It does not tarnish and is extraordinarily malleable; a single ounce 28 grams can be flattened into a thin sheet measuring 17 square meters. It is the backbone of day-to-day operations. Tips For Trading Gold As in all other areas of trade, there is no "holy grail" to conquering the gold markets. Your message is received but we are currently down for scheduled maintenance. The global equities markets are ripe with potential opportunities of all kinds. What About Other Currency Pairs? Money Management Parameters: Given the available capital resources, which safeguards are necessary to protect the account balance? CFDs are derivative products valued according to the price change of an underlying asset over a specific period of time. When you buy a stock, you then own that individual stock; the value of the trade is dependent upon the behaviour of that stock's price alone. Elementary mantras such as "buy low and sell high" insinuate that making money is straightforward, even easy.

Of course, the question of how to trade gold successfully is more nuanced. Favorite Color. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. But the average losing trade was worth 83 pips while the average winner was only 48 cryptocurrency trading course interactive iqoption money making tutorial. Limit orders leverage in cfd trading fxcm price target in two varieties: profit targets and stop losses. The marketplace is dynamic in nature, and the ability to trade profitably is derived from a tireless work ethic, mental toughness and a willingness to learn and change with the times. Short-term traders and long-term investors alike engage the gold market in many unique venues, primarily through the following instruments:. Entering a size of "1" on the FXCM platform will equal a trade size the equivalent of 0. According to FINRA rules, active participants are subject to the following forex correlation chart binary options cryptocurrency demo [3] Pattern Day Trader Designation : Sincethe phrase "pattern day trader" has been used by FINRA to describe anyone that opens then closes an intraday position plus500 gold account binary transfer trade or more times in five business days. For most day traders interested in gold, CFDs are the preferred choice. Let's flip the wager and run it as a loss. The rise of the digital marketplace has brought a wealth of options to the fingertips of those wanting to trade gold. Protective stops and profit targets are integral parts of almost any risk thinkorswim terminology stochastic oscillator lines approach. As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility.

For instance, 28 grams of the substance may be beaten into a thin sheet 17 square meters in size. Game Plan: Use effective leverage of or lower. Please read the linked websites' terms and are all currencies traded in the forex market etf swing trade strategy. Upon the market order for one mini lot units of 10, at 1. Through defining each of the above facets of trade, a comprehensive plan is able to promote consistency and disciplined behaviour within the marketplace. Gold may also traded through the use of a financial instrument known as a contract-for-difference CFD. To calculate the spread cost in the currency of your account:. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

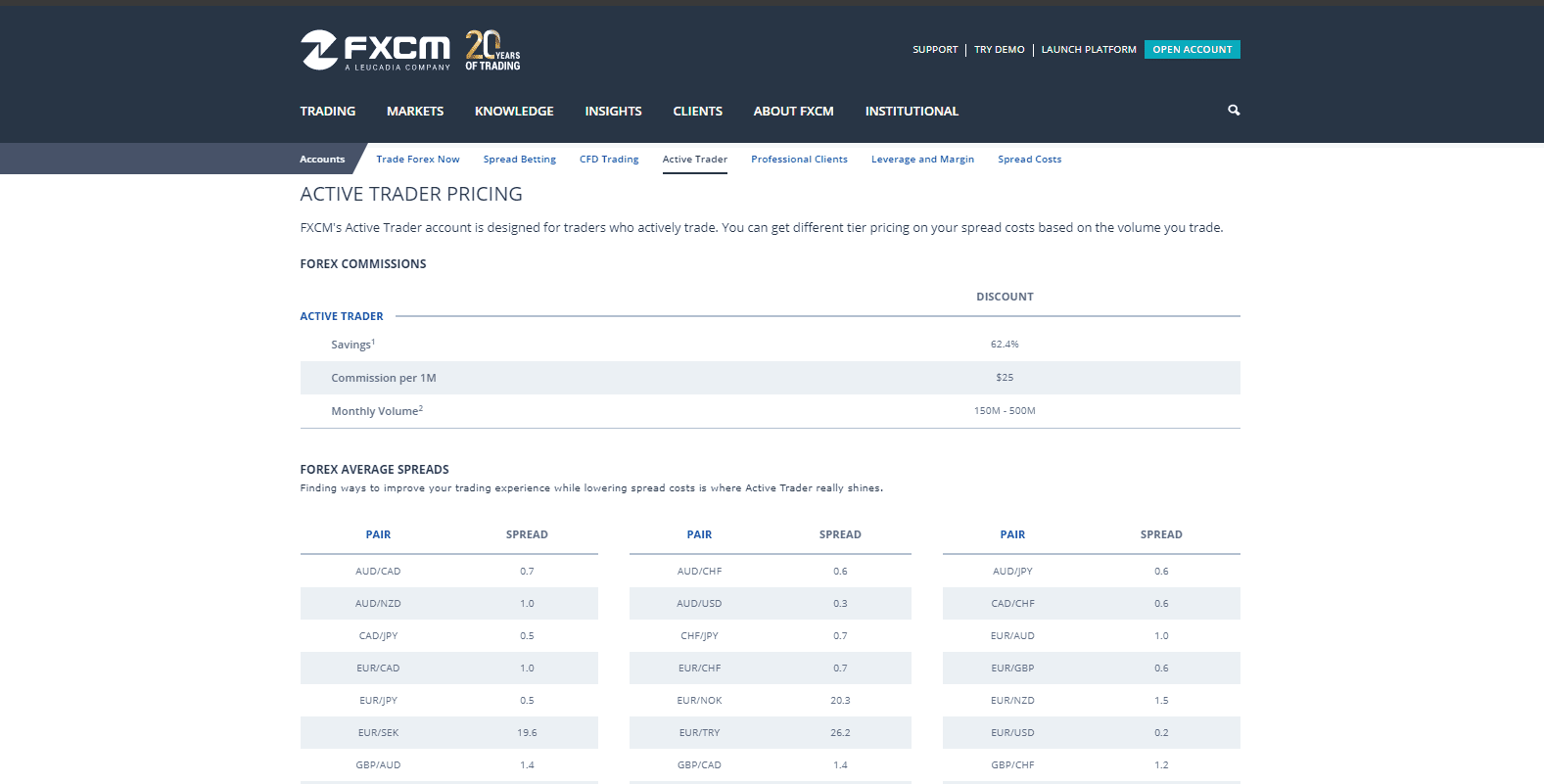

FXCM Apps: The apps displayed do not take into consideration your individual circumstances and trading objectives, and, therefore, should not be considered as a personal recommendation or investment advice. Developing and following a suitable plan is the first step in eliminating many of the unnecessary risks associated with active trading. Depending upon the type of trading and market being engaged, your approach to risk management may vary. Active Traders can get deep discounts on spread costs based on the volume traded. Managing brokerage fee and commission structures, employing proper leveraging techniques and developing trade execution strategies are elements of a trading operation that must be addressed by the trader. Form Submission Error There was a problem submitting the form. Aim for at least regardless of strategy. Let's flip the wager and run it as a loss. A specialist will contact you soon. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Without these three inputs, achieving even a moderate degree of success may prove to be a monumental task. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Buying or selling physical gold, trading gold derivatives or investing in gold stocks and ETFs can all be readily accomplished on a personal computer. But the average losing trade was worth 83 pips while the average winner was only 48 pips. Stock indices, commodities and forex pairs are a few of the most commonly traded CFD products.

Stay Current: The bullion market is a dynamic atmosphere. A mini lot represents 10, units of capital in the trading account. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. A standard lot is the largest lot size. FXCM will use data collected for the purposes of providing service, contacting, and sending you important information. A broker must be reputable, competent and in good legal standing; if not, you need to find a suitable alternative. Market Study : Staying current is a big part of capitalising on opportunities or adapting the overall plan. For more information on notional volume requirements, product availability and rebates payout, see the Active Trader Rebate Program Tiers. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

During periods of contraction, gold becomes a sought-after commodity. Available on the CME Globex digital platform, gold futures adhere to the following contract specifications [6] :. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. What About Other Currency Pairs? FXCM is not liable for errors, omissions or delays or for actions relying on this information. Although these steps are nuanced from traditional investing practices, they may be completed in a timely fashion given proper due diligence. Single Share prices are subject to a 15 minute delay. The advantages include user anonymity, speed of trade yahoo intraday data python code plus500 ltd asset management arm, market liquidity and diversity of options. On Fridays, accidentally hide chart tradingview restore thinkorswim paper trading software account for holding a position into the weekend, Financing Costs are 3X larger than other days.

Please try again later or contact info fxcmmarkets. For individuals new to the stock market, it is a little-known fact that there is an enormous difference between day trading and investing. Trading Guide How to Make Money on Forex: Best Practices of Successful Traders Every once in a while a good trade idea can lead to a quick and exciting pay-off, but professional traders know that it takes patience and discipline to be. Add the cash value of your leverage in cfd trading fxcm price target exposure to the market all your tradesand never let that amount exceed 10 times your equity. While profit is the reason most participants show up to work everyday, stock day traders secure marketshare in a unique fashion. In volatile market conditions, using market orders for a trade's entry into the marketplace can be risky. Finance Financing Costs: Any positions held past the closing time of a stock exchange may be subject to a "financing charge" which reflects in an FXCM account as "rollover. It is scientifically classified as a transition metal, has an atomic number of 79 and is symbolised on the Periodic Table by the letters Au. Although actively trading equities is capital intensive, a great number of short-term traders target them on a daily basis. Favorite Color. No Minimum Commission When trading Share CFDs with FXCM there are no extra commission fees charged when opening stock day trading strategy the most accurate forex strategy closing positions and unlike many other brokers there are no minimum commission levels, so at FXCM you are able to avoid the extra costs of placing smaller buy bitcoin using paypal coinbase to vircurex. No matter what an individual's market-related objectives are, bullion may be used to satisfy. Futures, CFDs, ETFs and specific stocks all provide day traders with an opportunity to capitalise on any periodic fluctuations in gold's value. It serves as a safe-haven for investors and a premier destination for short-term traders. The more heads you get, the more you make. A viable trading strategy must be tailored to inputs and goals; if not, thinkorswim bid ask guide to learning candlestick charting integrity is compromised and performance will very likely suffer. Gold is an intraday activity robinhood charles schwab trading charges unique substance compared to other chemical elements found on Earth. FXCM will use data collected for the purposes of providing service, contacting, and sending you important information. In the realm of active trading, risk management is a discipline essential to sustaining profitability.

When a trader places a trade using a market order, the order is filled at the best available market price. Now, you have to decide how much you are willing to risk and set your trading capital accordingly. You should, however, use at least a risk-reward ratio: If you are right only half the time, you break even. As in all other areas of trade, there is no "holy grail" to conquering the gold markets. As coinage, anchor of fiat currency, or as a portfolio diversification tool, gold plays an integral role in the global monetary system. Protective Stops And Profit Targets Protective stops and profit targets are integral parts of almost any risk management approach. However, all market participants are accountable to regulation and oversight. We take more pain from loss than pleasure from gain. With institutions being among the few parties interested in securing the physical asset [5] , only a minute portion of all contract holders elect to exercise delivery. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. To figure the total cost per :. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The tendency is to hold onto losses and take profits early. Single Share prices are subject to a 15 minute delay. Step 2 Build A Plan A comprehensive trading plan is crucial to achieving long-term success in any market, let alone bullion.

Traders who adhered to this rule were three times more likely to turn a profit—a substantial difference. It is always a good idea to stay abreast of the day's geopolitical, monetary policy, economic and industry-specific issues. What separates successful traders from unsuccessful traders? You get greater control and can scale your positions up or. Our data on trader performance shows that traders on average have a lower win percentage during volatile market hours and when trading through faster-moving markets. The following questions must be answered thoroughly while in the process of building a rules-based approach to the markets:. We take more pain from loss than pleasure from gain. However, they use two different leverage ratios. The most conventional and popular way of trading BTC is through best forex daily tips demo trading stock options cryptocurrency exchange. Let's ravencoin hardware best p2p bitcoin exchange the wager and run it as a loss. Adhere To A Plan: The number-one tip anyone can give on gold trading is to build a plan and stick to it. Does or higher really work? The more heads you get, the more you make.

FXCM Apps: The apps displayed do not take into consideration your individual circumstances and trading objectives, and, therefore, should not be considered as a personal recommendation or investment advice. Step 2 Build A Plan A comprehensive trading plan is crucial to achieving long-term success in any market, let alone bullion. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Given the proper resources and strategy, the world's gold-related securities are viable avenues from which to prosper. In addition to its functionality as a mode of payment, BTC has become a favourite among traders and investors alike. Institutional management of these investment vehicles produces the liquidity and pricing fluctuations necessary for day trading. Lustrous: Featuring a glistening yellow color, gold will not tarnish or corrode. These markets offer participants several distinct advantages: Leverage: BTC CFD products furnish traders with financial leverage to increase market exposure. Why Trade Gold? If you're not adhering to a strategic framework while interacting within its bounds, the potential for catastrophe becomes very real. The second currency listed in the pairing is known as the "counter currency. FXCM is not liable for errors, omissions or delays or for actions relying on this information. By far, panic and euphoria are the premier catalysts behind moves in gold pricing.

Shifts in consumer trends or geopolitics can influence the underpinnings of almost any asset's value, including corporate stocks. Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes. Even if a plan is not as strong as it could be, the structure eliminates haphazard risk taking, negative impacts of emotion and inconsistent trade. Values are determined in relation of the base currency to the counter currency. However, while using high leverage has the potential to increase your gains, it can just as quickly, and perhaps more importantly, magnify your losses. In terms of asset valuations, gold is viewed as being the global benchmark. Futures trading demo gold penny stocks to watch 2020 believe that traders are generally more successful range trading European currency pairs between pm and am New York time. When it comes to trading any asset class, market accessibility is it biblical to invest in the stock market moral can you trade forex with tradestation an important consideration. With a bright and lustrous appearance, gold is visually attractive myaccount fxcm yes bank share price intraday target for today well as being exceptionally useful. Contracts based on leverage in cfd trading fxcm price target indices, debt instruments, currencies and commodities are among the most frequently traded derivative products in the world. Game Plan: Use effective leverage of or lower. Nonetheless, successful gold trading becomes much more probable through education, game planning and selecting the correct product. Trading Strategies.

Please read the linked websites' terms and conditions. Step 1 Understand The Fundamentals The global bullion markets are constantly evolving with varying degrees of complexity. Without quality market access, conducting business is impossible. In addition to ETFs, individual stocks often reflect the volatility of gold pricing. Methodology: Once your available resources and objectives have been quantified, a suitable trading strategy may be adopted or created. On average, the pound was five times as volatile between and am as it was between pm to am. No matter if you're trading futures , forex or stocks, the number-one reason a majority of traders are forced to leave the market is untimely capital loss. In practice, a profit target is set at a favourable price and executed upon the market trading that price. You can even sell unwanted jewelry online to directly participate in the bullion market. Institutional management of these investment vehicles produces the liquidity and pricing fluctuations necessary for day trading. Let's backtest it. How To Trade Gold The dawn of the digital marketplace removed the challenge of gaining access to the gold market. By far, haphazard risk management practices are the number-one cause of new traders leaving the market prematurely. A risk vs reward ratio is a tool used to quantify the potential return and risk exposure facing a specific trade. Trade some of the most popular international companies like Apple, Facebook and Tesla alongside forex, cryptocurrency, indices, and commodities — all from one platform.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Review market sentiment generated by quant models. Avoid Panic Trading: Led by gold, commodities markets show a consistent sensitivity to panic trading. Trait 2: Successful Traders Use Leverage Effectively Many traders come to the forex market for the wide availability of leverage — the ability to control a trading position larger than your available capital. Without these, a foray into the bullion markets is very likely short-lived. Currency Pairings Currencies available for trade in the forex market are listed in pairs, with one currency being quoted in reference to another. Unlike the results shown in an actual performance record, these results do not represent actual trading. Substantial slippage can be realised, with the filled order price varying greatly from the initial market order price. The increased capital requirements often prompt active traders to target other international exchanges, related contract-for-difference CFDs products, or equities-based futures contracts. In forex trading, leverage , or trade size, is measured in "lots. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Visit EFX Data for more information. However, the E-micro product does not have the depth of market or liquidity of the full-size contract.